Key Insights

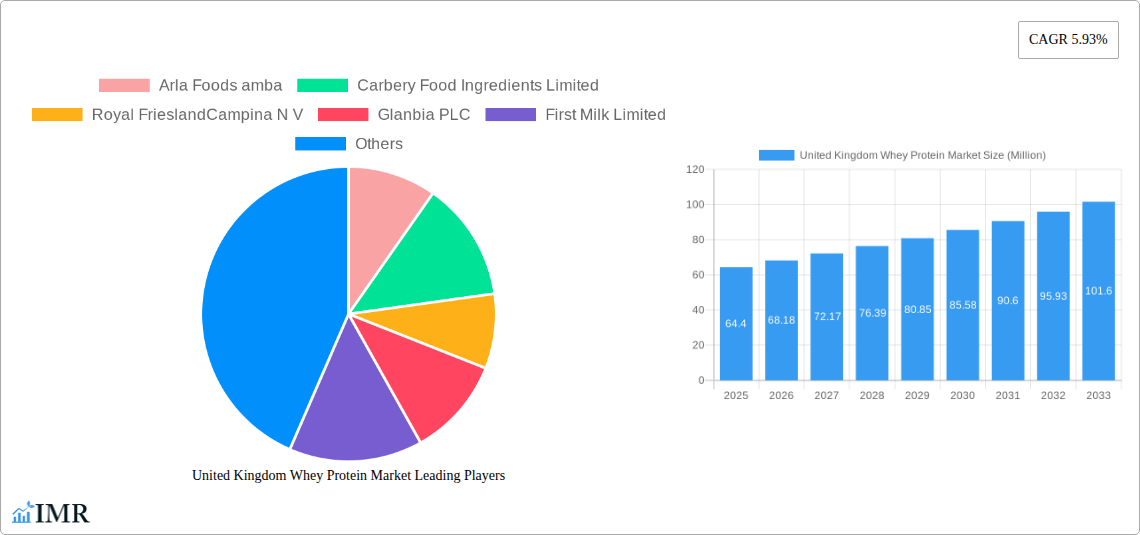

The United Kingdom whey protein market is poised for robust growth, projected to reach approximately USD 64.40 million by 2025. This expansion is fueled by a compound annual growth rate (CAGR) of 5.93%, indicating a consistent and healthy upward trajectory for the foreseeable future, extending through 2033. The market's dynamism is driven by several key factors, including the escalating consumer demand for protein-rich products, particularly within the fitness and health-conscious demographic. Growing awareness regarding the benefits of whey protein for muscle recovery, weight management, and overall well-being is a significant catalyst. Furthermore, the increasing integration of whey protein into diverse food and beverage applications, such as bakery items, dairy alternatives, and ready-to-eat meals, is broadening its consumer base and driving market penetration. The versatility of whey protein, available in various forms like concentrates, isolates, and hydrolyzed proteins, allows for tailored applications across different end-user segments, further contributing to its market appeal.

United Kingdom Whey Protein Market Market Size (In Million)

The market's growth is also supported by innovations in product development and formulation, catering to evolving consumer preferences for taste, texture, and specific nutritional profiles. The animal feed sector is another substantial contributor, leveraging whey protein for its nutritional benefits in livestock diets. Within the food and beverage segment, the expanding market for sports nutrition and specialized dietary supplements, including baby food and elderly nutrition, presents significant opportunities. While the market exhibits strong growth potential, certain factors could influence its pace. However, the overarching trend indicates a sustained demand, driven by health and wellness movements and the adaptability of whey protein across numerous applications in the UK.

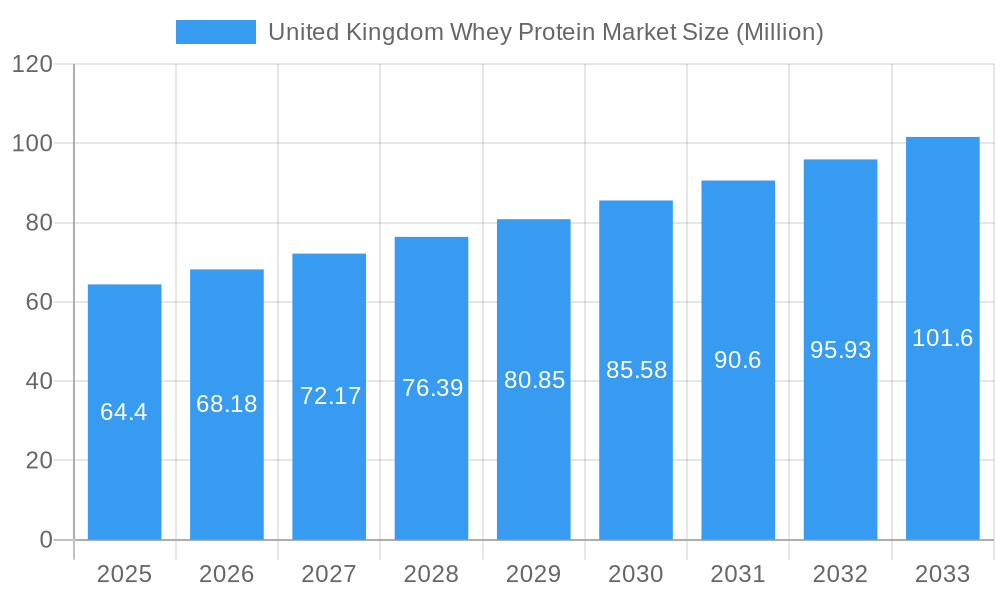

United Kingdom Whey Protein Market Company Market Share

United Kingdom Whey Protein Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers a definitive analysis of the United Kingdom whey protein market, encompassing its intricate dynamics, growth trajectories, and future potential. Leveraging extensive data for the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report provides unparalleled insights into market size, segmentation, key players, and emerging opportunities. This research is crucial for stakeholders seeking to understand the evolving landscape of whey protein in the UK, from its production and consumption trends to technological advancements and strategic initiatives.

United Kingdom Whey Protein Market Market Dynamics & Structure

The United Kingdom whey protein market, while experiencing robust growth, exhibits a moderately concentrated structure. Key players like Arla Foods Ingredients, Glanbia PLC, and Carbery Food Ingredients Limited hold significant market share, driven by their established distribution networks and product portfolios. Technological innovation is a primary driver, with continuous advancements in processing techniques leading to higher purity whey protein isolates and hydrolysates, catering to specialized nutritional needs. Regulatory frameworks, particularly those concerning food safety and labeling, play a crucial role in shaping market entry and product development. The competitive landscape includes not only direct whey protein manufacturers but also substitute protein sources, such as plant-based alternatives and soy protein, influencing pricing and product differentiation strategies. End-user demographics are shifting, with increasing demand from the aging population for medical nutrition and a sustained appetite from the sports nutrition segment. Mergers and acquisitions are a notable trend, with companies seeking to consolidate their market position, expand their product offerings, and gain access to new technologies and customer bases. For instance, strategic collaborations, like the one between Arla Foods Ingredients and First Milk, highlight a trend towards optimizing production and expanding capabilities. The market's structure is further defined by the interplay between raw material sourcing, processing efficiency, and marketing strategies, all contributing to a dynamic and evolving industry.

- Market Concentration: Moderately concentrated with key players dominating market share.

- Technological Innovation: Driven by advancements in isolation and hydrolysis techniques, leading to premium product offerings.

- Regulatory Frameworks: Strict adherence to food safety and labeling regulations is paramount.

- Competitive Substitutes: Presence of plant-based proteins and other animal-derived proteins influencing market dynamics.

- End-User Demographics: Growing demand from sports nutrition, infant formula, and elderly nutrition segments.

- M&A Trends: Strategic consolidations and collaborations to enhance market reach and product portfolios.

United Kingdom Whey Protein Market Growth Trends & Insights

The United Kingdom whey protein market is poised for substantial expansion, driven by a confluence of factors including rising health consciousness, an increasing demand for functional foods, and a burgeoning sports nutrition sector. The market size is projected to witness significant growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033. This growth is underpinned by the increasing adoption of whey protein supplements and ingredients across various end-user segments. Technological disruptions, such as advancements in ultrafiltration and ion-exchange chromatography, are enabling the production of higher-purity whey protein products, including isolates and hydrolysates, which command premium pricing and cater to niche markets like medical nutrition and sensitive digestive needs.

Consumer behavior is a pivotal influence, with a growing segment of the UK population actively seeking protein-rich diets for muscle building, weight management, and overall well-being. The expansion of the Food and Beverages segment, particularly in bakery, dairy alternatives, and ready-to-eat/cook products, signifies the integration of whey protein into everyday consumables. Furthermore, the Supplements segment, especially Sport/Performance Nutrition and Baby Food and Infant Formula, continues to be a stronghold, benefiting from increased awareness of the benefits of protein for recovery, growth, and development. The elderly nutrition and medical nutrition sectors also present considerable untapped potential, as the demand for protein fortification in therapeutic diets grows. The market penetration of whey protein is steadily increasing, moving beyond traditional athletic circles into mainstream consumer awareness. This evolving perception of whey protein as a versatile and beneficial ingredient is a key driver of its sustained market growth and adoption rates. The base year of 2025 marks a pivotal point, with established market trends expected to accelerate into the forecast period.

Dominant Regions, Countries, or Segments in United Kingdom Whey Protein Market

The United Kingdom whey protein market is characterized by the significant dominance of the Supplements segment, which, in turn, is primarily propelled by the Sport/Performance Nutrition sub-segment. This dominance is a direct reflection of the UK's robust fitness culture, widespread participation in athletic activities, and a deep-seated consumer awareness regarding the role of protein in muscle recovery, growth, and overall physical performance. The market share within this segment is substantial, estimated to be in the range of xx% of the total market value in 2025.

Several key drivers contribute to the preeminence of Sport/Performance Nutrition:

- Economic Policies: While not directly sector-specific, a strong UK economy supports consumer spending on health and wellness products, including premium supplements.

- Infrastructure: The availability of well-established distribution networks, including online retailers, specialty sports stores, and pharmacies, ensures widespread accessibility of whey protein products.

- Consumer Behavior Shifts: A growing emphasis on preventative healthcare and proactive fitness regimes encourages individuals to invest in performance-enhancing nutrition.

- Marketing and Influencer Culture: The active promotion of whey protein by fitness influencers, athletes, and sports science professionals significantly boosts its appeal and adoption rates.

Within the broader Supplements category, Baby Food and Infant Formula also represents a critical and growing sub-segment. Increasing parental awareness of the nutritional importance of protein for infant development, coupled with a demand for high-quality, easily digestible protein sources, fuels this demand. The Elderly Nutrition and Medical Nutrition sub-segment, though currently smaller, is exhibiting rapid growth due to the aging UK population and the increasing need for protein-rich diets to combat sarcopenia and support recovery from illness.

The Food and Beverages segment, while significant in volume, is diversified. Dairy and Dairy Alternative Products and Snacks are key areas where whey protein is increasingly incorporated to enhance nutritional profiles. However, their individual market share within the overall whey protein market is less concentrated than the dedicated supplement categories.

Concentrates form a substantial portion of the Form segment due to their cost-effectiveness and versatility, but the demand for higher-purity Isolates and Hydrolyzed whey protein is steadily increasing, driven by specific consumer preferences and applications requiring faster absorption or reduced allergenicity.

United Kingdom Whey Protein Market Product Landscape

The United Kingdom whey protein market is witnessing a wave of innovation focused on enhanced purity, bioavailability, and functional benefits. Manufacturers are increasingly developing specialized whey protein hydrolysates for rapid absorption, crucial for post-workout recovery, and isolates with extremely low lactose and fat content to cater to individuals with sensitivities. Product diversification extends to new flavor profiles, plant-based protein blends for synergistic benefits, and the incorporation of probiotics and digestive enzymes for improved gut health. Performance metrics are centered on protein content, amino acid profiles, dissolution rates, and allergenicity, with a growing emphasis on sustainable sourcing and ethical production practices. Unique selling propositions often revolve around specific protein fractions, proprietary processing techniques, and targeted health benefits, such as bone health or immune support.

Key Drivers, Barriers & Challenges in United Kingdom Whey Protein Market

Key Drivers:

- Rising Health and Wellness Consciousness: Increased consumer awareness of protein's benefits for muscle health, weight management, and overall well-being.

- Growth in Sports Nutrition: The expanding fitness industry and the popularity of athletic pursuits drive demand for performance-enhancing supplements.

- Functional Food Integration: Growing trend of incorporating whey protein into everyday food and beverage products for added nutritional value.

- Technological Advancements: Improved processing techniques leading to higher purity and specialized whey protein forms (isolates, hydrolysates).

- Aging Population: Increased demand for medical nutrition and dietary supplements to support the health needs of the elderly.

Barriers & Challenges:

- Price Volatility of Raw Materials: Fluctuations in milk prices can impact production costs and the final price of whey protein.

- Competition from Plant-Based Alternatives: Growing consumer preference for vegan and plant-based diets presents a competitive threat.

- Regulatory Scrutiny: Stringent food safety regulations and labeling requirements can pose compliance challenges.

- Supply Chain Disruptions: Potential for disruptions in the dairy supply chain, impacting availability and cost.

- Consumer Perceptions and Misconceptions: Some consumers may harbor misconceptions about whey protein, requiring targeted education campaigns.

Emerging Opportunities in United Kingdom Whey Protein Market

Emerging opportunities in the UK whey protein market lie in the further development of specialized functional ingredients tailored for specific health outcomes. The burgeoning market for plant-based and dairy-free alternatives presents an opportunity for blended protein products that combine the benefits of whey with other protein sources, catering to a wider consumer base. Innovative applications in the "free-from" category, such as lactose-free and gluten-free formulations, are gaining traction. Furthermore, the increasing focus on sustainable and traceable sourcing offers a competitive advantage for manufacturers committed to ethical practices. The personalized nutrition trend also opens avenues for customized whey protein formulations based on individual dietary needs and fitness goals.

Growth Accelerators in the United Kingdom Whey Protein Market Industry

Several catalysts are accelerating the long-term growth of the UK whey protein industry. Technological breakthroughs in enzymatic hydrolysis and membrane filtration are enabling the production of novel whey protein peptides with enhanced biological activity and improved digestibility. Strategic partnerships between dairy cooperatives, ingredient suppliers, and finished product manufacturers are streamlining the supply chain and fostering product innovation. Market expansion strategies are increasingly focused on tapping into the underserved elderly nutrition and medical nutrition segments, where the demand for high-quality protein is significant. The continuous investment in research and development to uncover new health benefits and applications of whey protein further propels its market trajectory.

Key Players Shaping the United Kingdom Whey Protein Market Market

Arla Foods amba Carbery Food Ingredients Limited Royal FrieslandCampina N V Glanbia PLC First Milk Limited Lactoprot Deutschland GmbH Volac International Limited Morinaga Milk Industry Co Ltd Groupe Lactalis Kerry Group plc

Notable Milestones in United Kingdom Whey Protein Market Sector

- November 2022: Arla Foods Ingredients and British dairy cooperative First Milk collaborated to produce a specialist whey protein powder at its Lake District Creamery. First Milk manufactured Nutrilac FO-7875 on behalf of Arla Foods Ingredients. Whey protein concentrate powder, WPC80, will continue to be produced by First Milk and marketed through its current partnership.

- March 2022: Arla announced a 5-year expansion strategy for the United Kingdom. As a part of the strategy, the company announced its plans to make long-term investments in its United Kingdom supply chain and key sales channels.

- March 2021: First Milk Limited, a dairy cooperative based in the United Kingdom, announced its plans to invest approximately GBP 12.5 million (USD 17.25 million) for the expansion of its two cheese and whey production facilities in the United Kingdom.

In-Depth United Kingdom Whey Protein Market Market Outlook

The future outlook for the United Kingdom whey protein market is exceptionally bright, driven by a sustained increase in consumer health consciousness and an expanding range of applications. Growth accelerators, including ongoing technological innovations in processing and the strategic integration of whey protein into mainstream food and beverage products, are poised to significantly enhance market penetration. The increasing demand from the aging demographic for specialized nutritional support, alongside the persistent strength of the sports nutrition sector, presents a robust foundation for future expansion. Furthermore, the growing emphasis on sustainable sourcing and product transparency will likely shape competitive advantages, encouraging a more responsible and health-conscious market evolution. The market is expected to capitalize on these trends, projecting strong and consistent growth in the coming years.

United Kingdom Whey Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Hydrolyzed

- 1.3. Isolates

-

2. End User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Dairy and Dairy Alternative Products

- 2.3.5. RTE/RTC Food Products

- 2.3.6. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

United Kingdom Whey Protein Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Whey Protein Market Regional Market Share

Geographic Coverage of United Kingdom Whey Protein Market

United Kingdom Whey Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Sports & Fitness Activities Driving the Market; Rising Demand for Fortified Food & Beverages

- 3.3. Market Restrains

- 3.3.1. Prevalence of Lactose Intolerance

- 3.4. Market Trends

- 3.4.1. Adoption of Sports & Fitness Activities Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Whey Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Hydrolyzed

- 5.1.3. Isolates

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Dairy and Dairy Alternative Products

- 5.2.3.5. RTE/RTC Food Products

- 5.2.3.6. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arla Foods amba

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carbery Food Ingredients Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Royal FrieslandCampina N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Glanbia PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 First Milk Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lactoprot Deutschland GmbH*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volac International Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Morinaga Milk Industry Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Groupe Lactalis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kerry Group plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arla Foods amba

List of Figures

- Figure 1: United Kingdom Whey Protein Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Whey Protein Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Whey Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 2: United Kingdom Whey Protein Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 3: United Kingdom Whey Protein Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United Kingdom Whey Protein Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 5: United Kingdom Whey Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United Kingdom Whey Protein Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Whey Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 8: United Kingdom Whey Protein Market Volume K Tons Forecast, by Form 2020 & 2033

- Table 9: United Kingdom Whey Protein Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: United Kingdom Whey Protein Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 11: United Kingdom Whey Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Whey Protein Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Whey Protein Market?

The projected CAGR is approximately 5.93%.

2. Which companies are prominent players in the United Kingdom Whey Protein Market?

Key companies in the market include Arla Foods amba, Carbery Food Ingredients Limited, Royal FrieslandCampina N V, Glanbia PLC, First Milk Limited, Lactoprot Deutschland GmbH*List Not Exhaustive, Volac International Limited, Morinaga Milk Industry Co Ltd, Groupe Lactalis, Kerry Group plc.

3. What are the main segments of the United Kingdom Whey Protein Market?

The market segments include Form, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Sports & Fitness Activities Driving the Market; Rising Demand for Fortified Food & Beverages.

6. What are the notable trends driving market growth?

Adoption of Sports & Fitness Activities Driving the Market.

7. Are there any restraints impacting market growth?

Prevalence of Lactose Intolerance.

8. Can you provide examples of recent developments in the market?

November 2022: Arla Foods Ingredients and British dairy cooperative First Milk collaborated to produce a specialist whey protein powder at its Lake District Creamery. First Milk manufactured Nutrilac FO-7875 on behalf of Arla Foods Ingredients. Whey protein concentrate powder, WPC80, will continue to be produced by First Milk and marketed through its current partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Whey Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Whey Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Whey Protein Market?

To stay informed about further developments, trends, and reports in the United Kingdom Whey Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence