Key Insights

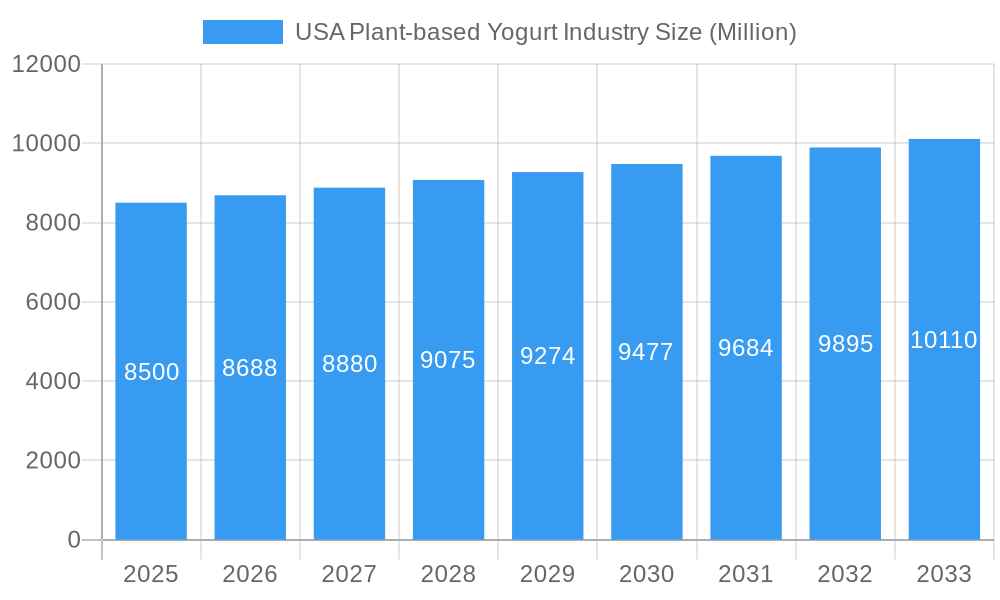

The United States plant-based yogurt market is experiencing substantial expansion, driven by a growing consumer preference for healthier and more sustainable food choices. This trend is underpinned by heightened awareness of plant-based diets' health advantages, such as improved digestion and reduced chronic disease risk, alongside increasing concerns for environmental sustainability and animal welfare. Consumers are actively seeking dairy yogurt alternatives, stimulating product innovation and ingredient diversification. Key growth drivers include expanding product portfolios with diverse plant bases (almond, soy, coconut, oat), innovative flavor profiles, and functional enhancements like added probiotics and protein. This dynamic market is projected to reach a market size of 3182.6 million by the base year 2025, with a projected CAGR of 12.7%.

USA Plant-based Yogurt Industry Market Size (In Billion)

Market growth is further accelerated by evolving consumer lifestyles and enhanced accessibility of plant-based yogurts across various distribution channels. Supermarkets and hypermarkets are expanding their dedicated plant-based sections, while convenience stores and online retail platforms are increasing product availability. This accessibility, coupled with continuous product development and strategic marketing by leading companies, is poised to sustain the market's positive trajectory. Potential restraints, such as the perceived higher cost of some plant-based options and established consumer loyalty to traditional dairy yogurt, are being addressed through production efficiencies and taste innovation. The market exhibits strong segmentation, with robust performance anticipated in both dairy-based and non-dairy yogurt categories, and a notable consumer inclination towards flavored varieties over plain options.

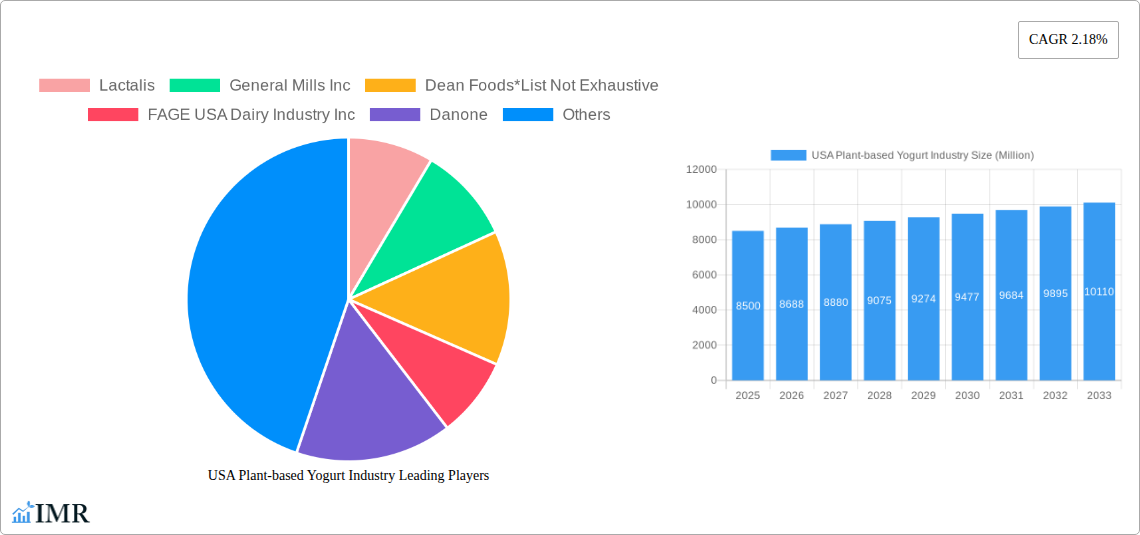

USA Plant-based Yogurt Industry Company Market Share

USA Plant-based Yogurt Industry Report: Growth, Trends, and Market Outlook (2019-2033)

This comprehensive report delves into the dynamic USA plant-based yogurt market, offering deep insights into its structure, growth trajectory, and future potential. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis is essential for industry stakeholders seeking to navigate the evolving landscape of dairy-alternative yogurts. We explore market concentration, technological innovations, regulatory impacts, competitive dynamics, and consumer behavior shifts, providing quantitative data in million units and qualitative analysis. This report is designed to maximize search engine visibility with high-traffic keywords and deliver actionable insights for professionals in the dairy and plant-based food industries.

USA Plant-based Yogurt Industry Market Dynamics & Structure

The USA plant-based yogurt market is characterized by a moderately concentrated structure, with a few major players holding significant market share while a growing number of niche and emerging brands vie for consumer attention. Technological innovation is a key driver, particularly in developing improved textures, flavors, and nutritional profiles for non-dairy alternatives, aiming to closely mimic or even surpass the sensory experience of traditional dairy yogurt. Regulatory frameworks primarily focus on food safety, labeling accuracy, and permissible health claims, which can influence product development and marketing strategies. Competitive product substitutes are abundant, ranging from conventional dairy yogurt to other plant-based fermented products and dairy-free desserts. End-user demographics are increasingly diverse, with a strong uptake among health-conscious consumers, vegans, lactose-intolerant individuals, and environmentally aware shoppers. Merger and acquisition (M&A) trends indicate a consolidation drive as larger food corporations seek to expand their plant-based portfolios and smaller innovative companies aim for broader distribution and resources. Innovation barriers include the high cost of scaling plant-based ingredient sourcing, achieving consumer acceptance for novel ingredients, and the ongoing challenge of replicating the creamy texture and mouthfeel of dairy yogurt.

- Market Concentration: Dominated by a mix of established dairy giants and specialized plant-based brands.

- Technological Drivers: Focus on ingredient innovation for taste, texture, and nutritional fortification.

- Regulatory Landscape: Emphasis on food safety, labeling, and health claim substantiation.

- Competitive Substitutes: Dairy yogurt, other fermented plant-based options, and dairy-free desserts.

- End-User Demographics: Health-conscious, vegan, lactose-intolerant, and environmentally aware consumers.

- M&A Activity: Strategic acquisitions to enhance portfolio diversity and market reach.

- Innovation Barriers: Cost of ingredients, consumer acceptance, and replicating dairy texture.

USA Plant-based Yogurt Industry Growth Trends & Insights

The USA plant-based yogurt market has witnessed robust growth, propelled by a confluence of escalating consumer demand for healthier and more sustainable food options, alongside continuous innovation in product development and ingredient sourcing. From 2019 to the base year of 2025, the market size has expanded significantly, driven by increasing consumer awareness of the health benefits associated with plant-based diets, such as improved gut health and reduced saturated fat intake, as well as a growing concern for the environmental footprint of food production. The adoption rates for plant-based yogurts have surged, with a notable segment of the population actively seeking dairy alternatives due to lactose intolerance, allergies, or personal ethical choices. Technological disruptions have played a pivotal role, with advancements in fermentation processes, encapsulation technologies for probiotics, and the utilization of novel plant protein sources like fava bean, pea, and algae contributing to improved product quality and variety. These innovations have enabled manufacturers to offer yogurts with enhanced nutritional profiles, including higher protein content and essential vitamins and minerals, effectively closing the perceived gap with traditional dairy yogurts.

Consumer behavior shifts are deeply embedded in this growth narrative. There's a discernible move towards premiumization, with consumers willing to pay a higher price for plant-based yogurts that offer superior taste, texture, and functional benefits. The demand for transparent ingredient lists, clean labels, and ethically sourced ingredients is also on the rise, influencing product formulations and brand messaging. Furthermore, the influence of social media and online health communities has amplified awareness and trial of plant-based yogurts, accelerating their integration into daily diets. The market penetration of plant-based yogurts continues to climb, gradually eroding the dominance of conventional dairy options in certain consumer segments. This evolution is not just about replacing dairy but about offering a distinct and often superior product experience that resonates with modern consumers' evolving values. The CAGR during the historical period of 2019-2024 demonstrated a strong upward trend, and projections for the forecast period of 2025-2033 indicate sustained, high-magnitude growth as plant-based diets become more mainstream and product offerings continue to diversify.

Dominant Regions, Countries, or Segments in USA Plant-based Yogurt Industry

Within the USA plant-based yogurt industry, the Non-dairy Yogurt segment exhibits dominant growth, driven by widespread consumer preference for dairy-free options and increasing availability across various retail channels. This segment's ascent is primarily fueled by health-conscious consumers, individuals with lactose intolerance, and a growing vegan and vegetarian population seeking sustainable and ethical food choices. The economic policies in the United States, such as incentives for sustainable agriculture and growing consumer purchasing power for health-focused products, further bolster the demand for non-dairy alternatives. Infrastructure development, particularly in food processing and distribution networks, ensures that these products reach consumers efficiently, from urban centers to suburban and even rural areas.

- Non-dairy Yogurt Dominance: Surpassing dairy-based yogurt in growth and consumer adoption due to evolving dietary preferences and health consciousness.

- Key Drivers:

- Health and Wellness Trends: Increasing demand for gut-friendly and nutrient-rich alternatives.

- Dietary Restrictions: High prevalence of lactose intolerance and dairy allergies.

- Vegan and Vegetarian Lifestyles: Growing ethical and environmental considerations.

- Product Innovation: Enhanced taste, texture, and nutritional profiles of plant-based options.

- Retail Availability: Widespread placement in major supermarkets and specialty stores.

Among the Product Types, Flavored Yogurt holds a significant share, mirroring the broader yogurt market trend where consumers often opt for enhanced taste experiences. The appeal of flavored plant-based yogurts lies in their ability to offer diverse taste profiles, from classic fruit flavors to more exotic and dessert-like options, making them an attractive choice for a wider consumer base, including children and those new to plant-based diets.

- Flavored Yogurt Appeal: Offers a gateway to plant-based yogurts for a broader consumer base, catering to diverse taste preferences.

- Drivers:

- Consumer Palatability: Enhanced taste as a primary purchasing driver.

- Variety and Innovation: Constant introduction of new and exciting flavor combinations.

- Snack and Dessert Appeal: Versatility in consumption occasions.

The Supermarkets/Hypermarkets Distribution Channel is paramount for the plant-based yogurt industry, providing the broadest reach and accessibility to the majority of US consumers. These outlets are critical for both established brands and emerging players to achieve significant sales volumes and market penetration. Their extensive shelf space dedicated to dairy and non-dairy alternatives reflects the growing importance of plant-based options in the modern grocery landscape.

- Supermarkets/Hypermarkets Dominance: The primary channel for accessibility and mass market penetration.

- Drivers:

- Consumer Convenience: One-stop shopping for diverse household needs.

- Product Visibility: Prominent placement and merchandising opportunities.

- Competitive Pricing: Ability to offer competitive prices due to scale.

- Brand Exposure: Reaching a vast and diverse consumer base.

USA Plant-based Yogurt Industry Product Landscape

The USA plant-based yogurt product landscape is a testament to relentless innovation, with manufacturers focusing on enhancing sensory attributes and nutritional value. Products derived from almond, soy, coconut, cashew, and oat continue to be popular, with emerging ingredients like fava bean and avocado gaining traction. Innovations are centered around achieving a creamy, thick texture that rivals traditional dairy yogurt, often through advanced blending techniques and the use of natural thickeners. Nutritional fortification with probiotics, vitamins (like B12 and D), and minerals (like calcium) is a key selling proposition, appealing to health-conscious consumers seeking functional benefits. Unique selling propositions often include allergen-free formulations, organic certifications, and sustainable sourcing practices, catering to a discerning consumer base. Technological advancements in fermentation and ingredient processing are enabling cleaner labels and more authentic taste profiles, further driving consumer acceptance and market growth.

Key Drivers, Barriers & Challenges in USA Plant-based Yogurt Industry

Key Drivers:

- Rising Health Consciousness: Consumers are increasingly opting for plant-based diets for perceived health benefits, including improved digestion and reduced risk of chronic diseases.

- Growing Environmental Concerns: The lower environmental impact of plant-based food production compared to dairy is a significant motivator for many consumers.

- Increased Product Availability and Variety: A wider range of plant-based yogurts, from various bases and flavors, is now readily accessible, catering to diverse preferences.

- Innovation in Taste and Texture: Manufacturers are continually improving the palatability and mouthfeel of plant-based yogurts, making them more appealing to a broader audience.

Barriers & Challenges:

- Price Premium: Plant-based yogurts often come at a higher price point than traditional dairy yogurts, which can deter price-sensitive consumers.

- Nutritional Gaps: Some plant-based yogurts may lack essential nutrients like vitamin B12 or calcium naturally found in dairy, requiring fortification.

- Taste and Texture Perception: Despite advancements, some consumers still perceive plant-based yogurts as having an inferior taste or texture compared to dairy alternatives.

- Supply Chain Volatility: Sourcing of specialized plant-based ingredients can be subject to fluctuations in availability and cost.

- Regulatory Clarity on Labeling: Ambiguities in labeling regulations for plant-based alternatives can sometimes create confusion for consumers and challenges for manufacturers.

Emerging Opportunities in USA Plant-based Yogurt Industry

Emerging opportunities in the USA plant-based yogurt industry are vast and varied. There is a significant untapped market in functional yogurts offering specific health benefits, such as enhanced immunity or stress reduction, leveraging the natural properties of plant-based ingredients and added probiotics. Innovative applications beyond traditional snacking are also emerging, with plant-based yogurts being incorporated into savory dishes, baking, and as bases for smoothies and dips, expanding their versatility. Evolving consumer preferences for unique flavor profiles, such as exotic fruits, floral notes, and savory infusions, present avenues for product differentiation. Furthermore, the growing demand for ethically sourced and transparently produced food items creates opportunities for brands that prioritize sustainability and fair labor practices throughout their supply chains. The development of more accessible and affordable plant-based yogurt options could also unlock significant growth in broader consumer segments.

Growth Accelerators in the USA Plant-based Yogurt Industry Industry

The USA plant-based yogurt industry is poised for accelerated growth driven by several key catalysts. Technological breakthroughs in ingredient processing and fermentation are continually enhancing the quality, taste, and nutritional profile of plant-based yogurts, effectively reducing the sensory gap with dairy counterparts. Strategic partnerships between ingredient suppliers, yogurt manufacturers, and retail chains are crucial for ensuring efficient distribution and widespread availability, fostering increased consumer trial and adoption. Furthermore, market expansion strategies that focus on educating consumers about the benefits of plant-based alternatives and highlighting product innovation will play a vital role. The increasing integration of plant-based yogurts into mainstream dietary recommendations by health professionals and the growing influence of social media trends promoting plant-forward eating are also significant growth accelerators, driving sustained demand and market penetration.

Key Players Shaping the USA Plant-based Yogurt Industry Market

- Lactalis

- General Mills Inc

- Dean Foods

- FAGE USA Dairy Industry Inc

- Danone

- Anderson Erickson Dairy

- Dairy Farmers of America Inc

- Chobani LLC

- Tillamook County Creamery Association

- Hain Celestial Group

Notable Milestones in USA Plant-based Yogurt Industry Sector

- June 2022: The chewy candy company HI-CHEW partnered with Menchie's Frozen Yogurt in North America to launch a limited edition HI-CHEWTM Rainbow Sherbet Flavor frozen yogurt, showcasing cross-industry collaboration and innovative flavor introductions.

- June 2022: Yogurtland, a frozen yogurt company, introduced two new limited-time flavors for summer: strawberry mango sorbet and passion fruit mango tart. Yogurtland sells its Strawberry Mangonada cup exclusively online at yogurt-land.com, the Yogurtland app, and DoorDash. Online-exclusive cups and summer flavors are available at participating locations, highlighting the growing importance of online sales channels and limited-edition offerings.

- June 2022: Danone North America launched its latest product Activia+ Multi-Benefit Probiotic Yogurt Drinks. Activia+ is an excellent source (20% DV) of vitamins C, D, and zinc to support the immune system and is packed with billions of live and active probiotics that help support gut health, emphasizing product innovation focused on functional health benefits and immune support.

In-Depth USA Plant-based Yogurt Industry Market Outlook

The USA plant-based yogurt industry is set for an exceptionally promising future, characterized by sustained high growth and expanding market penetration. Future market potential is largely driven by continued advancements in ingredient technology, leading to even more dairy-like textures and sophisticated flavor profiles that will appeal to a broader consumer base. Strategic opportunities lie in further developing functional yogurts tailored to specific health needs, such as digestive wellness, cognitive function, and athletic recovery, tapping into the growing demand for personalized nutrition. The expansion of the online retail channel and direct-to-consumer models presents a significant avenue for growth, allowing for direct engagement with consumers and the provision of niche and customized products. As consumer awareness of the environmental and ethical benefits of plant-based diets continues to rise, the market is expected to solidify its position as a major category within the broader food industry, offering compelling value propositions beyond mere dairy replacement.

USA Plant-based Yogurt Industry Segmentation

-

1. Category

- 1.1. Dairy-Based Yogurt

- 1.2. Non-dairy Yogurt

-

2. Product Type

- 2.1. Plain Yogurt

- 2.2. Flavored Yogurt

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Specialty Stores

- 3.4. Online Retail

- 3.5. Other Channels

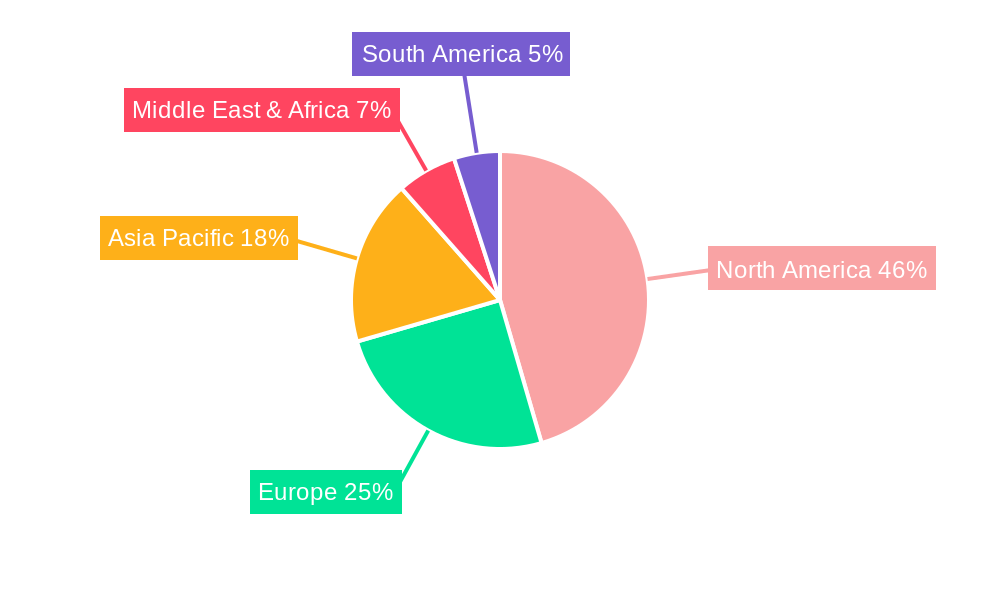

USA Plant-based Yogurt Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Plant-based Yogurt Industry Regional Market Share

Geographic Coverage of USA Plant-based Yogurt Industry

USA Plant-based Yogurt Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood

- 3.3. Market Restrains

- 3.3.1. Rising Concern About Quality and Safety Standards of Canned Tuna

- 3.4. Market Trends

- 3.4.1. Growing Digestive Heath Concerns Heating up Demand for Probiotic Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Dairy-Based Yogurt

- 5.1.2. Non-dairy Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plain Yogurt

- 5.2.2. Flavored Yogurt

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Retail

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. North America USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Dairy-Based Yogurt

- 6.1.2. Non-dairy Yogurt

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Plain Yogurt

- 6.2.2. Flavored Yogurt

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Convenience Stores

- 6.3.3. Specialty Stores

- 6.3.4. Online Retail

- 6.3.5. Other Channels

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. South America USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Dairy-Based Yogurt

- 7.1.2. Non-dairy Yogurt

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Plain Yogurt

- 7.2.2. Flavored Yogurt

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Convenience Stores

- 7.3.3. Specialty Stores

- 7.3.4. Online Retail

- 7.3.5. Other Channels

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Europe USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Dairy-Based Yogurt

- 8.1.2. Non-dairy Yogurt

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Plain Yogurt

- 8.2.2. Flavored Yogurt

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Convenience Stores

- 8.3.3. Specialty Stores

- 8.3.4. Online Retail

- 8.3.5. Other Channels

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Middle East & Africa USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Dairy-Based Yogurt

- 9.1.2. Non-dairy Yogurt

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Plain Yogurt

- 9.2.2. Flavored Yogurt

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Convenience Stores

- 9.3.3. Specialty Stores

- 9.3.4. Online Retail

- 9.3.5. Other Channels

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Asia Pacific USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Category

- 10.1.1. Dairy-Based Yogurt

- 10.1.2. Non-dairy Yogurt

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Plain Yogurt

- 10.2.2. Flavored Yogurt

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Convenience Stores

- 10.3.3. Specialty Stores

- 10.3.4. Online Retail

- 10.3.5. Other Channels

- 10.1. Market Analysis, Insights and Forecast - by Category

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lactalis

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Mills Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dean Foods*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FAGE USA Dairy Industry Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danone

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Anderson Erickson Dairy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dairy Farmers of America Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chobani LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tillamook County Creamery Association

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hain Celestial Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lactalis

List of Figures

- Figure 1: Global USA Plant-based Yogurt Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America USA Plant-based Yogurt Industry Revenue (million), by Category 2025 & 2033

- Figure 3: North America USA Plant-based Yogurt Industry Revenue Share (%), by Category 2025 & 2033

- Figure 4: North America USA Plant-based Yogurt Industry Revenue (million), by Product Type 2025 & 2033

- Figure 5: North America USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America USA Plant-based Yogurt Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: North America USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America USA Plant-based Yogurt Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America USA Plant-based Yogurt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America USA Plant-based Yogurt Industry Revenue (million), by Category 2025 & 2033

- Figure 11: South America USA Plant-based Yogurt Industry Revenue Share (%), by Category 2025 & 2033

- Figure 12: South America USA Plant-based Yogurt Industry Revenue (million), by Product Type 2025 & 2033

- Figure 13: South America USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America USA Plant-based Yogurt Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 15: South America USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America USA Plant-based Yogurt Industry Revenue (million), by Country 2025 & 2033

- Figure 17: South America USA Plant-based Yogurt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe USA Plant-based Yogurt Industry Revenue (million), by Category 2025 & 2033

- Figure 19: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Category 2025 & 2033

- Figure 20: Europe USA Plant-based Yogurt Industry Revenue (million), by Product Type 2025 & 2033

- Figure 21: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe USA Plant-based Yogurt Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 23: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe USA Plant-based Yogurt Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa USA Plant-based Yogurt Industry Revenue (million), by Category 2025 & 2033

- Figure 27: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Category 2025 & 2033

- Figure 28: Middle East & Africa USA Plant-based Yogurt Industry Revenue (million), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa USA Plant-based Yogurt Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa USA Plant-based Yogurt Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific USA Plant-based Yogurt Industry Revenue (million), by Category 2025 & 2033

- Figure 35: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Category 2025 & 2033

- Figure 36: Asia Pacific USA Plant-based Yogurt Industry Revenue (million), by Product Type 2025 & 2033

- Figure 37: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific USA Plant-based Yogurt Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific USA Plant-based Yogurt Industry Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 2: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 6: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 13: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 20: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 21: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 33: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 34: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Category 2020 & 2033

- Table 43: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 44: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global USA Plant-based Yogurt Industry Revenue million Forecast, by Country 2020 & 2033

- Table 46: China USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific USA Plant-based Yogurt Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Plant-based Yogurt Industry?

The projected CAGR is approximately 12.7%.

2. Which companies are prominent players in the USA Plant-based Yogurt Industry?

Key companies in the market include Lactalis, General Mills Inc, Dean Foods*List Not Exhaustive, FAGE USA Dairy Industry Inc, Danone, Anderson Erickson Dairy, Dairy Farmers of America Inc, Chobani LLC, Tillamook County Creamery Association, Hain Celestial Group.

3. What are the main segments of the USA Plant-based Yogurt Industry?

The market segments include Category, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3182.6 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood.

6. What are the notable trends driving market growth?

Growing Digestive Heath Concerns Heating up Demand for Probiotic Products.

7. Are there any restraints impacting market growth?

Rising Concern About Quality and Safety Standards of Canned Tuna.

8. Can you provide examples of recent developments in the market?

In June 2022, The chewy candy company HI-CHEW partnered with Menchie's Frozen Yogurt in North America to launch a limited edition HI-CHEWTM Rainbow Sherbet Flavor frozen yogurt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Plant-based Yogurt Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Plant-based Yogurt Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Plant-based Yogurt Industry?

To stay informed about further developments, trends, and reports in the USA Plant-based Yogurt Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence