Key Insights

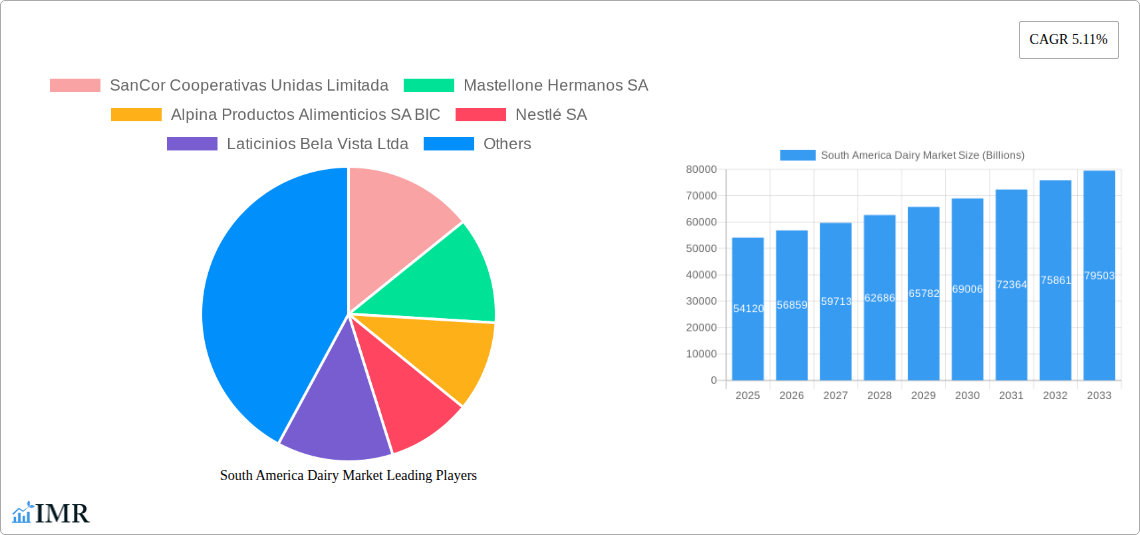

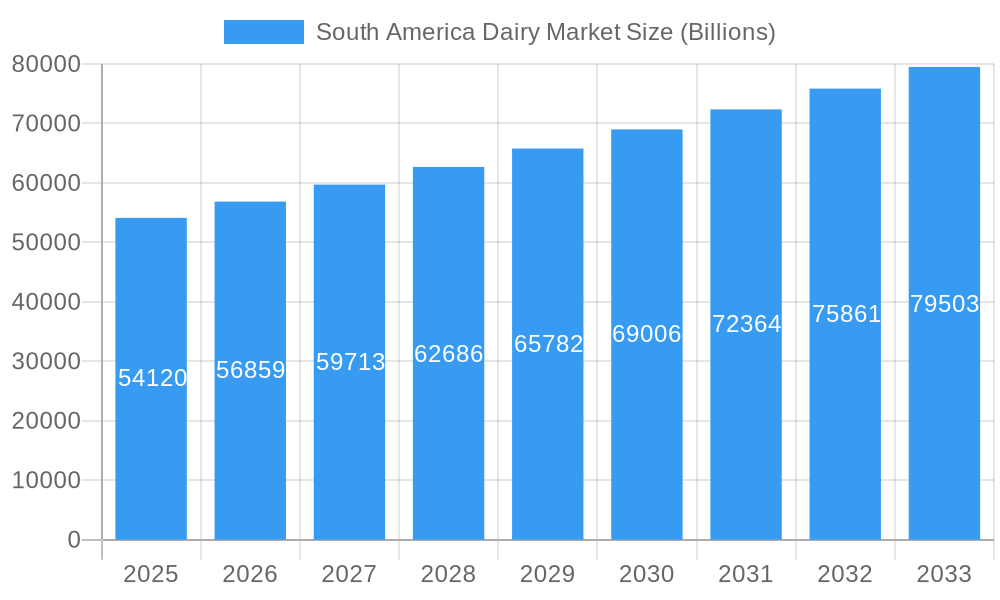

The South American dairy market is poised for significant expansion, projected to reach a substantial \$54.12 billion by 2025, with a healthy Compound Annual Growth Rate (CAGR) of 5.11% anticipated through 2033. This robust growth is being propelled by a confluence of evolving consumer preferences and economic development across the region. A key driver is the increasing demand for value-added dairy products, such as specialized yogurts, artisanal cheeses, and convenient dairy desserts, reflecting a growing middle class with greater disposable income and a desire for healthier, more sophisticated food options. Furthermore, the expanding food service industry, particularly in countries like Brazil and Colombia, is contributing to on-trade consumption of dairy, boosting overall market value. The rise of online retail channels is also democratizing access to a wider array of dairy products, catering to diverse consumer needs and preferences, from fresh milk to indulgent frozen desserts.

South America Dairy Market Market Size (In Billion)

While growth is strong, certain factors present opportunities for strategic market players. The market is segmented across a wide spectrum of dairy categories, including butter, cheese, cream, dairy desserts, milk, sour milk drinks, and yogurt, offering diverse avenues for product innovation and market penetration. Distribution channels are equally varied, encompassing both off-trade (convenience stores, online retail, specialist retailers, supermarkets, and hypermarkets) and on-trade segments, demanding tailored strategies for each. Major players like Nestlé SA, Danone SA, and Groupe Lactalis are well-positioned to capitalize on these trends, though localized players such as SanCor Cooperativas Unidas Limitada and Mastellone Hermanos SA hold significant regional influence. Addressing evolving consumer health consciousness through low-fat or lactose-free options, and expanding the reach of convenient, on-the-go dairy snacks will be crucial for sustained market leadership.

South America Dairy Market Company Market Share

South America Dairy Market: Comprehensive Analysis and Forecast (2019-2033)

This in-depth report provides a comprehensive analysis of the South America dairy market, forecasting its trajectory from 2019 to 2033. With a base year of 2025, the report delves into market dynamics, growth trends, dominant regions, product landscape, key drivers, barriers, emerging opportunities, and growth accelerators. We leverage extensive data to offer actionable insights for industry professionals, investors, and stakeholders seeking to capitalize on the evolving South American dairy sector. The analysis covers a wide array of product categories including Butter (Cultured Butter, Uncultured Butter), Cheese (Natural Cheese, Processed Cheese), Cream (Double Cream, Single Cream, Whipping Cream, Others), Dairy Desserts (Cheesecakes, Frozen Desserts, Ice Cream, Mousses), Milk (Condensed milk, Flavored Milk, Fresh Milk, Powdered Milk, UHT Milk), Sour Milk Drinks, and Yogurt (Flavored Yogurt, Unflavored Yogurt), alongside distribution channels like Off-Trade (Convenience Stores, Online Retail, Specialist Retailers, Supermarkets and Hypermarkets, Others) and On-Trade.

South America Dairy Market Market Dynamics & Structure

The South America dairy market is characterized by a moderate concentration, with key players like SanCor Cooperativas Unidas Limitada, Mastellone Hermanos SA, Alpina Productos Alimenticios SA BIC, Nestlé SA, Laticinios Bela Vista Ltda, Danone SA, Sucesores de Alfredo Williner S, Lacteos Betania SA, and Groupe Lactalis holding significant market shares. Technological innovation is a primary driver, with companies investing in advanced processing techniques to enhance shelf life and nutritional content, particularly for UHT Milk and Powdered Milk. Regulatory frameworks, while varying by country, often focus on food safety standards and fair trade practices. Competitive product substitutes, such as plant-based milk alternatives, are gaining traction, prompting dairy producers to innovate with fortified and functional dairy products. End-user demographics are shifting towards younger, urbanized populations with increasing disposable incomes, driving demand for convenient and premium dairy options like Dairy Desserts and specialized Yogurt products. Mergers and acquisitions (M&A) remain a significant trend, with larger entities acquiring smaller players to expand their product portfolios and geographic reach. For instance, the Lactalis acquisition in Brazil highlights this consolidation. While innovation is robust, barriers include high capital investment for new technologies and navigating diverse national regulations.

- Market Concentration: Moderate, with a few dominant players and a significant number of regional and local producers.

- Technological Innovation Drivers: Shelf-life extension, nutritional fortification, new product development in dairy desserts and specialized yogurts, and sustainable packaging solutions.

- Regulatory Frameworks: Primarily focused on food safety, quality control, and trade agreements, with ongoing efforts to standardize practices across the region.

- Competitive Product Substitutes: Growing presence of plant-based alternatives impacting demand for traditional Milk and Cream products.

- End-User Demographics: Young, urban populations with increasing purchasing power and a preference for convenient, healthy, and premium dairy products.

- M&A Trends: Active, driven by the pursuit of market consolidation, product diversification, and expansion into new territories.

- Quantitative Insights: While specific market share percentages for individual companies are proprietary, the top five players are estimated to hold over 60% of the market. M&A deal volumes have seen a consistent increase year-on-year.

- Qualitative Factors: Innovation barriers include the cost of adopting advanced processing equipment and the complexities of adhering to different national food standards.

South America Dairy Market Growth Trends & Insights

The South America dairy market is poised for robust growth, driven by evolving consumer preferences, increasing disposable incomes, and a growing demand for nutritious food products. The market size is projected to expand significantly, with a compound annual growth rate (CAGR) estimated at XX% during the forecast period. Adoption rates for value-added dairy products, such as Flavored Yogurt, Dairy Desserts, and specialized Cheese varieties, are on the rise as consumers seek healthier and more indulgent options. Technological disruptions, including advancements in UHT processing and aseptic packaging, are enhancing the availability and affordability of UHT Milk and other dairy staples across the region, particularly in remote areas.

Consumer behavior shifts are a key factor, with a growing awareness of the health benefits associated with dairy consumption. This is fueling demand for products rich in protein and calcium, such as Fresh Milk and Cheese. The increasing urbanization and busy lifestyles are also contributing to the demand for convenient dairy formats, including Powdered Milk for easy reconstitution and ready-to-eat Dairy Desserts. Furthermore, the expansion of e-commerce platforms and the growing popularity of Online Retail for grocery shopping are opening new avenues for dairy product distribution. The report forecasts the market to reach an estimated value of $XX billion by 2033, up from $XX billion in 2025. The penetration of premium dairy products is expected to increase, especially in major urban centers. The historical period (2019-2024) saw a steady rise in demand, with the COVID-19 pandemic highlighting the essential nature of dairy products and their role in household consumption. The base year 2025 serves as a crucial benchmark for analyzing future growth trajectories and understanding the immediate pre-forecast market landscape.

Dominant Regions, Countries, or Segments in South America Dairy Market

Brazil stands out as the dominant region within the South America dairy market, driven by its large population, significant agricultural output, and robust domestic demand. Its extensive dairy farming infrastructure and strong presence of major dairy companies contribute to its leading position. Within Brazil, the Milk segment, particularly Fresh Milk and UHT Milk, commands the largest market share due to its staple consumption across all demographics. However, segments like Cheese (both Natural Cheese and Processed Cheese) and Yogurt are witnessing accelerated growth, fueled by an increasing consumer preference for diverse culinary experiences and convenient, protein-rich snacks.

In terms of distribution channels, Off-Trade channels are dominant, with Supermarkets and Hypermarkets acting as the primary retail points for a vast array of dairy products. The rapid expansion of Online Retail in recent years has also become a significant growth driver, offering consumers greater convenience and access to a wider selection of products, including niche Dairy Desserts and specialized Cream products. Alpina's launch of Alpina Snacks, a dried cheese snack, in Colombia illustrates the innovation occurring within the Cheese segment to cater to on-the-go consumption trends. Economic policies supporting the agricultural sector, investments in cold chain infrastructure, and increasing consumer disposable income are key drivers behind Brazil's dominance and the overall market growth. The sheer volume of dairy production and consumption in Brazil sets the pace for the entire South American region.

- Dominant Region: Brazil.

- Key Drivers: Large population, strong agricultural base, high domestic consumption, significant investments by major dairy players.

- Dominant Country (within the region): Brazil.

- Market Share: Estimated to hold over 40% of the total South America dairy market.

- Growth Potential: Driven by increasing urbanization, evolving consumer tastes, and a growing middle class.

- Dominant Segment (by volume): Milk.

- Sub-segments: Fresh Milk and UHT Milk are foundational, with consistent demand.

- Fastest Growing Segment (by value): Dairy Desserts and Premium Cheese.

- Drivers: Increasing disposable incomes, demand for indulgence, and health-conscious product development.

- Key Distribution Channel: Off-Trade, specifically Supermarkets and Hypermarkets.

- Emerging Trend: Significant growth in Online Retail, particularly for specialized and premium products.

- Industry Development Impact: Alpina's snack launch in Colombia demonstrates the strategic shift towards convenient and innovative Cheese products, catering to evolving consumer lifestyles.

South America Dairy Market Product Landscape

The South America dairy market is a dynamic arena for product innovation, with a strong focus on enhancing nutritional value, convenience, and sensory appeal. Companies are increasingly developing Powdered Milk formulations with added vitamins and minerals, catering to a health-conscious consumer base. In the Cheese category, there's a notable trend towards artisanal and premium Natural Cheese varieties, alongside advancements in shelf-stable Processed Cheese for broader accessibility. Dairy Desserts are evolving beyond traditional offerings, with the introduction of healthier options, reduced sugar formulations, and exciting new flavors in Ice Cream and Cheesecakes. The Yogurt segment continues to innovate with probiotic-rich options and diverse fruit infusions, while Cream products are seeing new applications in culinary and baking sectors. Nestlé's initiative to switch to paper straws for its products exemplifies the industry's commitment to sustainable packaging solutions, influencing the broader product landscape.

Key Drivers, Barriers & Challenges in South America Dairy Market

The South America dairy market is propelled by several key drivers. A rising middle class with increased disposable incomes is a significant factor, fueling demand for a wider range of dairy products, from staple Milk to premium Dairy Desserts. Growing health and wellness consciousness among consumers is another major driver, increasing the demand for protein-rich and fortified dairy options like Yogurt and Cheese. Technological advancements in processing and packaging, such as improved UHT Milk technologies, are enhancing product shelf-life and accessibility across the region. Favorable government policies supporting the dairy sector, including subsidies and trade agreements, also contribute to market growth.

However, the market faces several barriers and challenges. Fluctuations in raw milk prices, driven by climate conditions and feed costs, can impact profitability. Stringent and varying regulatory standards across different South American countries can create compliance hurdles for businesses operating regionally. Competition from plant-based alternatives is a growing concern, requiring dairy producers to differentiate their products through innovation and value addition. Supply chain inefficiencies, particularly in logistics and cold chain infrastructure in some areas, can lead to product spoilage and increased costs. Additionally, economic instability and currency fluctuations in certain countries can affect consumer purchasing power and investment decisions.

Emerging Opportunities in South America Dairy Market

Emerging opportunities in the South America dairy market are plentiful, stemming from evolving consumer demands and untapped market potential. There is a significant opportunity in the development of functional dairy products, such as lactose-free Milk and Yogurt, and those fortified with probiotics and prebiotics, catering to the growing health-conscious segment. The demand for plant-based dairy alternatives is also creating a complementary opportunity for traditional dairy producers to innovate and expand their offerings, potentially through hybrid products or by investing in sustainable sourcing. The expansion of e-commerce platforms presents a substantial opportunity for increased reach, especially for niche and premium products like gourmet Cheese and specialized Dairy Desserts, allowing companies to bypass traditional retail limitations. Furthermore, untapped rural markets with developing infrastructure represent a long-term growth avenue for basic dairy products like Powdered Milk and Fresh Milk.

Growth Accelerators in the South America Dairy Market Industry

Several growth accelerators are shaping the long-term expansion of the South America dairy market. Technological breakthroughs in dairy farming, including precision agriculture and improved animal health management, are leading to increased milk yields and better quality, thereby reducing production costs. Strategic partnerships and collaborations between dairy cooperatives, processors, and retailers are optimizing supply chains and expanding market reach. For instance, collaborations to improve cold chain logistics can unlock growth in previously inaccessible regions. Market expansion strategies, such as introducing innovative product lines that cater to specific dietary needs or preferences, are crucial. Alpina's move into dried cheese snacks is a prime example of creating new consumption occasions and expanding the market. Furthermore, investments in branding and marketing campaigns that highlight the health benefits and versatility of dairy products are vital for sustained consumer engagement and demand.

Key Players Shaping the South America Dairy Market Market

- SanCor Cooperativas Unidas Limitada

- Mastellone Hermanos SA

- Alpina Productos Alimenticios SA BIC

- Nestlé SA

- Laticinios Bela Vista Ltda

- Danone SA

- Sucesores de Alfredo Williner S

- Lacteos Betania SA

- Groupe Lactalis

Notable Milestones in South America Dairy Market Sector

- January 2022: Alpina launched Alpina Snacks, a dried cheese snack brand, in Colombia, expanding its product portfolio into convenient snack options.

- May 2021: Nestlé switched from plastic to paper straws and box covers for its MILO® and KLIM® products, preventing the use of 13 metric tons of plastic and the emission of 19.5 metric tons of CO2 annually, demonstrating a commitment to sustainability.

- April 2021: Lactalis acquired assets in Brazil belonging to Cativa and also signed a long-term milk supply contract with the cooperative. The new deal in Brazil for Lactalis is involved in the production of milk, cream, butter, cheese, and dairy ingredients under the brands Parmalat, Galbani, and Président, highlighting significant market consolidation and expansion.

In-Depth South America Dairy Market Market Outlook

The future outlook for the South America dairy market is exceptionally bright, driven by a convergence of positive market forces. Continued economic development across several South American nations will bolster consumer spending power, directly translating into increased demand for a diverse range of dairy products, from essential Milk to indulgent Dairy Desserts. The growing emphasis on health and nutrition will continue to fuel the growth of functional dairy, such as probiotic Yogurt and fortified Milk, presenting substantial opportunities for innovation and market penetration. Strategic investments in sustainable farming practices and advanced processing technologies are expected to enhance efficiency and product quality, further solidifying the dairy sector's position. The ongoing expansion of retail infrastructure, including the digital transformation of distribution channels, will ensure greater accessibility and cater to evolving consumer shopping habits. This combination of economic uplift, consumer awareness, technological advancement, and improved distribution lays a strong foundation for sustained growth and profitability in the South America dairy market.

South America Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

South America Dairy Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Dairy Market Regional Market Share

Geographic Coverage of South America Dairy Market

South America Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Dairy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SanCor Cooperativas Unidas Limitada

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mastellone Hermanos SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alpina Productos Alimenticios SA BIC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nestlé SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Laticinios Bela Vista Ltda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Danone SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sucesores de Alfredo Williner S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lacteos Betania SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Groupe Lactalis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SanCor Cooperativas Unidas Limitada

List of Figures

- Figure 1: South America Dairy Market Revenue Breakdown (Billions, %) by Product 2025 & 2033

- Figure 2: South America Dairy Market Share (%) by Company 2025

List of Tables

- Table 1: South America Dairy Market Revenue Billions Forecast, by Category 2020 & 2033

- Table 2: South America Dairy Market Volume Liters Forecast, by Category 2020 & 2033

- Table 3: South America Dairy Market Revenue Billions Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Dairy Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Dairy Market Revenue Billions Forecast, by Region 2020 & 2033

- Table 6: South America Dairy Market Volume Liters Forecast, by Region 2020 & 2033

- Table 7: South America Dairy Market Revenue Billions Forecast, by Category 2020 & 2033

- Table 8: South America Dairy Market Volume Liters Forecast, by Category 2020 & 2033

- Table 9: South America Dairy Market Revenue Billions Forecast, by Distribution Channel 2020 & 2033

- Table 10: South America Dairy Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Dairy Market Revenue Billions Forecast, by Country 2020 & 2033

- Table 12: South America Dairy Market Volume Liters Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Dairy Market Revenue (Billions) Forecast, by Application 2020 & 2033

- Table 14: Brazil South America Dairy Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 15: Argentina South America Dairy Market Revenue (Billions) Forecast, by Application 2020 & 2033

- Table 16: Argentina South America Dairy Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 17: Chile South America Dairy Market Revenue (Billions) Forecast, by Application 2020 & 2033

- Table 18: Chile South America Dairy Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 19: Colombia South America Dairy Market Revenue (Billions) Forecast, by Application 2020 & 2033

- Table 20: Colombia South America Dairy Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 21: Peru South America Dairy Market Revenue (Billions) Forecast, by Application 2020 & 2033

- Table 22: Peru South America Dairy Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 23: Venezuela South America Dairy Market Revenue (Billions) Forecast, by Application 2020 & 2033

- Table 24: Venezuela South America Dairy Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 25: Ecuador South America Dairy Market Revenue (Billions) Forecast, by Application 2020 & 2033

- Table 26: Ecuador South America Dairy Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 27: Bolivia South America Dairy Market Revenue (Billions) Forecast, by Application 2020 & 2033

- Table 28: Bolivia South America Dairy Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 29: Paraguay South America Dairy Market Revenue (Billions) Forecast, by Application 2020 & 2033

- Table 30: Paraguay South America Dairy Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 31: Uruguay South America Dairy Market Revenue (Billions) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South America Dairy Market Volume (Liters) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Dairy Market?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the South America Dairy Market?

Key companies in the market include SanCor Cooperativas Unidas Limitada, Mastellone Hermanos SA, Alpina Productos Alimenticios SA BIC, Nestlé SA, Laticinios Bela Vista Ltda, Danone SA, Sucesores de Alfredo Williner S, Lacteos Betania SA, Groupe Lactalis.

3. What are the main segments of the South America Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.12 Billions as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2022: Alpina launched Alpina Snacks, a dried cheese snack brand, in Colombia.May 2021: Nestlé switched from plastic to paper straws and box covers for its MILO® and KLIM® products, preventing the use of 13 metric tons of plastic and the emission of 19.5 metric tons of CO2 annually.April 2021: Lactalis acquired assets in Brazil belonging to Cativa and also signed a long-term milk supply contract with the cooperative. The new deal in Brazil for Lactalis is involved in the production of milk, cream, butter, cheese, and dairy ingredients under the brands Parmalat, Galbani, and Président.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billions and volume, measured in Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Dairy Market?

To stay informed about further developments, trends, and reports in the South America Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence