Key Insights

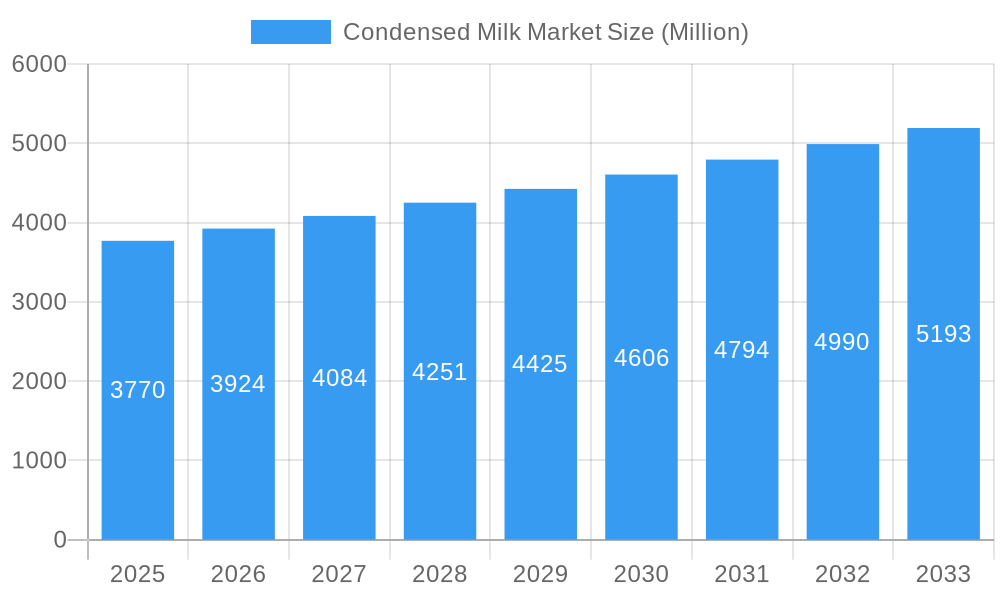

The global Condensed Milk Market is experiencing robust expansion, projected to reach an estimated USD 3.77 Billion in 2025, with a commendable Compound Annual Growth Rate (CAGR) of 4.20%. This sustained growth trajectory, anticipated to continue through 2033, is fueled by a confluence of evolving consumer preferences and innovative product development. A primary driver is the increasing demand for convenience and versatility in food preparation, with condensed milk serving as a key ingredient in a wide array of desserts, beverages, and baked goods. Furthermore, the rising popularity of lactose-free and plant-based diets has spurred significant innovation in the non-dairy segment, with almond, oat, and soy-based condensed milk alternatives gaining substantial traction. This diversification caters to a broader consumer base and opens new avenues for market penetration. The market's expansion is also supported by the growing influence of online retail channels, which offer enhanced accessibility and a wider selection of products to consumers worldwide. The Asia Pacific region, in particular, is demonstrating significant growth potential, driven by a large population and increasing disposable incomes, leading to a greater adoption of processed food products.

Condensed Milk Market Market Size (In Billion)

Despite the overall positive outlook, the market faces certain challenges. Fluctuations in raw material prices, particularly for dairy, can impact profit margins for manufacturers and potentially influence consumer pricing. Regulatory landscapes concerning food processing and labeling also require careful navigation by market players. However, strategic product innovation, focusing on health-conscious options, and expanding distribution networks are key strategies for overcoming these restraints. The market segmentation analysis reveals a dynamic landscape across product types, packaging formats, and distribution channels. While dairy-based condensed milk continues to hold a significant share, the non-dairy segment is rapidly emerging as a growth powerhouse. The preference for convenient packaging solutions, such as tubes and bottles, is also on the rise, catering to on-the-go consumption trends. Leading companies are actively investing in research and development to launch novel products and enhance their market presence across diverse geographical regions, including North America, Europe, Asia Pacific, South America, and the Middle East & Africa, underscoring the global appeal and growth potential of the condensed milk market.

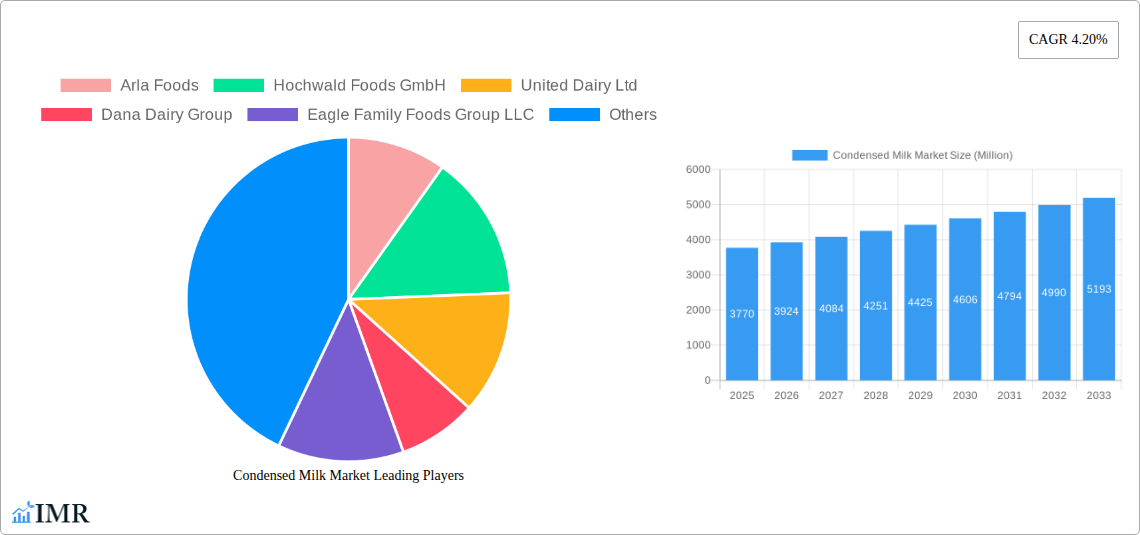

Condensed Milk Market Company Market Share

This in-depth report provides a robust analysis of the global Condensed Milk Market, forecasting its trajectory from 2019 to 2033, with a base and estimated year of 2025. Delve into the intricate dynamics, growth drivers, and emerging opportunities within this evolving sector, uncovering valuable insights for industry stakeholders. Our analysis spans Dairy Condensed Milk and Non-Dairy Condensed Milk, considering various Packaging Types including Cans, Tubes, and Bottles, and exploring diverse Distribution Channels such as Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, and Online Retail. Values are presented in Million Units.

Condensed Milk Market Market Dynamics & Structure

The Condensed Milk Market exhibits a moderate to high degree of market concentration, with established global players holding significant market shares. Technological innovation is a key driver, particularly in developing non-dairy condensed milk alternatives and improving processing efficiencies for extended shelf life and enhanced nutritional profiles. Regulatory frameworks surrounding food safety, labeling, and ingredient sourcing play a crucial role in shaping market entry and product development. Competitive product substitutes, such as evaporated milk and plant-based creamer alternatives, exert pressure, necessitating continuous product differentiation and value addition. End-user demographics are shifting, with increasing demand from developing economies and a growing segment of health-conscious consumers opting for plant-based condensed milk. Mergers and acquisitions (M&A) are strategic tools for consolidation and market expansion, with recent deal volumes indicating a healthy appetite for acquiring innovative technologies and expanding geographical reach. For instance, the Dairy Condensed Milk segment currently accounts for approximately 85% of the global market share. Barriers to innovation include high R&D costs for novel ingredients and the stringent regulatory approval processes for new product formulations.

- Market Concentration: Moderate to High.

- Key Technological Innovation Drivers: Shelf-life extension, non-dairy formulation advancements, and cost-effective production methods.

- Regulatory Frameworks: Strict adherence to food safety standards (e.g., HACCP, ISO 22000).

- Competitive Product Substitutes: Evaporated milk, creamers, plant-based milk alternatives.

- End-User Demographics: Growing demand from infant nutrition, confectionery, and baking industries, alongside increasing interest in vegan and lactose-free options.

- M&A Trends: Strategic acquisitions to gain market share and access new technologies. Recent M&A activity has seen an average of 5-7 significant deals annually in the past three years.

Condensed Milk Market Growth Trends & Insights

The Condensed Milk Market is poised for robust growth, driven by several interconnected trends that are reshaping consumption patterns and industry practices. The global market size, valued at an estimated 15,600 Million Units in 2024, is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period of 2025-2033, reaching an estimated 23,000 Million Units by 2033. Adoption rates for both traditional dairy and emerging non-dairy condensed milk products are on an upward trajectory. Technological disruptions, such as advancements in UHT (Ultra-High Temperature) processing and the development of innovative plant-based condensed milk formulations using ingredients like coconut, oats, and almonds, are expanding product accessibility and catering to diverse dietary needs. Consumer behavior shifts are a significant influence, marked by a growing preference for convenience, indulgence, and healthier alternatives. The increasing use of condensed milk in a wide array of culinary applications, from desserts and beverages to savory dishes and as a base for infant formula, further fuels demand.

The online retail channel is experiencing exponential growth, with a projected CAGR of 6.8%, driven by the convenience of e-commerce platforms and the increasing adoption of digital shopping habits. This channel allows for greater product visibility and direct consumer engagement, enabling manufacturers to gather valuable feedback and tailor offerings. Furthermore, the rising disposable incomes in emerging economies are contributing to increased per capita consumption of dairy and non-dairy condensed milk products, particularly in regions like Southeast Asia and Latin America. The confectionery and bakery sectors, major end-users of condensed milk, are also witnessing a steady demand for premium and innovative dessert ingredients, further stimulating market expansion. The dairy condensed milk segment, while mature, continues to hold its ground due to its established appeal and widespread use, but the non-dairy condensed milk segment is emerging as a significant growth driver, with an anticipated CAGR of 7.5% over the forecast period.

Key metrics such as market penetration for plant-based condensed milk are expected to double from 15% in 2024 to 30% by 2033 in developed markets. The average spending on condensed milk per household is also projected to increase by 3% annually, driven by a combination of premiumization and increased usage frequency. This growth is underpinned by a strong emphasis on product quality, nutritional value, and sustainable sourcing practices, which are increasingly important considerations for today's consumers. The market penetration of condensed milk in the ready-to-eat meal sector is also a nascent but promising area, projected to grow at a CAGR of 4.5% as manufacturers explore new applications.

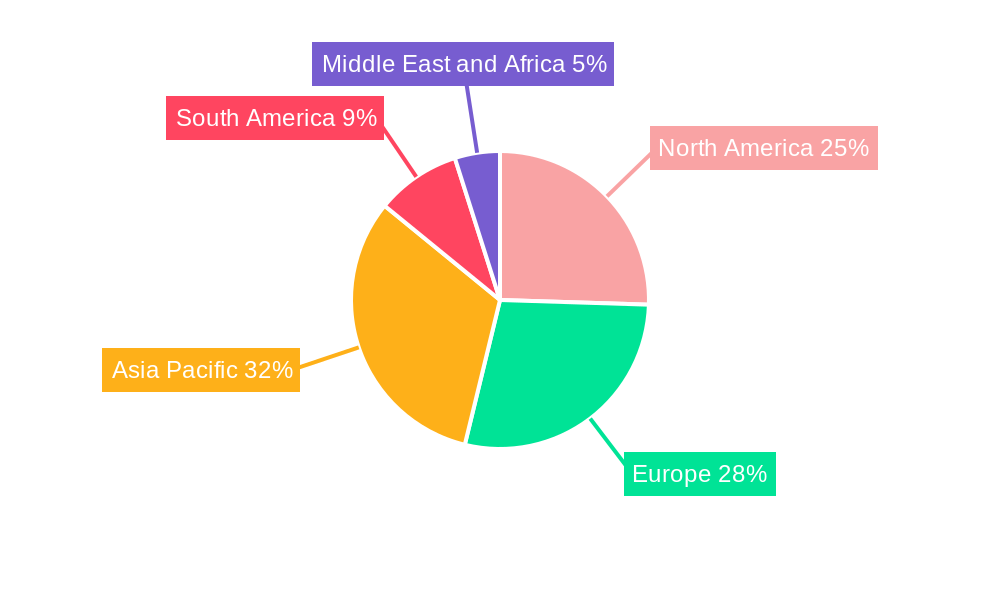

Dominant Regions, Countries, or Segments in Condensed Milk Market

The Asia Pacific region is projected to be the dominant force in the global Condensed Milk Market, driven by a confluence of factors including a large and growing population, rising disposable incomes, and deeply ingrained culinary traditions that heavily feature condensed milk. Within this region, India and China stand out as key growth engines. India, with its vast dairy production and strong demand for traditional sweets and desserts, will continue to be a cornerstone of the Dairy Condensed Milk segment. The market share for Dairy Condensed Milk in India alone is estimated to be around 25% of the global market. Conversely, China is demonstrating rapid growth in both dairy and non-dairy condensed milk categories, fueled by an expanding middle class and a burgeoning food processing industry.

The Supermarkets and Hypermarkets distribution channel is expected to maintain its leadership, accounting for approximately 40% of the global Condensed Milk Market share. This dominance is attributed to their wide reach, product variety, and ability to cater to a broad consumer base. However, Online Retail is the fastest-growing channel, projected to witness a CAGR of 6.8% during the forecast period, as consumers increasingly opt for the convenience of doorstep delivery and access to a wider selection of niche and specialized condensed milk products, including plant-based options.

The Product Type segment of Dairy Condensed Milk will continue to hold the largest market share, estimated at 78% of the total market value, due to its long-standing popularity and diverse applications in traditional recipes. However, the Non-Dairy Condensed Milk segment is experiencing remarkable growth, with an anticipated CAGR of 7.5%, driven by increasing consumer awareness of lactose intolerance, ethical considerations, and the demand for vegan alternatives. Key drivers for the dominance of Asia Pacific include:

- Economic Policies: Favorable government policies supporting the dairy and food processing industries in countries like India and China.

- Infrastructure: Robust supply chain networks and cold storage facilities facilitating wider distribution.

- Consumer Preferences: A strong cultural affinity for desserts and baked goods that utilize condensed milk as a key ingredient.

- Population Growth: A large and expanding consumer base driving overall demand.

Within the Packaging Type segment, Cans are expected to retain their dominant position due to their cost-effectiveness, long shelf life, and traditional appeal, particularly in Supermarkets and Hypermarkets. However, Bottles are gaining traction in convenience formats and for premium product offerings.

The growth potential within the Specialty Stores channel for Non-Dairy Condensed Milk is significant, driven by health-conscious consumers seeking out organic, artisanal, and allergen-free products.

Condensed Milk Market Product Landscape

The Condensed Milk Market product landscape is characterized by continuous innovation aimed at enhancing consumer appeal and broadening applications. Manufacturers are actively developing non-dairy condensed milk varieties using ingredients like coconut, oats, and almonds, catering to the burgeoning vegan and lactose-intolerant consumer base. Product differentiation also extends to flavor variations, such as sweetened and unsweetened condensed milk, as well as flavored options like caramel and chocolate, targeting specific dessert and beverage applications. Innovations in packaging are also notable, with the introduction of convenient squeezable tubes and single-serving bottles, appealing to on-the-go consumers. Performance metrics are being optimized through improved processing techniques that enhance texture, flavor stability, and shelf life, ensuring consistent quality across different applications, from confectionery and baking to beverages and infant nutrition.

Key Drivers, Barriers & Challenges in Condensed Milk Market

Key Drivers:

The Condensed Milk Market is propelled by several key drivers. The ever-increasing demand from the confectionery and bakery industries for consistent and high-quality ingredients is a primary growth engine. Growing global populations and rising disposable incomes, particularly in emerging economies, are expanding the consumer base for condensed milk products. The surge in demand for non-dairy condensed milk alternatives, driven by health consciousness, dietary restrictions, and ethical consumerism, presents a significant opportunity. Furthermore, the versatility of condensed milk in various culinary applications, from desserts and beverages to infant formula and savory dishes, fuels its widespread adoption. Technological advancements in processing and preservation techniques are also contributing to improved product quality and extended shelf life, enhancing consumer appeal and reducing waste.

Barriers & Challenges:

Despite robust growth, the Condensed Milk Market faces several challenges and barriers. Fluctuations in raw material prices, particularly milk solids, can impact profit margins and necessitate price adjustments, potentially affecting demand. Stringent regulatory requirements concerning food safety, labeling, and ingredient sourcing add to production costs and can delay new product introductions. The competitive landscape is intense, with numerous established players and the threat of substitutes like evaporated milk and plant-based creamers. Supply chain disruptions, exacerbated by global events, can lead to stockouts and impact production schedules. Furthermore, consumer perception regarding the health implications of high sugar content in traditional sweetened condensed milk can pose a challenge, driving the demand for lower-sugar or sugar-free alternatives. The energy-intensive nature of milk processing also presents environmental considerations and regulatory pressures.

Emerging Opportunities in Condensed Milk Market

Emerging opportunities within the Condensed Milk Market are significant and varied. The burgeoning demand for plant-based condensed milk presents a substantial untapped market, with innovation in ingredient sourcing and formulation holding immense potential. The expansion of the market into novel applications, such as functional foods and beverages, where condensed milk can serve as a base for added nutrients or specific health benefits, offers a new avenue for growth. Developing countries with growing economies and increasing middle-class populations represent fertile ground for market expansion, particularly for affordable and accessible dairy condensed milk products. The rise of e-commerce and direct-to-consumer (DTC) models opens up opportunities for niche product offerings and personalized consumer experiences, especially for specialized non-dairy and premium condensed milk varieties. Furthermore, the increasing consumer focus on sustainability and ethical sourcing is creating demand for condensed milk products with transparent supply chains and eco-friendly packaging.

Growth Accelerators in the Condensed Milk Market Industry

The Condensed Milk Market industry's long-term growth is being accelerated by several key catalysts. Technological breakthroughs in non-dairy ingredient processing and formulation are enabling the creation of superior tasting and textured plant-based alternatives, broadening their appeal beyond traditional dairy consumers. Strategic partnerships between dairy producers, ingredient suppliers, and food manufacturers are fostering innovation and accelerating product development cycles. Market expansion strategies, particularly focusing on untapped geographies and leveraging the growing middle class in developing nations, are critical growth accelerators. The increasing demand for ready-to-drink beverages and convenience foods, where condensed milk serves as a key ingredient for texture and sweetness, is also a significant growth factor. Furthermore, the focus on product diversification, including the development of sugar-free, low-fat, and fortified condensed milk options, caters to evolving consumer preferences and health trends, driving sustained market growth.

Key Players Shaping the Condensed Milk Market Market

- Nestle S A

- Arla Foods

- Hochwald Foods GmbH

- United Dairy Ltd

- Dana Dairy Group

- Eagle Family Foods Group LLC

- Nature's Charm

- Amul

- Morinaga Milk Industry Co Ltd

- Santini Foods Inc

Notable Milestones in Condensed Milk Market Sector

- 2022: Nature's Charm launches a new line of coconut-based sweetened condensed milk, significantly expanding their non-dairy offerings and capturing a growing segment of vegan consumers.

- 2021: Arla Foods invests in advanced UHT processing technology to extend the shelf life and improve the quality of their dairy condensed milk products, enhancing competitiveness in the global market.

- 2020: The COVID-19 pandemic leads to a surge in home baking and cooking, driving increased demand for condensed milk in traditional supermarkets and hypermarkets and through online retail channels.

- 2019: Morinaga Milk Industry Co Ltd introduces innovative packaging for its condensed milk, including smaller, single-serving tubes, catering to convenience-seeking consumers.

- 2023: Amul collaborates with dairy farmers to improve milk quality and sustainable farming practices, ensuring a consistent supply of high-quality raw materials for their dairy condensed milk production.

In-Depth Condensed Milk Market Market Outlook

The future outlook for the Condensed Milk Market is exceptionally promising, with sustained growth anticipated driven by ongoing innovation and evolving consumer demands. The continued rise of the non-dairy condensed milk segment, fueled by health and ethical considerations, will be a major growth accelerator, with significant opportunities for new product development and market penetration. Expansion into emerging economies, where increasing disposable incomes and urbanization are driving demand for convenience and indulgent food products, represents a substantial growth avenue. Strategic alliances and acquisitions will continue to play a vital role in market consolidation and the expansion of product portfolios. The focus on premiumization, healthy alternatives, and sustainable production practices will shape future product development, ensuring the Condensed Milk Market remains dynamic and responsive to global consumer trends, with a projected market value to reach over 23,000 Million Units by 2033.

Condensed Milk Market Segmentation

-

1. Product Type

- 1.1. Dairy

- 1.2. Non-Dairy

-

2. Packaging Type

- 2.1. Cans

- 2.2. Tubes

- 2.3. Bottles

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Convenience Stores

- 3.3. Specialty Stores

- 3.4. Online Retails

- 3.5. Others

Condensed Milk Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Condensed Milk Market Regional Market Share

Geographic Coverage of Condensed Milk Market

Condensed Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1. Elevating Demand for Non-Dairy Based Product Offerings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Condensed Milk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dairy

- 5.1.2. Non-Dairy

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Cans

- 5.2.2. Tubes

- 5.2.3. Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Retails

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Condensed Milk Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Dairy

- 6.1.2. Non-Dairy

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Cans

- 6.2.2. Tubes

- 6.2.3. Bottles

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets and Hypermarkets

- 6.3.2. Convenience Stores

- 6.3.3. Specialty Stores

- 6.3.4. Online Retails

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Condensed Milk Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Dairy

- 7.1.2. Non-Dairy

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Cans

- 7.2.2. Tubes

- 7.2.3. Bottles

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets and Hypermarkets

- 7.3.2. Convenience Stores

- 7.3.3. Specialty Stores

- 7.3.4. Online Retails

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Condensed Milk Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Dairy

- 8.1.2. Non-Dairy

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Cans

- 8.2.2. Tubes

- 8.2.3. Bottles

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets and Hypermarkets

- 8.3.2. Convenience Stores

- 8.3.3. Specialty Stores

- 8.3.4. Online Retails

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Condensed Milk Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Dairy

- 9.1.2. Non-Dairy

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Cans

- 9.2.2. Tubes

- 9.2.3. Bottles

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets and Hypermarkets

- 9.3.2. Convenience Stores

- 9.3.3. Specialty Stores

- 9.3.4. Online Retails

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Condensed Milk Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Dairy

- 10.1.2. Non-Dairy

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Cans

- 10.2.2. Tubes

- 10.2.3. Bottles

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets and Hypermarkets

- 10.3.2. Convenience Stores

- 10.3.3. Specialty Stores

- 10.3.4. Online Retails

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Arla Foods

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hochwald Foods GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 United Dairy Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dana Dairy Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eagle Family Foods Group LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nature's Charm

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amul

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Morinaga Milk Industry Co Ltd *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nestle S A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Santini Foods Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Arla Foods

List of Figures

- Figure 1: Global Condensed Milk Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Condensed Milk Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Condensed Milk Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Condensed Milk Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 5: North America Condensed Milk Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America Condensed Milk Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Condensed Milk Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Condensed Milk Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Condensed Milk Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Condensed Milk Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Condensed Milk Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Condensed Milk Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 13: Europe Condensed Milk Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 14: Europe Condensed Milk Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Condensed Milk Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Condensed Milk Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Condensed Milk Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Condensed Milk Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Condensed Milk Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Condensed Milk Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 21: Asia Pacific Condensed Milk Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Asia Pacific Condensed Milk Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Condensed Milk Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Condensed Milk Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Condensed Milk Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Condensed Milk Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Condensed Milk Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Condensed Milk Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 29: South America Condensed Milk Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 30: South America Condensed Milk Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Condensed Milk Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Condensed Milk Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Condensed Milk Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Condensed Milk Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Condensed Milk Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Condensed Milk Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 37: Middle East and Africa Condensed Milk Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 38: Middle East and Africa Condensed Milk Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Condensed Milk Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Condensed Milk Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Condensed Milk Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Condensed Milk Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Condensed Milk Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Global Condensed Milk Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Condensed Milk Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Condensed Milk Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Condensed Milk Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 7: Global Condensed Milk Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Condensed Milk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Condensed Milk Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Condensed Milk Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 15: Global Condensed Milk Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Condensed Milk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Spain Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Russia Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Condensed Milk Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 25: Global Condensed Milk Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 26: Global Condensed Milk Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Condensed Milk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Australia Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Condensed Milk Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Condensed Milk Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 35: Global Condensed Milk Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Condensed Milk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Condensed Milk Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 41: Global Condensed Milk Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 42: Global Condensed Milk Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Condensed Milk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: South Africa Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Saudi Arabia Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East and Africa Condensed Milk Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Condensed Milk Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Condensed Milk Market?

Key companies in the market include Arla Foods, Hochwald Foods GmbH, United Dairy Ltd, Dana Dairy Group, Eagle Family Foods Group LLC, Nature's Charm, Amul, Morinaga Milk Industry Co Ltd *List Not Exhaustive, Nestle S A, Santini Foods Inc.

3. What are the main segments of the Condensed Milk Market?

The market segments include Product Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

Elevating Demand for Non-Dairy Based Product Offerings.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Condensed Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Condensed Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Condensed Milk Market?

To stay informed about further developments, trends, and reports in the Condensed Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence