Key Insights

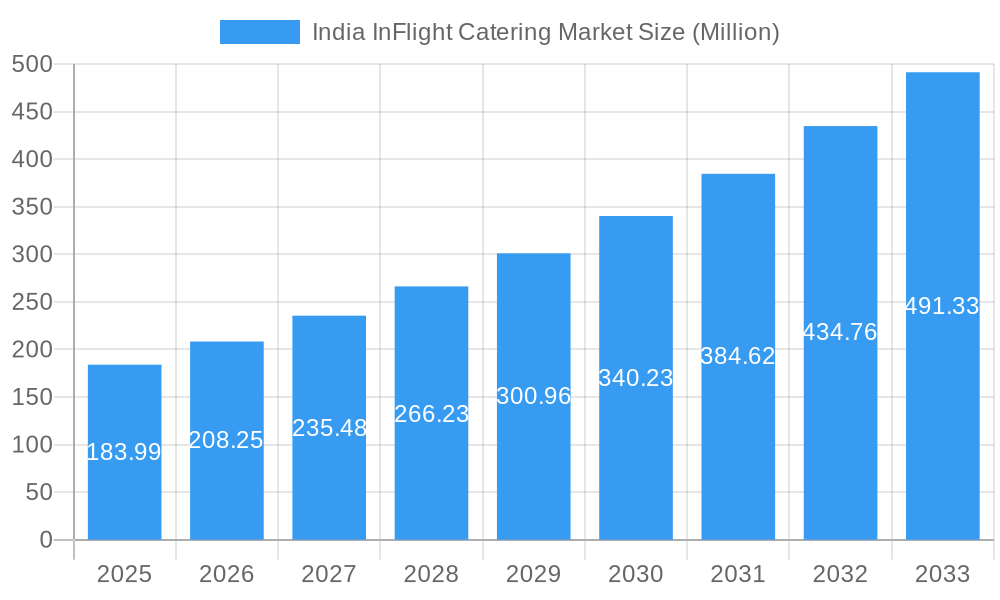

The India in-flight catering market, valued at $183.99 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 13.16% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning aviation industry in India, characterized by increasing passenger numbers and a rising middle class with greater disposable income, significantly boosts demand for in-flight meals and beverages. A shift towards premium travel experiences, including enhanced in-flight catering services, further contributes to market growth. The diversification of offerings, encompassing meals, bakery items, confectionery, and beverages catering to diverse dietary preferences and needs, also plays a crucial role. Competition amongst full-service carriers (FSCs) and low-cost carriers (LCCs) to enhance passenger satisfaction through improved catering options is another important driver. Furthermore, strategic partnerships between airlines and catering companies, along with technological advancements in food preparation and delivery, streamline operations and contribute to market expansion.

India InFlight Catering Market Market Size (In Million)

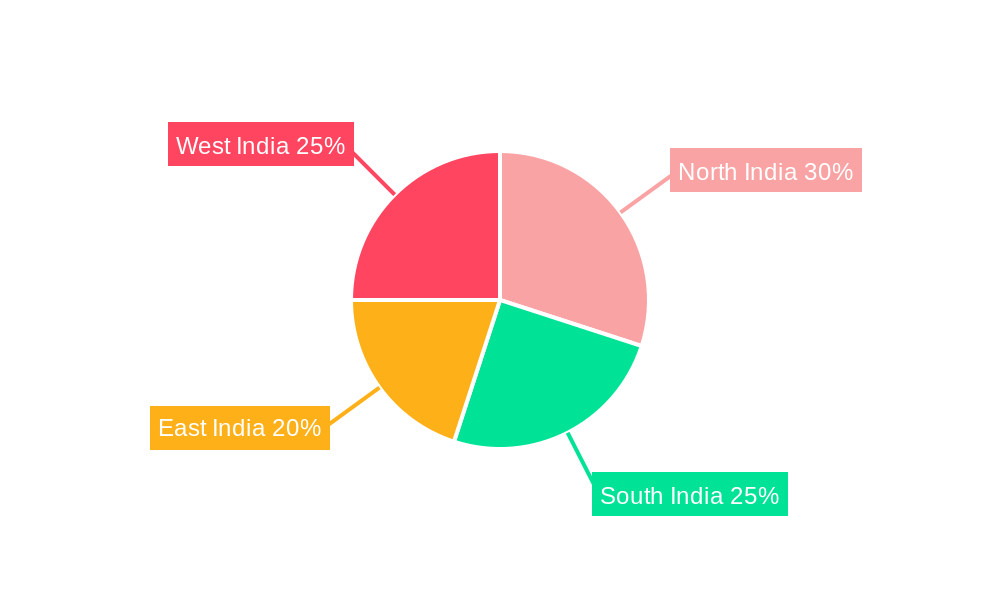

However, challenges remain. Fluctuations in fuel prices, impacting airline profitability and potentially affecting catering budgets, pose a risk. Stringent food safety regulations and the need for continuous compliance add operational complexities. Maintaining consistent quality across diverse geographical locations and managing supply chain disruptions present ongoing hurdles. The market is segmented by aircraft class (economy, business, first), flight service type (FSC, LCC, hybrid), and food type (meals, bakery, beverages, other). Key players such as TajSATS Air Catering Limited, Lulu Flight Kitchen Private Limited, and Ambassador's Sky Chef are actively shaping the market landscape through strategic expansions and service improvements. The regional distribution, across North, South, East, and West India, reflects varying levels of air travel demand and economic activity, which will be a key driver for strategic investments in the coming years.

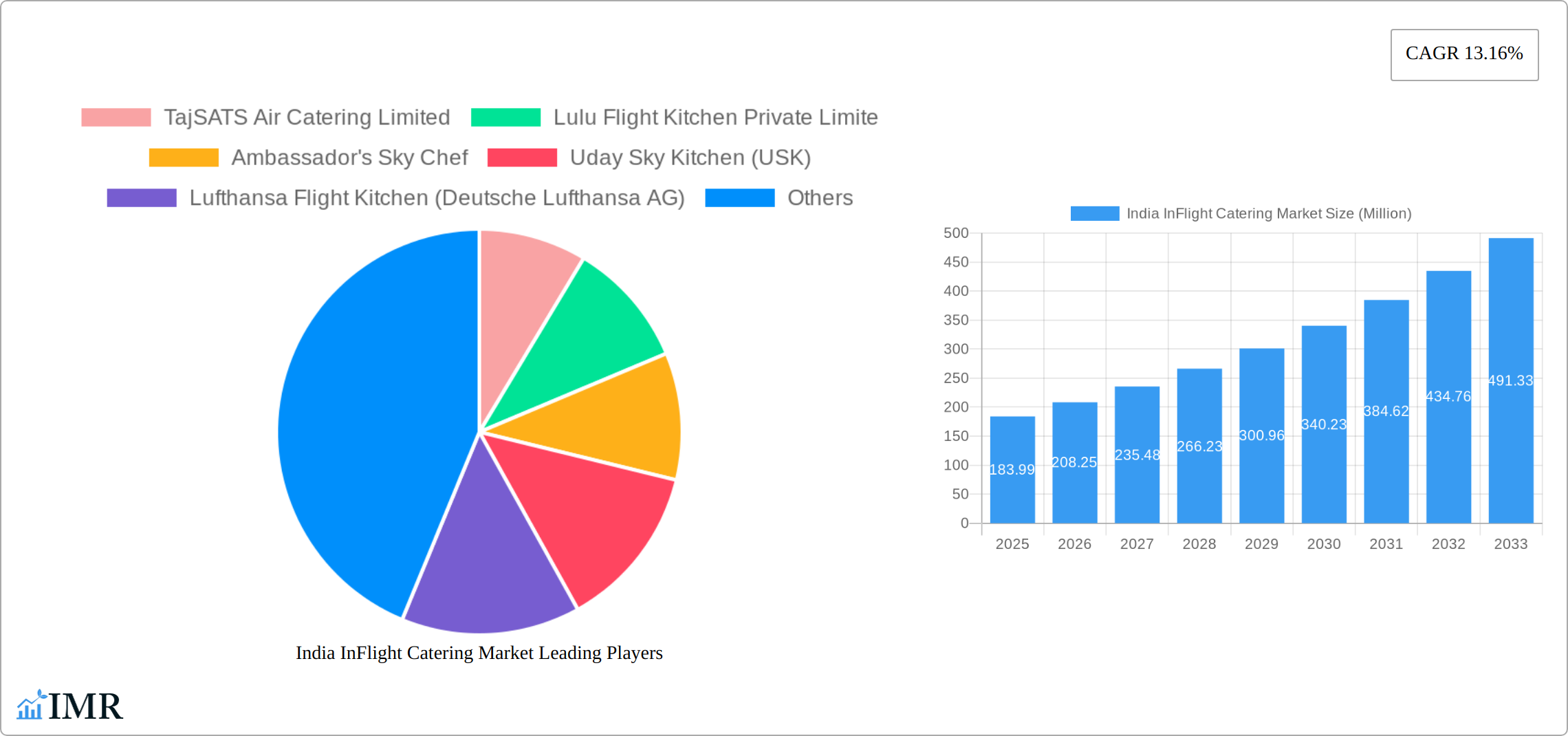

India InFlight Catering Market Company Market Share

India InFlight Catering Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India InFlight Catering Market, encompassing market dynamics, growth trends, regional segmentation, competitive landscape, and future outlook. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. This analysis will equip industry professionals, investors, and stakeholders with crucial insights to navigate this dynamic market. The market is segmented by Aircraft Class (Economy, Business, First), Flight Service Type (Full Service Carriers, Low-cost Carriers, Hybrid), and Food Type (Meals, Bakery & Confectionery, Beverages, Others). The parent market is the Indian aviation industry, and the child market is the in-flight food and beverage service segment. The total market size in 2025 is estimated at XX Million.

India InFlight Catering Market Dynamics & Structure

The Indian InFlight Catering market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, driven by automation and sustainable practices, is a major driver. Stringent regulatory frameworks concerning food safety and hygiene significantly impact operational costs and efficiency. The market witnesses competitive pressures from product substitutes like pre-packaged meals and onboard snack options. The end-user demographic is diverse, catering to varying preferences and dietary requirements across different classes of air travel. M&A activity remains relatively low, with a predicted XX deals in the forecast period (2025-2033), reflecting a stable yet competitive landscape.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately XX% of the market share in 2025.

- Technological Innovation: Focus on automation in food preparation, sustainable packaging, and personalized meal options.

- Regulatory Framework: Stringent food safety and hygiene regulations from the DGCA (Directorate General of Civil Aviation) influence operational costs.

- Competitive Substitutes: Pre-packaged meals and onboard snack options pose a competitive threat.

- End-User Demographics: Diverse, influenced by class of travel (economy, business, first), age, and dietary preferences.

- M&A Activity: Relatively low, with an estimated XX merger and acquisition deals expected during 2025-2033.

India InFlight Catering Market Growth Trends & Insights

The Indian InFlight Catering market is experiencing robust growth, fueled by the expansion of the aviation sector. The market size increased from XX Million in 2019 to XX Million in 2024 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX% during the forecast period. This growth is driven by increasing air passenger traffic, rising disposable incomes, and evolving consumer preferences towards diverse and high-quality in-flight meals. Technological advancements in food preservation and customization further contribute to market expansion. The adoption rate of premium meal options is also increasing, especially in the business and first-class segments.

Dominant Regions, Countries, or Segments in India InFlight Catering Market

The key growth drivers in the India InFlight Catering market include:

- Metropolitan Cities: Mumbai, Delhi, Bengaluru, and Chennai dominate due to high air passenger traffic and established airline hubs.

- Full-Service Carriers: Contribute significantly to market revenue due to their provision of comprehensive meal services.

- Meals Segment: Remains the largest segment by food type, with increasing demand for diverse and customized meals.

- Business & First Class: These segments drive higher revenue due to premium meal offerings and higher price points.

Key Factors for Dominance:

- High Air Passenger Traffic: Growth in air travel directly fuels demand for in-flight catering services.

- Infrastructure Development: Expansion of airports and airline operations supports increased catering requirements.

- Economic Growth: Rising disposable incomes and increased tourism contribute to higher demand.

India InFlight Catering Market Product Landscape

The product landscape is evolving to offer a sophisticated and health-conscious dining experience. There's a marked shift towards highly personalized meal options, meticulously designed to cater to a spectrum of dietary needs and preferences, including but not limited to vegetarian, vegan, gluten-free, diabetic-friendly, and allergen-specific meals. Sustainability is no longer an afterthought but a core strategy, with a significant emphasis on adopting eco-friendly and biodegradable packaging materials to minimize environmental impact and align with global sustainability goals. Technological advancements are revolutionizing the sector, focusing on AI-driven menu optimization for reduced waste and enhanced customer satisfaction, as well as the implementation of advanced food preservation techniques to ensure unwavering quality and freshness throughout the extended journey. Unique selling propositions are increasingly centered on the provenance of ingredients, offering locally sourced and premium quality produce, extensive customization capabilities, and an unwavering commitment to the highest standards of hygiene and food safety, creating a distinct competitive edge.

Key Drivers, Barriers & Challenges in India InFlight Catering Market

Key Drivers:

- Exponential Growth in Air Passenger Traffic: The burgeoning Indian aviation sector, fueled by a growing middle class and increased affordability, directly translates to a sustained and escalating demand for comprehensive in-flight catering services across all classes of travel.

- Surge in Disposable Incomes and Premiumization: As disposable incomes rise, consumers are increasingly willing to spend on enhanced travel experiences, driving a higher demand for premium, gourmet, and customized meal options that offer superior taste and variety.

- Government's Focus on Tourism and Connectivity: Proactive government initiatives aimed at boosting domestic and international tourism, coupled with the expansion of air connectivity to Tier 2 and Tier 3 cities, are significantly expanding the airline network and, consequently, the reach and necessity of in-flight catering.

- Evolving Passenger Expectations: Today's travelers expect a dining experience that rivals ground-based restaurants, pushing catering providers to innovate and offer diverse, high-quality, and culturally relevant culinary selections.

Key Challenges:

- Complexities of Cold Chain and Supply Chain Management: Ensuring the integrity and freshness of perishable food products throughout a multi-stage supply chain, from sourcing to preparation and final delivery on aircraft, presents significant logistical hurdles and potential for spoilage, demanding robust cold chain management.

- Adherence to Stringent Food Safety and Regulatory Mandates: Navigating and complying with rigorous international and domestic food safety regulations, including HACCP, FSSAI, and airline-specific hygiene standards, adds considerable operational costs and requires continuous investment in training and quality control.

- Intensifying Market Competition and Price Sensitivity: The Indian in-flight catering market is characterized by fierce competition among established global players and agile local caterers, leading to price pressures and the constant need for differentiation through service quality and innovation.

- Operational Constraints of Aircraft Operations: Limited galley space, strict weight restrictions, and the need for rapid service delivery on board aircraft pose unique operational challenges that require specialized preparation and packaging solutions.

Emerging Opportunities in India InFlight Catering Market

Emerging opportunities include:

- Expansion into regional airports: Untapped potential exists in catering to smaller airports and regional airlines.

- Focus on specialized diets: Catering to specific dietary requirements (e.g., religious, allergies) presents a significant opportunity.

- Sustainable and eco-friendly options: Demand for sustainable packaging and reduced carbon footprint is increasing.

Growth Accelerators in the India InFlight Catering Market Industry

The trajectory of long-term growth for the India InFlight Catering market will be significantly propelled by the strategic adoption of cutting-edge technological advancements in automated meal preparation, predictive inventory management, and advanced packaging solutions that extend shelf life and enhance presentation. Forging strategic alliances and exclusive partnerships with major airlines, leading food aggregators, and specialized ingredient suppliers will be pivotal in securing long-term contracts and expanding market share. Furthermore, a focused effort on geographic expansion into emerging aviation hubs within India and exploring opportunities in neighboring international routes will unlock new revenue streams. A relentless emphasis on hyper-personalization of meal offerings, leveraging data analytics to anticipate passenger preferences, and delivering an unparalleled level of customer-centric service across all touchpoints will be critical differentiators, fostering loyalty and driving sustained market expansion.

Key Players Shaping the India InFlight Catering Market Market

- TajSATS Air Catering Limited

- Lulu Flight Kitchen Private Limited

- Ambassador's Sky Chef

- Uday Sky Kitchen (USK)

- Lufthansa Flight Kitchen (Deutsche Lufthansa AG)

- Skygourmet Catering Private Limited

- Gate Group

- Casino Air Caterers & Flight Services

- Oberoi Flight Services (Oberoi Group)

- Muthoot Skychef (Muthoot Finance Ltd)

Notable Milestones in India InFlight Catering Market Sector

- 2020: Introduction of contactless delivery systems by several major players.

- 2022: Implementation of stricter hygiene protocols by the DGCA post-pandemic.

- 2023: Launch of several new meal customization options by key players.

In-Depth India InFlight Catering Market Market Outlook

The India InFlight Catering market is poised for robust and sustained expansion, underpinned by the phenomenal growth of the Indian aviation sector and a discerning, increasingly affluent passenger base that demands high-quality, diverse, and safe in-flight culinary experiences. The confluence of strategic collaborations between catering companies and airlines, the integration of innovative technologies in production and logistics, and a deep commitment to sustainable and ethical operational practices will be the cornerstones of success in this dynamic and rapidly evolving market. Projections for the forecast period (2025-2033) indicate a highly promising outlook, with substantial opportunities for significant market expansion, enhanced operational efficiencies, and increased profitability for key stakeholders who can effectively adapt to changing consumer preferences and industry trends.

India InFlight Catering Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India InFlight Catering Market Segmentation By Geography

- 1. India

India InFlight Catering Market Regional Market Share

Geographic Coverage of India InFlight Catering Market

India InFlight Catering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Low Cost Carriers are Expected to Show Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India InFlight Catering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TajSATS Air Catering Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lulu Flight Kitchen Private Limite

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ambassador's Sky Chef

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uday Sky Kitchen (USK)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lufthansa Flight Kitchen (Deutsche Lufthansa AG)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Skygourmet Catering Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gate Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Casino Air Caterers & Flight Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oberoi Flight Services (Oberoi Group)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Muthoot Skychef (Muthoot Finance Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 TajSATS Air Catering Limited

List of Figures

- Figure 1: India InFlight Catering Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India InFlight Catering Market Share (%) by Company 2025

List of Tables

- Table 1: India InFlight Catering Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: India InFlight Catering Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India InFlight Catering Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India InFlight Catering Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India InFlight Catering Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India InFlight Catering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: India InFlight Catering Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: India InFlight Catering Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India InFlight Catering Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India InFlight Catering Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India InFlight Catering Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India InFlight Catering Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India InFlight Catering Market?

The projected CAGR is approximately 13.16%.

2. Which companies are prominent players in the India InFlight Catering Market?

Key companies in the market include TajSATS Air Catering Limited, Lulu Flight Kitchen Private Limite, Ambassador's Sky Chef, Uday Sky Kitchen (USK), Lufthansa Flight Kitchen (Deutsche Lufthansa AG), Skygourmet Catering Private Limited, Gate Group, Casino Air Caterers & Flight Services, Oberoi Flight Services (Oberoi Group), Muthoot Skychef (Muthoot Finance Ltd).

3. What are the main segments of the India InFlight Catering Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 183.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Low Cost Carriers are Expected to Show Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India InFlight Catering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India InFlight Catering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India InFlight Catering Market?

To stay informed about further developments, trends, and reports in the India InFlight Catering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence