Key Insights

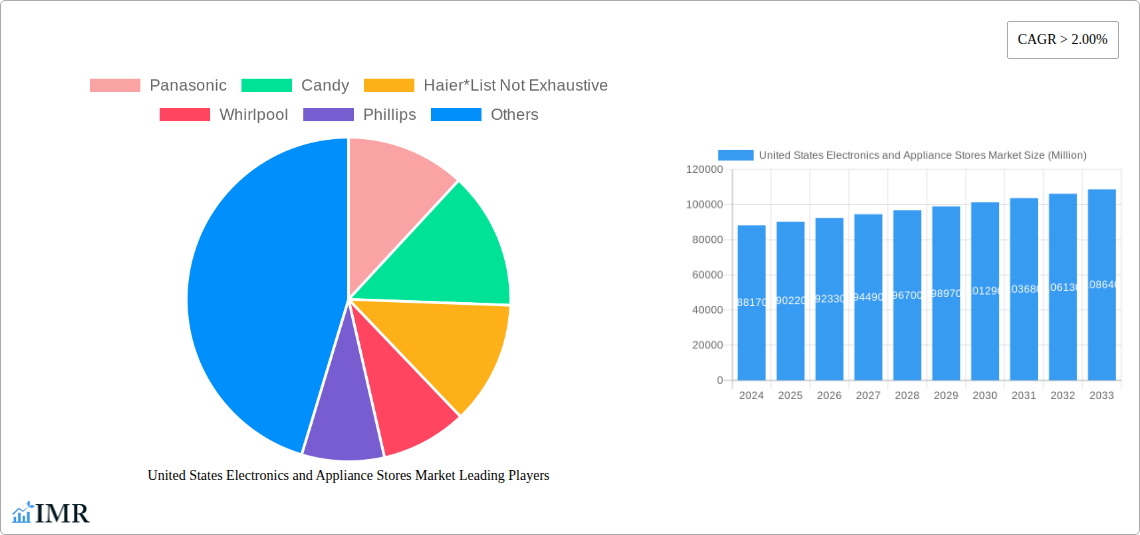

The United States Electronics and Appliance Stores Market is poised for steady growth, reaching an estimated $88.17 billion in 2024, with a projected Compound Annual Growth Rate (CAGR) of 2.3% through 2033. This robust expansion is fueled by several key drivers, including an increasing consumer demand for smart home technology, energy-efficient appliances, and cutting-edge consumer electronics. The desire for enhanced convenience, entertainment, and modern living continues to propel sales across various retail channels. Furthermore, technological advancements leading to more innovative and feature-rich products are consistently attracting consumer interest and driving upgrade cycles. The market is also benefiting from a resurgence in home improvement activities, with consumers investing in both new appliances and upgraded electronic systems for their residences.

United States Electronics and Appliance Stores Market Market Size (In Billion)

Several trends are shaping the competitive landscape of the US electronics and appliance retail sector. The rise of online retail continues to be a significant force, offering consumers unparalleled convenience, wider product selection, and competitive pricing. This has led to an evolution in brick-and-mortar stores, with many adopting omnichannel strategies to integrate their online and offline presence. Exclusive retailers and showrooms are focusing on providing premium customer experiences and showcasing high-end products, while inclusive dealers are adapting by offering a broader range of brands and price points. While the market is generally stable, potential restraints such as supply chain disruptions, rising inflation impacting consumer discretionary spending, and intense price competition among retailers could pose challenges. Nevertheless, the underlying demand for technologically advanced and efficient home products is expected to sustain positive market momentum.

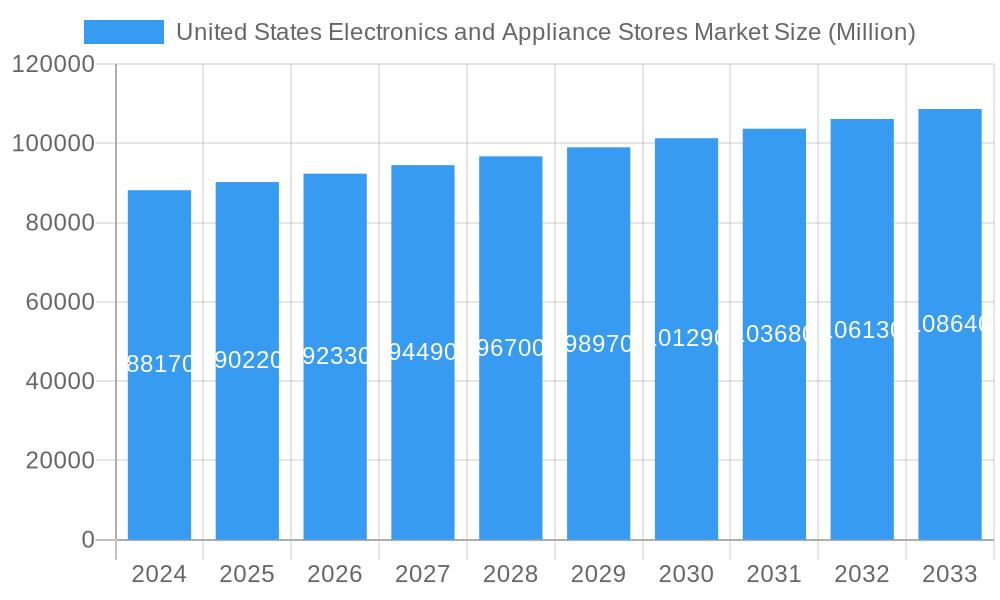

United States Electronics and Appliance Stores Market Company Market Share

This report provides an in-depth analysis of the United States Electronics and Appliance Stores Market, a dynamic sector driven by technological innovation, evolving consumer preferences, and strategic industry consolidation. Delve into the market's structure, growth trajectory, dominant segments, and the competitive landscape, offering invaluable insights for manufacturers, retailers, investors, and industry stakeholders. The analysis covers the period from 2019 to 2033, with a base year of 2025, and includes historical data from 2019-2024 and forecast data from 2025-2033.

United States Electronics and Appliance Stores Market Market Dynamics & Structure

The United States electronics and appliance stores market is characterized by a moderate to high level of market concentration, with major players like Whirlpool, GE Appliances (a Haier company), and Panasonic holding significant shares. Technological innovation remains a primary driver, fueled by advancements in smart home technology, energy efficiency, and connected devices. Regulatory frameworks, including energy efficiency standards and consumer protection laws, shape product development and market access. The competitive landscape is influenced by direct product substitutes, such as the DIY repair market and the growing prevalence of refurbished goods. End-user demographics are shifting, with an increasing demand for premium, feature-rich, and sustainable products from a digitally-savvy consumer base. Mergers and acquisitions (M&A) are a significant trend, consolidating market power and expanding product portfolios, as evidenced by Whirlpool's acquisition of InSinkErator and Mitsubishi Electric's acquisition of Computer Protection Technology, Inc. (CPT).

- Market Concentration: Dominated by a few key players, but with a robust ecosystem of independent retailers.

- Technological Innovation Drivers: Smart home integration, AI-powered features, energy efficiency mandates, and enhanced user experience.

- Regulatory Frameworks: Energy Star certifications, FCC regulations, and consumer data privacy laws.

- Competitive Product Substitutes: DIY repair, rental services, and the secondary market for used appliances.

- End-User Demographics: Increasing demand from Millennials and Gen Z for connected and sustainable products.

- M&A Trends: Strategic acquisitions to expand market reach, acquire new technologies, and enhance product offerings.

United States Electronics and Appliance Stores Market Growth Trends & Insights

The United States electronics and appliance stores market is poised for robust growth, driven by a confluence of economic recovery, increasing disposable incomes, and a persistent demand for upgraded and technologically advanced home solutions. The market size evolution is projected to show a steady upward trend, with a Compound Annual Growth Rate (CAGR) estimated at xx% during the forecast period. Adoption rates for smart home devices and energy-efficient appliances are accelerating as consumers become more aware of the benefits in terms of convenience, cost savings, and environmental impact. Technological disruptions, such as the integration of artificial intelligence (AI) into appliances for personalized user experiences, are redefining product capabilities and consumer expectations. Shifts in consumer behavior, including a greater emphasis on online purchasing, subscription-based services for maintenance and upgrades, and a growing preference for sustainable and eco-friendly products, are significantly shaping market dynamics. The base year, 2025, represents a pivotal point where these trends are becoming increasingly ingrained in consumer purchasing decisions. The market penetration of premium and feature-rich appliances continues to expand, reflecting a growing consumer willingness to invest in home comfort and efficiency. The increasing adoption of AI, as exemplified by GE Appliances' Flavorly™ AI feature, signifies a paradigm shift towards more intuitive and personalized home appliance interactions. Furthermore, the post-pandemic emphasis on home improvement and enhancement continues to fuel demand for both essential and aspirational electronic and appliance purchases.

Dominant Regions, Countries, or Segments in United States Electronics and Appliance Stores Market

The United States electronics and appliance stores market exhibits dominance across several key segments and regions, driven by a combination of economic strength, consumer demographics, and established retail infrastructure. Among the Type segments, Consumer Electronic Stores are anticipated to lead market growth, reflecting the continuous innovation and high demand for cutting-edge gadgets, entertainment systems, and smart home devices. The Ownership segment is witnessing a strong performance from Retail Chains, owing to their extensive distribution networks, brand recognition, and ability to offer bundled deals and financing options. In terms of Type of Store, Online retail channels are experiencing exponential growth, driven by convenience, wider product selection, and competitive pricing, though Inclusive Retailers/Dealers Stores also maintain a significant presence, offering a blend of product availability and personalized customer service.

Key drivers for this dominance include:

- Economic Policies: Favorable economic conditions and consumer spending power in major metropolitan areas.

- Infrastructure: Well-developed logistics and supply chain networks facilitating efficient product distribution.

- Consumer Demographics: A large and affluent population with a high propensity to adopt new technologies and upgrade home appliances.

- Market Share: Consumer Electronic Stores, particularly those with a strong online presence, command a substantial market share.

- Growth Potential: The continuous evolution of consumer electronics and the increasing integration of smart technology offer significant growth potential.

While Consumer Electronic Stores lead, Hardware Suppliers are also crucial, especially for essential appliances and home improvement components. The growth of smart home technology is also bolstering the demand within specialized Security Stores offering integrated smart security and appliance systems. The interplay between online and physical retail continues to evolve, with consumers often utilizing online research for offline purchases, highlighting the importance of an omnichannel strategy. The large metropolitan areas, such as those in California, Texas, and the Northeast, are significant hubs for appliance sales due to higher population density and disposable income.

United States Electronics and Appliance Stores Market Product Landscape

The United States electronics and appliance stores market is characterized by a rapidly evolving product landscape, driven by an emphasis on smart technology, energy efficiency, and enhanced user experience. Innovations include AI-powered refrigerators that track inventory and suggest recipes, smart ovens with remote cooking capabilities, and energy-efficient washing machines with advanced fabric care. Unique selling propositions often revolve around seamless integration with smart home ecosystems, personalized settings, and sustainable design. Technological advancements are pushing the boundaries of convenience, connectivity, and performance, with a growing focus on intuitive user interfaces and data-driven insights for appliance management.

Key Drivers, Barriers & Challenges in United States Electronics and Appliance Stores Market

Key Drivers:

- Technological Advancements: The continuous innovation in smart home technology, AI integration, and energy-efficient solutions drives consumer demand for upgraded appliances and electronics.

- Economic Growth: Rising disposable incomes and consumer confidence fuel increased spending on durable goods and home improvements.

- Consumer Preferences for Convenience & Efficiency: Growing demand for products that simplify daily tasks, save time, and reduce utility costs.

- Government Initiatives: Energy efficiency standards and rebates incentivize the purchase of eco-friendly appliances.

Barriers & Challenges:

- Supply Chain Disruptions: Global supply chain issues can lead to product shortages, increased costs, and longer lead times, impacting availability and pricing.

- Economic Volatility: Inflationary pressures and potential economic downturns can dampen consumer spending on non-essential items.

- Intense Competition: A saturated market with numerous players, including online retailers and direct-to-consumer brands, creates pricing pressures.

- Rapid Product Obsolescence: The fast pace of technological change can make products quickly outdated, leading to inventory management challenges.

- Regulatory Compliance: Navigating complex and evolving regulations related to energy efficiency, safety, and data privacy requires continuous adaptation.

Emerging Opportunities in United States Electronics and Appliance Stores Market

Emerging opportunities in the United States electronics and appliance stores market lie in the continued expansion of the smart home ecosystem, with a focus on interoperability and integrated AI solutions. The growing consumer demand for sustainable and eco-friendly products presents a significant opportunity for brands offering energy-efficient appliances with reduced environmental footprints. Furthermore, the burgeoning market for refurbished and certified pre-owned electronics and appliances caters to budget-conscious consumers and promotes circular economy principles. The development of personalized consumer experiences through data analytics and AI, as seen with GE Appliances' Flavorly™ AI, opens new avenues for customer engagement and loyalty. There's also an untapped potential in catering to niche markets, such as the aging population requiring user-friendly assistive technologies, and in providing comprehensive service and maintenance packages that extend product lifecycles.

Growth Accelerators in the United States Electronics and Appliance Stores Market Industry

Several key catalysts are accelerating long-term growth in the United States electronics and appliance stores market. The relentless pace of technological breakthroughs, particularly in artificial intelligence and the Internet of Things (IoT), is continuously creating new product categories and enhancing existing ones, making appliances more intuitive and interconnected. Strategic partnerships, such as the one between GE Appliances and Google Cloud, are crucial for developing advanced functionalities and expanding market reach through innovative solutions. Market expansion strategies, including the development of omnichannel retail experiences that seamlessly integrate online and offline channels, are vital for capturing a broader customer base. The increasing consumer awareness and demand for sustainable and energy-efficient products also act as a significant growth accelerator, pushing manufacturers to invest in greener technologies and production methods.

Key Players Shaping the United States Electronics and Appliance Stores Market Market

- Panasonic

- Candy

- Haier

- Whirlpool

- Phillips

- Bosch

- Toshiba

- Hitachi Limited

- GE Appliance

Notable Milestones in United States Electronics and Appliance Stores Market Sector

- August 2023: GE Appliances, a Haier company, and Google Cloud expanded their partnership to enhance and personalize consumer experiences with generative AI. GE Appliances’ SmartHQ consumer app will use Google Cloud’s generative AI platform, Vertex AI, to offer users the ability to generate custom recipes based on the food in their kitchen with its new feature called Flavorly™ AI. This milestone highlights the growing importance of AI in enhancing consumer interaction and product utility.

- November 2022: Whirlpool completes the acquisition of InSinkErator, which is the world's largest manufacturer of food waste disposers and hot water dispensers for home and commercial use. This acquisition strengthens Whirlpool's position in the kitchen appliance sector and expands its product portfolio in essential home utility solutions.

- February 2022: Mitsubishi Electric Corporation acquired Computer Protection Technology, Inc. (CPT), headquartered in San Diego, with an aim towards expanding its uninterruptible power supply (UPS) business in North America. This strategic move underscores the growing demand for reliable power solutions in data centers and other critical infrastructure, impacting the broader electronics market.

In-Depth United States Electronics and Appliance Stores Market Market Outlook

The future outlook for the United States electronics and appliance stores market is exceptionally promising, driven by sustained innovation and evolving consumer needs. Growth accelerators, including the pervasive integration of AI and IoT into home appliances, will continue to redefine consumer expectations and product functionalities. Strategic partnerships and collaborative efforts, exemplified by the GE Appliances and Google Cloud alliance, will be pivotal in developing next-generation smart home solutions that offer unparalleled personalization and convenience. The increasing consumer drive towards sustainability and energy efficiency will foster the adoption of eco-friendly appliances, creating a significant market segment. The expansion of omnichannel retail strategies will ensure greater accessibility and enhanced customer journeys. Overall, the market is poised for substantial growth, fueled by technological advancements, shifting consumer preferences, and a commitment to delivering intelligent, efficient, and user-centric home solutions.

United States Electronics and Appliance Stores Market Segmentation

-

1. Type

- 1.1. Hardware Supplier

- 1.2. Security Stores

- 1.3. Consumer Electronic Store

-

2. Ownership

- 2.1. Retail Chain

- 2.2. Independent Retailer

-

3. Type of Store

- 3.1. Exclusive Retailers/showroom

- 3.2. Inclusive Retailers/Dealers Store

- 3.3. Online

United States Electronics and Appliance Stores Market Segmentation By Geography

- 1. United States

United States Electronics and Appliance Stores Market Regional Market Share

Geographic Coverage of United States Electronics and Appliance Stores Market

United States Electronics and Appliance Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Innovation in LED Display; Increased Applications for Digital Signage

- 3.3. Market Restrains

- 3.3.1. Shorter Operating Range of WiGig Products

- 3.4. Market Trends

- 3.4.1. AI And IOT Enabled Electronic Appliance DrivingUS Electronics and Appliance Stores Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware Supplier

- 5.1.2. Security Stores

- 5.1.3. Consumer Electronic Store

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. Retail Chain

- 5.2.2. Independent Retailer

- 5.3. Market Analysis, Insights and Forecast - by Type of Store

- 5.3.1. Exclusive Retailers/showroom

- 5.3.2. Inclusive Retailers/Dealers Store

- 5.3.3. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Candy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Haier*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Whirlpool

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Phillips

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bosch

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toshiba

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hitachi Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GE Appliance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: United States Electronics and Appliance Stores Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Electronics and Appliance Stores Market Share (%) by Company 2025

List of Tables

- Table 1: United States Electronics and Appliance Stores Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: United States Electronics and Appliance Stores Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 3: United States Electronics and Appliance Stores Market Revenue undefined Forecast, by Type of Store 2020 & 2033

- Table 4: United States Electronics and Appliance Stores Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: United States Electronics and Appliance Stores Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: United States Electronics and Appliance Stores Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 7: United States Electronics and Appliance Stores Market Revenue undefined Forecast, by Type of Store 2020 & 2033

- Table 8: United States Electronics and Appliance Stores Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Electronics and Appliance Stores Market?

The projected CAGR is approximately 2.3%.

2. Which companies are prominent players in the United States Electronics and Appliance Stores Market?

Key companies in the market include Panasonic, Candy, Haier*List Not Exhaustive, Whirlpool, Phillips, Bosch, Toshiba, Hitachi Limited, GE Appliance.

3. What are the main segments of the United States Electronics and Appliance Stores Market?

The market segments include Type, Ownership, Type of Store.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Innovation in LED Display; Increased Applications for Digital Signage.

6. What are the notable trends driving market growth?

AI And IOT Enabled Electronic Appliance DrivingUS Electronics and Appliance Stores Market.

7. Are there any restraints impacting market growth?

Shorter Operating Range of WiGig Products.

8. Can you provide examples of recent developments in the market?

In August 2023, GE Appliances, a Haier company, and Google Cloud expanded their partnership to enhance and personalize consumer experiences with generative AI. GE Appliances’ SmartHQ consumer app will use Google Cloud’s generative AI platform, Vertex AI, to offer users the ability to generate custom recipes based on the food in their kitchen with its new feature called Flavorly™ AI.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Electronics and Appliance Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Electronics and Appliance Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Electronics and Appliance Stores Market?

To stay informed about further developments, trends, and reports in the United States Electronics and Appliance Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence