Key Insights

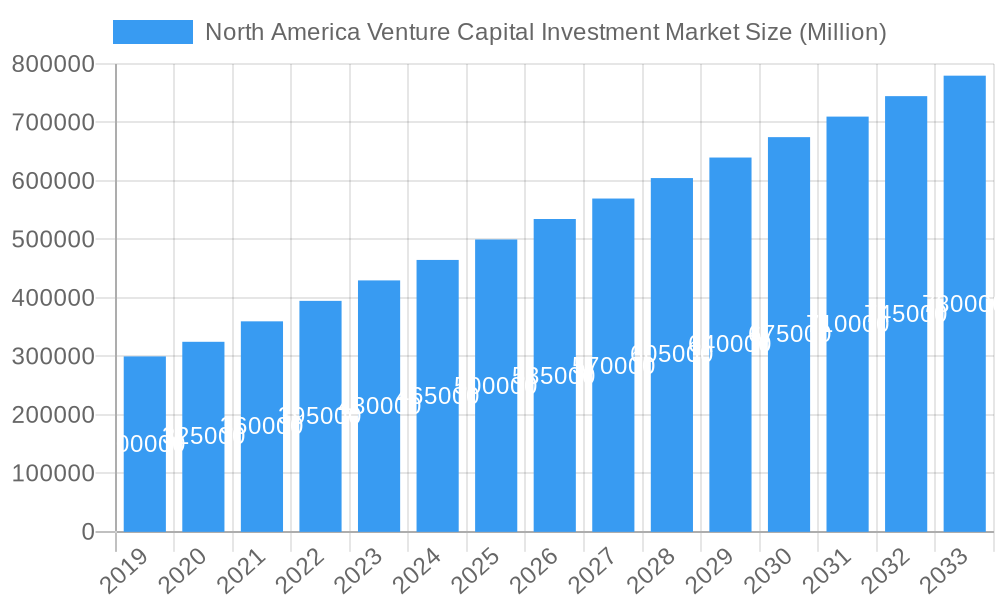

The North America Venture Capital Investment Market is poised for robust expansion, projected to surpass USD 500 billion by 2025 and sustain a Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This significant market size is fueled by a dynamic ecosystem of innovation and a sustained appetite for high-growth potential businesses. Key drivers include the relentless digital transformation across industries, leading to substantial investments in Fintech for streamlined financial services and IT Hardware and Services for critical infrastructure. The burgeoning pharmaceutical and biotech sectors, driven by advancements in medical research and personalized healthcare, are also attracting considerable venture capital. Furthermore, evolving consumer preferences and the demand for sustainable solutions are stimulating investments in the Consumer Goods sector, while a renewed focus on infrastructure and renewable energy sources is bolstering opportunities in the Industrial/Energy segment. The market's growth is characterized by a strategic shift in investment stages, with significant activity observed across Angel/Seed, Early-stage, and Later-stage funding rounds, indicating a mature and supportive investment landscape.

North America Venture Capital Investment Market Market Size (In Billion)

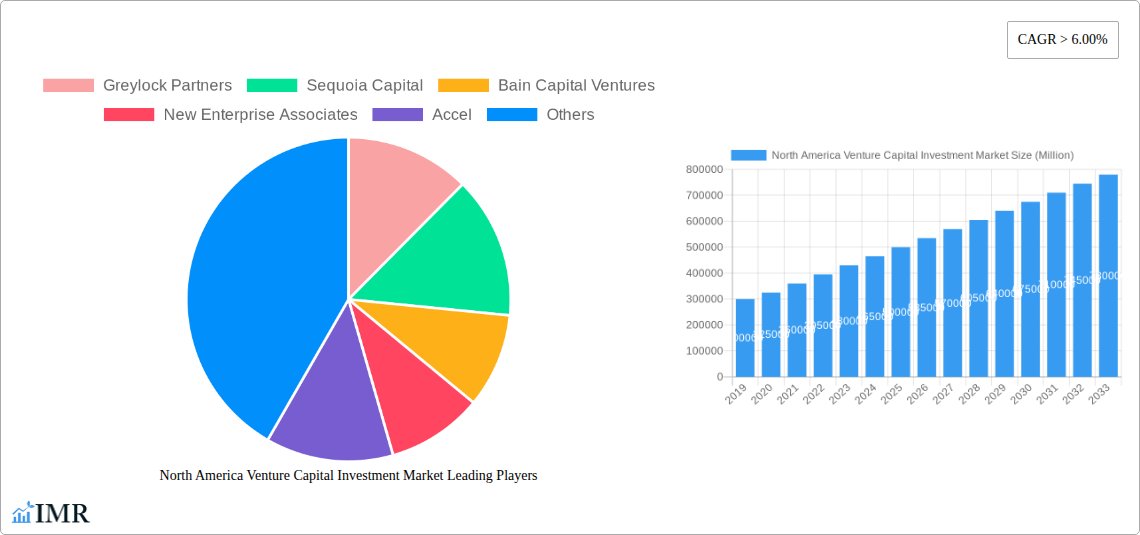

While the market exhibits strong growth trajectories, certain restraints warrant consideration. Increasing regulatory scrutiny in various sectors, particularly Fintech and Pharma, can create hurdles for portfolio companies. Furthermore, intense competition among venture capital firms for attractive deals can lead to higher valuations, potentially impacting future returns. Geopolitical uncertainties and evolving economic conditions also introduce an element of risk. Nevertheless, the unwavering entrepreneurial spirit in North America, coupled with the presence of leading venture capital firms like Greylock Partners, Sequoia Capital, and Bain Capital Ventures, continues to foster innovation and attract significant capital. These firms, along with others such as New Enterprise Associates, Accel, and Khosla Ventures, are instrumental in identifying and nurturing disruptive technologies and business models, ensuring the continued vibrancy and expansion of the North American venture capital landscape. The market's segmentation by industry highlights the diverse opportunities available, from cutting-edge biotech to essential industrial advancements.

North America Venture Capital Investment Market Company Market Share

Here is a compelling, SEO-optimized report description for the North America Venture Capital Investment Market, integrating high-traffic keywords and structured as requested.

Report Title: North America Venture Capital Investment Market: Growth, Trends, and Future Outlook (2019–2033)

Report Description:

Unlock critical insights into the North America Venture Capital Investment Market with this comprehensive report, covering the period from 2019 to 2033, with a base and estimated year of 2025. This in-depth analysis explores the dynamic landscape of venture capital funding across the United States and Canada, focusing on startup funding, venture capital deals, and investment trends. Our report delves into early-stage investing, seed funding, and late-stage investment, examining key industry verticals such as Fintech, Pharma and Biotech, Consumer Goods, Industrial/Energy, and IT Hardware and Services. Discover the strategies of leading venture capital firms like Greylock Partners, Sequoia Capital, Bain Capital Ventures, and New Enterprise Associates. We provide a granular view of market dynamics, growth drivers, emerging opportunities, and competitive landscapes, essential for investors, entrepreneurs, and industry stakeholders seeking to capitalize on the burgeoning North American innovation ecosystem.

North America Venture Capital Investment Market Market Dynamics & Structure

The North America Venture Capital Investment Market exhibits a dynamic and evolving structure, characterized by significant market concentration among a few dominant players while simultaneously fostering a vibrant ecosystem for emerging ventures. Technological innovation remains a paramount driver, with continuous advancements in AI, machine learning, cloud computing, and biotechnology fueling new investment avenues. Regulatory frameworks, though generally supportive of innovation, can present complexities for cross-border investments and specific industry sectors. Competitive product substitutes are less about direct replacements and more about the rapid commoditization of existing technologies, forcing startups to continuously innovate. End-user demographics are increasingly tech-savvy and demand-driven, influencing investment decisions towards solutions addressing evolving consumer needs and pain points. Mergers & Acquisitions (M&A) trends are robust, serving as key exit strategies for venture capitalists and consolidation opportunities for established corporations, further shaping market concentration.

- Market Concentration: A significant portion of venture capital is concentrated within a few leading firms, though a dispersed landscape of smaller and specialized funds exists.

- Technological Innovation Drivers: AI, automation, sustainable technologies, and digital transformation are key areas attracting substantial venture capital.

- Regulatory Frameworks: Evolving data privacy laws (e.g., CCPA), evolving financial regulations, and sector-specific compliance requirements impact investment strategies.

- Competitive Product Substitutes: The speed of technological advancement leads to rapid obsolescence and the emergence of disruptive solutions.

- End-User Demographics: A growing demand for personalized, sustainable, and digitally integrated products and services is shaping investment preferences.

- M&A Trends: High-profile acquisitions by large tech companies and strategic consolidations are prevalent exit strategies, influencing market dynamics and valuations.

North America Venture Capital Investment Market Growth Trends & Insights

The North America Venture Capital Investment Market has witnessed substantial growth and transformation over the historical period (2019–2024) and is projected for continued robust expansion through the forecast period (2025–2033). Market size evolution has been driven by a confluence of factors, including an unprecedented surge in technological innovation, a resilient entrepreneurial spirit, and supportive economic policies. Adoption rates for groundbreaking technologies across sectors like Fintech and Pharma and Biotech have accelerated, creating fertile ground for venture-backed startups. Technological disruptions are not merely incremental but transformative, reshaping entire industries and creating new market opportunities. Consumer behavior shifts, particularly accelerated by global events, have led to a heightened demand for digital solutions, remote work capabilities, and personalized experiences, all of which are key areas of venture capital focus. The market is expected to demonstrate a Compound Annual Growth Rate (CAGR) of approximately xx% between 2025 and 2033, reflecting sustained investor confidence and innovation. Market penetration in emerging technologies is rapidly increasing, with early-stage companies achieving significant traction faster than in previous cycles. The influx of capital, particularly from institutional investors and corporate venture arms, has amplified the funding ecosystem. The base year of 2025 is anticipated to see investment volumes of $XXX,XXX million, a figure expected to grow significantly as we move into the forecast period. The ongoing digitalization of economies, coupled with a strong pipeline of innovative startups, underpins this optimistic outlook, indicating a persistent demand for venture capital to fuel the next wave of technological advancements and market leaders.

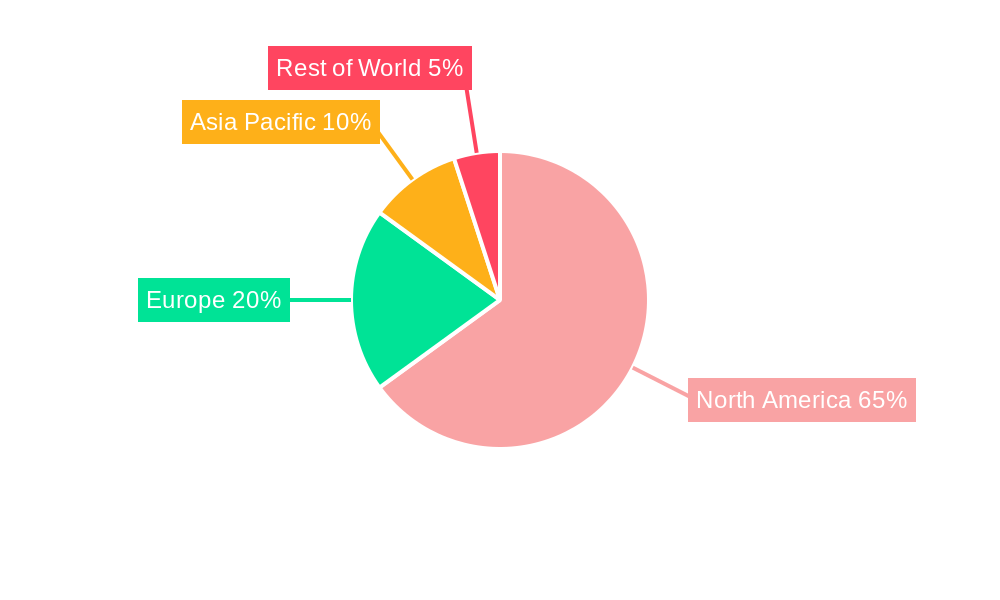

Dominant Regions, Countries, or Segments in North America Venture Capital Investment Market

The North America Venture Capital Investment Market is characterized by the undeniable dominance of the United States, which consistently accounts for the lion's share of venture capital deployment and deal activity. Within the United States, regions like Silicon Valley (California), New York, and increasingly, the Boston/Cambridge tech hub, are epicenters of venture capital investment, drawing a disproportionate amount of capital and talent.

Among the various segments, Fintech and Pharma and Biotech have emerged as exceptionally strong growth drivers.

- Fintech: This segment benefits from ongoing digital transformation in financial services, the rise of neobanks, payment solutions, blockchain technologies, and regulatory technology (RegTech). The demand for efficient, secure, and accessible financial solutions fuels substantial investment, with market share in Fintech venture funding consistently exceeding xx% in recent years. Economic policies encouraging financial innovation and a large consumer base for digital financial services further bolster its dominance.

- Pharma and Biotech: Driven by advancements in genomics, personalized medicine, gene editing, and novel drug discovery, this sector attracts significant capital for its high-impact potential and long-term returns. The aging population, increasing healthcare expenditures, and the persistent need for innovative medical treatments create a continuous demand for venture funding. The robust research infrastructure and presence of leading academic institutions in North America also contribute to its strong performance, with investments in this sector often reaching xx% of total VC funding.

While IT Hardware and Services and Consumer Goods also receive substantial investment, their growth, though steady, is often outpaced by the rapid innovation cycles and massive potential returns seen in Fintech and Pharma/Biotech. The Angel/Seed Investing stage is crucial for nurturing innovation, but Later-stage Investing often sees larger deal sizes, reflecting the maturation of successful companies. The overall growth potential in these dominant segments is projected to remain exceptionally high throughout the forecast period, making them prime areas for venture capital allocation.

North America Venture Capital Investment Market Product Landscape

The product landscape within the North America Venture Capital Investment Market is characterized by a relentless pursuit of innovation and disruption across diverse technological domains. Venture-backed companies are launching cutting-edge solutions ranging from AI-powered software platforms and advanced biotechnological therapeutics to sustainable energy technologies and next-generation consumer electronics. Unique selling propositions often revolve around enhanced efficiency, novel functionalities, data-driven insights, and superior user experiences. Technological advancements are frequently seen in areas such as machine learning algorithms for predictive analytics, CRISPR-based gene editing for therapeutic applications, and novel materials for renewable energy solutions. Performance metrics are rigorously assessed, focusing on scalability, market adoption rates, customer acquisition costs, and tangible impact on end-user industries. The emphasis is on developing products that not only solve existing problems but also anticipate future market needs, thereby securing a competitive edge in a rapidly evolving technological environment.

Key Drivers, Barriers & Challenges in North America Venture Capital Investment Market

Key Drivers:

- Technological Advancements: Breakthroughs in AI, cloud computing, biotechnology, and sustainable technologies create new investment opportunities.

- Robust Startup Ecosystem: A well-established culture of entrepreneurship, coupled with access to skilled talent, fuels innovation.

- Supportive Economic Policies: Government initiatives, R&D tax credits, and favorable regulatory environments encourage investment.

- Increasing Demand for Digital Solutions: The ongoing digital transformation across all sectors drives demand for innovative technologies.

- Institutional Investor Confidence: Growing participation from pension funds, endowments, and sovereign wealth funds provides substantial capital.

Barriers & Challenges:

- Valuation Bubbles and Market Correction: Overvaluation of startups can lead to market corrections and investor caution.

- Regulatory Hurdles: Evolving regulations in sectors like Fintech and Healthcare can create compliance complexities and delays.

- Intense Competition: The high level of investment activity leads to fierce competition for promising startups and deal flow.

- Talent Acquisition and Retention: Securing and retaining top talent remains a significant challenge for many venture-backed companies.

- Geopolitical and Economic Uncertainty: Global economic slowdowns and geopolitical instability can impact investor sentiment and funding availability.

- Supply Chain Disruptions: For hardware-intensive industries, global supply chain issues can hinder production and scalability.

Emerging Opportunities in North America Venture Capital Investment Market

Emerging opportunities in the North America Venture Capital Investment Market are abundant, particularly in nascent and rapidly growing sectors. The increasing focus on sustainability and climate tech presents a vast landscape for investment in renewable energy solutions, carbon capture technologies, and circular economy initiatives. The decentralized finance (DeFi) space continues to evolve, offering potential for innovative blockchain-based financial instruments and platforms. Furthermore, the convergence of healthcare and technology, often termed HealthTech or Digital Health, is a fertile ground for startups developing AI-driven diagnostics, remote patient monitoring systems, and personalized wellness solutions. The expanding creator economy and the need for advanced tools and platforms to support content creation and monetization also represent a significant emerging area. Finally, the growing adoption of the metaverse and related technologies, including AR/VR, is opening up new avenues for investment in virtual experiences, digital assets, and immersive technologies.

Growth Accelerators in the North America Venture Capital Investment Market Industry

Several key catalysts are accelerating long-term growth within the North America Venture Capital Investment Market. Firstly, continuous technological breakthroughs in artificial intelligence, quantum computing, and advanced materials are creating entirely new industries and revolutionizing existing ones, demanding significant venture capital infusion. Secondly, strategic partnerships between venture capital firms, corporations, and academic institutions are fostering a more robust innovation pipeline and facilitating faster market entry for startups. These collaborations often involve co-investment opportunities, accelerator programs, and joint research initiatives. Thirdly, the ongoing market expansion strategies driven by globalization and the digitalization of economies are opening up new territories and customer bases for North American startups, thereby increasing their potential for scale and return on investment. The ability of venture capital to fuel this expansion and tap into emerging global demands is a critical growth accelerator.

Key Players Shaping the North America Venture Capital Investment Market Market

- Greylock Partners

- Sequoia Capital

- Bain Capital Ventures

- New Enterprise Associates

- Accel

- Khosla Ventures

- Real Ventures

- Tiger Global Management

- Matrix Partners

- Index Ventures

Notable Milestones in North America Venture Capital Investment Market Sector

- June 2022: Fund Corporation for the Overseas Development of Japan's ICT and Postal Services Inc. announced an investment in Sony Innovation Fund 3. This new fund targeted venture companies in high-growth sectors, including ICT services such as health tech and fintech. As a limited partner, this investment was expected to support business growth and investment in startups in the United States, Canada, and other countries, signaling international investor confidence and a focus on strategic growth sectors.

- May 2023: AXA Venture Partners, a global venture capital firm, announced the launch of a new strategy with a EUR 1.5 Billion fund. This strategy specifically targets late-stage tech companies and includes plans to bring new talent into its North American team. This move indicates a strong commitment to the North American market and a focus on scaling established, high-growth technology companies, further solidifying the market's attractiveness for late-stage funding.

In-Depth North America Venture Capital Investment Market Market Outlook

The future market potential of the North America Venture Capital Investment Market is exceptionally promising, driven by a confluence of accelerating forces. Continued advancements in AI, biotechnology, and sustainable technologies will create new investment frontiers and fuel the growth of disruptive startups. The increasing integration of technology across all industries, from traditional manufacturing to personalized healthcare, will sustain a robust demand for venture capital. Strategic partnerships between venture capital firms and established corporations will accelerate market entry and scalability for innovative companies. Furthermore, the growing appetite for impact investing, which prioritizes both financial returns and positive societal outcomes, will open new avenues for capital deployment in areas like climate tech and social enterprises. The robust pipeline of entrepreneurial talent and the continued influx of institutional capital position North America to remain the global leader in venture capital investment, fostering innovation and driving economic growth for years to come.

North America Venture Capital Investment Market Segmentation

-

1. Stage of Investment

- 1.1. Angel/Seed Investing

- 1.2. Early-stage Investing

- 1.3. Later-stage Investing

-

2. Industry

- 2.1. Fintech

- 2.2. Pharma and Biotech

- 2.3. Consumer Goods

- 2.4. Industrial/Energy

- 2.5. IT Hardware and Services

- 2.6. Other Industries

North America Venture Capital Investment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Venture Capital Investment Market Regional Market Share

Geographic Coverage of North America Venture Capital Investment Market

North America Venture Capital Investment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investment in Fintech and Life Science Industry; Rising Number of Unicorns In North America

- 3.3. Market Restrains

- 3.3.1. Rising Risk in Market with Global Economic Uncertainity; Majority of Growth limited in ICT and Life Science segment

- 3.4. Market Trends

- 3.4.1. Canada Increasing Venture Capital Scenario is Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Venture Capital Investment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Stage of Investment

- 5.1.1. Angel/Seed Investing

- 5.1.2. Early-stage Investing

- 5.1.3. Later-stage Investing

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Fintech

- 5.2.2. Pharma and Biotech

- 5.2.3. Consumer Goods

- 5.2.4. Industrial/Energy

- 5.2.5. IT Hardware and Services

- 5.2.6. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Stage of Investment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Greylock Partners

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sequoia Capital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bain Capital Ventures

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 New Enterprise Associates

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Khosla Ventures

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Real Ventures

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tiger Global Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Matrix Partners

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Index Ventures

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Greylock Partners

List of Figures

- Figure 1: North America Venture Capital Investment Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Venture Capital Investment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Venture Capital Investment Market Revenue undefined Forecast, by Stage of Investment 2020 & 2033

- Table 2: North America Venture Capital Investment Market Revenue undefined Forecast, by Industry 2020 & 2033

- Table 3: North America Venture Capital Investment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Venture Capital Investment Market Revenue undefined Forecast, by Stage of Investment 2020 & 2033

- Table 5: North America Venture Capital Investment Market Revenue undefined Forecast, by Industry 2020 & 2033

- Table 6: North America Venture Capital Investment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Venture Capital Investment Market?

The projected CAGR is approximately 20.3%.

2. Which companies are prominent players in the North America Venture Capital Investment Market?

Key companies in the market include Greylock Partners, Sequoia Capital, Bain Capital Ventures, New Enterprise Associates, Accel, Khosla Ventures, Real Ventures, Tiger Global Management, Matrix Partners, Index Ventures.

3. What are the main segments of the North America Venture Capital Investment Market?

The market segments include Stage of Investment, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Investment in Fintech and Life Science Industry; Rising Number of Unicorns In North America.

6. What are the notable trends driving market growth?

Canada Increasing Venture Capital Scenario is Fueling the Market.

7. Are there any restraints impacting market growth?

Rising Risk in Market with Global Economic Uncertainity; Majority of Growth limited in ICT and Life Science segment.

8. Can you provide examples of recent developments in the market?

June 2022: Fund Corporation for the Overseas Development of Japan's ICT and Postal Services Inc. announced an investment in Sony Innovation Fund 3, which was a new investment fund targeting venture companies in industry sectors with high growth potential, including ICT services such as health tech and fintech, as a limited partner. This fund was expected to support business growth and Investment in Startups in the United States, Canada, and other countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Venture Capital Investment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Venture Capital Investment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Venture Capital Investment Market?

To stay informed about further developments, trends, and reports in the North America Venture Capital Investment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence