Key Insights

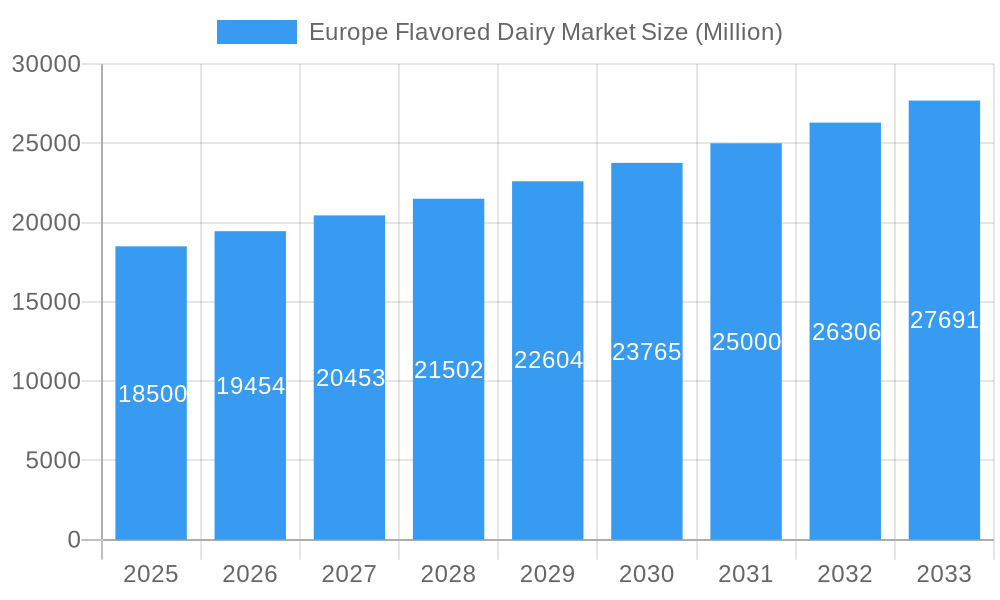

The European Flavored Dairy Market is projected for substantial growth, with an estimated market size of $18,500 million by 2025 and a robust Compound Annual Growth Rate (CAGR) of 5.48% through 2033. This expansion is driven by evolving consumer preferences for sophisticated and indulgent dairy profiles, including premium and gourmet flavors beyond traditional options, fruit fusions, exotic spices, and dessert-inspired varieties. Growing health consciousness also fuels demand for products with perceived health benefits like probiotics or added vitamins. The plant-based segment, propelled by veganism and lactose intolerance, is a significant contributor, introducing diverse flavors and competing effectively with traditional dairy offerings.

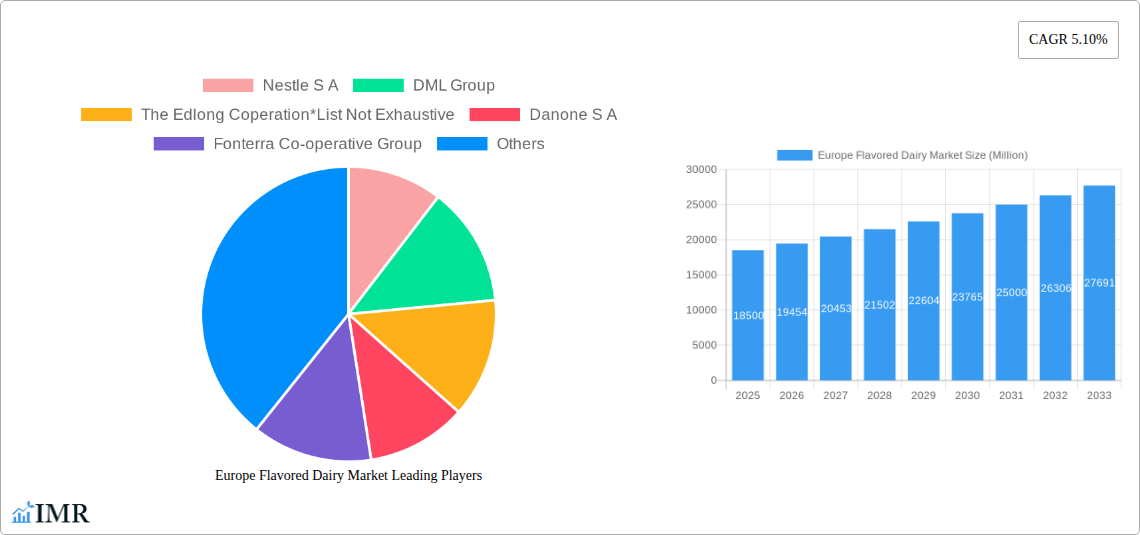

Europe Flavored Dairy Market Market Size (In Billion)

The market's positive trajectory is further supported by evolving distribution channels and strategic initiatives. Supermarkets and hypermarkets remain key, complemented by the growing importance of convenience stores for impulse purchases. Leading global players such as Nestle S.A., Danone S.A., and Fonterra Co-operative Group, alongside specialized ingredient and flavor companies like The Edlong Corporation, are investing in innovation and catering to diverse European tastes across France, Germany, Italy, Spain, and the United Kingdom. While opportunities are strong, participants must strategically navigate potential restraints like fluctuating raw material costs and increasing regulatory scrutiny on labeling and health claims.

Europe Flavored Dairy Market Company Market Share

This comprehensive report delivers a granular analysis of the Europe Flavored Dairy Market. It examines parent market trends in dairy and plant-based beverages, and child market segments including flavored yogurts, milk, and desserts. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Insights are derived from current market data and expert projections, detailing growth drivers, market segmentation, competitive landscapes, and emerging opportunities. All quantitative data is presented in 3.6 billion units for clarity.

Europe Flavored Dairy Market Market Dynamics & Structure

The Europe Flavored Dairy Market exhibits a moderately concentrated structure, with key players like Nestle S.A., Danone S.A., and Fonterra Co-operative Group holding significant market share. Technological innovation is primarily driven by the demand for novel flavors, healthier formulations with reduced sugar and natural ingredients, and improved shelf-life technologies. Regulatory frameworks concerning food safety, labeling, and ingredient sourcing play a crucial role in shaping market entry and product development. Competitive product substitutes, particularly in the plant-based alternatives segment, are increasingly influencing consumer choices, necessitating continuous product differentiation for dairy-based offerings. End-user demographics are shifting towards younger, health-conscious consumers seeking convenient and indulgent yet nutritious options. Mergers and acquisitions (M&A) are a prevalent strategy for market expansion and portfolio diversification. For instance, the past three years have seen an estimated 15-20 M&A deals focused on acquiring innovative flavor technologies or expanding into new product categories within the European market. Barriers to innovation include high R&D costs, stringent regulatory approvals for novel ingredients, and consumer resistance to perceived artificial flavors.

Europe Flavored Dairy Market Growth Trends & Insights

The Europe Flavored Dairy Market is poised for robust expansion, driven by evolving consumer preferences and a surge in product innovation. The market size, projected to reach approximately 28,500 Million units in the base year 2025, is expected to witness a Compound Annual Growth Rate (CAGR) of 5.5% during the forecast period (2025-2033). Adoption rates for flavored dairy products remain high across all age groups, with a particular emphasis on on-the-go consumption formats. Technological disruptions are significantly impacting product development, with advancements in fermentation techniques, encapsulation technologies for sustained flavor release, and the incorporation of functional ingredients like probiotics and prebiotics becoming mainstream. Consumer behavior shifts are a pivotal growth catalyst, with a growing demand for premium and artisanal flavored dairy products, as well as a heightened awareness of health and wellness. This translates into a preference for products with natural colors and flavors, reduced sugar content, and ethically sourced ingredients. Market penetration for specialized products, such as lactose-free flavored yogurts and plant-based milk alternatives with diverse flavor profiles, is steadily increasing, indicating a maturing and diversifying market. The historical period (2019-2024) saw an estimated market evolution from 24,000 Million units to 27,000 Million units, demonstrating a consistent upward trajectory.

Dominant Regions, Countries, or Segments in Europe Flavored Dairy Market

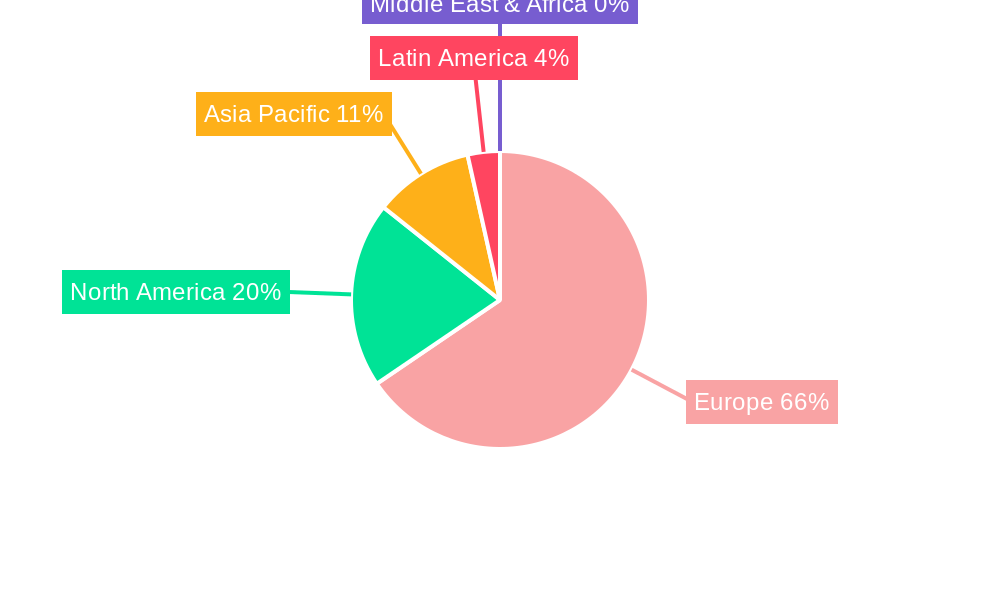

The Dairy Based segment, particularly flavored yogurts and milk, is the dominant force within the Europe Flavored Dairy Market. Within this segment, Germany, France, and the United Kingdom are leading countries, contributing significantly to the market's overall value.

- Dominance of Dairy Based Segment: This segment benefits from established consumer trust, a wide array of existing product formulations, and strong distribution networks. The perceived health benefits associated with dairy, such as calcium and protein content, continue to resonate with a broad consumer base.

- Germany: Characterized by a strong demand for traditional dairy products with innovative flavor twists, Germany exhibits high per capita consumption of flavored yogurts and milk. Government initiatives supporting dairy farming and product innovation further bolster its market position. In 2025, Germany is estimated to hold a 18% share of the European market.

- France: Renowned for its culinary heritage, France showcases a strong inclination towards premium and gourmet flavored dairy offerings. French consumers are receptive to sophisticated flavor profiles and aesthetically appealing packaging, driving innovation in this sector. The French market is projected to contribute 16% to the overall market in 2025.

- United Kingdom: The UK market demonstrates a dynamic blend of traditional and novel flavored dairy consumption. There is a significant and growing demand for plant-based alternatives, but also a sustained appetite for classic dairy flavors. The convenience store channel plays a vital role in product accessibility. The UK market is expected to capture a 14% share in 2025.

- Supermarkets/Hypermarkets: These distribution channels remain paramount for the Europe Flavored Dairy Market, offering extensive product variety and catering to bulk purchasing. Their dominance is attributed to their wide reach, competitive pricing, and promotional activities. In 2025, supermarkets/hypermarkets are anticipated to account for approximately 65% of all flavored dairy product sales.

- Growth Potential: While the Dairy Based segment leads, the Plant Based segment is experiencing exponential growth, driven by increasing veganism, lactose intolerance, and environmental concerns. This rapid expansion presents a significant future opportunity.

Europe Flavored Dairy Market Product Landscape

Product innovation in the Europe Flavored Dairy Market is characterized by a surge in exotic and functional flavor profiles, catering to evolving consumer palates and wellness trends. Companies are increasingly focusing on natural and organic ingredients, with a growing demand for plant-based alternatives in a variety of flavors. Applications range from breakfast staples like flavored yogurts and milk drinks to indulgent desserts and functional beverages. Performance metrics are closely tied to ingredient quality, flavor authenticity, and nutritional benefits. Unique selling propositions often lie in the use of superfruits, botanical extracts, and adaptogens to enhance both taste and perceived health benefits. Technological advancements in flavor encapsulation are enabling longer-lasting and more intense taste experiences.

Key Drivers, Barriers & Challenges in Europe Flavored Dairy Market

Key Drivers:

- Rising demand for indulgent yet healthy options: Consumers seek products that offer both a treat and nutritional benefits.

- Growing popularity of plant-based alternatives: Driven by ethical, environmental, and health concerns.

- Innovation in flavor profiles: Introduction of unique, exotic, and functional flavors.

- Convenience and on-the-go consumption trends: Demand for single-serve and portable products.

- Increasing disposable income and consumer spending power: Enabling purchases of premium and specialty flavored dairy.

Barriers & Challenges:

- Intensifying competition: From both established dairy players and emerging plant-based brands.

- Fluctuating raw material costs: Volatility in dairy and ingredient prices impacts profitability.

- Stringent regulatory landscape: Compliance with food safety and labeling standards can be complex.

- Consumer perception of 'artificial' ingredients: Growing preference for natural and clean-label products.

- Supply chain disruptions: Geopolitical events and logistical challenges can impact availability and cost. Estimated impact of supply chain issues on market availability is around 5-7% in the past year.

Emerging Opportunities in Europe Flavored Dairy Market

Emerging opportunities in the Europe Flavored Dairy Market lie in the continued expansion of the plant-based segment, offering a vast untapped potential for innovative flavors and textures. There is a growing consumer interest in functional dairy and plant-based products fortified with vitamins, minerals, and probiotics, creating a niche for scientifically backed formulations. Furthermore, the demand for ethically sourced and sustainable products is on the rise, presenting opportunities for brands that can demonstrate transparent supply chains and eco-friendly practices. The development of personalized nutrition solutions within the flavored dairy space also holds significant promise.

Growth Accelerators in the Europe Flavored Dairy Market Industry

Long-term growth in the Europe Flavored Dairy Market will be significantly accelerated by ongoing technological breakthroughs in flavor science and processing. Strategic partnerships between dairy producers, flavor houses, and ingredient suppliers are crucial for developing novel and appealing products. Market expansion strategies, including penetration into underserved geographical areas within Europe and the development of innovative packaging solutions for enhanced shelf appeal and convenience, will further fuel growth. The increasing adoption of digital marketing and e-commerce platforms will also play a vital role in reaching a wider consumer base and driving sales.

Key Players Shaping the Europe Flavored Dairy Market Market

- Nestle S.A.

- DML Group

- The Edlong Coperation

- Danone S.A.

- Fonterra Co-operative Group

- Shamrock Foods Company

- Dr. Oetker

Notable Milestones in Europe Flavored Dairy Market Sector

- 2023: Launch of a new range of low-sugar, fruit-infused Greek yogurts by Danone S.A., catering to health-conscious consumers.

- 2022: Nestle S.A. expanded its plant-based flavored milk portfolio with new oat and almond milk-based varieties, tapping into growing vegan demand.

- 2021: The Edlong Corporation introduced innovative dairy-free flavor solutions, enabling a wider range of plant-based flavored dairy alternatives.

- 2020: Fonterra Co-operative Group partnered with a leading European retailer to launch a line of premium flavored milk drinks fortified with vitamins and minerals.

- 2019: Dr. Oetker acquired a significant stake in a niche flavored dairy dessert producer, indicating consolidation in the premium segment.

In-Depth Europe Flavored Dairy Market Market Outlook

The future of the Europe Flavored Dairy Market appears exceptionally promising, propelled by the synergistic forces of consumer demand for health and indulgence, coupled with continuous product innovation. Growth accelerators such as advanced ingredient technologies and strategic collaborations will solidify market expansion. Untapped opportunities in personalized nutrition and sustainable sourcing offer fertile ground for pioneering brands. Stakeholders can anticipate a market increasingly characterized by its diversity, catering to a spectrum of dietary preferences and wellness aspirations, ensuring sustained growth and evolving consumer engagement.

Europe Flavored Dairy Market Segmentation

-

1. Type

- 1.1. Dairy Based

- 1.2. Plant Based

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Other Distribution Channels

Europe Flavored Dairy Market Segmentation By Geography

-

1. Europe

- 1.1. France

- 1.2. Germany

- 1.3. Italy

- 1.4. United Kingdom

- 1.5. Spain

- 1.6. Russia

- 1.7. Rest of Europe

Europe Flavored Dairy Market Regional Market Share

Geographic Coverage of Europe Flavored Dairy Market

Europe Flavored Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water

- 3.4. Market Trends

- 3.4.1. Growing Demand For Chocolate Milk Flavor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Flavored Dairy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dairy Based

- 5.1.2. Plant Based

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestle S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DML Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Edlong Coperation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Danone S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fonterra Co-operative Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shamrock Foods Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dr Oetkar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Nestle S A

List of Figures

- Figure 1: Europe Flavored Dairy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Flavored Dairy Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Flavored Dairy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Flavored Dairy Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Flavored Dairy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Flavored Dairy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Flavored Dairy Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Flavored Dairy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: France Europe Flavored Dairy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Flavored Dairy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Italy Europe Flavored Dairy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Flavored Dairy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Flavored Dairy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Russia Europe Flavored Dairy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Flavored Dairy Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Flavored Dairy Market?

The projected CAGR is approximately 5.48%.

2. Which companies are prominent players in the Europe Flavored Dairy Market?

Key companies in the market include Nestle S A, DML Group, The Edlong Coperation*List Not Exhaustive, Danone S A, Fonterra Co-operative Group, Shamrock Foods Company, Dr Oetkar.

3. What are the main segments of the Europe Flavored Dairy Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water.

6. What are the notable trends driving market growth?

Growing Demand For Chocolate Milk Flavor.

7. Are there any restraints impacting market growth?

Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Flavored Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Flavored Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Flavored Dairy Market?

To stay informed about further developments, trends, and reports in the Europe Flavored Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence