Key Insights

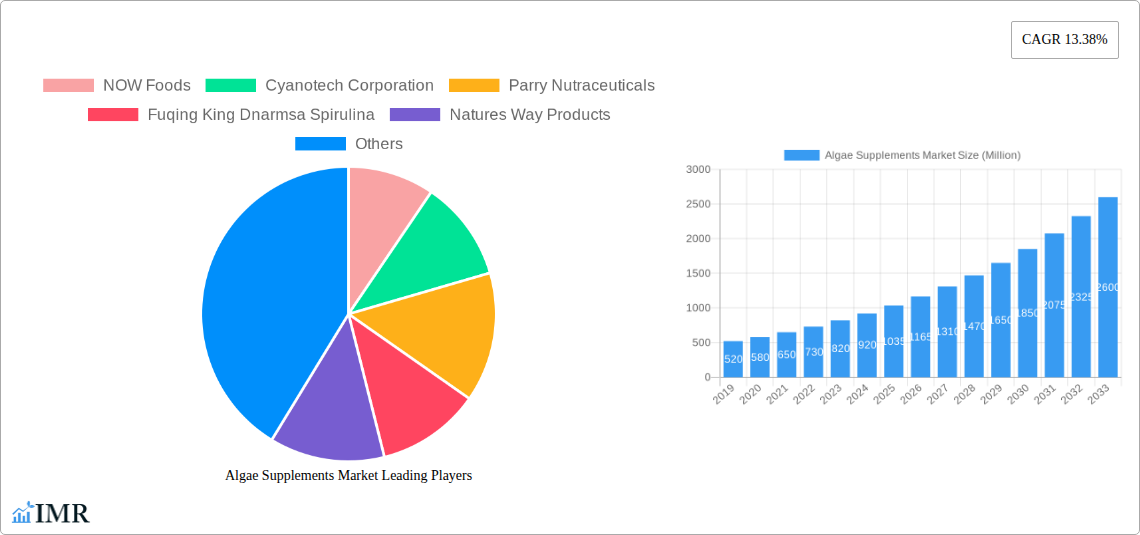

The global algae supplements market is poised for substantial expansion, projected to reach a significant valuation by 2033, driven by an impressive Compound Annual Growth Rate (CAGR) of 13.38%. This robust growth is fueled by escalating consumer awareness regarding the potent health benefits of algae-derived ingredients, including spirulina, astaxanthin, and chlorella. These superfoods are increasingly recognized for their rich nutritional profiles, offering a wealth of vitamins, minerals, antioxidants, and omega-3 fatty acids. The market's expansion is further propelled by the growing demand for natural and plant-based dietary supplements, aligning with global wellness trends and the increasing adoption of vegetarian and vegan lifestyles. Emerging applications in sports nutrition, cognitive health, and immune support are also contributing to market dynamism. Innovations in cultivation and extraction technologies are improving product quality and availability, making these supplements more accessible and appealing to a broader consumer base. The increasing prevalence of chronic diseases and the desire for preventative healthcare solutions are also creating a fertile ground for the growth of the algae supplements market.

Algae Supplements Market Market Size (In Million)

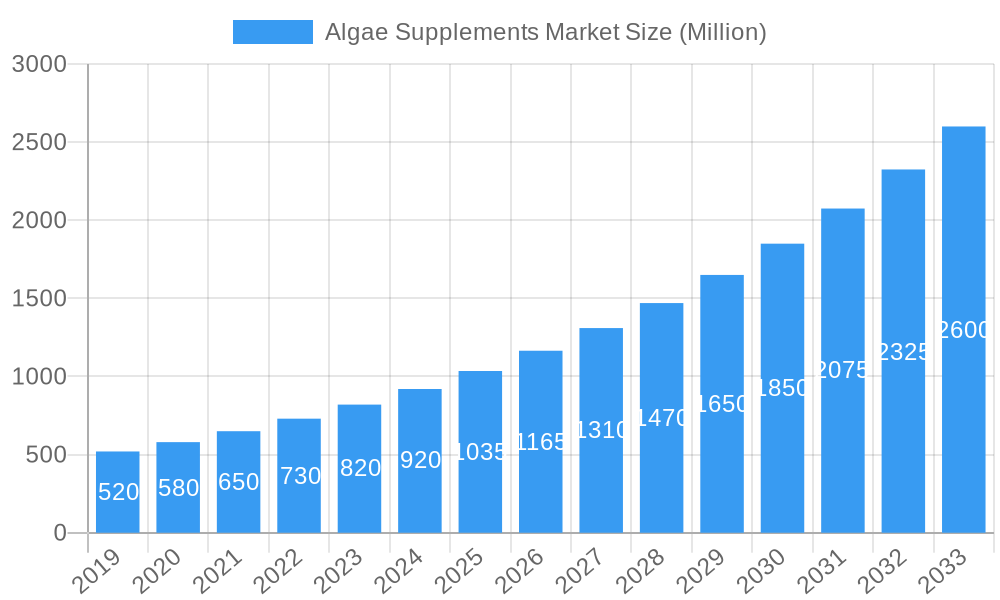

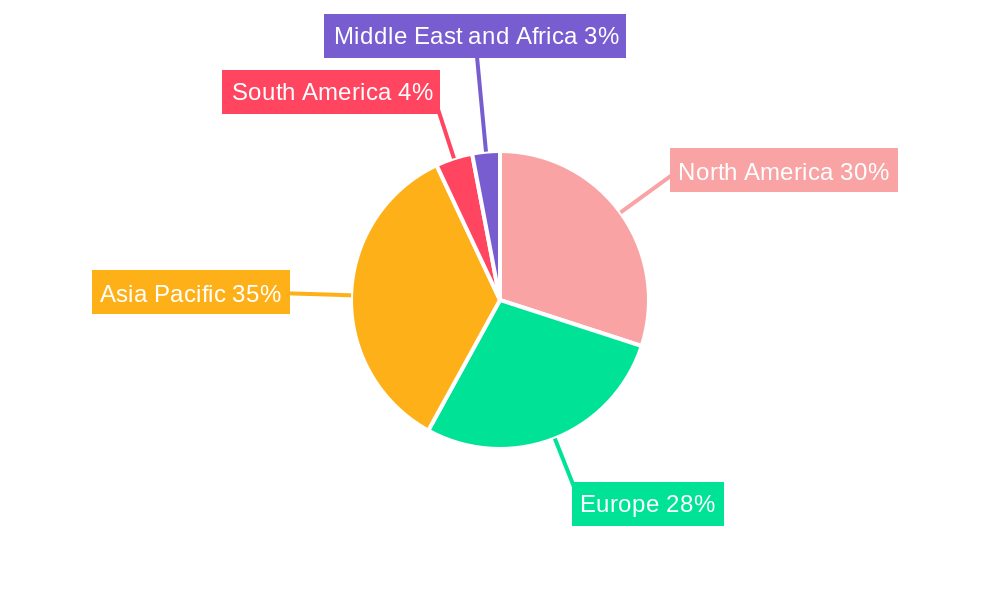

The market's segmentation by product type reveals spirulina and astaxanthin as key growth drivers, owing to their well-established efficacy in boosting energy, reducing inflammation, and supporting eye health. Chlorella also holds a significant share, valued for its detoxifying properties. The powder form is currently dominant, favored for its versatility in smoothies and various food preparations, though tablets and capsules are gaining traction due to convenience. Geographically, the Asia Pacific region is anticipated to lead market growth, driven by a large population, increasing disposable incomes, and a traditional understanding of algae's health benefits. North America and Europe are also substantial markets, characterized by high health consciousness and a strong demand for premium dietary supplements. While the market is brimming with opportunities, potential restraints include fluctuating raw material prices and stringent regulatory approvals for new product formulations. However, ongoing research and development, coupled with strategic collaborations among key players like NOW Foods, Cyanotech Corporation, and Parry Nutraceuticals, are expected to overcome these challenges and sustain the market's upward trajectory.

Algae Supplements Market Company Market Share

Unlock the potential of the burgeoning algae supplements market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides critical insights into market dynamics, growth trajectories, regional dominance, and the competitive landscape. Essential for industry professionals, manufacturers, distributors, and investors, this report details key segments, including spirulina, astaxanthin, and chlorella supplements, across various forms such as powder, tablet, and capsule.

Algae Supplements Market Market Dynamics & Structure

The global algae supplements market is characterized by a moderately concentrated structure, with key players focusing on technological innovation, product differentiation, and strategic partnerships. Drives for innovation stem from increasing consumer awareness regarding the health benefits of algae-derived nutrients, leading to R&D efforts in extraction processes and novel formulations. Regulatory frameworks, particularly concerning dietary supplements and novel food ingredients, play a crucial role in market entry and product development. Competitive product substitutes, such as plant-based extracts and synthetic vitamins, present a challenge, necessitating a focus on the unique value proposition of algae. End-user demographics are expanding, encompassing health-conscious individuals, athletes, and aging populations seeking preventative health solutions. Mergers and acquisitions (M&A) are a growing trend, as larger companies seek to expand their portfolios and gain access to specialized algae cultivation and processing technologies.

- Market Concentration: Moderate, with a blend of established and emerging players.

- Technological Innovation Drivers: Enhanced extraction efficiency, development of bioavailable forms, and novel delivery systems.

- Regulatory Frameworks: FDA, EFSA, and other regional bodies governing supplement safety and claims.

- Competitive Product Substitutes: Plant-based omega-3s, synthetic vitamins, and other superfood ingredients.

- End-User Demographics: Growing demand from nutraceutical, functional food, and cosmetic sectors.

- M&A Trends: Strategic acquisitions for portfolio expansion and technological integration.

Algae Supplements Market Growth Trends & Insights

The algae supplements market is poised for robust expansion, driven by a confluence of factors including escalating health and wellness consciousness, a growing preference for natural and sustainable ingredients, and advancements in algae cultivation and processing technologies. The market size is projected to witness a significant Compound Annual Growth Rate (CAGR) of approximately 9.5% from 2025 to 2033, reaching an estimated value of $6,500 million by 2025. Adoption rates for algae-based supplements are steadily increasing across developed and developing economies, fueled by increasing awareness of their potent antioxidant, anti-inflammatory, and nutritional properties. Technological disruptions, such as improvements in photobioreactor technology for controlled algae cultivation and more efficient downstream processing, are enhancing product quality and reducing production costs. Consumer behavior shifts are evident, with a greater inclination towards vegan, non-GMO, and sustainably sourced supplements. The perceived superior bioavailability and unique nutrient profiles of algae, such as spirulina for protein and vitamins, astaxanthin for its exceptional antioxidant power, and chlorella for detoxification, are key drivers behind this paradigm shift. The historical period (2019-2024) laid the foundation for this growth, with steady market penetration and increasing consumer acceptance. The forecast period (2025-2033) is expected to witness accelerated growth as these trends mature and new applications emerge.

Dominant Regions, Countries, or Segments in Algae Supplements Market

North America currently holds a dominant position in the global algae supplements market, driven by a mature nutraceutical industry, high disposable incomes, and a deeply ingrained health and wellness culture. The United States, in particular, is a leading consumer and producer, with a substantial demand for spirulina, astaxanthin, and chlorella supplements. This dominance is further bolstered by a strong regulatory framework that supports the growth of dietary supplements and a proactive consumer base that readily adopts scientifically backed health products. The market here is projected to be valued at $1,800 million in 2025.

- North America's Dominance:

- Market Share: Accounted for approximately 35% of the global market in 2025.

- Key Drivers: High consumer awareness of health benefits, strong presence of supplement manufacturers, and advanced distribution channels.

- Economic Policies: Favorable regulatory environment for dietary supplements and a robust healthcare system.

- Infrastructure: Well-developed retail and online distribution networks for supplement accessibility.

In terms of product type, Spirulina supplements are expected to lead the market, estimated to reach $1,950 million in 2025. Its widespread recognition as a complete protein source rich in vitamins, minerals, and antioxidants makes it a staple in many health regimens.

- Spirulina's Leading Role:

- Nutritional Profile: High protein content, essential amino acids, vitamins (A, B complex, K), and minerals (iron, magnesium).

- Health Benefits: Antioxidant, anti-inflammatory, immune-boosting, and potential for energy enhancement.

- Consumer Appeal: Versatile use in smoothies, powders, and capsules, appealing to a broad demographic.

- Market Penetration: Established consumer base and widespread availability.

Regarding form, Powder supplements are anticipated to capture the largest market share, estimated at $2,100 million in 2025. This is attributed to their versatility in consumption (smoothies, juices, direct mixing) and often perceived cost-effectiveness and purity.

- Powder Form's Popularity:

- Versatility: Easy to incorporate into daily diets, appealing to a wide range of consumers.

- Concentration: Often perceived to contain higher concentrations of active ingredients.

- Cost-Effectiveness: Generally more affordable per serving compared to capsules or tablets.

- Target Demographics: Athletes, health enthusiasts, and those seeking customizable dosage.

Algae Supplements Market Product Landscape

The algae supplements market is experiencing a surge in product innovation focused on enhanced efficacy, palatability, and targeted health applications. Manufacturers are developing novel extraction techniques to preserve the delicate phytonutrients and improve bioavailability, leading to products with demonstrably superior health outcomes. For instance, advancements in astaxanthin encapsulation are boosting its absorption rate, making it a highly sought-after ingredient for eye health, skin rejuvenation, and sports performance. The increasing demand for plant-based and sustainable ingredients is driving the development of vegan algae supplements and formulations that leverage the unique nutritional profiles of specific algae species. Performance metrics are increasingly scrutinized, with a focus on scientifically validated health claims and transparent sourcing.

Key Drivers, Barriers & Challenges in Algae Supplements Market

Key Drivers:

- Growing Health Consciousness: Increasing consumer awareness of the preventative and therapeutic benefits of algae-derived nutrients, including antioxidants, omega-3 fatty acids, and vitamins.

- Demand for Natural and Sustainable Products: A significant shift towards natural, plant-based, and ethically sourced ingredients, aligning with algae's eco-friendly cultivation potential.

- Technological Advancements: Innovations in algae cultivation, extraction, and processing technologies are improving product quality, efficiency, and cost-effectiveness.

- Expanding Applications: Increasing use of algae supplements in functional foods, beverages, and the cosmetics industry.

Barriers & Challenges:

- High Production Costs: Certain algae cultivation and extraction processes can be capital-intensive, leading to higher product pricing.

- Regulatory Hurdles: Navigating diverse and evolving regulatory landscapes for dietary supplements across different regions can be complex.

- Consumer Education: Lack of widespread awareness about the specific benefits and diverse types of algae supplements compared to more established supplements.

- Supply Chain Volatility: Dependence on specific environmental conditions for cultivation can lead to potential supply chain disruptions.

- Competition from Substitutes: Availability of alternative sources for similar nutrients, such as fish oil for omega-3s or other plant-based protein powders. The market is projected to face a supply chain constraint impact of approximately 10% if not managed effectively.

Emerging Opportunities in Algae Supplements Market

Emerging opportunities in the algae supplements market lie in the development of specialized formulations targeting specific health conditions, such as cognitive function, immune support, and gut health. The growing demand for personalized nutrition presents a significant avenue, with algae's customizable nutrient profiles lending themselves well to tailored supplement blends. Furthermore, the untapped potential of various algae species beyond spirulina and chlorella offers fertile ground for research and product development, promising novel bioactive compounds and health benefits. The expansion into emerging economies with increasing disposable incomes and growing health awareness also represents a substantial growth frontier.

Growth Accelerators in the Algae Supplements Market Industry

Long-term growth in the algae supplements industry is being accelerated by continuous technological breakthroughs in sustainable algae cultivation, such as closed-loop systems and enhanced photobioreactor designs, which are reducing environmental impact and production costs. Strategic partnerships between algae producers, supplement manufacturers, and research institutions are fostering innovation and expanding market reach. Furthermore, the increasing integration of algae-derived ingredients into mainstream food and beverage products, beyond traditional supplements, is creating new consumption channels and broadening consumer exposure. The growing scientific validation of algae's health benefits, supported by robust clinical studies, is also a significant growth accelerator, building consumer trust and demand.

Key Players Shaping the Algae Supplements Market Market

- NOW Foods

- Cyanotech Corporation

- Parry Nutraceuticals

- Fuqing King Dnarmsa Spirulina

- Natures Way Products

- Kent BioEnergy Corporation

- Algae Health Sciences

- Pharmavite LLC

- Doctor's Best

- Vitamin Discount Center

Notable Milestones in Algae Supplements Market Sector

- May 2024: Algine Plus launched its product line on Walmart, including Ocean Greens, Astaxanthin, and Phosphatidylserine, aiming for wider market accessibility.

- October 2022: Solabia-Algatech introduced Astaxanthin Gummies with vitamin C, offering a vegan and palatable delivery method for its flagship astaxanthin ingredient.

- August 2022: SOUL +FIX announced its entry into the Southeast Asian market with its blue spirulina powder supplement and plans for further R&D into new formulations.

In-Depth Algae Supplements Market Market Outlook

The future outlook for the algae supplements market is exceptionally promising, driven by sustained innovation and evolving consumer preferences. Growth accelerators such as advancements in sustainable cultivation techniques, strategic collaborations, and the increasing use of algae in diverse food applications are set to propel the market forward. The emphasis on scientifically validated health benefits and the inherent natural and sustainable appeal of algae position it favorably against synthetic alternatives. The market is expected to witness continued expansion as new species are explored, novel delivery systems are developed, and global awareness of algae's multifaceted health advantages continues to rise. The projected market size is expected to reach $7,850 million by 2033.

Algae Supplements Market Segmentation

-

1. Product Type

- 1.1. Spirulina

- 1.2. Astaxanthin

- 1.3. Chlorella

- 1.4. Combination Supplements

-

2. Form

- 2.1. Powder

- 2.2. Tablet

- 2.3. Capsule

- 2.4. Liquid

Algae Supplements Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Algae Supplements Market Regional Market Share

Geographic Coverage of Algae Supplements Market

Algae Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Awareness Related to Algae-based Supplements; Surging Demand for Plant-based Supplements

- 3.3. Market Restrains

- 3.3.1. Growing Consumer Awareness Related to Algae-based Supplements; Surging Demand for Plant-based Supplements

- 3.4. Market Trends

- 3.4.1. Rising Awareness Regarding the Health Benefits of Spirulina Supplements Driving Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Algae Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Spirulina

- 5.1.2. Astaxanthin

- 5.1.3. Chlorella

- 5.1.4. Combination Supplements

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Powder

- 5.2.2. Tablet

- 5.2.3. Capsule

- 5.2.4. Liquid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Algae Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Spirulina

- 6.1.2. Astaxanthin

- 6.1.3. Chlorella

- 6.1.4. Combination Supplements

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Powder

- 6.2.2. Tablet

- 6.2.3. Capsule

- 6.2.4. Liquid

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Algae Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Spirulina

- 7.1.2. Astaxanthin

- 7.1.3. Chlorella

- 7.1.4. Combination Supplements

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Powder

- 7.2.2. Tablet

- 7.2.3. Capsule

- 7.2.4. Liquid

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Algae Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Spirulina

- 8.1.2. Astaxanthin

- 8.1.3. Chlorella

- 8.1.4. Combination Supplements

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Powder

- 8.2.2. Tablet

- 8.2.3. Capsule

- 8.2.4. Liquid

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Algae Supplements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Spirulina

- 9.1.2. Astaxanthin

- 9.1.3. Chlorella

- 9.1.4. Combination Supplements

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Powder

- 9.2.2. Tablet

- 9.2.3. Capsule

- 9.2.4. Liquid

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Algae Supplements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Spirulina

- 10.1.2. Astaxanthin

- 10.1.3. Chlorella

- 10.1.4. Combination Supplements

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Powder

- 10.2.2. Tablet

- 10.2.3. Capsule

- 10.2.4. Liquid

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NOW Foods

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cyanotech Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Parry Nutraceuticals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fuqing King Dnarmsa Spirulina

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Natures Way Products

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kent BioEnergy Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Algae Health Sciences

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pharmavite LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Doctor's Best

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vitamin Discount Center*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NOW Foods

List of Figures

- Figure 1: Global Algae Supplements Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Algae Supplements Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Algae Supplements Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Algae Supplements Market Volume (Billion), by Product Type 2025 & 2033

- Figure 5: North America Algae Supplements Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Algae Supplements Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Algae Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 8: North America Algae Supplements Market Volume (Billion), by Form 2025 & 2033

- Figure 9: North America Algae Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 10: North America Algae Supplements Market Volume Share (%), by Form 2025 & 2033

- Figure 11: North America Algae Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Algae Supplements Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Algae Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Algae Supplements Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Algae Supplements Market Revenue (Million), by Product Type 2025 & 2033

- Figure 16: Europe Algae Supplements Market Volume (Billion), by Product Type 2025 & 2033

- Figure 17: Europe Algae Supplements Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Algae Supplements Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Algae Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 20: Europe Algae Supplements Market Volume (Billion), by Form 2025 & 2033

- Figure 21: Europe Algae Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 22: Europe Algae Supplements Market Volume Share (%), by Form 2025 & 2033

- Figure 23: Europe Algae Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Algae Supplements Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Algae Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Algae Supplements Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Algae Supplements Market Revenue (Million), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Algae Supplements Market Volume (Billion), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Algae Supplements Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Algae Supplements Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Algae Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 32: Asia Pacific Algae Supplements Market Volume (Billion), by Form 2025 & 2033

- Figure 33: Asia Pacific Algae Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 34: Asia Pacific Algae Supplements Market Volume Share (%), by Form 2025 & 2033

- Figure 35: Asia Pacific Algae Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Algae Supplements Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Algae Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Algae Supplements Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Algae Supplements Market Revenue (Million), by Product Type 2025 & 2033

- Figure 40: South America Algae Supplements Market Volume (Billion), by Product Type 2025 & 2033

- Figure 41: South America Algae Supplements Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: South America Algae Supplements Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: South America Algae Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 44: South America Algae Supplements Market Volume (Billion), by Form 2025 & 2033

- Figure 45: South America Algae Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 46: South America Algae Supplements Market Volume Share (%), by Form 2025 & 2033

- Figure 47: South America Algae Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Algae Supplements Market Volume (Billion), by Country 2025 & 2033

- Figure 49: South America Algae Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Algae Supplements Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Algae Supplements Market Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Algae Supplements Market Volume (Billion), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Algae Supplements Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Algae Supplements Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Algae Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 56: Middle East and Africa Algae Supplements Market Volume (Billion), by Form 2025 & 2033

- Figure 57: Middle East and Africa Algae Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 58: Middle East and Africa Algae Supplements Market Volume Share (%), by Form 2025 & 2033

- Figure 59: Middle East and Africa Algae Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Algae Supplements Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Algae Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Algae Supplements Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Algae Supplements Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Algae Supplements Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Algae Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 4: Global Algae Supplements Market Volume Billion Forecast, by Form 2020 & 2033

- Table 5: Global Algae Supplements Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Algae Supplements Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Algae Supplements Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Algae Supplements Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Global Algae Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 10: Global Algae Supplements Market Volume Billion Forecast, by Form 2020 & 2033

- Table 11: Global Algae Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Algae Supplements Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Algae Supplements Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Algae Supplements Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 15: Global Algae Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 16: Global Algae Supplements Market Volume Billion Forecast, by Form 2020 & 2033

- Table 17: Global Algae Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Algae Supplements Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Algae Supplements Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Algae Supplements Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 21: Global Algae Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 22: Global Algae Supplements Market Volume Billion Forecast, by Form 2020 & 2033

- Table 23: Global Algae Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Algae Supplements Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Algae Supplements Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Algae Supplements Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 27: Global Algae Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 28: Global Algae Supplements Market Volume Billion Forecast, by Form 2020 & 2033

- Table 29: Global Algae Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Algae Supplements Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Algae Supplements Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Algae Supplements Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Algae Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 34: Global Algae Supplements Market Volume Billion Forecast, by Form 2020 & 2033

- Table 35: Global Algae Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Algae Supplements Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algae Supplements Market?

The projected CAGR is approximately 13.38%.

2. Which companies are prominent players in the Algae Supplements Market?

Key companies in the market include NOW Foods, Cyanotech Corporation, Parry Nutraceuticals, Fuqing King Dnarmsa Spirulina, Natures Way Products, Kent BioEnergy Corporation, Algae Health Sciences, Pharmavite LLC, Doctor's Best, Vitamin Discount Center*List Not Exhaustive.

3. What are the main segments of the Algae Supplements Market?

The market segments include Product Type, Form.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Awareness Related to Algae-based Supplements; Surging Demand for Plant-based Supplements.

6. What are the notable trends driving market growth?

Rising Awareness Regarding the Health Benefits of Spirulina Supplements Driving Market Growth.

7. Are there any restraints impacting market growth?

Growing Consumer Awareness Related to Algae-based Supplements; Surging Demand for Plant-based Supplements.

8. Can you provide examples of recent developments in the market?

May 2024: Algine Plus, a manufacturer of algae-based dietary supplements, launched its product line on Walmart. The product line includes products such as Algine Plus Ocean Greens, Algine Plus Astaxanthin, and Algine Plus Phosphatidylserine. This was part of the company’s goal to expand its reach and make its premium offerings accessible to a wider audience worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algae Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algae Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algae Supplements Market?

To stay informed about further developments, trends, and reports in the Algae Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence