Key Insights

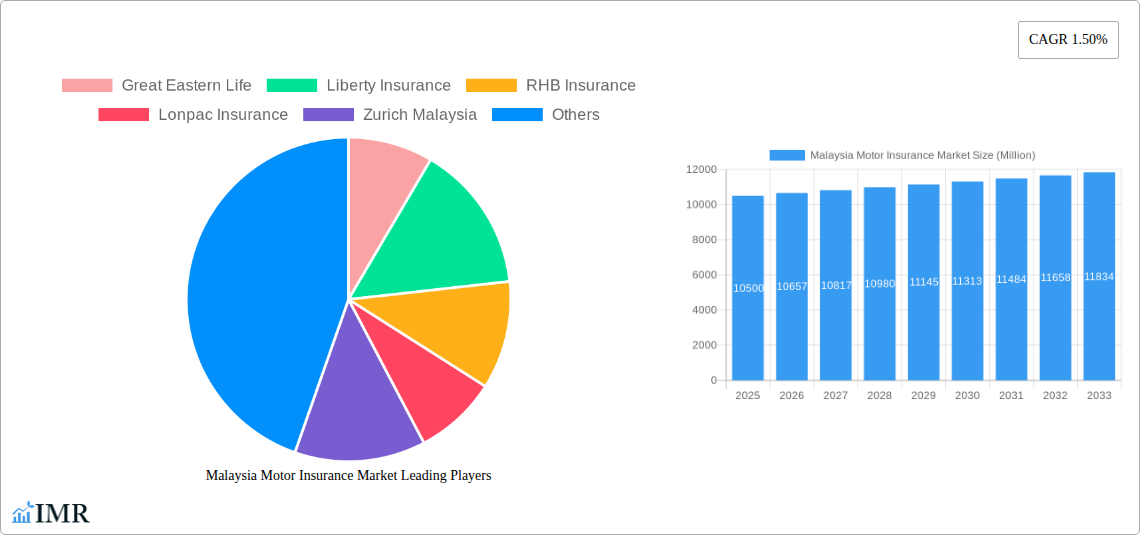

The Malaysian motor insurance market is projected for robust growth, driven by rising vehicle ownership and an expanding middle class. With an estimated market size of MYR 10.5 billion in 2025, the sector anticipates a Compound Annual Growth Rate (CAGR) of 2.2% from 2024 to 2033. Key growth drivers include an increasing vehicle fleet for both personal and commercial use, and a rising demand for comprehensive insurance policies offering extensive coverage. Digital platforms are also reshaping distribution, complementing traditional agent and broker networks. Mandatory third-party liability insurance ensures consistent market demand.

Malaysia Motor Insurance Market Market Size (In Billion)

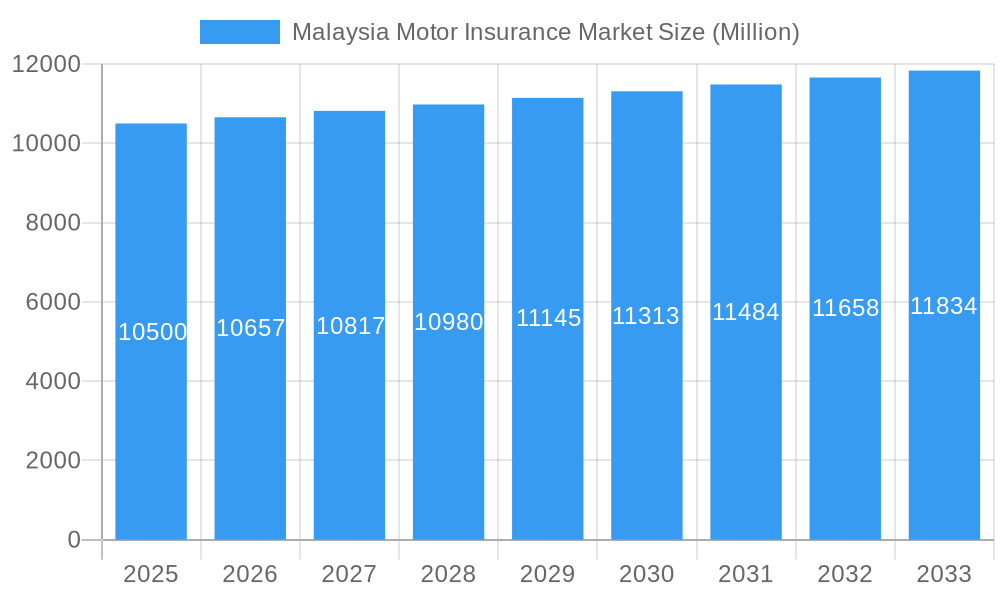

Potential growth constraints include increasing vehicle lifespan and escalating repair costs, which may encourage a shift towards basic coverage. Intensified competition, especially from digital-first insurers, could impact premium pricing. However, strategic expansion of distribution channels, including financial institution partnerships and leveraging existing agent networks, is expected to offset these challenges. Leading insurers such as Great Eastern Life, Liberty Insurance, RHB Insurance, Lonpac Insurance, Zurich Malaysia, Pacific Orient, MSIG Malaysia, Takaful IKLHAS, Takaful Malaysia, and Allianz are focused on product innovation and enhanced customer engagement to secure market share in the essential Malaysian motor insurance sector.

Malaysia Motor Insurance Market Company Market Share

This report delivers an in-depth analysis of the Malaysia Motor Insurance Market, a dynamic sector anticipating significant expansion. We meticulously examine car insurance Malaysia, vehicle insurance Malaysia, and motor takaful Malaysia, providing critical insights for industry stakeholders. Our comprehensive research covers the base year (2024), with projections extending through the forecast period (2025-2033). Expect detailed breakdowns of motor insurance companies Malaysia, including Great Eastern Life, Liberty Insurance, RHB Insurance, Lonpac Insurance, Zurich Malaysia, Pacific Orient, MSIG Insurance, Takaful IKLHAS, Takaful Malaysia, and Allianz. Market segmentation includes Insurance Type (Third Party Liability, Comprehensive) and Distribution Channel (Agents, Brokers, Banks, Online, Other).

Malaysia Motor Insurance Market Dynamics & Structure

The Malaysia Motor Insurance Market exhibits a moderately concentrated structure, with key players like MSIG Malaysia and Great Eastern Life holding significant market share. Technological innovation, particularly in areas like telematics and AI-driven claims processing, is a major driver of change, enhancing operational efficiency and customer experience. The regulatory framework, overseen by Bank Negara Malaysia, plays a crucial role in ensuring market stability and consumer protection. Competitive product substitutes include various riders and add-ons offered by insurers, catering to diverse customer needs. End-user demographics are shifting, with a growing young, tech-savvy population influencing demand for digital distribution channels and personalized insurance products. Mergers and Acquisitions (M&A) activity has been moderate, primarily focused on consolidating market presence and expanding product portfolios.

- Market Concentration: Dominance by a few large insurers with increasing competition from digital-first entities.

- Technological Innovation: Telematics adoption, AI in claims, and online policy management are key growth enablers.

- Regulatory Landscape: Strict regulations by Bank Negara Malaysia ensuring solvency and fair practices.

- Product Substitutes: Expanding range of add-ons and customizable policy features.

- End-User Demographics: Growing influence of younger, digitally inclined consumers.

- M&A Trends: Strategic acquisitions aimed at market consolidation and expanding service offerings.

Malaysia Motor Insurance Market Growth Trends & Insights

The Malaysia Motor Insurance Market is projected to witness robust growth, driven by increasing vehicle ownership and a rising awareness of the necessity of insurance protection. Our analysis, powered by extensive data and forecasting models, indicates a steady evolution in market size, with Comprehensive coverage segments likely to outpace Third Party Liability due to a greater perceived value by consumers. The adoption rates of digital platforms for purchasing and managing policies are on a significant upward trajectory, reflecting changing consumer behavior. Technological disruptions, such as the integration of IoT devices for proactive risk assessment and usage-based insurance models, are poised to reshape the market. Consumer behavior shifts towards seeking convenience, transparency, and personalized offerings will continue to be a dominant force. The market penetration of motor insurance in Malaysia is expected to deepen as economic conditions improve and more individuals recognize the financial security provided by adequate coverage.

Dominant Regions, Countries, or Segments in Malaysia Motor Insurance Market

Within the Malaysia Motor Insurance Market, the Comprehensive insurance segment stands out as the primary driver of market growth. This dominance is fueled by a growing consumer understanding of the broader protection offered, extending beyond basic liability. Economically vibrant regions, particularly in Peninsular Malaysia such as Selangor and the Federal Territory of Kuala Lumpur, exhibit higher adoption rates due to greater disposable incomes and a higher density of vehicle ownership. The increasing prevalence of sophisticated vehicles also contributes to the demand for more extensive coverage. The Online distribution channel is rapidly gaining prominence, mirroring the broader digital transformation in Malaysia. This channel offers unparalleled convenience and competitive pricing, attracting a significant portion of new policy purchases.

- Insurance Type Dominance: Comprehensive insurance leads due to enhanced protection perception and increasing vehicle complexity.

- Key Drivers: Rising vehicle values, demand for broader risk mitigation.

- Distribution Channel Growth: Online channels are surging, driven by convenience and accessibility.

- Key Drivers: Digital adoption, competitive pricing, user-friendly platforms.

- Regional Concentration: Major urban centers in Peninsular Malaysia show higher penetration and premium volumes.

- Key Drivers: Higher vehicle density, stronger economic activity, increased consumer awareness.

Malaysia Motor Insurance Market Product Landscape

The product landscape within the Malaysia Motor Insurance Market is characterized by continuous innovation aimed at meeting evolving consumer demands. Beyond traditional Third Party Liability and Comprehensive policies, insurers are increasingly offering specialized add-ons such as flood cover, strike and riot cover, and roadside assistance. The integration of telematics technology is enabling the development of usage-based insurance (UBI) products, where premiums are determined by driving behavior, promoting safer driving practices. Performance metrics are being redefined through quicker claims processing powered by AI and advanced data analytics, leading to enhanced customer satisfaction. Unique selling propositions often revolve around competitive pricing, extensive repair networks, and superior customer service. Technological advancements are focused on digital platforms for seamless policy management and claims submission.

Key Drivers, Barriers & Challenges in Malaysia Motor Insurance Market

Key Drivers:

- Increasing Vehicle Ownership: A growing national fleet directly correlates with a larger potential customer base for motor insurance.

- Rising Consumer Awareness: Greater understanding of financial protection against unforeseen accidents and vehicle damage.

- Technological Advancements: Telematics and digital platforms are enhancing efficiency and customer experience, driving adoption.

- Government Initiatives: Road safety campaigns and potential for mandatory digital reporting to boost insurance uptake.

Barriers & Challenges:

- Price Sensitivity: Consumers often seek the cheapest available coverage, creating pricing pressure on insurers.

- Fraudulent Claims: The prevalence of fraudulent activities can inflate premiums and impact profitability.

- Regulatory Hurdles: Evolving regulations require continuous adaptation and investment in compliance.

- Intense Competition: A crowded market with numerous players vying for market share.

- Economic Downturns: Economic instability can reduce disposable income, impacting new policy purchases and renewals.

Emerging Opportunities in Malaysia Motor Insurance Market

Emerging opportunities within the Malaysia Motor Insurance Market lie in the expansion of digital ecosystems and the personalization of insurance products. The increasing adoption of Electric Vehicles (EVs) presents a nascent but significant opportunity for specialized EV insurance policies, catering to unique battery warranty and charging infrastructure risks. Furthermore, the growing gig economy and the rise of ride-sharing services create a demand for flexible, on-demand motor insurance solutions. Insurers can leverage data analytics to develop highly personalized product offerings, addressing specific driver profiles and risk appetites. Partnerships with automotive manufacturers and technology providers for integrated insurance solutions at the point of sale also represent a key growth avenue.

Growth Accelerators in the Malaysia Motor Insurance Market Industry

Several key factors are accelerating growth in the Malaysia Motor Insurance Market. The continued push towards digitalization by insurers, offering seamless online purchase and claims processes, is a major catalyst. Strategic partnerships between insurance companies and automotive manufacturers are creating bundled offerings, making insurance more accessible at the point of vehicle purchase. Furthermore, the increasing demand for add-on features and broader coverage options, driven by greater consumer awareness and the rising complexity of vehicles, is expanding the market. Government initiatives promoting road safety and digital transformation also contribute to a favorable growth environment for the industry.

Key Players Shaping the Malaysia Motor Insurance Market Market

- Great Eastern Life

- Liberty Insurance

- RHB Insurance

- Lonpac Insurance

- Zurich Malaysia

- Pacific Orient

- MSIG Malaysia

- Takaful IKLHAS

- Takaful Malaysia

- Allianz

Notable Milestones in Malaysia Motor Insurance Market Sector

- 2022: The General Insurance Association of Malaysia (PIAM) and Malaysian Takaful Association (MTA) launched the year-long PIAM-MTA 2022 nationwide Road Safety Campaign in Kuala Lumpur.

- 2022: Etiqa General Insurance Bhd and Syarikat Takaful Malaysia Am Bhd (Takaful Malaysia) emerged as winners at the Motor Insurance and Takaful Award 2021/22, recognizing top companies in the sector.

In-Depth Malaysia Motor Insurance Market Market Outlook

The Malaysia Motor Insurance Market is poised for sustained growth, driven by a confluence of increasing vehicle parc, evolving consumer preferences for digital convenience, and a maturing awareness of the importance of comprehensive coverage. Key growth accelerators include the continued innovation in product offerings, such as usage-based insurance and specialized EV policies, and strategic collaborations between insurers and automotive players. The digital distribution channel is expected to further consolidate its position, offering seamless customer journeys. Emerging opportunities in tailored insurance for the gig economy and the proactive use of data analytics for personalized risk assessment will also shape future market expansion. The overall outlook remains highly positive, indicating a dynamic and expanding landscape for motor insurance providers and consumers alike.

Malaysia Motor Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Third Party Liability

- 1.2. Comprehensive

-

2. Distribution channel

- 2.1. Agents

- 2.2. Brokers

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Malaysia Motor Insurance Market Segmentation By Geography

- 1. Malaysia

Malaysia Motor Insurance Market Regional Market Share

Geographic Coverage of Malaysia Motor Insurance Market

Malaysia Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Motor Vehicles In The Region; Increasing competition among the players decreasing insurance price.

- 3.3. Market Restrains

- 3.3.1. Fluctuating Inflation Rate affecting sales of Motor vehicle; Negative Impact of Covid On per capita Income in Malaysia

- 3.4. Market Trends

- 3.4.1. Phase Liberalization Of The Industry And New Insurance Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Third Party Liability

- 5.1.2. Comprehensive

- 5.2. Market Analysis, Insights and Forecast - by Distribution channel

- 5.2.1. Agents

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Great Eastern Life

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liberty Insurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RHB Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lonpac Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zurich Malaysia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pacific Orient

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MSIG Malaysia**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takaful IKLHAS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Takaful Malaysia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Allianz

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Great Eastern Life

List of Figures

- Figure 1: Malaysia Motor Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Malaysia Motor Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Motor Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 2: Malaysia Motor Insurance Market Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 3: Malaysia Motor Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Malaysia Motor Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 5: Malaysia Motor Insurance Market Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 6: Malaysia Motor Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Motor Insurance Market?

The projected CAGR is approximately 2.2%.

2. Which companies are prominent players in the Malaysia Motor Insurance Market?

Key companies in the market include Great Eastern Life, Liberty Insurance, RHB Insurance, Lonpac Insurance, Zurich Malaysia, Pacific Orient, MSIG Malaysia**List Not Exhaustive, Takaful IKLHAS, Takaful Malaysia, Allianz.

3. What are the main segments of the Malaysia Motor Insurance Market?

The market segments include Insurance Type, Distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Motor Vehicles In The Region; Increasing competition among the players decreasing insurance price..

6. What are the notable trends driving market growth?

Phase Liberalization Of The Industry And New Insurance Products.

7. Are there any restraints impacting market growth?

Fluctuating Inflation Rate affecting sales of Motor vehicle; Negative Impact of Covid On per capita Income in Malaysia.

8. Can you provide examples of recent developments in the market?

In 2022, the General Insurance Association of Malaysia(PIAM) and Malaysian Takaful Association(MTA) launched the year-long PIAM-MTA 2022 nationwide Road Safety Campaign in Kuala Lumpur.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Motor Insurance Market?

To stay informed about further developments, trends, and reports in the Malaysia Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence