Key Insights

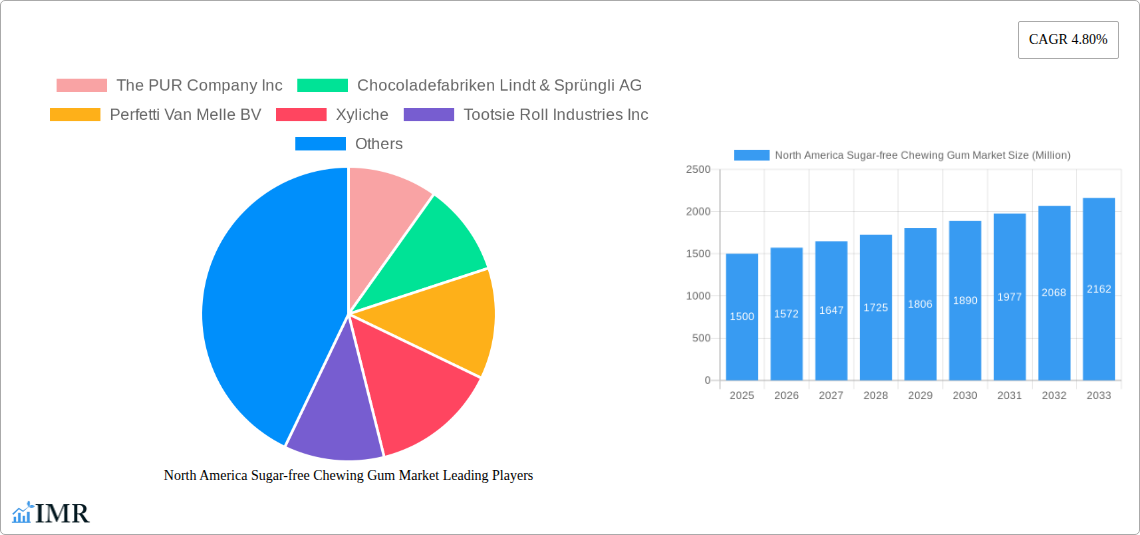

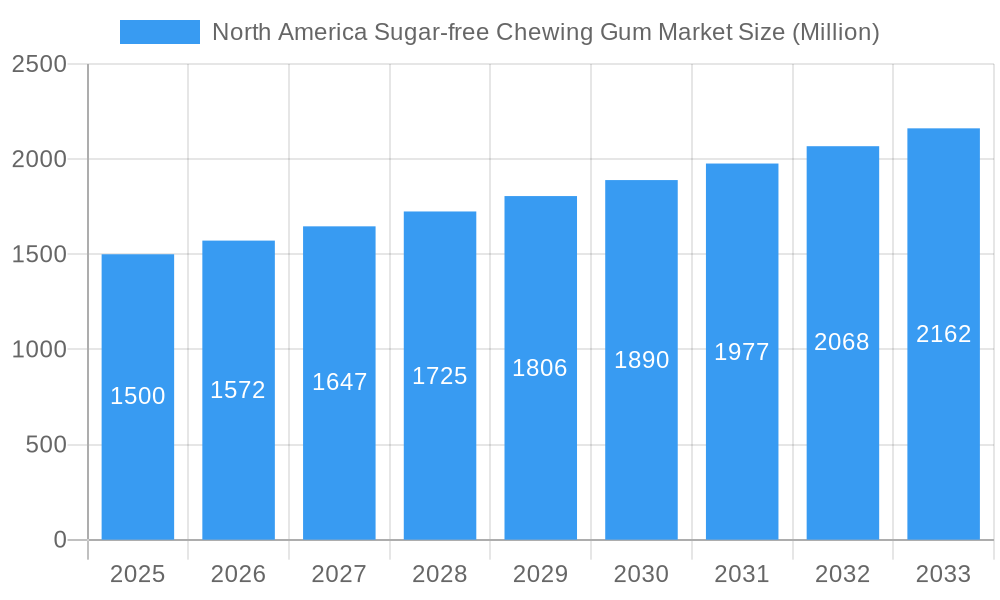

The North American Sugar-free Chewing Gum Market is projected to experience robust growth, driven by a confluence of increasing health consciousness, a desire for oral hygiene benefits, and the expanding reach of innovative product offerings. With an estimated market size of approximately $1,500 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 4.80%, the market is poised for sustained expansion through 2033. Key growth drivers include a heightened consumer awareness of the detrimental effects of sugar consumption on dental health and overall well-being, leading to a preference for sugar-free alternatives. Furthermore, the ongoing trend of consumers seeking convenient and portable ways to freshen breath and maintain oral hygiene fuels demand for chewing gum. The industry is also benefiting from continuous product innovation, with manufacturers introducing new flavors, functional ingredients (such as xylitol for cavity prevention), and more sustainable packaging solutions. The expansion of distribution channels, particularly the growing prominence of online retail stores and the strategic placement of sugar-free options in convenience stores and supermarkets, is also crucial in making these products more accessible to a wider consumer base.

North America Sugar-free Chewing Gum Market Market Size (In Billion)

The market's trajectory is supported by a diverse range of companies actively competing and innovating within the North American landscape. While the restrains such as potential price sensitivity and the availability of alternative oral care products exist, the trends like the rise of natural and plant-based ingredients, the introduction of functional gums with added vitamins or stress-relief properties, and the growing demand for personalized flavor profiles are expected to shape the future of this market. The distribution channel segmentation reveals that convenience stores and online retail stores are emerging as particularly dynamic segments, catering to the on-the-go lifestyles and digital purchasing habits of North American consumers. Supermarkets and hypermarkets continue to be significant players, offering a broad selection to a large demographic. As the focus on preventative health and wellness intensifies, the North America Sugar-free Chewing Gum Market is well-positioned to capitalize on these evolving consumer preferences, solidifying its importance in the confectionery and oral care sectors.

North America Sugar-free Chewing Gum Market Company Market Share

This comprehensive report delves into the dynamic North America Sugar-free Chewing Gum Market, offering an in-depth analysis of its growth drivers, segmentation, competitive landscape, and future outlook. With a focus on high-traffic keywords such as "sugar-free gum market," "North America chewing gum," "functional gum," and "health-conscious consumers," this report is optimized for maximum search engine visibility and designed to engage industry professionals seeking actionable intelligence. We meticulously examine parent and child market trends, presenting all quantitative values in Million units for clarity and precision.

North America Sugar-free Chewing Gum Market Market Dynamics & Structure

The North America sugar-free chewing gum market is characterized by a moderate to high concentration, with key players like Mars Incorporated, Mondelēz International Inc., and Perfetti Van Melle BV holding significant market share. Technological innovation remains a primary driver, particularly in developing novel formulations that offer enhanced functional benefits beyond oral hygiene, such as stress relief, cognitive enhancement, and immune support. Regulatory frameworks, primarily concerning food safety and ingredient labeling, are generally supportive, though evolving consumer perceptions around artificial sweeteners necessitate continuous adaptation. Competitive product substitutes include traditional sugared gums, confectionery products, and alternative breath fresheners. End-user demographics skew towards health-conscious individuals, millennials, and Gen Z consumers actively seeking sugar alternatives and products with added nutritional value. Mergers and acquisitions (M&A) activity, while not as frequent as in other FMCG sectors, plays a role in market consolidation and expansion of product portfolios.

- Market Concentration: Moderate to High, with top 5 players holding an estimated XX% of the market share.

- Technological Innovation Drivers: Development of natural sweeteners, advanced flavor encapsulation, and incorporation of functional ingredients (vitamins, probiotics, adaptogens).

- Regulatory Frameworks: Strict adherence to FDA guidelines for food additives and labeling.

- Competitive Product Substitutes: Traditional chewing gum, mints, breath strips, and other sugar-free confectionery.

- End-User Demographics: Growing demand from health-conscious millennials and Gen Z, individuals with diabetes, and those pursuing weight management.

- M&A Trends: Strategic acquisitions to gain access to innovative technologies or expand into niche segments of the sugar-free gum market.

North America Sugar-free Chewing Gum Market Growth Trends & Insights

The North America sugar-free chewing gum market is poised for robust growth, driven by an escalating consumer consciousness regarding the detrimental effects of sugar consumption. This heightened awareness fuels a significant shift towards sugar-free alternatives across various food and beverage categories, with chewing gum being a prominent beneficiary. The market size evolution reflects this trend, with an estimated market value of USD XXXX Million units in the base year 2025, projected to reach USD YYYY Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period 2025-2033. Adoption rates of sugar-free chewing gum are steadily increasing, particularly among health-focused demographics and individuals managing chronic conditions like diabetes. Technological disruptions are evident in the development of advanced, natural sweetener formulations and the integration of functional ingredients that offer tangible health benefits, moving beyond basic oral care. Consumer behavior shifts are marked by a preference for transparency in ingredients, a demand for sustainably sourced products, and an increased willingness to pay a premium for gums that offer a holistic wellness proposition. The penetration of sugar-free gum into mainstream consumer habits is further amplified by widespread availability across diverse retail channels and effective marketing campaigns highlighting health and wellness attributes.

Dominant Regions, Countries, or Segments in North America Sugar-free Chewing Gum Market

The United States consistently emerges as the dominant region within the North America sugar-free chewing gum market. Its leadership is underpinned by a confluence of factors including a large and health-conscious consumer base, robust economic policies that support market growth, and a highly developed retail infrastructure. The sheer population size and disposable income levels in the US translate into significant demand for health-oriented products, including sugar-free chewing gum. Furthermore, extensive distribution networks, encompassing convenience stores, online retail platforms, and supermarkets/hypermarkets, ensure widespread accessibility for consumers.

Within the United States, Supermarkets/Hypermarkets represent the leading distribution channel for sugar-free chewing gum. These large format retail outlets offer a broad selection, competitive pricing, and the convenience of one-stop shopping, making them the preferred choice for a majority of consumers purchasing FMCG products. The strategic placement of chewing gum at checkouts further capitalizes on impulse purchases.

- Dominant Region: United States

- Key Drivers: Large health-conscious population, high disposable income, advanced retail infrastructure, strong brand presence.

- Market Share: Estimated to hold over XX% of the North American market.

- Leading Distribution Channel: Supermarket/Hypermarket

- Dominance Factors: Wide product variety, competitive pricing, strategic checkout placement, consumer convenience.

- Growth Potential: Continuous expansion of private label sugar-free options and strategic promotional activities.

- Other Significant Channels:

- Convenience Stores: Crucial for impulse purchases and immediate accessibility.

- Online Retail Stores: Rapidly growing, driven by e-commerce adoption and convenience.

- Others: Including pharmacies, drug stores, and specialty health stores, catering to specific consumer needs.

North America Sugar-free Chewing Gum Market Product Landscape

The North America sugar-free chewing gum market is witnessing a surge in product innovation, moving beyond traditional mint and fruit flavors. Manufacturers are increasingly focusing on functional benefits, incorporating ingredients like vitamins, minerals, probiotics, and even adaptogens to cater to evolving consumer demands for wellness. Unique selling propositions now revolve around extended freshness, enamel protection, breath enhancement with natural active ingredients, and stress-relieving properties. Technological advancements in flavor encapsulation ensure long-lasting taste experiences, while the utilization of natural sweeteners like xylitol, erythritol, and stevia addresses concerns surrounding artificial additives. This product diversification is crucial for maintaining consumer engagement and capturing a larger market share.

Key Drivers, Barriers & Challenges in North America Sugar-free Chewing Gum Market

The North America sugar-free chewing gum market is propelled by several key drivers. The escalating global health and wellness trend, a growing awareness of the negative impacts of sugar consumption, and an increasing prevalence of diabetes and obesity are pushing consumers towards sugar-free alternatives. Technological advancements in natural sweeteners and functional ingredient integration further enhance product appeal. Additionally, aggressive marketing campaigns by key players highlighting the health benefits and convenience of sugar-free gum contribute significantly to its market growth.

However, the market also faces notable barriers and challenges. Negative perceptions and ongoing research regarding the long-term effects of artificial sweeteners can act as a restraint for some consumer segments. Fluctuations in raw material prices, particularly for natural sweeteners, can impact production costs and profit margins. Intense competition from other sugar-free confectionery and snack options, coupled with the maturity of the chewing gum market in certain segments, presents ongoing competitive pressures. Supply chain disruptions and evolving regulatory landscapes regarding food additives also pose potential challenges.

Emerging Opportunities in North America Sugar-free Chewing Gum Market

Emerging opportunities within the North America sugar-free chewing gum market lie in the expansion of functional benefits beyond oral care. This includes the development of gums targeted at cognitive enhancement, sleep support, and immune system boosting, tapping into the growing nutraceuticals trend. Untapped markets include more niche demographics with specific dietary needs or lifestyle preferences. Innovative applications, such as biodegradable gum bases and personalized flavor profiles, also present significant growth potential. Evolving consumer preferences for sustainable packaging and ethically sourced ingredients offer avenues for brand differentiation and market penetration.

Growth Accelerators in the North America Sugar-free Chewing Gum Market Industry

Long-term growth in the North America sugar-free chewing gum industry is being significantly accelerated by continuous technological breakthroughs in natural sweetener technologies and the integration of a wider array of health-promoting ingredients. Strategic partnerships between gum manufacturers and health and wellness brands are creating synergistic marketing opportunities and expanding consumer reach. Furthermore, the ongoing expansion of e-commerce platforms provides direct access to a broader consumer base, facilitating faster product adoption and sales growth. Market expansion strategies, including the introduction of innovative product formats and flavor profiles tailored to diverse cultural preferences, are also key catalysts for sustained growth.

Key Players Shaping the North America Sugar-free Chewing Gum Market Market

- The PUR Company Inc

- Chocoladefabriken Lindt & Sprüngli AG

- Perfetti Van Melle BV

- Xyliche

- Tootsie Roll Industries Inc

- The Bazooka Companies Inc

- Simply Gum Inc

- Mars Incorporated

- Ford Gum & Machine Company Inc

- Mondelēz International Inc

- The Hershey Company

- Mazee LLC

Notable Milestones in North America Sugar-free Chewing Gum Market Sector

- December 2022: Perfetti Van Melle launched new functional benefit variants of its Mentos and Smint gum editions with vitamins and health benefits to help boost the appeal of both brands in a new market. The new Mentos range is sugar-free, contains vitamins such as B6, C, and B12, and features a liquid center that provides “long-lasting freshness.” It is available in a variety of citrus flavors.

- December 2021: Perfetti Van Melle BV added a new production line at its facility near Erlanger, Kentucky, with a USD 10 million investment. This expansion enhances their manufacturing capacity for popular brands like Airheads, Mentos, Fruit-Tella, and Chupa Chups, including their sugar-free variants.

- October 2021: Perfetti Van Melle USA Inc. launched a berry flavor of its Mentos Gum with Vitamins, diversifying its product offerings and catering to consumer demand for both flavor and functional benefits in sugar-free gum.

In-Depth North America Sugar-free Chewing Gum Market Market Outlook

The future outlook for the North America sugar-free chewing gum market is exceptionally promising, characterized by sustained growth fueled by a persistent consumer drive towards healthier lifestyle choices. The market's trajectory is being significantly shaped by advancements in functional ingredients and natural sweetener technologies, which are enabling the creation of highly differentiated products that offer tangible health benefits beyond basic oral hygiene. Strategic alliances and partnerships will continue to be crucial for expanding market reach and leveraging synergistic marketing initiatives. The growing preference for sustainable practices and transparent ingredient sourcing presents a key opportunity for brands to build consumer loyalty and capture market share in this evolving landscape. The market is expected to witness further innovation in product formats and flavor profiles, catering to an increasingly sophisticated consumer base.

North America Sugar-free Chewing Gum Market Segmentation

-

1. Distribution Channel

- 1.1. Convenience Store

- 1.2. Online Retail Store

- 1.3. Supermarket/Hypermarket

- 1.4. Others

North America Sugar-free Chewing Gum Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Sugar-free Chewing Gum Market Regional Market Share

Geographic Coverage of North America Sugar-free Chewing Gum Market

North America Sugar-free Chewing Gum Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Influence of Endorsements

- 3.2.2 Aggressive Marketing

- 3.2.3 and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products; Fluctuating Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sugar-free Chewing Gum Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Convenience Store

- 5.1.2. Online Retail Store

- 5.1.3. Supermarket/Hypermarket

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The PUR Company Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chocoladefabriken Lindt & Sprüngli AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Perfetti Van Melle BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xyliche

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tootsie Roll Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Bazooka Companies Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Simply Gum Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mars Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ford Gum & Machine Company Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mondelēz International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Hershey Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mazee LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 The PUR Company Inc

List of Figures

- Figure 1: North America Sugar-free Chewing Gum Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Sugar-free Chewing Gum Market Share (%) by Company 2025

List of Tables

- Table 1: North America Sugar-free Chewing Gum Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 2: North America Sugar-free Chewing Gum Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: North America Sugar-free Chewing Gum Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Sugar-free Chewing Gum Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States North America Sugar-free Chewing Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Sugar-free Chewing Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Sugar-free Chewing Gum Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sugar-free Chewing Gum Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the North America Sugar-free Chewing Gum Market?

Key companies in the market include The PUR Company Inc, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle BV, Xyliche, Tootsie Roll Industries Inc, The Bazooka Companies Inc, Simply Gum Inc, Mars Incorporated, Ford Gum & Machine Company Inc, Mondelēz International Inc, The Hershey Company, Mazee LLC.

3. What are the main segments of the North America Sugar-free Chewing Gum Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements. Aggressive Marketing. and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products; Fluctuating Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

December 2022: Perfetti Van Melle launched new functional benefit variants of its Mentos and Smint gum editions with vitamins and health benefits to help boost the appeal of both brands in a new market. The new Mentos range is sugar-free, contains vitamins such as B6, C, and B12, and features a liquid center that provides “long-lasting freshness.” It is available in a variety of citrus flavors.December 2021: Perfetti Van Melle BV, which produces Airheads, Mentos, Fruit-Tella, and Chupa Chups, added a new production line at its facility near Erlanger, Kentucky, with a USD 10 million investment.October 2021: Perfetti Van Melle USA Inc. launched a berry flavor of its Mentos Gum with Vitamins.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sugar-free Chewing Gum Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sugar-free Chewing Gum Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sugar-free Chewing Gum Market?

To stay informed about further developments, trends, and reports in the North America Sugar-free Chewing Gum Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence