Key Insights

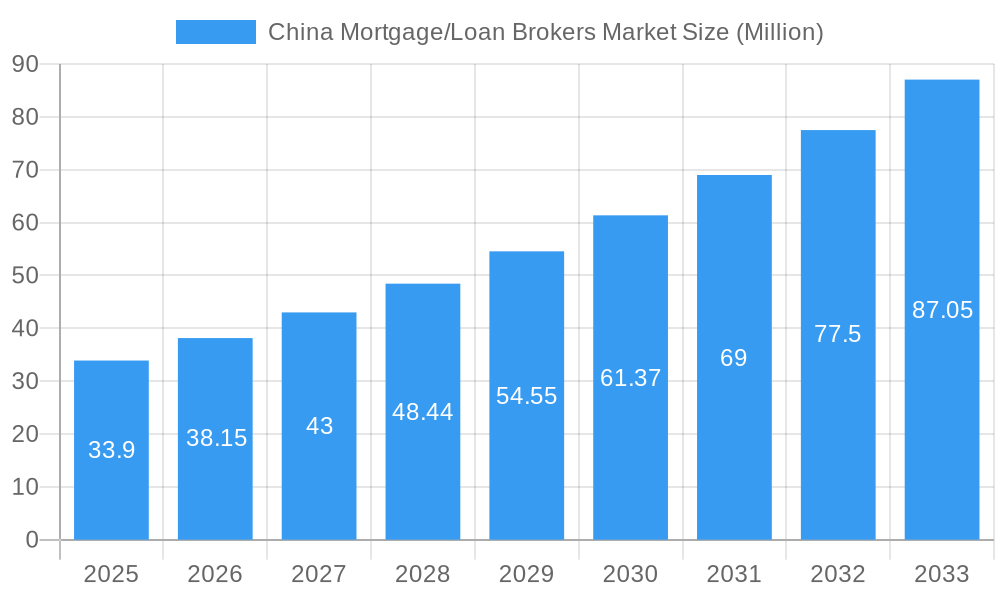

The China mortgage and loan broker market is poised for substantial expansion, projected to reach a valuation of USD 33.90 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.56%. This robust growth is primarily propelled by an escalating demand for homeownership, a burgeoning middle class with increased disposable income, and supportive government initiatives aimed at stimulating the real estate sector. The market is characterized by a diverse range of mortgage loan types, including conventional, jumbo, and government-insured loans, catering to varied borrower profiles. Furthermore, the prevalence of 30-year mortgages remains a dominant trend, offering long-term affordability, while the interplay between fixed-rate and adjustable-rate options provides flexibility for consumers. Primary mortgage lenders are expected to lead the provider segment, facilitating a significant volume of transactions, alongside the integral role played by secondary mortgage lenders in the market's liquidity and development.

China Mortgage/Loan Brokers Market Market Size (In Million)

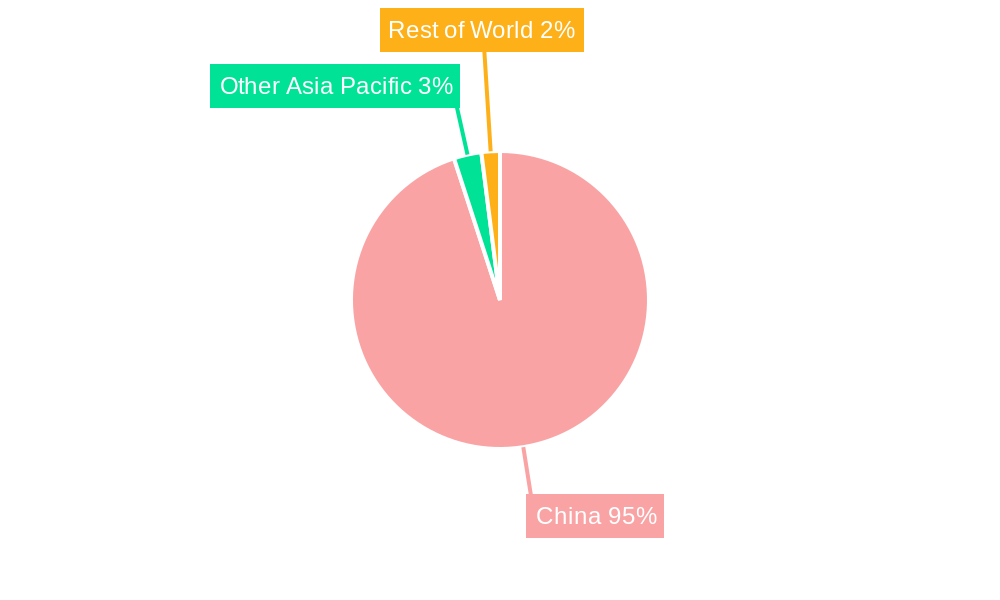

Navigating this dynamic landscape presents both opportunities and challenges. While the sheer volume of transactions and the consistent demand for housing fuel market expansion, potential restraints may emerge from evolving regulatory frameworks, fluctuating interest rate environments, and the increasing digital transformation of financial services, which could alter traditional broker roles. The market's geographic focus is significantly concentrated within China, underscoring its immense potential as a singular, high-growth region. Key players like Mitsubishi UFJ Financial Group, Mizuho Financial Group, and Bank of China are actively involved, shaping the competitive dynamics and service offerings. The increasing sophistication of financial products and the growing consumer reliance on expert advice for complex mortgage decisions will likely solidify the importance of skilled loan brokers in the foreseeable future, ensuring continued market relevance and growth.

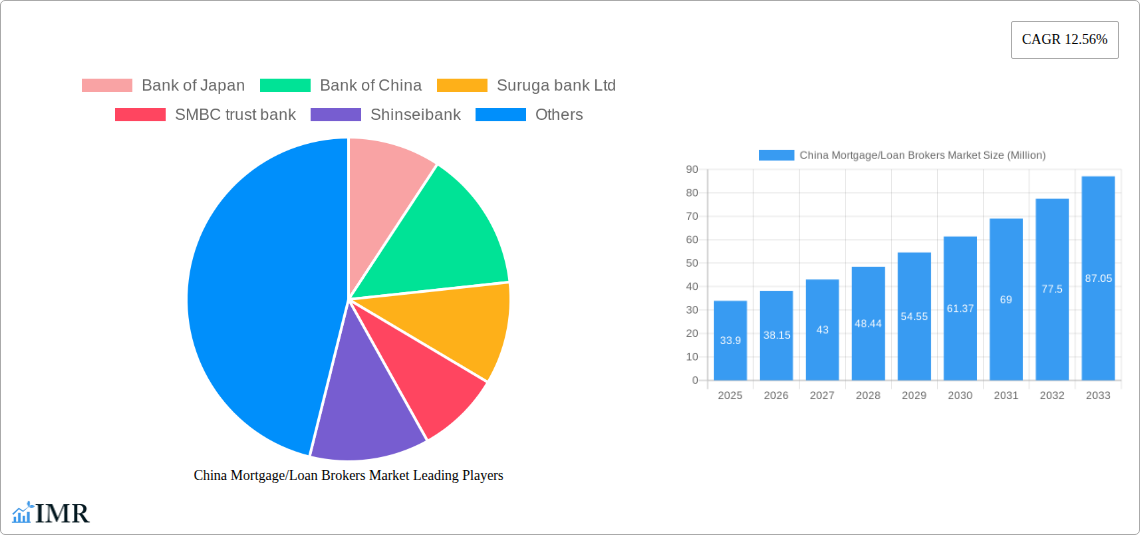

China Mortgage/Loan Brokers Market Company Market Share

Unlocking China's Housing Finance Future: A Comprehensive Report on the Mortgage/Loan Brokers Market

This in-depth report provides a strategic analysis of the China Mortgage/Loan Brokers Market, a vital component of the nation's burgeoning real estate and financial sectors. Explore market dynamics, growth trends, regional dominance, product innovations, key players, and future opportunities. This report is meticulously designed for industry professionals, investors, and policymakers seeking to navigate the complexities and capitalize on the immense potential of China's mortgage and loan brokerage landscape. Values are presented in Million units.

China Mortgage/Loan Brokers Market Market Dynamics & Structure

The China Mortgage/Loan Brokers Market is characterized by a dynamic interplay of technological advancements, evolving regulatory landscapes, and shifting consumer demographics. Market concentration varies across different segments, with primary lenders holding a significant share, but the role of secondary lenders and specialized brokers is expanding. Technological innovation, particularly in digital platforms and AI-driven underwriting, is a key driver, reducing operational costs and enhancing customer experience. However, regulatory frameworks, including evolving mortgage policies and data privacy laws, pose both opportunities and challenges for market participants. Competitive product substitutes, such as direct bank lending and peer-to-peer financing, exert continuous pressure, necessitating constant adaptation and differentiation. End-user demographics are shifting, with an increasing demand for flexible loan terms and personalized financial solutions, driven by a growing middle class and urbanization trends. Merger and acquisition (M&A) activities are anticipated to increase as larger entities seek to consolidate market share and acquire technological capabilities.

- Market Concentration: Dominated by primary mortgage lenders, with increasing participation from specialized brokers and secondary lenders.

- Technological Innovation: Driven by digital lending platforms, AI for credit assessment, and blockchain for transaction security.

- Regulatory Frameworks: Influenced by government policies on property markets, interest rates, and financial inclusion.

- Competitive Product Substitutes: Direct bank loans, alternative financing, and fintech solutions.

- End-User Demographics: Influenced by urbanization, rising incomes, and evolving housing needs.

- M&A Trends: Expected to see consolidation as companies seek scale and technological integration.

China Mortgage/Loan Brokers Market Growth Trends & Insights

The China Mortgage/Loan Brokers Market is poised for robust expansion, projected to grow at a significant Compound Annual Growth Rate (CAGR) from 2025 to 2033. This growth will be propelled by sustained urbanization, a growing middle class with increasing disposable income, and supportive government policies aimed at stimulating the housing market. The adoption rate of digital mortgage solutions is escalating, with consumers embracing online platforms for loan applications, comparisons, and pre-approvals. Technological disruptions, such as the integration of big data analytics and machine learning in credit scoring, are enhancing efficiency and risk management for lenders and brokers alike. Consumer behavior is shifting towards greater transparency and convenience, with a preference for services that offer a streamlined and personalized mortgage experience. The market penetration of mortgage brokerage services is expected to deepen as awareness grows and trust in these intermediaries increases.

The evolution of the China Mortgage/Loan Brokers Market is intricately linked to the broader economic landscape and governmental directives. The forecast period (2025–2033) anticipates a sustained upward trajectory, fueled by factors such as increased disposable incomes, a rising demand for homeownership, and supportive government initiatives designed to stabilize and invigorate the real estate sector. Market size is projected to expand significantly, driven by both an increase in the volume of mortgage originations and a greater reliance on specialized brokerage services to navigate complex loan offerings.

Technological disruptions are playing a pivotal role in reshaping the market. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into loan application processing, credit assessment, and risk evaluation is becoming commonplace. These technologies not only expedite the approval process but also enhance accuracy and reduce operational costs for mortgage lenders and brokers. Furthermore, the proliferation of online mortgage platforms and mobile applications is transforming consumer behavior, enabling borrowers to compare rates, access information, and initiate applications with unprecedented ease and convenience.

Consumer behavior shifts are marked by a growing demand for personalized financial advice and a desire for efficient, transparent, and convenient mortgage solutions. The younger demographic, in particular, is more inclined to leverage digital tools and seek out brokers who can offer tailored guidance and a seamless experience. This trend is creating opportunities for fintech-driven brokerage firms and established players that can adapt their services to meet these evolving expectations. Market penetration of mortgage brokerage services is expected to increase as more consumers recognize the value proposition of expert guidance in navigating the complexities of the mortgage landscape.

The base year of 2025 serves as a critical juncture, with the China Mortgage/Loan Brokers Market demonstrating strong momentum. Over the historical period (2019–2024), the market witnessed steady growth, punctuated by periods of regulatory adjustments and economic fluctuations. The estimated market size for 2025 reflects this ongoing expansion, with projections indicating continued acceleration in the subsequent years.

Key metrics to watch include the CAGR of the market, which is expected to remain robust throughout the forecast period. Market penetration rates will also be crucial indicators of the growing reliance on mortgage brokers. Technological adoption rates, particularly for digital tools and AI-powered solutions, will highlight the industry's commitment to innovation and efficiency. Finally, consumer satisfaction scores related to mortgage acquisition processes will provide valuable insights into the effectiveness of brokerage services and the overall health of the market.

Dominant Regions, Countries, or Segments in China Mortgage/Loan Brokers Market

The China Mortgage/Loan Brokers Market is experiencing significant growth driven by several key segments and regions. Among the Type of Mortgage Loan, Conventional Mortgage Loans are anticipated to continue dominating the market, owing to their widespread applicability for a vast majority of homebuyers. However, the growth of Jumbo Loans is also noteworthy, reflecting the increasing number of high-net-worth individuals and the expansion of premium housing markets in major metropolitan areas. Government-insured Mortgage Loans play a crucial role in promoting housing affordability and accessibility, particularly for first-time homebuyers and lower-income segments, thereby contributing consistently to market volume.

In terms of Mortgage Loan Terms, the 30-year Mortgage remains the most popular choice due to its affordability and lower monthly payments, making homeownership accessible to a broader population. The 20-year Mortgage is also gaining traction as borrowers seek to reduce their long-term interest payments while maintaining manageable monthly installments. The 15-year Mortgage appeals to financially stable borrowers who wish to pay off their loans faster and build equity more rapidly.

The Interest Rate landscape sees a dynamic interplay between Fixed-Rate and Adjustable-Rate mortgages. Fixed-rate mortgages are generally preferred for their predictability and stability, particularly in an environment of potential interest rate fluctuations. Adjustable-rate mortgages, while offering potentially lower initial rates, are chosen by borrowers who anticipate interest rate decreases or plan to sell their property before the rate adjusts significantly.

The Provider segment is primarily driven by Primary Mortgage Lenders, such as banks and credit unions, who directly originate and service loans. However, the role of Secondary Mortgage Lenders and specialized mortgage brokers is expanding, providing liquidity and offering diverse financing options.

Geographically, major economic hubs like Shanghai, Beijing, Shenzhen, and Guangzhou are expected to remain the dominant regions, driven by their strong economies, high population density, and substantial real estate markets. These cities often lead in the adoption of innovative mortgage products and services. The growth potential in Tier 2 and Tier 3 cities is also significant, as urbanization continues and housing demand expands into these areas.

Key drivers for market growth in these dominant regions and segments include robust economic policies that support homeownership, ongoing infrastructure development that enhances property values, and a growing middle class with increasing purchasing power. Government initiatives aimed at stimulating the real estate market and promoting financial inclusion also play a critical role. The market share of conventional mortgage loans is substantial, estimated to be around 60-70% of the total mortgage market, while jumbo loans contribute around 15-20%. Government-insured loans account for approximately 10-15%, with other loan types making up the remainder. The 30-year mortgage term typically holds over 50% of the market share for new originations.

China Mortgage/Loan Brokers Market Product Landscape

The China Mortgage/Loan Brokers Market is witnessing a surge in product innovation focused on enhancing customer experience and operational efficiency. Leading companies are developing advanced digital platforms that offer end-to-end loan application processing, from initial inquiry to final disbursement. These platforms integrate AI-powered tools for credit assessment, document verification, and personalized loan recommendations, significantly reducing processing times and improving accuracy. Unique selling propositions include speed, transparency, and personalized service, catering to the evolving demands of tech-savvy consumers. Technological advancements are also enabling the offering of a wider range of mortgage products, including green mortgages for energy-efficient homes and flexible repayment options tailored to individual financial circumstances. The performance metrics being optimized include loan approval rates, processing turnaround times, and customer satisfaction scores.

Key Drivers, Barriers & Challenges in China Mortgage/Loan Brokers Market

Key Drivers:

The China Mortgage/Loan Brokers Market is propelled by several powerful forces. Economic growth and rising disposable incomes are fundamental, empowering more individuals to pursue homeownership. Government policies supporting the real estate sector and financial inclusion initiatives create a favorable environment for mortgage origination and brokerage. Technological advancements, particularly in digital lending platforms and AI-driven analytics, are enhancing efficiency, reducing costs, and improving customer experience, making the mortgage process more accessible and transparent. The increasing urbanization rate continues to fuel demand for housing in urban centers, thereby driving the need for mortgage financing.

Barriers & Challenges:

Despite the growth, the market faces significant challenges. Stringent regulatory frameworks and evolving compliance requirements can create hurdles for new entrants and necessitate continuous adaptation from existing players. High competition from established banks and a growing number of fintech startups puts pressure on margins and requires constant innovation. Supply chain issues, although less pronounced in services, can indirectly impact the market through delays in property registration or valuation processes. Economic downturns or fluctuations in the property market can lead to decreased demand for mortgages and increased default risks. For instance, a sudden increase in interest rates could dampen borrowing enthusiasm, impacting loan volumes by an estimated 5-10% in a given quarter. Furthermore, consumer trust and awareness regarding the services of independent mortgage brokers are still developing, requiring significant effort in education and relationship building.

Emerging Opportunities in China Mortgage/Loan Brokers Market

Emerging opportunities in the China Mortgage/Loan Brokers Market lie in several key areas. The increasing demand for specialized mortgage products, such as those for first-time homebuyers, self-employed individuals, or those seeking investment properties, presents a significant growth avenue. The digitalization of the mortgage process continues to evolve, with opportunities in developing more sophisticated AI-driven advisory tools and blockchain-based platforms for enhanced security and transparency. Untapped markets in lower-tier cities and rural areas offer substantial potential as urbanization spreads and economic development increases disposable incomes. Evolving consumer preferences for green and sustainable housing are creating demand for mortgage products that support eco-friendly properties, presenting a niche but growing market. The integration of financial technology (fintech) solutions into brokerage services, offering a more holistic financial planning approach, is another promising area.

Growth Accelerators in the China Mortgage/Loan Brokers Market Industry

Several catalysts are accelerating the long-term growth of the China Mortgage/Loan Brokers Market. Technological breakthroughs in AI, big data analytics, and cloud computing are fundamentally reshaping how mortgages are originated, underwritten, and serviced, leading to greater efficiency and personalized offerings. Strategic partnerships between mortgage brokers, fintech companies, and traditional financial institutions are creating synergistic ecosystems that expand market reach and enhance service capabilities. Market expansion strategies, including focusing on underserved demographics and geographical regions, are unlocking new customer segments. Furthermore, a continued emphasis on regulatory reforms that promote transparency and consumer protection will foster greater trust and encourage wider adoption of brokerage services. The development of innovative financial products that cater to diverse borrower needs will also act as a significant growth accelerator.

Key Players Shaping the China Mortgage/Loan Brokers Market Market

- Bank of Japan

- Bank of China

- Suruga bank Ltd

- SMBC trust bank

- Shinseibank

- United Overseas Bank

- Overseas Chinese Banking Corp

- Sumitomo Mitsui Financial Group

- Mitsubishi UFJ Financial Group

- Mizuho Financial Group

Notable Milestones in China Mortgage/Loan Brokers Market Sector

- September 2023: The Agricultural Bank of China (ABC) launched a global matchmaking platform during the Belt and Road Agricultural Cooperation and Development Forum in Beijing, indicating an expansion into international agricultural finance and potentially cross-border mortgage opportunities.

- June 2023: HSBC Bank (China) Company Limited acquired Citi’s retail wealth management portfolio in mainland China, signaling a strategic move to enhance its presence in the Chinese financial services market, which could include increased focus on mortgage and lending services.

In-Depth China Mortgage/Loan Brokers Market Market Outlook

The China Mortgage/Loan Brokers Market is set for a period of sustained and dynamic growth, driven by a confluence of supportive economic conditions, evolving consumer behavior, and rapid technological integration. Growth accelerators, including advancements in AI for personalized loan assessments and the increasing adoption of digital platforms, will continue to enhance efficiency and accessibility for borrowers. Strategic partnerships between traditional lenders and innovative fintech firms are expected to create more comprehensive financial solutions. Furthermore, the market's outlook is bolstered by ongoing government support for the housing sector and initiatives promoting financial inclusion, which will continue to expand the customer base for mortgage services. Emerging opportunities in niche markets, such as green mortgages and lending for underserved demographics, will further diversify revenue streams and foster innovation, positioning the market for significant expansion and transformation in the coming years.

China Mortgage/Loan Brokers Market Segmentation

-

1. Type of Mortgage Loan

- 1.1. Conventional Mortgage Loan

- 1.2. Jumbo Loans

- 1.3. Government-insured Mortgage Loans

- 1.4. Other Type of Mortgage Loans

-

2. Mortgage Loan Terms

- 2.1. 30- years Mortgage

- 2.2. 20-year Mortgage

- 2.3. 15-year Mortgage

- 2.4. Other Mortgage Loan Terms

-

3. Interest Rate

- 3.1. Fixed-Rate

- 3.2. Adjustable-Rate

-

4. Provider

- 4.1. Primary Mortgage Lender

- 4.2. Secondary Mortgage Lender

China Mortgage/Loan Brokers Market Segmentation By Geography

- 1. China

China Mortgage/Loan Brokers Market Regional Market Share

Geographic Coverage of China Mortgage/Loan Brokers Market

China Mortgage/Loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in China household Wealth; Increasing Penetration rate among investors

- 3.3. Market Restrains

- 3.3.1. Surge in China household Wealth; Increasing Penetration rate among investors

- 3.4. Market Trends

- 3.4.1. Change in Monetary factors affecting China Mortgage/Loan Brokers market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Mortgage Loan

- 5.1.1. Conventional Mortgage Loan

- 5.1.2. Jumbo Loans

- 5.1.3. Government-insured Mortgage Loans

- 5.1.4. Other Type of Mortgage Loans

- 5.2. Market Analysis, Insights and Forecast - by Mortgage Loan Terms

- 5.2.1. 30- years Mortgage

- 5.2.2. 20-year Mortgage

- 5.2.3. 15-year Mortgage

- 5.2.4. Other Mortgage Loan Terms

- 5.3. Market Analysis, Insights and Forecast - by Interest Rate

- 5.3.1. Fixed-Rate

- 5.3.2. Adjustable-Rate

- 5.4. Market Analysis, Insights and Forecast - by Provider

- 5.4.1. Primary Mortgage Lender

- 5.4.2. Secondary Mortgage Lender

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type of Mortgage Loan

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bank of Japan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bank of China

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suruga bank Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SMBC trust bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shinseibank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 United Overseas Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Overseas Chinese Banking Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sumitomo Mitsui Financial Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi UFJ Financial Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mizuho Financial Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bank of Japan

List of Figures

- Figure 1: China Mortgage/Loan Brokers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Mortgage/Loan Brokers Market Share (%) by Company 2025

List of Tables

- Table 1: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Type of Mortgage Loan 2020 & 2033

- Table 2: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Type of Mortgage Loan 2020 & 2033

- Table 3: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Mortgage Loan Terms 2020 & 2033

- Table 4: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Mortgage Loan Terms 2020 & 2033

- Table 5: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Interest Rate 2020 & 2033

- Table 6: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Interest Rate 2020 & 2033

- Table 7: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 8: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 9: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Type of Mortgage Loan 2020 & 2033

- Table 12: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Type of Mortgage Loan 2020 & 2033

- Table 13: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Mortgage Loan Terms 2020 & 2033

- Table 14: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Mortgage Loan Terms 2020 & 2033

- Table 15: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Interest Rate 2020 & 2033

- Table 16: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Interest Rate 2020 & 2033

- Table 17: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 18: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 19: China Mortgage/Loan Brokers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Mortgage/Loan Brokers Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Mortgage/Loan Brokers Market?

The projected CAGR is approximately 12.56%.

2. Which companies are prominent players in the China Mortgage/Loan Brokers Market?

Key companies in the market include Bank of Japan, Bank of China, Suruga bank Ltd, SMBC trust bank, Shinseibank, United Overseas Bank, Overseas Chinese Banking Corp, Sumitomo Mitsui Financial Group, Mitsubishi UFJ Financial Group, Mizuho Financial Group**List Not Exhaustive.

3. What are the main segments of the China Mortgage/Loan Brokers Market?

The market segments include Type of Mortgage Loan, Mortgage Loan Terms, Interest Rate, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in China household Wealth; Increasing Penetration rate among investors.

6. What are the notable trends driving market growth?

Change in Monetary factors affecting China Mortgage/Loan Brokers market..

7. Are there any restraints impacting market growth?

Surge in China household Wealth; Increasing Penetration rate among investors.

8. Can you provide examples of recent developments in the market?

In September 2023, the Agricultural Bank of China (ABC), one of the four major state-owned banks in the country, launched a global matchmaking platform during the Belt and Road Agricultural Cooperation and Development Forum in Beijing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Mortgage/Loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Mortgage/Loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Mortgage/Loan Brokers Market?

To stay informed about further developments, trends, and reports in the China Mortgage/Loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence