Key Insights

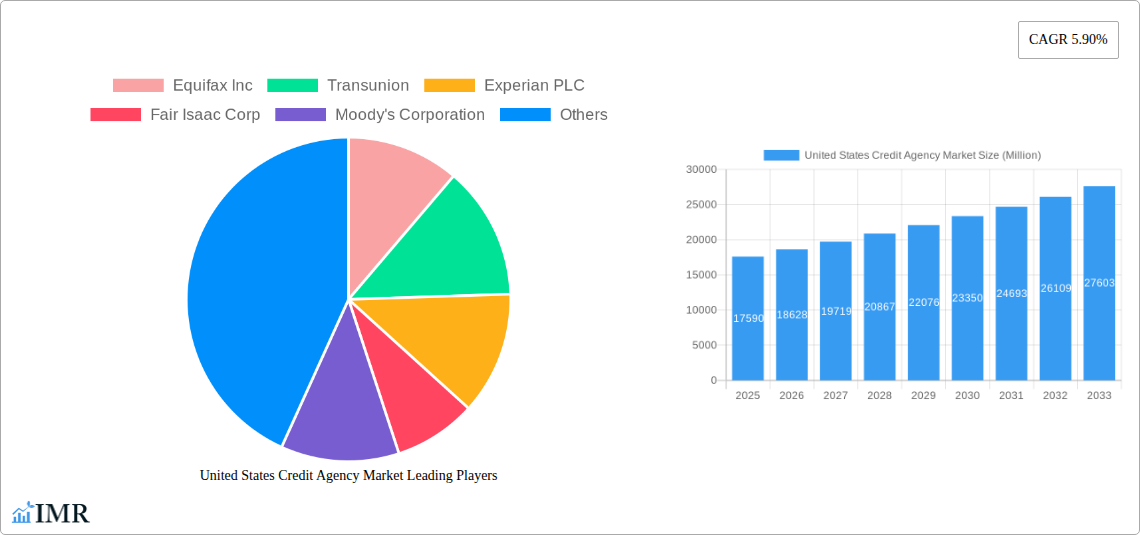

The United States credit agency market is projected for robust growth, estimated at a valuation of $17.59 billion. This expansion is underpinned by a Compound Annual Growth Rate (CAGR) of 5.90% through 2033, indicating a sustained upward trajectory driven by increasing demand for comprehensive credit information and risk management solutions across various sectors. Key market drivers include the escalating complexity of financial transactions, the growing need for accurate credit scoring to facilitate lending decisions, and the continuous evolution of regulatory frameworks governing financial institutions. The digital transformation of businesses, particularly the surge in direct-to-consumer models and online financial services, further necessitates reliable credit assessment tools to mitigate risks and build customer trust.

United States Credit Agency Market Market Size (In Billion)

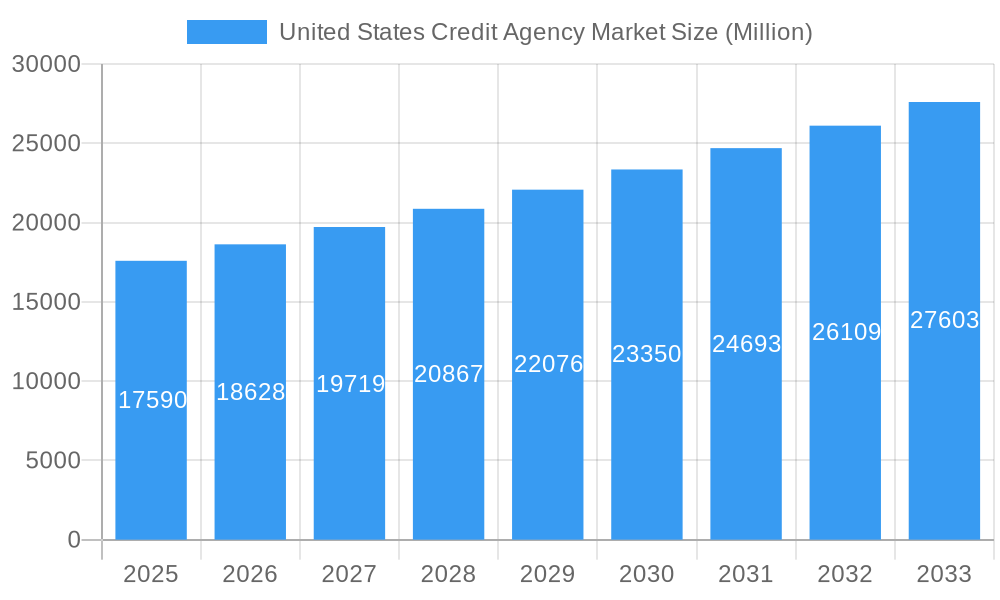

The market is segmented across diverse client types and industry verticals, reflecting its widespread applicability. Individual consumers increasingly rely on credit agencies for personal financial management and access to credit, while commercial entities, from small businesses to large corporations, utilize these services for underwriter risk, supply chain management, and investment decisions. Prominent sectors like healthcare, financial services, and media and technology are significant contributors, leveraging credit insights for operational efficiency and strategic planning. Emerging trends, such as the integration of alternative data sources to enhance credit scoring accuracy for underserved populations and the rise of sophisticated fraud detection mechanisms, are shaping the market landscape. While the market exhibits strong growth potential, certain restraints, such as evolving data privacy regulations and concerns regarding data security breaches, require careful navigation by market players. The United States remains the dominant region, with established players like Equifax, TransUnion, and Experian leading innovation and service delivery.

United States Credit Agency Market Company Market Share

United States Credit Agency Market: Comprehensive Market Insights and Future Outlook (2019-2033)

This in-depth report provides an exhaustive analysis of the United States Credit Agency Market, covering historical trends, current dynamics, and future projections from 2019 to 2033. Delving into market segmentation, growth drivers, challenges, and key player strategies, this report is an indispensable resource for industry stakeholders seeking to understand and capitalize on opportunities within this vital sector. We explore the intricate parent and child market relationships, offering a granular view of market evolution and pinpointing lucrative investment avenues. With a focus on high-traffic keywords, this SEO-optimized report ensures maximum visibility for industry professionals navigating the complex landscape of credit reporting, scoring, and risk management.

United States Credit Agency Market Market Dynamics & Structure

The United States Credit Agency Market is characterized by a concentrated structure, dominated by a few key players who hold significant market share. Technological innovation is a primary driver, with advancements in AI, machine learning, and big data analytics continually reshaping credit scoring models and risk assessment methodologies. Regulatory frameworks, such as the Fair Credit Reporting Act (FCRA) and the upcoming comprehensive data privacy regulations, play a crucial role in shaping market operations and consumer trust. Competitive product substitutes are emerging, including alternative data providers and decentralized credit systems, forcing incumbent agencies to innovate rapidly. End-user demographics are shifting, with an increasing demand for personalized financial insights and transparent credit reporting from both individuals and businesses. Mergers and acquisitions (M&A) trends are active as larger entities seek to expand their service offerings and market reach, consolidating power and enhancing capabilities.

- Market Concentration: Highly concentrated, with the top three credit bureaus holding a substantial majority of the market share.

- Technological Innovation Drivers: AI-powered credit scoring, predictive analytics, real-time data integration, and blockchain for data security.

- Regulatory Frameworks: FCRA compliance, data privacy regulations (e.g., CCPA, potential federal legislation), and industry-specific reporting standards.

- Competitive Product Substitutes: Alternative data scoring, fintech lending platforms, and peer-to-peer credit assessment tools.

- End-User Demographics: Growing demand for financial inclusion, simplified credit access for underserved populations, and advanced analytics for commercial clients.

- M&A Trends: Consolidation for scale, acquisition of niche technology providers, and strategic partnerships to expand data sources and service portfolios.

United States Credit Agency Market Growth Trends & Insights

The United States Credit Agency Market is poised for robust growth, driven by an increasing reliance on credit for personal and commercial transactions, coupled with evolving data analytics capabilities. The market size has witnessed consistent expansion, fueled by a growing volume of credit-based activities and the imperative for accurate risk assessment by lenders. Adoption rates for advanced credit scoring models are on an upward trajectory as financial institutions seek to mitigate risk and improve lending efficiency. Technological disruptions, including the integration of artificial intelligence and machine learning, are revolutionizing how creditworthiness is evaluated, leading to more dynamic and predictive scoring. Consumer behavior shifts are also playing a significant role, with a greater emphasis on financial health, digital access to credit information, and personalized financial management tools. The projected Compound Annual Growth Rate (CAGR) for the forecast period indicates a strong, sustained expansion. Market penetration is deep, but the untapped potential lies in expanding services to new demographics and leveraging alternative data sources for a more inclusive credit ecosystem. The transition towards digital-first solutions and the increasing sophistication of fraud detection mechanisms will further propel market evolution.

Dominant Regions, Countries, or Segments in United States Credit Agency Market

The Financial Services vertical stands as the undisputed dominant segment within the United States Credit Agency Market, consistently driving growth and innovation. This dominance is rooted in the fundamental reliance of the financial industry on credit for a vast array of operations, including lending, underwriting, and risk management. Financial institutions, from large commercial banks to specialized lenders and fintech startups, are primary consumers of credit reporting and scoring services, necessitating comprehensive and accurate data to make informed decisions. The sheer volume of financial transactions and the inherent need for robust risk mitigation strategies within this sector create a perpetual demand for credit agency services.

- Financial Services Dominance Factors:

- Pervasive Credit Dependence: The banking, lending, and investment sectors are intrinsically built upon credit mechanisms, requiring continuous credit evaluation.

- Regulatory Mandates: Stringent regulations within the financial industry mandate thorough applicant screening and risk assessment, directly benefiting credit agencies.

- High Transaction Volume: The immense volume of loans, mortgages, credit cards, and other financial products processed daily generates substantial demand for credit data.

- Sophisticated Risk Management: Financial institutions are at the forefront of adopting advanced analytics and predictive modeling to manage credit risk, driving demand for innovative solutions from credit bureaus.

- Growth Potential: The continuous evolution of financial products and services, including emerging areas like digital lending and buy-now-pay-later schemes, further expands the need for credit agency services.

While Financial Services leads, other segments are showing significant growth potential. The Direct-to-Consumer vertical is expanding rapidly as individuals seek greater control over their financial health and access to credit. Similarly, the Automotive and Retail and E-commerce sectors are increasingly leveraging credit agency data for financing options and fraud prevention. The Government and Public Sector also represents a significant, albeit more niche, market for background checks and risk assessments. The Healthcare and Telecom and Utilities sectors are also growing their utilization of credit data for patient financing, service subscriptions, and fraud detection, indicating a broadening application base across the economy.

United States Credit Agency Market Product Landscape

The product landscape of the United States Credit Agency Market is characterized by a suite of sophisticated solutions designed to assess, manage, and monitor creditworthiness. Core offerings include credit reports, which provide a comprehensive history of an individual's or business's credit activity, and credit scores, which are predictive numerical representations of credit risk. Innovations are increasingly focused on leveraging alternative data sources, such as rent payments, utility bills, and even educational attainment, to provide a more holistic view of creditworthiness, particularly for those with limited traditional credit histories. Advanced analytics, powered by AI and machine learning, are being integrated to offer predictive insights, fraud detection services, and personalized financial management tools. The performance metrics for these products are centered on accuracy, predictive power, speed of delivery, and compliance with evolving regulatory standards.

Key Drivers, Barriers & Challenges in United States Credit Agency Market

Key Drivers:

- Growing Demand for Credit: Increased consumer and business reliance on credit for purchases, investments, and operations fuels demand for credit assessment.

- Technological Advancements: AI, machine learning, and big data analytics enable more accurate and predictive credit scoring, driving adoption of advanced solutions.

- Regulatory Compliance: Evolving regulations necessitate robust data management and reporting, creating opportunities for compliance-focused services.

- Financial Inclusion Initiatives: Efforts to expand credit access to underserved populations drive demand for alternative data solutions.

- Fraud Prevention Needs: The escalating threat of financial fraud compels businesses to invest in advanced verification and monitoring services.

Barriers & Challenges:

- Data Privacy Concerns: Increasing consumer awareness and stringent data privacy regulations pose challenges in data collection and utilization.

- Data Accuracy and Integrity: Maintaining the accuracy and integrity of vast datasets is a continuous challenge, susceptible to errors and disputes.

- Regulatory Hurdles: Navigating complex and evolving regulatory landscapes requires significant investment in compliance and legal expertise.

- Public Perception and Trust: Negative public perception regarding credit reporting practices and data breaches can impact trust and adoption.

- Competition from Fintech: The rise of agile fintech companies offering alternative lending and credit assessment models presents competitive pressure.

Emerging Opportunities in United States Credit Agency Market

Emerging opportunities within the United States Credit Agency Market lie in the expansion of alternative data integration, particularly for assessing creditworthiness in underserved populations. The growing "buy now, pay later" (BNPL) market presents a significant area for developing specialized credit assessment tools. Furthermore, the demand for identity verification and fraud prevention services is escalating across various sectors, including e-commerce and healthcare, creating new avenues for credit agencies to leverage their expertise. The increasing focus on ESG (Environmental, Social, and Governance) factors may also lead to the development of new credit assessment metrics related to social impact and ethical business practices. The development of real-time credit monitoring and advisory services for individuals, empowering them to actively manage their financial health, represents another promising frontier.

Growth Accelerators in the United States Credit Agency Market Industry

Several key catalysts are accelerating growth within the United States Credit Agency Market. Technological breakthroughs, especially in artificial intelligence and machine learning, are continuously enhancing the predictive power of credit scoring models, making them more accurate and efficient. Strategic partnerships between credit bureaus and fintech companies are expanding service offerings and reach, integrating new data sources and distribution channels. The ongoing digitization of financial services globally is creating a persistent demand for reliable credit assessment, driving market expansion. Furthermore, government initiatives aimed at promoting financial inclusion and responsible lending are creating a more favorable environment for credit agencies to innovate and serve a broader customer base.

Key Players Shaping the United States Credit Agency Market Market

- Equifax Inc

- TransUnion

- Experian PLC

- Fair Isaac Corp

- Moody's Corporation

- Fitch Ratings

- S&P Global Inc

- Kroll Bond Rating Agency (KBRA)

- Morningstar DBRS

- A M Best Ratings

Notable Milestones in United States Credit Agency Market Sector

- June 2024: Equifax unveiled an education verification tool, Talent Report High School, tailored to assist employers and background screeners in confirming high school diploma details during pre-employment checks. This solution offers real-time verification of US high school diploma data, made possible by its direct integration with the National Student Clearinghouse.

- June 2024: TransUnion and Asurint Partnered to offer cutting-edge screening solutions for Multifamily Property Managers. Multifamily property managers grapple with the demanding responsibility of screening applicants. They must efficiently perform comprehensive criminal background checks while navigating stricter consumer privacy laws. TransUnion unveiled a strategic alliance with Asurint to deliver a compliance-centric approach to criminal background screening.

In-Depth United States Credit Agency Market Market Outlook

The United States Credit Agency Market is set for sustained and dynamic growth, driven by the confluence of technological innovation, evolving regulatory landscapes, and an ever-increasing demand for sophisticated risk assessment solutions. The market's future potential is significant, particularly in the integration of alternative data for enhanced financial inclusion and the development of AI-driven predictive analytics that offer deeper insights into consumer and business behavior. Strategic opportunities abound for market players that can effectively navigate data privacy regulations, build and maintain consumer trust, and adapt to the rapid pace of digital transformation. The ongoing evolution of financial services, including the burgeoning fintech sector and the expansion of digital lending, will continue to create new avenues for credit agencies to provide essential services and solidify their indispensable role in the economy.

United States Credit Agency Market Segmentation

-

1. Client Type

- 1.1. Individual

- 1.2. Commercial

-

2. Vertical

- 2.1. Direct-to-Consumer

- 2.2. Government and Public Sector

- 2.3. Healthcare

- 2.4. Financial Services

- 2.5. Software and Professional Services

- 2.6. Media and Technology

- 2.7. Automotive

- 2.8. Telecom and Utilities

- 2.9. Retail and E-commerce

- 2.10. Other Verticals

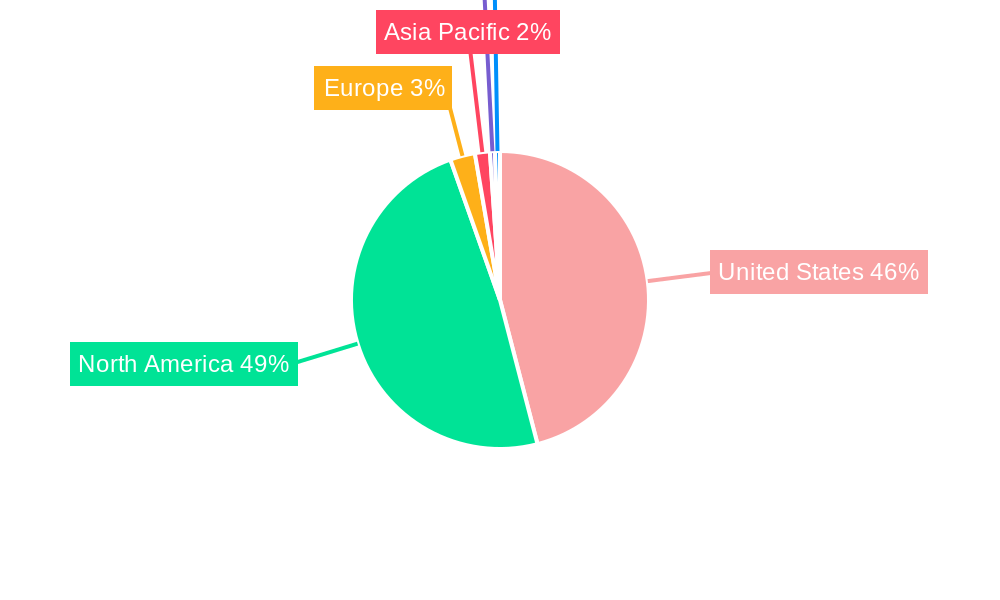

United States Credit Agency Market Segmentation By Geography

- 1. United States

United States Credit Agency Market Regional Market Share

Geographic Coverage of United States Credit Agency Market

United States Credit Agency Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demands Of Credit Reports With Increasing Fraud And Cyber Threats

- 3.3. Market Restrains

- 3.3.1. Rising Demands Of Credit Reports With Increasing Fraud And Cyber Threats

- 3.4. Market Trends

- 3.4.1. Rising Trends In Consumer Credit Outstanding

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Credit Agency Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. Individual

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Vertical

- 5.2.1. Direct-to-Consumer

- 5.2.2. Government and Public Sector

- 5.2.3. Healthcare

- 5.2.4. Financial Services

- 5.2.5. Software and Professional Services

- 5.2.6. Media and Technology

- 5.2.7. Automotive

- 5.2.8. Telecom and Utilities

- 5.2.9. Retail and E-commerce

- 5.2.10. Other Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Equifax Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Transunion

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Experian PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fair Isaac Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moody's Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fitch Ratings

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 S&P Global Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kroll Bond Rating Agency (KBRA)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Morningstar DBRS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 A M Best Ratings**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Equifax Inc

List of Figures

- Figure 1: United States Credit Agency Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Credit Agency Market Share (%) by Company 2025

List of Tables

- Table 1: United States Credit Agency Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: United States Credit Agency Market Volume Billion Forecast, by Client Type 2020 & 2033

- Table 3: United States Credit Agency Market Revenue Million Forecast, by Vertical 2020 & 2033

- Table 4: United States Credit Agency Market Volume Billion Forecast, by Vertical 2020 & 2033

- Table 5: United States Credit Agency Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Credit Agency Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Credit Agency Market Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: United States Credit Agency Market Volume Billion Forecast, by Client Type 2020 & 2033

- Table 9: United States Credit Agency Market Revenue Million Forecast, by Vertical 2020 & 2033

- Table 10: United States Credit Agency Market Volume Billion Forecast, by Vertical 2020 & 2033

- Table 11: United States Credit Agency Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Credit Agency Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Credit Agency Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the United States Credit Agency Market?

Key companies in the market include Equifax Inc, Transunion, Experian PLC, Fair Isaac Corp, Moody's Corporation, Fitch Ratings, S&P Global Inc, Kroll Bond Rating Agency (KBRA), Morningstar DBRS, A M Best Ratings**List Not Exhaustive.

3. What are the main segments of the United States Credit Agency Market?

The market segments include Client Type, Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demands Of Credit Reports With Increasing Fraud And Cyber Threats.

6. What are the notable trends driving market growth?

Rising Trends In Consumer Credit Outstanding.

7. Are there any restraints impacting market growth?

Rising Demands Of Credit Reports With Increasing Fraud And Cyber Threats.

8. Can you provide examples of recent developments in the market?

June 2024: Equifax unveiled an education verification tool, Talent Report High School, tailored to assist employers and background screeners in confirming high school diploma details during pre-employment checks. This solution offers real-time verification of US high school diploma data, made possible by its direct integration with the National Student Clearinghouse.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Credit Agency Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Credit Agency Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Credit Agency Market?

To stay informed about further developments, trends, and reports in the United States Credit Agency Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence