Key Insights

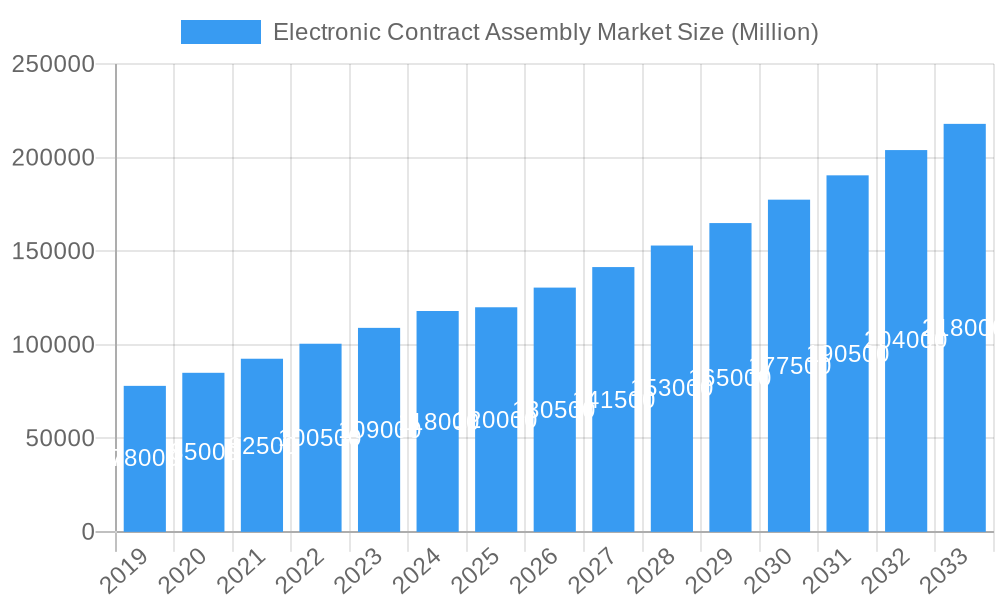

The global Electronic Contract Assembly market is projected for substantial growth, reaching an estimated market size of $790.42 billion by 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 11% from 2025 to 2033. Key drivers include the increasing adoption of outsourced manufacturing for specialized expertise, cost optimization, and accelerated time-to-market across diverse industries. Significant demand stems from the healthcare sector's reliance on advanced medical device components, automotive industry innovations in electronic systems, and the IT and Telecom sectors' need for high-volume, quality-assured assembly. Miniaturization and enhanced functionality in electronic devices further fuel the demand for specialized contract assembly.

Electronic Contract Assembly Market Market Size (In Billion)

The market comprises several key segments, with PCB Assembly Services holding a leading position. Cable/Harness Assembly Services and Membrane/Keypad Switch Assembly Services are also vital for specific product requirements. While market expansion is anticipated, geopolitical factors and raw material price volatility present potential challenges. However, the presence of major players and strategic growth initiatives in regions like Asia Pacific, particularly China and India, are expected to support continued market momentum throughout the forecast period (2025-2033), reinforcing the market's integral role in the global electronics supply chain.

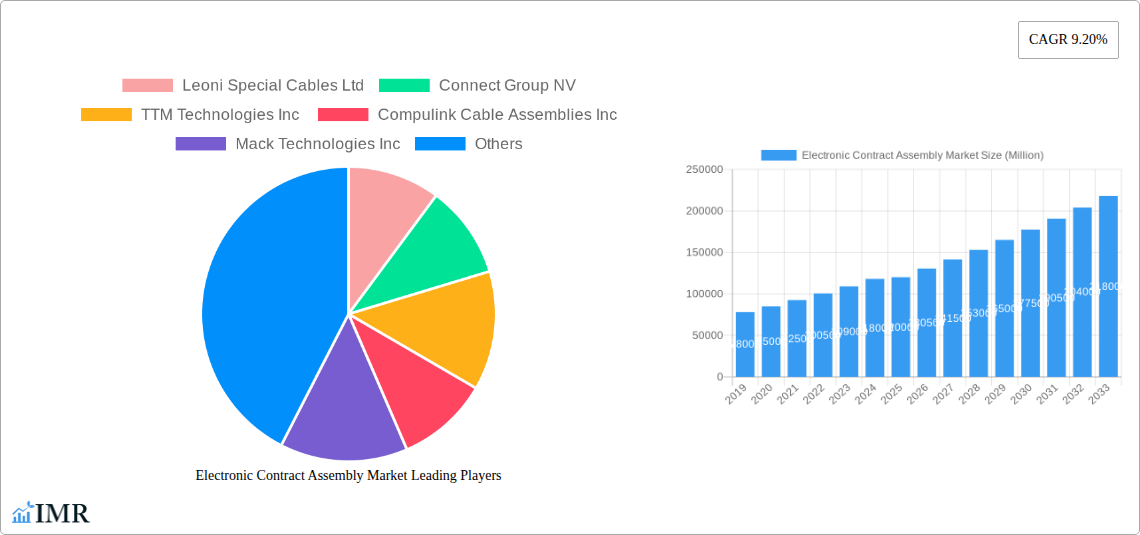

Electronic Contract Assembly Market Company Market Share

Electronic Contract Assembly Market Report: Comprehensive Analysis and Future Outlook (2019–2033)

Unlock critical insights into the global Electronic Contract Assembly market, a rapidly evolving sector crucial for advancements in healthcare, automotive, industrial automation, and telecommunications. This in-depth report, covering the historical period of 2019-2024, base year 2025, and a forecast period extending to 2033, provides a definitive analysis of market dynamics, growth drivers, key players, and emerging opportunities. Essential for industry leaders, strategists, and investors, this report empowers informed decision-making in a competitive landscape.

Electronic Contract Assembly Market Market Dynamics & Structure

The Electronic Contract Assembly market exhibits a moderately concentrated structure, with several key players holding significant market share while a multitude of smaller, specialized firms cater to niche requirements. Technological innovation serves as a primary driver, fueled by increasing demand for miniaturization, higher performance, and enhanced durability in electronic devices across all sectors. Regulatory frameworks, particularly those pertaining to electronic manufacturing services (EMS), printed circuit board (PCB) assembly, and cable harness manufacturing, influence production standards and market entry. Competitive product substitutes are emerging, driven by advancements in material science and automated manufacturing processes, though the specialized nature of contract assembly limits direct substitution for complex assemblies. End-user demographics are shifting towards a greater reliance on sophisticated electronic systems, particularly in the burgeoning IoT (Internet of Things) and 5G infrastructure domains, necessitating advanced assembly capabilities. Mergers & Acquisitions (M&A) trends indicate a strategic consolidation, with larger players acquiring smaller, innovative firms to expand their service portfolios and geographical reach. For instance, in the parent market of Electronics Manufacturing Services (EMS), M&A activities are frequent, aiming to capture a larger share of the child market of Electronic Contract Assembly.

- Market Concentration: Dominated by a mix of large global EMS providers and specialized contract manufacturers.

- Technological Innovation: Driven by demand for advanced components, miniaturization, and high-reliability assemblies.

- Regulatory Frameworks: Compliance with international standards for quality, safety, and environmental impact is paramount.

- Competitive Substitutes: Emerging in materials and semi-automated solutions, but specialized expertise remains a barrier.

- End-User Demographics: Growing demand from burgeoning sectors like automotive electronics, medical devices, and industrial automation.

- M&A Trends: Strategic acquisitions to gain market share, technological capabilities, and diversified service offerings within the EMS ecosystem.

Electronic Contract Assembly Market Growth Trends & Insights

The Electronic Contract Assembly market is poised for robust expansion, driven by an escalating demand for outsourced electronic manufacturing solutions across diverse industries. The market size evolution has seen a consistent upward trajectory, a trend anticipated to accelerate. Adoption rates of contract assembly services are increasing as companies focus on core competencies, leveraging the expertise and efficiency of specialized providers for their electronic production needs. Technological disruptions, such as the widespread implementation of Industry 4.0 principles and advanced automation in PCB assembly services and cable/harness assembly services, are reshaping production processes, leading to higher throughput and improved quality. Consumer behavior shifts, characterized by an insatiable appetite for smarter, more connected devices, are further propelling demand for sophisticated electronic assemblies. The global Electronic Contract Assembly market size is projected to reach substantial figures, with a notable Compound Annual Growth Rate (CAGR) anticipated over the forecast period. Market penetration is deepening as more businesses recognize the cost-effectiveness and scalability offered by contract assembly. The increasing complexity of electronic products, from advanced medical implants to sophisticated automotive control units, mandates specialized assembly capabilities that contract manufacturers are uniquely positioned to provide. This sustained demand, coupled with ongoing technological advancements, solidifies the positive outlook for the electronic contract manufacturing market.

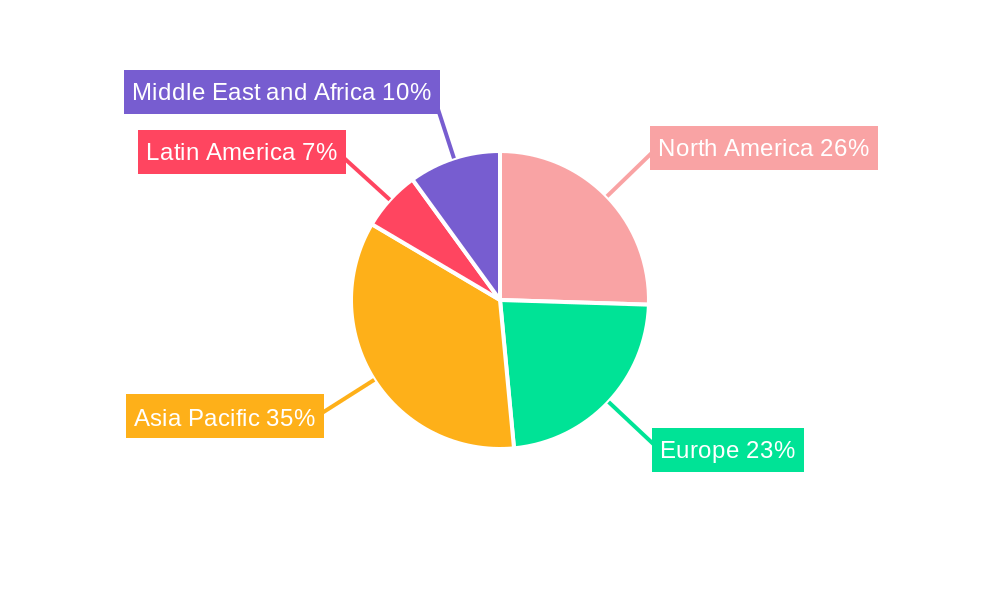

Dominant Regions, Countries, or Segments in Electronic Contract Assembly Market

The IT and Telecom segment, particularly encompassing PCB Assembly Services, is a dominant force driving growth within the Electronic Contract Assembly market. This segment's leadership is fueled by the relentless expansion of digital infrastructure, the proliferation of 5G networks, and the ever-increasing demand for advanced computing and communication devices. Countries like China, Taiwan, and South Korea are central hubs for electronic contract manufacturing, leveraging their established manufacturing prowess, robust supply chains, and significant investments in advanced manufacturing technologies. These regions benefit from supportive government policies, extensive infrastructure development, and a highly skilled workforce dedicated to the electronics industry.

In terms of Type of Activity, PCB Assembly Services are at the forefront, providing the foundational electronic circuitry for an extensive array of products. This is closely followed by Cable/Harness Assembly Services, which are indispensable for connecting components and enabling system functionality across industries like automotive and industrial automation. The Application sector of Automotive is also a significant growth engine, driven by the electrification of vehicles, the integration of advanced driver-assistance systems (ADAS), and the increasing prevalence of complex electronic control units (ECUs). The Healthcare sector is another critical area, with a growing demand for miniaturized, high-reliability medical devices and diagnostic equipment requiring specialized contract assembly.

- Dominant Segment (Type of Activity): PCB Assembly Services – forming the backbone of nearly all electronic devices.

- Key Drivers: Miniaturization, complex circuitry requirements, demand for high-density interconnect (HDI) boards.

- Market Share: Consistently holds the largest share due to its fundamental role.

- Dominant Segment (Application): IT and Telecom – driven by digital transformation and connectivity.

- Key Drivers: 5G rollout, cloud computing infrastructure, IoT device proliferation, consumer electronics demand.

- Growth Potential: High, due to continuous innovation and network upgrades.

- Leading Regions/Countries: Asia-Pacific, specifically China, Taiwan, and South Korea.

- Economic Policies: Favorable investment climates and government support for manufacturing.

- Infrastructure: Advanced manufacturing facilities, logistics networks, and skilled labor pools.

- Supply Chain Integration: Highly developed and efficient supply chains for electronic components.

- Significant Growth Areas: Automotive (EVs, ADAS), Healthcare (medical devices, diagnostics), Industrial (automation, IoT).

Electronic Contract Assembly Market Product Landscape

The product landscape within the Electronic Contract Assembly market is characterized by increasing complexity and customization. Manufacturers are offering a broad spectrum of solutions, from simple wire harnesses to intricate multi-layer Printed Circuit Board assemblies populated with the latest semiconductor components. Innovations focus on enhancing reliability, miniaturization, and performance to meet the stringent demands of modern electronic devices. Unique selling propositions often lie in advanced manufacturing capabilities, such as high-precision soldering techniques, conformal coating services for environmental protection, and rigorous testing protocols to ensure product integrity. Technological advancements in automated assembly equipment and sophisticated quality control systems are critical differentiators, enabling manufacturers to handle intricate designs and meet high-volume production requirements efficiently.

Key Drivers, Barriers & Challenges in Electronic Contract Assembly Market

Key Drivers:

- Growing Demand for Advanced Electronics: The ubiquitous nature of electronic devices in healthcare, automotive, industrial, and IT sectors fuels the need for specialized assembly.

- Focus on Core Competencies: Companies increasingly outsource assembly to concentrate on R&D and product design.

- Cost-Effectiveness and Scalability: Contract manufacturers offer economies of scale and flexible production capacities.

- Technological Advancements: The need for assembly of increasingly complex and miniaturized components drives innovation in contract manufacturing.

Barriers & Challenges:

- Supply Chain Volatility: Disruptions in the global supply chain for electronic components can impact production schedules and costs.

- Intellectual Property Protection: Ensuring the security of sensitive designs and manufacturing processes is crucial.

- Stringent Quality and Regulatory Standards: Meeting diverse and evolving industry-specific compliance requirements can be challenging.

- Intense Competition: A highly competitive market can lead to pricing pressures and necessitate continuous investment in technology and efficiency.

- Skilled Workforce Shortages: Finding and retaining skilled technicians and engineers for advanced assembly processes can be a bottleneck.

- Geopolitical Instability: Trade tensions and regional conflicts can disrupt global manufacturing operations and supply chains.

Emerging Opportunities in Electronic Contract Assembly Market

Emerging opportunities in the Electronic Contract Assembly market are abundant, driven by transformative technological shifts and evolving consumer needs. The burgeoning Internet of Things (IoT) ecosystem presents a significant avenue, with the demand for smart devices requiring specialized, high-volume contract assembly. The rapid growth of the electric vehicle (EV) market necessitates specialized battery management systems, power electronics, and sensor assemblies, creating substantial opportunities for manufacturers with relevant expertise. Furthermore, the increasing adoption of AI and machine learning in industrial automation and consumer electronics will drive demand for complex, integrated electronic modules. The growing emphasis on sustainability and circular economy principles is also opening doors for contract manufacturers offering eco-friendly production processes and end-of-life management solutions. Expansion into emerging geographical markets with growing industrial bases also represents a key opportunity.

Growth Accelerators in the Electronic Contract Assembly Market Industry

Several catalysts are accelerating long-term growth in the Electronic Contract Assembly market. Technological breakthroughs in areas like advanced semiconductor packaging, additive manufacturing (3D printing of electronics), and robotics are enhancing assembly precision, efficiency, and enabling the creation of novel electronic functionalities. Strategic partnerships between contract manufacturers and component suppliers, as well as with end-product manufacturers, are fostering innovation and creating more integrated supply chains. Market expansion strategies, including diversification into high-growth application sectors like medical devices and aerospace, and the establishment of manufacturing facilities in regions with strong market demand, are further propelling growth. The increasing complexity and miniaturization of electronic components, coupled with the demand for highly integrated systems, create a continuous need for specialized assembly expertise, thus acting as a sustained growth accelerator.

Key Players Shaping the Electronic Contract Assembly Market Market

- Leoni Special Cables Ltd

- Connect Group NV

- TTM Technologies Inc

- Compulink Cable Assemblies Inc

- Mack Technologies Inc

- ATL Technology

- Amphenol Interconnect Products Corp (AIPC)

- Season Group International Co Ltd

- Volex Group PLC

Notable Milestones in Electronic Contract Assembly Market Sector

- October 2021: Amphenol launched a new range of robust display solutions, the Mini DisplayPort and HDMI connectors, designed for harsh environments such as C5ISR, ground vehicles, and naval equipment, ensuring reliable transmission between displays, cameras, and computers. This innovation caters to the growing demand for durable connectivity in critical applications.

- November 2020: Advanced Circuits introduced "PCB Artist," a free PCB design layout software aimed at speeding up the design process and identifying potential errors before prototyping or production, addressing a key challenge for electronics designers. This initiative democratizes PCB design and improves manufacturing efficiency.

In-Depth Electronic Contract Assembly Market Market Outlook

The future outlook for the Electronic Contract Assembly market is exceptionally promising, driven by sustained innovation and expanding application scopes. Growth accelerators like the relentless advancement in semiconductor technology, the increasing integration of smart functionalities across all product categories, and the global push towards digital transformation will continue to fuel demand for sophisticated assembly services. Strategic collaborations and the adoption of Industry 4.0 principles, including AI-powered automation and advanced data analytics for quality control, will enhance operational efficiency and competitiveness. Emerging opportunities in sectors like advanced medical devices, renewable energy systems, and next-generation communication infrastructure present substantial avenues for market expansion. As industries continue to prioritize core competencies and seek cost-effective, scalable manufacturing solutions, the role of specialized electronic contract assemblers will become even more indispensable, solidifying their position as critical enablers of technological progress.

Electronic Contract Assembly Market Segmentation

-

1. Type of Activity

- 1.1. PCB Assembly Services

- 1.2. Cable/Harness Assembly Services

- 1.3. Membrane/Keypad Switch Assembly Services

-

2. Application

- 2.1. Healthcare

- 2.2. Automotive

- 2.3. Industrial

- 2.4. IT and Telecom

- 2.5. Other Applications

Electronic Contract Assembly Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. South Africa

- 5.3. Saudi Arabia

- 5.4. Rest Of MEA

Electronic Contract Assembly Market Regional Market Share

Geographic Coverage of Electronic Contract Assembly Market

Electronic Contract Assembly Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of MEMS Technology; Increasing demand of water treatment facilities in the region

- 3.3. Market Restrains

- 3.3.1. ; Lack of Standard Protocols for the Development of Power Modules; Slow Adoption of New Technologies Derailing Innovation

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electronic Contract Assembly Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Activity

- 5.1.1. PCB Assembly Services

- 5.1.2. Cable/Harness Assembly Services

- 5.1.3. Membrane/Keypad Switch Assembly Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Healthcare

- 5.2.2. Automotive

- 5.2.3. Industrial

- 5.2.4. IT and Telecom

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Activity

- 6. North America Electronic Contract Assembly Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Activity

- 6.1.1. PCB Assembly Services

- 6.1.2. Cable/Harness Assembly Services

- 6.1.3. Membrane/Keypad Switch Assembly Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Healthcare

- 6.2.2. Automotive

- 6.2.3. Industrial

- 6.2.4. IT and Telecom

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type of Activity

- 7. Europe Electronic Contract Assembly Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Activity

- 7.1.1. PCB Assembly Services

- 7.1.2. Cable/Harness Assembly Services

- 7.1.3. Membrane/Keypad Switch Assembly Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Healthcare

- 7.2.2. Automotive

- 7.2.3. Industrial

- 7.2.4. IT and Telecom

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type of Activity

- 8. Asia Pacific Electronic Contract Assembly Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Activity

- 8.1.1. PCB Assembly Services

- 8.1.2. Cable/Harness Assembly Services

- 8.1.3. Membrane/Keypad Switch Assembly Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Healthcare

- 8.2.2. Automotive

- 8.2.3. Industrial

- 8.2.4. IT and Telecom

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type of Activity

- 9. Latin America Electronic Contract Assembly Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Activity

- 9.1.1. PCB Assembly Services

- 9.1.2. Cable/Harness Assembly Services

- 9.1.3. Membrane/Keypad Switch Assembly Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Healthcare

- 9.2.2. Automotive

- 9.2.3. Industrial

- 9.2.4. IT and Telecom

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type of Activity

- 10. Middle East and Africa Electronic Contract Assembly Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Activity

- 10.1.1. PCB Assembly Services

- 10.1.2. Cable/Harness Assembly Services

- 10.1.3. Membrane/Keypad Switch Assembly Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Healthcare

- 10.2.2. Automotive

- 10.2.3. Industrial

- 10.2.4. IT and Telecom

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type of Activity

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Leoni Special Cables Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Connect Group NV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TTM Technologies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Compulink Cable Assemblies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mack Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ATL Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amphenol Interconnect Products Corp (AIPC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Season Group International Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Volex Group PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Leoni Special Cables Ltd

List of Figures

- Figure 1: Global Electronic Contract Assembly Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Electronic Contract Assembly Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Electronic Contract Assembly Market Revenue (billion), by Type of Activity 2025 & 2033

- Figure 4: North America Electronic Contract Assembly Market Volume (K Unit), by Type of Activity 2025 & 2033

- Figure 5: North America Electronic Contract Assembly Market Revenue Share (%), by Type of Activity 2025 & 2033

- Figure 6: North America Electronic Contract Assembly Market Volume Share (%), by Type of Activity 2025 & 2033

- Figure 7: North America Electronic Contract Assembly Market Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Electronic Contract Assembly Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Electronic Contract Assembly Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Electronic Contract Assembly Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Electronic Contract Assembly Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Electronic Contract Assembly Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Electronic Contract Assembly Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Electronic Contract Assembly Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Electronic Contract Assembly Market Revenue (billion), by Type of Activity 2025 & 2033

- Figure 16: Europe Electronic Contract Assembly Market Volume (K Unit), by Type of Activity 2025 & 2033

- Figure 17: Europe Electronic Contract Assembly Market Revenue Share (%), by Type of Activity 2025 & 2033

- Figure 18: Europe Electronic Contract Assembly Market Volume Share (%), by Type of Activity 2025 & 2033

- Figure 19: Europe Electronic Contract Assembly Market Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Electronic Contract Assembly Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Electronic Contract Assembly Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Electronic Contract Assembly Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Electronic Contract Assembly Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Electronic Contract Assembly Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Electronic Contract Assembly Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Electronic Contract Assembly Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Electronic Contract Assembly Market Revenue (billion), by Type of Activity 2025 & 2033

- Figure 28: Asia Pacific Electronic Contract Assembly Market Volume (K Unit), by Type of Activity 2025 & 2033

- Figure 29: Asia Pacific Electronic Contract Assembly Market Revenue Share (%), by Type of Activity 2025 & 2033

- Figure 30: Asia Pacific Electronic Contract Assembly Market Volume Share (%), by Type of Activity 2025 & 2033

- Figure 31: Asia Pacific Electronic Contract Assembly Market Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Pacific Electronic Contract Assembly Market Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Electronic Contract Assembly Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Electronic Contract Assembly Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Electronic Contract Assembly Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Electronic Contract Assembly Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Electronic Contract Assembly Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Electronic Contract Assembly Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Electronic Contract Assembly Market Revenue (billion), by Type of Activity 2025 & 2033

- Figure 40: Latin America Electronic Contract Assembly Market Volume (K Unit), by Type of Activity 2025 & 2033

- Figure 41: Latin America Electronic Contract Assembly Market Revenue Share (%), by Type of Activity 2025 & 2033

- Figure 42: Latin America Electronic Contract Assembly Market Volume Share (%), by Type of Activity 2025 & 2033

- Figure 43: Latin America Electronic Contract Assembly Market Revenue (billion), by Application 2025 & 2033

- Figure 44: Latin America Electronic Contract Assembly Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: Latin America Electronic Contract Assembly Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Latin America Electronic Contract Assembly Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Latin America Electronic Contract Assembly Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Latin America Electronic Contract Assembly Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Electronic Contract Assembly Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Electronic Contract Assembly Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Electronic Contract Assembly Market Revenue (billion), by Type of Activity 2025 & 2033

- Figure 52: Middle East and Africa Electronic Contract Assembly Market Volume (K Unit), by Type of Activity 2025 & 2033

- Figure 53: Middle East and Africa Electronic Contract Assembly Market Revenue Share (%), by Type of Activity 2025 & 2033

- Figure 54: Middle East and Africa Electronic Contract Assembly Market Volume Share (%), by Type of Activity 2025 & 2033

- Figure 55: Middle East and Africa Electronic Contract Assembly Market Revenue (billion), by Application 2025 & 2033

- Figure 56: Middle East and Africa Electronic Contract Assembly Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa Electronic Contract Assembly Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Electronic Contract Assembly Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Electronic Contract Assembly Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Electronic Contract Assembly Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Electronic Contract Assembly Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Electronic Contract Assembly Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electronic Contract Assembly Market Revenue billion Forecast, by Type of Activity 2020 & 2033

- Table 2: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Type of Activity 2020 & 2033

- Table 3: Global Electronic Contract Assembly Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Electronic Contract Assembly Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Electronic Contract Assembly Market Revenue billion Forecast, by Type of Activity 2020 & 2033

- Table 8: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Type of Activity 2020 & 2033

- Table 9: Global Electronic Contract Assembly Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Electronic Contract Assembly Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Global Electronic Contract Assembly Market Revenue billion Forecast, by Type of Activity 2020 & 2033

- Table 18: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Type of Activity 2020 & 2033

- Table 19: Global Electronic Contract Assembly Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Global Electronic Contract Assembly Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Germany Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: France Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: France Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Electronic Contract Assembly Market Revenue billion Forecast, by Type of Activity 2020 & 2033

- Table 32: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Type of Activity 2020 & 2033

- Table 33: Global Electronic Contract Assembly Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Global Electronic Contract Assembly Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: China Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: China Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Japan Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Japan Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: India Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: India Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Rest of Asia Pacific Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Rest of Asia Pacific Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Global Electronic Contract Assembly Market Revenue billion Forecast, by Type of Activity 2020 & 2033

- Table 46: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Type of Activity 2020 & 2033

- Table 47: Global Electronic Contract Assembly Market Revenue billion Forecast, by Application 2020 & 2033

- Table 48: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 49: Global Electronic Contract Assembly Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Brazil Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Brazil Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Argentina Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Argentina Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Rest of South America Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of South America Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Global Electronic Contract Assembly Market Revenue billion Forecast, by Type of Activity 2020 & 2033

- Table 58: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Type of Activity 2020 & 2033

- Table 59: Global Electronic Contract Assembly Market Revenue billion Forecast, by Application 2020 & 2033

- Table 60: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 61: Global Electronic Contract Assembly Market Revenue billion Forecast, by Country 2020 & 2033

- Table 62: Global Electronic Contract Assembly Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 63: UAE Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: UAE Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: South Africa Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: South Africa Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Saudi Arabia Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: Saudi Arabia Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: Rest Of MEA Electronic Contract Assembly Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Rest Of MEA Electronic Contract Assembly Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Contract Assembly Market?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the Electronic Contract Assembly Market?

Key companies in the market include Leoni Special Cables Ltd, Connect Group NV, TTM Technologies Inc , Compulink Cable Assemblies Inc, Mack Technologies Inc, ATL Technology, Amphenol Interconnect Products Corp (AIPC), Season Group International Co Ltd, Volex Group PLC.

3. What are the main segments of the Electronic Contract Assembly Market?

The market segments include Type of Activity, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 790.42 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of MEMS Technology; Increasing demand of water treatment facilities in the region.

6. What are the notable trends driving market growth?

Consumer Electronics to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Lack of Standard Protocols for the Development of Power Modules; Slow Adoption of New Technologies Derailing Innovation.

8. Can you provide examples of recent developments in the market?

October 2021 - Amphenol has launched a new range of robust display solutions, the Mini DisplayPort and HDMI connectors. Amphenol's new solution is designed to transmit video data and information in the harsh environment of equipment such as C5ISR, ground vehicles, and the Navy. These new connectors are built to ensure reliable transmission between display screens, cameras, and computers. The new Rugged Display Solutions range covers protocols such as DisplayPort and HDMI. A standard DisplayPort or HDMI plug or cord set can be converted into a military-grade solution for harsh environments with a high level of sealing and durability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electronic Contract Assembly Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electronic Contract Assembly Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electronic Contract Assembly Market?

To stay informed about further developments, trends, and reports in the Electronic Contract Assembly Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence