Key Insights

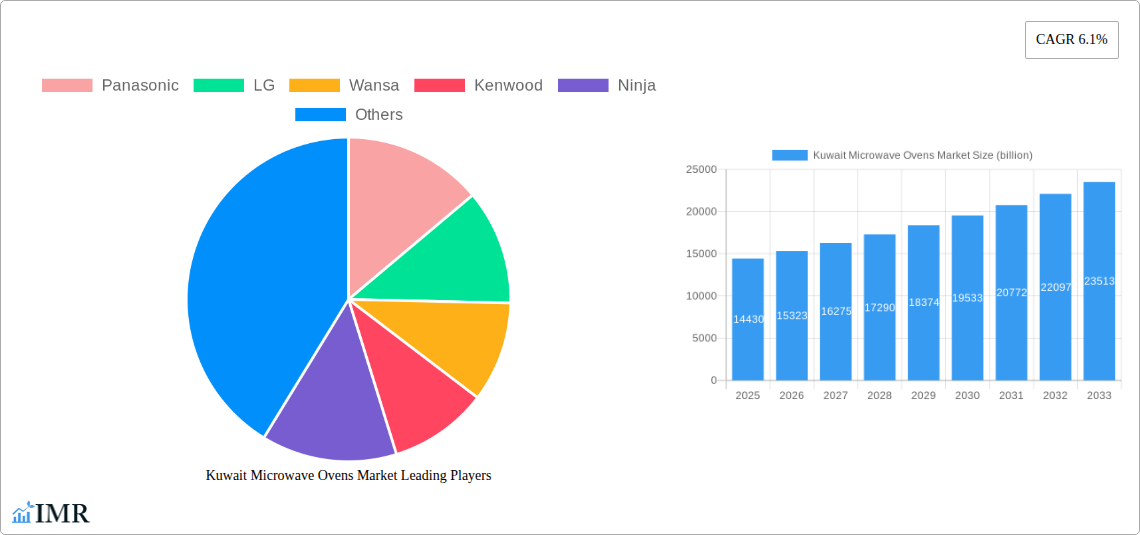

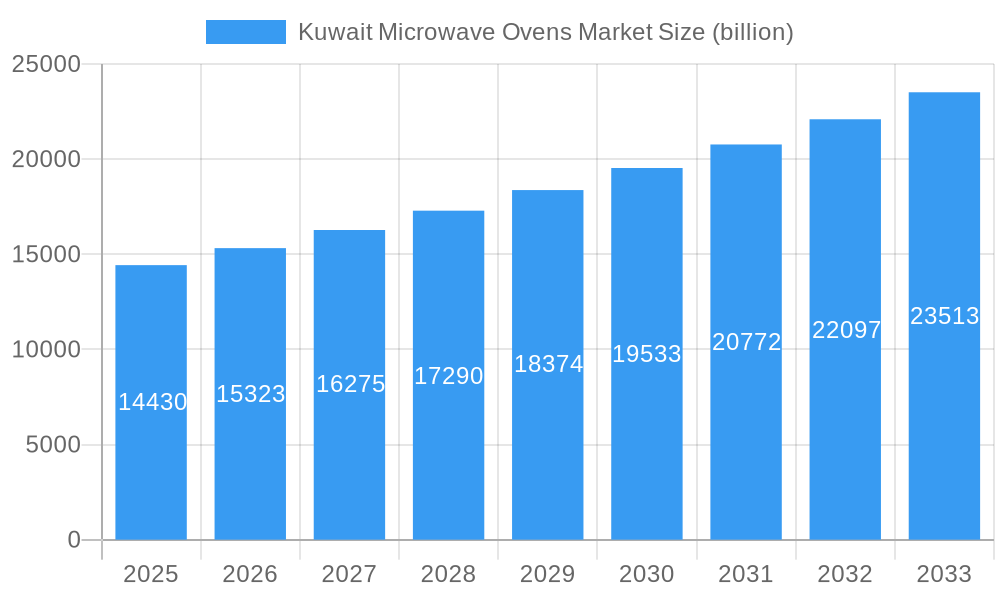

The Kuwait microwave oven market is poised for robust expansion, projected to reach an estimated USD 14.43 billion in 2025 and experience a CAGR of 6.1% during the forecast period of 2025-2033. This growth is fueled by several key drivers, including increasing disposable incomes, a burgeoning demand for convenient cooking solutions, and the growing adoption of smart home technologies in residential segments. The commercial sector, encompassing restaurants, hotels, and catering services, is also a significant contributor, driven by the need for efficient food preparation and reheating. Furthermore, the expanding retail landscape, with a strong presence of multi-branded and exclusive stores, alongside the rapid rise of e-commerce, ensures wider accessibility for consumers across Kuwait. The market's segmentation by type reveals a strong preference for Convectional and Grill microwave ovens due to their versatility in cooking, baking, and grilling, catering to diverse culinary needs.

Kuwait Microwave Ovens Market Market Size (In Billion)

The Kuwait microwave oven market is experiencing dynamic trends that shape its trajectory. The increasing integration of smart features and connectivity in microwave ovens, allowing for app control and pre-programmed recipes, is a significant trend appealing to tech-savvy consumers. The demand for energy-efficient models also continues to grow, aligning with global sustainability efforts. While the market is generally optimistic, certain restraints, such as the initial high cost of advanced models and the availability of alternative cooking appliances, could influence purchasing decisions. However, the overarching growth drivers and the strategic presence of major global players like Panasonic, LG, Samsung, and Midea, who are continuously innovating and expanding their product portfolios, are expected to propel the market forward. The focus on enhancing user experience and offering a wider range of functionalities will be crucial for sustained growth across all segments.

Kuwait Microwave Ovens Market Company Market Share

This in-depth report provides a meticulous examination of the Kuwait Microwave Ovens Market, encompassing historical trends, current dynamics, and future projections. Delve into market segmentation by Type (Convectional, Grill, Solo), End-User (Residential, Commercial), and Distribution Channel (Multi-Branded Stores, Exclusive Stores, Online Stores, Other Distribution Channels). Gain critical insights into the parent market, understanding its influence and trajectory, alongside a detailed analysis of the child market's specific growth drivers and challenges. The study, covering the period from 2019 to 2033 with a base year of 2025, offers a robust forecast for 2025-2033, with historical data from 2019-2024.

Kuwait Microwave Ovens Market Market Dynamics & Structure

The Kuwait Microwave Ovens Market is characterized by a moderately concentrated structure, with major international players like Panasonic, LG, Samsung, and Midea holding significant market shares. Technological innovation is a primary driver, fueled by consumer demand for advanced features such as smart connectivity, healthier cooking options, and energy efficiency. Regulatory frameworks in Kuwait are generally supportive of consumer electronics, with a focus on product safety and standards. Competitive product substitutes include traditional ovens and other cooking appliances, but microwave ovens maintain a distinct advantage in speed and convenience. End-user demographics reveal a growing young, tech-savvy population in the residential segment, alongside an expanding hospitality and food service sector for commercial applications. Mergers and acquisitions (M&A) trends are less pronounced in this specific market, with most growth stemming from organic product development and market penetration.

- Market Concentration: Moderate, dominated by a few key international brands.

- Technological Innovation Drivers: Smart features, health-conscious cooking, energy efficiency, convenience.

- Regulatory Frameworks: Supportive of consumer electronics, with emphasis on safety and standards.

- Competitive Product Substitutes: Traditional ovens, other cooking appliances.

- End-User Demographics: Growing young, tech-savvy residential consumers and expanding commercial food service sector.

- M&A Trends: Less prevalent, with organic growth being the primary strategy.

Kuwait Microwave Ovens Market Growth Trends & Insights

The Kuwait Microwave Ovens Market is poised for sustained growth, driven by an escalating demand for modern kitchen appliances and evolving consumer lifestyles. Over the forecast period (2025–2033), the market is expected to witness a significant increase in adoption rates, particularly for multi-functional microwave ovens that offer grilling and convection capabilities. Technological disruptions, such as the integration of AI and IoT in kitchen appliances, are set to redefine user experience. Consumer behavior is shifting towards convenience-driven solutions and a greater emphasis on healthy cooking methods, making advanced microwave ovens increasingly attractive. The market penetration of smart microwave ovens is projected to rise substantially as consumers become more comfortable with connected home ecosystems. The overall market size is anticipated to expand due to increased disposable incomes and a rising trend of modernizing home kitchens. The adoption of online shopping channels for consumer electronics is also a significant factor contributing to market accessibility and growth.

Dominant Regions, Countries, or Segments in Kuwait Microwave Ovens Market

Within the Kuwait Microwave Ovens Market, the Residential end-user segment is expected to be the dominant force driving market growth. This dominance is attributed to several key factors, including a rapidly growing young population, increasing urbanization, and a rising trend of nuclear families with a preference for modern, time-saving kitchen solutions. The expanding disposable incomes of Kuwaiti households further empower them to invest in advanced kitchen appliances like multi-functional microwave ovens.

- Residential End-User Dominance Drivers:

- Young and Tech-Savvy Population: Kuwait has a significant youth demographic that readily adopts new technologies and values convenience.

- Urbanization and Modern Lifestyles: Increasing urbanization leads to smaller living spaces and a greater need for compact, efficient appliances. Modern lifestyles prioritize quick meal preparation.

- Rising Disposable Incomes: Enhanced purchasing power allows consumers to opt for higher-end and feature-rich microwave ovens.

- Preference for Multi-Functional Appliances: Consumers are increasingly looking for appliances that can perform multiple cooking functions (grilling, convection, steaming), reducing the need for separate devices.

- Growing Interest in Home Cooking and Healthy Eating: Despite the convenience, there's a parallel trend towards home-cooked meals, and advanced microwave ovens cater to this by offering healthier cooking options.

In terms of distribution channels, Multi-Branded Stores currently hold a significant market share due to their widespread presence and ability to offer a diverse range of brands and models under one roof, catering to a broad spectrum of consumer preferences and price points. However, Online Stores are rapidly gaining traction and are projected to witness the highest growth rate. This surge is driven by the convenience of online shopping, competitive pricing, wider product selection, and the increasing digital literacy of Kuwaiti consumers.

- Distribution Channel Insights:

- Multi-Branded Stores: Established presence, wide variety, caters to diverse preferences.

- Online Stores: Fastest-growing segment due to convenience, competitive pricing, and accessibility.

- Exclusive Stores: Niche appeal, focus on premium brands and customer service.

- Other Distribution Channels: Including hypermarkets and smaller electronics retailers, contribute to overall market reach.

By Type, Convectional microwave ovens are likely to exhibit the strongest growth. This is directly linked to the increasing demand for versatile cooking appliances that can perform baking, roasting, and grilling, mirroring the functionalities of traditional ovens while offering the speed and convenience of microwaves.

- Type Segment Insights:

- Convectional: High demand due to multi-functional cooking capabilities, ideal for baking and roasting.

- Grill: Popular for adding browning and crispiness to food.

- Solo: Basic functionality, typically more affordable, catering to budget-conscious consumers.

Kuwait Microwave Ovens Market Product Landscape

The Kuwait Microwave Ovens Market is witnessing a wave of product innovations focused on enhancing user experience and catering to evolving culinary trends. Companies are introducing models with advanced smart features, including Wi-Fi connectivity for remote control and access to recipe apps, voice command integration, and AI-powered cooking programs that automatically adjust settings for optimal results. The emphasis on healthier cooking is evident in the incorporation of steam cooking functions and improved convection technologies that allow for oil-free frying and baking. Performance metrics are being refined with faster heating times, more uniform cooking, and energy-efficient designs. Unique selling propositions revolve around sleek aesthetics, intuitive interfaces, and specialized cooking functions that appeal to both novice home cooks and culinary enthusiasts.

Key Drivers, Barriers & Challenges in Kuwait Microwave Ovens Market

Key Drivers:

- Increasing Disposable Income: Higher purchasing power enables consumers to invest in premium and feature-rich microwave ovens.

- Growing Demand for Convenience: Busy lifestyles drive the need for quick and efficient cooking solutions.

- Technological Advancements: Smart features, AI integration, and multi-functional capabilities enhance product appeal.

- Rising Trend of Modern Kitchens: Consumers are investing in upgrading their home appliances for aesthetic and functional reasons.

- Health and Wellness Consciousness: Demand for healthier cooking methods like steaming and grilling is increasing.

Barriers & Challenges:

- Intense Competition: A saturated market with numerous global and local players leads to price pressures.

- Economic Fluctuations: Potential downturns in the economy can impact consumer spending on non-essential appliances.

- Supply Chain Disruptions: Global supply chain issues can affect product availability and increase import costs.

- Customer Education: Convincing consumers of the benefits of advanced features and higher-priced models requires effective marketing.

- Counterfeit Products: The presence of counterfeit goods can erode market trust and impact legitimate sales.

Emerging Opportunities in Kuwait Microwave Ovens Market

Emerging opportunities in the Kuwait Microwave Ovens Market lie in the continued integration of smart home technology, creating a more connected and automated kitchen experience. The development of specialized microwave ovens catering to specific dietary needs, such as low-carb or gluten-free cooking, presents a niche but growing market. Furthermore, exploring partnerships with culinary influencers and online recipe platforms can boost brand visibility and educate consumers on the versatile cooking capabilities of modern microwave ovens. There is also an untapped potential in offering enhanced after-sales services and personalized warranty packages to build customer loyalty.

Growth Accelerators in the Kuwait Microwave Ovens Market Industry

Long-term growth in the Kuwait Microwave Ovens Market will be significantly accelerated by continuous technological breakthroughs in areas like energy efficiency and advanced cooking functionalities. Strategic partnerships between appliance manufacturers and smart home technology providers will create more integrated and seamless user experiences. Market expansion strategies, including targeted marketing campaigns focusing on the health benefits and convenience of advanced microwave ovens, will be crucial. The increasing adoption of e-commerce platforms by consumers will also act as a growth accelerator, providing wider reach and accessibility for a broader range of products.

Key Players Shaping the Kuwait Microwave Ovens Market Market

- Panasonic

- LG

- Wansa

- Kenwood

- Ninja

- Daewoo

- Comfee

- Toshiba

- Samsung

- Midea

Notable Milestones in Kuwait Microwave Ovens Market Sector

- December 2021: LG launched LG's InstaView Double Oven Gas Slide-in Range and the Over-the-Range Microwave Oven, which connect with the LG ThinQ Recipe app, allowing owners to find recipes and cook thousands of step-by-step recipes with guidance from their appliances.

- March 2021: Samsung announced the expansion of its kitchen appliances range by launching the "Baker Series Microwaves" that come with industry-first features such as steaming, grilling and frying with pro-level convection features that will appeal to young millennials who have turned into home chefs and are adopting healthy eating habits.

In-Depth Kuwait Microwave Ovens Market Market Outlook

The Kuwait Microwave Ovens Market is set for a promising future, driven by a confluence of technological innovation, evolving consumer preferences, and economic development. Growth accelerators such as the increasing integration of AI and IoT in appliances, coupled with a heightened consumer focus on health-conscious cooking, will continue to propel market expansion. Strategic collaborations between manufacturers and technology firms, alongside robust marketing efforts highlighting the convenience and versatility of modern microwave ovens, will further solidify market growth. The sustained trend of home kitchen modernization and the increasing reliance on online retail channels will also contribute to a dynamic and expanding market landscape.

Kuwait Microwave Ovens Market Segmentation

-

1. Type

- 1.1. Convectional

- 1.2. Grill

- 1.3. Solo

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Multi-Branded Stores

- 3.2. Exclusive Stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

Kuwait Microwave Ovens Market Segmentation By Geography

- 1. Kuwait

Kuwait Microwave Ovens Market Regional Market Share

Geographic Coverage of Kuwait Microwave Ovens Market

Kuwait Microwave Ovens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Vehicle Safety

- 3.2.2 Emission

- 3.2.3 and Fleet Management Regulations; Advancements Such as Route Calculation

- 3.2.4 Vehicle Tracking

- 3.2.5 and Fuel Pilferage

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Increase in the percentage of Sales through Online mode

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Microwave Ovens Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Convectional

- 5.1.2. Grill

- 5.1.3. Solo

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi-Branded Stores

- 5.3.2. Exclusive Stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wansa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kenwood

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ninja

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daewoo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Comfee

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toshiba

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Kuwait Microwave Ovens Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Kuwait Microwave Ovens Market Share (%) by Company 2025

List of Tables

- Table 1: Kuwait Microwave Ovens Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Kuwait Microwave Ovens Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Kuwait Microwave Ovens Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Kuwait Microwave Ovens Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Kuwait Microwave Ovens Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Kuwait Microwave Ovens Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Kuwait Microwave Ovens Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Kuwait Microwave Ovens Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 13: Kuwait Microwave Ovens Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Kuwait Microwave Ovens Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Kuwait Microwave Ovens Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Microwave Ovens Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Kuwait Microwave Ovens Market?

Key companies in the market include Panasonic, LG, Wansa, Kenwood, Ninja, Daewoo, Comfee, Toshiba, Samsung, Midea.

3. What are the main segments of the Kuwait Microwave Ovens Market?

The market segments include Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.43 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Vehicle Safety. Emission. and Fleet Management Regulations; Advancements Such as Route Calculation. Vehicle Tracking. and Fuel Pilferage.

6. What are the notable trends driving market growth?

Increase in the percentage of Sales through Online mode.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

On December 2021, LG has launched LG's InstaView Double Oven Gas Slide-in Range and the Over-the-Range Microwave Oven connect with the LG ThinQ Recipe app which will allow owners to find recipes and cook thousands of step-by-step recipes with guidance from their appliances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Microwave Ovens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Microwave Ovens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Microwave Ovens Market?

To stay informed about further developments, trends, and reports in the Kuwait Microwave Ovens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence