Key Insights

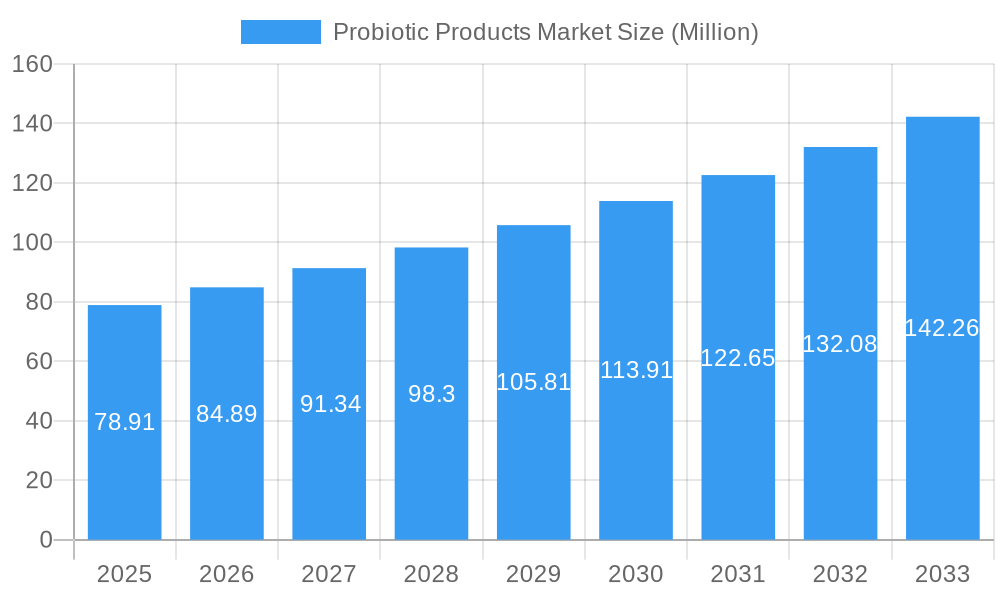

The global Probiotic Products Market is poised for significant expansion, currently valued at $78.91 Million and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 7.53%. This upward trajectory is primarily fueled by increasing consumer awareness regarding the health benefits associated with gut health and the microbiome. Probiotic-rich foods and supplements are gaining traction as consumers actively seek natural and functional ingredients to support their well-being, boost immunity, and improve digestive health. The growing demand for personalized nutrition and preventive healthcare further bolsters market growth. Key drivers include advancements in research and development leading to innovative probiotic strains, the rising prevalence of gastrointestinal disorders, and the increasing adoption of probiotics in animal feed to enhance livestock health and productivity. The market is also benefiting from the expanding distribution networks, including a strong surge in online retail, making these products more accessible to a wider consumer base.

Probiotic Products Market Market Size (In Million)

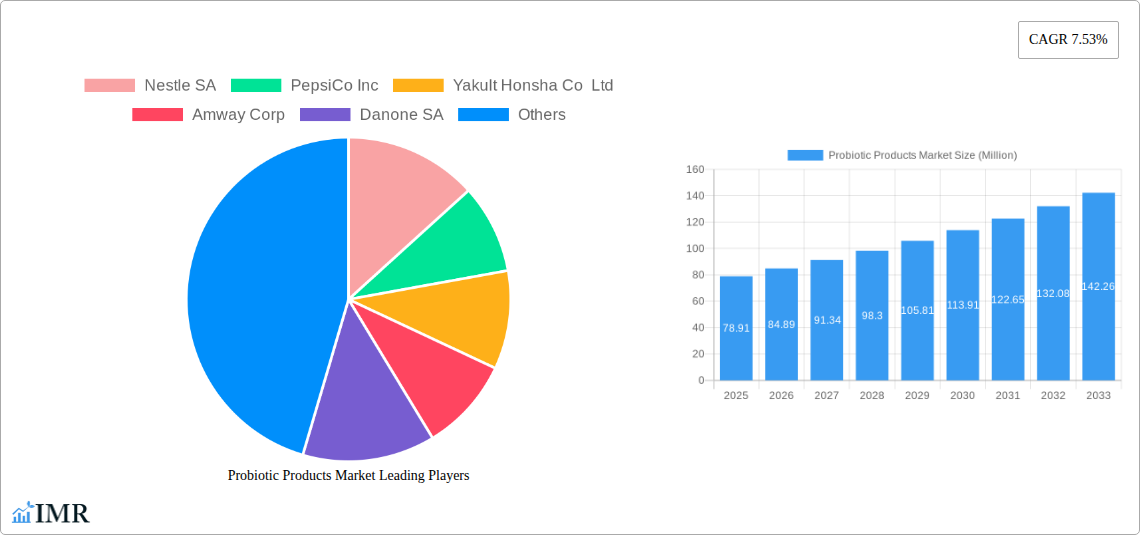

The market's dynamic nature is further shaped by distinct segmentation across product types and distribution channels. Probiotic Foods, encompassing yogurt, bakery/breakfast cereals, and baby food, represent a substantial segment, alongside Probiotic Drinks, both fruit-based and dairy-based, which are witnessing considerable consumer interest. Dietary supplements are another cornerstone of the market, catering to individuals seeking targeted probiotic intake. Animal feeds/foods are also a growing area, highlighting the comprehensive application of probiotics. Geographically, North America and Europe are leading the market, driven by high disposable incomes and a strong focus on health and wellness. However, the Asia Pacific region is emerging as a high-growth area, with increasing health consciousness and a burgeoning middle class. While the market exhibits strong growth potential, potential restraints could include regulatory hurdles in certain regions, the need for consumer education regarding effective probiotic use, and the potential for product commoditization, necessitating continuous innovation and differentiation by key players like Nestle SA, PepsiCo Inc., and Danone SA.

Probiotic Products Market Company Market Share

This comprehensive report offers an in-depth analysis of the global probiotic products market, encompassing a detailed examination of market dynamics, growth trends, regional dominance, product landscape, key drivers and barriers, emerging opportunities, growth accelerators, and the competitive environment. With a study period spanning 2019–2033, a base year of 2025, and a forecast period of 2025–2033, this report provides actionable insights for stakeholders seeking to navigate and capitalize on this rapidly expanding industry. Leveraging a robust methodology, we project the market size to reach $XX million units by 2033, driven by increasing consumer awareness of gut health, the growing demand for natural health solutions, and continuous product innovation.

Probiotic Products Market Market Dynamics & Structure

The probiotic products market is characterized by a moderately concentrated structure, with key players like Nestle SA, Danone SA, and PepsiCo Inc. holding significant market share. Technological innovation is a primary driver, focusing on novel strains, improved delivery mechanisms, and enhanced product efficacy. Regulatory frameworks, particularly concerning health claims and product labeling, play a crucial role in shaping market entry and competition. Competitive product substitutes include prebiotics, synbiotics, and other functional foods, necessitating continuous differentiation. End-user demographics are broad, with a growing segment of health-conscious millennials and an aging population seeking preventative health solutions. Mergers and acquisitions (M&A) trends indicate consolidation and strategic expansion, with an estimated XX M&A deals in the historical period (2019-2024).

- Market Concentration: Dominated by a few large multinational corporations alongside a growing number of niche and specialized manufacturers.

- Technological Innovation Drivers: Development of targeted probiotic strains, encapsulation technologies for enhanced survivability, and combination products with other bioactive ingredients.

- Regulatory Frameworks: Stringent regulations in regions like the EU and North America regarding permissible health claims and product safety standards.

- Competitive Product Substitutes: Increasing availability of prebiotic ingredients, fermented foods without declared probiotic benefits, and fortified food products.

- End-User Demographics: Growing interest from all age groups, with particular emphasis on millennials and Gen Z for preventative wellness and on the elderly for age-related health concerns.

- M&A Trends: Strategic acquisitions focused on expanding product portfolios, gaining access to new technologies, and entering emerging geographical markets.

Probiotic Products Market Growth Trends & Insights

The global probiotic products market is poised for robust expansion, fueled by a confluence of evolving consumer preferences and scientific advancements. The increasing global focus on preventative healthcare and the growing understanding of the gut microbiome's impact on overall well-being are major catalysts. This has translated into higher adoption rates for probiotic-fortified foods, beverages, and dietary supplements. Technological disruptions, such as the development of more resilient probiotic strains and innovative delivery systems, are further enhancing product efficacy and consumer appeal. Consumer behavior shifts towards natural and organic products, coupled with a demand for personalized nutrition, are creating significant opportunities for market players. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Market penetration is expected to rise from an estimated XX% in the base year to XX% by the end of the forecast period.

- Market Size Evolution: The market has demonstrated consistent growth, driven by increased product availability and consumer education regarding the benefits of probiotics.

- Adoption Rates: Escalating adoption across various age groups and lifestyle segments, with a noticeable surge in functional food and beverage categories.

- Technological Disruptions: Advancements in strain identification, fermentation techniques, and shelf-life extension technologies are improving the quality and accessibility of probiotic products.

- Consumer Behavior Shifts: A pronounced shift towards proactive health management, a preference for plant-based and natural ingredients, and a growing interest in personalized dietary recommendations.

- Market Penetration: Increasing penetration into mainstream food and beverage markets, moving beyond niche health food stores.

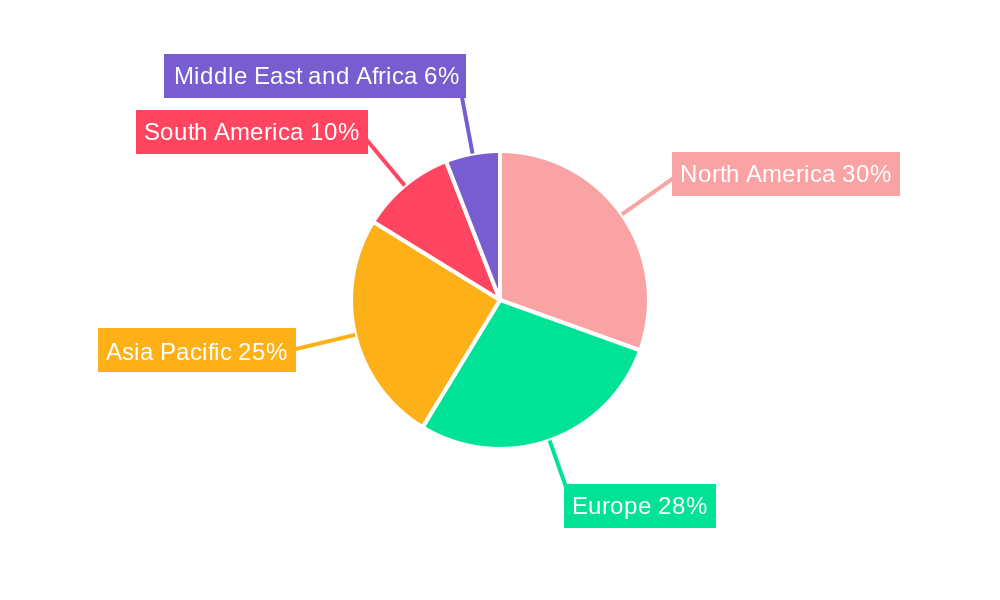

Dominant Regions, Countries, or Segments in Probiotic Products Market

The probiotic products market is experiencing significant growth across various regions, with North America and Europe currently leading in market share, driven by high consumer awareness and a strong presence of established players. Asia-Pacific, however, is emerging as a high-growth region due to a rising middle class, increasing disposable incomes, and a growing acceptance of functional foods and supplements. Within the product segments, Probiotic Foods, particularly Yogurt and Baby Food and Infant Formula, command substantial market share. The Dietary Supplements segment is also a significant contributor, driven by the demand for targeted health solutions. In terms of distribution channels, Supermarkets/Hypermarkets and Pharmacies and Health Stores remain dominant, but Online Retail Stores are rapidly gaining traction, offering convenience and a wider product selection.

Dominant Regions:

- North America: High consumer spending on health and wellness, robust research and development, and established distribution networks.

- Europe: Strong regulatory support for health claims, widespread consumer education, and a mature market for functional foods and beverages.

- Asia-Pacific: Rapidly growing market due to increasing awareness, rising disposable incomes, and a burgeoning middle class actively seeking health-conscious options.

Dominant Segments (Type):

- Probiotic Foods:

- Yogurt: A perennial favorite due to its widespread availability and established association with gut health.

- Baby Food and Infant Formula: A critical segment driven by parental concern for infant immunity and digestive health, with innovations in specialized formulas.

- Dietary Supplements: Offers targeted solutions for specific health concerns, appealing to a health-conscious demographic seeking direct probiotic intake.

- Probiotic Foods:

Dominant Distribution Channels:

- Supermarkets/Hypermarkets: Broad reach and accessibility for everyday consumers.

- Pharmacies and Health Stores: Trusted sources for health-related products, often featuring specialized or premium probiotic offerings.

- Online Retail Stores: Rapidly expanding channel offering convenience, competitive pricing, and access to a wider array of niche and international brands.

Probiotic Products Market Product Landscape

The probiotic products market is characterized by continuous innovation in strain development and formulation. Companies are focusing on scientifically validated strains with demonstrated efficacy for specific health benefits, such as digestive health, immune support, and mental well-being. Novel delivery systems, including microencapsulation and delayed-release technologies, are enhancing probiotic survivability and targeted action. Applications are diversifying beyond traditional dairy products to include fruit-based beverages, baked goods, and specialized infant nutrition. Performance metrics are increasingly tied to strain viability, shelf-life stability, and demonstrable health outcomes, with many products highlighting their unique selling propositions based on proprietary strains and extensive clinical research.

Key Drivers, Barriers & Challenges in Probiotic Products Market

Key Drivers:

- Growing Health Consciousness: Increasing consumer awareness of the link between gut health and overall well-being.

- Demand for Natural and Organic Products: Preference for natural ingredients and preventative health solutions.

- Advancements in Probiotic Research: Scientific validation of probiotic benefits for various health conditions.

- Innovation in Product Formats: Development of diverse and appealing product forms, from functional foods to convenient supplements.

- Rising Disposable Incomes: Increased purchasing power for premium health products, especially in emerging economies.

Barriers & Challenges:

- Regulatory Hurdles: Stringent regulations and varying claims substantiation requirements across different regions can hinder market entry and product differentiation.

- Consumer Education: Despite growing awareness, there remains a need for further education to differentiate between various probiotic strains and their specific benefits.

- Shelf-Life Stability: Maintaining probiotic viability throughout the product's shelf life can be a significant technical challenge.

- Cost of Production: Developing and manufacturing high-quality probiotic products with viable strains can be expensive, impacting pricing and accessibility.

- Competition from Substitutes: Intense competition from prebiotics, synbiotics, and other functional food ingredients.

Emerging Opportunities in Probiotic Products Market

Emerging opportunities in the probiotic products market lie in the development of personalized probiotic formulations tailored to individual needs based on gut microbiome analysis. The burgeoning plant-based food and beverage sector presents a significant avenue for innovation, with a growing demand for vegan probiotic options. Furthermore, the application of probiotics in areas beyond digestive health, such as mental well-being (psychobiotics), skin health, and even sports nutrition, offers substantial untapped potential. Expansion into emerging markets with increasing health awareness also represents a key growth avenue.

Growth Accelerators in the Probiotic Products Market Industry

Several catalysts are accelerating long-term growth in the probiotic products market. Technological breakthroughs in strain identification and cultivation are leading to the discovery of novel probiotics with enhanced functionalities. Strategic partnerships between food and beverage manufacturers and specialized probiotic ingredient suppliers are fostering product innovation and market penetration. Furthermore, a growing emphasis on evidence-based health claims and clinical research is building consumer trust and driving demand. Market expansion strategies, including targeted marketing campaigns and increased availability through diverse distribution channels, are also playing a crucial role.

Key Players Shaping the Probiotic Products Market Market

- Nestle SA

- PepsiCo Inc.

- Yakult Honsha Co Ltd.

- Amway Corp.

- Danone SA

- Reckitt Benckiser LLC

- BioGaia

- Now Foods

- Lifeway Foods Inc.

- Morinaga Milk Industry Co Ltd.

Notable Milestones in Probiotic Products Market Sector

- January 2023: KeVita, a Tropicana-owned brand, expanded its line of Sparkling Probiotic Lemonade with the addition of mango flavor to the existing range of classic and peach probiotic lemonade. The products are available in US retail chains such as Kroger and Walmart.

- September 2022: Nestle Garden of Life launched its first probiotic product in China, which can be used in infant foods. Under the baby food category, baby cereal accounts for a major share of the segment, led by growing innovations in the segment.

- July 2022: BioGaia launched a new product BioGaia Pharax, a probiotic product to support children's respiratory health, in the UK market.

In-Depth Probiotic Products Market Market Outlook

The future outlook for the probiotic products market remains exceptionally bright, driven by sustained consumer interest in gut health and preventative wellness. The market will likely witness an acceleration in the development of specialized probiotics targeting specific health concerns, from immune function to mood regulation. Increased collaboration between research institutions and industry players will fuel the discovery of novel strains and applications. Strategic market expansion into underserved regions and a continued focus on e-commerce will further enhance accessibility. Overall, the market is poised for continued robust growth, offering significant opportunities for innovation and strategic investment in the coming years.

Probiotic Products Market Segmentation

-

1. Type

-

1.1. Probiotic Foods

- 1.1.1. Yogurt

- 1.1.2. Bakery/Breakfast Cereals

- 1.1.3. Baby Food and Infant Formula

- 1.1.4. Other Probiotic Foods

-

1.2. Probiotic Drinks

- 1.2.1. Fruit-based Probiotic Drinks

- 1.2.2. Dairy-based Probiotic Drinks

- 1.3. Dietary Supplements

- 1.4. Animal Feeds/Foods

-

1.1. Probiotic Foods

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies and Health Stores

- 2.3. Convenience Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Probiotic Products Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Probiotic Products Market Regional Market Share

Geographic Coverage of Probiotic Products Market

Probiotic Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For Ready Meals Food Products to Influence Growth; Increasing Demand for Organic and Vegan Ready-to-Eat food products.

- 3.3. Market Restrains

- 3.3.1. Rising Concern Over Health Issues Associated with Processed Foods

- 3.4. Market Trends

- 3.4.1. Rising Health Awareness Promoting Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Probiotic Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Probiotic Foods

- 5.1.1.1. Yogurt

- 5.1.1.2. Bakery/Breakfast Cereals

- 5.1.1.3. Baby Food and Infant Formula

- 5.1.1.4. Other Probiotic Foods

- 5.1.2. Probiotic Drinks

- 5.1.2.1. Fruit-based Probiotic Drinks

- 5.1.2.2. Dairy-based Probiotic Drinks

- 5.1.3. Dietary Supplements

- 5.1.4. Animal Feeds/Foods

- 5.1.1. Probiotic Foods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies and Health Stores

- 5.2.3. Convenience Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Probiotic Products Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Probiotic Foods

- 6.1.1.1. Yogurt

- 6.1.1.2. Bakery/Breakfast Cereals

- 6.1.1.3. Baby Food and Infant Formula

- 6.1.1.4. Other Probiotic Foods

- 6.1.2. Probiotic Drinks

- 6.1.2.1. Fruit-based Probiotic Drinks

- 6.1.2.2. Dairy-based Probiotic Drinks

- 6.1.3. Dietary Supplements

- 6.1.4. Animal Feeds/Foods

- 6.1.1. Probiotic Foods

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Pharmacies and Health Stores

- 6.2.3. Convenience Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Probiotic Products Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Probiotic Foods

- 7.1.1.1. Yogurt

- 7.1.1.2. Bakery/Breakfast Cereals

- 7.1.1.3. Baby Food and Infant Formula

- 7.1.1.4. Other Probiotic Foods

- 7.1.2. Probiotic Drinks

- 7.1.2.1. Fruit-based Probiotic Drinks

- 7.1.2.2. Dairy-based Probiotic Drinks

- 7.1.3. Dietary Supplements

- 7.1.4. Animal Feeds/Foods

- 7.1.1. Probiotic Foods

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Pharmacies and Health Stores

- 7.2.3. Convenience Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Probiotic Products Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Probiotic Foods

- 8.1.1.1. Yogurt

- 8.1.1.2. Bakery/Breakfast Cereals

- 8.1.1.3. Baby Food and Infant Formula

- 8.1.1.4. Other Probiotic Foods

- 8.1.2. Probiotic Drinks

- 8.1.2.1. Fruit-based Probiotic Drinks

- 8.1.2.2. Dairy-based Probiotic Drinks

- 8.1.3. Dietary Supplements

- 8.1.4. Animal Feeds/Foods

- 8.1.1. Probiotic Foods

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Pharmacies and Health Stores

- 8.2.3. Convenience Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Probiotic Products Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Probiotic Foods

- 9.1.1.1. Yogurt

- 9.1.1.2. Bakery/Breakfast Cereals

- 9.1.1.3. Baby Food and Infant Formula

- 9.1.1.4. Other Probiotic Foods

- 9.1.2. Probiotic Drinks

- 9.1.2.1. Fruit-based Probiotic Drinks

- 9.1.2.2. Dairy-based Probiotic Drinks

- 9.1.3. Dietary Supplements

- 9.1.4. Animal Feeds/Foods

- 9.1.1. Probiotic Foods

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Pharmacies and Health Stores

- 9.2.3. Convenience Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Probiotic Products Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Probiotic Foods

- 10.1.1.1. Yogurt

- 10.1.1.2. Bakery/Breakfast Cereals

- 10.1.1.3. Baby Food and Infant Formula

- 10.1.1.4. Other Probiotic Foods

- 10.1.2. Probiotic Drinks

- 10.1.2.1. Fruit-based Probiotic Drinks

- 10.1.2.2. Dairy-based Probiotic Drinks

- 10.1.3. Dietary Supplements

- 10.1.4. Animal Feeds/Foods

- 10.1.1. Probiotic Foods

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Pharmacies and Health Stores

- 10.2.3. Convenience Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PepsiCo Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Yakult Honsha Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amway Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danone SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Reckitt Benckiser LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BioGaia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Now Foods

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lifeway Foods Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Morinaga Milk Industry Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global Probiotic Products Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Probiotic Products Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Probiotic Products Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Probiotic Products Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Probiotic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Probiotic Products Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Probiotic Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Probiotic Products Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Probiotic Products Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Probiotic Products Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Probiotic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Probiotic Products Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Probiotic Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Probiotic Products Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Probiotic Products Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Probiotic Products Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Probiotic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Probiotic Products Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Probiotic Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Probiotic Products Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Probiotic Products Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Probiotic Products Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Probiotic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Probiotic Products Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Probiotic Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Probiotic Products Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Probiotic Products Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Probiotic Products Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Probiotic Products Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Probiotic Products Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Probiotic Products Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Probiotic Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Probiotic Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Probiotic Products Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Probiotic Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Probiotic Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Probiotic Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Probiotic Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Probiotic Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Probiotic Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Probiotic Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Probiotic Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Probiotic Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Probiotic Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Probiotic Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Probiotic Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Probiotic Products Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Probiotic Products Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Probiotic Products Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Probiotic Products Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Probiotic Products Market?

The projected CAGR is approximately 7.53%.

2. Which companies are prominent players in the Probiotic Products Market?

Key companies in the market include Nestle SA, PepsiCo Inc, Yakult Honsha Co Ltd, Amway Corp, Danone SA, Reckitt Benckiser LLC, BioGaia, Now Foods, Lifeway Foods Inc *List Not Exhaustive, Morinaga Milk Industry Co Ltd.

3. What are the main segments of the Probiotic Products Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Ready Meals Food Products to Influence Growth; Increasing Demand for Organic and Vegan Ready-to-Eat food products..

6. What are the notable trends driving market growth?

Rising Health Awareness Promoting Demand.

7. Are there any restraints impacting market growth?

Rising Concern Over Health Issues Associated with Processed Foods.

8. Can you provide examples of recent developments in the market?

In January 2023, KeVita, a Tropicana-owned brand, expanded its line of Sparkling Probiotic Lemonade with the addition of mango flavor to the existing range of classic and peach probiotic lemonade. The products are available in US retail chains such as Kroger and Walmart.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Probiotic Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Probiotic Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Probiotic Products Market?

To stay informed about further developments, trends, and reports in the Probiotic Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence