Key Insights

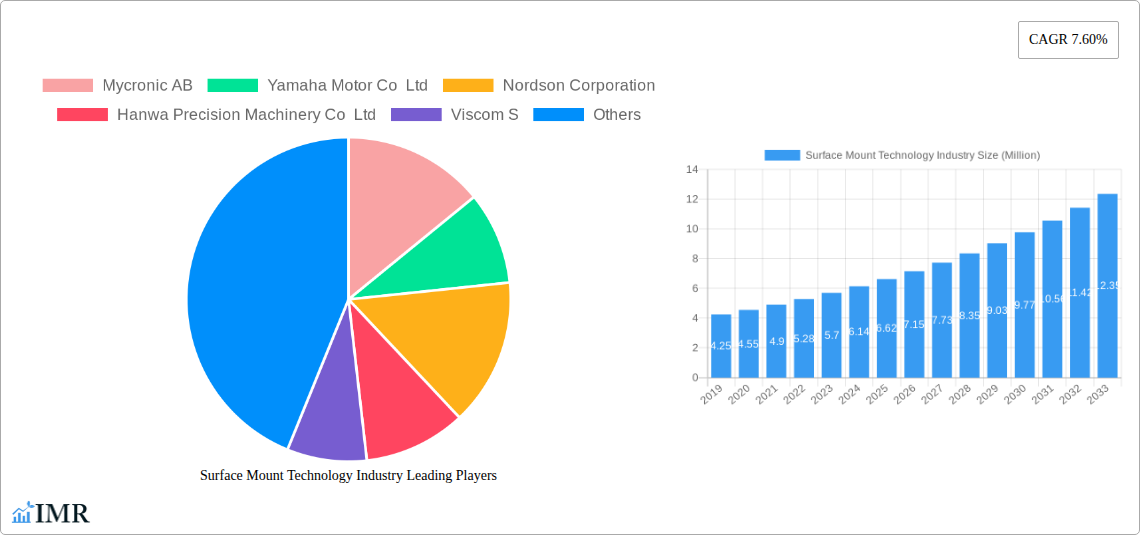

The Surface Mount Technology (SMT) market is poised for robust expansion, projected to reach a substantial size by 2033. The current market size of $6.14 billion, with an impressive Compound Annual Growth Rate (CAGR) of 7.60% from 2019 to 2033, underscores the dynamic nature and increasing demand for SMT solutions. This growth is propelled by the insatiable appetite for miniaturized and high-performance electronic devices across various sectors. The proliferation of consumer electronics, driven by the continuous innovation in smartphones, wearables, and smart home devices, forms a significant pillar of this expansion. Furthermore, the automotive industry's rapid shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) necessitates sophisticated electronic components, thereby fueling SMT adoption. Industrial electronics, with the ongoing trend of automation and Industry 4.0, also represents a key growth driver, demanding efficient and reliable electronic manufacturing processes. The healthcare sector's increasing reliance on compact and advanced medical devices further contributes to this upward trajectory.

Surface Mount Technology Industry Market Size (In Million)

Key trends shaping the SMT landscape include the relentless pursuit of higher component density and smaller form factors, demanding advanced placement and soldering technologies. The integration of artificial intelligence (AI) and machine learning (ML) in SMT equipment for enhanced process control, defect detection, and predictive maintenance is also a significant trend, improving efficiency and reducing downtime. Advanced packaging techniques, such as System-in-Package (SiP) and 3D packaging, are gaining prominence, requiring specialized SMT capabilities. However, challenges such as the increasing complexity of electronic components, the need for skilled labor to operate advanced SMT machinery, and the ever-present pressure for cost optimization can act as restraints. Despite these challenges, the inherent advantages of SMT—including improved electrical performance, reduced board size, and higher production yields—ensure its continued dominance in electronic manufacturing. Regions like Asia are expected to lead the market due to their established manufacturing base and growing domestic demand, while North America and Europe are strong contenders driven by technological innovation and high-value applications.

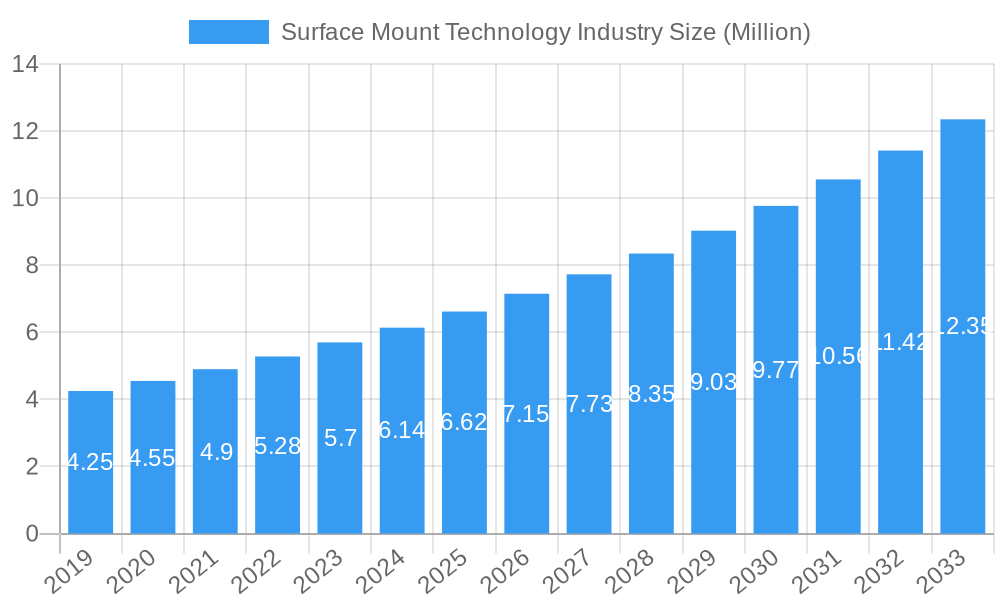

Surface Mount Technology Industry Company Market Share

Surface Mount Technology (SMT) Industry: Comprehensive Market Analysis & Future Outlook (2019-2033)

Unlock unparalleled insights into the global Surface Mount Technology (SMT) industry with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market dynamics, growth trends, regional dominance, product landscapes, key drivers, emerging opportunities, and the strategic moves of major players. Essential for industry professionals seeking to navigate the evolving SMT ecosystem, understand its intricate parent and child market relationships, and capitalize on future growth trajectories. All quantitative values are presented in Million units for clarity.

Surface Mount Technology Industry Market Dynamics & Structure

The Surface Mount Technology (SMT) industry is characterized by a moderately concentrated market structure, driven by significant technological innovation, particularly in automation and miniaturization. Key drivers include the relentless demand for smaller, more powerful, and cost-effective electronic devices across various end-user sectors. Regulatory frameworks, while generally supportive of technological advancement, can introduce complexities related to environmental standards and material sourcing. Competitive product substitutes, though limited in direct function, emerge from alternative assembly methods or entirely new device designs that reduce reliance on traditional SMT processes. End-user demographics are increasingly sophisticated, demanding higher performance and integrated functionalities, pushing SMT capabilities to their limits. Mergers and acquisitions (M&A) activity remains a notable trend, with larger players consolidating market share and acquiring specialized technologies to enhance their product portfolios and expand their global reach. For instance, the period has seen several strategic acquisitions aimed at bolstering capabilities in advanced packaging and high-precision placement. The market's growth is further influenced by the interplay between its parent market (overall electronics manufacturing) and its child markets (specific component and device manufacturing).

- Market Concentration: Moderate, with a mix of large established players and specialized smaller firms.

- Technological Innovation Drivers: Miniaturization, increased component density, high-speed placement, advanced inspection systems, and integration of AI/ML in SMT processes.

- Regulatory Frameworks: Focus on RoHS compliance, lead-free soldering, and evolving environmental standards influencing material choices and manufacturing processes.

- Competitive Product Substitutes: While direct substitutes for SMT assembly are scarce, innovation in areas like System-in-Package (SiP) and advanced semiconductor integration can alter demand patterns.

- End-User Demographics: Growing demand for smart devices, connected vehicles, wearable technology, and miniaturized medical implants.

- M&A Trends: Ongoing consolidation to gain market share, acquire intellectual property, and expand geographical presence, particularly in high-growth regions.

Surface Mount Technology Industry Growth Trends & Insights

The Surface Mount Technology (SMT) industry is poised for robust expansion driven by the insatiable global appetite for electronic devices. Market size evolution reflects this demand, with significant growth anticipated throughout the forecast period. Adoption rates of SMT are consistently high, particularly in sectors like consumer electronics and automotive, where the need for compact and high-performance components is paramount. Technological disruptions are a constant feature, with advancements in pick-and-place machinery, soldering techniques, and automated optical inspection (AOI) systems continually pushing the boundaries of efficiency and precision. These innovations are not merely incremental; they represent paradigm shifts in manufacturing capabilities. Consumer behavior shifts, such as the increasing demand for personalized and feature-rich gadgets, directly translate into higher volumes and greater complexity for SMT production lines. The integration of IoT devices, the proliferation of electric vehicles, and the ongoing digital transformation across industries are powerful catalysts for SMT market growth. The industry's ability to adapt to these dynamic trends, coupled with its inherent cost-effectiveness and scalability, underpins its sustained upward trajectory. The CAGR for the SMT industry is projected to be xx% over the forecast period, indicating a healthy and consistent growth trajectory fueled by these powerful macro and micro-economic forces. Market penetration of advanced SMT solutions is expanding into niche sectors like medical devices and aerospace, demonstrating the technology's versatility.

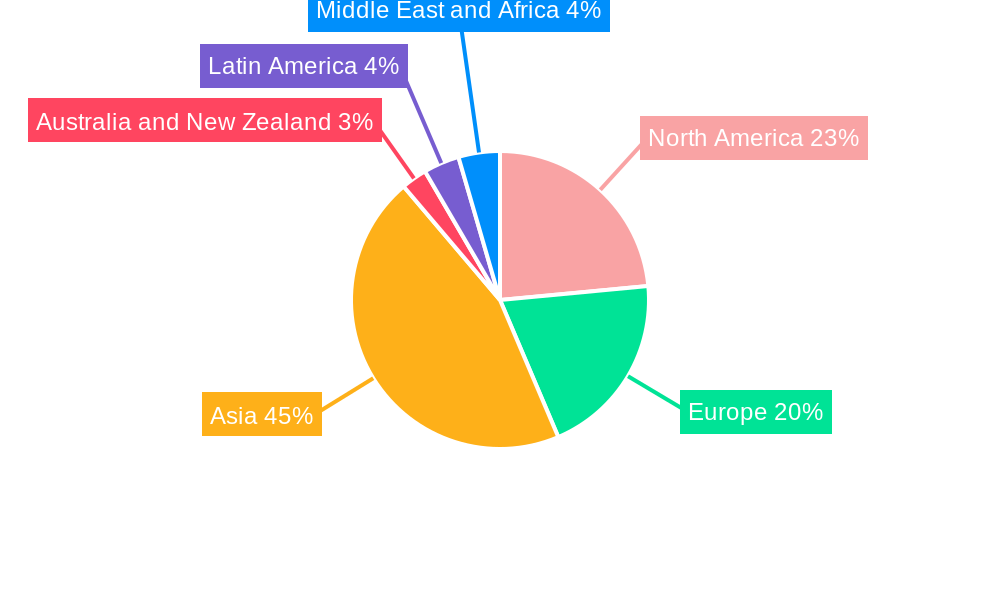

Dominant Regions, Countries, or Segments in Surface Mount Technology Industry

The Surface Mount Technology (SMT) industry's dominance is intricately linked to the production hubs of its primary component and end-user segments. Consumer Electronics stands out as a leading end-user industry, driving substantial demand for SMT services. This segment's growth is propelled by continuous product innovation, rapid upgrade cycles, and the sheer volume of devices manufactured globally. Countries within Asia, particularly China, Taiwan, and South Korea, are central to this dominance due to their established electronics manufacturing ecosystems, skilled labor force, and favorable investment policies. The parent market of overall electronics manufacturing heavily influences the SMT industry's regional distribution.

Within the component landscape, Passive Components (Resistors, Capacitors) and Active Components (Transistors, Integrated Circuits) are foundational to SMT. The immense global production volumes of these components directly translate into a high demand for SMT processes. The increasing complexity and miniaturization of these components necessitate advanced SMT solutions, further solidifying their dominance.

- Leading End-User Industry: Consumer Electronics, owing to its vast market size and continuous demand for new and updated devices.

- Key Drivers: Rapid product life cycles, increasing device functionality, growing demand for smart home devices, wearables, and mobile accessories.

- Market Share Impact: Consumer electronics account for an estimated xx% of the total SMT market demand.

- Dominant Component Segments: Passive Components and Active Components are the bedrock of SMT.

- Key Drivers: Ubiquity in almost all electronic devices, continuous innovation in miniaturization and performance, and high-volume manufacturing requirements.

- Growth Potential: These segments offer consistent growth due to their essential nature in the electronics supply chain.

- Regional Dominance: Asia-Pacific, particularly East Asia, remains the manufacturing powerhouse for SMT due to established supply chains and technological expertise.

- Economic Policies: Government initiatives promoting electronics manufacturing and R&D significantly contribute to regional dominance.

- Infrastructure: Robust industrial infrastructure, including specialized manufacturing zones and logistics networks, supports high-volume SMT operations.

Surface Mount Technology Industry Product Landscape

The Surface Mount Technology (SMT) industry product landscape is defined by sophisticated machinery and advanced materials that enable the precise placement of electronic components onto printed circuit boards (PCBs). Key innovations include high-speed pick-and-place machines capable of placing millions of components per hour, advanced soldering equipment utilizing vapor phase and selective soldering technologies for superior joint integrity, and automated inspection systems (AOI and X-ray) ensuring defect detection at microscopic levels. Unique selling propositions revolve around increased throughput, enhanced accuracy, greater flexibility for handling diverse component sizes and types, and reduced operational costs. Technological advancements are increasingly focused on Industry 4.0 integration, featuring smart factories with real-time data analytics, predictive maintenance, and automated material handling. This continuous evolution ensures that SMT remains at the forefront of electronics manufacturing, facilitating the creation of smaller, more complex, and higher-performing electronic devices.

Key Drivers, Barriers & Challenges in Surface Mount Technology Industry

Key Drivers:

The Surface Mount Technology (SMT) industry is propelled by several critical factors. The ever-increasing demand for miniaturized and high-performance electronic devices across consumer electronics, automotive, and healthcare sectors is a primary driver. Technological advancements in SMT equipment, such as faster pick-and-place machines and more sophisticated inspection systems, enable manufacturers to produce more complex boards with higher yields. The growing trend towards IoT devices, smart wearables, and electric vehicles further fuels the need for advanced SMT capabilities. Cost-effectiveness and efficiency gains offered by SMT processes compared to older through-hole technologies also contribute significantly.

Barriers & Challenges:

Despite its robust growth, the SMT industry faces several challenges. The initial capital investment required for advanced SMT equipment can be substantial, posing a barrier for smaller manufacturers. Stringent quality control requirements and the need for highly skilled labor to operate and maintain these sophisticated machines present ongoing challenges. Supply chain disruptions, particularly for critical components and materials, can impact production schedules and costs, as witnessed by recent global events. Increasing environmental regulations, such as lead-free soldering mandates, necessitate continuous process adjustments and material innovation. Furthermore, intense competition within the SMT equipment manufacturing sector can lead to price pressures. The projected supply chain impact due to geopolitical factors is estimated at xx% of production downtime.

Emerging Opportunities in Surface Mount Technology Industry

Emerging opportunities in the Surface Mount Technology (SMT) industry are abundant, driven by evolving technological landscapes and shifting consumer demands. The rapid growth of the Internet of Things (IoT) ecosystem, encompassing smart homes, industrial automation, and connected infrastructure, presents a significant demand for specialized, miniaturized, and high-reliability SMT solutions. The expansion of electric and autonomous vehicles is creating new opportunities for advanced SMT applications in complex control units, sensor integration, and power electronics. Furthermore, the increasing adoption of wearable technology and advanced medical devices, such as implantable sensors and diagnostic equipment, requires ultra-miniaturization and high-precision SMT processes. The development of novel materials, including flexible PCBs and advanced conductive inks, opens avenues for new product designs and applications. The ongoing digital transformation across industries is also creating a need for sophisticated electronics, driving demand for SMT capabilities. The market for specialized SMT services for niche applications is projected to grow by xx% annually.

Growth Accelerators in the Surface Mount Technology Industry Industry

Several catalysts are accelerating the long-term growth of the Surface Mount Technology (SMT) industry. Technological breakthroughs in areas such as advanced robotics, artificial intelligence for process optimization, and machine learning for predictive maintenance are enhancing SMT line efficiency and reducing operational costs. Strategic partnerships between equipment manufacturers, component suppliers, and end-product developers are fostering innovation and creating integrated solutions tailored to specific industry needs. The global expansion of manufacturing capabilities, particularly in emerging economies, is opening new markets and increasing overall SMT demand. The increasing complexity and functionality of electronic devices, driven by consumer expectations and industry advancements, necessitate more sophisticated SMT processes, thus acting as a consistent growth accelerator. Furthermore, government initiatives and investments in advanced manufacturing and electronics industries in various regions are providing a supportive environment for SMT market expansion. The adoption of Industry 4.0 principles is a major growth accelerator, projected to increase overall SMT output by xx% within the next five years.

Key Players Shaping the Surface Mount Technology Industry Market

- Mycronic AB

- Yamaha Motor Co Ltd

- Nordson Corporation

- Hanwa Precision Machinery Co Ltd

- Viscom AG

- Juki Corporation

- Zhejiang Neoden Technology Co Ltd

- Fuji Corporation

- Europlacer Limited

- ASMPT

- Panasonic Corporation

Notable Milestones in Surface Mount Technology Industry Sector

- June 2024: Beifu Electronic Technology Co. Ltd, Shanghai, integrated Europlacer's cutting-edge pick-and-place technology, significantly ramping up production efficiency and achieving swifter changeovers and enhanced flexibility with Europlacer's Atom pick-and-place range.

- April 2024: TVS Electronics announced its venture into the electronics manufacturing services (EMS) sector, with a focus on defense and railway products. The company is strategizing to expand its SMT line, which commenced operations in February 2024, with a vision to have six operational SMT lines at its Tumakuru facility by 2028, engaging with tech partners from Taiwan, South Korea, Japan, and China.

In-Depth Surface Mount Technology Industry Market Outlook

The Surface Mount Technology (SMT) industry's future outlook is exceptionally positive, driven by pervasive digital transformation and relentless innovation in electronic device design. Growth accelerators such as AI-driven automation, advanced robotics, and the increasing demand for high-density interconnects will continue to shape manufacturing processes. Strategic partnerships and collaborative ecosystems will foster the development of next-generation SMT solutions capable of meeting the challenges of miniaturization, increased performance, and cost efficiency. Emerging markets, coupled with the expansion of key end-user industries like automotive (especially EVs) and advanced healthcare, present significant untapped potential. The industry's adaptability to evolving technological paradigms and its integral role in the electronics supply chain position it for sustained and dynamic growth, making it a critical component of the global manufacturing landscape. The projected market potential for advanced SMT solutions in specialized sectors is estimated to reach xx Million units in revenue by 2033.

Surface Mount Technology Industry Segmentation

-

1. Component

-

1.1. Passive Components

- 1.1.1. Resistors

- 1.1.2. Capacitors

-

1.2. Active Components

- 1.2.1. Transistors

- 1.2.2. Integrated Circuits

-

1.1. Passive Components

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. Industrial Electronics

- 2.4. Aerospace and Defense

- 2.5. Healthcare

- 2.6. Other End-user Industries

Surface Mount Technology Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Surface Mount Technology Industry Regional Market Share

Geographic Coverage of Surface Mount Technology Industry

Surface Mount Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Defense Budgets Across Geographies

- 3.3. Market Restrains

- 3.3.1. Highly Consolidated Market

- 3.4. Market Trends

- 3.4.1. Consumer Electronics End-user Industry Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Surface Mount Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Passive Components

- 5.1.1.1. Resistors

- 5.1.1.2. Capacitors

- 5.1.2. Active Components

- 5.1.2.1. Transistors

- 5.1.2.2. Integrated Circuits

- 5.1.1. Passive Components

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Industrial Electronics

- 5.2.4. Aerospace and Defense

- 5.2.5. Healthcare

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Surface Mount Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Passive Components

- 6.1.1.1. Resistors

- 6.1.1.2. Capacitors

- 6.1.2. Active Components

- 6.1.2.1. Transistors

- 6.1.2.2. Integrated Circuits

- 6.1.1. Passive Components

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Consumer Electronics

- 6.2.2. Automotive

- 6.2.3. Industrial Electronics

- 6.2.4. Aerospace and Defense

- 6.2.5. Healthcare

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Surface Mount Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Passive Components

- 7.1.1.1. Resistors

- 7.1.1.2. Capacitors

- 7.1.2. Active Components

- 7.1.2.1. Transistors

- 7.1.2.2. Integrated Circuits

- 7.1.1. Passive Components

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Consumer Electronics

- 7.2.2. Automotive

- 7.2.3. Industrial Electronics

- 7.2.4. Aerospace and Defense

- 7.2.5. Healthcare

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Surface Mount Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Passive Components

- 8.1.1.1. Resistors

- 8.1.1.2. Capacitors

- 8.1.2. Active Components

- 8.1.2.1. Transistors

- 8.1.2.2. Integrated Circuits

- 8.1.1. Passive Components

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Consumer Electronics

- 8.2.2. Automotive

- 8.2.3. Industrial Electronics

- 8.2.4. Aerospace and Defense

- 8.2.5. Healthcare

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Surface Mount Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Passive Components

- 9.1.1.1. Resistors

- 9.1.1.2. Capacitors

- 9.1.2. Active Components

- 9.1.2.1. Transistors

- 9.1.2.2. Integrated Circuits

- 9.1.1. Passive Components

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Consumer Electronics

- 9.2.2. Automotive

- 9.2.3. Industrial Electronics

- 9.2.4. Aerospace and Defense

- 9.2.5. Healthcare

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Surface Mount Technology Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Passive Components

- 10.1.1.1. Resistors

- 10.1.1.2. Capacitors

- 10.1.2. Active Components

- 10.1.2.1. Transistors

- 10.1.2.2. Integrated Circuits

- 10.1.1. Passive Components

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Consumer Electronics

- 10.2.2. Automotive

- 10.2.3. Industrial Electronics

- 10.2.4. Aerospace and Defense

- 10.2.5. Healthcare

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Surface Mount Technology Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Passive Components

- 11.1.1.1. Resistors

- 11.1.1.2. Capacitors

- 11.1.2. Active Components

- 11.1.2.1. Transistors

- 11.1.2.2. Integrated Circuits

- 11.1.1. Passive Components

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Consumer Electronics

- 11.2.2. Automotive

- 11.2.3. Industrial Electronics

- 11.2.4. Aerospace and Defense

- 11.2.5. Healthcare

- 11.2.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Mycronic AB

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Yamaha Motor Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Nordson Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hanwa Precision Machinery Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Viscom S

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Juki Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Zhejiang Neoden Technology Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Fuji Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Europlacer Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ASMPT

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Panasonic Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Mycronic AB

List of Figures

- Figure 1: Global Surface Mount Technology Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Surface Mount Technology Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Surface Mount Technology Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Surface Mount Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Surface Mount Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Surface Mount Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Surface Mount Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Surface Mount Technology Industry Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Surface Mount Technology Industry Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Surface Mount Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Surface Mount Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Surface Mount Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Surface Mount Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Surface Mount Technology Industry Revenue (Million), by Component 2025 & 2033

- Figure 15: Asia Surface Mount Technology Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Surface Mount Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Surface Mount Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Surface Mount Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Surface Mount Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Surface Mount Technology Industry Revenue (Million), by Component 2025 & 2033

- Figure 21: Australia and New Zealand Surface Mount Technology Industry Revenue Share (%), by Component 2025 & 2033

- Figure 22: Australia and New Zealand Surface Mount Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Australia and New Zealand Surface Mount Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Australia and New Zealand Surface Mount Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Surface Mount Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Surface Mount Technology Industry Revenue (Million), by Component 2025 & 2033

- Figure 27: Latin America Surface Mount Technology Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Latin America Surface Mount Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Latin America Surface Mount Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Latin America Surface Mount Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Surface Mount Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Surface Mount Technology Industry Revenue (Million), by Component 2025 & 2033

- Figure 33: Middle East and Africa Surface Mount Technology Industry Revenue Share (%), by Component 2025 & 2033

- Figure 34: Middle East and Africa Surface Mount Technology Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Middle East and Africa Surface Mount Technology Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Middle East and Africa Surface Mount Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Surface Mount Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Surface Mount Technology Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Surface Mount Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Surface Mount Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Surface Mount Technology Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Surface Mount Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Surface Mount Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Surface Mount Technology Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global Surface Mount Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Surface Mount Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Surface Mount Technology Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 11: Global Surface Mount Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Surface Mount Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Surface Mount Technology Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global Surface Mount Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Surface Mount Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Surface Mount Technology Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Surface Mount Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Surface Mount Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Surface Mount Technology Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 20: Global Surface Mount Technology Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Surface Mount Technology Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Surface Mount Technology Industry?

The projected CAGR is approximately 7.60%.

2. Which companies are prominent players in the Surface Mount Technology Industry?

Key companies in the market include Mycronic AB, Yamaha Motor Co Ltd, Nordson Corporation, Hanwa Precision Machinery Co Ltd, Viscom S, Juki Corporation, Zhejiang Neoden Technology Co Ltd, Fuji Corporation, Europlacer Limited, ASMPT, Panasonic Corporation.

3. What are the main segments of the Surface Mount Technology Industry?

The market segments include Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Defense Budgets Across Geographies.

6. What are the notable trends driving market growth?

Consumer Electronics End-user Industry Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Highly Consolidated Market.

8. Can you provide examples of recent developments in the market?

June 2024 - Beifu Electronic Technology Co. Ltd, based in Shanghai, has recently integrated Europlacer's cutting-edge pick-and-place technology into its operations. Beifu Electronic has significantly ramped up its production efficiency in the last two years, courtesy of Europlacer's Atom pick-and-place range. With a pressing need for swift changeovers and enhanced flexibility, Beifu Electronic turned to Europlacer's Atom technology, finding it the ideal fit. Due to the Atom range, Beifu Electric has bolstered its production capabilities and slashed turnaround times while upholding its stringent quality benchmarks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Surface Mount Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Surface Mount Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Surface Mount Technology Industry?

To stay informed about further developments, trends, and reports in the Surface Mount Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence