Key Insights

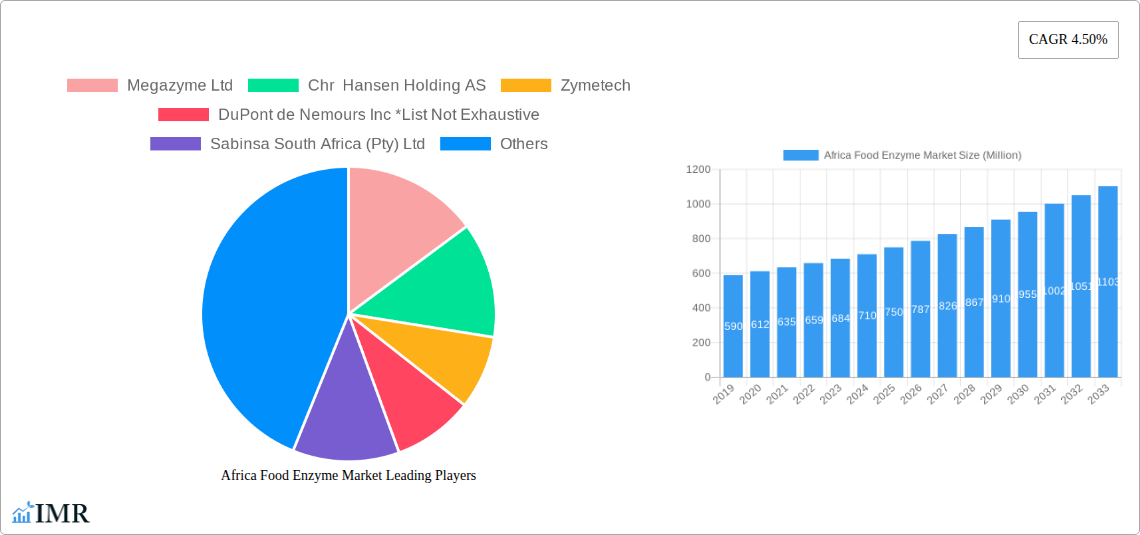

The Africa Food Enzyme Market is projected for significant expansion, expected to reach approximately USD 2.98 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This growth is primarily driven by escalating demand for processed foods and beverages across the continent, attributed to a growing middle class with increased disposable income and rapid urbanization. Key drivers include a rising consumer preference for natural and clean-label ingredients, fostering the adoption of food enzymes as alternatives to synthetic additives. Technological advancements in enzyme efficiency and specificity are further accelerating their utilization across diverse food applications. The expanding food processing industry, complemented by governmental efforts to enhance domestic food production and food security, also significantly contributes to market growth.

Africa Food Enzyme Market Market Size (In Billion)

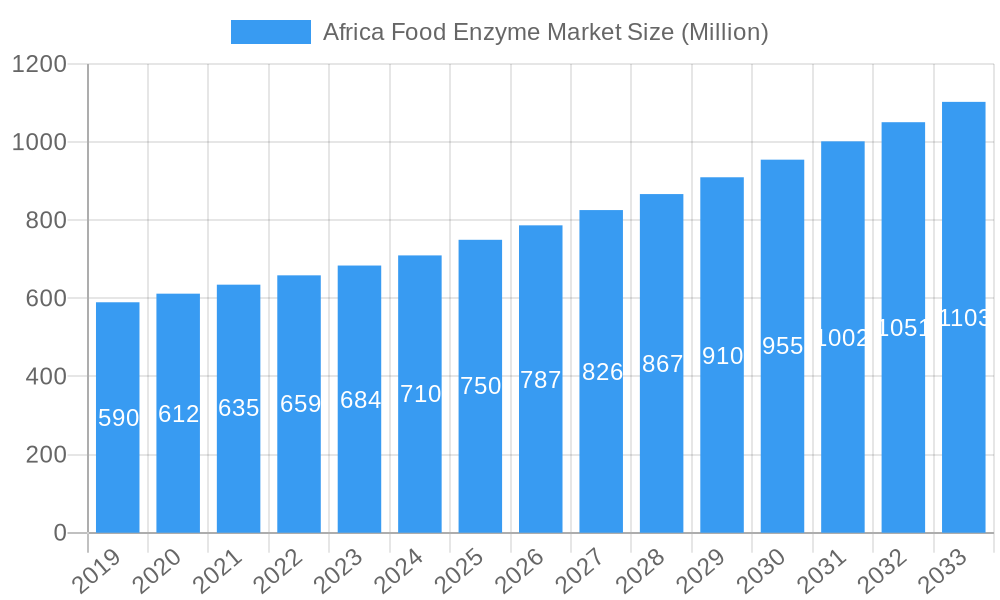

Market segmentation by enzyme type indicates that Carbohydrases are expected to lead due to their widespread use in baking, brewing, and fruit juice processing. Proteases and Lipases are also anticipated to experience steady growth, driven by their applications in meat tenderization, dairy processing, and flavor enhancement. By application, the Bakery segment is forecast to dominate, followed by Dairy and Frozen Desserts and Meat, Poultry, and Seafood Products, reflecting evolving dietary habits and increased consumption of these categories. Leading market players, including Megazyme Ltd, Chr Hansen Holding AS, and DuPont de Nemours Inc, are actively investing in research and development and expanding distribution networks. Significant market potential is observed in African nations such as Nigeria, South Africa, and Egypt, owing to their large populations and developing food industries.

Africa Food Enzyme Market Company Market Share

This report offers a comprehensive analysis of the Africa Food Enzyme Market, a dynamic sector influenced by increasing demand for processed foods, biotechnological advancements, and a growing emphasis on sustainable food production. The study examines the broader Global Food Enzymes market and the specific African Food Enzymes segment, providing a holistic perspective on market trends, growth drivers, and competitive dynamics. The analysis covers the period from 2019 to 2033, with 2025 serving as the base year.

Africa Food Enzyme Market Market Dynamics & Structure

The Africa Food Enzyme Market is characterized by a moderately concentrated landscape, with key players investing heavily in research and development to enhance enzyme efficacy and expand application areas. Technological innovation, particularly in enzyme immobilization and genetic engineering, is a significant driver, enabling the development of more stable and cost-effective enzymes. Regulatory frameworks are evolving across the continent, aiming to ensure food safety and quality, which indirectly influences the adoption of advanced enzyme technologies. Competitive product substitutes, such as chemical additives, exist, but the inherent benefits of enzymes, including their specificity, mild processing conditions, and environmental friendliness, are increasingly favored by manufacturers. End-user demographics are shifting towards younger, urbanized populations with a greater demand for convenient and processed food products. Mergers and acquisitions (M&A) activity, while not as prevalent as in mature markets, is a growing trend as larger companies seek to expand their African footprint and acquire specialized enzyme technologies.

- Market Concentration: Moderately concentrated, with a few dominant global players and a growing number of regional and specialized manufacturers.

- Technological Innovation Drivers: Enzyme immobilization techniques, genetic modification for enhanced yield and specificity, and development of enzymes for novel food applications.

- Regulatory Frameworks: Emerging and strengthening, focusing on food safety standards, GRAS (Generally Recognized As Safe) status for enzymes, and labeling requirements.

- Competitive Product Substitutes: Chemical additives for texture enhancement, preservation, and flavor modification; however, enzyme benefits are increasingly recognized.

- End-User Demographics: Growing middle class, urbanization, and a younger population driving demand for convenience foods and beverages.

- M&A Trends: Increasing interest from international companies in acquiring African enzyme producers or establishing local partnerships to gain market access.

Africa Food Enzyme Market Growth Trends & Insights

The Africa Food Enzyme Market is poised for substantial growth, driven by a confluence of economic, demographic, and technological factors. The overall global food enzyme market provides a strong foundation, with advancements and increasing adoption in developed regions often influencing emerging markets like Africa. Within Africa, the food enzyme market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This expansion is fueled by the rising demand for processed and convenience foods, which rely heavily on enzymes for improved texture, shelf-life, and flavor profiles. For instance, the bakery sector, a significant consumer of amylases and proteases, is experiencing rapid growth due to increased urbanization and changing dietary habits. Similarly, the dairy and frozen desserts segment is adopting lactase and protease enzymes to produce lactose-free products and enhance texture. Technological disruptions, such as the development of highly specific and thermotolerant enzymes, are making them more viable for the diverse processing conditions found across African food industries. Consumer behavior shifts, including a growing preference for healthier and more natural ingredients, further favor the use of food enzymes over artificial additives. The market penetration of food enzymes in Africa, while still lower than in developed regions, is steadily increasing as awareness of their benefits and cost-effectiveness grows. The base year market size is estimated at $850 Million in 2025.

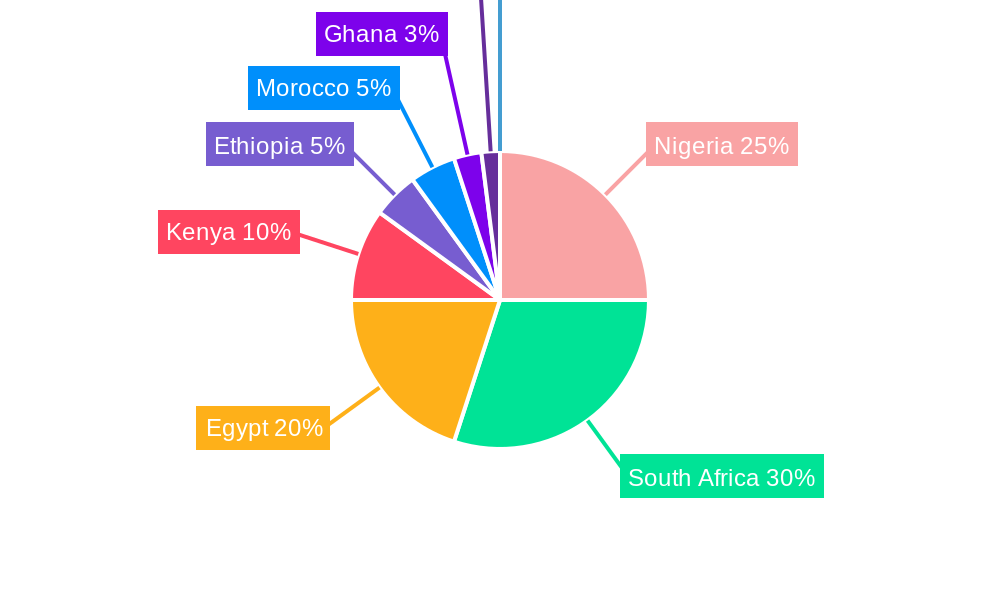

Dominant Regions, Countries, or Segments in Africa Food Enzyme Market

Within the Africa Food Enzyme Market, South Africa stands out as the dominant country, driving significant demand due to its well-established food processing industry, advanced infrastructure, and higher adoption rates of modern technologies. The Carbohydrase segment, particularly amylases, is a leading type of enzyme fueling this growth. These enzymes are indispensable in the baking industry for improving dough handling, crumb structure, and bread volume, a critical factor given the large consumer base for bread products. South Africa's significant dairy production and consumption also bolster the demand for lactases, contributing to the overall dominance of carbohydrases.

Beyond South Africa, Nigeria and Egypt are emerging as key growth markets, supported by their large populations and expanding food processing sectors. In Nigeria, the increasing demand for bakery products and beverages is driving the adoption of various enzyme types. Egypt's robust confectionery and dairy industries also present substantial opportunities.

The Bakery application segment is a primary growth engine across the continent. Enzymes in bakery products improve dough extensibility, reduce mixing times, enhance crust browning, and extend shelf life, all crucial for large-scale commercial baking operations prevalent in Africa. Following closely are the Dairy and Frozen Desserts and Beverages application segments, which are increasingly leveraging enzymes for product innovation and efficiency.

- Dominant Country: South Africa, owing to its advanced food processing infrastructure and consumer demand for processed foods.

- Key Application Segment: Bakery, driven by the widespread consumption of bread and baked goods.

- Leading Enzyme Type: Carbohydrase (especially amylases), essential for bakery and dairy applications.

- Emerging Growth Markets: Nigeria and Egypt, with their large populations and expanding food industries.

- Growth Drivers in Dominant Segments:

- Bakery: Increased demand for processed baked goods, desire for improved texture and shelf-life, and cost-effectiveness of enzymes.

- Dairy: Production of lactose-free products, enhanced texture in yogurts and ice creams, and improved cheese ripening.

- Beverages: Clarification of juices, improved fermentation efficiency in brewing, and stabilization of fruit-based drinks.

Africa Food Enzyme Market Product Landscape

The Africa Food Enzyme Market product landscape is characterized by an increasing availability of specialized enzymes tailored for specific African food processing needs. Innovations are focused on enhancing enzyme stability under variable temperature and pH conditions, crucial for diverse processing environments across the continent. Key product developments include highly active amylases for improved baking performance, proteases for meat tenderization and dairy applications, and lipases for flavor development in confectionery and dairy products. Unique selling propositions for many enzyme products revolve around their ability to improve yield, reduce processing times, and lower energy consumption. Technological advancements in enzyme production, such as submerged fermentation and the development of recombinant enzymes, are leading to more cost-effective and environmentally friendly enzyme solutions. The market is seeing a rise in enzyme blends designed for synergistic effects in complex food systems.

Key Drivers, Barriers & Challenges in Africa Food Enzyme Market

Key Drivers:

- Growing Demand for Processed & Convenience Foods: Urbanization and changing lifestyles are increasing the consumption of ready-to-eat meals, snacks, and beverages, all of which benefit from enzyme technology.

- Technological Advancements: Improved enzyme efficacy, stability, and specificity, driven by R&D, make them more attractive for diverse applications.

- Focus on Food Safety and Quality: Enzymes offer a natural and effective way to enhance food safety, texture, and nutritional value, aligning with evolving consumer expectations.

- Cost-Effectiveness and Efficiency: Enzymes can reduce processing times, energy consumption, and raw material wastage, leading to significant cost savings for food manufacturers.

- Clean Labeling Trend: Consumers increasingly prefer natural ingredients, making enzymes a preferred alternative to artificial additives.

Barriers & Challenges:

- Limited Awareness and Technical Expertise: Many smaller food manufacturers in Africa may lack awareness of the full potential of enzymes or possess the technical expertise for optimal application.

- High Initial Investment Costs: While enzymes can lead to long-term savings, the initial procurement and integration costs can be a barrier for some businesses.

- Supply Chain and Logistics: Inefficient supply chains and logistical challenges in some regions can impact the availability and timely delivery of enzyme products.

- Regulatory Hurdles: Inconsistent and evolving regulatory frameworks across different African countries can create complexities for enzyme suppliers and users.

- Competition from Chemical Additives: Established use and lower perceived cost of chemical additives in some sectors pose a competitive challenge.

Emerging Opportunities in Africa Food Enzyme Market

Emerging opportunities in the Africa Food Enzyme Market lie in the untapped potential of under-served application areas and the growing demand for specialized enzymes. There is a significant opportunity in developing enzymes for the processing of indigenous African crops and ingredients, adding value and expanding their market reach. The burgeoning plant-based food sector across Africa presents a unique avenue for enzyme applications in creating novel textures and flavors. Furthermore, the increasing focus on waste reduction and valorization within the food industry opens doors for enzymes in byproduct utilization and the development of sustainable food systems. As consumer awareness of health and wellness grows, enzymes that enhance nutritional profiles or offer specific health benefits will also witness increasing demand. The expansion of e-commerce platforms for food ingredients also presents an opportunity to reach a wider customer base.

Growth Accelerators in the Africa Food Enzyme Market Industry

Several catalysts are accelerating the growth of the Africa Food Enzyme Market. Strategic partnerships between global enzyme manufacturers and local African food companies are crucial for knowledge transfer, market penetration, and customized product development. Government initiatives promoting food processing, value addition, and food safety standards are indirectly spurring enzyme adoption. Technological breakthroughs in enzyme engineering, leading to more robust and versatile enzymes, will further expand their applicability. The increasing investment in food processing infrastructure across the continent, from small-scale enterprises to large industrial facilities, creates a fertile ground for enzyme integration. Moreover, the rising trend of contract manufacturing for food products will drive the demand for standardized and efficient ingredient solutions, including enzymes.

Key Players Shaping the Africa Food Enzyme Market Market

- Megazyme Ltd

- Chr Hansen Holding AS

- Zymetech

- DuPont de Nemours Inc

- Sabinsa South Africa (Pty) Ltd

- AEB Africa (PTY) LTD

Notable Milestones in Africa Food Enzyme Market Sector

- 2021: Chr. Hansen Holding A/S expands its product portfolio for the African dairy industry, introducing new enzyme solutions for yogurt and cheese production.

- 2022: Megazyme Ltd launches a series of advanced enzyme testing kits specifically tailored for African food quality control laboratories.

- 2023: AEB Africa (PTY) LTD announces a significant investment in its local production capabilities to meet the growing demand for brewing enzymes in the East African region.

- 2023: DuPont de Nemours Inc. forms a strategic alliance with a leading Nigerian food manufacturer to develop enzymes for enhanced bread-making in the region.

- 2024: Sabinsa South Africa (Pty) Ltd introduces novel protease enzymes for the meat processing industry, focusing on improving tenderness and reducing processing costs.

In-Depth Africa Food Enzyme Market Market Outlook

The Africa Food Enzyme Market is projected to experience sustained and robust growth in the coming years, driven by fundamental shifts in food consumption patterns and ongoing technological advancements. The integration of enzymes into the core of food manufacturing processes will become increasingly commonplace, offering solutions for enhanced product quality, increased operational efficiency, and improved sustainability. Strategic collaborations, targeted R&D, and a keen understanding of local market needs will be pivotal for success. The market’s future outlook is bright, with significant opportunities for innovation and expansion, promising a substantial contribution to the continent's evolving food industry.

Africa Food Enzyme Market Segmentation

-

1. Type

- 1.1. Carbohydrase

- 1.2. Protease

- 1.3. Lipase

- 1.4. Others

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy and Frozen Desserts

- 2.4. Meat, Poultry and Sea Food Products

- 2.5. Beverages

- 2.6. Others

Africa Food Enzyme Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Food Enzyme Market Regional Market Share

Geographic Coverage of Africa Food Enzyme Market

Africa Food Enzyme Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. Acquisitive Demand of Carbohydrases in Food Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Food Enzyme Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbohydrase

- 5.1.2. Protease

- 5.1.3. Lipase

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy and Frozen Desserts

- 5.2.4. Meat, Poultry and Sea Food Products

- 5.2.5. Beverages

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Megazyme Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chr Hansen Holding AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zymetech

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DuPont de Nemours Inc *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sabinsa South Africa (Pty) Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AEB Africa (PTY) LTD

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Megazyme Ltd

List of Figures

- Figure 1: Africa Food Enzyme Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Food Enzyme Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Food Enzyme Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Africa Food Enzyme Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Africa Food Enzyme Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Africa Food Enzyme Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Africa Food Enzyme Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Africa Food Enzyme Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Nigeria Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: South Africa Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Egypt Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Kenya Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Ethiopia Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Morocco Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Ghana Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Algeria Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Tanzania Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Ivory Coast Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Food Enzyme Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Africa Food Enzyme Market?

Key companies in the market include Megazyme Ltd, Chr Hansen Holding AS, Zymetech, DuPont de Nemours Inc *List Not Exhaustive, Sabinsa South Africa (Pty) Ltd, AEB Africa (PTY) LTD.

3. What are the main segments of the Africa Food Enzyme Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

Acquisitive Demand of Carbohydrases in Food Industries.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Food Enzyme Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Food Enzyme Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Food Enzyme Market?

To stay informed about further developments, trends, and reports in the Africa Food Enzyme Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence