Key Insights

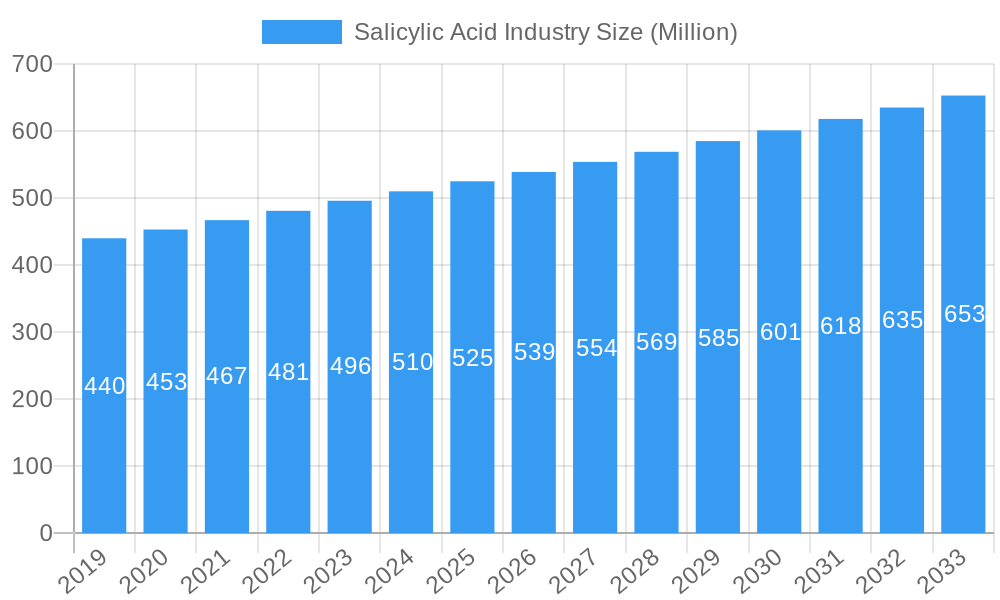

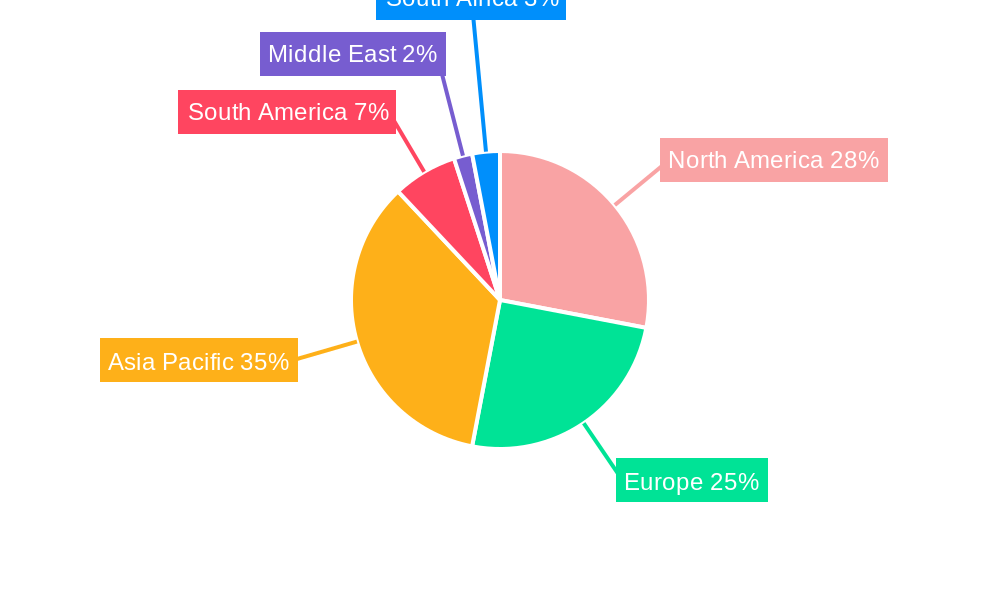

The global Salicylic Acid market is poised for robust growth, projected to reach approximately $520 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.80% expected to sustain its trajectory through 2033. This expansion is primarily fueled by the escalating demand across its key application segments: Pharmaceuticals, Cosmetics and Personal Care, and Food and Beverage. In the pharmaceutical realm, salicylic acid's established efficacy in treating skin conditions like acne, psoriasis, and warts, coupled with its role as a precursor in synthesizing various drugs, underpins consistent market penetration. The burgeoning personal care and cosmetics industry further amplifies demand, driven by consumer preference for skincare products offering exfoliation, anti-aging, and blemish control properties. Additionally, its application as a food preservative and in flavoring agents contributes to its sustained market relevance. Geographically, Asia Pacific, led by China and India, is expected to emerge as a significant growth engine, owing to expanding healthcare infrastructure, rising disposable incomes, and a burgeoning cosmetics industry. North America and Europe, established markets, will continue to represent substantial demand owing to advanced R&D and high consumer awareness.

Salicylic Acid Industry Market Size (In Million)

However, the market faces certain restraints, including stringent regulatory frameworks surrounding the use and manufacturing of pharmaceutical-grade salicylic acid and potential price volatility of raw materials. The synthesis of salicylic acid is largely dependent on phenol and carbon dioxide, whose prices can fluctuate based on global petrochemical market dynamics. Furthermore, the increasing availability of alternative ingredients in the cosmetics sector and the growing preference for natural or organic skincare solutions could pose a challenge to synthetic salicylic acid's market share. Despite these hurdles, ongoing research and development into novel applications, such as in the synthesis of new polymers and advanced materials, coupled with increasing adoption in emerging economies, are expected to offset these restraints and propel the market forward. Key players like Merck & Co. Inc., Thermo Fisher Scientific, and Zhenjiang Gaopeng Pharmaceutical Co. Ltd. are actively investing in capacity expansion and product innovation to capitalize on these evolving market dynamics.

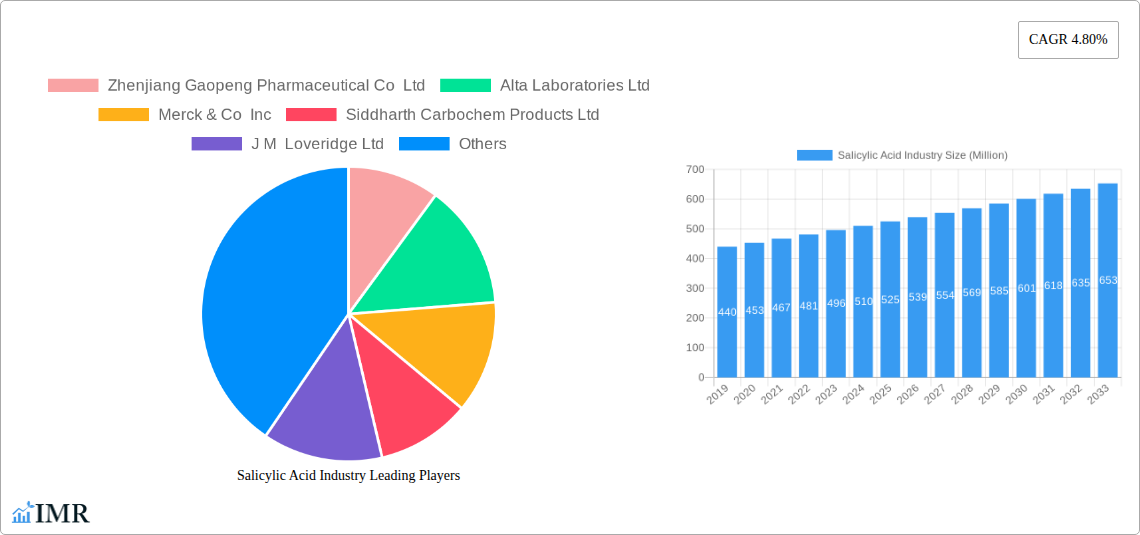

Salicylic Acid Industry Company Market Share

Salicylic Acid Industry Market Research Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Salicylic Acid industry, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report offers critical insights for stakeholders seeking to navigate this dynamic market. We have meticulously integrated high-traffic keywords to maximize search engine visibility and engage industry professionals, covering parent and child markets for enhanced attraction. All values are presented in Million units for clarity and comparability.

Salicylic Acid Industry Market Dynamics & Structure

The Salicylic Acid industry exhibits a moderately concentrated market structure, with a few dominant players holding significant market share, alongside a growing number of smaller, specialized manufacturers. Technological innovation is a key driver, particularly in developing more efficient and sustainable production methods and exploring novel applications in pharmaceuticals and high-performance cosmetics. Regulatory frameworks, such as stringent purity standards for pharmaceutical-grade salicylic acid and evolving cosmetic ingredient regulations in regions like the EU, significantly influence market entry and product development. Competitive product substitutes, while limited for its core therapeutic and exfoliating properties, exist in broader categories of skincare actives and industrial chemicals. End-user demographics are diverse, spanning pharmaceutical formulators, cosmetic brands, food and beverage producers, and industrial manufacturers, each with distinct quality and volume requirements. Mergers and Acquisitions (M&A) trends are observed as companies seek to consolidate market position, expand product portfolios, and gain access to new technologies or geographical markets. For instance, acquisitions of smaller specialty chemical producers by larger conglomerates aim to enhance vertical integration and market reach.

- Market Concentration: Characterized by a mix of large-scale producers and niche suppliers.

- Technological Innovation Drivers: Focus on green chemistry, advanced synthesis, and formulation improvements.

- Regulatory Frameworks: Stringent quality control for pharmaceutical applications, evolving cosmetic safety standards.

- Competitive Product Substitutes: Limited direct substitutes, but broader competition in end-use application categories.

- End-User Demographics: Diversified across pharmaceutical, cosmetic, food & beverage, and industrial sectors.

- M&A Trends: Strategic acquisitions to expand capabilities and market footprint.

Salicylic Acid Industry Growth Trends & Insights

The Salicylic Acid industry is poised for robust growth, driven by escalating demand across its diverse applications. The market size is projected to evolve significantly, with adoption rates for high-purity salicylic acid accelerating in the pharmaceutical sector, particularly for dermatological treatments and as an intermediate in active pharmaceutical ingredient (API) synthesis. Technological disruptions are playing a crucial role, with advancements in continuous manufacturing processes leading to improved yields and reduced environmental impact. Furthermore, the increasing focus on personalized medicine and advanced skincare formulations is spurring innovation in salicylic acid derivatives and encapsulated forms, enhancing efficacy and reducing potential irritation. Consumer behavior shifts are also influencing the market, with a growing preference for scientifically-backed skincare ingredients and a heightened awareness of the benefits of salicylic acid in treating acne, psoriasis, and other skin conditions. The CAGR for the Salicylic Acid market is estimated to be robust, reflecting its staple status in various industries and its expanding utility. Market penetration is expected to deepen in emerging economies as access to advanced healthcare and premium cosmetic products increases. The historical period (2019-2024) has seen steady growth, underpinned by increasing awareness and application expansion. The base year (2025) is anticipated to represent a significant milestone, with continued expansion projected into the forecast period (2025-2033). The estimated year (2025) anticipates a strong market performance, with specific market size evolution detailed in the full report.

Dominant Regions, Countries, or Segments in Salicylic Acid Industry

The Cosmetics and Personal Care segment stands out as a primary driver of growth within the Salicylic Acid industry, reflecting its widespread adoption in skincare formulations for acne treatment, exfoliation, and anti-aging products. North America and Europe currently dominate this segment, driven by a mature beauty market, high consumer spending on premium skincare, and strong regulatory support for effective cosmetic ingredients. The United States, in particular, commands a substantial market share due to the presence of major cosmetic brands and a strong emphasis on research and development in dermatological science.

Key Drivers in Cosmetics and Personal Care:

- Consumer Demand: Growing consumer awareness of salicylic acid's efficacy in treating common skin concerns like acne and hyperpigmentation.

- Product Innovation: Continuous development of new formulations, including serums, toners, and cleansers, incorporating salicylic acid.

- E-commerce Growth: Increased accessibility of salicylic acid-containing products through online retail channels.

- Premiumization Trends: A shift towards higher-concentration, targeted treatments leveraging salicylic acid's exfoliating properties.

The Pharmaceuticals segment also plays a critical role, with salicylic acid serving as a key ingredient in over-the-counter (OTC) medications for warts, calluses, and dandruff, as well as an intermediate in the synthesis of pharmaceuticals like aspirin. Asia Pacific, especially China and India, is emerging as a significant region for pharmaceutical-grade salicylic acid production and consumption, owing to a large population, expanding healthcare infrastructure, and a growing pharmaceutical manufacturing base. Government initiatives supporting domestic API production further bolster this growth.

Key Drivers in Pharmaceuticals:

- Therapeutic Efficacy: Established track record of salicylic acid in treating various dermatological and inflammatory conditions.

- API Intermediate Demand: Its role in the synthesis of widely used drugs, including aspirin.

- Healthcare Accessibility: Increasing access to healthcare and OTC medications in developing economies.

- R&D Investment: Ongoing research into new therapeutic applications and derivatives of salicylic acid.

The Food and Beverage segment, while smaller compared to the other two, sees salicylic acid utilized as a preservative in certain food products and as a laboratory reagent. Growth in this segment is influenced by food safety regulations and the demand for shelf-life extension solutions.

Salicylic Acid Industry Product Landscape

The Salicylic Acid product landscape is characterized by its purity grades and derivative forms tailored for specific applications. Pharmaceutical-grade salicylic acid, manufactured to stringent USP/EP standards, is vital for its use in API synthesis and dermatological medications, offering high efficacy and minimal impurities. Cosmetic-grade salicylic acid, while also requiring high purity, focuses on optimal particle size and solubility for effective exfoliation and pore-cleansing in topical formulations. Technical-grade salicylic acid finds application in industrial processes and as a precursor for other chemicals. Innovations are centered on enhanced solubility, controlled release mechanisms, and the development of less irritating ester derivatives that retain therapeutic benefits. These advancements are critical for unlocking new application areas and improving user experience across all segments.

Key Drivers, Barriers & Challenges in Salicylic Acid Industry

Key Drivers: The Salicylic Acid industry is propelled by a confluence of factors. The escalating demand for effective skincare solutions, particularly for acne and dermatological conditions, is a primary driver. Technological advancements in production, leading to higher purity and more sustainable manufacturing processes, further enhance market appeal. The pharmaceutical industry's continuous need for salicylic acid as an API intermediate and for direct therapeutic applications provides a stable demand base. Moreover, increasing consumer awareness about ingredient efficacy and the benefits of exfoliation fuels growth in the cosmetics sector.

- Growing Skincare Market: Increased demand for acne treatments and exfoliants.

- Pharmaceutical Applications: Continuous use as an intermediate and active ingredient.

- Technological Advancements: Improved production efficiency and sustainability.

- Consumer Education: Greater understanding of salicylic acid's benefits.

Barriers & Challenges: Despite its promising outlook, the industry faces several challenges. Stringent regulatory compliance for pharmaceutical and cosmetic applications can be a barrier to entry and a significant cost factor. Fluctuations in raw material prices, such as phenol, can impact profit margins. Environmental concerns related to chemical manufacturing and waste disposal necessitate investment in greener processes. Intense competition among manufacturers can lead to price pressures, especially in commodity grades. Supply chain disruptions, geopolitical instability, and evolving trade policies can also pose significant hurdles to consistent production and distribution.

- Regulatory Hurdles: Strict quality and safety standards.

- Raw Material Volatility: Price fluctuations of key inputs.

- Environmental Scrutiny: Pressure for sustainable production practices.

- Competitive Landscape: Price wars and market saturation in certain segments.

- Supply Chain Vulnerabilities: Disruptions due to global events.

Emerging Opportunities in Salicylic Acid Industry

Emerging opportunities in the Salicylic Acid industry lie in the development of novel delivery systems that enhance efficacy and reduce irritation, particularly for sensitive skin types. The exploration of salicylic acid derivatives with targeted anti-inflammatory or antimicrobial properties presents a significant avenue for pharmaceutical innovation. Furthermore, the growing trend of natural and sustainable beauty is creating opportunities for bio-based salicylic acid production or formulations emphasizing its plant-derived origins. Untapped markets in developing regions, with increasing disposable incomes and growing awareness of personal care, offer substantial growth potential. The application of salicylic acid in advanced materials and industrial processes, beyond its traditional uses, also represents an emerging frontier.

Growth Accelerators in the Salicylic Acid Industry Industry

Growth in the Salicylic Acid industry is being significantly accelerated by technological breakthroughs in synthesis and purification, leading to more cost-effective and environmentally friendly production methods. Strategic partnerships between raw material suppliers and end-product manufacturers are streamlining supply chains and fostering collaborative innovation. The increasing global demand for dermatological treatments, driven by aging populations and a greater focus on skin health, acts as a powerful catalyst. Furthermore, the expansion of e-commerce platforms and direct-to-consumer (DTC) sales models is increasing accessibility to salicylic acid-based products, thereby broadening market reach and consumer adoption. Market expansion strategies, including entry into emerging economies with nascent cosmetic and pharmaceutical sectors, are also playing a crucial role in driving sustained growth.

Key Players Shaping the Salicylic Acid Industry Market

- Zhenjiang Gaopeng Pharmaceutical Co Ltd

- Alta Laboratories Ltd

- Merck & Co Inc

- Siddharth Carbochem Products Ltd

- J M Loveridge Ltd

- Seqens SAS

- Spectrum Chemical Manufacturing Corp

- Shandong Xinhua Longxin Chemical Co Ltd

- Hebei Jingye Group

- Thermo Fisher Scientific

Notable Milestones in Salicylic Acid Industry Sector

- 2019: Increased regulatory scrutiny on cosmetic ingredients globally, impacting formulation standards for salicylic acid.

- 2020: Supply chain disruptions due to the COVID-19 pandemic, highlighting the need for resilient manufacturing and sourcing strategies.

- 2021: Growing emphasis on sustainable chemical production, driving investment in greener synthesis routes for salicylic acid.

- 2022: Launch of novel salicylic acid derivatives with enhanced skin penetration and reduced irritation profiles.

- 2023: Significant increase in demand for dermatological treatments, boosting the pharmaceutical application segment.

- 2024: Acquisitions by larger chemical companies aimed at consolidating market share and expanding product portfolios.

In-Depth Salicylic Acid Industry Market Outlook

The Salicylic Acid industry is set for continued expansion, driven by its indispensable role in pharmaceuticals and the ever-growing cosmetics and personal care sectors. Key growth accelerators, including advancements in green chemistry, strategic market penetration into emerging economies, and the development of innovative product formulations, will shape the future landscape. The increasing consumer focus on effective and science-backed skincare ingredients, coupled with the pharmaceutical industry's reliance on salicylic acid as a foundational chemical, ensures sustained demand. Strategic partnerships and ongoing research into new applications and derivatives will further unlock market potential. The outlook remains robust, with significant opportunities for innovation and market leadership for companies that can adeptly navigate regulatory environments and capitalize on evolving consumer preferences.

Salicylic Acid Industry Segmentation

-

1. Application

- 1.1. Food and Beverage

- 1.2. Cosmetics and Personal Care

- 1.3. Pharmaceuticals

Salicylic Acid Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Salicylic Acid Industry Regional Market Share

Geographic Coverage of Salicylic Acid Industry

Salicylic Acid Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Salicylic acid is a precursor to aspirin (acetylsalicylic acid)

- 3.2.2 one of the most commonly used drugs worldwide for pain relief

- 3.2.3 anti-inflammatory

- 3.2.4 and antipyretic purposes. The ongoing demand for over-the-counter (OTC) pain relievers and anti-inflammatory drugs drives the demand for salicylic acid.

- 3.3. Market Restrains

- 3.3.1 While salicylic acid is effective

- 3.3.2 it can cause skin irritation

- 3.3.3 dryness

- 3.3.4 and other side effects

- 3.3.5 particularly when used in high concentrations. These potential side effects can limit its use in skincare products

- 3.3.6 especially for consumers with sensitive skin.

- 3.4. Market Trends

- 3.4.1 The trend towards personalized skincare is driving the development of new formulations that include salicylic acid

- 3.4.2 tailored to specific skin types and conditions. The ingredient is increasingly found in a variety of personal care products beyond just acne treatments

- 3.4.3 such as exfoliants

- 3.4.4 shampoos

- 3.4.5 and body washes.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Salicylic Acid Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food and Beverage

- 5.1.2. Cosmetics and Personal Care

- 5.1.3. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East

- 5.2.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Salicylic Acid Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food and Beverage

- 6.1.2. Cosmetics and Personal Care

- 6.1.3. Pharmaceuticals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Salicylic Acid Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food and Beverage

- 7.1.2. Cosmetics and Personal Care

- 7.1.3. Pharmaceuticals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Salicylic Acid Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food and Beverage

- 8.1.2. Cosmetics and Personal Care

- 8.1.3. Pharmaceuticals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Salicylic Acid Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food and Beverage

- 9.1.2. Cosmetics and Personal Care

- 9.1.3. Pharmaceuticals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Salicylic Acid Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food and Beverage

- 10.1.2. Cosmetics and Personal Care

- 10.1.3. Pharmaceuticals

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. South Africa Salicylic Acid Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Food and Beverage

- 11.1.2. Cosmetics and Personal Care

- 11.1.3. Pharmaceuticals

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Zhenjiang Gaopeng Pharmaceutical Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Alta Laboratories Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Merck & Co Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Siddharth Carbochem Products Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 J M Loveridge Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Seqens SAS

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Spectrum Chemical Manufacturing Corp

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Shandong Xinhua Longxin Chemical Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hebei Jingye Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Thermo Fisher Scientific

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Zhenjiang Gaopeng Pharmaceutical Co Ltd

List of Figures

- Figure 1: Global Salicylic Acid Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Salicylic Acid Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Salicylic Acid Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Salicylic Acid Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Salicylic Acid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Salicylic Acid Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Salicylic Acid Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Salicylic Acid Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Salicylic Acid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Salicylic Acid Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Salicylic Acid Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Salicylic Acid Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Salicylic Acid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Salicylic Acid Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: South America Salicylic Acid Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Salicylic Acid Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Salicylic Acid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Salicylic Acid Industry Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East Salicylic Acid Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East Salicylic Acid Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East Salicylic Acid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: South Africa Salicylic Acid Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South Africa Salicylic Acid Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South Africa Salicylic Acid Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South Africa Salicylic Acid Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Salicylic Acid Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Salicylic Acid Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Salicylic Acid Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Salicylic Acid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Salicylic Acid Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Salicylic Acid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Russia Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Salicylic Acid Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Salicylic Acid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: China Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Australia Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Salicylic Acid Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Salicylic Acid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Salicylic Acid Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Salicylic Acid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Salicylic Acid Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Salicylic Acid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East Salicylic Acid Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Salicylic Acid Industry?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Salicylic Acid Industry?

Key companies in the market include Zhenjiang Gaopeng Pharmaceutical Co Ltd, Alta Laboratories Ltd, Merck & Co Inc, Siddharth Carbochem Products Ltd, J M Loveridge Ltd, Seqens SAS, Spectrum Chemical Manufacturing Corp, Shandong Xinhua Longxin Chemical Co Ltd, Hebei Jingye Group, Thermo Fisher Scientific.

3. What are the main segments of the Salicylic Acid Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Salicylic acid is a precursor to aspirin (acetylsalicylic acid). one of the most commonly used drugs worldwide for pain relief. anti-inflammatory. and antipyretic purposes. The ongoing demand for over-the-counter (OTC) pain relievers and anti-inflammatory drugs drives the demand for salicylic acid..

6. What are the notable trends driving market growth?

The trend towards personalized skincare is driving the development of new formulations that include salicylic acid. tailored to specific skin types and conditions. The ingredient is increasingly found in a variety of personal care products beyond just acne treatments. such as exfoliants. shampoos. and body washes..

7. Are there any restraints impacting market growth?

While salicylic acid is effective. it can cause skin irritation. dryness. and other side effects. particularly when used in high concentrations. These potential side effects can limit its use in skincare products. especially for consumers with sensitive skin..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Salicylic Acid Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Salicylic Acid Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Salicylic Acid Industry?

To stay informed about further developments, trends, and reports in the Salicylic Acid Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence