Key Insights

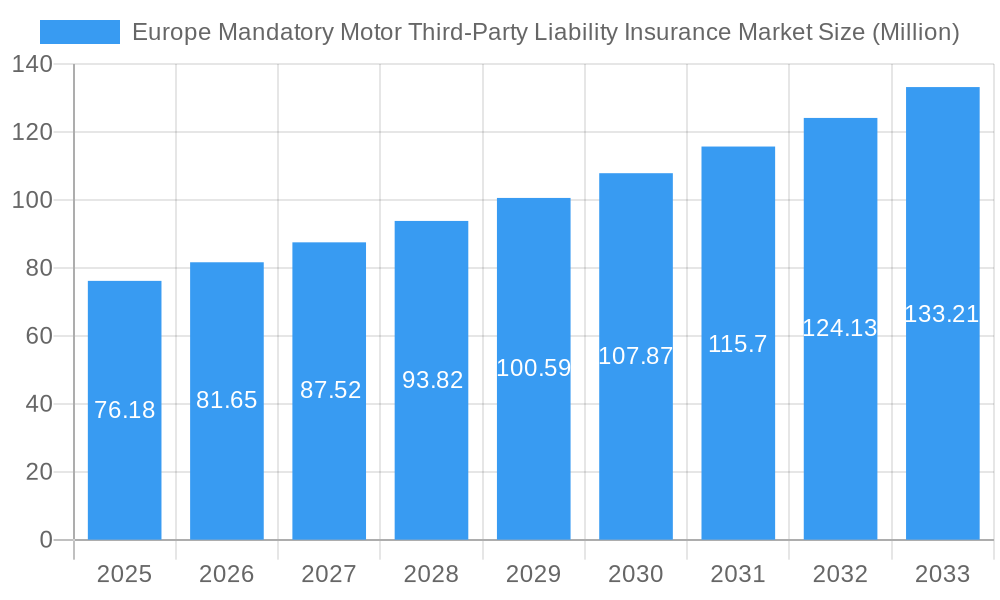

The Europe Mandatory Motor Third-Party Liability Insurance Market is poised for robust expansion, projected to reach a significant market size of USD 76.18 million, exhibiting a Compound Annual Growth Rate (CAGR) of 7.24% from 2025 to 2033. This sustained growth is primarily fueled by increasing vehicle ownership across the European continent, a continuous rise in the number of registered vehicles, and stricter regulatory mandates for third-party liability coverage. The growing awareness among vehicle owners regarding the financial and legal ramifications of accidents, coupled with evolving insurance policies that offer comprehensive protection against bodily injury and property damage, are key drivers propelling the market forward. Furthermore, advancements in technology, such as telematics and AI-driven claims processing, are enhancing operational efficiencies for insurers and improving customer experiences, thereby contributing to market expansion. The market is segmented across various types, including Bodily Injury Liability and Property Damage Liability, with distribution channels encompassing Independent Agents/Brokers, Direct Sales, and Banks, catering to both Personal and Commercial applications.

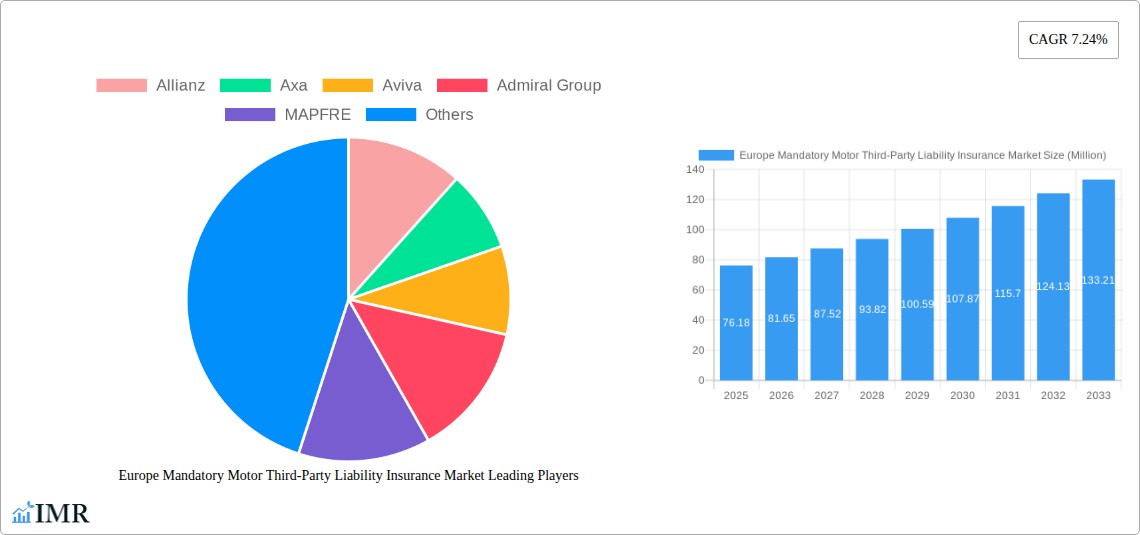

Europe Mandatory Motor Third-Party Liability Insurance Market Market Size (In Million)

The European market for Mandatory Motor Third-Party Liability Insurance is characterized by significant activity from major global players like Allianz, Axa, Aviva, and Admiral Group, alongside regional specialists such as MAPFRE and Ergo Insurance, all vying for market share. Key regions like the United Kingdom, Germany, and France are expected to remain dominant, driven by their large vehicle fleets and well-established insurance infrastructures. While the market presents lucrative opportunities, certain restraints such as intense competition leading to price sensitivity and the potential for regulatory changes that could impact pricing structures, warrant careful consideration by market participants. However, the overarching trend of increasing per capita income and the continuous need for essential vehicle insurance are expected to outweigh these challenges, ensuring a dynamic and growing market landscape for mandatory motor third-party liability insurance in Europe throughout the forecast period.

Europe Mandatory Motor Third-Party Liability Insurance Market Company Market Share

This in-depth report provides a critical analysis of the Europe Mandatory Motor Third-Party Liability Insurance Market. Discover key market dynamics, growth trends, dominant segments, and future opportunities shaping this essential insurance sector. Essential for insurers, regulators, and industry stakeholders seeking to understand and capitalize on the evolving landscape of compulsory automotive insurance across Europe.

Study Period: 2019–2033 | Base Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Keywords: Europe Motor Insurance, Third-Party Liability Insurance, Mandatory Car Insurance, Auto Insurance Europe, Bodily Injury Liability, Property Damage Liability, Insurance Distribution Channels, Personal Auto Insurance, Commercial Auto Insurance, Insurance Market Analysis, Insurance M&A, Insurance Regulatory Frameworks, Digital Insurance Europe, Insurtech Motor, Motor Liability Insurance Trends.

Europe Mandatory Motor Third-Party Liability Insurance Market Dynamics & Structure

The Europe Mandatory Motor Third-Party Liability Insurance Market is characterized by a moderately concentrated structure, with established players like Allianz, Axa, and Aviva holding significant market share. Technological innovation is increasingly driven by the integration of telematics and AI in risk assessment and claims processing, aiming to enhance efficiency and personalize policy offerings. Regulatory frameworks, overseen by bodies such as BaFin, play a crucial role in dictating policy terms, minimum coverage limits, and consumer protection standards across member states, influencing market entry and product development. Competitive product substitutes are limited due to the mandatory nature of third-party liability, but the rise of usage-based insurance (UBI) and digital-first platforms are indirectly influencing pricing and customer experience. End-user demographics are diverse, encompassing a vast pool of personal vehicle owners and a significant commercial fleet segment. Mergers and acquisitions (M&A) are a notable trend, with companies like Allianz and Aviva strategically acquiring businesses to expand their portfolios and market reach. For instance, Allianz's acquisition of Tua Assicurazioni and Aviva's acquisition of AIG Life UK highlight a consolidation trend.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Technological Innovation: Telematics, AI in risk assessment, digital claims processing.

- Regulatory Frameworks: Strong influence from national regulators (e.g., BaFin) and EU directives.

- Competitive Dynamics: Primarily focused on service differentiation and pricing efficiency rather than direct product substitution.

- M&A Trends: Active consolidation with strategic acquisitions to gain market share and capabilities.

- End-User Demographics: Broad base of personal and commercial vehicle owners.

Europe Mandatory Motor Third-Party Liability Insurance Market Growth Trends & Insights

The Europe Mandatory Motor Third-Party Liability Insurance Market is poised for steady growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This growth is underpinned by an increasing vehicle parc across the continent and the unwavering mandatory nature of third-party liability coverage, ensuring a stable demand base. Market penetration remains high, approaching near-universal coverage for registered vehicles, with minor variations across different countries influenced by enforcement and economic conditions. Technological disruptions, particularly the adoption of telematics and data analytics, are significantly reshaping market dynamics. These advancements enable more accurate risk profiling, leading to personalized pricing and a more efficient claims management process, thereby improving customer satisfaction and insurer profitability. Consumer behavior is shifting towards digital channels for policy acquisition and management, favoring convenience and transparency. Insurers are responding by investing heavily in online platforms and mobile applications. The evolving mobility landscape, including the gradual introduction of autonomous vehicles and the increasing prevalence of electric vehicles, presents both challenges and opportunities, requiring insurers to adapt their underwriting models and product offerings. The impact of economic policies and consumer disposable income also plays a significant role, influencing purchasing power and the demand for ancillary insurance products.

The market size evolution is projected to see the total market value reach an estimated EUR 155,000 Million by 2033, up from an estimated EUR 105,000 Million in 2025. This growth trajectory highlights the resilience and consistent demand for this essential insurance. Adoption rates for digital insurance services continue to climb, with an estimated 65% of new policy purchases initiated online by 2025, rising to 78% by 2033. Technological disruptions are not just limited to telematics; the use of AI for fraud detection and automated claims assessment is expected to reduce operational costs by an estimated 15% over the forecast period. Consumer behavior shifts are further evidenced by a growing preference for bundled insurance products, with an estimated 30% of policyholders opting for additional coverage beyond the mandatory third-party liability by 2030. The growing importance of environmental consciousness is also influencing the market, with a projected 20% increase in demand for specialized insurance for electric and hybrid vehicles by 2028. Furthermore, the increasing average vehicle age in certain European regions, coupled with a persistent need for road safety, continues to drive consistent demand for motor third-party liability insurance. The overall sentiment in the market is one of cautious optimism, with a focus on leveraging technology and adapting to evolving consumer needs to maintain a competitive edge.

Dominant Regions, Countries, or Segments in Europe Mandatory Motor Third-Party Liability Insurance Market

The Bodily Injury Liability segment is projected to remain the dominant segment within the Europe Mandatory Motor Third-Party Liability Insurance Market, consistently driving market growth and accounting for an estimated 60% of the total market value by 2025, expanding to 62% by 2033. This dominance stems from the inherent risk and severity associated with personal injuries arising from road accidents, necessitating comprehensive coverage. Countries with higher population densities and greater vehicle ownership, such as Germany, France, and the United Kingdom, represent the leading national markets, collectively accounting for over 65% of the total European market share. These countries benefit from robust economies, well-developed road infrastructures, and stringent enforcement of mandatory insurance laws.

Dominant Segment (Type): Bodily Injury Liability is expected to continue its leadership due to the high potential cost of claims.

- Market Share (2025): Approximately 60%

- Projected Market Share (2033): Approximately 62%

- Key Drivers: Legal mandates, severity of injury claims, increasing healthcare costs.

Leading Countries:

- Germany: Robust automotive industry, high vehicle density, and strong regulatory enforcement.

- Market Share (2025): Estimated 18%

- Growth Potential: Stable due to high car ownership and strict compliance.

- France: Significant vehicle parc, comprehensive road network, and active insurance market.

- Market Share (2025): Estimated 15%

- Growth Potential: Moderate, driven by population and economic stability.

- United Kingdom: Large insurance market, advanced regulatory framework, and high adoption of digital services.

- Market Share (2025): Estimated 14%

- Growth Potential: Steady, with a focus on technological integration.

- Germany: Robust automotive industry, high vehicle density, and strong regulatory enforcement.

Dominant Distribution Channel: Independent Agents/Brokers continue to hold a significant share, particularly in complex commercial segments and for consumers seeking personalized advice. However, Direct Sales are rapidly gaining traction due to the convenience of online purchasing and a younger demographic's preference for digital interactions, projected to grow at a CAGR of 7.2% over the forecast period. Banks also play a role, often offering insurance as part of broader financial packages.

- Independent Agents/Brokers: Valued for expertise and personal touch.

- Market Share (2025): Approximately 40%

- Direct Sales: Rapidly growing due to convenience and digital adoption.

- Market Share (2025): Approximately 35%

- CAGR (2025-2033): 7.2%

- Banks: Integrated offerings in financial products.

- Market Share (2025): Approximately 20%

- Independent Agents/Brokers: Valued for expertise and personal touch.

Dominant Application: The Personal application segment is the largest, driven by individual car ownership. However, the Commercial segment, encompassing fleets of vehicles for businesses, represents a substantial and growing market, characterized by higher average policy values and a demand for tailored risk management solutions.

- Personal: Largest segment due to widespread individual vehicle ownership.

- Market Share (2025): Approximately 70%

- Commercial: Growing segment with higher policy values and specialized needs.

- Market Share (2025): Approximately 30%

- Growth Potential: Higher than personal, driven by business expansion and fleet management needs.

- Personal: Largest segment due to widespread individual vehicle ownership.

The interplay of these regional and segmental factors creates a dynamic market landscape, with insurers strategically targeting specific demographics and distribution channels to optimize their growth and profitability. Economic policies, infrastructure development, and evolving consumer preferences will continue to shape the dominance of these regions and segments in the coming years.

Europe Mandatory Motor Third-Party Liability Insurance Market Product Landscape

The product landscape for Europe Mandatory Motor Third-Party Liability Insurance is characterized by standardization due to regulatory requirements, yet differentiation is emerging through add-on services and digital integration. Core products universally cover Bodily Injury Liability and Property Damage Liability, providing essential financial protection against claims arising from accidents. While the fundamental coverage remains consistent across the EU, insurers are innovating by offering flexible policy terms, such as pay-as-you-drive options and usage-based insurance (UBI) linked to telematics devices, which monitor driving behavior. These innovations allow for more personalized premiums, particularly for low-mileage drivers or those with demonstrably safe driving habits. Furthermore, advancements in claims processing, leveraging AI and digital platforms, are enhancing the customer experience by speeding up settlement times and reducing administrative burdens. The integration of these digital tools and data analytics represents a significant technological advancement, enabling insurers to better assess risk and offer more competitive pricing. The focus is on delivering a seamless customer journey from policy inception to claims settlement, with unique selling propositions often revolving around superior customer service, competitive pricing, and innovative digital features.

Key Drivers, Barriers & Challenges in Europe Mandatory Motor Third-Party Liability Insurance Market

Key Drivers:

- Mandatory Nature: Legal requirement ensures a baseline demand across all EU member states.

- Increasing Vehicle Parc: Growing number of registered vehicles, particularly in emerging EU economies.

- Technological Advancements: Telematics, AI, and digital platforms enhance risk assessment, pricing, and customer experience.

- Growing Awareness of Financial Protection: Consumers increasingly understand the importance of adequate insurance coverage against potential liabilities.

- Economic Growth & Disposable Income: Higher disposable incomes in many European countries support sustained insurance purchases.

Key Barriers & Challenges:

- Intense Competition & Price Sensitivity: The commoditized nature of the product leads to significant price wars, impacting profitability margins.

- Evolving Regulatory Landscape: Harmonization of regulations across the EU can be complex, and changes can require significant system adjustments.

- Fraudulent Claims: Persistent issue of motor insurance fraud leads to increased claims costs and potentially higher premiums.

- Data Privacy Concerns: Strict GDPR regulations can pose challenges in collecting and utilizing driving data for risk assessment.

- Underwriting Complexities: Insuring new risks associated with electric vehicles and autonomous driving requires new underwriting models.

- Supply Chain Issues: While not directly impacting insurance products, broader economic factors like supply chain disruptions can affect the cost of vehicle repairs, indirectly influencing claims.

Emerging Opportunities in Europe Mandatory Motor Third-Party Liability Insurance Market

Emerging opportunities in the Europe Mandatory Motor Third-Party Liability Insurance Market lie in the continued digital transformation and the evolving mobility ecosystem. The expansion of Insurtech solutions offers avenues for developing more agile and customer-centric products, leveraging big data and AI for hyper-personalization of policies and claims. The growing adoption of electric vehicles (EVs) and the anticipated rise of autonomous driving present a significant opportunity for insurers to develop specialized coverage and risk management strategies tailored to these new vehicle technologies. Furthermore, exploring untapped markets within less saturated regions of Eastern Europe, where vehicle ownership is rising, can provide substantial growth potential. The development of integrated mobility platforms, offering insurance as part of a broader transportation service package, also represents a promising avenue for innovation and market penetration.

Growth Accelerators in the Europe Mandatory Motor Third-Party Liability Insurance Market Industry

Several key factors are accelerating growth in the Europe Mandatory Motor Third-Party Liability Insurance Market. The ongoing digitalization of the insurance value chain, from customer acquisition to claims handling, is a primary accelerator, enhancing operational efficiency and customer engagement. Strategic partnerships between traditional insurers and technology providers (Insurtechs) are fostering innovation and enabling the rapid deployment of new digital products and services. Furthermore, a growing focus on proactive risk management through telematics and data analytics allows insurers to offer incentives for safer driving, thereby reducing claims frequency and cost, which in turn can lead to more competitive pricing and increased market share. Government initiatives aimed at promoting road safety and penalizing uninsured drivers also contribute to sustained demand and market expansion.

Key Players Shaping the Europe Mandatory Motor Third-Party Liability Insurance Market Market

- Allianz

- Axa

- Aviva

- Admiral Group

- MAPFRE

- Chubb Limited

- Generali Group

- Ergo Insurance

- SCOR

Notable Milestones in Europe Mandatory Motor Third-Party Liability Insurance Market Sector

- April 2024: Aviva PLC ("Aviva") announced the acquisition of AIG Life Limited ("AIG Life UK") from Corebridge Financial Inc., a subsidiary of American International Group Inc. After receiving all requisite approvals, the acquisition was finalized for EUR 453 million (USD 497.95 million). This move strengthens Aviva's presence in the UK insurance market.

- March 2024: Allianz finalized its acquisition of Tua Assicurazioni in Italy. Allianz SpA confirmed the successful acquisition of Tua Assicurazioni SpA from Assicurazioni Generali SpA. The deal was sealed for EUR 280 million (USD 307.78 million). Tua Assicurazioni boasts a robust property and casualty (P/C) insurance portfolio, generating approximately EUR 280 million (USD 307.78 million) in gross written premiums in 2022. Notably, this was largely facilitated through its extensive network of nearly 500 agents, enhancing Allianz's Italian market reach and distribution capabilities.

In-Depth Europe Mandatory Motor Third-Party Liability Insurance Market Market Outlook

The future outlook for the Europe Mandatory Motor Third-Party Liability Insurance Market is characterized by continued innovation and adaptation. Growth accelerators, including the pervasive adoption of digital technologies for policy management and claims processing, will drive efficiency and enhance customer experience. Strategic partnerships and M&A activities will continue to reshape the competitive landscape, with companies seeking to expand their geographical reach and technological capabilities. The market is expected to benefit from increasing vehicle parc in certain regions and a persistent demand for financial protection. Opportunities abound in developing tailored products for the evolving automotive sector, such as electric vehicles and potentially autonomous systems, alongside untapped potential in emerging European markets. Navigating regulatory changes and addressing the persistent challenge of fraud will remain critical for sustained profitability. Overall, the market presents a robust outlook, driven by regulatory certainty and technological advancements that promise a more efficient and customer-centric future for motor third-party liability insurance.

Europe Mandatory Motor Third-Party Liability Insurance Market Segmentation

-

1. Type

- 1.1. Bodily Injury Liability

- 1.2. Property Damage Liability

-

2. Distribution Channel

- 2.1. Independent Agents/Brokers

- 2.2. Direct Sales

- 2.3. Banks

-

3. Application

- 3.1. Personal

- 3.2. Commercial

Europe Mandatory Motor Third-Party Liability Insurance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

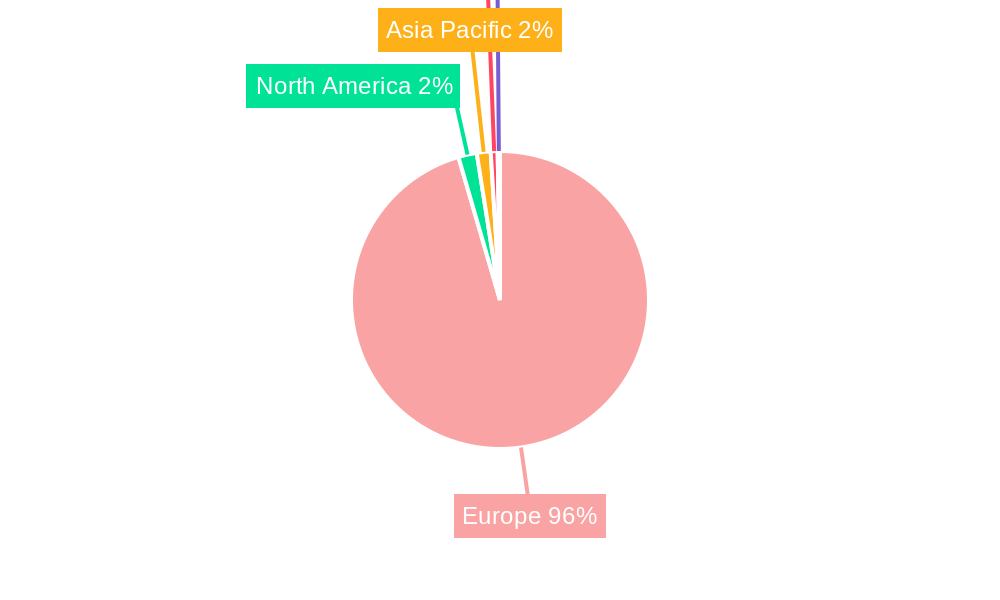

Europe Mandatory Motor Third-Party Liability Insurance Market Regional Market Share

Geographic Coverage of Europe Mandatory Motor Third-Party Liability Insurance Market

Europe Mandatory Motor Third-Party Liability Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Vehicle Ownership

- 3.3. Market Restrains

- 3.3.1. Increasing Vehicle Ownership

- 3.4. Market Trends

- 3.4.1. Increasing Number of Vehicles on the Road to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Mandatory Motor Third-Party Liability Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Bodily Injury Liability

- 5.1.2. Property Damage Liability

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Independent Agents/Brokers

- 5.2.2. Direct Sales

- 5.2.3. Banks

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Allianz

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Axa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aviva

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Admiral Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MAPFRE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chubb Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Generali Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BaFin

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ergo Insurance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SCOR**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Allianz

List of Figures

- Figure 1: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Mandatory Motor Third-Party Liability Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Europe Mandatory Motor Third-Party Liability Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Mandatory Motor Third-Party Liability Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Mandatory Motor Third-Party Liability Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Mandatory Motor Third-Party Liability Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Mandatory Motor Third-Party Liability Insurance Market?

The projected CAGR is approximately 7.24%.

2. Which companies are prominent players in the Europe Mandatory Motor Third-Party Liability Insurance Market?

Key companies in the market include Allianz, Axa, Aviva, Admiral Group, MAPFRE, Chubb Limited, Generali Group, BaFin, Ergo Insurance, SCOR**List Not Exhaustive.

3. What are the main segments of the Europe Mandatory Motor Third-Party Liability Insurance Market?

The market segments include Type, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Vehicle Ownership.

6. What are the notable trends driving market growth?

Increasing Number of Vehicles on the Road to Drive Market Growth.

7. Are there any restraints impacting market growth?

Increasing Vehicle Ownership.

8. Can you provide examples of recent developments in the market?

April 2024: Aviva PLC ("Aviva") announced the acquisition of AIG Life Limited ("AIG Life UK") from Corebridge Financial Inc., a subsidiary of American International Group Inc. After receiving all requisite approvals, the acquisition was finalized for EUR 453 million (USD 497.95 million).March 2024: Allianz finalized its acquisition of Tua Assicurazioni in Italy. Allianz SpA confirmed the successful acquisition of Tua Assicurazioni SpA from Assicurazioni Generali SpA. The deal was sealed for EUR 280 million (USD 307.78 million). Tua Assicurazioni boasts a robust property and casualty (P/C) insurance portfolio, generating approximately EUR 280 million (USD 307.78 million) in gross written premiums in 2022. Notably, this was largely facilitated through its extensive network of nearly 500 agents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Mandatory Motor Third-Party Liability Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Mandatory Motor Third-Party Liability Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Mandatory Motor Third-Party Liability Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Mandatory Motor Third-Party Liability Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence