Key Insights

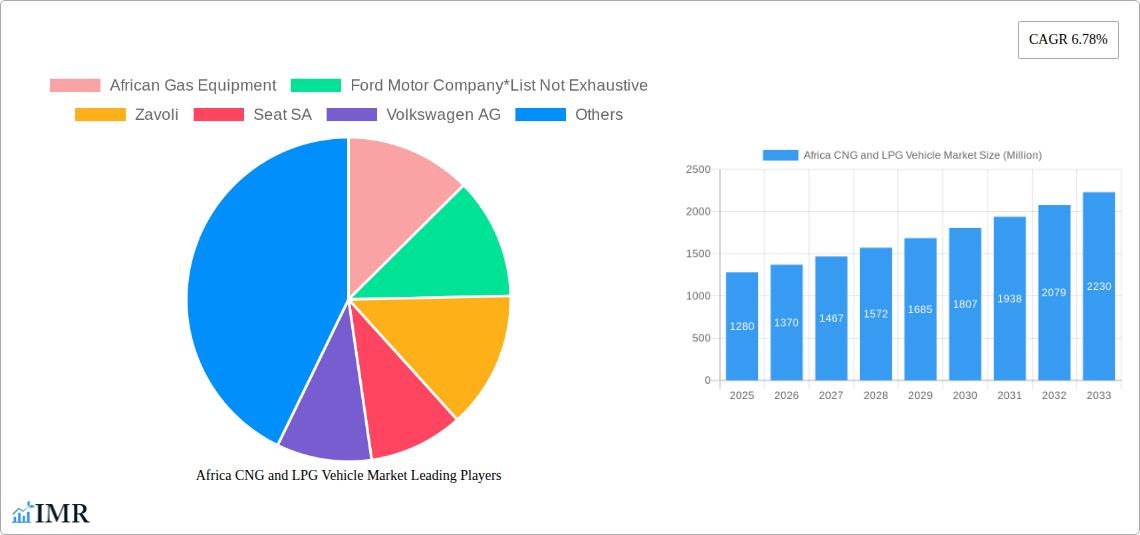

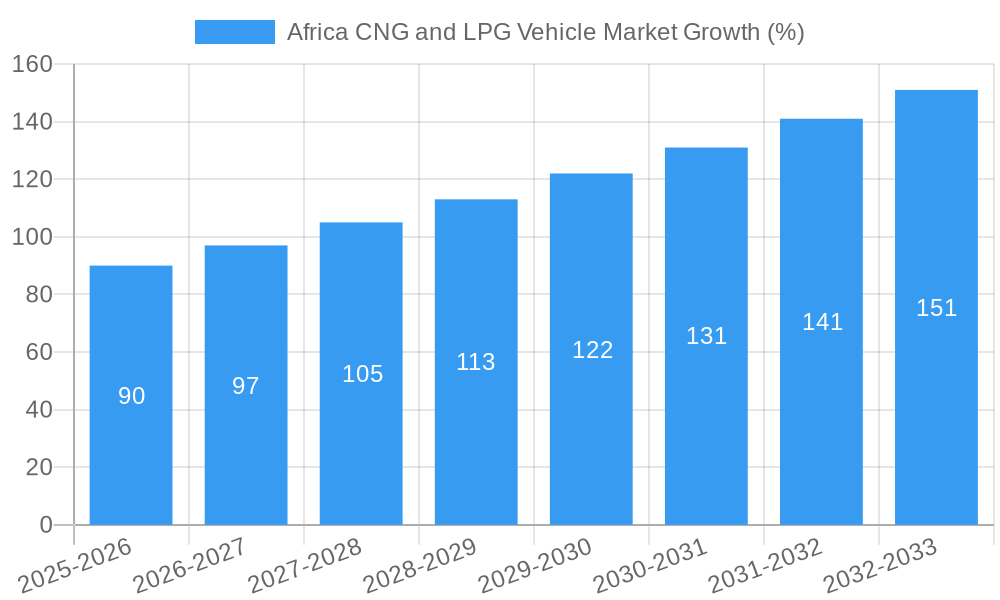

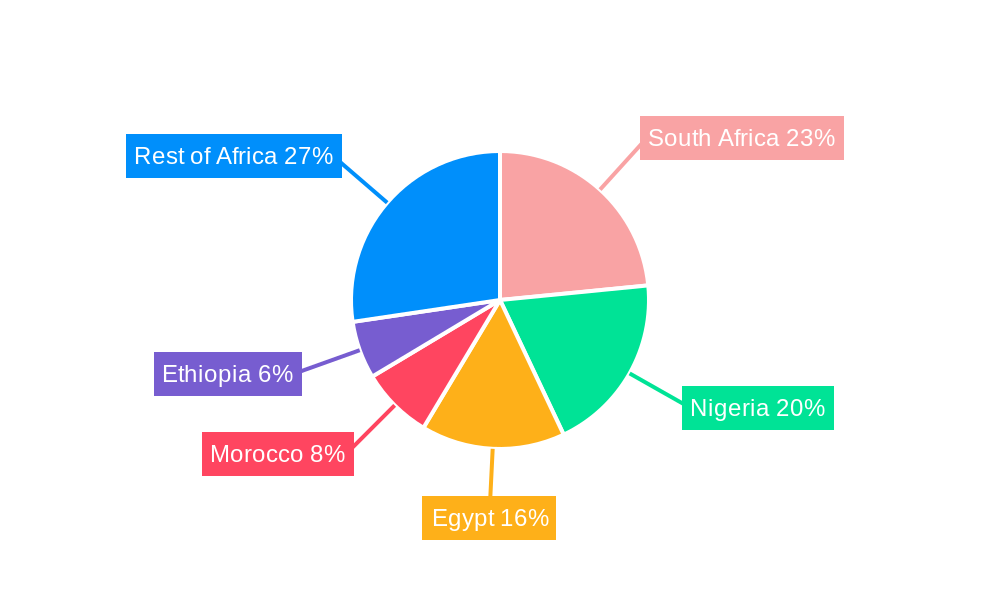

The Africa CNG and LPG vehicle market, valued at $1.28 billion in 2025, is projected to experience robust growth, driven by increasing fuel prices, stringent emission regulations, and government initiatives promoting cleaner transportation alternatives across the continent. South Africa, Nigeria, and Egypt represent the largest national markets, benefiting from established automotive industries and expanding infrastructure for alternative fuels. The passenger car segment currently dominates, although the commercial vehicle segment is anticipated to witness significant growth fueled by the cost-effectiveness of CNG and LPG in fleet operations. Key growth drivers include the rising adoption of CNG and LPG vehicles by both OEMs and the aftermarket, coupled with favorable government policies in several key African nations offering incentives for alternative fuel adoption. Challenges remain, however, including limited refueling infrastructure in certain regions, particularly outside major cities, and the need for greater consumer awareness about the benefits of these fuel types. Furthermore, the initial investment cost for CNG/LPG vehicle conversion or purchase might present a barrier for some consumers, particularly in lower-income segments. Despite these hurdles, the long-term outlook for the African CNG and LPG vehicle market remains positive, with a projected compound annual growth rate (CAGR) of 6.78% from 2025 to 2033. This growth will be further fueled by technological advancements in vehicle conversion kits and refueling infrastructure development, as well as increasing public and private investments in sustainable transportation solutions across the African continent.

The diverse landscape of the African market presents both opportunities and challenges for industry players. Competition is expected to intensify among established OEMs like Volkswagen, Ford, and others alongside specialized CNG/LPG equipment manufacturers. Strategic partnerships and investments in infrastructure development will be crucial for companies seeking to capitalize on the market’s potential. Future success hinges on effective strategies that address the specific needs and challenges of individual African markets, encompassing localized marketing campaigns, tailored financing options, and robust after-sales support networks. The long-term viability of CNG and LPG as viable alternatives depends on the continuous expansion of fueling infrastructure and the broader adoption of supportive policies by African governments.

Africa CNG and LPG Vehicle Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa CNG and LPG vehicle market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for industry professionals, investors, and policymakers seeking to understand and capitalize on the burgeoning opportunities within this dynamic sector. The report analyzes the parent market (Alternative Fuel Vehicles in Africa) and the child market (CNG and LPG Vehicles). Expected market size in Million units is provided where available, otherwise predictions are given.

Africa CNG and LPG Vehicle Market Dynamics & Structure

The African CNG and LPG vehicle market is characterized by a fragmented landscape, with a mix of established international players and emerging local businesses. Market concentration is relatively low, with no single dominant player. Technological innovation is primarily driven by the need to improve fuel efficiency and reduce emissions, alongside government incentives and regulations. The regulatory framework varies across different African nations, influencing adoption rates and market growth. Competitive product substitutes include gasoline and diesel vehicles, posing ongoing challenges. End-user demographics are diverse, encompassing both private individuals and commercial fleets. M&A activity remains moderate, reflecting the market's developmental stage.

- Market Concentration: Low (xx%)

- Technological Innovation Drivers: Fuel efficiency, emission reduction, government policies.

- Regulatory Frameworks: Varied across countries, impacting adoption.

- Competitive Product Substitutes: Gasoline, diesel vehicles.

- M&A Deal Volumes: xx (2019-2024)

Africa CNG and LPG Vehicle Market Growth Trends & Insights

The Africa CNG and LPG vehicle market exhibits significant growth potential, driven by factors such as rising fuel prices, increasing environmental awareness, and government support for alternative fuel vehicles. The market size has witnessed considerable expansion from xx Million units in 2019 to xx Million units in 2024, projecting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological advancements in CNG and LPG vehicle technology are further accelerating adoption. Consumer behavior is shifting towards fuel-efficient and environmentally friendly options, bolstering market demand. Market penetration is expected to increase from xx% in 2024 to xx% by 2033. Challenges like infrastructure limitations and inconsistent regulatory frameworks need addressing to sustain this growth.

Dominant Regions, Countries, or Segments in Africa CNG and LPG Vehicle Market

South Africa, Nigeria, and Egypt represent the leading markets for CNG and LPG vehicles in Africa, driven by a combination of factors. South Africa benefits from established automotive infrastructure and a relatively developed regulatory framework. Nigeria’s large population and growing urban centers fuel high demand, while Egypt’s strategic location and government initiatives support market growth. The commercial vehicle segment exhibits faster growth compared to passenger cars, driven by cost savings and logistical advantages. OEM sales channels currently dominate, though the aftermarket is showing promising growth potential. Compressed Natural Gas (CNG) currently holds a larger market share than Liquified Petroleum Gas (LPG) due to existing natural gas infrastructure in some regions.

- Key Drivers (South Africa): Established automotive industry, relatively developed regulatory framework.

- Key Drivers (Nigeria): Large population, urbanization, increasing fleet size.

- Key Drivers (Egypt): Strategic location, government initiatives, existing gas infrastructure.

- Key Drivers (Commercial Vehicles): Cost savings, logistical advantages.

- Market Share (CNG): xx%

- Market Share (LPG): xx%

Africa CNG and LPG Vehicle Market Product Landscape

The product landscape is characterized by diverse vehicle types, including passenger cars and commercial vehicles, fitted with CNG or LPG kits. These kits vary in terms of technology, performance, and cost. Technological advancements focus on improving fuel efficiency, reducing emissions, and enhancing safety. Unique selling propositions include lower running costs, reduced emissions, and compatibility with existing vehicle models. The market is witnessing a gradual shift towards more sophisticated and integrated CNG/LPG systems.

Key Drivers, Barriers & Challenges in Africa CNG and LPG Vehicle Market

Key Drivers: Rising fuel prices, environmental concerns, government incentives (tax breaks, subsidies), and improved vehicle technology are major drivers. Government initiatives promoting alternative fuels and advancements in CNG/LPG technology also contribute significantly.

Key Challenges: Limited refueling infrastructure, inconsistent regulatory environments across nations, high initial investment costs for vehicles and infrastructure, and challenges with vehicle maintenance and repair. Furthermore, competition from gasoline and diesel vehicles poses a challenge in certain segments. The lack of skilled technicians to service CNG/LPG vehicles also acts as a restraint.

Emerging Opportunities in Africa CNG and LPG Vehicle Market

Untapped markets in East and Central Africa offer significant growth opportunities. The growing popularity of ride-hailing services presents a large potential customer base for CNG/LPG vehicles. Further innovation in CNG/LPG technology, including the development of more efficient and durable kits, can drive market expansion. Government partnerships with private sector stakeholders can create favorable conditions for investment and development in the sector.

Growth Accelerators in the Africa CNG and LPG Vehicle Market Industry

Technological breakthroughs, such as the development of advanced CNG/LPG fuel systems and improved vehicle designs, are critical growth catalysts. Strategic partnerships between vehicle manufacturers, fuel suppliers, and governments will stimulate market growth. Expansion strategies focused on underserved markets in East and Central Africa and efforts to improve refueling infrastructure and technician training programs will unlock significant market potential.

Key Players Shaping the Africa CNG and LPG Vehicle Market Market

- African Gas Equipment

- Ford Motor Company

- Zavoli

- Seat SA

- Volkswagen AG

- Valtec

- ExoGas

- Cummins Inc

- Iveco S p A

- BRC Gas Equipments

- AB Volvo

Notable Milestones in Africa CNG and LPG Vehicle Market Sector

- November 2023: Tanzania launches its first integrated CNG filling station and conversion center.

- September 2023: Asiko opens a 300-metric-tonne LPG and CNG depot in Nigeria.

- May 2022: TAQA Arabia delivers five CNG vehicles to Equatorial Guinea.

- March 2022: Suzuki introduces its second-generation Celerio with an OE CNG kit in South Africa.

In-Depth Africa CNG and LPG Vehicle Market Market Outlook

The Africa CNG and LPG vehicle market is poised for substantial growth over the next decade, driven by a confluence of factors including rising fuel costs, environmental regulations, and technological advancements. Strategic investments in infrastructure development, coupled with supportive government policies, will be crucial in unlocking the market's full potential. Companies that effectively address the challenges related to infrastructure and consumer adoption stand to gain significant market share. The focus should be on reducing the initial cost of adoption, improving the maintenance infrastructure and enhancing consumer awareness to fuel long-term sustained growth.

Africa CNG and LPG Vehicle Market Segmentation

-

1. Fuel Type

- 1.1. Compressed Natural Gas

- 1.2. Liquified Petroleum Gas

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

Africa CNG and LPG Vehicle Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa CNG and LPG Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investments in Refueling Infrastructure Is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Inadequate Regulatory Frameworks is Anticipated to Restrain the Market Growth

- 3.4. Market Trends

- 3.4.1. Compressed Natural Gas will Hold Highest Growth Potential

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Compressed Natural Gas

- 5.1.2. Liquified Petroleum Gas

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. South Africa Africa CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 African Gas Equipment

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ford Motor Company*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Zavoli

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Seat SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Volkswagen AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Valtec

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ExoGas

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Cummins Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Iveco S p A

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BRC Gas Equipments

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 AB Volvo

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 African Gas Equipment

List of Figures

- Figure 1: Africa CNG and LPG Vehicle Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa CNG and LPG Vehicle Market Share (%) by Company 2024

List of Tables

- Table 1: Africa CNG and LPG Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa CNG and LPG Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 3: Africa CNG and LPG Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Africa CNG and LPG Vehicle Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 5: Africa CNG and LPG Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa CNG and LPG Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa CNG and LPG Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 14: Africa CNG and LPG Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Africa CNG and LPG Vehicle Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: Africa CNG and LPG Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Nigeria Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Egypt Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ethiopia Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Morocco Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Ghana Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Algeria Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Tanzania Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Ivory Coast Africa CNG and LPG Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa CNG and LPG Vehicle Market?

The projected CAGR is approximately 6.78%.

2. Which companies are prominent players in the Africa CNG and LPG Vehicle Market?

Key companies in the market include African Gas Equipment, Ford Motor Company*List Not Exhaustive, Zavoli, Seat SA, Volkswagen AG, Valtec, ExoGas, Cummins Inc, Iveco S p A, BRC Gas Equipments, AB Volvo.

3. What are the main segments of the Africa CNG and LPG Vehicle Market?

The market segments include Fuel Type, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Investments in Refueling Infrastructure Is Driving the Market Growth.

6. What are the notable trends driving market growth?

Compressed Natural Gas will Hold Highest Growth Potential.

7. Are there any restraints impacting market growth?

Inadequate Regulatory Frameworks is Anticipated to Restrain the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2023: Tanzania introduced its inaugural integrated facility for compressed natural gas (CNG), marking the country's debut of a combined CNG filling station and conversion center.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa CNG and LPG Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa CNG and LPG Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa CNG and LPG Vehicle Market?

To stay informed about further developments, trends, and reports in the Africa CNG and LPG Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence