Key Insights

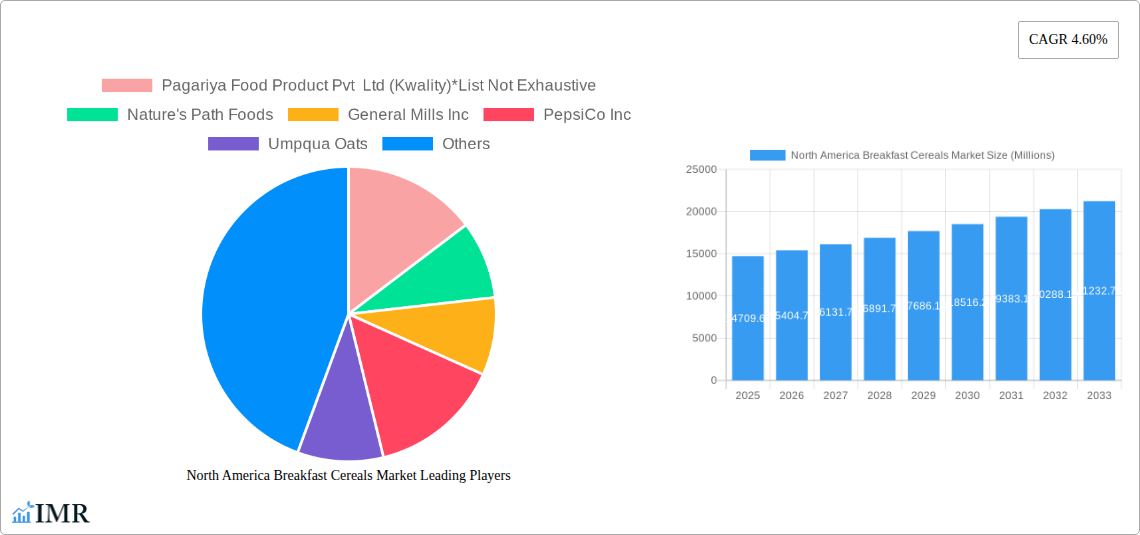

The North American breakfast cereal market is projected for significant growth, anticipated to reach $27.6 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.99%. This expansion is fueled by shifting consumer preferences towards convenience and health-oriented breakfast solutions. The 'Ready-to-eat Cereals' segment is expected to dominate, while 'Ready-to-cook Cereals' offer growing appeal. Corn-based cereals will maintain their lead, with blended and other varieties serving niche demands. Supermarkets, hypermarkets, and online retail channels are crucial for distribution. Key players like General Mills and PepsiCo are driving innovation and market penetration.

North America Breakfast Cereals Market Market Size (In Billion)

Emerging trends favoring plant-based and gluten-free options, alongside a demand for natural ingredients, reduced sugar, and fortified nutrition, present significant opportunities. While competitive pressures and raw material price volatility are potential challenges, ongoing R&D and expansion in online retail are expected to support continued market success across the United States, Canada, and Mexico.

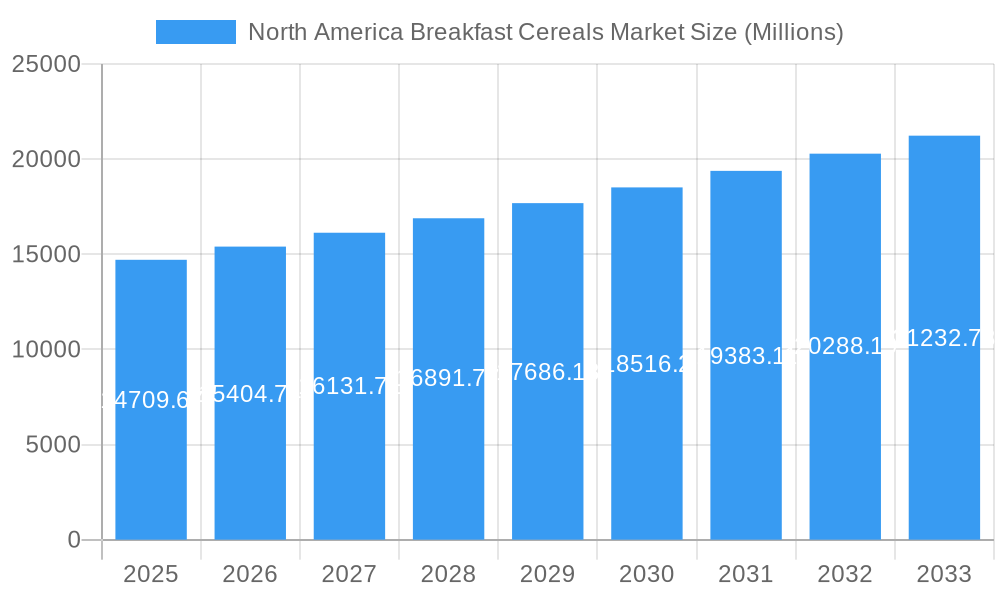

North America Breakfast Cereals Market Company Market Share

North America Breakfast Cereals Market: Comprehensive Market Analysis, Trends, and Forecast (2019-2033)

This comprehensive report delivers an in-depth analysis of the North America Breakfast Cereals Market, covering market dynamics, growth trends, regional dominance, product innovation, key players, and future outlook. With a meticulous focus on ready-to-eat cereals, ready-to-cook cereals, corn-based breakfast cereals, and online retail stores as high-traffic segments, this report is an indispensable resource for industry professionals, investors, and stakeholders seeking to understand the evolving landscape. Values are presented in Millions units.

North America Breakfast Cereals Market Market Dynamics & Structure

The North America breakfast cereals market exhibits a moderately concentrated structure, with a few major players like General Mills Inc., PepsiCo Inc., and Kellogg NA Co. holding significant market shares, estimated to be around 60-70% collectively. Technological innovation is a key driver, particularly in developing healthier and more convenient options, such as gluten-free and protein-fortified cereals. Regulatory frameworks, including labeling laws and nutritional standards, influence product development and marketing strategies. Competitive product substitutes, such as breakfast bars, yogurts, and fruit, pose a constant challenge, necessitating continuous product differentiation. End-user demographics reveal a growing demand for nutritious and convenient breakfast solutions among millennials and Gen Z consumers. Mergers and acquisitions (M&A) activity, while not at an extreme level, has seen strategic consolidation to enhance market reach and product portfolios, with approximately 5-10 significant deals recorded annually during the historical period. Barriers to innovation include high R&D costs and the need for extensive consumer testing to ensure product acceptance.

- Market Concentration: Moderately concentrated with key players holding substantial market share.

- Technological Innovation: Focus on healthier ingredients, convenience, and specialized dietary needs.

- Regulatory Frameworks: Impact on product formulation, labeling, and marketing.

- Competitive Substitutes: Diverse range of alternative breakfast options influencing consumer choices.

- End-User Demographics: Growing demand from younger demographics for healthy and convenient options.

- M&A Trends: Strategic acquisitions for market expansion and portfolio enhancement.

- Innovation Barriers: High R&D investment and consumer acceptance hurdles.

North America Breakfast Cereals Market Growth Trends & Insights

The North America Breakfast Cereals Market is projected to experience robust growth throughout the forecast period, driven by an increasing consumer preference for convenient and nutritious breakfast options. The market size, valued at approximately USD 9,870.5 Million in the base year 2025, is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period of 2025–2033, reaching an estimated USD 14,055.2 Million by 2033. Adoption rates for healthier cereals, such as those with reduced sugar content and added fiber, are steadily rising. Technological disruptions in food processing and ingredient sourcing are enabling manufacturers to introduce innovative product formulations that cater to specific dietary needs, including keto-friendly and plant-based options. Consumer behavior shifts are evident, with a growing emphasis on health and wellness, leading to a demand for transparency in ingredients and sustainable sourcing practices. The market penetration of ready-to-eat cereals is expected to remain dominant, accounting for over 80% of the market share, while ready-to-cook cereals are witnessing a niche growth driven by a renewed interest in traditional breakfast preparation. The increasing influence of online retail channels is also a significant trend, providing consumers with greater accessibility and a wider selection of products.

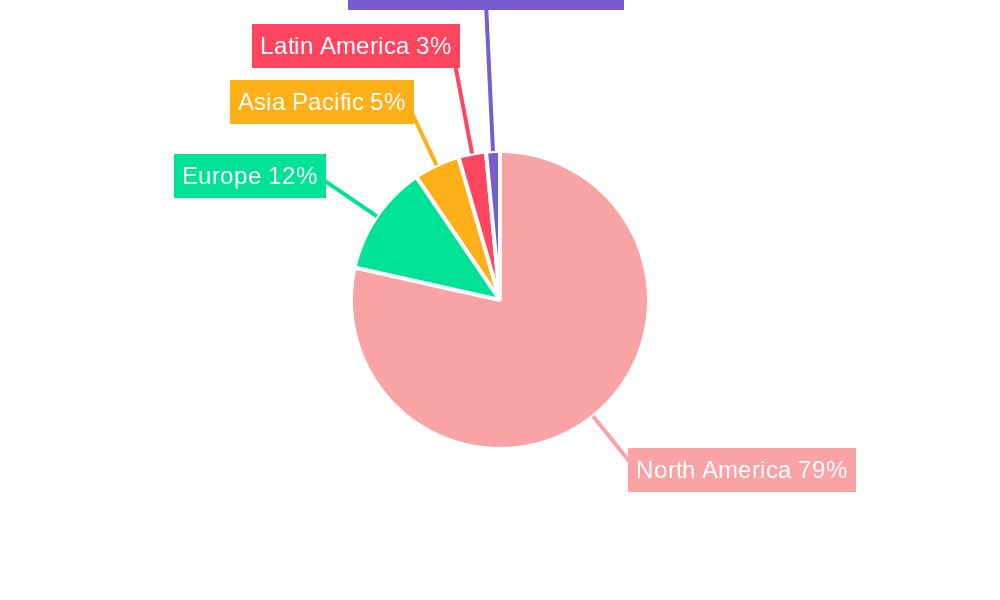

Dominant Regions, Countries, or Segments in North America Breakfast Cereals Market

Within the North America Breakfast Cereals Market, the United States stands out as the dominant country, consistently capturing a market share exceeding 75% throughout the study period. This dominance is fueled by a large consumer base, higher disposable incomes, and a deeply ingrained breakfast cereal culture. The Ready-to-eat Cereals segment, projected to reach approximately USD 11,500 Million by 2033, continues to be the largest and most influential segment within the market. Its growth is propelled by convenience, diverse flavor profiles, and aggressive marketing by major brands. Within product types, Corn-based Breakfast Cereals retain a significant market share, estimated at around 35-40%, due to their widespread availability and long-standing consumer acceptance. However, Mixed/Blended Breakfast Cereals, offering unique flavor combinations and enhanced nutritional profiles, are experiencing a faster growth rate, indicating evolving consumer preferences for variety and perceived health benefits.

In terms of distribution channels, Supermarkets/Hypermarkets remain the primary sales avenue, accounting for over 50% of market revenue due to their extensive reach and product variety. Nevertheless, Online Retail Stores are exhibiting the most dynamic growth, with an estimated CAGR of 6.8% during the forecast period, driven by the convenience of home delivery, wider product selection, and competitive pricing. This digital shift is particularly appealing to younger demographics and busy urban populations. Economic policies promoting healthy eating habits and investments in robust supply chain infrastructure further solidify the leadership of the United States. The ongoing demand for fortified and whole-grain options, coupled with the increasing adoption of online shopping for groceries, are key factors supporting the dominance of these segments and reinforcing the overall growth trajectory of the North America breakfast cereals market.

- Dominant Country: United States.

- Key Drivers: Large consumer base, high disposable income, established cereal culture, aggressive marketing.

- Dominant Segment (Type): Ready-to-eat Cereals.

- Growth Drivers: Convenience, diverse flavors, brand loyalty, marketing campaigns.

- Leading Product Type: Corn-based Breakfast Cereals (significant but with growing competition).

- Dominance Factors: Widespread availability, consumer familiarity.

- Emerging Product Type: Mixed/Blended Breakfast Cereals.

- Growth Potential: Evolving consumer taste, demand for unique formulations and perceived health benefits.

- Dominant Distribution Channel: Supermarkets/Hypermarkets.

- Factors: Extensive reach, product variety, accessibility.

- Fastest Growing Distribution Channel: Online Retail Stores.

- Catalysts: Convenience, wider selection, competitive pricing, digital adoption by consumers.

North America Breakfast Cereals Market Product Landscape

The North America breakfast cereals market is characterized by continuous product innovation aimed at meeting evolving consumer demands for health, convenience, and taste. Leading companies are introducing a plethora of new products, including those with reduced sugar content, higher fiber, added protein, and natural ingredients. Gluten-free, organic, and plant-based cereal options are gaining significant traction, catering to specific dietary needs and preferences. Innovations in ready-to-cook cereals are also emerging, focusing on quicker preparation times and enhanced nutritional profiles. Performance metrics are increasingly tied to nutritional content, ingredient transparency, and sustainable packaging. Unique selling propositions often revolve around claims of improved digestive health, sustained energy release, and allergen-free formulations.

Key Drivers, Barriers & Challenges in North America Breakfast Cereals Market

Key Drivers:

- Health and Wellness Trend: Growing consumer awareness regarding the importance of a nutritious breakfast drives demand for healthier cereal options, such as whole-grain, high-fiber, and low-sugar varieties.

- Convenience and Portability: The fast-paced lifestyle of consumers in North America fuels the demand for ready-to-eat cereals that offer a quick and easy breakfast solution.

- Product Innovation and Diversification: Manufacturers are continuously launching new flavors, textures, and formulations, including those catering to specific dietary needs like gluten-free and keto, attracting a wider consumer base.

- Growing Online Retail Presence: The increasing accessibility and convenience of online grocery shopping are expanding the reach of breakfast cereals to a broader audience.

Barriers & Challenges:

- Intense Competition from Substitutes: The breakfast cereals market faces stiff competition from a wide array of alternative breakfast options, including yogurt, granola bars, smoothies, and eggs, which can limit market share growth.

- Price Sensitivity and Economic Downturns: Consumers, especially in challenging economic conditions, may opt for cheaper breakfast alternatives or reduce their consumption of premium-priced cereals, impacting sales volumes.

- Negative Perceptions of Sugar Content: Despite efforts to reformulate products, some consumers remain concerned about the sugar content in traditional breakfast cereals, leading them to seek alternatives.

- Supply Chain Disruptions and Raw Material Volatility: Fluctuations in the cost and availability of key raw materials, such as grains, and potential supply chain disruptions can impact production costs and product availability. The estimated impact of these challenges can lead to a potential market revenue reduction of 5-10% in a given year.

Emerging Opportunities in North America Breakfast Cereals Market

Emerging opportunities lie in the continued development of plant-based and allergen-free breakfast cereals, catering to the growing vegan and health-conscious populations. The expansion of private label brands by major retailers offers a significant avenue for market penetration, providing consumers with more affordable yet quality options. Furthermore, the trend towards personalized nutrition presents an opportunity for customized cereal blends and fortified options based on individual dietary needs. The integration of smart packaging and interactive consumer experiences through mobile applications can also enhance brand engagement and create new revenue streams. The market for fortified breakfast cereals with added vitamins and minerals is also poised for significant expansion, aligning with the increasing focus on preventative health.

Growth Accelerators in the North America Breakfast Cereals Market Industry

Key catalysts driving long-term growth in the North America Breakfast Cereals Market include advancements in ingredient sourcing and processing technologies that enable the creation of healthier and more sustainable products. Strategic partnerships and collaborations, such as those observed between cereal brands and fruit or dairy companies, amplify marketing reach and introduce innovative product bundles. The ongoing shift towards direct-to-consumer (DTC) sales models, particularly through e-commerce platforms, is unlocking new customer segments and enhancing brand loyalty. Furthermore, proactive engagement with health and wellness influencers and endorsements from nutrition experts are crucial in shaping consumer perceptions and driving adoption of perceived healthier cereal options.

Key Players Shaping the North America Breakfast Cereals Market Market

- General Mills Inc.

- PepsiCo Inc.

- Kellogg NA Co

- Post Consumer Brands LLC

- Nature's Path Foods

- Pagariya Food Product Pvt Ltd (Kwality)

- Umpqua Oats

- Bob's Red Mill Natural Foods

- Attune Foods

- Barbara's Bakery

Notable Milestones in North America Breakfast Cereals Market Sector

- Dec 2022: Pagariya Food Product Pvt. Ltd. (Kwality) launched a new line of ready-to-eat nutritious and delicious cereal, expanding its international reach to over 32 countries, including the United States.

- Feb 2022: Post Holdings introduced "Incredi-Bowl," a keto-friendly breakfast cereal available in three varieties: frosted flakes, chocolate crunch, and honey nut hoops.

- Jan 2022: General Mills Big G cereals, Chiquita bananas, and Yoplait yogurt partnered for the "Go Bananas for Breakfast!" campaign to boost sales of their respective breakfast products.

In-Depth North America Breakfast Cereals Market Market Outlook

The future outlook for the North America Breakfast Cereals Market is exceptionally promising, underpinned by a confluence of sustained health consciousness, evolving consumer lifestyles, and continuous innovation. The market is set to witness accelerated growth driven by the increasing demand for plant-based, organic, and gluten-free options. Strategic expansions into untapped demographics and a heightened focus on personalized nutrition will further propel market value. The ongoing digital transformation, with a strong emphasis on online retail and direct-to-consumer channels, will democratize access and foster greater consumer engagement. Companies that successfully integrate sustainability into their supply chains and product offerings will also capture significant market share. The estimated market value by 2033 signifies a robust expansion, indicating a resilient and dynamic industry poised for significant future opportunities.

North America Breakfast Cereals Market Segmentation

-

1. Type

- 1.1. Ready-to-cook Cereals

- 1.2. Ready-to-eat Cereals

-

2. Product Type

- 2.1. Corn-based Breakfast Cereals

- 2.2. Mixed/Blended Breakfast Cereals

- 2.3. Other Product Types

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience/Grocery Stores

- 3.3. Specialist Stores

- 3.4. Online Retail Stores

- 3.5. Other Distribution Channels

North America Breakfast Cereals Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Breakfast Cereals Market Regional Market Share

Geographic Coverage of North America Breakfast Cereals Market

North America Breakfast Cereals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Clean Label Ingredients; Growing Health Consciousness of Consumers

- 3.3. Market Restrains

- 3.3.1. Higher Manufacturing Cost

- 3.4. Market Trends

- 3.4.1. Rising Demand for Ready-to-eat Breakfast Cereals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Breakfast Cereals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ready-to-cook Cereals

- 5.1.2. Ready-to-eat Cereals

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Corn-based Breakfast Cereals

- 5.2.2. Mixed/Blended Breakfast Cereals

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience/Grocery Stores

- 5.3.3. Specialist Stores

- 5.3.4. Online Retail Stores

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pagariya Food Product Pvt Ltd (Kwality)*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nature's Path Foods

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Mills Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PepsiCo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Umpqua Oats

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kellogg NA Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Post Consumer Brands LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bob's Red Mill Natural Foods

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Attune Foods

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Barbara's Bakery

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pagariya Food Product Pvt Ltd (Kwality)*List Not Exhaustive

List of Figures

- Figure 1: North America Breakfast Cereals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Breakfast Cereals Market Share (%) by Company 2025

List of Tables

- Table 1: North America Breakfast Cereals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Breakfast Cereals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: North America Breakfast Cereals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: North America Breakfast Cereals Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 5: North America Breakfast Cereals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Breakfast Cereals Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Breakfast Cereals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Breakfast Cereals Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: North America Breakfast Cereals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Breakfast Cereals Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: North America Breakfast Cereals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: North America Breakfast Cereals Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 13: North America Breakfast Cereals Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Breakfast Cereals Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Breakfast Cereals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Breakfast Cereals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: United States North America Breakfast Cereals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States North America Breakfast Cereals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Breakfast Cereals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Breakfast Cereals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Breakfast Cereals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Breakfast Cereals Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Breakfast Cereals Market?

The projected CAGR is approximately 2.99%.

2. Which companies are prominent players in the North America Breakfast Cereals Market?

Key companies in the market include Pagariya Food Product Pvt Ltd (Kwality)*List Not Exhaustive, Nature's Path Foods, General Mills Inc, PepsiCo Inc, Umpqua Oats, Kellogg NA Co, Post Consumer Brands LLC, Bob's Red Mill Natural Foods, Attune Foods, Barbara's Bakery .

3. What are the main segments of the North America Breakfast Cereals Market?

The market segments include Type, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Clean Label Ingredients; Growing Health Consciousness of Consumers.

6. What are the notable trends driving market growth?

Rising Demand for Ready-to-eat Breakfast Cereals.

7. Are there any restraints impacting market growth?

Higher Manufacturing Cost.

8. Can you provide examples of recent developments in the market?

Dec 2022: From the house of Pagariya Food Product Pvt. Ltd, Kwality, one of the major producers of masalas, instant mixes, and breakfast cereals, announced its new line of ready-to-eat nutritious and delicious cereal. Pagariya Food Products expanded internationally, exporting to over 32 countries, including the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Breakfast Cereals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Breakfast Cereals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Breakfast Cereals Market?

To stay informed about further developments, trends, and reports in the North America Breakfast Cereals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence