Key Insights

The global Packaged Rice market is projected for significant expansion, estimated to reach USD 33.16 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 8% through 2033. This growth is fueled by evolving consumer preferences for convenient, hygienic food options, increasing urbanization, and rising disposable incomes, particularly in emerging economies. Enhanced awareness of food safety and quality, coupled with the convenience of pre-packaged rice for modern lifestyles, are key market drivers. The introduction of value-added products like flavored, fortified, and organic rice varieties is attracting broader consumer segments and driving market penetration. The expansion of modern retail channels, including supermarkets and e-commerce platforms, is improving product accessibility and further stimulating demand across diverse regions.

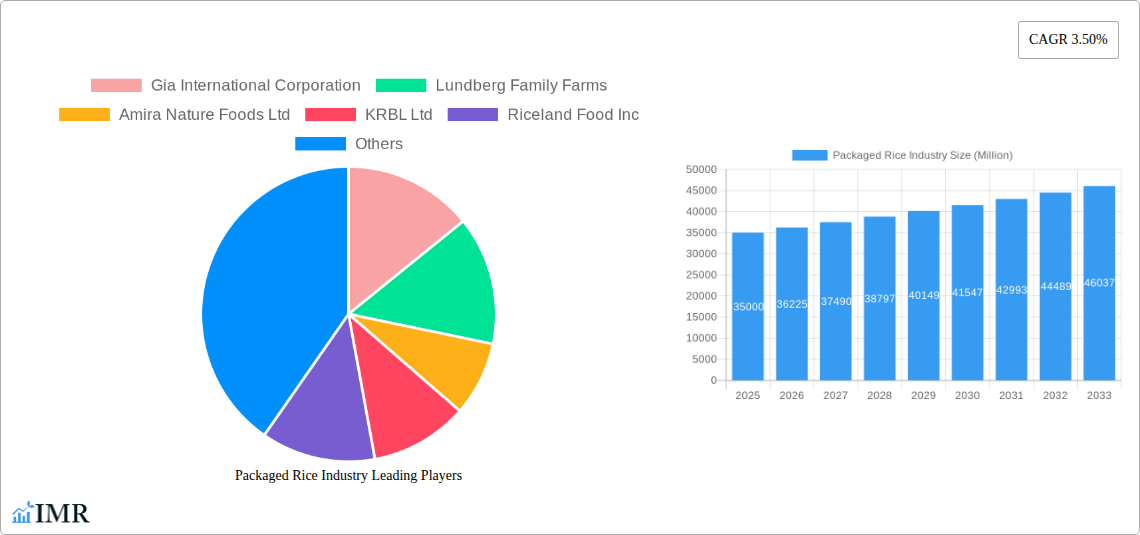

Packaged Rice Industry Market Size (In Billion)

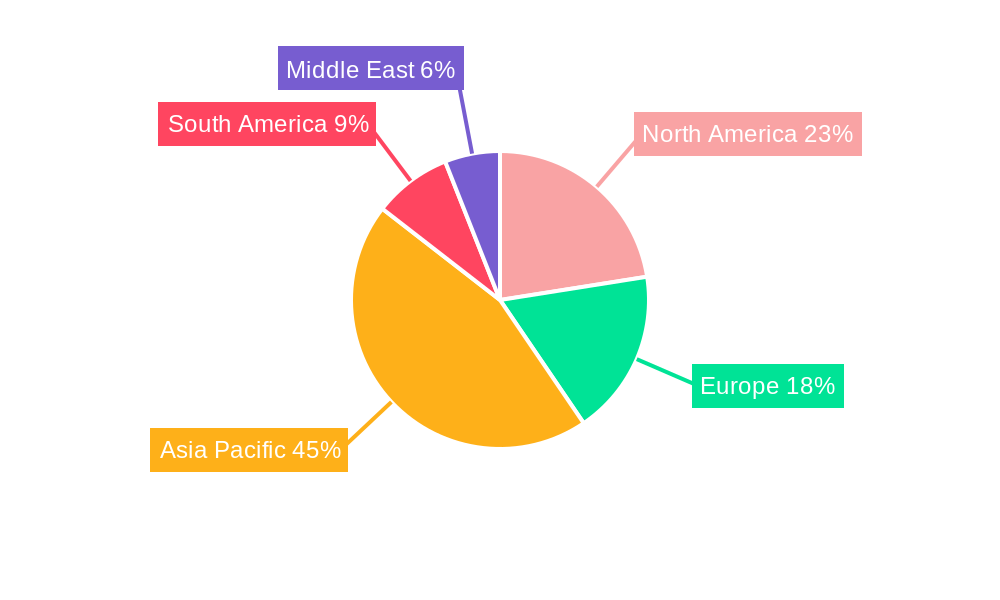

The market exhibits segmentation across rice types and consumer preferences. Long-grain rice currently dominates due to its staple status, but short-grain and medium-grain segments are gaining traction driven by regional culinary trends. While white rice remains prevalent due to affordability, there is a notable increase in demand for healthier options such as brown rice and red rice, reflecting growing health consciousness. Basmati rice continues to occupy a premium segment, recognized for its aromatic qualities and its importance as an export commodity. Geographically, Asia Pacific leads the market, attributed to high population density and the central role of rice in nutrition. North America and Europe are experiencing substantial growth, influenced by expatriate populations and a rising appreciation for global cuisines. Leading companies are prioritizing product innovation, sustainable sourcing, and distribution network expansion to capitalize on these trends and maintain a competitive advantage.

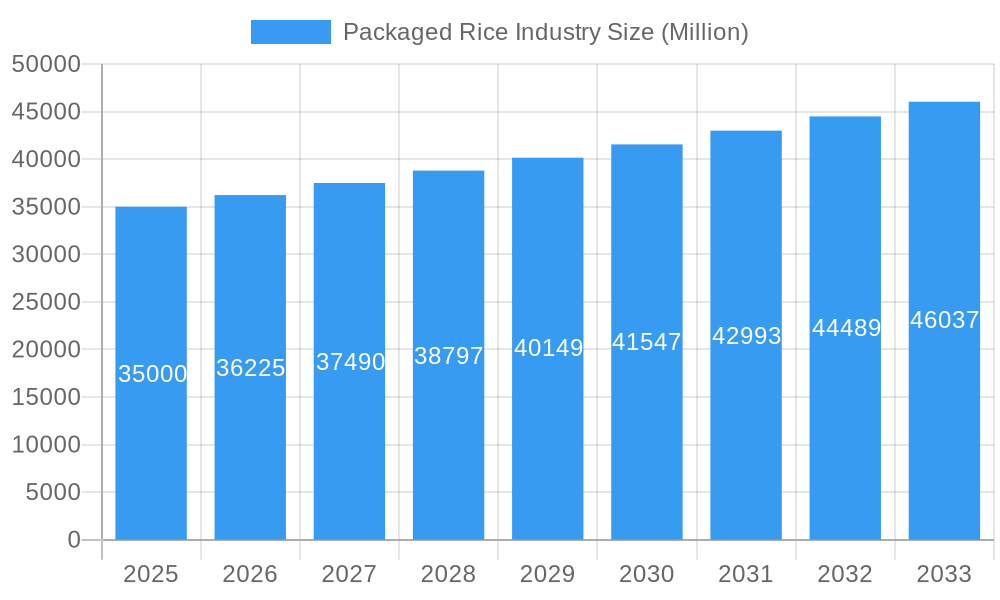

Packaged Rice Industry Company Market Share

This comprehensive report provides strategic analysis of the global Packaged Rice market, offering critical insights into market dynamics, growth trends, and competitive landscapes from 2019 to 2033. Utilizing 2025 as the base year, this research leverages historical data (2019-2024) and forecasts (2025-2033) to deliver actionable intelligence. The report meticulously analyzes key market segments, incorporating high-traffic SEO keywords such as 'Packaged Rice Market Analysis', 'Rice Industry Growth', 'Branded Rice Trends', 'Packaged Food Market Insights', and 'Grain Industry Forecasts' to maximize professional visibility.

Packaged Rice Industry Market Dynamics & Structure

The Packaged Rice Industry exhibits a moderately consolidated market structure, influenced by strategic mergers, acquisitions, and the emergence of innovative product offerings. Technological advancements in milling, packaging, and supply chain logistics are key drivers of efficiency and product quality, impacting rice product development and food packaging solutions. Regulatory frameworks governing food safety, labeling, and import/export policies play a significant role in shaping market access and competition. The availability of competitive product substitutes, such as other grains and alternative carbohydrate sources, necessitates a focus on value-added rice products and specialty rice varieties. End-user demographics, characterized by growing health consciousness and demand for convenience, are increasingly influencing product diversification and marketing strategies. Mergers and acquisitions (M&A) trends are evident, with larger players consolidating their market positions and expanding their portfolios.

- Market Concentration: Moderate, with key players holding significant shares.

- Technological Innovation: Focus on automated milling, advanced packaging for extended shelf life, and traceability solutions.

- Regulatory Landscape: Stringent food safety standards (e.g., HACCP, ISO) and diverse national labeling requirements.

- Product Substitutes: Quinoa, pasta, and other processed grains.

- End-User Demographics: Young urban professionals, health-conscious consumers, and families seeking convenience.

- M&A Trends: Strategic acquisitions to gain market share and access new brands/technologies. Example: Adani Wilmar's acquisition of the Kohinoor brand.

Packaged Rice Industry Growth Trends & Insights

The Packaged Rice Industry is projected to experience robust growth, driven by an escalating global population, increasing urbanization, and a discernible shift in consumer preferences towards convenient and healthy food options. The market size is expected to expand significantly, reflecting higher adoption rates of branded and processed rice varieties. Technological disruptions, particularly in rice processing technology and sustainable packaging, are reshaping the industry's landscape, leading to the introduction of value-added products like organic, fortified, and parboiled rice. Consumer behavior shifts are marked by a growing demand for premium Basmati rice, organic rice, and specialty rice types that offer distinct nutritional benefits and culinary experiences. The rising disposable incomes in developing economies, coupled with a growing awareness of food quality and safety, further fuel the demand for packaged rice.

The compound annual growth rate (CAGR) for the global rice market within the packaged segment is anticipated to be a healthy XX%, indicating sustained expansion throughout the forecast period. Market penetration is deepening as consumers move away from bulk, unpackaged rice towards more hygienic, traceable, and branded alternatives. This trend is particularly pronounced in emerging economies where the organized retail sector is expanding. The focus on health and wellness trends is leading to a surge in demand for brown rice, red rice, and other whole-grain rice varieties, positioning these as key growth drivers. Furthermore, innovations in packaging, such as resealable bags and smaller portion sizes, cater to the needs of modern households and busy lifestyles, boosting market growth. The integration of digital platforms and e-commerce channels for online rice sales is also a significant contributor, enhancing accessibility and convenience for consumers. The food industry trends towards convenience and premiumization are directly benefiting the packaged rice sector.

Dominant Regions, Countries, or Segments in Packaged Rice Industry

The Packaged Rice Industry is experiencing significant growth driven by key regions and segments that are capitalizing on specific market dynamics. Asia Pacific, particularly India and Southeast Asian countries, continues to be a dominant force due to its established rice-consuming culture, large population base, and rapidly expanding organized retail sector. The demand for Basmati rice in these regions, both domestically and for export, is a major growth engine.

- Dominant Region: Asia Pacific.

- Key Drivers: Large consumer base, cultural affinity for rice, expanding middle class, increasing urbanization, and growing organized retail penetration.

- Market Share: Accounts for over XX% of the global packaged rice market.

- Growth Potential: High, driven by increasing disposable incomes and adoption of branded products.

Among the product types, White Rice continues to hold the largest market share due to its widespread consumption and affordability. However, Brown Rice and Red Rice are witnessing accelerated growth rates, fueled by increasing consumer awareness of their superior nutritional profiles and health benefits. The Basmati Rice segment also commands a significant premium and is a key driver of value growth, particularly in export markets and for specific consumer segments seeking high-quality aromatic rice.

- Dominant Segment (Type): White Rice (in terms of volume), Basmati Rice (in terms of value and premium segment).

- White Rice Drivers: Staple food, affordability, and widespread availability.

- Basmati Rice Drivers: Premium quality, aromatic properties, and strong export demand.

- Emerging Growth (Type): Brown Rice and Red Rice, driven by health and wellness trends.

In terms of distribution channels, Supermarkets/Hypermarkets are the leading channels, offering a wide selection of brands and product varieties. However, Online Retail Stores are exhibiting the fastest growth, reflecting the increasing adoption of e-commerce for grocery purchases. This channel offers unparalleled convenience and accessibility, particularly for consumers in urban areas.

- Dominant Distribution Channel: Supermarkets/Hypermarkets.

- Drivers: Wide product availability, promotional activities, and established consumer shopping habits.

- Fastest Growing Channel: Online Retail Stores.

- Online Retail Drivers: Convenience, wider selection, competitive pricing, and home delivery services.

The prevalence of Long Grain Rice in many key markets, particularly for specific culinary applications like pilafs and biryanis, solidifies its position as a significant segment. However, the growing interest in diverse culinary traditions is also boosting the demand for Medium Grain Rice and Short Grain Rice in specific applications and regional markets.

- Dominant Segment (Size): Long Grain Rice.

- Drivers: Versatility in cooking, preference in key cuisines.

- Growth Potential (Other Sizes): Increasing demand for specific culinary applications driving Medium and Short Grain Rice.

Packaged Rice Industry Product Landscape

The Packaged Rice Industry product landscape is characterized by a steady stream of innovations aimed at enhancing consumer convenience, health benefits, and product quality. Key innovations include the development of quick-cooking rice varieties, fortified rice with essential vitamins and minerals, and a growing range of organic and specialty rice types like black rice and wild rice. Companies are investing in advanced packaging technologies that extend shelf life, maintain freshness, and offer improved aesthetics. Unique selling propositions often revolve around specific rice varietals like premium Basmati, ethically sourced organic options, and gluten-free alternatives. Technological advancements in milling processes ensure consistent grain quality and reduced breakage, contributing to a superior end product.

Key Drivers, Barriers & Challenges in Packaged Rice Industry

The Packaged Rice Industry is propelled by several key drivers, including the increasing global demand for staple food, rising health consciousness leading to demand for healthier rice options, and the growing influence of organized retail and e-commerce channels. Technological advancements in processing and packaging also contribute significantly.

- Key Drivers:

- Global population growth and increasing demand for staple foods.

- Rising health awareness driving demand for brown, red, and organic rice.

- Expansion of organized retail and online grocery platforms.

- Technological innovations in milling, packaging, and fortification.

- Premiumization trends favoring high-quality rice varieties like Basmati.

However, the industry faces significant challenges and barriers. Supply chain disruptions due to climate change and geopolitical factors can impact raw material availability and price volatility. Stringent and diverse regulatory frameworks across different countries pose compliance hurdles. Intense competition from both established brands and smaller regional players, coupled with price sensitivity in certain markets, can limit profit margins.

- Key Barriers & Challenges:

- Supply chain vulnerabilities (weather, logistics, trade policies).

- Price volatility of paddy and finished rice.

- Intense competition and price wars.

- Varying and complex international food safety and labeling regulations.

- Consumer price sensitivity in emerging markets.

- Perceived higher cost of packaged rice compared to unpackaged alternatives.

Emerging Opportunities in Packaged Rice Industry

Emerging opportunities in the Packaged Rice Industry lie in tapping into the growing demand for value-added and niche products. The "superfoods" trend is creating a market for ancient grains and specialty rice varieties with unique nutritional profiles. Furthermore, the increasing focus on sustainability presents opportunities for eco-friendly packaging solutions and ethically sourced rice. Expanding into untapped geographical markets with growing disposable incomes and developing tailored product offerings for specific dietary needs (e.g., low-glycemic rice) also represent significant growth avenues.

- Opportunities:

- Growth in demand for organic, non-GMO, and specialty rice (e.g., black, red).

- Development of functional rice products (fortified, low-glycemic).

- Expansion into emerging markets with rising consumer spending.

- Innovation in sustainable and biodegradable packaging.

- Catering to evolving consumer preferences for convenience and premium quality.

Growth Accelerators in the Packaged Rice Industry Industry

Several growth accelerators are poised to significantly bolster the Packaged Rice Industry. Technological breakthroughs in precision agriculture can lead to improved yields and quality of rice cultivation, ensuring a stable supply chain. Strategic partnerships between rice producers, food manufacturers, and retail chains can enhance market reach and distribution efficiency. Furthermore, aggressive market expansion strategies, including entry into new geographies and the acquisition of smaller regional brands, will contribute to sustained long-term growth. The increasing consumer awareness and demand for healthier, convenient, and traceable food products will continue to be a primary growth catalyst.

Key Players Shaping the Packaged Rice Industry Market

- Gia International Corporation

- Lundberg Family Farms

- Amira Nature Foods Ltd

- KRBL Ltd

- Riceland Food Inc

- Tan Long Group

- Adani Group

- Producers Rice Mills Inc

- Thai Hua Co Ltd

- Riviana Foods Inc

Notable Milestones in Packaged Rice Industry Sector

- May 2022: Adani Wilmar announced the acquisition of the Kohinoor Brand in India from McCormick Switzerland GMBH. This strategic move bolstered their portfolio with both premium Basmati rice (Kohinoor) and affordable rice (Charminar).

- July 2022: Tan Long Group achieved a significant milestone with the initial shipment of ST25 rice, a Vietnamese specialty recognized as the world's best rice, to Japan, marking an expansion into a key international market.

- October 2021: Organic India, a prominent player in the organic food sector, launched an expanded range of organic products, including organic basmati rice, red rice, and black rice, catering to the growing demand for organic and health-conscious food options.

In-Depth Packaged Rice Industry Market Outlook

The future outlook for the Packaged Rice Industry is exceptionally promising, driven by a confluence of sustained demand, evolving consumer preferences, and ongoing innovation. Growth accelerators such as the expanding middle class in developing economies, coupled with the increasing adoption of online retail channels, will further fuel market expansion. Strategic investments in sustainable production practices and the development of value-added products will be crucial for capturing market share and ensuring long-term profitability. The industry is well-positioned to capitalize on global trends emphasizing health, convenience, and product traceability, making it a dynamic and resilient sector within the broader food industry.

Packaged Rice Industry Segmentation

-

1. Size

- 1.1. Short Grain Rice

- 1.2. Medium Grain Rice

- 1.3. Long Grain Rice

-

2. Type

- 2.1. White Rice

- 2.2. Red Rice

- 2.3. Brown Rice

- 2.4. Basmati Rice

- 2.5. Others

-

3. Distibution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience/ Grocery Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

Packaged Rice Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Packaged Rice Industry Regional Market Share

Geographic Coverage of Packaged Rice Industry

Packaged Rice Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. Increasing demand for Premium Packaged Rice

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaged Rice Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Short Grain Rice

- 5.1.2. Medium Grain Rice

- 5.1.3. Long Grain Rice

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. White Rice

- 5.2.2. Red Rice

- 5.2.3. Brown Rice

- 5.2.4. Basmati Rice

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience/ Grocery Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. North America Packaged Rice Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Short Grain Rice

- 6.1.2. Medium Grain Rice

- 6.1.3. Long Grain Rice

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. White Rice

- 6.2.2. Red Rice

- 6.2.3. Brown Rice

- 6.2.4. Basmati Rice

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Convenience/ Grocery Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. Europe Packaged Rice Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Short Grain Rice

- 7.1.2. Medium Grain Rice

- 7.1.3. Long Grain Rice

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. White Rice

- 7.2.2. Red Rice

- 7.2.3. Brown Rice

- 7.2.4. Basmati Rice

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Convenience/ Grocery Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Asia Pacific Packaged Rice Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Short Grain Rice

- 8.1.2. Medium Grain Rice

- 8.1.3. Long Grain Rice

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. White Rice

- 8.2.2. Red Rice

- 8.2.3. Brown Rice

- 8.2.4. Basmati Rice

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Convenience/ Grocery Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. South America Packaged Rice Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Short Grain Rice

- 9.1.2. Medium Grain Rice

- 9.1.3. Long Grain Rice

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. White Rice

- 9.2.2. Red Rice

- 9.2.3. Brown Rice

- 9.2.4. Basmati Rice

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Convenience/ Grocery Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. Middle East Packaged Rice Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Short Grain Rice

- 10.1.2. Medium Grain Rice

- 10.1.3. Long Grain Rice

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. White Rice

- 10.2.2. Red Rice

- 10.2.3. Brown Rice

- 10.2.4. Basmati Rice

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Convenience/ Grocery Stores

- 10.3.3. Online Retail Stores

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. Saudi Arabia Packaged Rice Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Size

- 11.1.1. Short Grain Rice

- 11.1.2. Medium Grain Rice

- 11.1.3. Long Grain Rice

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. White Rice

- 11.2.2. Red Rice

- 11.2.3. Brown Rice

- 11.2.4. Basmati Rice

- 11.2.5. Others

- 11.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 11.3.1. Supermarkets/Hypermarkets

- 11.3.2. Convenience/ Grocery Stores

- 11.3.3. Online Retail Stores

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Size

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Gia International Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Lundberg Family Farms

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Amira Nature Foods Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 KRBL Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Riceland Food Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Tan Long Group*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Adani Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Producers Rice Mills Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Thai Hua Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Riviana Foods Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Gia International Corporation

List of Figures

- Figure 1: Global Packaged Rice Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Packaged Rice Industry Revenue (billion), by Size 2025 & 2033

- Figure 3: North America Packaged Rice Industry Revenue Share (%), by Size 2025 & 2033

- Figure 4: North America Packaged Rice Industry Revenue (billion), by Type 2025 & 2033

- Figure 5: North America Packaged Rice Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Packaged Rice Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 7: North America Packaged Rice Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 8: North America Packaged Rice Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Packaged Rice Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Packaged Rice Industry Revenue (billion), by Size 2025 & 2033

- Figure 11: Europe Packaged Rice Industry Revenue Share (%), by Size 2025 & 2033

- Figure 12: Europe Packaged Rice Industry Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Packaged Rice Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Packaged Rice Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 15: Europe Packaged Rice Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 16: Europe Packaged Rice Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Packaged Rice Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Packaged Rice Industry Revenue (billion), by Size 2025 & 2033

- Figure 19: Asia Pacific Packaged Rice Industry Revenue Share (%), by Size 2025 & 2033

- Figure 20: Asia Pacific Packaged Rice Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Asia Pacific Packaged Rice Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Packaged Rice Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 23: Asia Pacific Packaged Rice Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 24: Asia Pacific Packaged Rice Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Packaged Rice Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Packaged Rice Industry Revenue (billion), by Size 2025 & 2033

- Figure 27: South America Packaged Rice Industry Revenue Share (%), by Size 2025 & 2033

- Figure 28: South America Packaged Rice Industry Revenue (billion), by Type 2025 & 2033

- Figure 29: South America Packaged Rice Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Packaged Rice Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 31: South America Packaged Rice Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 32: South America Packaged Rice Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Packaged Rice Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Packaged Rice Industry Revenue (billion), by Size 2025 & 2033

- Figure 35: Middle East Packaged Rice Industry Revenue Share (%), by Size 2025 & 2033

- Figure 36: Middle East Packaged Rice Industry Revenue (billion), by Type 2025 & 2033

- Figure 37: Middle East Packaged Rice Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East Packaged Rice Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 39: Middle East Packaged Rice Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 40: Middle East Packaged Rice Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Packaged Rice Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Saudi Arabia Packaged Rice Industry Revenue (billion), by Size 2025 & 2033

- Figure 43: Saudi Arabia Packaged Rice Industry Revenue Share (%), by Size 2025 & 2033

- Figure 44: Saudi Arabia Packaged Rice Industry Revenue (billion), by Type 2025 & 2033

- Figure 45: Saudi Arabia Packaged Rice Industry Revenue Share (%), by Type 2025 & 2033

- Figure 46: Saudi Arabia Packaged Rice Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 47: Saudi Arabia Packaged Rice Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 48: Saudi Arabia Packaged Rice Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Saudi Arabia Packaged Rice Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Packaged Rice Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 2: Global Packaged Rice Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Packaged Rice Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Global Packaged Rice Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Packaged Rice Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 6: Global Packaged Rice Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Packaged Rice Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 8: Global Packaged Rice Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Packaged Rice Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 14: Global Packaged Rice Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global Packaged Rice Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 16: Global Packaged Rice Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Germany Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Italy Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Russia Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Packaged Rice Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 25: Global Packaged Rice Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Packaged Rice Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 27: Global Packaged Rice Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: China Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: India Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Australia Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Packaged Rice Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 34: Global Packaged Rice Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 35: Global Packaged Rice Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 36: Global Packaged Rice Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Packaged Rice Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 41: Global Packaged Rice Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Global Packaged Rice Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 43: Global Packaged Rice Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global Packaged Rice Industry Revenue billion Forecast, by Size 2020 & 2033

- Table 45: Global Packaged Rice Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 46: Global Packaged Rice Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 47: Global Packaged Rice Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: South Africa Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East Packaged Rice Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaged Rice Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Packaged Rice Industry?

Key companies in the market include Gia International Corporation, Lundberg Family Farms, Amira Nature Foods Ltd, KRBL Ltd, Riceland Food Inc, Tan Long Group*List Not Exhaustive, Adani Group, Producers Rice Mills Inc, Thai Hua Co Ltd, Riviana Foods Inc.

3. What are the main segments of the Packaged Rice Industry?

The market segments include Size, Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.16 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

Increasing demand for Premium Packaged Rice.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

In May 2022, Adani Wilmar announced the acquisition of Kohinoor Brand in India from McCormick Switzerland GMBH. The acquisition includes the Kohinoor brand portfolio comprising of Kohinoor for premium Basmati rice and Charminar for affordable rice.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaged Rice Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaged Rice Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaged Rice Industry?

To stay informed about further developments, trends, and reports in the Packaged Rice Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence