Key Insights

The Epitaxy Equipment market is projected for substantial growth, with an estimated market size of $8.74 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 8.79%. This expansion is primarily attributed to the escalating demand for advanced semiconductors in sectors like photonics and high-performance computing. The increasing adoption of wide-bandgap materials, including Gallium Nitride (GaN) and Silicon Carbide (SiC), for power electronics, electric vehicles, and 5G infrastructure serves as a key catalyst. Technologies such as Metal-Organic Chemical Vapor Deposition (MOCVD) and Molecular Beam Epitaxy (MBE) are pivotal in enabling the precise deposition of these critical materials, facilitating the development of more compact, faster, and energy-efficient electronic components. The growth of data centers, the proliferation of IoT devices, and advancements in artificial intelligence further underscore the need for sophisticated epitaxial solutions, ensuring a sustained upward trajectory for the market.

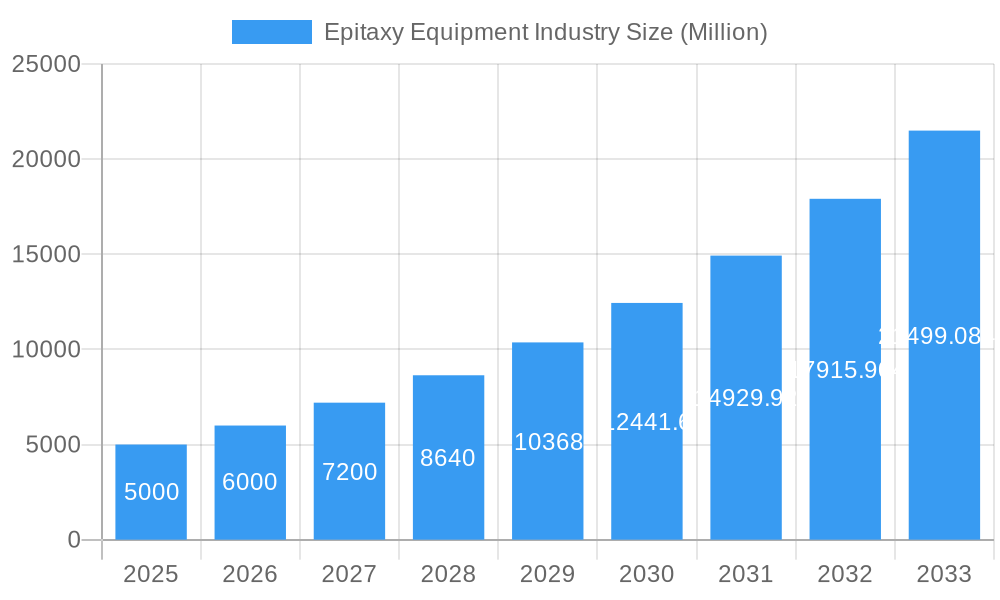

Epitaxy Equipment Industry Market Size (In Billion)

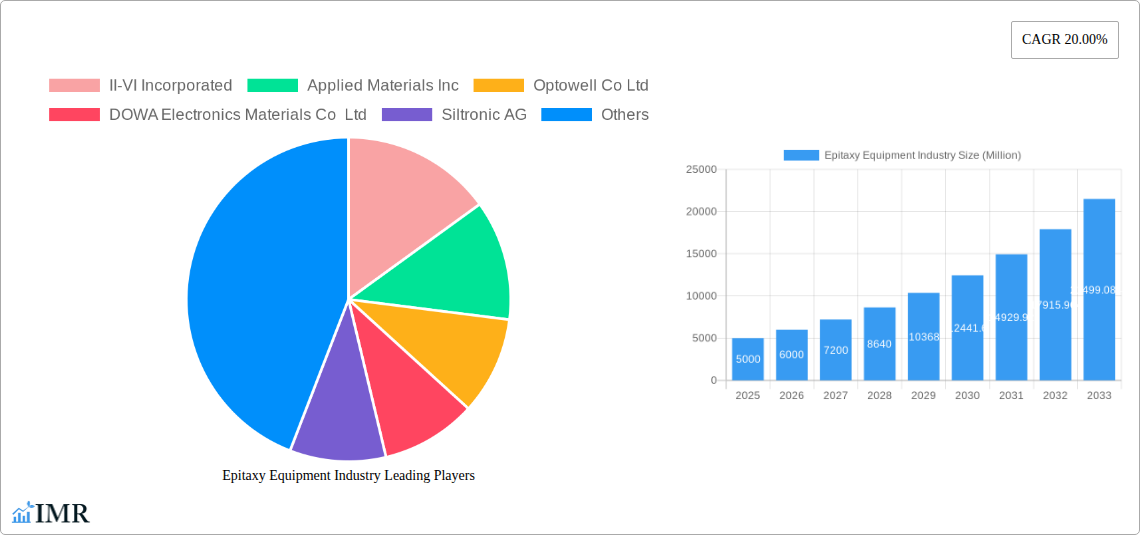

Key market players, including Applied Materials Inc., II-VI Incorporated, and Tokyo Electron Limited, alongside specialized firms like Aixtron SE and Optowell Co Ltd, are actively engaged in research and development to pioneer next-generation epitaxy equipment. Their focus lies on enhancing throughput, improving uniformity, and refining process control. While significant market drivers are present, potential restraints such as the substantial capital investment for advanced epitaxy tools and the inherent complexity of manufacturing processes may present challenges for new entrants. Nevertheless, the persistent trends of miniaturization, increased power efficiency, and the continuous evolution of electronic device capabilities strongly support the ongoing growth and innovation within the epitaxy equipment sector, particularly in regions with robust manufacturing and R&D capabilities.

Epitaxy Equipment Industry Company Market Share

This comprehensive report offers critical insights into the global Epitaxy Equipment market. It analyzes market dynamics, growth trends, dominant segments, product landscape, key players, and future opportunities, providing a strategic roadmap for stakeholders. Covering MOCVD, HT CVD, and MBE equipment for photonics, semiconductor, and wide-bandgap material applications, this study is essential for understanding market concentration, innovation drivers, regulatory frameworks, competitive substitutes, end-user demographics, and M&A trends.

Epitaxy Equipment Industry Market Dynamics & Structure

The epitaxy equipment market is characterized by moderate to high concentration, with key players like Applied Materials Inc., Tokyo Electron Limited, and Aixtron SE holding significant shares. Technological innovation is the primary driver, fueled by the relentless demand for advanced semiconductors, high-performance photonics, and next-generation power devices utilizing wide-bandgap materials. The intricate nature of epitaxy processes, requiring precise control over atomic layer deposition, creates substantial barriers to entry for new competitors. Regulatory frameworks, particularly those related to export controls and environmental standards, also play a crucial role in shaping market access and operational costs.

- Market Concentration: Dominated by a few major global players, with strategic alliances and acquisitions shaping competitive landscapes.

- Technological Innovation Drivers: The pursuit of smaller, faster, and more energy-efficient electronic components, alongside advancements in optical communication and solid-state lighting, are paramount.

- Regulatory Frameworks: Stringent quality control standards and international trade policies influence manufacturing practices and market accessibility.

- Competitive Product Substitutes: While direct substitutes for epitaxy equipment are limited within its core applications, advancements in alternative deposition techniques for specific niche applications present indirect competition.

- End-User Demographics: The primary end-users are semiconductor foundries, integrated device manufacturers (IDMs), and research institutions focused on advanced materials.

- M&A Trends: Expect ongoing consolidation, driven by the need for scale, R&D investment, and market expansion. A projected xx M&A deals are anticipated within the forecast period.

Epitaxy Equipment Industry Growth Trends & Insights

The global epitaxy equipment market is poised for robust growth, driven by the escalating demand across the semiconductor, photonics, and wide-bandgap material sectors. The market is projected to grow from an estimated XXX Million units in the base year 2025 to XXX Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This expansion is underpinned by the increasing adoption of advanced chip architectures, the proliferation of 5G infrastructure, the burgeoning growth of electric vehicles (EVs) and renewable energy systems reliant on wide-bandgap semiconductors, and the continuous innovation in optical technologies.

The historical period (2019–2024) witnessed steady growth, with initial disruptions from global supply chain challenges gradually giving way to renewed investment spurred by the digital transformation initiatives and the demand for advanced electronics. The base year 2025 represents a crucial inflection point, with significant capital expenditure expected from leading semiconductor manufacturers investing in next-generation fabrication facilities and wafer processing capabilities. Technological disruptions, such as the advancement in Atomic Layer Deposition (ALD) techniques and the increasing complexity of epitaxial layer structures, are further fueling the need for sophisticated and precise epitaxy equipment.

Consumer behavior shifts towards devices with enhanced processing power, superior imaging capabilities, and greater energy efficiency directly translate into increased demand for advanced semiconductor devices, which are heavily reliant on epitaxy processes. Market penetration of epitaxy equipment is deepening in emerging economies, driven by government initiatives to bolster domestic semiconductor manufacturing capabilities and the growing consumer electronics market. The increasing complexity of semiconductor nodes, moving towards sub-10nm processes, necessitates advanced epitaxy equipment capable of depositing ultra-thin and highly uniform layers, thus driving innovation and market expansion. The report estimates the market size to reach XXX Million units in 2025.

Dominant Regions, Countries, or Segments in Epitaxy Equipment Industry

The Semiconductor application segment, with an estimated market share of XX% in 2025, is unequivocally the dominant force driving growth within the global epitaxy equipment industry. This dominance is directly attributable to the insatiable and ever-expanding global demand for integrated circuits (ICs) across a multitude of end-user industries, including consumer electronics, automotive, telecommunications, and data centers. The relentless pursuit of Moore's Law, pushing for smaller, faster, and more energy-efficient transistors, necessitates increasingly sophisticated epitaxy processes for advanced node fabrication.

Key drivers contributing to the semiconductor segment's supremacy include:

- Technological Advancements: The development of advanced FinFET, Gate-All-Around (GAA) transistor architectures, and complex 3D NAND flash memory technologies relies heavily on precise epitaxial deposition of critical materials like silicon, silicon germanium (SiGe), and various III-V compounds.

- Global Chip Shortage & Geopolitical Influence: Recent global chip shortages have spurred significant investment in expanding semiconductor manufacturing capacity, particularly in Asia and North America, further boosting demand for epitaxy equipment. Geopolitical considerations are also driving regionalization of supply chains, leading to new fab constructions.

- Automotive and IoT Revolution: The proliferation of electric vehicles (EVs), autonomous driving systems, and the Internet of Things (IoT) devices are creating unprecedented demand for high-performance semiconductors, many of which require specialized epitaxial layers for enhanced functionality and reliability.

- Research and Development Investment: Leading semiconductor companies continue to invest heavily in R&D for next-generation semiconductor materials and device structures, directly translating into demand for cutting-edge epitaxy solutions.

While the Semiconductor segment reigns supreme, the Photonics and Wide-bandgap Material segments are experiencing substantial growth and are critical for future market expansion. The Photonics segment, estimated at XX% market share in 2025, is driven by the growth in optical communications, data centers, laser technology, and advanced display technologies. The Wide-bandgap Material segment, including Gallium Nitride (GaN) and Silicon Carbide (SiC), is experiencing exponential growth, driven by the demand for high-power and high-frequency devices in EVs, renewable energy inverters, and 5G base stations. These segments, though smaller in current market size, offer significant growth potential and represent key areas for future innovation and investment.

Epitaxy Equipment Industry Product Landscape

The epitaxy equipment product landscape is characterized by continuous innovation focused on enhancing precision, throughput, and material control. Leading manufacturers offer advanced MOCVD (Metal-Organic Chemical Vapor Deposition) reactors capable of depositing ultra-thin, uniform epitaxial layers with atomic-level accuracy. These systems are crucial for fabricating advanced semiconductor devices, enabling the production of smaller and more powerful microchips. Furthermore, HT CVD (High-Temperature Chemical Vapor Deposition) and MBE (Molecular Beam Epitaxy) systems are crucial for specialized applications, including high-performance photonics and wide-bandgap semiconductor devices. The unique selling propositions of these machines lie in their ability to achieve exceptional material quality, low defect densities, and precise compositional control, vital for achieving desired device performance and reliability in cutting-edge technologies.

Key Drivers, Barriers & Challenges in Epitaxy Equipment Industry

Key Drivers:

- Exponential Demand for Advanced Semiconductors: The relentless growth in AI, 5G, IoT, and automotive electronics fuels the need for sophisticated epitaxy equipment for next-generation chip manufacturing.

- Growth in Photonics and Optical Technologies: Advancements in optical communication, LiDAR, and advanced displays require high-quality epitaxial materials, driving demand for specialized equipment.

- Expansion of Wide-Bandgap Semiconductor Applications: The electrification of transportation and the renewable energy sector are creating significant demand for GaN and SiC devices, necessitating advanced epitaxy solutions.

- Technological Advancements in Epitaxy Processes: Continuous improvements in MOCVD, HT CVD, and MBE technologies offer higher precision, throughput, and yield, attracting capital investment.

Barriers & Challenges:

- High Capital Expenditure and R&D Costs: The development and manufacturing of epitaxy equipment require substantial financial investment, creating a barrier for smaller players.

- Complex Manufacturing Processes and Supply Chain Volatility: Intricate manufacturing requirements and global supply chain disruptions can impact production schedules and material availability. The estimated impact of supply chain issues on market growth is projected at xx% reduction in potential growth.

- Stringent Quality and Purity Requirements: Achieving the extremely high levels of material purity and structural perfection required for advanced semiconductor fabrication presents significant technical challenges.

- Skilled Workforce Shortage: The specialized nature of epitaxy technology creates a demand for highly skilled engineers and technicians, leading to potential talent acquisition challenges.

- Geopolitical Tensions and Trade Restrictions: International trade policies and geopolitical factors can impact market access and the flow of critical components.

Emerging Opportunities in Epitaxy Equipment Industry

Emerging opportunities in the epitaxy equipment industry lie in the continuous refinement of equipment for next-generation semiconductor nodes, including those beyond 2nm. The rapid advancement of compound semiconductors for high-frequency applications in 6G communications and satellite technology presents a significant growth avenue. Furthermore, the increasing demand for high-performance sensors for advanced driver-assistance systems (ADAS) and industrial automation will drive the need for specialized epitaxial materials. Untapped markets in advanced packaging technologies, where precise layer deposition is critical for interconnectivity and performance, also represent a promising frontier.

Growth Accelerators in the Epitaxy Equipment Industry Industry

Long-term growth in the epitaxy equipment industry is being significantly accelerated by breakthroughs in novel materials for advanced electronics and photonics, such as 2D materials and quantum dots. Strategic partnerships between equipment manufacturers, material suppliers, and semiconductor fabs are crucial for co-developing next-generation epitaxy solutions tailored to specific application requirements. Market expansion into emerging economies with growing semiconductor manufacturing ambitions, supported by government incentives, also acts as a powerful growth catalyst.

Key Players Shaping the Epitaxy Equipment Industry Market

- II-VI Incorporated

- Applied Materials Inc.

- Optowell Co Ltd

- DOWA Electronics Materials Co Ltd

- Siltronic AG

- Aixtron SE

- Intelligent Epitaxy Technology Inc

- Tokyo Electron Limited

- NuFlare Technology Inc (Toshiba Electronic Devices and Storage Corporation)

Notable Milestones in Epitaxy Equipment Industry Sector

- 2019: Significant advancements in MOCVD reactor design, enabling higher throughput and improved uniformity for advanced semiconductor nodes.

- 2020: Increased focus on GaN and SiC epitaxy equipment development, driven by the growing EV market and renewable energy sector.

- 2021: Major semiconductor manufacturers announce substantial investments in new fab construction, boosting demand for epitaxy equipment.

- 2022: Innovations in in-situ monitoring and control systems for epitaxy processes, enhancing precision and reducing process development time.

- 2023: Emergence of new players and strategic collaborations focusing on specialized epitaxy applications, such as those for advanced photonics and quantum computing.

- 2024: Anticipated announcements of next-generation epitaxy platforms designed for sub-3nm semiconductor nodes.

In-Depth Epitaxy Equipment Industry Market Outlook

The epitaxy equipment industry is set for sustained and significant growth, driven by the foundational role of epitaxy in advanced semiconductor, photonics, and wide-bandgap material technologies. Future market potential is immense, with continuous demand for higher performance, increased efficiency, and novel functionalities in electronic and optoelectronic devices. Strategic opportunities abound in customizing equipment for emerging applications like advanced AI accelerators, next-generation displays, and robust power electronics for the burgeoning green energy sector. The industry's trajectory is firmly rooted in technological innovation and the ever-increasing complexity and sophistication of the devices it enables.

Epitaxy Equipment Industry Segmentation

-

1. Technology

- 1.1. MOCVD

- 1.2. HT CVD

- 1.3. MBE

-

2. Application

- 2.1. Photonics

- 2.2. Semiconductor

- 2.3. Wide-bandgap Material

- 2.4. Others

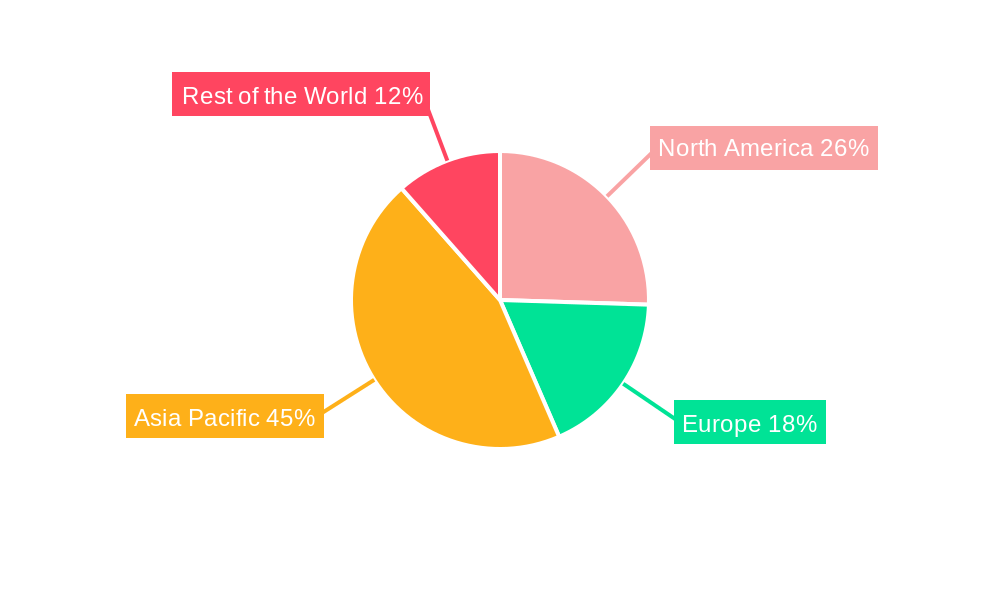

Epitaxy Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Epitaxy Equipment Industry Regional Market Share

Geographic Coverage of Epitaxy Equipment Industry

Epitaxy Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Continuous Introduction of Disruptive LED Devices; Growing Use in Power Applications is Expected to Act as Driver

- 3.3. Market Restrains

- 3.3.1. ; Complexities Associated with the Design

- 3.4. Market Trends

- 3.4.1. Continuous Introduction of Disruptive LED Devices will Act as a Driver

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Epitaxy Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. MOCVD

- 5.1.2. HT CVD

- 5.1.3. MBE

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Photonics

- 5.2.2. Semiconductor

- 5.2.3. Wide-bandgap Material

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Epitaxy Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. MOCVD

- 6.1.2. HT CVD

- 6.1.3. MBE

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Photonics

- 6.2.2. Semiconductor

- 6.2.3. Wide-bandgap Material

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Epitaxy Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. MOCVD

- 7.1.2. HT CVD

- 7.1.3. MBE

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Photonics

- 7.2.2. Semiconductor

- 7.2.3. Wide-bandgap Material

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Epitaxy Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. MOCVD

- 8.1.2. HT CVD

- 8.1.3. MBE

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Photonics

- 8.2.2. Semiconductor

- 8.2.3. Wide-bandgap Material

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World Epitaxy Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. MOCVD

- 9.1.2. HT CVD

- 9.1.3. MBE

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Photonics

- 9.2.2. Semiconductor

- 9.2.3. Wide-bandgap Material

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 II-VI Incorporated

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Applied Materials Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Optowell Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 DOWA Electronics Materials Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siltronic AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aixtron SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Intelligent Epitaxy Technology Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tokyo Electron Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 NuFlare Technology Inc (Toshiba Electronic Devices and Storage Corporation)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 II-VI Incorporated

List of Figures

- Figure 1: Global Epitaxy Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Epitaxy Equipment Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Epitaxy Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 4: North America Epitaxy Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 5: North America Epitaxy Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Epitaxy Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Epitaxy Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Epitaxy Equipment Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Epitaxy Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Epitaxy Equipment Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Epitaxy Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Epitaxy Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Epitaxy Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Epitaxy Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Epitaxy Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 16: Europe Epitaxy Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 17: Europe Epitaxy Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe Epitaxy Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 19: Europe Epitaxy Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Epitaxy Equipment Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Epitaxy Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Epitaxy Equipment Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Epitaxy Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Epitaxy Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Epitaxy Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Epitaxy Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Epitaxy Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 28: Asia Pacific Epitaxy Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 29: Asia Pacific Epitaxy Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Asia Pacific Epitaxy Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 31: Asia Pacific Epitaxy Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Pacific Epitaxy Equipment Industry Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Epitaxy Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Epitaxy Equipment Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Epitaxy Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Epitaxy Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Epitaxy Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Epitaxy Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Epitaxy Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 40: Rest of the World Epitaxy Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 41: Rest of the World Epitaxy Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Rest of the World Epitaxy Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 43: Rest of the World Epitaxy Equipment Industry Revenue (billion), by Application 2025 & 2033

- Figure 44: Rest of the World Epitaxy Equipment Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Rest of the World Epitaxy Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Rest of the World Epitaxy Equipment Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Rest of the World Epitaxy Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Rest of the World Epitaxy Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Epitaxy Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Epitaxy Equipment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Epitaxy Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Global Epitaxy Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Epitaxy Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Epitaxy Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 9: Global Epitaxy Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Epitaxy Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Epitaxy Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 15: Global Epitaxy Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Global Epitaxy Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Epitaxy Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 21: Global Epitaxy Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Epitaxy Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Epitaxy Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 26: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Global Epitaxy Equipment Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Global Epitaxy Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Epitaxy Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Epitaxy Equipment Industry?

The projected CAGR is approximately 8.79%.

2. Which companies are prominent players in the Epitaxy Equipment Industry?

Key companies in the market include II-VI Incorporated, Applied Materials Inc, Optowell Co Ltd, DOWA Electronics Materials Co Ltd, Siltronic AG, Aixtron SE, Intelligent Epitaxy Technology Inc, Tokyo Electron Limited, NuFlare Technology Inc (Toshiba Electronic Devices and Storage Corporation).

3. What are the main segments of the Epitaxy Equipment Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.74 billion as of 2022.

5. What are some drivers contributing to market growth?

; Continuous Introduction of Disruptive LED Devices; Growing Use in Power Applications is Expected to Act as Driver.

6. What are the notable trends driving market growth?

Continuous Introduction of Disruptive LED Devices will Act as a Driver.

7. Are there any restraints impacting market growth?

; Complexities Associated with the Design.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Epitaxy Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Epitaxy Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Epitaxy Equipment Industry?

To stay informed about further developments, trends, and reports in the Epitaxy Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence