Key Insights

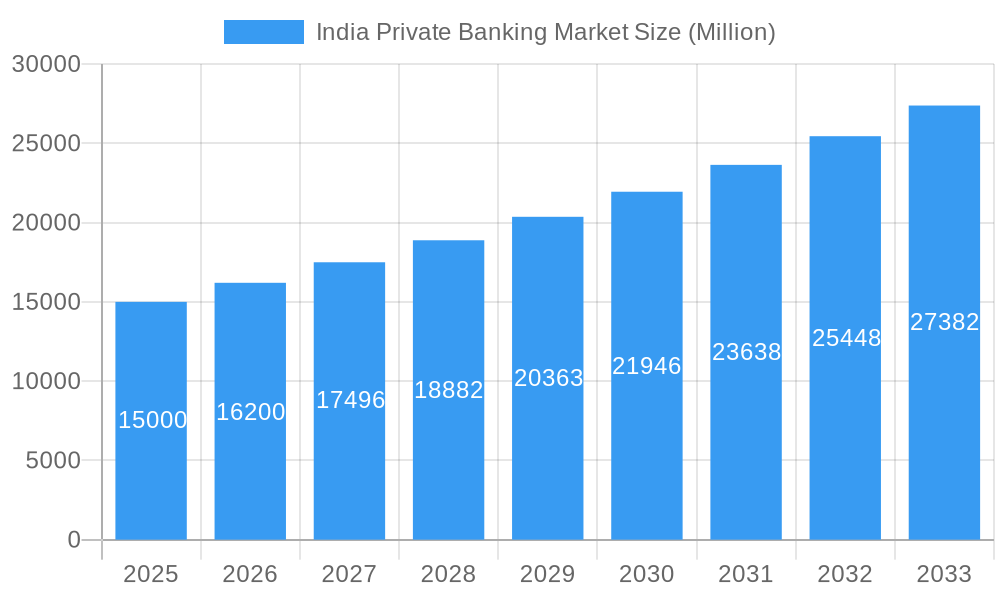

India's private banking market is demonstrating strong expansion, propelled by rising disposable incomes, enhanced financial literacy, and a growing affluent demographic. The market is projected to reach $505.61 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.4% from a base year of 2025. This growth is driven by the increasing adoption of digital banking, demand for personalized wealth management, and expanding private banking services into Tier 2 and Tier 3 cities.

India Private Banking Market Market Size (In Billion)

Leading institutions are strategically investing in technology and diversifying product portfolios to meet the needs of High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs). Intense competition centers on differentiated services, superior customer experiences, and innovative financial products. Regulatory shifts and macroeconomic variables, including interest rate movements, will continue to shape market dynamics. The market is segmented by services (wealth management, investment banking), customer demographics (HNWIs, UHNWIs), and geography.

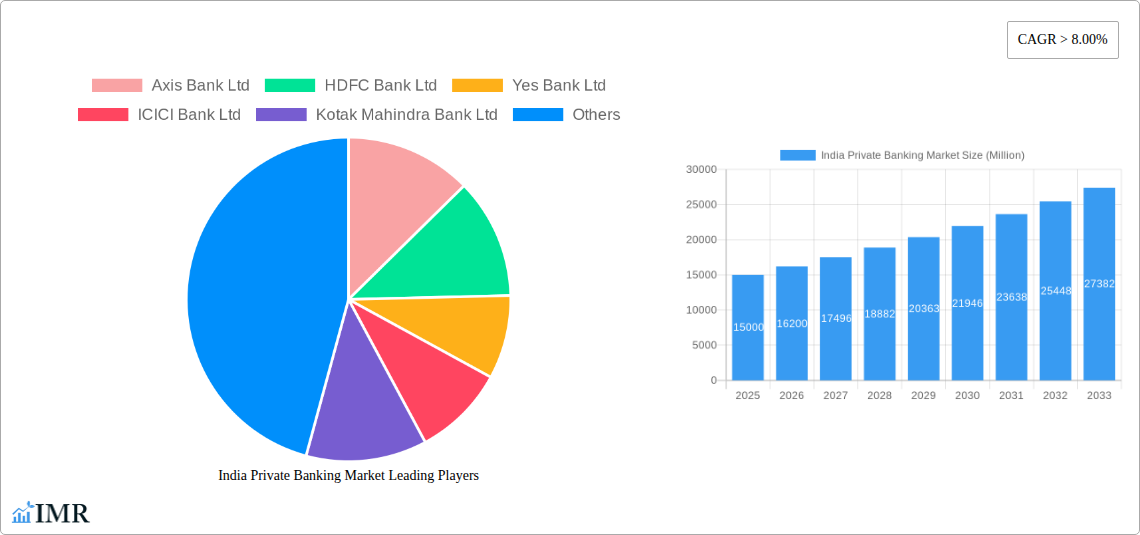

India Private Banking Market Company Market Share

Looking forward, government initiatives in financial inclusion, infrastructure development, and the expanding digital economy will fuel market growth through 2033. Expect increased market consolidation, driven by mergers and acquisitions. The integration of fintech solutions and artificial intelligence in private banking operations will redefine the competitive landscape. Furthermore, the rising preference for sustainable and ethical investments will spur product innovation. The Indian private banking sector offers substantial opportunities for both established and emerging players who can adapt to evolving trends and embrace new technologies.

India Private Banking Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India Private Banking Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a focus on key segments and leading players like Axis Bank, HDFC Bank, and ICICI Bank, this report is an essential resource for industry professionals, investors, and strategic planners. The report covers the period from 2019 to 2033, with a base year of 2025. The market size is presented in Million units.

India Private Banking Market Dynamics & Structure

The Indian private banking market is characterized by a dynamic interplay of factors, shaping its structure and future trajectory. Market concentration is relatively high, with a few major players dominating the landscape. Technological innovation, driven by the increasing adoption of digital banking and fintech solutions, is a key driver of market growth. However, regulatory frameworks, including those governing data privacy and security, pose both challenges and opportunities. The emergence of fintech companies as competitive product substitutes necessitates continuous adaptation and innovation from traditional private banks. End-user demographics, with a growing affluent and high-net-worth individual (HNWI) segment, fuel demand for sophisticated wealth management and investment services. Mergers and acquisitions (M&A) are a prominent feature, exemplified by recent significant deals such as the HDFC-HDFC Bank merger.

- Market Concentration: High, with top 5 banks controlling approximately XX% of the market (2024).

- Technological Innovation: Strong focus on digital banking, AI-powered solutions, and personalized services.

- Regulatory Framework: Evolving regulations around data protection and financial inclusion influence market strategies.

- Competitive Substitutes: Fintech companies are emerging as strong competitors, offering disruptive services.

- End-User Demographics: Growth in the HNWI segment drives demand for premium banking products.

- M&A Activity: Significant M&A activity, with XX major deals recorded between 2019-2024, indicating consolidation.

India Private Banking Market Growth Trends & Insights

The India Private Banking market has experienced substantial growth during the historical period (2019-2024), driven by factors such as rising disposable incomes, increasing financial literacy, and the expanding HNWI population. The market size is projected to reach XX Million units by 2025, exhibiting a CAGR of XX% during the forecast period (2025-2033). Technological disruptions, particularly in digital banking and mobile payments, have significantly impacted adoption rates, leading to increased customer engagement and improved service delivery. Consumer behavior is shifting towards personalized financial solutions, demanding sophisticated wealth management services and tailored investment products. The market's growth trajectory reflects a confluence of economic expansion, technological advancements, and evolving consumer preferences.

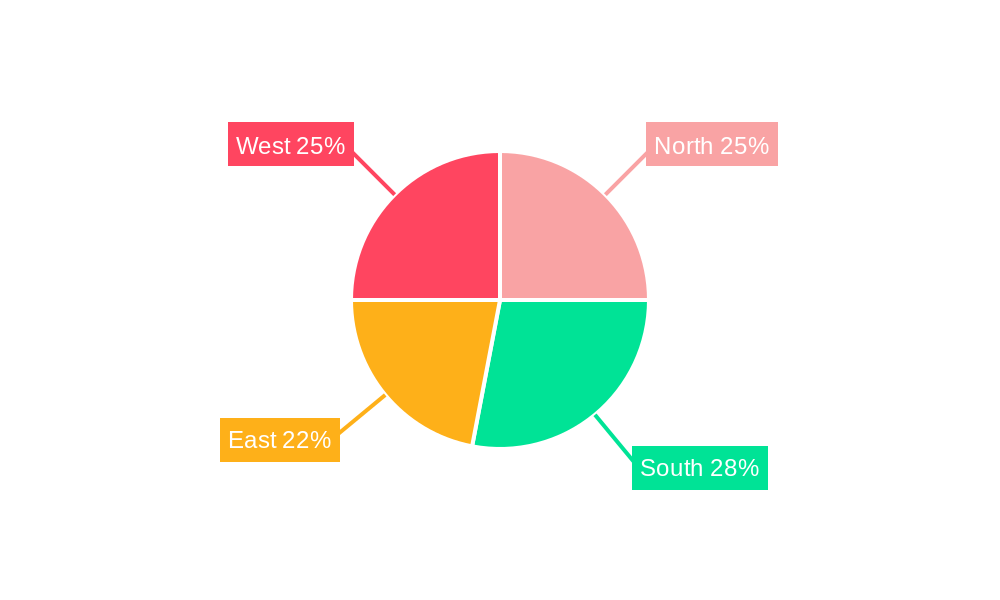

Dominant Regions, Countries, or Segments in India Private Banking Market

The Metropolitan areas of Mumbai, Delhi, Bangalore and Chennai dominate the India Private Banking market, accounting for approximately XX% of the total market value in 2024. This dominance stems from higher concentrations of HNWIs, robust economic activity, and well-developed infrastructure. These regions benefit from the presence of major financial hubs, attracting both domestic and international private banking institutions. Furthermore, the strong presence of major multinational corporations and large industrial conglomerates in these cities contributes to high demand for private banking services. The strong regulatory framework in these urban centers also provides a stable environment for banking institutions to operate.

- Key Drivers in Metropolitan Areas:

- High concentration of HNWIs

- Strong economic activity

- Well-developed financial infrastructure

- Presence of major corporations

- Favorable regulatory environment

India Private Banking Market Product Landscape

Private banking products in India encompass a wide range of services tailored to the unique needs of HNWIs, including wealth management, investment banking, private equity, and bespoke financial advisory services. Significant innovation is witnessed in the integration of digital platforms with traditional services, enhancing customer experience and efficiency. The emphasis is on personalized solutions that leverage cutting-edge technology like AI and machine learning to offer tailored recommendations and risk management strategies. Key performance metrics include client acquisition costs, customer retention rates, and return on investment from investment portfolios. Unique selling propositions frequently include access to exclusive investment opportunities and privileged customer service.

Key Drivers, Barriers & Challenges in India Private Banking Market

Key Drivers: The growth of the Indian private banking market is fueled by rising disposable incomes, increasing financial literacy, and a burgeoning HNWI segment. Government initiatives promoting financial inclusion further stimulate market expansion. Technological advancements, particularly in digital banking and fintech solutions, enhance efficiency and accessibility.

Key Challenges: Regulatory changes, especially concerning data privacy and security, present significant challenges. Competition from both established players and new fintech entrants requires continuous innovation and adaptation. Supply chain disruptions and geopolitical uncertainties can also affect market stability.

Emerging Opportunities in India Private Banking Market

Untapped market potential exists in Tier 2 and 3 cities, where affluent individuals are increasingly seeking sophisticated banking services. The growth of digital banking presents significant opportunities to enhance customer reach and service delivery. Demand for specialized products, such as sustainable investing and impact finance, is also on the rise. Furthermore, growing awareness about financial planning and wealth management creates a fertile ground for the private banking sector.

Growth Accelerators in the India Private Banking Market Industry

Strategic partnerships between private banks and fintech companies can unlock significant growth opportunities. Investments in cutting-edge technologies, such as AI and blockchain, are critical for enhancing operational efficiency and security. Expanding into underserved markets through digital channels can drive customer acquisition and market penetration. Furthermore, focusing on client-centric solutions and personalized services will drive future market expansion.

Key Players Shaping the India Private Banking Market Market

- Axis Bank Ltd

- HDFC Bank Ltd

- Yes Bank Ltd

- ICICI Bank Ltd

- Kotak Mahindra Bank Ltd

- IndusInd Bank

- IDBI Bank Ltd

- Federal Bank

- IDFC First Bank Ltd

- City Union Bank Ltd

- *List Not Exhaustive

Notable Milestones in India Private Banking Market Sector

- December 2022: Housing Development Finance Corporation (HDFC) announced a merger with HDFC Bank. The merger is expected to conclude in Q2 of 2023, significantly altering the market landscape.

- March 2022: Axis Bank proposed the acquisition of Citibank's consumer businesses in India. This acquisition bolstered Axis Bank’s position and market share.

In-Depth India Private Banking Market Market Outlook

The future of the India Private Banking market is promising, with continued growth driven by economic expansion, rising affluence, and technological innovation. Strategic partnerships, investments in digital technologies, and expansion into underserved markets will be crucial for sustained success. The increasing adoption of personalized financial solutions and customized investment strategies will shape the market's future trajectory. The market is expected to experience a strong upward trajectory, presenting attractive opportunities for existing and new players alike.

India Private Banking Market Segmentation

-

1. BY Banking Sector

-

1.1. Retail Banking

- 1.1.1. Commercial Banking

- 1.1.2. Investment Banking

-

1.1. Retail Banking

India Private Banking Market Segmentation By Geography

- 1. India

India Private Banking Market Regional Market Share

Geographic Coverage of India Private Banking Market

India Private Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Private Sector Bank Assets is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Private Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Banking Sector

- 5.1.1. Retail Banking

- 5.1.1.1. Commercial Banking

- 5.1.1.2. Investment Banking

- 5.1.1. Retail Banking

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by BY Banking Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Axis Bank Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HDFC Bank Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yes Bank Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ICICI Bank Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kotak Mahindra Bank Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Induslnd Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IDBI Bank Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Federal Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IDFC First Bank Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 City Union Bank Ltd *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Axis Bank Ltd

List of Figures

- Figure 1: India Private Banking Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Private Banking Market Share (%) by Company 2025

List of Tables

- Table 1: India Private Banking Market Revenue billion Forecast, by BY Banking Sector 2020 & 2033

- Table 2: India Private Banking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India Private Banking Market Revenue billion Forecast, by BY Banking Sector 2020 & 2033

- Table 4: India Private Banking Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Private Banking Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the India Private Banking Market?

Key companies in the market include Axis Bank Ltd, HDFC Bank Ltd, Yes Bank Ltd, ICICI Bank Ltd, Kotak Mahindra Bank Ltd, Induslnd Bank, IDBI Bank Ltd, Federal Bank, IDFC First Bank Ltd, City Union Bank Ltd *List Not Exhaustive.

3. What are the main segments of the India Private Banking Market?

The market segments include BY Banking Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 505.61 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Private Sector Bank Assets is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Housing Development Finance Corporation (HDFC) announced a merger with HDFC Bank. The merger is expected to conclude in Q2 of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Private Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Private Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Private Banking Market?

To stay informed about further developments, trends, and reports in the India Private Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence