Key Insights

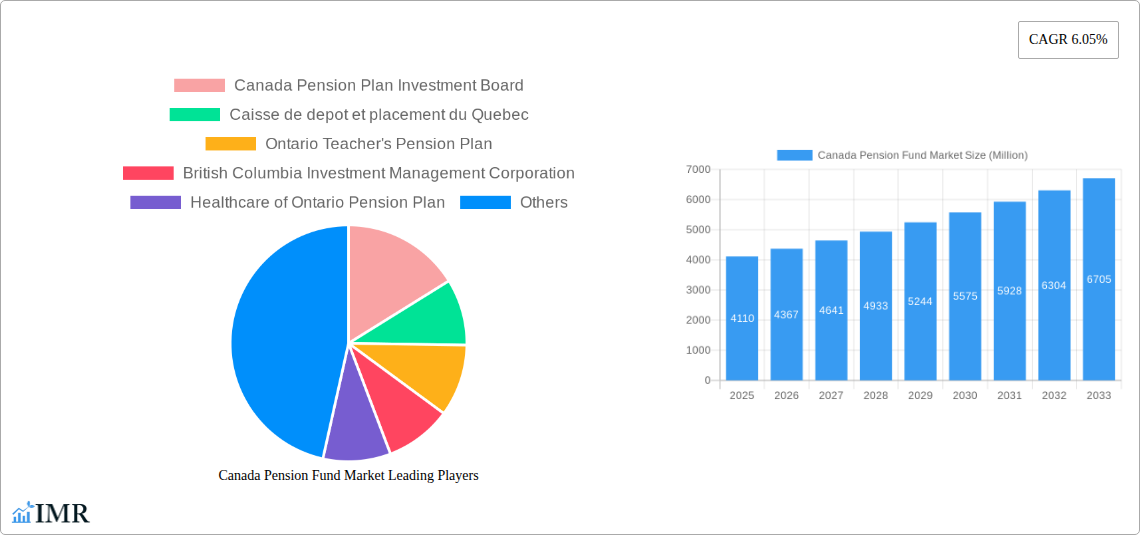

The Canada Pension Fund market, valued at $4.11 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.05% from 2025 to 2033. This growth is fueled by several key drivers. Increasing life expectancy and a growing aging population necessitate larger pension fund reserves to meet future retirement obligations. Furthermore, government initiatives promoting retirement savings and the rising adoption of sophisticated investment strategies by pension fund managers contribute significantly to market expansion. The market's expansion is also driven by a growing awareness among individuals of the importance of long-term financial planning and securing a comfortable retirement. Increased regulatory scrutiny and a focus on Environmental, Social, and Governance (ESG) investing are also shaping the investment landscape, pushing fund managers to adopt more sustainable and responsible investment practices. Competitive pressures among fund managers are fostering innovation in investment strategies and portfolio diversification, further fueling market growth.

Canada Pension Fund Market Market Size (In Billion)

Despite the positive outlook, the market faces certain challenges. Fluctuations in global financial markets and geopolitical uncertainties pose significant risks to investment returns. Moreover, the increasing regulatory burden on pension fund managers, coupled with pressure to deliver strong returns in a low-interest-rate environment, presents considerable hurdles. However, the long-term outlook for the Canadian pension fund market remains positive, driven by the demographic trends and the increasing importance of retirement savings. The significant involvement of major players like the Canada Pension Plan Investment Board, Caisse de dépôt et placement du Québec, and Ontario Teachers' Pension Plan underscores the market's strength and future potential. Segment-specific analyses, while not detailed in the provided data, would reveal further insights into specific investment strategies and asset allocation within the market.

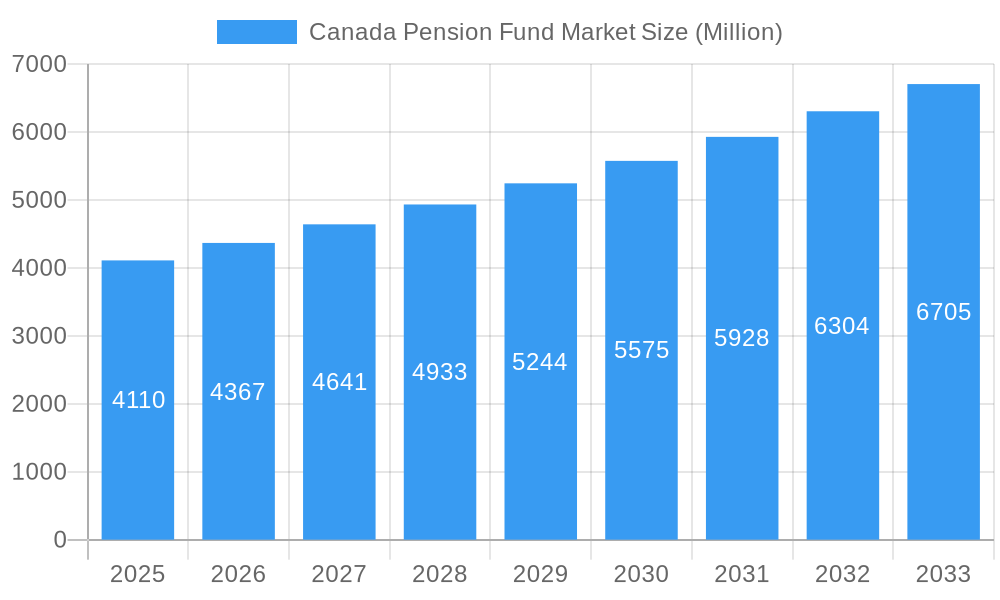

Canada Pension Fund Market Company Market Share

Canada Pension Fund Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada Pension Fund Market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The study delves into parent and child markets, offering granular insights for investors, industry professionals, and strategic decision-makers.

Canada Pension Fund Market Market Dynamics & Structure

This section analyzes the structure and dynamics of the Canadian pension fund market, examining market concentration, technological advancements, regulatory landscapes, competitive dynamics, end-user demographics, and merger and acquisition (M&A) activity. The Canadian pension fund market is characterized by a relatively concentrated landscape dominated by large institutional investors. However, the market is dynamic, witnessing significant technological innovation and evolving regulatory frameworks. The market is also seeing increased M&A activity as institutions seek to expand their portfolios and enhance their investment strategies. While accurate market share data is proprietary and not publicly released in its entirety, we estimate the top 5 players hold approximately xx% of the market.

- Market Concentration: High, with a few dominant players controlling a significant share.

- Technological Innovation: Increasing adoption of AI, big data analytics, and alternative investment strategies drive innovation.

- Regulatory Framework: Stringent regulations and oversight contribute to market stability but can hinder rapid expansion.

- Competitive Landscape: Intense competition among large players, with smaller firms seeking niche opportunities.

- End-User Demographics: Focus on providing retirement income to a growing and aging population.

- M&A Activity: Steady increase in M&A activity, reflecting industry consolidation and strategic expansion. Estimated annual deal volume for 2024: xx Million.

Canada Pension Fund Market Growth Trends & Insights

The Canadian pension fund market has experienced robust growth over the past few years, driven by factors such as increased government contributions, growing contributions from private employers, and strong investment returns. The market is expected to continue growing at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a market size of xx Million by 2033. This growth is primarily fueled by increased investment activity in diverse asset classes, a growing pool of savings, and technological advancements enhancing investment management. A shift towards sustainable and responsible investing is also impacting market behavior.

Market size evolution shows a steady increase, driven primarily by strong investment performance and continued growth in assets under management. Adoption rates for new technologies like AI are relatively high among larger players. However, smaller firms might face challenges in adopting such technologies due to limited resources. Consumer behavior is shifting towards a greater emphasis on long-term financial security and ethical investing practices.

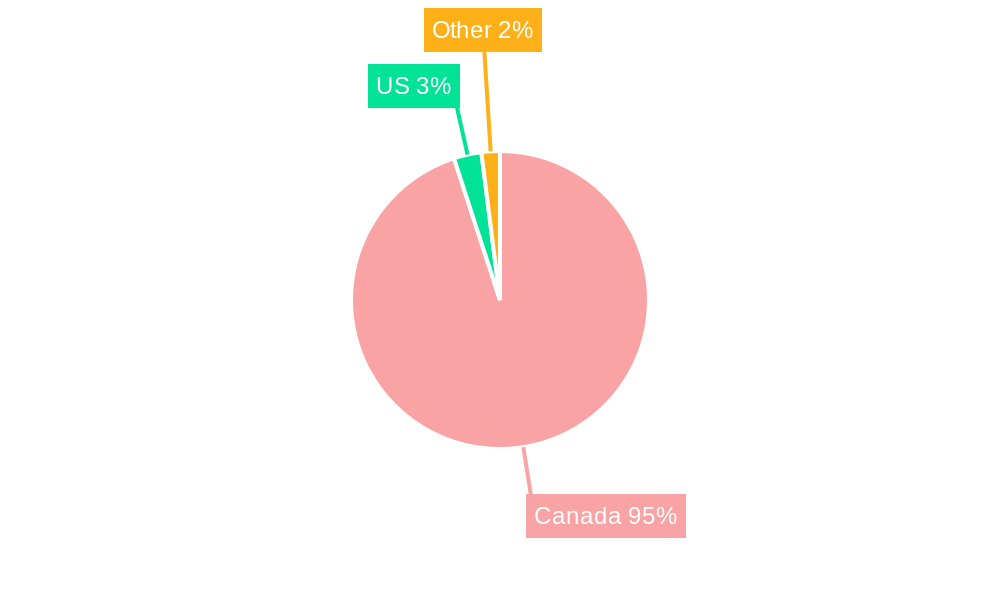

Dominant Regions, Countries, or Segments in Canada Pension Fund Market

While the Canadian pension fund market is largely national in scope, Ontario and Quebec consistently demonstrate the strongest growth due to higher population density, a robust financial sector, and established institutional frameworks. These regions attract substantial investment and exhibit higher levels of activity in both public and private pension plans.

- Key Drivers in Ontario and Quebec:

- Strong economic activity and government support.

- Highly developed financial infrastructure.

- Significant concentration of large institutional investors.

- High levels of private sector pension plan contributions.

The market dominance of these regions is due to a combination of factors, including higher concentration of contributing employees, advanced investment strategies employed by local pension funds, and strong governmental support. Their growth potential remains substantial owing to future population growth and continued economic expansion.

Canada Pension Fund Market Product Landscape

The Canadian pension fund market offers a range of investment products, including equities, fixed-income securities, real estate, infrastructure, and private equity. Recent product innovations have focused on integrating ESG (Environmental, Social, and Governance) factors into investment decisions, creating tailored products for various risk profiles, and adopting cutting-edge technology for improved portfolio management. These products offer diversified investment opportunities tailored to specific risk tolerance and long-term goals. Technological advancements such as AI-driven risk management and portfolio optimization tools are significantly enhancing efficiency and performance metrics.

Key Drivers, Barriers & Challenges in Canada Pension Fund Market

Key Drivers:

- Growing aging population increasing demand for retirement income.

- Increasing government and private sector contributions.

- Strong investment returns and diversified portfolios.

- Technological advancements in investment management.

Challenges and Restraints:

- Increasing regulatory scrutiny and compliance costs. (Estimated annual cost increase xx Million)

- Market volatility and geopolitical risks impacting investment performance.

- Competition from other investment vehicles and international players.

Emerging Opportunities in Canada Pension Fund Market

- Growth in alternative investments: Increasing allocation to infrastructure, private equity, and renewable energy.

- ESG investing: Expanding demand for sustainable and responsible investment products.

- Technological innovation: Leveraging AI and big data analytics for enhanced risk management and portfolio optimization.

- International expansion: Canadian pension funds increasing investments in global markets.

Growth Accelerators in the Canada Pension Fund Market Industry

Technological advancements, particularly in AI and big data analytics, are significantly accelerating growth. Strategic partnerships between pension funds and technology firms are improving efficiency and investment strategies. The expansion into new asset classes and geographical markets is further driving expansion. The increasing focus on ESG investments also provides opportunities for growth and strengthens long-term market prospects.

Key Players Shaping the Canada Pension Fund Market Market

- Canada Pension Plan Investment Board

- Caisse de dépôt et placement du Québec

- Ontario Teacher's Pension Plan

- British Columbia Investment Management Corporation

- Healthcare of Ontario Pension Plan

- PSP Investments

- OMERS Retirement System

- T Rowe Price

- Impax Asset Management

- Mawer Investment Management Ltd

Notable Milestones in Canada Pension Fund Market Sector

- June 2023: Qualtrics acquisition by Silver Lake, with participation from CPP Investments. This signals the growing interest of Canadian pension funds in technology investments.

- May 2023: Franklin Templeton's strategic partnership with Power Corporation of Canada and Great-West Lifeco, Inc., illustrating the growing collaboration within the Canadian financial sector.

In-Depth Canada Pension Fund Market Market Outlook

The Canadian pension fund market is poised for continued growth, driven by a combination of factors, including technological innovation, the aging population, and an increasing focus on sustainable investments. The market presents significant opportunities for strategic partnerships and investment in emerging asset classes. The future potential is substantial, indicating a positive long-term outlook for investors and industry players alike.

Canada Pension Fund Market Segmentation

-

1. Plan Type

- 1.1. Distributed Contribution

- 1.2. Distributed Benefit

- 1.3. Reserved Fund

- 1.4. Hybrid

Canada Pension Fund Market Segmentation By Geography

- 1. Canada

Canada Pension Fund Market Regional Market Share

Geographic Coverage of Canada Pension Fund Market

Canada Pension Fund Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift to Capital Light Products from traditional products.; A push for technology led engagement

- 3.3. Market Restrains

- 3.3.1. Shift to Capital Light Products from traditional products.; A push for technology led engagement

- 3.4. Market Trends

- 3.4.1. Increase in Inflation affecting Canada Pension funds Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Pension Fund Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Plan Type

- 5.1.1. Distributed Contribution

- 5.1.2. Distributed Benefit

- 5.1.3. Reserved Fund

- 5.1.4. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Plan Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Canada Pension Plan Investment Board

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caisse de depot et placement du Quebec

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ontario Teacher's Pension Plan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 British Columbia Investment Management Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Healthcare of Ontario Pension Plan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PSP Investment Board

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OMERS Retirement System

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 T Rowe Price

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Impax Asset Management

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mawer Investment Management Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Canada Pension Plan Investment Board

List of Figures

- Figure 1: Canada Pension Fund Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Pension Fund Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Pension Fund Market Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 2: Canada Pension Fund Market Volume Trillion Forecast, by Plan Type 2020 & 2033

- Table 3: Canada Pension Fund Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Pension Fund Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 5: Canada Pension Fund Market Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 6: Canada Pension Fund Market Volume Trillion Forecast, by Plan Type 2020 & 2033

- Table 7: Canada Pension Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Canada Pension Fund Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Pension Fund Market?

The projected CAGR is approximately 6.05%.

2. Which companies are prominent players in the Canada Pension Fund Market?

Key companies in the market include Canada Pension Plan Investment Board, Caisse de depot et placement du Quebec, Ontario Teacher's Pension Plan, British Columbia Investment Management Corporation, Healthcare of Ontario Pension Plan, PSP Investment Board, OMERS Retirement System, T Rowe Price, Impax Asset Management, Mawer Investment Management Ltd **List Not Exhaustive.

3. What are the main segments of the Canada Pension Fund Market?

The market segments include Plan Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Shift to Capital Light Products from traditional products.; A push for technology led engagement.

6. What are the notable trends driving market growth?

Increase in Inflation affecting Canada Pension funds Market.

7. Are there any restraints impacting market growth?

Shift to Capital Light Products from traditional products.; A push for technology led engagement.

8. Can you provide examples of recent developments in the market?

In June 2023, Qualtrics, the pioneer and foremost provider of Experience Management (XM) software, announced that its acquisition by Silver Lake, a prominent in technology investment globally, in collaboration with Canada Pension Plan Investment Board (CPP Investments).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Pension Fund Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Pension Fund Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Pension Fund Market?

To stay informed about further developments, trends, and reports in the Canada Pension Fund Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence