Key Insights

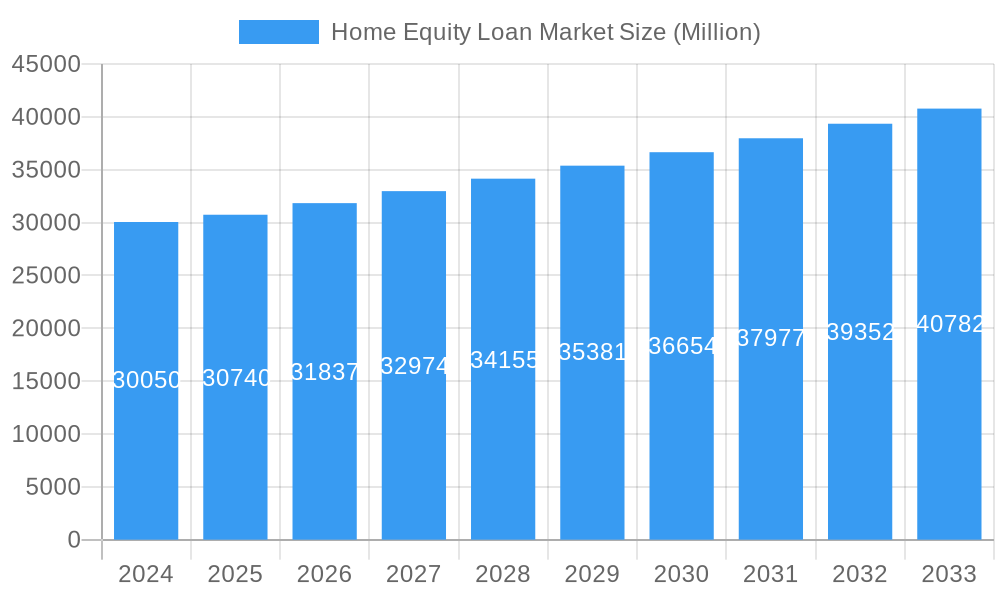

The global home equity loan market is poised for steady expansion, with a current valuation of approximately $30.74 billion. Projected to grow at a Compound Annual Growth Rate (CAGR) of 3.50% from 2025 to 2033, this indicates a robust and sustained upward trajectory for the industry. This growth is primarily fueled by a confluence of economic and demographic factors. As interest rates stabilize and housing markets show resilience, homeowners are increasingly looking to leverage the equity built up in their properties for various purposes, including home renovations, debt consolidation, and significant life events like education or healthcare expenses. The availability of diverse loan products, such as fixed-rate loans and Home Equity Lines of Credit (HELOCs), caters to a broad spectrum of borrower needs and risk appetites, further stimulating demand. The evolving financial landscape, with the increasing presence of online lenders and credit unions alongside traditional banks, is also enhancing accessibility and competition, driving innovation and better customer service.

Home Equity Loan Market Market Size (In Billion)

Key drivers for this market's ascent include favorable lending conditions, rising homeownership rates in developed economies, and a growing consumer confidence in leveraging existing assets. The desire for property improvements and the need for accessible funds for personal expenditures will continue to propel the market forward. While the market benefits from these tailwinds, potential restraints such as fluctuating interest rate environments and stringent lending regulations in certain regions could present localized challenges. However, the overall outlook remains positive, with strong demand anticipated across major geographies like North America and Europe, and emerging opportunities in the Asia Pacific region. The competitive landscape, featuring established financial institutions and agile fintech players, will likely foster innovation in product offerings and digital lending experiences, ultimately benefiting consumers and solidifying the market's growth trajectory over the forecast period.

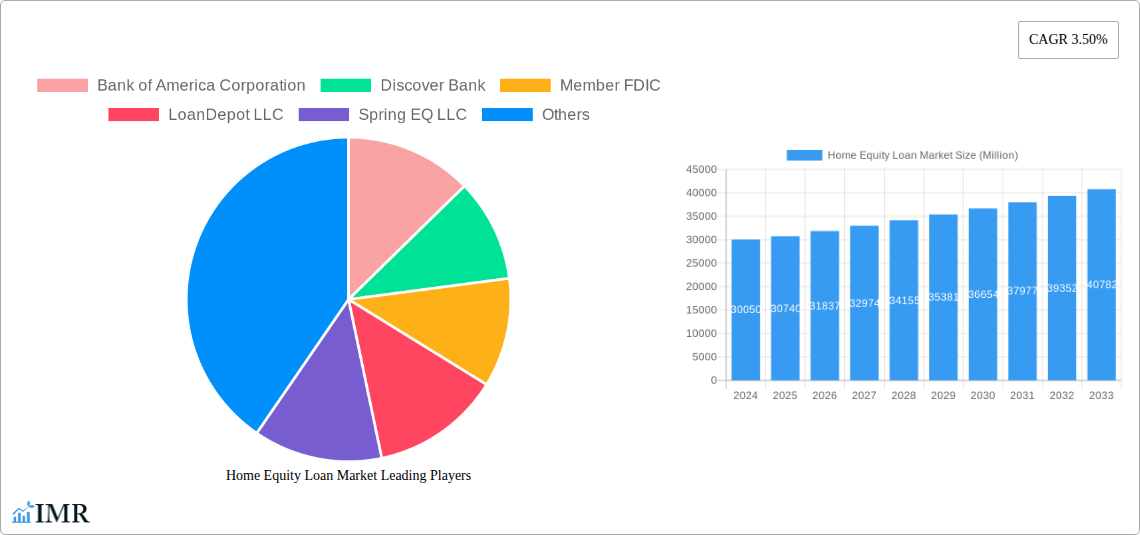

Home Equity Loan Market Company Market Share

Unlock strategic insights into the burgeoning Home Equity Loan market with this in-depth report. Covering the extensive 2019-2033 study period, including a 2025 base and estimated year, this analysis delves into market size evolution, growth trends, regional dominance, product innovations, and key player strategies. Essential for mortgage lenders, financial institutions, real estate investors, and industry analysts seeking to capitalize on the home equity loan market growth, HELOC market trends, and fixed rate home equity loan opportunities.

Home Equity Loan Market Market Dynamics & Structure

The Home Equity Loan market is characterized by a dynamic and evolving structure, influenced by a confluence of technological advancements, regulatory shifts, and evolving consumer behavior. Market concentration varies across regions, with established financial institutions like Bank of America Corporation, U S Bank, and The PNC Financial Services Group Inc holding significant sway, particularly in the traditional banking segment. However, the rise of online lenders such as LoanDepot LLC and specialized providers like Spring EQ LLC is reshaping the competitive landscape, driving innovation and enhancing accessibility. Technological innovation, particularly in digital lending platforms and AI-driven underwriting, acts as a significant growth driver, streamlining application processes and improving risk assessment. Regulatory frameworks, including those governing interest rates and lending practices, play a crucial role in shaping market access and product development. Competitive product substitutes, such as personal loans and refinancing options, present a constant challenge, necessitating a focus on competitive interest rates and flexible terms. End-user demographics are increasingly diverse, with a growing demand from younger homeowners seeking to leverage equity for various financial needs. Mergers and acquisitions (M&A) are a notable trend, exemplified by Redfin's acquisition of Bay Equity Home Loans in April 2022 for USD 137.8 Million, signaling a strategic move to integrate financing into the broader real estate transaction.

- Market Concentration: Moderate to high in traditional banking, increasing competition from online lenders.

- Technological Innovation Drivers: Digital lending platforms, AI in underwriting, enhanced customer experience tools.

- Regulatory Frameworks: Evolving consumer protection laws and interest rate regulations.

- Competitive Product Substitutes: Personal loans, balance transfers, cash-out refinancing.

- End-User Demographics: Growing demand from millennials and Gen Z homeowners for debt consolidation, home improvements, and investment.

- M&A Trends: Strategic acquisitions aimed at expanding service offerings and customer reach.

Home Equity Loan Market Growth Trends & Insights

The Home Equity Loan market is poised for substantial growth, driven by a combination of favorable economic conditions, increasing homeownership rates, and evolving consumer financial needs. The market size evolution is projected to witness a healthy Compound Annual Growth Rate (CAGR) of approximately 7.8% from 2025 to 2033, reaching an estimated market value of over $1.2 Trillion in 2033 (in Million units). Adoption rates for home equity products are steadily increasing as homeowners become more comfortable leveraging their accumulated equity for a range of purposes, from funding major home renovations and consolidating higher-interest debt to financing education and unexpected expenses. Technological disruptions are playing a pivotal role in this expansion. Digital lending platforms have significantly reduced application times and improved customer convenience, making home equity loans more accessible than ever before. AI-powered underwriting systems are enhancing risk assessment accuracy, potentially leading to more competitive interest rates and broader product availability. Furthermore, the shift in consumer behavior towards greater financial flexibility and self-directed financial management is fueling demand for products that offer liquidity against home assets. The increasing prominence of hybrid financing models, combining features of both home equity loans and lines of credit, also contributes to market growth by offering tailored solutions to diverse borrower profiles. The sustained low-interest rate environment in the historical period (2019-2024) has made borrowing against home equity an attractive proposition for many homeowners, further solidifying the market's upward trajectory. This trend is expected to continue as lenders adapt to dynamic economic conditions, offering innovative products that meet the evolving demands of homeowners seeking to unlock the value of their properties. The penetration of home equity products is anticipated to deepen, especially among first-time homeowners who are increasingly aware of the strategic financial benefits these loans can offer.

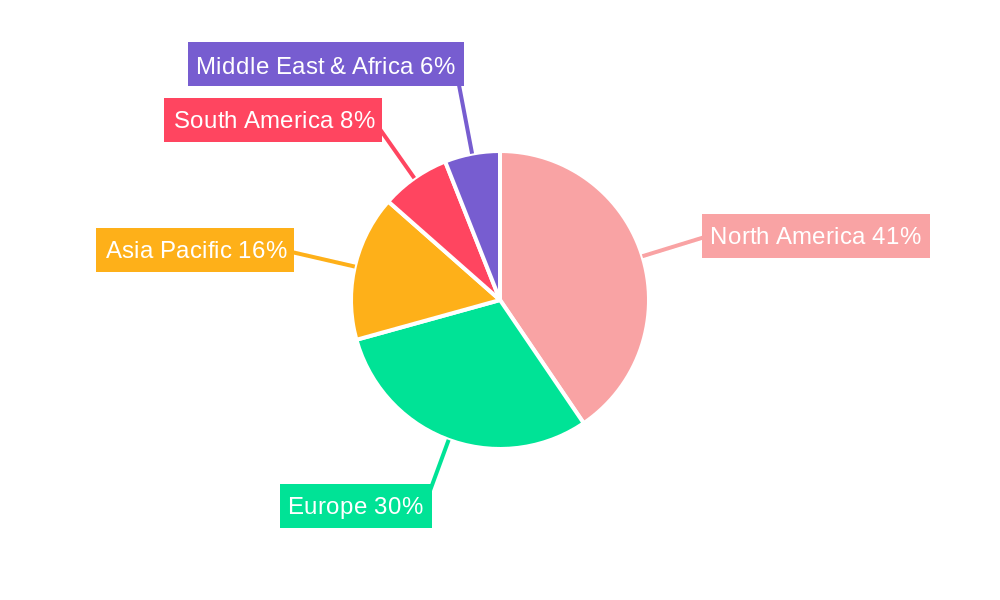

Dominant Regions, Countries, or Segments in Home Equity Loan Market

The Home Equity Loan market exhibits distinct regional and segment dominance, with the United States consistently emerging as the leading country and Banks as the dominant service provider. This leadership is underpinned by several key factors, including a robust real estate market, a high rate of homeownership, and a well-established financial infrastructure. In the United States, the sheer volume of homeownership and the significant appreciation in home values over the historical period (2019-2024) have created a vast pool of potential borrowers. Economic policies that encourage homeownership and provide stable lending environments further bolster this dominance.

Within the Types segment, Fixed Rate Loans and Home Equity Line of Credit (HELOC) both command significant market share. Fixed-rate loans appeal to borrowers seeking predictability in their monthly payments, particularly in an environment of potential interest rate fluctuations. HELOCs, on the other hand, offer flexibility for ongoing or variable borrowing needs, making them popular for home improvement projects or managing fluctuating expenses. The choice between these often depends on individual financial circumstances and risk appetite.

The Service Providers landscape is currently dominated by Banks, which benefit from established customer relationships, trust, and extensive branch networks. However, the Online segment is rapidly gaining traction due to its convenience, competitive pricing, and faster processing times. Credit Unions also play a significant role, particularly in serving their member bases with personalized financial solutions. The "Others" category, encompassing independent mortgage brokers and fintech companies, is a growing force, driving innovation and challenging traditional models.

- Leading Country: United States, due to high homeownership rates, significant home value appreciation, and stable economic policies.

- Dominant Segment (Types): Both Fixed Rate Loans and Home Equity Line of Credit (HELOC) are major segments, catering to different borrower needs for predictability versus flexibility.

- Dominant Segment (Service Providers): Banks currently lead, leveraging trust and existing customer bases, with Online lenders showing rapid growth in market share and adoption.

- Key Drivers of Dominance: Economic stability, favorable lending regulations, established real estate markets, technological adoption, and consumer trust.

- Growth Potential: Continued growth is expected in online lending and specialized credit union offerings, alongside traditional banking services.

Home Equity Loan Market Product Landscape

The product landscape within the Home Equity Loan market is characterized by continuous innovation aimed at enhancing borrower convenience and lender efficiency. Key product innovations include streamlined digital application processes, offering near real-time pre-approvals and faster funding times. Many providers are now offering hybrid products that combine features of fixed-rate loans and HELOCs, providing borrowers with both payment stability and flexible access to funds. Performance metrics are increasingly focused on speed of approval, transparency of terms, and competitive interest rates. Unique selling propositions often revolve around lower fees, specialized loan programs for specific needs (e.g., renovation loans), and personalized customer service. Technological advancements in AI-driven credit scoring and automated underwriting are enabling lenders to offer more tailored loan products and manage risk more effectively, thereby expanding access to home equity financing for a wider range of consumers.

Key Drivers, Barriers & Challenges in Home Equity Loan Market

The Home Equity Loan market is propelled by several key drivers. Economic growth and a stable housing market with rising home values are paramount, providing homeowners with substantial equity to leverage. Low interest rate environments, historically conducive to borrowing, also significantly boost demand. Technological advancements in digital lending platforms enhance accessibility and customer experience. Government initiatives promoting homeownership and financial stability can also act as drivers.

However, the market faces significant barriers and challenges. Economic downturns and housing market corrections can curb demand and increase default risk. Rising interest rates can make borrowing less attractive and strain existing borrowers. Stringent regulatory frameworks and compliance requirements can increase operational costs for lenders. Supply chain issues are not directly applicable to financial products, but rather relate to the broader economic environment that influences lending capacity. Competitive pressures from alternative financing options and other lenders necessitate continuous innovation and competitive pricing.

Emerging Opportunities in Home Equity Loan Market

Emerging opportunities in the Home Equity Loan market lie in leveraging technology for enhanced customer experience and expanding access to underserved segments. The development of sophisticated AI and machine learning tools offers potential for more personalized loan offerings and more accurate risk assessment, allowing for potentially higher loan-to-value ratios for creditworthy borrowers. The growing interest in sustainable home improvements presents an opportunity for specialized green home equity loans. Furthermore, reaching younger demographics (millennials and Gen Z) who are increasingly entering homeownership and may have different financial needs and preferences represents a significant untapped market. The rise of embedded finance within real estate platforms also presents an opportunity for integrated home equity financing solutions.

Growth Accelerators in the Home Equity Loan Market Industry

Several catalysts are accelerating long-term growth in the Home Equity Loan market. Technological breakthroughs in digital lending and blockchain for enhanced security and transparency are fundamental. Strategic partnerships between traditional lenders, fintech companies, and real estate platforms are crucial for expanding reach and offering integrated solutions. Market expansion strategies focusing on emerging demographics and diverse financial needs, such as tapping into the growing demand for home renovation financing or debt consolidation, will drive sustained growth. The increasing focus on financial wellness among consumers, encouraging them to strategically utilize home equity, also acts as a significant growth accelerator.

Key Players Shaping the Home Equity Loan Market Market

- Bank of America Corporation

- Discover Bank, Member FDIC

- LoanDepot LLC

- Spring EQ LLC

- TBK BANK, SSB

- U S Bank

- Pentagon Federal Credit Union

- The PNC Financial Services Group Inc

Notable Milestones in Home Equity Loan Market Sector

- April 2022: Redfin, a prominent real estate company, acquired Bay Equity Home Loans for USD 137.8 Million, a strategic move to integrate financing into its comprehensive real estate services.

- July 2022: Ontario Teachers’ Pension Plan Board acquired HomeQ, the parent company of HomeEquity Bank, from Birch Hill Equity Partners Management Inc., expanding its investment portfolio in financial services and Canada's reverse mortgage sector.

In-Depth Home Equity Loan Market Market Outlook

The Home Equity Loan market is set for sustained growth, driven by a confluence of factors including evolving consumer financial behaviors, technological innovations, and a resilient housing market. Future market potential is significant, with increasing adoption of digital platforms enhancing accessibility and efficiency. Strategic opportunities abound in developing innovative loan products tailored to specific life stages and financial goals, such as financing sustainable home upgrades or supporting entrepreneurial ventures. The market's trajectory will be further shaped by the ongoing digitalization of financial services, fostering greater transparency and a more customer-centric approach. Lenders that effectively leverage data analytics and AI to understand borrower needs and mitigate risk will be best positioned for success in this dynamic environment. The continued emphasis on homeownership and wealth creation through real estate ensures a robust demand for home equity financing solutions in the coming years.

Home Equity Loan Market Segmentation

-

1. Types

- 1.1. Fixed Rate Loans

- 1.2. Home Equity Line of Credit

-

2. Service Providers

- 2.1. Banks

- 2.2. Online

- 2.3. Credit Union

- 2.4. Others

Home Equity Loan Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Home Equity Loan Market Regional Market Share

Geographic Coverage of Home Equity Loan Market

Home Equity Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase In Sales of Household Units; Higher Duration of Repayment

- 3.3. Market Restrains

- 3.3.1. Increase In Sales of Household Units; Higher Duration of Repayment

- 3.4. Market Trends

- 3.4.1. Access to Large Amount of Loan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Equity Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Fixed Rate Loans

- 5.1.2. Home Equity Line of Credit

- 5.2. Market Analysis, Insights and Forecast - by Service Providers

- 5.2.1. Banks

- 5.2.2. Online

- 5.2.3. Credit Union

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. North America Home Equity Loan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Types

- 6.1.1. Fixed Rate Loans

- 6.1.2. Home Equity Line of Credit

- 6.2. Market Analysis, Insights and Forecast - by Service Providers

- 6.2.1. Banks

- 6.2.2. Online

- 6.2.3. Credit Union

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Types

- 7. South America Home Equity Loan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Types

- 7.1.1. Fixed Rate Loans

- 7.1.2. Home Equity Line of Credit

- 7.2. Market Analysis, Insights and Forecast - by Service Providers

- 7.2.1. Banks

- 7.2.2. Online

- 7.2.3. Credit Union

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Types

- 8. Europe Home Equity Loan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Types

- 8.1.1. Fixed Rate Loans

- 8.1.2. Home Equity Line of Credit

- 8.2. Market Analysis, Insights and Forecast - by Service Providers

- 8.2.1. Banks

- 8.2.2. Online

- 8.2.3. Credit Union

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Types

- 9. Middle East & Africa Home Equity Loan Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Types

- 9.1.1. Fixed Rate Loans

- 9.1.2. Home Equity Line of Credit

- 9.2. Market Analysis, Insights and Forecast - by Service Providers

- 9.2.1. Banks

- 9.2.2. Online

- 9.2.3. Credit Union

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Types

- 10. Asia Pacific Home Equity Loan Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Types

- 10.1.1. Fixed Rate Loans

- 10.1.2. Home Equity Line of Credit

- 10.2. Market Analysis, Insights and Forecast - by Service Providers

- 10.2.1. Banks

- 10.2.2. Online

- 10.2.3. Credit Union

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Types

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bank of America Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Discover Bank

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Member FDIC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LoanDepot LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Spring EQ LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TBK BANK

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SSB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 U S Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pentagon Federal Credit Union

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The PNC Financial Services Group Inc **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bank of America Corporation

List of Figures

- Figure 1: Global Home Equity Loan Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Home Equity Loan Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Home Equity Loan Market Revenue (Million), by Types 2025 & 2033

- Figure 4: North America Home Equity Loan Market Volume (Billion), by Types 2025 & 2033

- Figure 5: North America Home Equity Loan Market Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Home Equity Loan Market Volume Share (%), by Types 2025 & 2033

- Figure 7: North America Home Equity Loan Market Revenue (Million), by Service Providers 2025 & 2033

- Figure 8: North America Home Equity Loan Market Volume (Billion), by Service Providers 2025 & 2033

- Figure 9: North America Home Equity Loan Market Revenue Share (%), by Service Providers 2025 & 2033

- Figure 10: North America Home Equity Loan Market Volume Share (%), by Service Providers 2025 & 2033

- Figure 11: North America Home Equity Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Home Equity Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Home Equity Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Home Equity Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Home Equity Loan Market Revenue (Million), by Types 2025 & 2033

- Figure 16: South America Home Equity Loan Market Volume (Billion), by Types 2025 & 2033

- Figure 17: South America Home Equity Loan Market Revenue Share (%), by Types 2025 & 2033

- Figure 18: South America Home Equity Loan Market Volume Share (%), by Types 2025 & 2033

- Figure 19: South America Home Equity Loan Market Revenue (Million), by Service Providers 2025 & 2033

- Figure 20: South America Home Equity Loan Market Volume (Billion), by Service Providers 2025 & 2033

- Figure 21: South America Home Equity Loan Market Revenue Share (%), by Service Providers 2025 & 2033

- Figure 22: South America Home Equity Loan Market Volume Share (%), by Service Providers 2025 & 2033

- Figure 23: South America Home Equity Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Home Equity Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 25: South America Home Equity Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Home Equity Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Home Equity Loan Market Revenue (Million), by Types 2025 & 2033

- Figure 28: Europe Home Equity Loan Market Volume (Billion), by Types 2025 & 2033

- Figure 29: Europe Home Equity Loan Market Revenue Share (%), by Types 2025 & 2033

- Figure 30: Europe Home Equity Loan Market Volume Share (%), by Types 2025 & 2033

- Figure 31: Europe Home Equity Loan Market Revenue (Million), by Service Providers 2025 & 2033

- Figure 32: Europe Home Equity Loan Market Volume (Billion), by Service Providers 2025 & 2033

- Figure 33: Europe Home Equity Loan Market Revenue Share (%), by Service Providers 2025 & 2033

- Figure 34: Europe Home Equity Loan Market Volume Share (%), by Service Providers 2025 & 2033

- Figure 35: Europe Home Equity Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Home Equity Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Home Equity Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Home Equity Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Home Equity Loan Market Revenue (Million), by Types 2025 & 2033

- Figure 40: Middle East & Africa Home Equity Loan Market Volume (Billion), by Types 2025 & 2033

- Figure 41: Middle East & Africa Home Equity Loan Market Revenue Share (%), by Types 2025 & 2033

- Figure 42: Middle East & Africa Home Equity Loan Market Volume Share (%), by Types 2025 & 2033

- Figure 43: Middle East & Africa Home Equity Loan Market Revenue (Million), by Service Providers 2025 & 2033

- Figure 44: Middle East & Africa Home Equity Loan Market Volume (Billion), by Service Providers 2025 & 2033

- Figure 45: Middle East & Africa Home Equity Loan Market Revenue Share (%), by Service Providers 2025 & 2033

- Figure 46: Middle East & Africa Home Equity Loan Market Volume Share (%), by Service Providers 2025 & 2033

- Figure 47: Middle East & Africa Home Equity Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Home Equity Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Home Equity Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Home Equity Loan Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Home Equity Loan Market Revenue (Million), by Types 2025 & 2033

- Figure 52: Asia Pacific Home Equity Loan Market Volume (Billion), by Types 2025 & 2033

- Figure 53: Asia Pacific Home Equity Loan Market Revenue Share (%), by Types 2025 & 2033

- Figure 54: Asia Pacific Home Equity Loan Market Volume Share (%), by Types 2025 & 2033

- Figure 55: Asia Pacific Home Equity Loan Market Revenue (Million), by Service Providers 2025 & 2033

- Figure 56: Asia Pacific Home Equity Loan Market Volume (Billion), by Service Providers 2025 & 2033

- Figure 57: Asia Pacific Home Equity Loan Market Revenue Share (%), by Service Providers 2025 & 2033

- Figure 58: Asia Pacific Home Equity Loan Market Volume Share (%), by Service Providers 2025 & 2033

- Figure 59: Asia Pacific Home Equity Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Home Equity Loan Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Home Equity Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Home Equity Loan Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Home Equity Loan Market Revenue Million Forecast, by Types 2020 & 2033

- Table 2: Global Home Equity Loan Market Volume Billion Forecast, by Types 2020 & 2033

- Table 3: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2020 & 2033

- Table 4: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2020 & 2033

- Table 5: Global Home Equity Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Home Equity Loan Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Home Equity Loan Market Revenue Million Forecast, by Types 2020 & 2033

- Table 8: Global Home Equity Loan Market Volume Billion Forecast, by Types 2020 & 2033

- Table 9: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2020 & 2033

- Table 10: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2020 & 2033

- Table 11: Global Home Equity Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Home Equity Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global Home Equity Loan Market Revenue Million Forecast, by Types 2020 & 2033

- Table 20: Global Home Equity Loan Market Volume Billion Forecast, by Types 2020 & 2033

- Table 21: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2020 & 2033

- Table 22: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2020 & 2033

- Table 23: Global Home Equity Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Home Equity Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Home Equity Loan Market Revenue Million Forecast, by Types 2020 & 2033

- Table 32: Global Home Equity Loan Market Volume Billion Forecast, by Types 2020 & 2033

- Table 33: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2020 & 2033

- Table 34: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2020 & 2033

- Table 35: Global Home Equity Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Home Equity Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global Home Equity Loan Market Revenue Million Forecast, by Types 2020 & 2033

- Table 56: Global Home Equity Loan Market Volume Billion Forecast, by Types 2020 & 2033

- Table 57: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2020 & 2033

- Table 58: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2020 & 2033

- Table 59: Global Home Equity Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Home Equity Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Home Equity Loan Market Revenue Million Forecast, by Types 2020 & 2033

- Table 74: Global Home Equity Loan Market Volume Billion Forecast, by Types 2020 & 2033

- Table 75: Global Home Equity Loan Market Revenue Million Forecast, by Service Providers 2020 & 2033

- Table 76: Global Home Equity Loan Market Volume Billion Forecast, by Service Providers 2020 & 2033

- Table 77: Global Home Equity Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Home Equity Loan Market Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Home Equity Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Home Equity Loan Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Equity Loan Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Home Equity Loan Market?

Key companies in the market include Bank of America Corporation, Discover Bank, Member FDIC, LoanDepot LLC, Spring EQ LLC, TBK BANK, SSB, U S Bank, Pentagon Federal Credit Union, The PNC Financial Services Group Inc **List Not Exhaustive.

3. What are the main segments of the Home Equity Loan Market?

The market segments include Types, Service Providers.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase In Sales of Household Units; Higher Duration of Repayment.

6. What are the notable trends driving market growth?

Access to Large Amount of Loan.

7. Are there any restraints impacting market growth?

Increase In Sales of Household Units; Higher Duration of Repayment.

8. Can you provide examples of recent developments in the market?

In April 2022, Redfin a real estate company based in Seattle (United States) acquired Bay Equity Home Loans with a sum of USD 137.8 Million. The merger accelerates Redfin’s strategy for expanding its business with customers to buy, sell, rent, and finance a home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Equity Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Equity Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Equity Loan Market?

To stay informed about further developments, trends, and reports in the Home Equity Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence