Key Insights

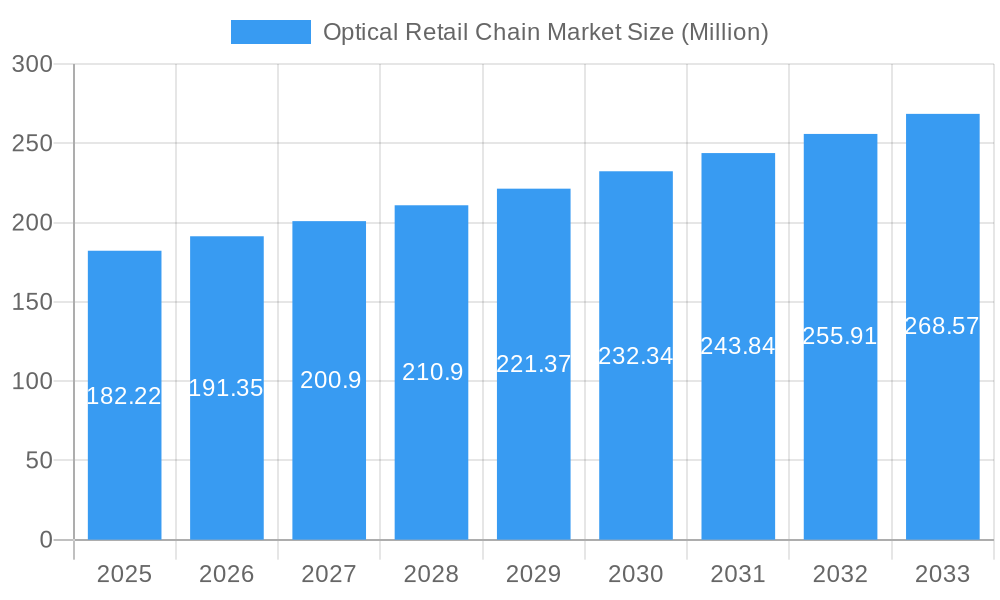

The global Optical Retail Chain Market is poised for significant expansion, projected to reach $182.22 million by 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.89% expected over the forecast period, indicating sustained momentum and increasing demand. A primary driver for this upward trajectory is the ever-growing awareness of eye health and the increasing prevalence of vision-related ailments across all age demographics. This surge in demand is further amplified by advancements in optical technologies, leading to more sophisticated and attractive eyewear solutions, including designer frames and specialized lenses. The beauty and personal care segment stands out as a dominant force, reflecting the integration of eyewear as a key fashion accessory. Moreover, the burgeoning disposable income in emerging economies and a growing preference for branded optical products contribute substantially to market expansion.

Optical Retail Chain Market Market Size (In Million)

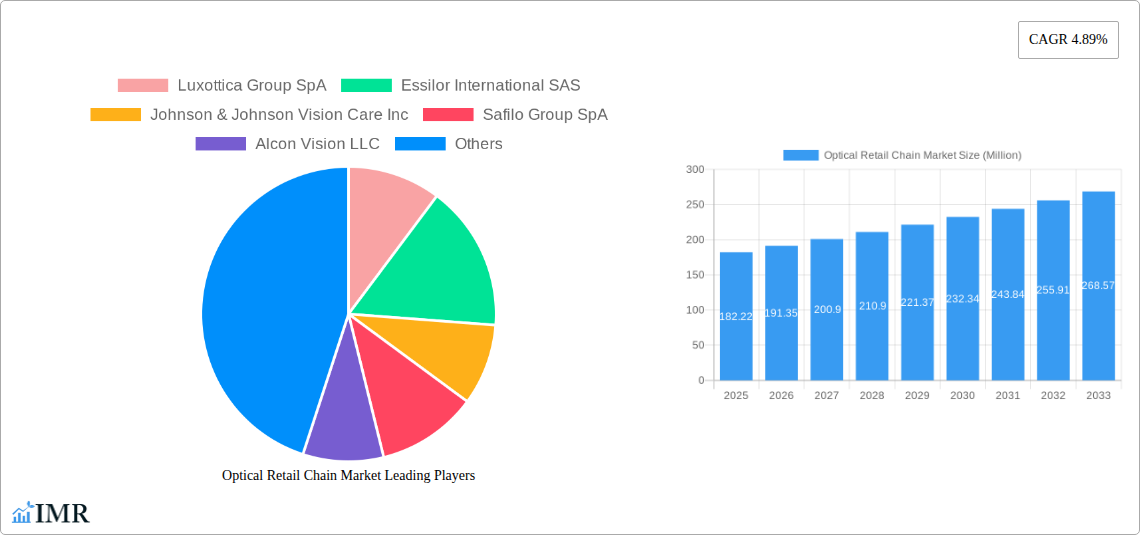

The market's expansion is also being shaped by evolving consumer behaviors and technological integration. The convenience offered by online payment modes and the growing adoption of e-commerce platforms for optical purchases are significant trends. While the online segment offers accessibility, the traditional Cash on Delivery (COD) method continues to hold sway, particularly in regions with lower digital penetration, ensuring a broad market reach. The increasing purchasing power of women, who are increasingly investing in eyewear for both functional and aesthetic reasons, is a key demographic driver. Furthermore, the expanding product portfolios, encompassing a wider range of eyewear for diverse needs and styles, along with strategic marketing initiatives by leading companies like Luxottica Group SpA, Essilor International SAS, and Johnson & Johnson Vision Care Inc., are vital in propelling market growth. Restraints such as intense competition and potential economic downturns are being effectively navigated through innovation and market penetration strategies.

Optical Retail Chain Market Company Market Share

Comprehensive Optical Retail Chain Market Report: Size, Trends, and Future Outlook (2019-2033)

This in-depth market research report provides a definitive analysis of the global Optical Retail Chain Market. Spanning a study period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, growth trends, regional dominance, product landscape, key players, and future opportunities. Designed for industry professionals, investors, and strategists, it delivers actionable insights into the evolving optical retail sector, including parent and child market analysis. All values are presented in Million units for clarity.

Optical Retail Chain Market Market Dynamics & Structure

The optical retail chain market exhibits a dynamic structure characterized by moderate to high concentration, heavily influenced by technological innovation and evolving consumer demands for visual health and fashion. Key players like Luxottica Group SpA and Essilor International SAS, through their extensive global presence and strategic acquisitions, significantly shape market concentration. Technological advancements in lens technology, frame materials, and diagnostic tools act as potent innovation drivers. Regulatory frameworks, particularly concerning optical prescriptions, product quality standards, and data privacy for online sales, play a crucial role in shaping market operations. Competitive product substitutes, ranging from generic eyewear to advanced smart glasses, continuously push for differentiation. End-user demographics, with increasing awareness of eye health among all age groups, present a broad customer base. Mergers and acquisitions (M&A) trends are prominent, as seen in Alcon's acquisition of Aerie Pharmaceuticals, indicating a drive for vertical integration and portfolio expansion in the ophthalmic sector.

- Market Concentration: Dominated by a few major global players, with Luxottica Group SpA and Essilor International SAS holding significant market share.

- Technological Innovation Drivers: Advancements in lens materials (e.g., photochromic, blue-light filtering), frame designs, and digital optometry solutions.

- Regulatory Frameworks: Strict regulations on prescription dispensing, product safety, and international trade policies impact market access and operations.

- Competitive Product Substitutes: Growing competition from direct-to-consumer online brands and smart eyewear solutions.

- End-User Demographics: Shifting consumer preferences towards personalized eyewear, premium brands, and integrated vision care solutions.

- M&A Trends: Ongoing consolidation and strategic acquisitions to enhance product portfolios and market reach, exemplified by the Alcon and Aerie Pharmaceuticals deal.

Optical Retail Chain Market Growth Trends & Insights

The Optical Retail Chain Market is poised for robust growth, driven by a confluence of factors including increasing awareness of eye health, the growing prevalence of vision defects, and the rising demand for fashion-forward eyewear. The market size is projected to witness a substantial expansion from its 2019-2024 historical period through to the forecast period of 2025-2033. Adoption rates for advanced lens technologies, such as progressive lenses and blue-light filtering lenses, are on an upward trajectory, mirroring increased consumer understanding of their benefits for prolonged screen time and eye strain. Technological disruptions, including the integration of artificial intelligence in eye diagnostics and the proliferation of e-commerce platforms for eyewear sales, are fundamentally reshaping the retail landscape. Consumer behavior shifts are evident, with a greater emphasis on personalized vision solutions, branded products, and convenient purchasing experiences, both online and in-store. The market penetration of specialized optical services and products, catering to specific age groups and vision needs, is also expanding.

The child market segments within optical retail are experiencing unique growth patterns. The "Beauty and Personal Care" segment, encompassing stylish and prescription eyeglasses as fashion accessories, is driven by social media influence and brand endorsements, particularly among women and younger demographics. Conversely, the "Food and Beverages" and "Entertainment" segments, while not directly linked, are indirectly influencing the optical market by contributing to lifestyle spending and the need for vision correction due to increased screen usage in these activities. The "Others Services" segment, encompassing specialized eye care services and vision therapy, is also growing as awareness of comprehensive eye health increases.

In the end-user domain, "Men," "Women," and "Kids" all represent significant growth opportunities. While women have historically led the fashion eyewear segment, men's adoption of stylish and functional eyewear is steadily increasing. The children's segment is driven by the rising incidence of myopia and the demand for specialized eyewear that supports their development.

The "Mode of Payment" analysis reveals a strong shift towards "Online Payment" due to its convenience and the growth of e-commerce in optical retail. However, "Cash on Delivery" remains a relevant option in certain emerging markets and for specific consumer segments. This bifurcated payment landscape necessitates a multi-pronged approach for retailers.

The CAGR for the Optical Retail Chain Market is estimated at a healthy XX% over the forecast period, indicating sustained expansion. Market penetration of corrective lenses is expected to reach XX% of the global population by 2033, underscoring the vast untapped potential.

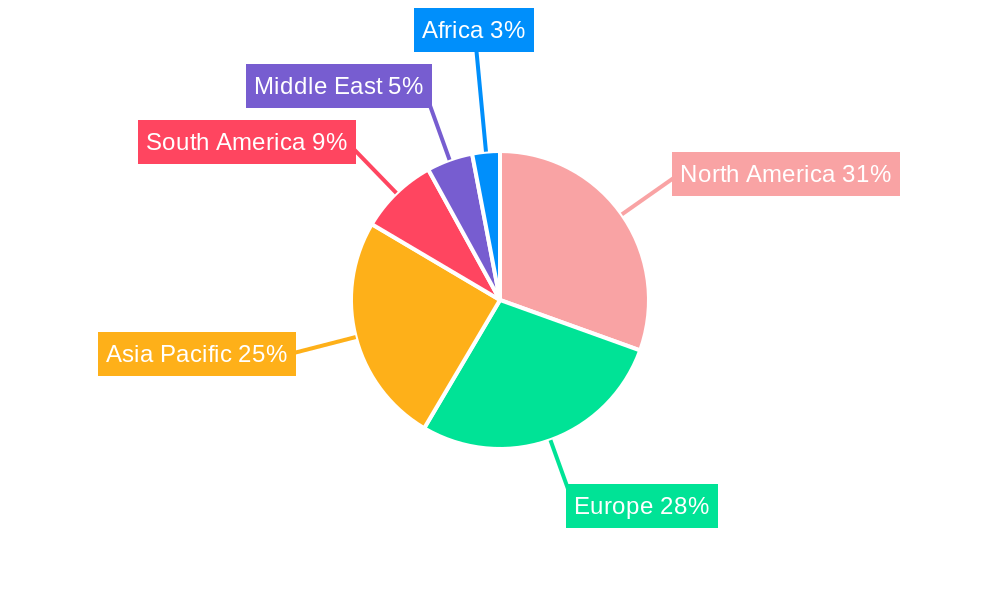

Dominant Regions, Countries, or Segments in Optical Retail Chain Market

The Asia Pacific region stands out as a dominant force in the global Optical Retail Chain Market, driven by a compelling combination of burgeoning economies, a rapidly expanding middle class, and increasing health consciousness. This dominance is further amplified by specific country-level growth within the region, notably China and India, which represent vast consumer bases with a growing disposable income and a heightened awareness of eye health. The increasing prevalence of myopia among children and young adults in these nations, coupled with the rising adoption of digital devices, fuels a consistent demand for corrective lenses and fashionable eyewear.

Within the Service segmentation, Beauty and Personal Care is a significant growth driver, transforming eyewear from a purely functional necessity into a key fashion statement. This segment is particularly strong among younger demographics and women, who are increasingly influenced by social media trends and celebrity endorsements for stylish frames and lenses. The demand for specialized lenses, such as those offering blue-light protection and UV filtering, also falls under this umbrella, catering to a growing health-conscious consumer base.

The End User segments of Men and Women are both crucial, with women historically leading in the fashion-driven aspects of eyewear, and men showing a steady increase in demand for both functional and stylish options. The Kids segment is experiencing robust growth due to the rising incidence of pediatric vision problems and increased parental focus on early intervention and protective eyewear.

Regarding the Mode of Payment, Online Payment is rapidly becoming the dominant method, propelled by the widespread adoption of e-commerce and the convenience it offers. This trend is particularly pronounced in developed markets but is gaining traction globally as digital infrastructure improves. While Cash on Delivery still holds relevance in specific emerging economies and for certain consumer segments, the overall trajectory points towards a digital-first payment ecosystem.

Key Drivers in Asia Pacific:

- Economic Growth: Rising disposable incomes leading to increased spending on premium and fashion eyewear.

- Healthcare Awareness: Growing consciousness about eye health and the importance of regular eye check-ups.

- Urbanization: Concentration of consumers in urban centers with better access to retail outlets and healthcare facilities.

- Government Initiatives: In some countries, government programs aimed at improving access to vision care contribute to market expansion.

- Technological Adoption: High smartphone penetration and internet access facilitate online sales and digital engagement.

Dominance Factors:

- Market Share: Asia Pacific accounts for an estimated XX% of the global optical retail market share.

- Growth Potential: The region is projected to exhibit a CAGR of XX% over the forecast period, outpacing other regions.

- Demographic Dividend: A young and growing population segment represents a sustained demand for optical products and services.

Optical Retail Chain Market Product Landscape

The optical retail chain market is characterized by a diverse and evolving product landscape, driven by continuous innovation in lens technology, frame materials, and integrated functionalities. Spectacles and contact lenses remain the core offerings, with advancements focusing on improved visual acuity, comfort, and UV protection. Smart eyewear, incorporating features like augmented reality and audio connectivity, represents a nascent but rapidly growing segment, promising to redefine the user experience. The performance metrics of these products are increasingly benchmarked against durability, optical precision, wearer comfort, and aesthetic appeal, catering to both functional needs and fashion trends. Unique selling propositions often lie in proprietary lens coatings, ergonomic frame designs, and personalized fitting solutions.

Key Drivers, Barriers & Challenges in Optical Retail Chain Market

The Optical Retail Chain Market is propelled by several key drivers. Technological advancements in lens manufacturing, such as the development of thinner, lighter, and more durable materials, significantly enhance product appeal and wearer comfort. The increasing global prevalence of vision impairments, including myopia, hyperopia, and presbyopia, due to factors like prolonged screen time and an aging population, creates a consistent demand for corrective eyewear. Furthermore, the growing trend of eyewear as a fashion accessory, with consumers seeking stylish frames that complement their personal style, drives market expansion.

However, the market also faces significant barriers and challenges. Intense competition from both established optical chains and a burgeoning number of online retailers, often with aggressive pricing strategies, poses a constant threat to profitability. Regulatory hurdles, including varying prescription validity laws across different regions and stringent product quality standards, can complicate market entry and expansion. Supply chain disruptions, particularly those stemming from global events or raw material availability, can impact product delivery timelines and costs. The high cost of advanced lens technologies can also be a barrier for price-sensitive consumers.

Key Drivers:

- Rising incidence of vision impairments globally.

- Eyewear as a fashion statement and personal expression.

- Technological innovations in lens materials and frame designs.

- Increased consumer awareness of eye health and regular check-ups.

Barriers & Challenges:

- Intense price competition from online and offline players.

- Navigating diverse and complex regulatory frameworks.

- Vulnerability to supply chain disruptions and raw material cost fluctuations.

- High upfront investment for advanced optical technologies.

- Counterfeit products impacting brand reputation and consumer trust.

Emerging Opportunities in Optical Retail Chain Market

Emerging opportunities in the Optical Retail Chain Market lie in the expansion of personalized vision solutions and the integration of telehealth services. The growing demand for customizable lenses, tailored to individual lifestyle needs and visual environments, presents a significant growth avenue. Furthermore, the untapped potential of emerging markets, where access to quality eye care is still limited, offers substantial opportunities for market penetration. The development of innovative applications for smart eyewear, beyond basic functionality, such as integration with health monitoring and diagnostic tools, is another area poised for rapid growth. Evolving consumer preferences for sustainable and eco-friendly eyewear options also present a niche but expanding market.

Growth Accelerators in the Optical Retail Chain Market Industry

Long-term growth in the Optical Retail Chain Market is being significantly accelerated by breakthroughs in ophthalmic biotechnology and the strategic expansion of direct-to-consumer (DTC) models. The development of advanced contact lenses, offering extended wear times and therapeutic drug delivery capabilities, is revolutionizing the vision correction landscape. Strategic partnerships between optical retailers and technology companies are fostering the creation of innovative smart eyewear that integrates seamlessly into users' digital lives. Furthermore, the continued proliferation of e-commerce platforms, coupled with the adoption of omnichannel retail strategies, allows for wider market reach and enhanced customer engagement, driving sustained growth.

Key Players Shaping the Optical Retail Chain Market Market

- Luxottica Group SpA

- Essilor International SAS

- Johnson & Johnson Vision Care Inc

- Safilo Group SpA

- Alcon Vision LLC

- Oakley Inc

- The Cooper Companies Inc

- Bausch & Lomb Incorporated

- Hoya Corporation

- Carl Zeiss AG

Notable Milestones in Optical Retail Chain Market Sector

- July 2023: Johnson & Johnson completed the sale of its Blink product line, including over-the-counter eye and contact lens drops, to Bausch + Lomb for USD 106.5 million. This divestment was a strategic move by Johnson & Johnson to exit the consumer business, allowing Bausch + Lomb to strengthen its position in the consumer eye care segment.

- November 2022: Alcon acquired Aerie Pharmaceuticals Inc., significantly strengthening its ophthalmic pharmaceutical business and acquiring a pipeline of pharmaceutical product candidates. This transaction aimed to enhance Alcon's position in the eye drug market, focusing on expanding its product portfolio and addressing unmet needs in glaucoma and other eye conditions.

In-Depth Optical Retail Chain Market Market Outlook

The future outlook for the Optical Retail Chain Market is exceptionally bright, fueled by a combination of demographic shifts, continuous technological innovation, and evolving consumer demands. Growth accelerators such as the increasing global burden of vision impairments, coupled with the growing acceptance of advanced lens technologies and personalized eyewear, will continue to propel market expansion. Strategic investments in research and development, focusing on smart eyewear and integrated vision care solutions, will unlock new revenue streams and enhance customer value. The ongoing trend towards omnichannel retail experiences, blending online convenience with in-store personalization, will be critical for success. Furthermore, the expanding healthcare infrastructure in emerging economies presents significant untapped potential, positioning the optical retail chain market for sustained and robust growth in the coming years.

Optical Retail Chain Market Segmentation

-

1. Service

- 1.1. Beauty and Personal Care

- 1.2. Food And Beverages

- 1.3. Entertainment

- 1.4. Others Services

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids

-

3. Mode of Payment

- 3.1. Online Payment

- 3.2. Cash on Delivery

Optical Retail Chain Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Russia

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. South Africa

- 6.2. Rest of Middle East

Optical Retail Chain Market Regional Market Share

Geographic Coverage of Optical Retail Chain Market

Optical Retail Chain Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness of Eye Health; Eyewear has Become an Integral Fashion Accessory

- 3.3. Market Restrains

- 3.3.1. Increasing Awareness of Eye Health; Eyewear has Become an Integral Fashion Accessory

- 3.4. Market Trends

- 3.4.1. Offline Optical Retail Chain is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Beauty and Personal Care

- 5.1.2. Food And Beverages

- 5.1.3. Entertainment

- 5.1.4. Others Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids

- 5.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.3.1. Online Payment

- 5.3.2. Cash on Delivery

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Asia Pacific Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Beauty and Personal Care

- 6.1.2. Food And Beverages

- 6.1.3. Entertainment

- 6.1.4. Others Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids

- 6.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 6.3.1. Online Payment

- 6.3.2. Cash on Delivery

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. North America Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Beauty and Personal Care

- 7.1.2. Food And Beverages

- 7.1.3. Entertainment

- 7.1.4. Others Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids

- 7.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 7.3.1. Online Payment

- 7.3.2. Cash on Delivery

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Beauty and Personal Care

- 8.1.2. Food And Beverages

- 8.1.3. Entertainment

- 8.1.4. Others Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids

- 8.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 8.3.1. Online Payment

- 8.3.2. Cash on Delivery

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South America Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Beauty and Personal Care

- 9.1.2. Food And Beverages

- 9.1.3. Entertainment

- 9.1.4. Others Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids

- 9.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 9.3.1. Online Payment

- 9.3.2. Cash on Delivery

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Beauty and Personal Care

- 10.1.2. Food And Beverages

- 10.1.3. Entertainment

- 10.1.4. Others Services

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Kids

- 10.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 10.3.1. Online Payment

- 10.3.2. Cash on Delivery

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. United Arab Emirates Optical Retail Chain Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Beauty and Personal Care

- 11.1.2. Food And Beverages

- 11.1.3. Entertainment

- 11.1.4. Others Services

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Men

- 11.2.2. Women

- 11.2.3. Kids

- 11.3. Market Analysis, Insights and Forecast - by Mode of Payment

- 11.3.1. Online Payment

- 11.3.2. Cash on Delivery

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Luxottica Group SpA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Essilor International SAS

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Johnson & Johnson Vision Care Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Safilo Group SpA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Alcon Vision LLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Oakley Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 The Cooper Companies Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Bausch & Lomb Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hoya Corportation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Carl Zeiss AG

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Luxottica Group SpA

List of Figures

- Figure 1: Global Optical Retail Chain Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Optical Retail Chain Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 4: Asia Pacific Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 5: Asia Pacific Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: Asia Pacific Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 7: Asia Pacific Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 8: Asia Pacific Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 9: Asia Pacific Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: Asia Pacific Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 11: Asia Pacific Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 12: Asia Pacific Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 13: Asia Pacific Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 14: Asia Pacific Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 15: Asia Pacific Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Asia Pacific Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Asia Pacific Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 20: North America Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 21: North America Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: North America Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 23: North America Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 24: North America Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 25: North America Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 26: North America Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 27: North America Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 28: North America Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 29: North America Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 30: North America Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 31: North America Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 32: North America Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 33: North America Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 36: Europe Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 37: Europe Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 38: Europe Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 39: Europe Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 40: Europe Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 41: Europe Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 42: Europe Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 43: Europe Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 44: Europe Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 45: Europe Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 46: Europe Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 47: Europe Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 52: South America Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 53: South America Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 54: South America Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 55: South America Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 56: South America Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 57: South America Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 60: South America Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 61: South America Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 62: South America Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 63: South America Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 64: South America Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 65: South America Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 68: Middle East Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 69: Middle East Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 70: Middle East Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 71: Middle East Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 72: Middle East Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 73: Middle East Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 74: Middle East Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 75: Middle East Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 76: Middle East Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 77: Middle East Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 78: Middle East Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 79: Middle East Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

- Figure 83: United Arab Emirates Optical Retail Chain Market Revenue (Million), by Service 2025 & 2033

- Figure 84: United Arab Emirates Optical Retail Chain Market Volume (Billion), by Service 2025 & 2033

- Figure 85: United Arab Emirates Optical Retail Chain Market Revenue Share (%), by Service 2025 & 2033

- Figure 86: United Arab Emirates Optical Retail Chain Market Volume Share (%), by Service 2025 & 2033

- Figure 87: United Arab Emirates Optical Retail Chain Market Revenue (Million), by End User 2025 & 2033

- Figure 88: United Arab Emirates Optical Retail Chain Market Volume (Billion), by End User 2025 & 2033

- Figure 89: United Arab Emirates Optical Retail Chain Market Revenue Share (%), by End User 2025 & 2033

- Figure 90: United Arab Emirates Optical Retail Chain Market Volume Share (%), by End User 2025 & 2033

- Figure 91: United Arab Emirates Optical Retail Chain Market Revenue (Million), by Mode of Payment 2025 & 2033

- Figure 92: United Arab Emirates Optical Retail Chain Market Volume (Billion), by Mode of Payment 2025 & 2033

- Figure 93: United Arab Emirates Optical Retail Chain Market Revenue Share (%), by Mode of Payment 2025 & 2033

- Figure 94: United Arab Emirates Optical Retail Chain Market Volume Share (%), by Mode of Payment 2025 & 2033

- Figure 95: United Arab Emirates Optical Retail Chain Market Revenue (Million), by Country 2025 & 2033

- Figure 96: United Arab Emirates Optical Retail Chain Market Volume (Billion), by Country 2025 & 2033

- Figure 97: United Arab Emirates Optical Retail Chain Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: United Arab Emirates Optical Retail Chain Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 3: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 6: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 7: Global Optical Retail Chain Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Optical Retail Chain Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 13: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 14: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 15: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: India Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: India Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: China Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Australia Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Australia Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 28: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 29: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 31: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 32: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 33: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 35: United States Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United States Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Canada Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Canada Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of North America Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of North America Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 42: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 43: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 45: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 46: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 47: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Germany Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Germany Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: France Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: France Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Russia Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Europe Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Europe Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 60: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 61: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 62: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 63: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 64: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 65: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 67: Brazil Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Brazil Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Argentina Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Argentina Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of South America Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of South America Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 74: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 75: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 76: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 77: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 78: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 79: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 81: Global Optical Retail Chain Market Revenue Million Forecast, by Service 2020 & 2033

- Table 82: Global Optical Retail Chain Market Volume Billion Forecast, by Service 2020 & 2033

- Table 83: Global Optical Retail Chain Market Revenue Million Forecast, by End User 2020 & 2033

- Table 84: Global Optical Retail Chain Market Volume Billion Forecast, by End User 2020 & 2033

- Table 85: Global Optical Retail Chain Market Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 86: Global Optical Retail Chain Market Volume Billion Forecast, by Mode of Payment 2020 & 2033

- Table 87: Global Optical Retail Chain Market Revenue Million Forecast, by Country 2020 & 2033

- Table 88: Global Optical Retail Chain Market Volume Billion Forecast, by Country 2020 & 2033

- Table 89: South Africa Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: South Africa Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Middle East Optical Retail Chain Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Middle East Optical Retail Chain Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optical Retail Chain Market?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the Optical Retail Chain Market?

Key companies in the market include Luxottica Group SpA, Essilor International SAS, Johnson & Johnson Vision Care Inc, Safilo Group SpA, Alcon Vision LLC, Oakley Inc, The Cooper Companies Inc, Bausch & Lomb Incorporated, Hoya Corportation, Carl Zeiss AG.

3. What are the main segments of the Optical Retail Chain Market?

The market segments include Service, End User, Mode of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 182.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness of Eye Health; Eyewear has Become an Integral Fashion Accessory.

6. What are the notable trends driving market growth?

Offline Optical Retail Chain is Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Awareness of Eye Health; Eyewear has Become an Integral Fashion Accessory.

8. Can you provide examples of recent developments in the market?

July 2023: Johnson & Johnson completed the sale of its Blink product line, which includes over-the-counter eye and contact lens drops, to Bausch + Lomb for USD 106.5 million. This divestment was a strategic move by Johnson & Johnson to exit the consumer business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optical Retail Chain Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optical Retail Chain Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optical Retail Chain Market?

To stay informed about further developments, trends, and reports in the Optical Retail Chain Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence