Key Insights

The Asia-Pacific motorhome market is projected to reach USD 6.5 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 3.8%. This expansion is driven by increasing disposable incomes, a growing preference for experiential travel, and enhanced tourism infrastructure. Consumers are drawn to the freedom and flexibility motorhomes offer. Government initiatives supporting tourism and infrastructure development, including improved road networks and camping facilities, are further stimulating market growth. Class B motorhomes (campervans) are gaining popularity for their urban maneuverability, while Class A models appeal to luxury travelers. Key end-user segments include direct buyers pursuing personal travel and fleet owners capitalizing on the rental market.

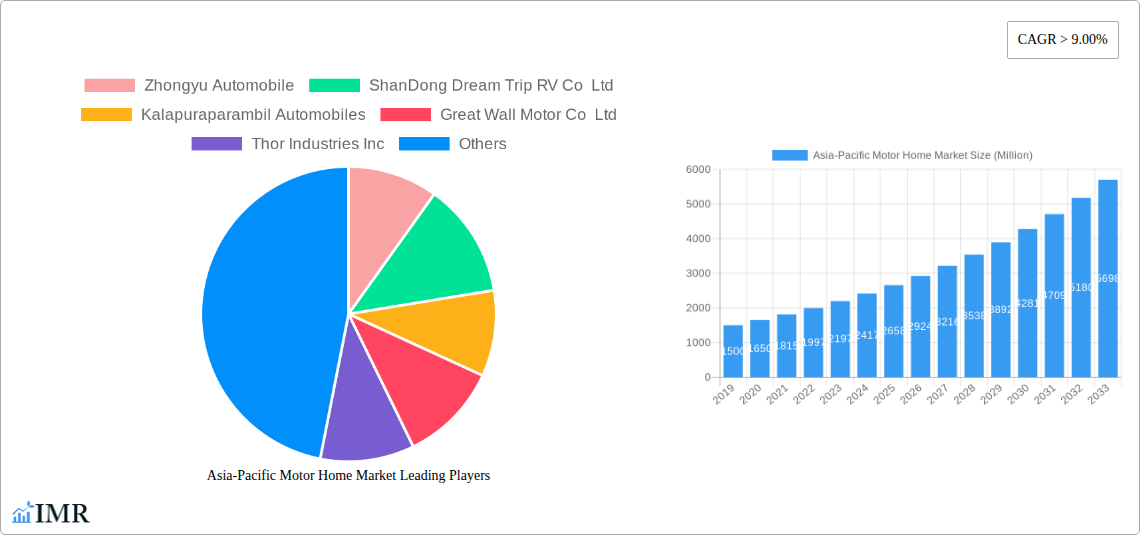

Asia-Pacific Motor Home Market Market Size (In Billion)

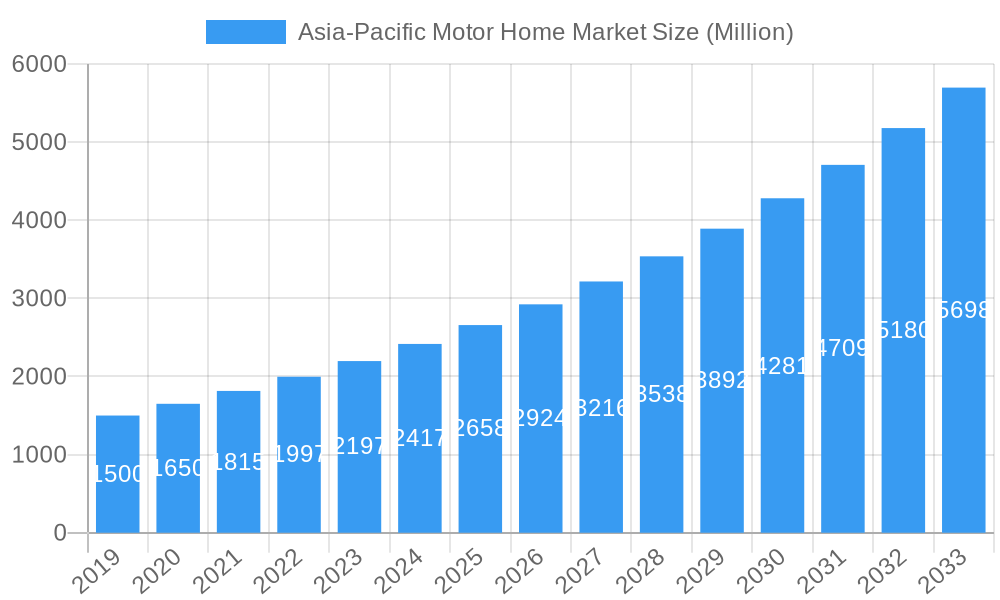

Despite positive growth prospects, the market faces challenges such as the high initial purchase cost of motorhomes, particularly in price-sensitive economies, and limited availability of dedicated parking and maintenance facilities in some areas. Evolving regulations regarding vehicle ownership and usage also present navigation complexities. However, the industry is adapting through innovative models like shared ownership and the development of more affordable options. Key players such as Zhongyu Automobile, Great Wall Motor Co Ltd, and Thor Industries Inc. are poised to innovate and cater to diverse consumer needs across the vast Asia-Pacific region.

Asia-Pacific Motor Home Market Company Market Share

Asia-Pacific Motor Home Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers an unparalleled analysis of the burgeoning Asia-Pacific Motor Home Market, meticulously detailing market dynamics, growth trajectories, and key influential players. Spanning the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period from 2025-2033, this study provides critical insights for industry stakeholders seeking to navigate and capitalize on this rapidly evolving sector. Our analysis delves into the nuances of parent and child markets, delivering a holistic view of market penetration, technological advancements, and consumer behavior shifts that are redefining recreational vehicle (RV) usage across the region. Presenting all values in Million Units, this report is your definitive guide to understanding the present landscape and future potential of the Asia-Pacific Motor Home Market.

Asia-Pacific Motor Home Market Market Dynamics & Structure

The Asia-Pacific Motor Home Market is characterized by a moderate to high concentration, with a few dominant players like Zhongyu Automobile, ShanDong Dream Trip RV Co Ltd, and Great Wall Motor Co Ltd holding significant market shares. Technological innovation is a key driver, with advancements in lightweight materials, smart connectivity, and energy-efficient designs rapidly gaining traction. Regulatory frameworks, particularly concerning vehicle standards, safety regulations, and road usage, are evolving and vary significantly across different countries, influencing market accessibility and product development. Competitive product substitutes include traditional camping, hotel accommodations, and car rentals, each offering different value propositions to potential consumers. End-user demographics are expanding, with a growing interest from younger demographics and urban dwellers seeking flexible travel solutions, alongside the established market of retirees and adventure enthusiasts. Mergers and acquisitions (M&A) are becoming more prevalent as companies seek to consolidate market positions, gain access to new technologies, and expand their geographical reach.

- Market Concentration: Dominated by key manufacturers with increasing consolidation trends.

- Technological Innovation: Focus on smart features, sustainable materials, and enhanced user experience.

- Regulatory Landscape: Emerging and evolving regulations impacting manufacturing and usage.

- Competitive Landscape: Competition from alternative travel and accommodation options.

- End-User Evolution: Growing appeal to diverse age groups and lifestyle preferences.

- M&A Activity: Strategic acquisitions for market expansion and technological integration.

Asia-Pacific Motor Home Market Growth Trends & Insights

The Asia-Pacific Motor Home Market is poised for substantial growth, driven by a confluence of evolving lifestyle choices, increasing disposable incomes, and a burgeoning interest in experiential travel. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period. This growth is fueled by a rising adoption rate of motorhomes as a flexible and independent mode of travel, particularly appealing to millennials and Gen Z who prioritize unique experiences over traditional tourism. Technological disruptions are playing a pivotal role, with the integration of IoT devices for remote monitoring, smart home features within RVs, and the development of more fuel-efficient and environmentally friendly engine technologies significantly enhancing the appeal and practicality of motorhome ownership. Consumer behavior shifts are evident, with a noticeable increase in demand for compact, maneuverable, and digitally integrated motorhomes suitable for both short weekend getaways and extended exploration. The post-pandemic era has further accelerated this trend, as individuals seek more controlled and personalized travel experiences, leading to a surge in direct sales and a greater emphasis on customization. The penetration of motorhomes into diverse segments, from urban explorers to adventure tourism operators, underscores the segment's adaptability. Furthermore, government initiatives promoting domestic tourism and infrastructure development, such as improved campgrounds and dedicated motorhome parking facilities, are contributing to a more favorable market environment. The perceived freedom and self-sufficiency offered by motorhomes resonate strongly with a growing segment of the population looking to escape urban congestion and reconnect with nature.

Dominant Regions, Countries, or Segments in Asia-Pacific Motor Home Market

The Asia-Pacific Motor Home Market is experiencing robust growth, with China emerging as the dominant country, significantly outpacing other nations in terms of production, sales volume, and market potential. This dominance is attributed to a confluence of factors including a rapidly expanding middle class with increasing disposable incomes, a growing appetite for leisure travel and outdoor activities, and proactive government support for the RV industry. China's extensive manufacturing capabilities and a strong domestic demand for recreational vehicles make it a pivotal market within the region.

Among the segments, Class C motorhomes are currently leading the market, driven by their versatility, relatively more affordable price point compared to Class A, and their suitability for families and couples. Their balanced features, offering comfortable living spaces with manageable driving dimensions, make them an attractive entry point for many new motorhome enthusiasts.

Dominant Country: China

- Drivers: High disposable income, growing middle class, increasing popularity of outdoor leisure, government support for RV manufacturing and tourism.

- Market Share: Holds the largest share of production and sales in the Asia-Pacific region.

- Growth Potential: Continued strong growth expected due to ongoing economic development and evolving consumer preferences.

Dominant Segment: Class C Motorhomes

- Drivers: Versatility for families and couples, balanced living and driving features, relatively lower cost of entry, appeal to first-time buyers.

- Market Share: Currently the largest segment by sales volume within the Asia-Pacific motorhome market.

- Growth Potential: Expected to maintain its lead with continuous innovation in design and amenities.

Other countries like Australia and South Korea are also significant contributors, each with their own unique market dynamics and consumer preferences. Australia, with its vast landscapes and established caravanning culture, continues to be a strong market for motorhomes, particularly among direct buyers seeking adventure travel. South Korea, while smaller, shows promising growth driven by an increasing interest in glamping and unique travel experiences. The Direct Buyers end-user segment is currently driving a significant portion of the market's growth, reflecting a strong consumer desire for personal ownership and the freedom associated with motorhome travel. This segment is characterized by individuals and families investing in motorhomes for personal use, weekend getaways, and extended vacations.

Asia-Pacific Motor Home Market Product Landscape

The product landscape in the Asia-Pacific Motor Home Market is evolving rapidly, with manufacturers focusing on enhancing user experience and functionality. Innovations are centered around lightweight construction for improved fuel efficiency, integration of smart home technologies for remote monitoring and control, and the incorporation of sustainable materials. Advanced entertainment systems, ergonomic interior designs, and efficient power solutions, including solar panel integration, are becoming standard features. Performance metrics are being optimized for diverse terrains and climates found across the region, with a growing emphasis on durability and ease of maintenance. Unique selling propositions often revolve around modular designs for customization, compact yet feature-rich layouts, and enhanced safety features.

Key Drivers, Barriers & Challenges in Asia-Pacific Motor Home Market

The Asia-Pacific Motor Home Market is propelled by several key drivers including a growing middle class with increased disposable income, a rising trend in experiential travel and outdoor recreation, and government initiatives promoting tourism and RV infrastructure development. Technological advancements in vehicle design and manufacturing are also contributing significantly.

Conversely, key barriers and challenges include the relatively high initial cost of motorhome ownership compared to other travel options, limited availability of dedicated campgrounds and parking facilities in many areas, and varying regulatory frameworks and licensing requirements across different countries. Supply chain disruptions and the need for specialized maintenance and repair services also pose significant hurdles.

Emerging Opportunities in Asia-Pacific Motor Home Market

Emerging opportunities in the Asia-Pacific Motor Home Market lie in the development of more affordable and compact motorhome models tailored for urban dwellers and younger demographics. The growing demand for eco-friendly and sustainable travel solutions presents a significant avenue for innovation in electric and hybrid motorhomes. Furthermore, the untapped potential in Southeast Asian countries and the expansion of the glamping and adventure tourism sectors offer considerable growth prospects. Innovative business models, such as subscription-based motorhome services and curated travel experiences, are also gaining traction.

Growth Accelerators in the Asia-Pacific Motor Home Market Industry

Long-term growth in the Asia-Pacific Motor Home Market will be accelerated by continued technological breakthroughs in battery technology for electric RVs, advancements in lightweight and durable materials, and the widespread adoption of smart connectivity features. Strategic partnerships between motorhome manufacturers, technology providers, and tourism operators will foster ecosystem development. Market expansion into emerging economies with developing tourism sectors, coupled with sustained government investment in RV infrastructure, will further propel growth. The increasing awareness and acceptance of motorhome travel as a legitimate and desirable lifestyle choice will also be a significant growth accelerator.

Key Players Shaping the Asia-Pacific Motor Home Market Market

- Zhongyu Automobile

- ShanDong Dream Trip RV Co Ltd

- Kalapuraparambil Automobiles

- Great Wall Motor Co Ltd

- Thor Industries Inc

- JCBL PLA Motorhome

- Baoding Zhongjin Braun RV Manufacturing Co Ltd

- SAIC Motor

- Zhongtian Gaoke Special Vehicle Co Ltd

Notable Milestones in Asia-Pacific Motor Home Market Sector

- 2020: Increased demand for personal travel and outdoor recreation due to global pandemic, leading to a surge in interest for motorhomes.

- 2021: Significant investments in smart technology integration and sustainable manufacturing practices by leading manufacturers.

- 2022: Expansion of RV rental services in key tourist destinations across Southeast Asia.

- 2023: Introduction of more compact and urban-friendly motorhome models to cater to younger demographics.

- 2024: Growing focus on electric and hybrid motorhome development and pre-orders in major markets like China.

In-Depth Asia-Pacific Motor Home Market Market Outlook

The future of the Asia-Pacific Motor Home Market is exceptionally promising, driven by a potent combination of evolving consumer aspirations and technological advancements. Growth accelerators such as the increasing adoption of electric and hybrid powertrains, further integration of IoT and AI for enhanced user experience, and the expansion of RV infrastructure will continue to shape the market. Strategic collaborations and the introduction of innovative ownership models, including shared ownership and subscription services, will democratize access and broaden the market's appeal. The continued focus on sustainability and eco-friendly travel solutions will unlock new opportunities for manufacturers who can effectively cater to this growing demand. The Asia-Pacific region's immense potential, fueled by economic growth and a burgeoning middle class eager for unique travel experiences, positions this market for sustained and significant expansion in the coming decade.

Asia-Pacific Motor Home Market Segmentation

-

1. Type

- 1.1. Class A

- 1.2. Class B

- 1.3. Class C

-

2. End User

- 2.1. Fleet Owners

- 2.2. Direct Buyers

Asia-Pacific Motor Home Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Motor Home Market Regional Market Share

Geographic Coverage of Asia-Pacific Motor Home Market

Asia-Pacific Motor Home Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Worldwide Supporting Education Infrastructure are Propelling Growth

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Compliance Standards Related to Emissions and Safety Present Hurdles

- 3.4. Market Trends

- 3.4.1. Used motorhome sales is anticipated to hinder the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Motor Home Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Class A

- 5.1.2. Class B

- 5.1.3. Class C

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Fleet Owners

- 5.2.2. Direct Buyers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zhongyu Automobile

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ShanDong Dream Trip RV Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kalapuraparambil Automobiles

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Great Wall Motor Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thor Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JCBL PLA Motorhome

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Baoding Zhongjin Braun RV Manufacturing Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAIC Motor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zhongtian Gaoke Special Vehicle Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Zhongyu Automobile

List of Figures

- Figure 1: Asia-Pacific Motor Home Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Motor Home Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Motor Home Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Motor Home Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Asia-Pacific Motor Home Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Motor Home Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Asia-Pacific Motor Home Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Asia-Pacific Motor Home Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Motor Home Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Motor Home Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Asia-Pacific Motor Home Market?

Key companies in the market include Zhongyu Automobile, ShanDong Dream Trip RV Co Ltd, Kalapuraparambil Automobiles, Great Wall Motor Co Ltd, Thor Industries Inc, JCBL PLA Motorhome, Baoding Zhongjin Braun RV Manufacturing Co Ltd, SAIC Motor, Zhongtian Gaoke Special Vehicle Co Ltd.

3. What are the main segments of the Asia-Pacific Motor Home Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Worldwide Supporting Education Infrastructure are Propelling Growth.

6. What are the notable trends driving market growth?

Used motorhome sales is anticipated to hinder the market growth.

7. Are there any restraints impacting market growth?

Stringent Regulatory Compliance Standards Related to Emissions and Safety Present Hurdles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Motor Home Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Motor Home Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Motor Home Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Motor Home Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence