Key Insights

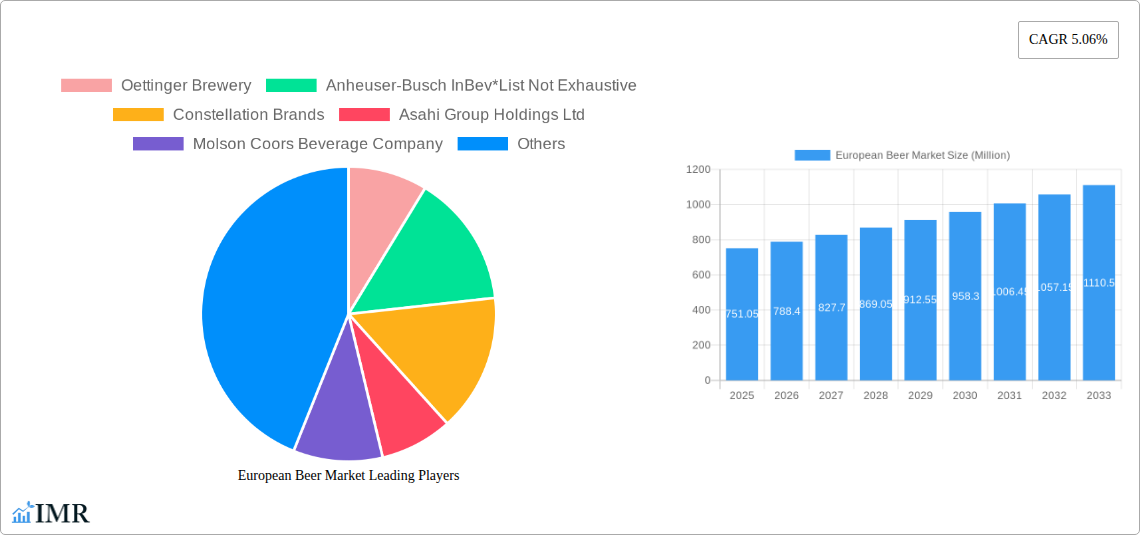

The European beer market is poised for robust growth, projected to reach a substantial USD 751.05 million by 2025, exhibiting a compound annual growth rate (CAGR) of 5.06% over the forecast period of 2025-2033. This expansion is fueled by a confluence of dynamic market drivers, including an increasing consumer preference for premium and craft beers, a growing demand for low- and no-alcohol beer options, and the pervasive influence of evolving lifestyle trends that favor social gatherings and diverse beverage choices. The market's resilience is further bolstered by significant investments in product innovation and attractive marketing campaigns by leading breweries, all aimed at capturing a larger share of this expanding market.

European Beer Market Market Size (In Million)

The market's trajectory is also shaped by prevailing trends such as the rise of e-commerce platforms for beer sales, enabling greater accessibility and convenience for consumers, and a heightened focus on sustainable brewing practices, appealing to an environmentally conscious consumer base. However, certain restraints could temper this growth, including the increasing health consciousness among consumers leading to reduced alcohol consumption in some segments, and fluctuating raw material costs, particularly for barley and hops, which can impact production expenses. The market is segmented by product type into Ale, Lager, and Other Product Types, with Lager historically dominating sales due to its widespread appeal. Distribution channels are broadly categorized into On-trade (bars, restaurants) and Off-trade (retail stores, supermarkets), with the off-trade segment experiencing notable growth due to changing purchasing habits. Key players like Anheuser-Busch InBev, Heineken NV, and Carlsberg Group are actively innovating to maintain their competitive edge and capitalize on emerging opportunities across Europe.

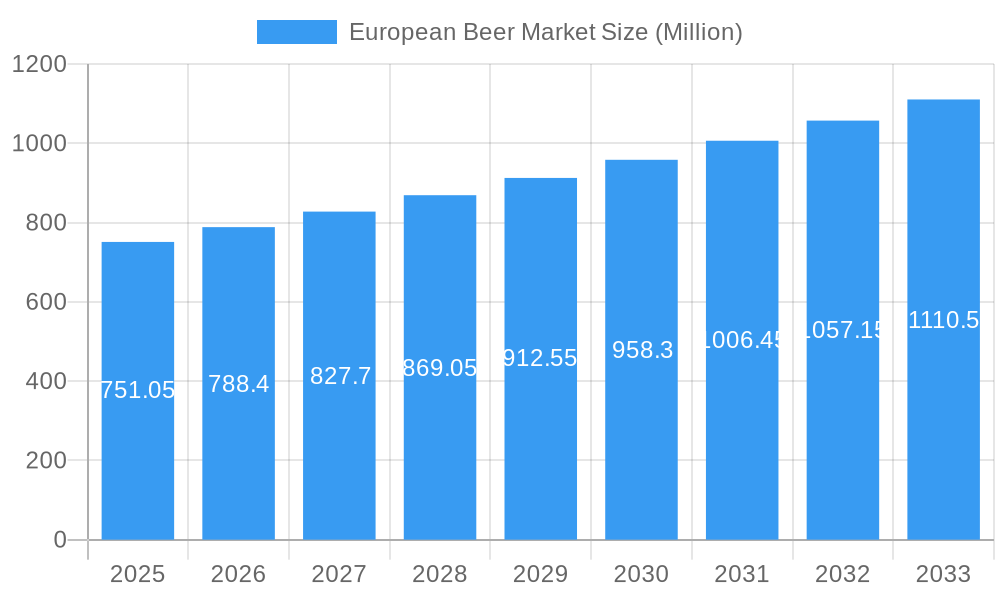

European Beer Market Company Market Share

Unlocking the European Beer Market: A Comprehensive Report (2019-2033)

This in-depth report provides an unparalleled analysis of the dynamic European Beer Market, meticulously covering its evolution from 2019 to 2033. Designed for industry professionals, investors, and market strategists, this research offers crucial insights into market size, segmentation, key players, and future trajectories. With a base year of 2025 and a forecast period extending to 2033, this report leverages extensive data and expert analysis to deliver actionable intelligence. We dissect parent and child market segments, product types (Ale, Lager, Other Product Types), and distribution channels (On-trade, Off-trade) to provide a holistic view of this significant industry. All quantitative data is presented in Million units for clarity and immediate application.

European Beer Market Market Dynamics & Structure

The European Beer Market is characterized by a moderate to high level of market concentration, with several dominant global players holding significant market share. Technological innovation is largely driven by advancements in brewing processes, sustainable packaging, and the development of new flavor profiles, particularly in the craft beer segment. Regulatory frameworks, including taxation, labeling requirements, and alcohol promotion restrictions, significantly influence market operations and product development. Competitive product substitutes, such as wine, spirits, and non-alcoholic beverages, exert continuous pressure, necessitating product differentiation and innovation. End-user demographics are shifting, with increasing demand for premium and craft beers, alongside a growing segment of health-conscious consumers opting for low-alcohol and alcohol-free options. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and portfolio expansion.

- Market Concentration: Dominated by a few large multinational corporations, but with a growing presence of independent and craft breweries.

- Technological Innovation Drivers: Improved brewing efficiency, automation in production, novel yeast strains, and sustainable packaging solutions (e.g., aluminum cans, biodegradable materials).

- Regulatory Frameworks: Varying alcohol excise duties across countries, strict advertising standards, and increasing focus on ingredient traceability and sustainability.

- Competitive Product Substitutes: Premium wines, artisanal spirits, and a wide array of non-alcoholic beverages are increasingly competing for consumer share.

- End-User Demographics: Growing preference for premium and specialty beers, increasing interest in global beer styles, and a significant rise in demand for low-alcohol and alcohol-free alternatives.

- M&A Trends: Ongoing consolidation among larger players and strategic acquisitions of successful craft breweries to gain market access and innovation capabilities.

European Beer Market Growth Trends & Insights

The European Beer Market has demonstrated robust growth trends throughout the historical period (2019-2024) and is projected to continue its upward trajectory through the forecast period (2025-2033). The market size evolution is influenced by a confluence of factors, including fluctuating disposable incomes, evolving consumer preferences, and strategic marketing initiatives by key industry players. Adoption rates for new product categories, such as craft beers and alcohol-free options, have seen significant acceleration. Technological disruptions, including advancements in brewing technology and direct-to-consumer e-commerce platforms, are reshaping distribution and consumer engagement. Consumer behavior shifts are profoundly impacting the market; there's a discernible move towards experiential consumption, a heightened appreciation for quality and provenance, and a growing emphasis on health and wellness. The CAGR of the European Beer Market is estimated at XX% during the forecast period, indicating sustained and healthy expansion. Market penetration of premium and craft segments continues to deepen, driven by consumer willingness to pay a premium for perceived quality and unique offerings. The increasing availability and quality of alcohol-free beers are also contributing to broader market appeal and accessibility.

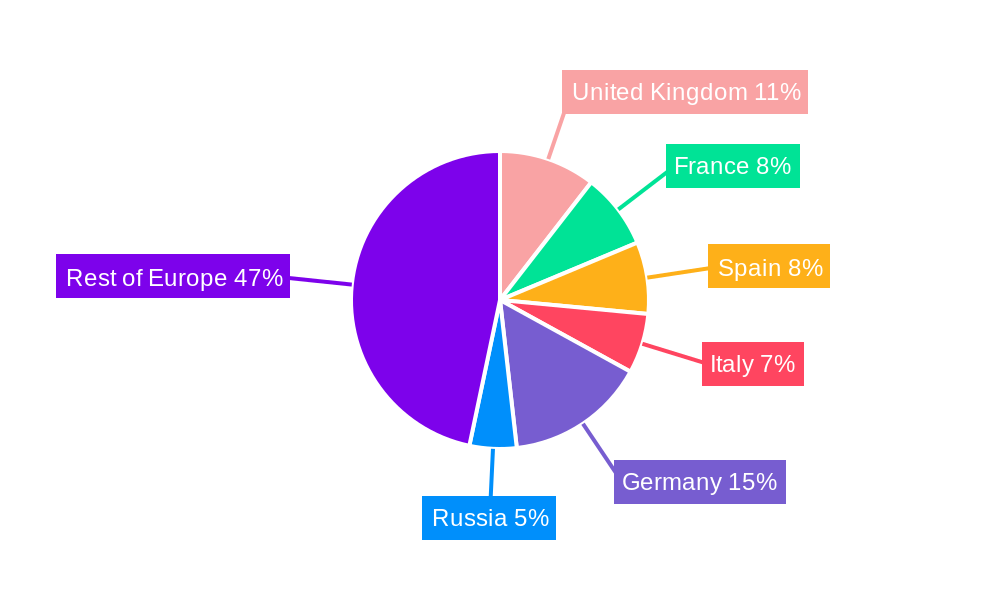

Dominant Regions, Countries, or Segments in European Beer Market

The Lager segment, particularly within the Off-trade distribution channel, is consistently the dominant force driving growth in the European Beer Market. This dominance is underpinned by a combination of deeply ingrained consumer habits, widespread availability, and effective marketing strategies by major brewers. In terms of geographical regions, Western Europe, encompassing countries like Germany, the United Kingdom, Spain, and France, continues to hold the largest market share due to its mature beer culture and substantial consumer base. However, Eastern European markets are exhibiting higher growth rates, fueled by improving economic conditions and a rising middle class with increasing disposable income.

Dominant Product Type: Lager:

- Market Share: Represents over XX% of the total European Beer Market volume.

- Key Drivers: Ubiquitous availability, broad consumer appeal, and established brand loyalty. Major brands continue to invest heavily in marketing and distribution, reinforcing Lager's stronghold.

- Growth Potential: While mature, innovation in craft lagers and variations with distinct flavor profiles offer sustained growth avenues.

Dominant Distribution Channel: Off-trade:

- Market Share: Accounts for approximately XX% of total beer sales volume.

- Key Drivers: Convenience, value offerings through multipacks, and the increasing popularity of home consumption. Supermarkets, hypermarkets, and convenience stores are key pillars of this channel.

- Growth Potential: E-commerce and online grocery platforms are rapidly expanding, presenting new opportunities for off-trade sales and enhanced consumer reach.

Dominant Regions (Example: Germany):

- Market Share: Germany consistently ranks as one of the largest beer markets in Europe.

- Key Drivers: Rich brewing heritage, diverse regional beer styles, strong domestic production, and a culture that embraces beer consumption. Favorable excise duties and a supportive regulatory environment for breweries also play a role.

- Growth Potential: While already mature, the German market benefits from continuous innovation in craft and specialty beers, catering to evolving consumer tastes.

European Beer Market Product Landscape

The European Beer Market product landscape is marked by continuous innovation, driven by consumer demand for variety and premium experiences. Lager remains the most prevalent product type, with ongoing efforts to introduce lighter, more sessionable versions and experimental flavor infusions. The Ale segment is experiencing significant growth, particularly with the rise of craft breweries offering diverse styles like IPAs, Pale Ales, and Stouts. "Other Product Types" encompasses a growing category of seltzers, fruit-infused beers, and low/zero-alcohol alternatives, appealing to health-conscious and diverse consumer groups. Performance metrics are increasingly focused on ABV content, flavor profiles, and perceived health benefits. Unique selling propositions often revolve around premium ingredients, traditional brewing methods, and sustainable production practices. Technological advancements in brewing, such as advanced fermentation techniques and cold-filtration processes, enhance flavor stability and product quality.

Key Drivers, Barriers & Challenges in European Beer Market

Key Drivers:

- Evolving Consumer Preferences: Growing demand for craft beers, premium offerings, and diverse flavor profiles.

- Health and Wellness Trends: Significant surge in demand for low-alcohol and alcohol-free beer options.

- Economic Recovery and Disposable Income: Improved economic conditions in various European nations boost consumer spending on premium beverages.

- Innovation in Product Development: Continuous introduction of new styles, flavors, and packaging formats to attract and retain consumers.

- Digitalization and E-commerce: Expansion of online sales channels for beer, offering greater accessibility and convenience.

Barriers & Challenges:

- Stringent Regulations and Taxation: High excise duties and complex advertising laws in some European countries can stifle growth and innovation.

- Supply Chain Disruptions: Volatility in raw material costs (e.g., barley, hops) and logistics challenges can impact profitability.

- Intense Competition: A highly saturated market with numerous established players and a constant influx of new entrants, particularly in the craft segment.

- Changing Consumption Habits: Shift towards other beverage categories and a general trend towards moderating alcohol intake in some demographics.

- Sustainability Concerns: Increasing pressure from consumers and regulators to adopt more sustainable production and packaging methods.

Emerging Opportunities in European Beer Market

Emerging opportunities in the European Beer Market are largely concentrated around the growing demand for alcohol-free and low-alcohol beers, catering to a health-conscious demographic and those seeking to moderate their alcohol intake without compromising on taste or experience. The craft beer segment continues to offer untapped potential, particularly in emerging markets within Eastern Europe, where a growing middle class is seeking premium and artisanal products. Furthermore, the rise of direct-to-consumer (DTC) sales models and subscription services presents an opportunity for breweries to build direct relationships with consumers, foster brand loyalty, and offer exclusive products. Innovative flavor profiles and hybrid beer styles, such as those blending beer with other fermented beverages or incorporating exotic ingredients, are also gaining traction and represent a space for differentiation.

Growth Accelerators in the European Beer Market Industry

Several catalysts are accelerating growth in the European Beer Market. Technological breakthroughs in brewing are enabling the creation of more sophisticated and consistent flavor profiles, particularly in the premium and craft segments. The increasing focus on sustainability across the value chain, from sourcing to packaging, resonates with environmentally conscious consumers and drives innovation. Strategic partnerships and collaborations between larger breweries and smaller craft producers are facilitating market expansion and access to new consumer bases. Furthermore, targeted marketing campaigns that emphasize heritage, quality ingredients, and unique brewing processes are effectively capturing consumer interest. The expansion of e-commerce and digital platforms for beer sales is also a significant growth accelerator, providing wider reach and convenience for consumers across the continent.

Key Players Shaping the European Beer Market Market

- Oettinger Brewery

- Anheuser-Busch InBev

- Constellation Brands

- Asahi Group Holdings Ltd

- Molson Coors Beverage Company

- Carlsberg Group

- The Boston Beer Company Inc

- Kirin Holdings Co Ltd

- Heineken NV

- Bitburger Brewery

Notable Milestones in European Beer Market Sector

- December 2023: AB-InBev expanded its product portfolio in the United Kingdom with the launch of Via Roma, a new 4.5 percent ABV Italian-style lager, exclusively at Sainsbury’s. This strategic move targets the growing demand for international beer styles in the UK off-trade.

- June 2023: The Brewers Association expanded its product portfolio in the United Kingdom by launching six American craft breweries, featuring 14 different beers, eight of which were previously unavailable in the UK, significantly enhancing the craft beer offering.

- April 2023: Heineken launched its Spanish lager brand Cruzcampo on draught into pubs and bars across the United Kingdom. The brand's production at Heineken's Manchester brewery positions it as a locally brewed beer with Spanish branding, appealing to both traditional and adventurous beer drinkers.

- March 2023: Carlsberg Marston’s Brewing Company launched Carlsberg 0.0 across the United Kingdom. This dedicated alcohol-free Pilsner aims to capture the growing market for zero-alcohol beverages by delivering a full-bodied beer experience.

- January 2023: Asahi Europe & International launched its alcohol-free beer, Asahi Super Dry 0.0%, across the United Kingdom. Available in bars, restaurants, and multipacks, this launch caters to the increasing consumer preference for non-alcoholic alternatives in various consumption occasions.

In-Depth European Beer Market Market Outlook

The European Beer Market outlook is highly positive, driven by sustained innovation and evolving consumer demands. Growth accelerators such as the burgeoning alcohol-free segment, the continued expansion of craft beer culture, and the increasing adoption of e-commerce channels will propel the market forward. Strategic opportunities lie in further penetration of emerging European economies, the development of unique and functional beer offerings, and the implementation of advanced sustainability practices that align with consumer values. Companies that can effectively leverage digital platforms for direct consumer engagement and adapt to regional taste preferences will be well-positioned for significant growth and market leadership in the coming years. The market's resilience and capacity for innovation suggest a robust and expanding future.

European Beer Market Segmentation

-

1. Product Type

- 1.1. Ale

- 1.2. Lager

- 1.3. Other Product Types

-

2. Distribution Channel

- 2.1. On-trade

- 2.2. Off-trade

European Beer Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Spain

- 4. Italy

- 5. Germany

- 6. Russia

- 7. Rest of Europe

European Beer Market Regional Market Share

Geographic Coverage of European Beer Market

European Beer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Alcoholic Beverages; Health Conscious Consumers Accelerating Demand For Gluten-free Beer

- 3.3. Market Restrains

- 3.3.1. Threat From Other Alcoholic Beverages

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Alcoholic Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Beer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ale

- 5.1.2. Lager

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Spain

- 5.3.4. Italy

- 5.3.5. Germany

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom European Beer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Ale

- 6.1.2. Lager

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France European Beer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Ale

- 7.1.2. Lager

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Spain European Beer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Ale

- 8.1.2. Lager

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy European Beer Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Ale

- 9.1.2. Lager

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Germany European Beer Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Ale

- 10.1.2. Lager

- 10.1.3. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia European Beer Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Ale

- 11.1.2. Lager

- 11.1.3. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Beer Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Ale

- 12.1.2. Lager

- 12.1.3. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. On-trade

- 12.2.2. Off-trade

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Oettinger Brewery

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Anheuser-Busch InBev*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Constellation Brands

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Asahi Group Holdings Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Molson Coors Beverage Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Carlsberg Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Boston Beer Company Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kirin Holdings Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Heineken NV

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bitburger Brewery

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Oettinger Brewery

List of Figures

- Figure 1: European Beer Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Beer Market Share (%) by Company 2025

List of Tables

- Table 1: European Beer Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: European Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 3: European Beer Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: European Beer Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 5: European Beer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: European Beer Market Volume liter Forecast, by Region 2020 & 2033

- Table 7: European Beer Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: European Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 9: European Beer Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: European Beer Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 11: European Beer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: European Beer Market Volume liter Forecast, by Country 2020 & 2033

- Table 13: European Beer Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: European Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 15: European Beer Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: European Beer Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 17: European Beer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: European Beer Market Volume liter Forecast, by Country 2020 & 2033

- Table 19: European Beer Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: European Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 21: European Beer Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: European Beer Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 23: European Beer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: European Beer Market Volume liter Forecast, by Country 2020 & 2033

- Table 25: European Beer Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: European Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 27: European Beer Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: European Beer Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 29: European Beer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: European Beer Market Volume liter Forecast, by Country 2020 & 2033

- Table 31: European Beer Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: European Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 33: European Beer Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: European Beer Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 35: European Beer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: European Beer Market Volume liter Forecast, by Country 2020 & 2033

- Table 37: European Beer Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: European Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 39: European Beer Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: European Beer Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 41: European Beer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: European Beer Market Volume liter Forecast, by Country 2020 & 2033

- Table 43: European Beer Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: European Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 45: European Beer Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: European Beer Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 47: European Beer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: European Beer Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Beer Market?

The projected CAGR is approximately 5.06%.

2. Which companies are prominent players in the European Beer Market?

Key companies in the market include Oettinger Brewery, Anheuser-Busch InBev*List Not Exhaustive, Constellation Brands, Asahi Group Holdings Ltd, Molson Coors Beverage Company, Carlsberg Group, The Boston Beer Company Inc, Kirin Holdings Co Ltd, Heineken NV, Bitburger Brewery.

3. What are the main segments of the European Beer Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 751.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Alcoholic Beverages; Health Conscious Consumers Accelerating Demand For Gluten-free Beer.

6. What are the notable trends driving market growth?

Increasing Demand for Alcoholic Beverages.

7. Are there any restraints impacting market growth?

Threat From Other Alcoholic Beverages.

8. Can you provide examples of recent developments in the market?

December 2023: AB-InBev expanded its product portfolio in the United Kingdom with the launch of a new 4.5 percent ABV Italian-style lager, Via Roma, exclusively at the supermarket chain Sainsbury’s. Oettinger Brewery Anheuser-Busch InBev*List Not Exhaustive Constellation Brands Asahi Group Holdings Ltd Molson Coors Beverage Company Carlsberg Group The Boston Beer Company Inc Kirin Holdings Co Ltd Heineken NV Bitburger Brewery

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Beer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Beer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Beer Market?

To stay informed about further developments, trends, and reports in the European Beer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence