Key Insights

The global Specialty Enzymes Market is projected for substantial growth, expected to reach $6.86 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This expansion is primarily driven by escalating demand for natural and sustainable ingredients across the food & beverage and pharmaceutical sectors. Growing consumer focus on health and wellness, coupled with increasing recognition of enzyme benefits for digestion, nutrient absorption, and product quality, are key market influencers. Technological advancements in enzyme production, including genetic engineering and fermentation, are enabling the development of more efficient and specific enzymes, thereby broadening their application spectrum. The pharmaceutical industry is actively employing enzymes in drug discovery, development, and targeted therapeutics, while the animal nutrition sector is adopting enzymes to enhance feed efficacy and mitigate environmental impact.

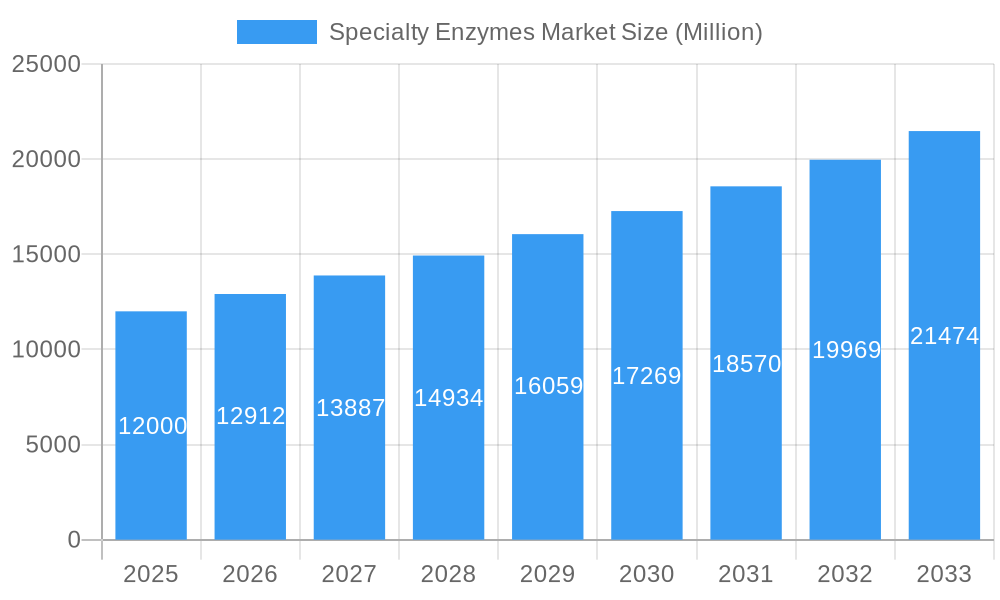

Specialty Enzymes Market Market Size (In Billion)

Market segmentation highlights key enzyme types: carbohydrases, proteases, and lipases, each serving distinct industrial requirements. In the food & beverage industry, these enzymes are vital for improving texture, flavor, shelf-life, and processing efficiency in products such as baked goods, dairy, and beverages. The pharmaceutical sector utilizes enzymes for therapeutic applications, diagnostics, and biopharmaceutical manufacturing. Despite robust growth, the market faces potential restraints including high production costs for certain specialized enzymes and stringent regulatory approval processes in select regions. Nevertheless, continuous innovation in enzyme applications, coupled with a rising global population and increasing disposable incomes, particularly in emerging economies like the Asia Pacific, signals a promising outlook for the specialty enzymes market. Leading market players are strategically investing in research and development to expand their product offerings and global presence.

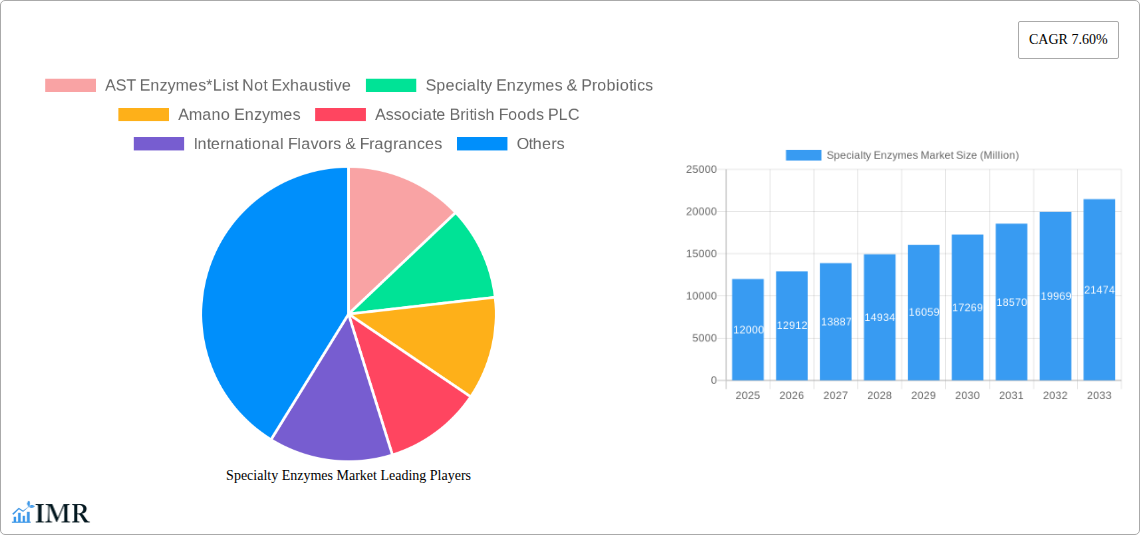

Specialty Enzymes Market Company Market Share

Gain comprehensive insights into the dynamic Specialty Enzymes Market, a sector experiencing significant expansion fueled by rising demand in the food & beverage, pharmaceutical, and animal nutrition industries. This report provides an in-depth analysis of market trends, growth drivers, key participants, and future opportunities, offering a vital strategic roadmap for stakeholders. We meticulously examine the parent industrial enzymes market and its sub-segment, the specialty enzymes market, to deliver a complete ecosystem overview. All data is presented in billions, with a focus on actionable intelligence.

Specialty Enzymes Market Market Dynamics & Structure

The specialty enzymes market is characterized by moderate to high concentration, with leading global players like Novozymes and DuPont dominating through continuous technological innovation and strategic acquisitions. The market's growth is propelled by advancements in enzyme engineering, directed evolution, and recombinant DNA technology, leading to the development of highly efficient and specific enzymes. Stringent regulatory frameworks, particularly in the food and pharmaceutical sectors, ensure product quality and safety, indirectly fostering trust and market adoption. However, the high cost of R&D and manufacturing, coupled with the availability of competitive chemical catalysts, presents a notable barrier. End-user demographics are shifting towards a greater appreciation for sustainable and naturally derived ingredients, directly benefiting the microbial and plant-based enzyme segments. Mergers and acquisitions are a recurring theme, with companies consolidating to expand their product portfolios and geographical reach. For instance, the proposed merger of Novozymes and Chr. Hansen signifies a major consolidation effort aimed at leveraging synergistic capabilities. The competitive landscape is shaped by established multinational corporations and emerging biotech firms, each striving for differentiation through novel enzyme applications and improved production processes. The market's structure is influenced by the increasing demand for enzymes in novel applications, such as bioplastics and sustainable chemical synthesis, further diversifying the industry's product substitutes and market concentration dynamics.

- Market Concentration: Moderately concentrated with a few key global players.

- Technological Innovation: Driven by advancements in enzyme engineering, fermentation, and downstream processing.

- Regulatory Frameworks: Stringent regulations in food and pharma drive demand for high-purity, well-characterized enzymes.

- Competitive Product Substitutes: Chemical catalysts, though facing increasing pressure from sustainable enzyme alternatives.

- End-User Demographics: Growing preference for natural, sustainable, and health-promoting ingredients.

- M&A Trends: Active consolidation to gain market share and diversify product offerings.

Specialty Enzymes Market Growth Trends & Insights

The specialty enzymes market has witnessed robust growth, evolving from a market size of approximately $XX,XXX Million in 2019 to an estimated $XX,XXX Million by the end of 2024. The forecast period from 2025 to 2033 projects a Compound Annual Growth Rate (CAGR) of X.XX%, indicating sustained and accelerated expansion. This impressive trajectory is fueled by several key trends. Firstly, the burgeoning demand for healthier and more convenient food and beverage products is a significant catalyst. Specialty enzymes are crucial for improving taste, texture, nutritional value, and shelf-life in products like dairy, baked goods, and beverages. For example, the use of lactase enzymes, as demonstrated by IFF's Nurica enzyme launch, allows for the creation of lactose-free dairy products, catering to a rapidly growing segment of the population. Secondly, the pharmaceutical industry's increasing reliance on enzymes for drug synthesis, diagnostics, and therapeutic applications is a major growth driver. Enzymes offer highly specific and efficient biocatalytic pathways, reducing the need for harsh chemicals and improving yields. The development of enzymes for diagnostics, particularly in the wake of global health concerns, has also seen a substantial uptick. Thirdly, the animal nutrition sector is increasingly adopting specialty enzymes to enhance feed digestibility, improve animal health, and reduce environmental impact, thereby driving demand for enzymes like proteases and carbohydrases. Adoption rates are high across all these segments, with a notable acceleration in emerging economies seeking to enhance their food processing and healthcare capabilities. Technological disruptions, including the discovery of novel enzymes from extremophiles and the development of enzyme immobilization techniques, are continuously expanding the application spectrum. Consumer behavior shifts towards sustainability and natural ingredients further bolster the market, as enzymes are perceived as environmentally friendly biocatalysts. The market penetration of specialty enzymes in various industrial processes is steadily increasing, replacing traditional chemical methods and contributing to a more sustainable industrial landscape.

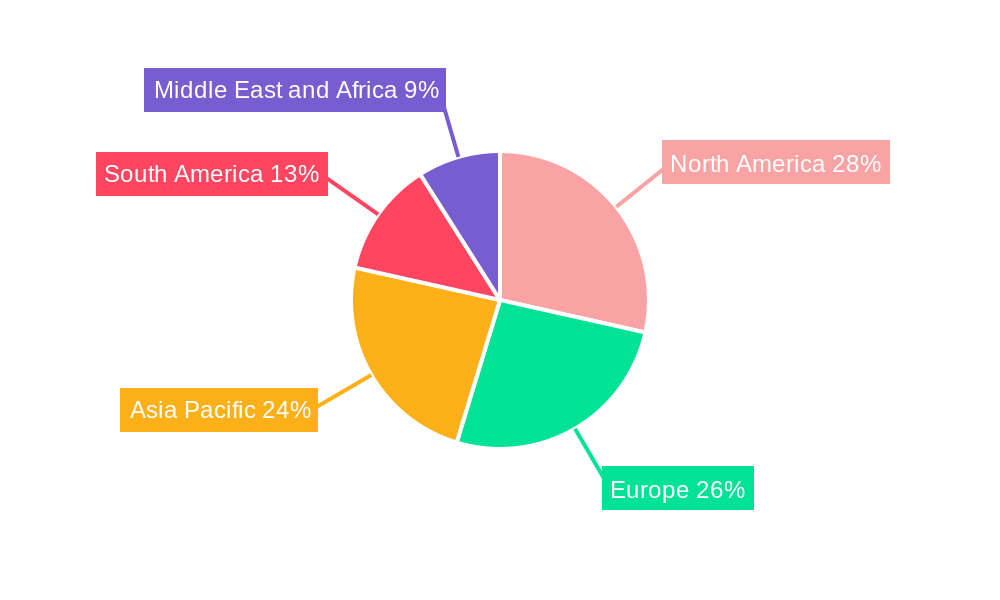

Dominant Regions, Countries, or Segments in Specialty Enzymes Market

North America currently stands as the dominant region in the specialty enzymes market, propelled by its advanced food processing infrastructure, significant pharmaceutical R&D investments, and strong consumer demand for premium and health-conscious products. The United States, in particular, accounts for a substantial market share due to its robust biotechnology sector and supportive regulatory environment for enzyme applications. The Food & Beverage application segment is the primary driver of this dominance, consuming a significant portion of specialty enzymes for a wide array of products. Within the Type segment, Carbohydrases and Proteases lead in terms of market share, owing to their extensive use in baking, brewing, dairy processing, and meat tenderization. Microbial sources are the most dominant Source in this region, accounting for over XX% of the market, due to their versatility, scalability, and cost-effectiveness in producing a broad spectrum of enzymes.

Key drivers contributing to North America's dominance include:

- Economic Policies: Favorable government policies supporting biotechnology research and development.

- Infrastructure: Well-developed industrial infrastructure for manufacturing and distribution of specialty enzymes.

- Consumer Demand: High consumer awareness and preference for enzyme-modified food products and nutraceuticals.

- R&D Investments: Significant investments in research and development by leading enzyme manufacturers.

- Regulatory Approval: Streamlined regulatory approval processes for new enzyme applications.

The Food & Beverage application segment is projected to maintain its leading position throughout the forecast period, driven by ongoing innovation in processed foods, beverages, and dietary supplements. The Microbial source segment will continue to be the largest contributor, owing to the continuous discovery and engineering of new microbial strains for enhanced enzyme production. Growth potential in this region remains strong, with emerging applications in biofuels and sustainable chemical manufacturing contributing to further market expansion.

Specialty Enzymes Market Product Landscape

The specialty enzymes market is characterized by a continuous stream of innovative products designed for enhanced efficacy, specificity, and sustainability. Product innovations focus on enzymes with improved thermal stability, pH tolerance, and catalytic efficiency for diverse applications. Key developments include novel proteases for dairy processing offering superior curd formation and whey protein modification, and advanced carbohydrases for efficient starch hydrolysis in baking and brewing. Lipases are being engineered for improved fat modification and flavor development in food products. Pharmaceutical applications are seeing the introduction of highly specific enzymes for chiral synthesis, significantly reducing by-products and improving yield. The unique selling propositions of these advanced enzymes lie in their ability to enable cleaner production processes, reduce energy consumption, and contribute to the development of high-value end products. Technological advancements, such as enzyme immobilization techniques, are also enhancing the reusability and cost-effectiveness of these biocatalysts, further driving their adoption across industries.

Key Drivers, Barriers & Challenges in Specialty Enzymes Market

Key Drivers:

- Growing Demand for Natural and Sustainable Ingredients: Consumers and industries are increasingly favoring enzyme-based solutions over chemical alternatives due to their eco-friendly nature.

- Advancements in Biotechnology: Continuous innovation in enzyme discovery, engineering, and production methods leads to more efficient and cost-effective enzymes.

- Expanding Applications: Increasing use of specialty enzymes in food & beverage, pharmaceuticals, animal nutrition, diagnostics, and industrial processes.

- Health and Wellness Trends: Demand for functional foods and dietary supplements requiring enzyme-based processing.

- Government Initiatives and Support: Favorable policies promoting the use of industrial biotechnology and sustainable practices.

Key Barriers & Challenges:

- High R&D and Production Costs: Development and large-scale production of specialty enzymes can be expensive, impacting pricing.

- Regulatory Hurdles: Obtaining regulatory approvals for new enzyme applications, especially in food and pharmaceuticals, can be a lengthy and complex process.

- Competition from Chemical Catalysts: While diminishing, chemical catalysts still offer a cost-effective alternative in certain applications.

- Supply Chain Disruptions: Global events can impact the availability of raw materials for enzyme production and distribution.

- Lack of Technical Expertise: In some developing regions, there may be a shortage of skilled professionals to effectively utilize and implement enzyme technologies.

Emerging Opportunities in Specialty Enzymes Market

The specialty enzymes market presents a wealth of emerging opportunities, driven by evolving consumer preferences and technological advancements. The rapidly growing market for plant-based foods is creating a significant demand for enzymes that can improve texture, flavor, and nutritional profiles of these alternatives. Furthermore, the burgeoning field of personalized medicine and diagnostics is spurring the development of highly specific enzymes for novel therapeutic and diagnostic applications. The increasing focus on circular economy principles is also opening doors for enzymes in waste valorization and the production of biofuels and biochemicals from renewable resources. Untapped markets in emerging economies, particularly in Asia and Africa, represent substantial growth potential as industrialization and consumer spending increase. Evolving consumer preferences for clean-label products and functional ingredients further underscore the demand for naturally derived enzymes.

Growth Accelerators in the Specialty Enzymes Market Industry

The long-term growth of the specialty enzymes market is being significantly accelerated by breakthroughs in synthetic biology and enzyme engineering, enabling the design of enzymes with unprecedented functionalities. Strategic partnerships between enzyme manufacturers, food and pharmaceutical companies, and academic institutions are fostering collaborative R&D and speeding up the commercialization of novel enzyme solutions. Market expansion strategies, including the development of customized enzyme formulations for specific industrial needs and penetration into new geographical markets, are also key growth catalysts. The increasing adoption of enzymes in the production of sustainable materials, such as biodegradable plastics and bio-based chemicals, further fuels market expansion and diversifies the industry's revenue streams.

Key Players Shaping the Specialty Enzymes Market Market

- AST Enzymes

- Specialty Enzymes & Probiotics

- Amano Enzymes

- Associate British Foods PLC

- International Flavors & Fragrances

- Novozymes

- Mitsubishi Chemical Corporation

- DuPont de Nemours Inc

- Kerry Inc

- Chr Hansen Holding A/S

- Koninklijke DSM N V

Notable Milestones in Specialty Enzymes Market Sector

- Dec 2022: Danish food ingredient and enzyme makers Novozymes and Chr. Hansen agreed to merge. This significant move aims to combine Novozymes' expertise in enzymes for household products, food and beverage, and biofuels with Chr. Hansen's focus on enzymes and microbial solutions for the food industry, creating a formidable entity in the bioscience sector.

- Apr 2021: Biocatalysts Ltd announced the launch of a new dairy enzyme, Promod™ 517MDP (P517MDP). This launch expanded their portfolio of Kosher and Halal-certified dairy protein enzymes, catering to specific market demands and regulatory requirements.

- Jan 2021: IFF introduced the Nurica enzyme, a lactase enzyme that empowers dairy processors to precisely adjust the sugar, fiber, and lactose content in various dairy products, including flavored milk, ice cream, and fermented dairy items, enhancing product customization and catering to dietary needs.

In-Depth Specialty Enzymes Market Market Outlook

The specialty enzymes market is poised for sustained and dynamic growth, driven by an increasing global imperative for sustainable and efficient industrial processes. Future market potential lies in the continued expansion of enzyme applications in biopharmaceuticals, diagnostics, and the circular economy, particularly in waste valorization and the production of high-value biochemicals. Strategic opportunities will arise from advancements in enzyme discovery through metagenomics and AI-driven protein design, enabling the creation of bespoke enzymes for niche applications. The growing demand for functional foods and personalized nutrition will further stimulate innovation in food enzymes. Furthermore, market expansion into underdeveloped regions, coupled with increasing regulatory support for bio-based solutions, will unlock significant growth avenues, ensuring the specialty enzymes market remains a vital and expanding sector of the global economy.

Specialty Enzymes Market Segmentation

-

1. Source

- 1.1. Plant

- 1.2. Animal

- 1.3. Microbial

-

2. Type

- 2.1. Carbohydrases

- 2.2. Proteases

- 2.3. Lipases

- 2.4. Other Types

-

3. Application

- 3.1. Food & Beverage

- 3.2. Pharmaceutical

- 3.3. Animal Nutrition

- 3.4. Other Applications

Specialty Enzymes Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Specialty Enzymes Market Regional Market Share

Geographic Coverage of Specialty Enzymes Market

Specialty Enzymes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Synthetic Food Colorant

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Processed Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Specialty Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Plant

- 5.1.2. Animal

- 5.1.3. Microbial

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Carbohydrases

- 5.2.2. Proteases

- 5.2.3. Lipases

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food & Beverage

- 5.3.2. Pharmaceutical

- 5.3.3. Animal Nutrition

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North America Specialty Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Plant

- 6.1.2. Animal

- 6.1.3. Microbial

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Carbohydrases

- 6.2.2. Proteases

- 6.2.3. Lipases

- 6.2.4. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Food & Beverage

- 6.3.2. Pharmaceutical

- 6.3.3. Animal Nutrition

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Europe Specialty Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Plant

- 7.1.2. Animal

- 7.1.3. Microbial

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Carbohydrases

- 7.2.2. Proteases

- 7.2.3. Lipases

- 7.2.4. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Food & Beverage

- 7.3.2. Pharmaceutical

- 7.3.3. Animal Nutrition

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Asia Pacific Specialty Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Plant

- 8.1.2. Animal

- 8.1.3. Microbial

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Carbohydrases

- 8.2.2. Proteases

- 8.2.3. Lipases

- 8.2.4. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Food & Beverage

- 8.3.2. Pharmaceutical

- 8.3.3. Animal Nutrition

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. South America Specialty Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Plant

- 9.1.2. Animal

- 9.1.3. Microbial

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Carbohydrases

- 9.2.2. Proteases

- 9.2.3. Lipases

- 9.2.4. Other Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Food & Beverage

- 9.3.2. Pharmaceutical

- 9.3.3. Animal Nutrition

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Middle East and Africa Specialty Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Plant

- 10.1.2. Animal

- 10.1.3. Microbial

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Carbohydrases

- 10.2.2. Proteases

- 10.2.3. Lipases

- 10.2.4. Other Types

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Food & Beverage

- 10.3.2. Pharmaceutical

- 10.3.3. Animal Nutrition

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AST Enzymes*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Specialty Enzymes & Probiotics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amano Enzymes

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Associate British Foods PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 International Flavors & Fragrances

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Novozymes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Chemical Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DuPont de Nemours Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kerry Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chr Hansen Holding A/S

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Koninklijke DSM N V

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 AST Enzymes*List Not Exhaustive

List of Figures

- Figure 1: Global Specialty Enzymes Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Specialty Enzymes Market Revenue (billion), by Source 2025 & 2033

- Figure 3: North America Specialty Enzymes Market Revenue Share (%), by Source 2025 & 2033

- Figure 4: North America Specialty Enzymes Market Revenue (billion), by Type 2025 & 2033

- Figure 5: North America Specialty Enzymes Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Specialty Enzymes Market Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Specialty Enzymes Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Specialty Enzymes Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Specialty Enzymes Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Specialty Enzymes Market Revenue (billion), by Source 2025 & 2033

- Figure 11: Europe Specialty Enzymes Market Revenue Share (%), by Source 2025 & 2033

- Figure 12: Europe Specialty Enzymes Market Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Specialty Enzymes Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Specialty Enzymes Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Specialty Enzymes Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Specialty Enzymes Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Specialty Enzymes Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Specialty Enzymes Market Revenue (billion), by Source 2025 & 2033

- Figure 19: Asia Pacific Specialty Enzymes Market Revenue Share (%), by Source 2025 & 2033

- Figure 20: Asia Pacific Specialty Enzymes Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Asia Pacific Specialty Enzymes Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Specialty Enzymes Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Asia Pacific Specialty Enzymes Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Specialty Enzymes Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Specialty Enzymes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Specialty Enzymes Market Revenue (billion), by Source 2025 & 2033

- Figure 27: South America Specialty Enzymes Market Revenue Share (%), by Source 2025 & 2033

- Figure 28: South America Specialty Enzymes Market Revenue (billion), by Type 2025 & 2033

- Figure 29: South America Specialty Enzymes Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Specialty Enzymes Market Revenue (billion), by Application 2025 & 2033

- Figure 31: South America Specialty Enzymes Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Specialty Enzymes Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Specialty Enzymes Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Specialty Enzymes Market Revenue (billion), by Source 2025 & 2033

- Figure 35: Middle East and Africa Specialty Enzymes Market Revenue Share (%), by Source 2025 & 2033

- Figure 36: Middle East and Africa Specialty Enzymes Market Revenue (billion), by Type 2025 & 2033

- Figure 37: Middle East and Africa Specialty Enzymes Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Specialty Enzymes Market Revenue (billion), by Application 2025 & 2033

- Figure 39: Middle East and Africa Specialty Enzymes Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Specialty Enzymes Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Specialty Enzymes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Specialty Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: Global Specialty Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Specialty Enzymes Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Specialty Enzymes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Specialty Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 6: Global Specialty Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Specialty Enzymes Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Specialty Enzymes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Specialty Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 14: Global Specialty Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global Specialty Enzymes Market Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Specialty Enzymes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Spain Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Italy Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Russia Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Specialty Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 25: Global Specialty Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Specialty Enzymes Market Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Global Specialty Enzymes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: China Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: India Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Australia Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Specialty Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 34: Global Specialty Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 35: Global Specialty Enzymes Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Specialty Enzymes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Specialty Enzymes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 41: Global Specialty Enzymes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Global Specialty Enzymes Market Revenue billion Forecast, by Application 2020 & 2033

- Table 43: Global Specialty Enzymes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: South Africa Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: United Arab Emirates Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East and Africa Specialty Enzymes Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Specialty Enzymes Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Specialty Enzymes Market?

Key companies in the market include AST Enzymes*List Not Exhaustive, Specialty Enzymes & Probiotics, Amano Enzymes, Associate British Foods PLC, International Flavors & Fragrances, Novozymes, Mitsubishi Chemical Corporation, DuPont de Nemours Inc, Kerry Inc, Chr Hansen Holding A/S, Koninklijke DSM N V.

3. What are the main segments of the Specialty Enzymes Market?

The market segments include Source, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.86 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Increasing Demand for Processed Food.

7. Are there any restraints impacting market growth?

Easy Availability of Synthetic Food Colorant.

8. Can you provide examples of recent developments in the market?

Dec 2022: Danish food ingredient and enzyme makers Novozymes and Chr. Hansen agreed to merge. In comparison, both firms produce enzymes, Chr. Hansen focuses on enzymes and microbial for the food industry, and Novozymes' major business areas include enzymes for household products, food and beverage, and biofuels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Specialty Enzymes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Specialty Enzymes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Specialty Enzymes Market?

To stay informed about further developments, trends, and reports in the Specialty Enzymes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence