Key Insights

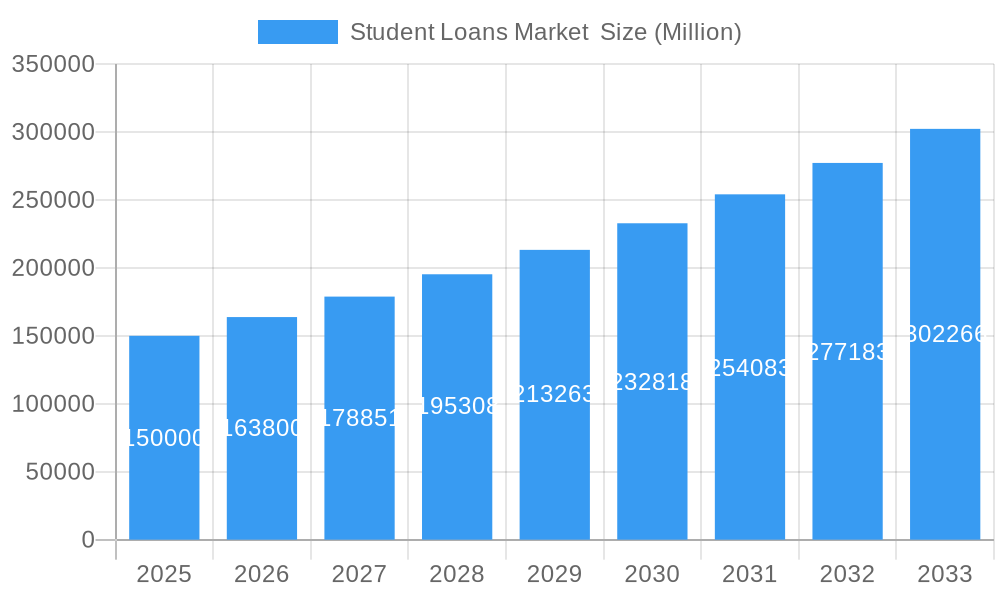

The global Student Loans Market is projected to experience substantial growth, with an estimated market size of $980.8 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 10.1% from a base year of 2024. This expansion is primarily attributed to the rising costs of higher education worldwide, increasing the demand for student financing. Key growth catalysts include supportive government initiatives enhancing educational accessibility and the growing pursuit of specialized, high-tuition degrees. Innovations in lending technology and the increasing number of international students further broaden market opportunities.

Student Loans Market Market Size (In Million)

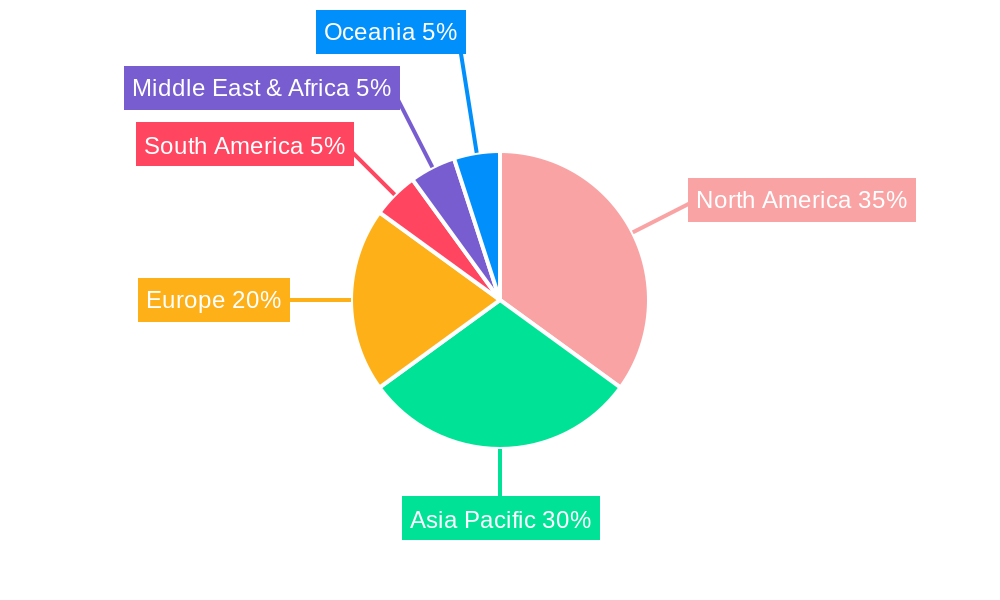

The market encompasses a variety of loan types, including government-backed and private loans, with diverse repayment structures such as standard, graduated, and income-driven options. Graduate and high school students, particularly those aged 25-34, represent significant borrower segments. Geographically, North America and Asia Pacific are expected to lead market growth, fueled by high education expenditures and strong demand in major economies. Emerging markets also offer considerable potential. However, potential market challenges include fluctuating interest rates, default risks, and evolving regulatory landscapes.

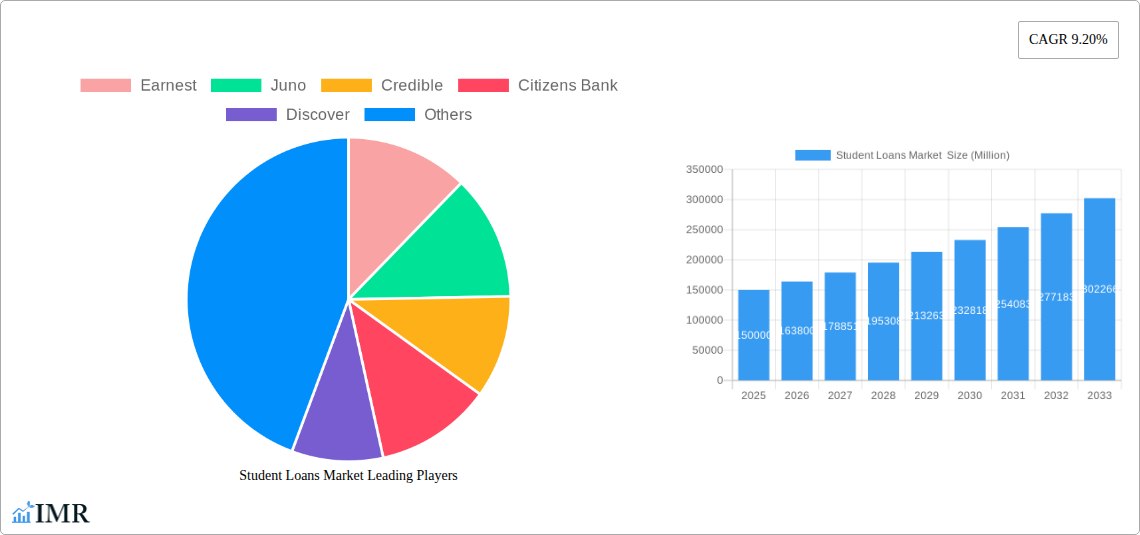

Student Loans Market Company Market Share

This comprehensive report offers critical insights into the global student loans market, covering the historical period of 2019-2024 and forecasting trends for 2025-2033. It details market dynamics, growth trajectories, regional leadership, product segmentation, key industry participants, and future prospects. Indispensable for financial institutions, educational bodies, policymakers, and investors navigating the dynamic student finance sector. All monetary values are presented in billion units.

Student Loans Market Market Dynamics & Structure

The student loans market exhibits a dynamic and multi-faceted structure, shaped by a complex interplay of regulatory frameworks, technological advancements, and evolving end-user demographics. Market concentration varies significantly between federal and private loan segments, with government-backed loans often dominating initial accessibility while private lenders innovate to cater to specific needs. Technological innovation drivers are primarily focused on streamlining application processes, improving risk assessment through AI and machine learning, and enhancing borrower experience via digital platforms. Regulatory frameworks, including interest rate caps, origination fees, and forgiveness programs, significantly influence market behavior and product development. Competitive product substitutes, such as scholarships, grants, and employer tuition assistance, play a crucial role in shaping demand for student loans. End-user demographics, particularly the increasing demand from graduate students and individuals pursuing higher education later in life, are driving product diversification. Mergers and acquisitions (M&A) trends are observed as larger financial institutions seek to expand their offerings or acquire specialized fintech capabilities in the student loan sector.

- Market Concentration: Shifting from traditional banking models to fintech-led solutions, with varying levels of competition across federal and private segments.

- Technological Innovation: Focus on AI for underwriting, blockchain for transparency, and digital platforms for seamless borrower interaction.

- Regulatory Frameworks: Government policies on interest rates, repayment options, and loan forgiveness significantly impact market growth and lender strategies.

- Competitive Product Substitutes: Scholarships, grants, and employer sponsorship represent significant alternatives impacting loan demand.

- End-User Demographics: Growing demand from graduate students and older learners necessitates tailored financial products.

- M&A Trends: Strategic acquisitions aimed at enhancing digital capabilities and expanding market reach by established financial players.

Student Loans Market Growth Trends & Insights

The student loans market is poised for significant evolution, driven by a confluence of economic, social, and technological factors. The market size is projected to expand steadily throughout the forecast period (2025–2033), fueled by rising tuition costs and an increasing global emphasis on higher education as a pathway to economic mobility. Adoption rates of digital lending platforms are accelerating, as borrowers seek more convenient and transparent application and management processes. Technological disruptions, including the integration of AI in credit scoring and personalized repayment plan recommendations, are reshaping the competitive landscape. Consumer behavior shifts are evident, with a growing preference for flexible repayment options, lower interest rates, and lenders that offer comprehensive financial guidance beyond just loan disbursement. The historical period (2019–2024) has laid the groundwork for this accelerated growth, characterized by an increasing volume of both federal and private loan origination. The base year of 2025 is expected to see a strong performance, setting a positive trajectory for the subsequent years. The estimated CAGR for the forecast period is xx%, indicating a robust expansion driven by these trends. Market penetration is expected to deepen, particularly among segments historically underserved by traditional financial institutions. The overarching trend is towards greater accessibility, affordability, and borrower empowerment within the student financing sector.

Dominant Regions, Countries, or Segments in Student Loans Market

The Federal/Government Loan segment consistently drives a substantial portion of the student loans market due to its widespread availability, often subsidized interest rates, and various borrower protection features. This segment's dominance is particularly pronounced in countries with robust public education systems and government-sponsored financial aid programs, such as the United States, where Federal Student Aid plays a pivotal role. The sheer volume of students accessing federal aid makes it a cornerstone of the market.

Key Drivers for Federal/Government Loan Dominance:

- Accessibility: Broad eligibility criteria and established infrastructure ensure wide reach.

- Affordability: Often characterized by lower interest rates and flexible repayment options like Income-Based Repayment (IBR) and Revised Pay As You Earn (REPAYE).

- Government Backing: Provides a sense of security and stability for borrowers and lenders.

- Policy Support: Ongoing government initiatives aimed at making higher education more accessible contribute to sustained demand.

Regionally, North America, particularly the United States, represents the most significant market for student loans. This is attributed to its high volume of higher education enrollment, substantial tuition fees necessitating external financing, and a well-developed financial services industry. The Graduate Students end-user segment is a crucial growth driver within this region and globally. Graduate education often involves higher costs and longer study periods, leading to larger loan amounts and increased demand for specialized financing solutions.

Factors contributing to North America's Dominance and Graduate Student Demand:

- High Cost of Education: Substantial tuition and living expenses necessitate significant borrowing.

- Strong Graduate Education System: Renowned universities attract a large international and domestic student population pursuing advanced degrees.

- Developed Financial Infrastructure: Presence of major lenders like Sallie Mae, Discover, and Citizens Bank, alongside innovative fintech players.

- Demand for Specialized Skills: Increasing emphasis on advanced degrees for career advancement fuels graduate enrollment.

While Federal/Government Loans and North America are dominant, the Private Loan segment is experiencing notable growth, driven by innovation from companies like Earnest, Juno, and Credible, offering competitive rates and flexible terms for those seeking alternatives or additional funding beyond federal limits. The 25 to 34 age group also represents a significant demographic, often balancing career aspirations with educational pursuits, and seeking financing for professional development or advanced degrees.

Student Loans Market Product Landscape

The product landscape of the student loans market is characterized by increasing specialization and technological integration. Traditional fixed and variable rate loans remain prevalent, but innovation is driving the development of income-share agreements (ISAs), coborrower options, and refinance products designed for post-graduation financial optimization. Companies like Credible and Juno leverage technology to offer comparison platforms, enabling borrowers to find the most suitable private loan options, while Earnest focuses on personalized loan terms and financial wellness tools. Mpower provides solutions tailored for international students, addressing unique financial needs and regulatory landscapes. Performance metrics are increasingly focused on borrower success rates, default prevention, and overall student financial well-being, moving beyond simple loan origination volumes.

Key Drivers, Barriers & Challenges in Student Loans Market

Key Drivers:

- Rising Cost of Higher Education: Persistent tuition fee increases necessitate external financing for a growing number of students.

- Demand for Skilled Workforce: Increased societal emphasis on higher education for career advancement fuels enrollment and loan demand.

- Technological Advancements: Fintech innovations are enhancing accessibility, streamlining application processes, and offering personalized solutions.

- Government Initiatives: Policies supporting student access to education, such as loan forgiveness programs or subsidized interest rates, indirectly drive market activity.

Barriers & Challenges:

- High Default Rates: Economic downturns and uncertain post-graduation employment prospects can lead to significant borrower defaults, impacting lender profitability.

- Regulatory Complexity: Navigating diverse federal and state regulations, alongside international financial laws, poses compliance challenges for lenders.

- Interest Rate Volatility: Fluctuations in benchmark interest rates can impact the cost of borrowing and the attractiveness of loan products.

- Competitive Saturation: The increasing number of lenders, both traditional and fintech, intensifies competition, pressuring margins.

- Economic Uncertainty: Broader economic instability can affect students' ability to secure employment and repay loans.

Emerging Opportunities in Student Loans Market

Emerging opportunities in the student loans market lie in catering to underserved populations and leveraging advanced technologies for personalized financial solutions. The growing international student market, as highlighted by Earnest's partnership with Nova Credit for International Private Student Loans, presents a significant avenue for growth. Furthermore, the demand for flexible and adaptive repayment structures that align with variable post-graduation incomes, such as income-share agreements and customized graduated plans, is on the rise. Fintech companies are uniquely positioned to offer innovative solutions for student loan refinancing, consolidation, and management, providing borrowers with greater control and potential cost savings. There is also an untapped potential in providing comprehensive financial literacy and career counseling services alongside loan products, fostering long-term borrower success and loyalty.

Growth Accelerators in the Student Loans Market Industry

Several catalysts are accelerating long-term growth in the student loans market. Technological breakthroughs in artificial intelligence and machine learning are enabling more sophisticated risk assessment, personalized loan offerings, and predictive analytics for default prevention. Strategic partnerships, such as those between fintech lenders and established financial institutions or educational technology providers, are expanding market reach and customer acquisition channels. Market expansion strategies, including targeting new demographic segments (e.g., adult learners, vocational training students) and exploring international markets, are also significant growth accelerators. The increasing focus on post-graduation financial wellness and the development of integrated financial planning tools are fostering deeper customer relationships and driving repeat business, solidifying the market's upward trajectory.

Key Players Shaping the Student Loans Market Market

- Earnest

- Juno

- Credible

- Citizens Bank

- Discover

- Mpower

- Prodigy

- Federal Student Aid

- Sallie Mae

- College Ave

Notable Milestones in Student Loans Market Sector

- October 2023: Discover unveiled its latest national brand campaign, "Especially for Everyone," featuring Jennifer Coolidge, marking its inaugural foray into promoting a deposit product, specifically the Discover Cashback Debit Checking Account. This campaign aims to broaden Discover's brand appeal and product visibility.

- July 2023: Earnest, a fintech company, partnered with Nova Credit, a global credit bureau, to introduce International Private Student Loans. This collaboration expands access to higher education financing for students worldwide.

In-Depth Student Loans Market Market Outlook

The student loans market is projected for continued robust expansion, fueled by persistent demand for higher education and ongoing technological innovation. Growth accelerators, including AI-driven lending solutions and strategic industry partnerships, are enhancing efficiency and accessibility. The increasing focus on personalized borrower experiences and flexible repayment options will further solidify market penetration. Emerging opportunities in international student financing and specialized loan products for diverse educational pathways present significant untapped potential. The industry is moving towards a more holistic approach, integrating financial guidance with lending, which will foster deeper borrower relationships and ensure sustained market vitality in the coming years.

Student Loans Market Segmentation

-

1. Type

- 1.1. Federal/Government Loan

- 1.2. Private Loan

-

2. Repayment Plan

- 2.1. Standard Repayment Plan

- 2.2. Graduated Repayment Plan

- 2.3. Revised Pay As You Earn (REPAYE)

- 2.4. Income-based (IBR)

- 2.5. Other Repayment Plans

-

3. Age Group

- 3.1. 24 or Younger

- 3.2. 25 to 34

- 3.3. Above 35

-

4. End User

- 4.1. Graduate Students

- 4.2. High School Student

- 4.3. Other End-Users

Student Loans Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Student Loans Market Regional Market Share

Geographic Coverage of Student Loans Market

Student Loans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market

- 3.4. Market Trends

- 3.4.1. High Education Costs is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Federal/Government Loan

- 5.1.2. Private Loan

- 5.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 5.2.1. Standard Repayment Plan

- 5.2.2. Graduated Repayment Plan

- 5.2.3. Revised Pay As You Earn (REPAYE)

- 5.2.4. Income-based (IBR)

- 5.2.5. Other Repayment Plans

- 5.3. Market Analysis, Insights and Forecast - by Age Group

- 5.3.1. 24 or Younger

- 5.3.2. 25 to 34

- 5.3.3. Above 35

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Graduate Students

- 5.4.2. High School Student

- 5.4.3. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Federal/Government Loan

- 6.1.2. Private Loan

- 6.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 6.2.1. Standard Repayment Plan

- 6.2.2. Graduated Repayment Plan

- 6.2.3. Revised Pay As You Earn (REPAYE)

- 6.2.4. Income-based (IBR)

- 6.2.5. Other Repayment Plans

- 6.3. Market Analysis, Insights and Forecast - by Age Group

- 6.3.1. 24 or Younger

- 6.3.2. 25 to 34

- 6.3.3. Above 35

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Graduate Students

- 6.4.2. High School Student

- 6.4.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Federal/Government Loan

- 7.1.2. Private Loan

- 7.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 7.2.1. Standard Repayment Plan

- 7.2.2. Graduated Repayment Plan

- 7.2.3. Revised Pay As You Earn (REPAYE)

- 7.2.4. Income-based (IBR)

- 7.2.5. Other Repayment Plans

- 7.3. Market Analysis, Insights and Forecast - by Age Group

- 7.3.1. 24 or Younger

- 7.3.2. 25 to 34

- 7.3.3. Above 35

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Graduate Students

- 7.4.2. High School Student

- 7.4.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Federal/Government Loan

- 8.1.2. Private Loan

- 8.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 8.2.1. Standard Repayment Plan

- 8.2.2. Graduated Repayment Plan

- 8.2.3. Revised Pay As You Earn (REPAYE)

- 8.2.4. Income-based (IBR)

- 8.2.5. Other Repayment Plans

- 8.3. Market Analysis, Insights and Forecast - by Age Group

- 8.3.1. 24 or Younger

- 8.3.2. 25 to 34

- 8.3.3. Above 35

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Graduate Students

- 8.4.2. High School Student

- 8.4.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Federal/Government Loan

- 9.1.2. Private Loan

- 9.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 9.2.1. Standard Repayment Plan

- 9.2.2. Graduated Repayment Plan

- 9.2.3. Revised Pay As You Earn (REPAYE)

- 9.2.4. Income-based (IBR)

- 9.2.5. Other Repayment Plans

- 9.3. Market Analysis, Insights and Forecast - by Age Group

- 9.3.1. 24 or Younger

- 9.3.2. 25 to 34

- 9.3.3. Above 35

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Graduate Students

- 9.4.2. High School Student

- 9.4.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Student Loans Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Federal/Government Loan

- 10.1.2. Private Loan

- 10.2. Market Analysis, Insights and Forecast - by Repayment Plan

- 10.2.1. Standard Repayment Plan

- 10.2.2. Graduated Repayment Plan

- 10.2.3. Revised Pay As You Earn (REPAYE)

- 10.2.4. Income-based (IBR)

- 10.2.5. Other Repayment Plans

- 10.3. Market Analysis, Insights and Forecast - by Age Group

- 10.3.1. 24 or Younger

- 10.3.2. 25 to 34

- 10.3.3. Above 35

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Graduate Students

- 10.4.2. High School Student

- 10.4.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Earnest

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Juno

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Credible

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Citizens Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Discover

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mpower

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Prodigy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Federal Student Aid

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sallie Mae

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 College Ave**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Earnest

List of Figures

- Figure 1: Global Student Loans Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Student Loans Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Student Loans Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Student Loans Market Revenue (billion), by Repayment Plan 2025 & 2033

- Figure 5: North America Student Loans Market Revenue Share (%), by Repayment Plan 2025 & 2033

- Figure 6: North America Student Loans Market Revenue (billion), by Age Group 2025 & 2033

- Figure 7: North America Student Loans Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 8: North America Student Loans Market Revenue (billion), by End User 2025 & 2033

- Figure 9: North America Student Loans Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Student Loans Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Student Loans Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Student Loans Market Revenue (billion), by Type 2025 & 2033

- Figure 13: South America Student Loans Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America Student Loans Market Revenue (billion), by Repayment Plan 2025 & 2033

- Figure 15: South America Student Loans Market Revenue Share (%), by Repayment Plan 2025 & 2033

- Figure 16: South America Student Loans Market Revenue (billion), by Age Group 2025 & 2033

- Figure 17: South America Student Loans Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 18: South America Student Loans Market Revenue (billion), by End User 2025 & 2033

- Figure 19: South America Student Loans Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: South America Student Loans Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Student Loans Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Student Loans Market Revenue (billion), by Type 2025 & 2033

- Figure 23: Europe Student Loans Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Student Loans Market Revenue (billion), by Repayment Plan 2025 & 2033

- Figure 25: Europe Student Loans Market Revenue Share (%), by Repayment Plan 2025 & 2033

- Figure 26: Europe Student Loans Market Revenue (billion), by Age Group 2025 & 2033

- Figure 27: Europe Student Loans Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 28: Europe Student Loans Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Europe Student Loans Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Student Loans Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe Student Loans Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Student Loans Market Revenue (billion), by Type 2025 & 2033

- Figure 33: Middle East & Africa Student Loans Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East & Africa Student Loans Market Revenue (billion), by Repayment Plan 2025 & 2033

- Figure 35: Middle East & Africa Student Loans Market Revenue Share (%), by Repayment Plan 2025 & 2033

- Figure 36: Middle East & Africa Student Loans Market Revenue (billion), by Age Group 2025 & 2033

- Figure 37: Middle East & Africa Student Loans Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 38: Middle East & Africa Student Loans Market Revenue (billion), by End User 2025 & 2033

- Figure 39: Middle East & Africa Student Loans Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East & Africa Student Loans Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa Student Loans Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Student Loans Market Revenue (billion), by Type 2025 & 2033

- Figure 43: Asia Pacific Student Loans Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Asia Pacific Student Loans Market Revenue (billion), by Repayment Plan 2025 & 2033

- Figure 45: Asia Pacific Student Loans Market Revenue Share (%), by Repayment Plan 2025 & 2033

- Figure 46: Asia Pacific Student Loans Market Revenue (billion), by Age Group 2025 & 2033

- Figure 47: Asia Pacific Student Loans Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 48: Asia Pacific Student Loans Market Revenue (billion), by End User 2025 & 2033

- Figure 49: Asia Pacific Student Loans Market Revenue Share (%), by End User 2025 & 2033

- Figure 50: Asia Pacific Student Loans Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific Student Loans Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 3: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 4: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Global Student Loans Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 8: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 9: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global Student Loans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 16: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 17: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Student Loans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 24: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 25: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global Student Loans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 37: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 38: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 39: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Global Student Loans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global Student Loans Market Revenue billion Forecast, by Type 2020 & 2033

- Table 48: Global Student Loans Market Revenue billion Forecast, by Repayment Plan 2020 & 2033

- Table 49: Global Student Loans Market Revenue billion Forecast, by Age Group 2020 & 2033

- Table 50: Global Student Loans Market Revenue billion Forecast, by End User 2020 & 2033

- Table 51: Global Student Loans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Student Loans Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Student Loans Market ?

The projected CAGR is approximately 10.1%.

2. Which companies are prominent players in the Student Loans Market ?

Key companies in the market include Earnest, Juno, Credible, Citizens Bank, Discover, Mpower, Prodigy, Federal Student Aid, Sallie Mae, College Ave**List Not Exhaustive.

3. What are the main segments of the Student Loans Market ?

The market segments include Type, Repayment Plan, Age Group, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 980.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market.

6. What are the notable trends driving market growth?

High Education Costs is Driving the Market.

7. Are there any restraints impacting market growth?

Government Initiatives are Driving the Market; Growing Aspirations for International Education is Driving the Market.

8. Can you provide examples of recent developments in the market?

October 2023: Discover unveiled its latest national brand campaign, titled "Especially for Everyone," featuring the acclaimed actress Jennifer Coolidge. In a groundbreaking move, Coolidge will take center stage in nationwide advertising efforts, spotlighting Discover's array of benefits and products. Of notable significance, this campaign marks the company's inaugural foray into promoting a deposit product, specifically highlighting Discover's Cashback Debit Checking Account.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Student Loans Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Student Loans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Student Loans Market ?

To stay informed about further developments, trends, and reports in the Student Loans Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence