Key Insights

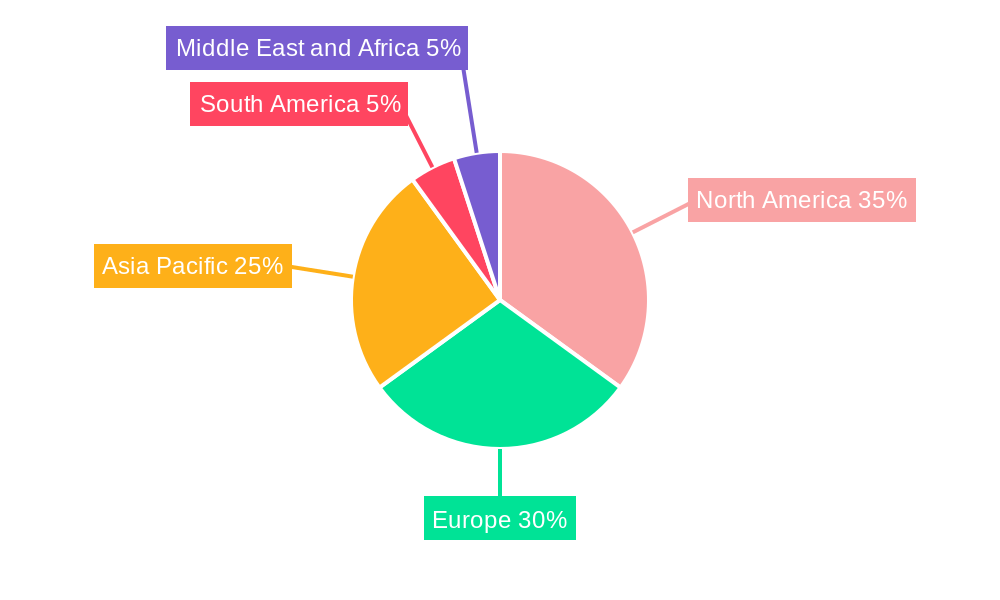

The Global Automotive Blockchain Market is projected for substantial growth, driven by enhanced supply chain transparency, secure vehicle data management, streamlined financial and insurance processes, and the rise of decentralized mobility. Key applications include Manufacturing, Supply Chain, Insurance, and Financial Transactions, serving diverse end-users from OEMs to MaaS providers. The market will witness adoption across Public, Private, and Hybrid blockchain models to meet varied industry demands. North America is anticipated to lead, supported by technological adoption and digital infrastructure. Europe offers significant opportunities due to automotive advancements and regulatory support. The Asia Pacific region, particularly China and India, is poised to be a major growth engine with its expanding automotive sector and innovation focus. Challenges such as integration complexity and regulatory uncertainties are present, but blockchain's inherent advantages in security, efficiency, and transparency are expected to drive market dominance.

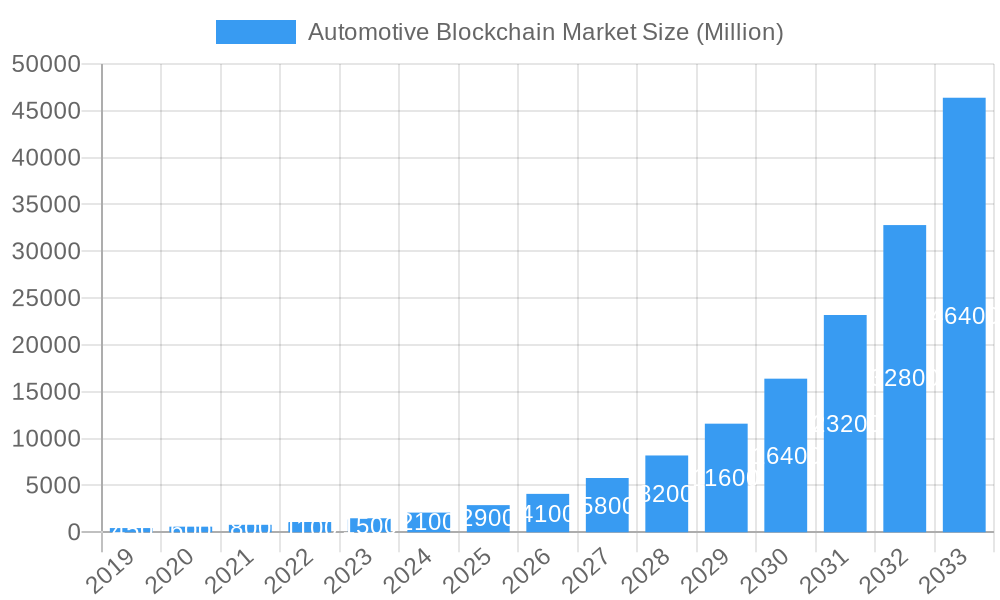

Automotive Blockchain Market Market Size (In Million)

This report offers an in-depth analysis of the Automotive Blockchain Market, detailing its evolution, growth trends, and competitive landscape. It provides critical insights for stakeholders in connected vehicles, transparent supply chains, and secure financial transactions. The analysis encompasses parent and child markets, offering a holistic view of opportunities and challenges. The forecast period extends to 2033, with a base year of 2025. Historical data from 2019–2024 informs projections. The estimated market size is 380 million units, with a projected compound annual growth rate (CAGR) of 29% from 2025 to 2033.

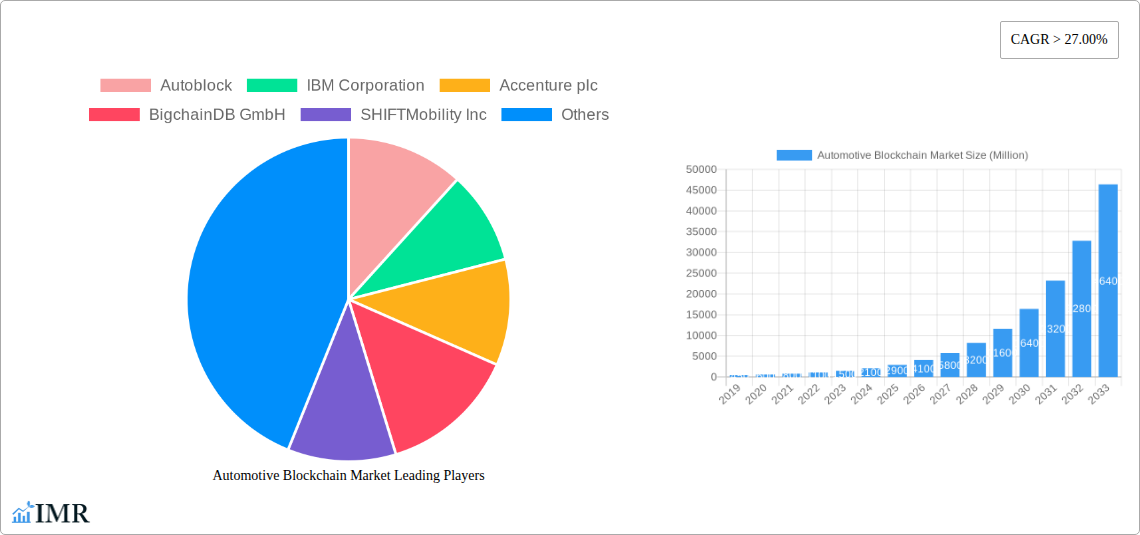

Automotive Blockchain Market Company Market Share

Automotive Blockchain Market Market Dynamics & Structure

The Automotive Blockchain Market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting end-user demands. Market concentration is currently moderate, with a growing number of technology providers and automotive giants actively investing in blockchain solutions. Key drivers include the escalating need for enhanced supply chain transparency, robust data security for connected vehicles, and streamlined financial transactions. Competitive product substitutes, though nascent, are emerging in areas like centralized databases and existing secure communication protocols, but blockchain offers a distinct advantage in decentralization and immutability. End-user demographics are broadening, encompassing not only OEMs and vehicle owners but also Mobility as a Service (MaaS) providers and insurance companies. Mergers and acquisitions (M&A) are anticipated to play a significant role in market consolidation, as larger players seek to acquire specialized blockchain expertise and innovative solutions.

- Technological Innovation Drivers: Increased demand for secure vehicle data management, counterfeit part prevention, transparent recalls, and efficient payment systems.

- Regulatory Frameworks: Evolving regulations around data privacy, cybersecurity, and the adoption of distributed ledger technology are shaping market entry and operational strategies.

- End-User Demographics: Growing adoption by OEMs for manufacturing and supply chain optimization, vehicle owners for digital identity and service history, and MaaS providers for ride-sharing and fleet management.

- M&A Trends: Strategic acquisitions of blockchain startups by established automotive and technology firms to accelerate innovation and market penetration.

Automotive Blockchain Market Growth Trends & Insights

The Automotive Blockchain Market is projected to experience robust growth, fueled by the intrinsic benefits of blockchain technology in addressing critical industry pain points. The market size is expected to witness a significant upward trajectory as adoption rates for blockchain-based solutions accelerate across various automotive applications. Technological disruptions, such as the integration of AI with blockchain for predictive maintenance and the development of more scalable and energy-efficient blockchain protocols, are poised to further stimulate growth. Consumer behavior shifts, particularly the increasing demand for data privacy and verifiable service histories, are creating fertile ground for blockchain-enabled solutions. The automotive supply chain blockchain segment is a primary growth engine, promising unprecedented visibility and traceability for parts and components from manufacturing to assembly. Furthermore, the automotive insurance blockchain is set to revolutionize claims processing and fraud detection, leading to greater efficiency and reduced costs. The broader automotive industry blockchain ecosystem benefits from these specialized applications, driving overall market penetration and value creation. The projected Compound Annual Growth Rate (CAGR) is expected to be substantial, indicating a strong future for blockchain integration in the automotive sector.

Dominant Regions, Countries, or Segments in Automotive Blockchain Market

The Automotive Blockchain Market is witnessing dominance across several key segments and regions, driven by technological adoption, regulatory support, and industrial demand. In terms of Application, the Supplychain segment is emerging as the most dominant, due to the critical need for enhanced traceability, counterfeit prevention, and optimized logistics within the complex automotive manufacturing ecosystem. The Manufacturing application also holds significant sway, with blockchain enabling secure and transparent production processes, component tracking, and quality control.

Geographically, North America and Europe are leading the charge in adopting Automotive Blockchain solutions. These regions benefit from established automotive industries, strong R&D investments, and supportive government initiatives promoting digital transformation.

Within End Users, OEMs are the primary drivers of adoption, leveraging blockchain to streamline their operations, enhance supply chain resilience, and improve vehicle lifecycle management.

The Type of blockchain seeing the most traction currently is Hybrid Blockchain, offering a balance between the transparency of public blockchains and the privacy and control of private blockchains, making it ideal for enterprise-level automotive applications.

- Key Drivers (Supplychain Application):

- Demand for end-to-end traceability of automotive parts.

- Mitigation of counterfeit parts and component fraud.

- Streamlined recall management and compliance.

- Improved efficiency in logistics and inventory management.

- Dominance Factors (North America & Europe):

- Presence of major automotive manufacturers and technology hubs.

- Proactive regulatory frameworks for digital technologies.

- Significant investment in R&D for automotive innovation.

- High consumer awareness and demand for secure vehicle data.

- Growth Potential (OEMs as End Users):

- Potential for substantial cost savings through process optimization.

- Enhanced brand reputation through increased transparency.

- Development of new service models and revenue streams.

Automotive Blockchain Market Product Landscape

The Automotive Blockchain Market product landscape is characterized by innovative solutions focused on enhancing security, transparency, and efficiency across the automotive value chain. Key product developments include decentralized platforms for managing vehicle identity, digital service records, and ownership transfer. Companies are offering blockchain-based solutions for supply chain traceability, enabling real-time tracking of parts and materials from origin to assembly, thus combating counterfeiting and ensuring quality. Furthermore, innovative applications in Automotive Insurance are emerging, leveraging blockchain for streamlined claims processing and fraud prevention. Performance metrics for these products often emphasize immutability, tamper-proof data recording, enhanced transaction speed, and reduced operational costs. Unique selling propositions revolve around the inherent security and decentralized nature of blockchain, providing a trusted ledger for all automotive-related data.

Key Drivers, Barriers & Challenges in Automotive Blockchain Market

The Automotive Blockchain Market is propelled by several key drivers. The escalating demand for enhanced supply chain transparency and traceability in the automotive industry is a primary force, aiming to combat counterfeiting and improve recall efficiency. The need for secure vehicle data management, including driver profiles, service history, and connectivity, is also a significant driver, especially with the rise of connected and autonomous vehicles. Streamlined financial transactions, such as secure payments for parts, services, and vehicle purchases, are further accelerating adoption.

- Key Drivers:

- Need for supply chain transparency and counterfeit prevention.

- Enhanced data security for connected vehicles.

- Efficient and secure financial transaction processing.

- Improved vehicle lifecycle management and traceability.

However, the market faces substantial barriers and challenges. The lack of standardization across blockchain platforms and protocols can hinder interoperability and widespread adoption. Scalability issues with existing blockchain technologies can limit their effectiveness for high-volume automotive transactions. Regulatory uncertainty and the evolving legal landscape surrounding blockchain and data privacy present significant hurdles. Furthermore, the high initial implementation costs and the need for skilled blockchain expertise can be prohibitive for some automotive players.

- Key Barriers & Challenges:

- Lack of industry-wide blockchain standards and interoperability.

- Scalability limitations for high-frequency transactions.

- Evolving and uncertain regulatory frameworks.

- High initial investment costs and complexity of integration.

- Need for specialized blockchain development talent.

Emerging Opportunities in Automotive Blockchain Market

Emerging opportunities in the Automotive Blockchain Market are vast and varied. The development of decentralized identity solutions for vehicles and drivers promises to revolutionize car ownership and access. The application of blockchain in managing vehicle-to-everything (V2X) communication data offers new avenues for smart city integration and traffic management. Furthermore, the potential for tokenization of automotive assets, such as fractional ownership of vehicles or usage rights, opens up new financial models and investment opportunities. The integration of blockchain with emerging technologies like the Internet of Things (IoT) for real-time vehicle diagnostics and predictive maintenance also presents a significant growth avenue.

Growth Accelerators in the Automotive Blockchain Market Industry

Several catalysts are accelerating the growth of the Automotive Blockchain Market. Technological breakthroughs, such as the development of more scalable and energy-efficient consensus mechanisms and Layer-2 solutions, are addressing previous limitations. Strategic partnerships between automotive OEMs, technology providers, and blockchain companies are crucial, fostering collaboration and driving innovation. Market expansion strategies, including pilot programs and consortium initiatives, are paving the way for broader industry adoption. The increasing focus on sustainability and ethical sourcing within automotive supply chains also presents an opportunity for blockchain to enhance transparency and accountability.

Key Players Shaping the Automotive Blockchain Market Market

- Autoblock

- IBM Corporation

- Accenture plc

- BigchainDB GmbH

- SHIFTMobility Inc

- Microsoft Corporation

- GEM

- Axt

- Tech Mahindra Limited

- Loyyal Corporation

- carVertical

Notable Milestones in Automotive Blockchain Market Sector

- April 2021: Tech Mahindra Ltd entered into an agreement with Quantoz to launch 'Stablecoin-As-A-Service' blockchain solutions, aiming to enhance financial transaction security and efficiency within various industries, including automotive.

- October 2020: Skoda Auto DigiLab partnered with Lumos Labs and Microsoft to identify blockchain solutions in manufacturing. This collaboration focuses on leveraging development expertise to pinpoint problem statements for startups developing innovative blockchain-based solutions for the automotive sector.

In-Depth Automotive Blockchain Market Market Outlook

The future outlook for the Automotive Blockchain Market is exceptionally promising, driven by a confluence of technological advancements and strategic industry initiatives. Growth accelerators, such as the ongoing development of more robust and scalable blockchain protocols and the increasing number of successful pilot projects, are steadily building momentum. Strategic partnerships between leading automotive manufacturers and technology giants are crucial in fostering an ecosystem that supports widespread adoption. The market is poised for significant expansion as blockchain solutions mature, offering unparalleled benefits in supply chain integrity, data security, and financial transaction efficiency, ultimately revolutionizing the automotive industry's operational landscape and customer experience.

Automotive Blockchain Market Segmentation

-

1. Application

- 1.1. Manufacturing

- 1.2. Supplychain

- 1.3. Insurance

- 1.4. Financial Transactions

- 1.5. Others

-

2. End Users

- 2.1. OEMs

- 2.2. Vehicle Owners

- 2.3. Mobility as a Service Provider

- 2.4. Others

-

3. Type

- 3.1. Public Blockchain

- 3.2. Private Blockchain

- 3.3. Hybrid Blockchain

Automotive Blockchain Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Automotive Blockchain Market Regional Market Share

Geographic Coverage of Automotive Blockchain Market

Automotive Blockchain Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Emission Regulations are Fueling the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Commercial Vehicle May Hamper the Growth

- 3.4. Market Trends

- 3.4.1. The vehicle manufacturing will see the largest use of blockchain technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Manufacturing

- 5.1.2. Supplychain

- 5.1.3. Insurance

- 5.1.4. Financial Transactions

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. OEMs

- 5.2.2. Vehicle Owners

- 5.2.3. Mobility as a Service Provider

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Public Blockchain

- 5.3.2. Private Blockchain

- 5.3.3. Hybrid Blockchain

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Manufacturing

- 6.1.2. Supplychain

- 6.1.3. Insurance

- 6.1.4. Financial Transactions

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End Users

- 6.2.1. OEMs

- 6.2.2. Vehicle Owners

- 6.2.3. Mobility as a Service Provider

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Public Blockchain

- 6.3.2. Private Blockchain

- 6.3.3. Hybrid Blockchain

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Manufacturing

- 7.1.2. Supplychain

- 7.1.3. Insurance

- 7.1.4. Financial Transactions

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End Users

- 7.2.1. OEMs

- 7.2.2. Vehicle Owners

- 7.2.3. Mobility as a Service Provider

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Public Blockchain

- 7.3.2. Private Blockchain

- 7.3.3. Hybrid Blockchain

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Manufacturing

- 8.1.2. Supplychain

- 8.1.3. Insurance

- 8.1.4. Financial Transactions

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End Users

- 8.2.1. OEMs

- 8.2.2. Vehicle Owners

- 8.2.3. Mobility as a Service Provider

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Public Blockchain

- 8.3.2. Private Blockchain

- 8.3.3. Hybrid Blockchain

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Manufacturing

- 9.1.2. Supplychain

- 9.1.3. Insurance

- 9.1.4. Financial Transactions

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End Users

- 9.2.1. OEMs

- 9.2.2. Vehicle Owners

- 9.2.3. Mobility as a Service Provider

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Public Blockchain

- 9.3.2. Private Blockchain

- 9.3.3. Hybrid Blockchain

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Manufacturing

- 10.1.2. Supplychain

- 10.1.3. Insurance

- 10.1.4. Financial Transactions

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End Users

- 10.2.1. OEMs

- 10.2.2. Vehicle Owners

- 10.2.3. Mobility as a Service Provider

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Public Blockchain

- 10.3.2. Private Blockchain

- 10.3.3. Hybrid Blockchain

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Autoblock

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Accenture plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BigchainDB GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SHIFTMobility Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GEM

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Axt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tech Mahindra Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Loyyal Corporatio

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 carVertical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Autoblock

List of Figures

- Figure 1: Global Automotive Blockchain Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Blockchain Market Revenue (million), by Application 2025 & 2033

- Figure 3: North America Automotive Blockchain Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Automotive Blockchain Market Revenue (million), by End Users 2025 & 2033

- Figure 5: North America Automotive Blockchain Market Revenue Share (%), by End Users 2025 & 2033

- Figure 6: North America Automotive Blockchain Market Revenue (million), by Type 2025 & 2033

- Figure 7: North America Automotive Blockchain Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Automotive Blockchain Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Automotive Blockchain Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Blockchain Market Revenue (million), by Application 2025 & 2033

- Figure 11: Europe Automotive Blockchain Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Automotive Blockchain Market Revenue (million), by End Users 2025 & 2033

- Figure 13: Europe Automotive Blockchain Market Revenue Share (%), by End Users 2025 & 2033

- Figure 14: Europe Automotive Blockchain Market Revenue (million), by Type 2025 & 2033

- Figure 15: Europe Automotive Blockchain Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Automotive Blockchain Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Automotive Blockchain Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Blockchain Market Revenue (million), by Application 2025 & 2033

- Figure 19: Asia Pacific Automotive Blockchain Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Automotive Blockchain Market Revenue (million), by End Users 2025 & 2033

- Figure 21: Asia Pacific Automotive Blockchain Market Revenue Share (%), by End Users 2025 & 2033

- Figure 22: Asia Pacific Automotive Blockchain Market Revenue (million), by Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Blockchain Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Blockchain Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Blockchain Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Automotive Blockchain Market Revenue (million), by Application 2025 & 2033

- Figure 27: South America Automotive Blockchain Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: South America Automotive Blockchain Market Revenue (million), by End Users 2025 & 2033

- Figure 29: South America Automotive Blockchain Market Revenue Share (%), by End Users 2025 & 2033

- Figure 30: South America Automotive Blockchain Market Revenue (million), by Type 2025 & 2033

- Figure 31: South America Automotive Blockchain Market Revenue Share (%), by Type 2025 & 2033

- Figure 32: South America Automotive Blockchain Market Revenue (million), by Country 2025 & 2033

- Figure 33: South America Automotive Blockchain Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Automotive Blockchain Market Revenue (million), by Application 2025 & 2033

- Figure 35: Middle East and Africa Automotive Blockchain Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East and Africa Automotive Blockchain Market Revenue (million), by End Users 2025 & 2033

- Figure 37: Middle East and Africa Automotive Blockchain Market Revenue Share (%), by End Users 2025 & 2033

- Figure 38: Middle East and Africa Automotive Blockchain Market Revenue (million), by Type 2025 & 2033

- Figure 39: Middle East and Africa Automotive Blockchain Market Revenue Share (%), by Type 2025 & 2033

- Figure 40: Middle East and Africa Automotive Blockchain Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Automotive Blockchain Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 3: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: Global Automotive Blockchain Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 7: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Global Automotive Blockchain Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 13: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 14: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 15: Global Automotive Blockchain Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 22: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 23: Global Automotive Blockchain Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: India Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: China Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Japan Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 30: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 31: Global Automotive Blockchain Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Brazil Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 36: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 37: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 38: Global Automotive Blockchain Market Revenue million Forecast, by Country 2020 & 2033

- Table 39: UAE Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Saudi Arabia Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East and Africa Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Blockchain Market?

The projected CAGR is approximately 29%.

2. Which companies are prominent players in the Automotive Blockchain Market?

Key companies in the market include Autoblock, IBM Corporation, Accenture plc, BigchainDB GmbH, SHIFTMobility Inc, Microsoft Corporation, GEM, Axt, Tech Mahindra Limited, Loyyal Corporatio, carVertical.

3. What are the main segments of the Automotive Blockchain Market?

The market segments include Application, End Users, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 380 million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Emission Regulations are Fueling the Market Growth.

6. What are the notable trends driving market growth?

The vehicle manufacturing will see the largest use of blockchain technology.

7. Are there any restraints impacting market growth?

High Cost of Electric Commercial Vehicle May Hamper the Growth.

8. Can you provide examples of recent developments in the market?

In April 2021, Tech Mahindra Ltd has entered into an agreement with the Netherlands-based Blockchain technology application incubator Quantoz to launch 'Stablecoin-As-A-Service' blockchain solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Blockchain Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Blockchain Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Blockchain Market?

To stay informed about further developments, trends, and reports in the Automotive Blockchain Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence