Key Insights

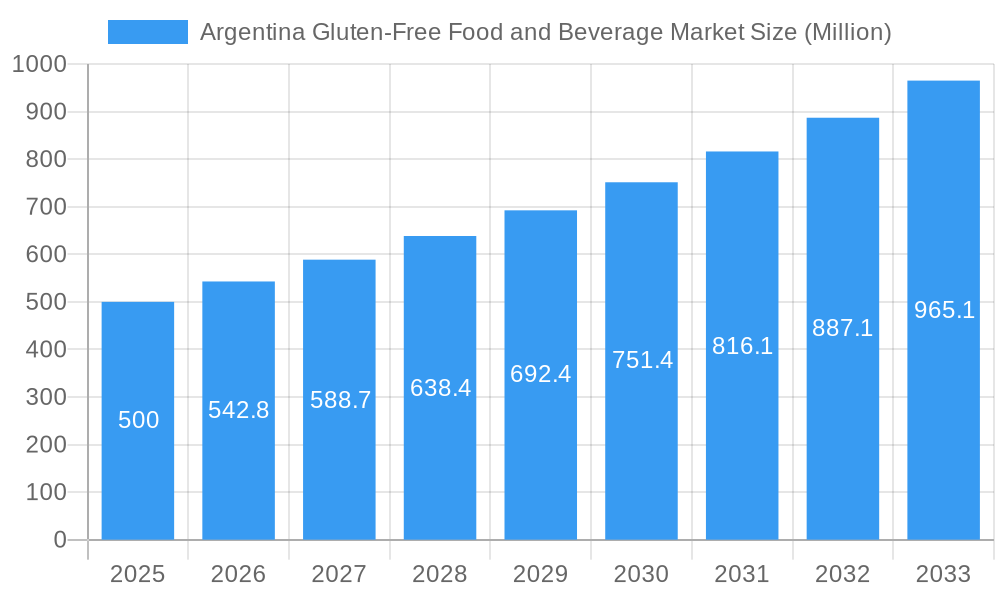

The Argentina Gluten-Free Food and Beverage Market is projected to experience substantial growth, driven by increased awareness of gluten-related disorders and the expanding adoption of healthier eating habits. The market, valued at 4654.54 million in the 2025 base year, is forecasted to expand at a Compound Annual Growth Rate (CAGR) of 8.56% through 2033. This growth is propelled by rising consumer demand for specialized gluten-free products, particularly in dairy/dairy substitutes, beverages, and baked goods, spurred by continuous innovation and enhanced product accessibility. Growing disposable incomes and the wider availability of gluten-free options across both retail and online channels are further boosting market penetration. Additionally, a heightened health consciousness among Argentinian consumers seeking alternatives to conventional wheat-based products for perceived wellness benefits beyond medical necessity significantly contributes to market expansion.

Argentina Gluten-Free Food and Beverage Market Market Size (In Billion)

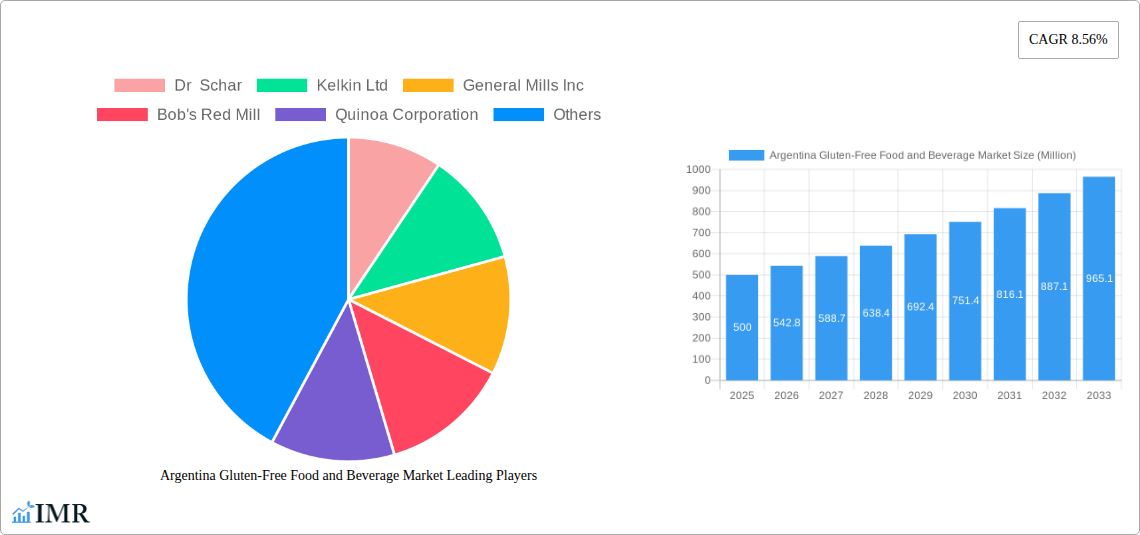

Key growth catalysts include shifting consumer lifestyles, improved diagnosis rates for gluten sensitivities, and government-led initiatives promoting healthier food consumption. However, market expansion is tempered by the higher cost of gluten-free ingredients and finished products compared to traditional alternatives, potentially impacting affordability. Challenges related to replicating the taste and texture of conventional gluten-containing foods, alongside a fragmented distribution landscape in certain areas, may also hinder widespread adoption. Emerging trends within the market include the increasing popularity of plant-based gluten-free options, the development of convenient gluten-free food products, and a strong emphasis on ingredient transparency and accurate allergen labeling. Prominent players such as Dr. Schär, General Mills Inc., and Bob's Red Mill are actively shaping the market with diverse product offerings and expanded distribution networks to meet escalating demand.

Argentina Gluten-Free Food and Beverage Market Company Market Share

This report offers a comprehensive analysis of the Argentina Gluten-Free Food and Beverage Market, including market size, growth forecasts, and key trends.

Argentina Gluten-Free Food and Beverage Market: In-depth Analysis & Future Outlook (2019-2033)

This comprehensive market research report offers an unparalleled deep dive into the Argentina Gluten-Free Food and Beverage Market. Navigating the evolving landscape of celiac disease diagnosis, gluten intolerance awareness, and the rising demand for allergy-friendly foods, this study provides critical insights for industry stakeholders. The report meticulously analyzes market dynamics, growth trends, competitive strategies, and future opportunities within this burgeoning sector. Leveraging a robust methodology, it forecasts market evolution from the base year 2025 through to 2033, building upon historical data from 2019 to 2024. Discover the critical drivers, emerging trends, and challenges shaping the Argentinian gluten-free industry, including segments like gluten-free beverages, gluten-free bread products, gluten-free cookies and snacks, and dairy substitutes.

Argentina Gluten-Free Food and Beverage Market Market Dynamics & Structure

The Argentina Gluten-Free Food and Beverage Market exhibits a moderate market concentration, with a mix of established multinational corporations and emerging local players vying for market share. Technological innovation is primarily driven by advancements in alternative grain processing, development of novel gluten-free flours, and improved food manufacturing techniques to enhance taste and texture. The regulatory framework, though still evolving, is increasingly supportive of food allergen labeling and product certification, encouraging market growth. Competitive product substitutes include a wider array of naturally gluten-free staples and a growing segment of "free-from" products beyond gluten. End-user demographics are broadening from a primary focus on individuals with diagnosed celiac disease to a significant portion of the population seeking healthier food choices and experiencing non-celiac gluten sensitivity. Mergers and acquisitions (M&A) trends, while not yet dominant, are anticipated to increase as larger players seek to expand their gluten-free product portfolios and regional presence.

- Market Concentration: Moderate, with key players holding significant but not monopolistic share.

- Technological Innovation Drivers: Enhanced processing of alternative grains (e.g., quinoa, amaranth), improved formulation for texture and taste, and advancements in bakery science.

- Regulatory Frameworks: Growing emphasis on clear allergen labeling, food safety standards, and certifications for gluten-free products.

- Competitive Product Substitutes: Naturally gluten-free grains, pseudo-cereals, and a burgeoning "free-from" product category.

- End-User Demographics: Expanding beyond celiacs to include those with gluten sensitivities, health-conscious consumers, and individuals seeking diversified diets.

- M&A Trends: Anticipated increase in strategic acquisitions by larger food companies to gain market access and diversify offerings.

Argentina Gluten-Free Food and Beverage Market Growth Trends & Insights

The Argentina Gluten-Free Food and Beverage Market is on a robust growth trajectory, fueled by an escalating prevalence of celiac disease, increased consumer awareness regarding gluten sensitivity, and a discernible shift towards healthier dietary habits across the nation. The market size has experienced a significant upward trend, with projected CAGR of XX% during the forecast period. This expansion is underpinned by rising adoption rates of gluten-free products, not just by diagnosed individuals but also by a growing segment of the population opting for them as a lifestyle choice. Technological disruptions are playing a pivotal role, with ongoing innovations in ingredient sourcing, product formulation, and manufacturing processes leading to more palatable and affordable gluten-free options. Consumer behavior shifts are characterized by a greater demand for transparency in ingredient lists, a preference for minimally processed foods, and an increasing willingness to experiment with new gluten-free product categories. The market penetration of gluten-free products is steadily increasing, moving beyond traditional bakery items to encompass a wider range of beverages, snacks, and convenience foods. This evolution is supported by advancements in alternative grain utilization, such as quinoa and amaranth, which are gaining traction as staple ingredients in gluten-free formulations. Furthermore, enhanced diagnostic capabilities and a greater understanding of the physiological impacts of gluten are contributing to a more informed consumer base actively seeking out gluten-free alternatives. The influence of social media and health influencers is also a significant factor, promoting gluten-free diets and driving demand for a wider variety of specialized products. The accessibility and availability of gluten-free options in mainstream retail channels, coupled with a growing number of dedicated gluten-free stores and online platforms, are further accelerating market penetration and consumer acceptance. The inherent health benefits associated with a gluten-free diet, when properly managed, are also a key attraction for a segment of the population concerned with digestive health and overall well-being.

Dominant Regions, Countries, or Segments in Argentina Gluten-Free Food and Beverage Market

Within the expansive Argentina Gluten-Free Food and Beverage Market, the Bread Products segment emerges as the dominant force, consistently capturing a substantial market share. This dominance is attributable to the foundational role bread plays in the Argentine diet, making gluten-free bread alternatives a critical necessity for individuals managing celiac disease or gluten sensitivities. Economic policies that support the food processing industry, coupled with investments in agricultural research for alternative grain cultivation (such as rice, corn, and quinoa), indirectly bolster the availability and affordability of gluten-free flour blends, the primary components of these products. Infrastructure development in logistics and distribution networks ensures that these essential gluten-free bread products reach a wider consumer base across urban and rural areas. The market share within this segment is significant, estimated to be around XX% of the total gluten-free food and beverage market in Argentina. The growth potential for gluten-free bread products remains exceptionally high, driven by ongoing innovation in texture, flavor, and shelf-life, addressing historical consumer complaints about the quality of early gluten-free bread offerings.

- Dominant Segment: Bread Products

- Key Drivers for Bread Products Dominance:

- Staple food in Argentine cuisine, creating immediate demand.

- Essential dietary requirement for individuals with celiac disease and gluten intolerance.

- Innovation in alternative flours and baking techniques improving quality.

- Increasing availability in mainstream supermarkets and bakeries.

- Market Share of Bread Products: Approximately XX% of the total gluten-free market.

- Growth Potential Factors: Continuous product development, price competitiveness, and expanding consumer base seeking palatable alternatives.

The Beverages segment also presents a compelling growth narrative, driven by the increasing availability of naturally gluten-free options like juices, teas, and waters, alongside a growing market for gluten-free alcoholic beverages such as beers and ciders. The Cookies and Snacks segment is another high-potential area, benefiting from a rising demand for convenient, on-the-go gluten-free options that cater to diverse taste preferences.

Argentina Gluten-Free Food and Beverage Market Product Landscape

The product landscape within the Argentina Gluten-Free Food and Beverage Market is characterized by continuous innovation aimed at enhancing taste, texture, and nutritional value. Key product innovations include the development of advanced gluten-free flour blends utilizing quinoa, amaranth, and sorghum, which offer improved protein content and a more desirable mouthfeel. Applications are expanding beyond traditional bakery goods to include gluten-free pasta, cereals, and ready-to-eat meals. Performance metrics are increasingly focused on mimicking the sensory attributes of conventional gluten-containing products, with advancements in hydrocolloid technology and enzymatic treatments playing a crucial role. Unique selling propositions revolve around allergen-free claims, clean ingredient labels, and fortification with essential nutrients. Technological advancements in extrusion and baking technologies are enabling the creation of a wider variety of gluten-free snacks and confectionery with improved shelf stability and crispness.

Key Drivers, Barriers & Challenges in Argentina Gluten-Free Food and Beverage Market

Key Drivers: The Argentina Gluten-Free Food and Beverage Market is propelled by several key drivers. The rising global and national awareness of celiac disease and gluten intolerance is a primary catalyst, leading to increased diagnosis and demand for specialized products. Technological advancements in alternative grain processing and food formulation are enabling the creation of tastier and more affordable gluten-free options. Growing health consciousness among consumers, who perceive gluten-free as a healthier lifestyle choice, further fuels market expansion. Government initiatives supporting food safety and labeling regulations also contribute to market growth by enhancing consumer trust.

Barriers & Challenges: Despite the positive outlook, the market faces significant barriers and challenges. High production costs associated with specialized ingredients and manufacturing processes can lead to premium pricing, limiting accessibility for a broader consumer base. Supply chain complexities and the availability of diverse gluten-free raw materials can pose logistical hurdles. Consumer perception regarding the taste and texture of some gluten-free products remains a challenge, requiring continuous product development. Stricter regulatory compliance for gluten-free certification can be resource-intensive for smaller manufacturers. Intense competition from both established brands and emerging players also presents a challenge.

Emerging Opportunities in Argentina Gluten-Free Food and Beverage Market

Emerging opportunities in the Argentina Gluten-Free Food and Beverage Market lie in several key areas. The growing demand for convenience-oriented gluten-free products, such as ready-to-eat meals, frozen foods, and healthy snack bars, presents a significant untapped market. There is substantial potential for innovative applications of indigenous Argentine grains like quinoa and amaranth in a wider range of product categories, capitalizing on their nutritional benefits and local appeal. The dairy/dairy substitutes segment is also ripe for expansion, with increasing consumer interest in plant-based, gluten-free alternatives. Furthermore, exploring opportunities in the foodservice sector, including restaurants and cafes offering dedicated gluten-free menus, can significantly broaden market reach. Targeted marketing campaigns that educate consumers about the benefits and diversity of gluten-free options can also unlock new growth avenues.

Growth Accelerators in the Argentina Gluten-Free Food and Beverage Market Industry

Several catalysts are accelerating the long-term growth of the Argentina Gluten-Free Food and Beverage Market. Technological breakthroughs in enzyme technology and advanced fermentation processes are enabling the creation of gluten-free products with superior textures and digestive properties. Strategic partnerships between ingredient suppliers, food manufacturers, and research institutions are fostering innovation and product development. Market expansion strategies, including penetration into underserved regions and the development of private-label gluten-free product lines for major retailers, are crucial growth accelerators. The increasing influence of online retail and direct-to-consumer models is also facilitating wider product accessibility and reach. Furthermore, educational initiatives by health organizations and industry bodies are raising awareness and promoting wider adoption of gluten-free diets.

Key Players Shaping the Argentina Gluten-Free Food and Beverage Market Market

- Dr Schar

- Kelkin Ltd

- General Mills Inc

- Bob's Red Mill

- Quinoa Corporation

- Cerealko

- Molinos Rio de la Plata

- CeliGourmet

Notable Milestones in Argentina Gluten-Free Food and Beverage Market Sector

- 2019: Increased availability of imported gluten-free specialty flours and baking mixes.

- 2020: Rise in online sales of gluten-free products driven by pandemic-related shopping shifts.

- 2021: Launch of several new Argentine brands focusing on naturally gluten-free snacks and baked goods.

- 2022: Enhanced regulatory clarity on gluten-free labeling standards introduced by the national food authority.

- 2023: Greater investment in domestic production of quinoa and amaranth for gluten-free applications.

- 2024: Expansion of gluten-free options in mainstream supermarket chains, including private-label offerings.

In-Depth Argentina Gluten-Free Food and Beverage Market Market Outlook

The outlook for the Argentina Gluten-Free Food and Beverage Market remains exceptionally bright, driven by sustained consumer demand and continuous innovation. Growth accelerators such as advancements in alternative grain utilization and improved processing technologies will continue to enhance product quality and affordability. Strategic partnerships and market expansion initiatives, particularly into foodservice and export markets, promise to broaden the industry's reach. The ongoing trend towards health and wellness ensures that gluten-free products will remain a preferred choice for a significant and growing consumer base. The market is poised for further diversification, with an expected surge in innovative product categories and the wider adoption of plant-based gluten-free alternatives. This dynamic landscape offers substantial strategic opportunities for both established players and new entrants to capitalize on the evolving needs of the Argentine consumer.

Argentina Gluten-Free Food and Beverage Market Segmentation

-

1. Product Type

- 1.1. Beverages

- 1.2. Bread Products

- 1.3. Cookies and Snacks

- 1.4. Condiments, Seasonings and Spreads

- 1.5. Dairy/Dairy Substitutes

- 1.6. Meat/Meat Substitutes

- 1.7. Other Gluten Products

Argentina Gluten-Free Food and Beverage Market Segmentation By Geography

- 1. Argentina

Argentina Gluten-Free Food and Beverage Market Regional Market Share

Geographic Coverage of Argentina Gluten-Free Food and Beverage Market

Argentina Gluten-Free Food and Beverage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Gluten free Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Gluten-Free Food and Beverage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beverages

- 5.1.2. Bread Products

- 5.1.3. Cookies and Snacks

- 5.1.4. Condiments, Seasonings and Spreads

- 5.1.5. Dairy/Dairy Substitutes

- 5.1.6. Meat/Meat Substitutes

- 5.1.7. Other Gluten Products

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dr Schar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kelkin Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Mills Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bob's Red Mill

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Quinoa Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cerealko

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Molinos Rio de la Plata

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CeliGourmet*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Dr Schar

List of Figures

- Figure 1: Argentina Gluten-Free Food and Beverage Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Argentina Gluten-Free Food and Beverage Market Share (%) by Company 2025

List of Tables

- Table 1: Argentina Gluten-Free Food and Beverage Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Argentina Gluten-Free Food and Beverage Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Argentina Gluten-Free Food and Beverage Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 4: Argentina Gluten-Free Food and Beverage Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Gluten-Free Food and Beverage Market?

The projected CAGR is approximately 8.56%.

2. Which companies are prominent players in the Argentina Gluten-Free Food and Beverage Market?

Key companies in the market include Dr Schar, Kelkin Ltd, General Mills Inc, Bob's Red Mill, Quinoa Corporation, Cerealko, Molinos Rio de la Plata, CeliGourmet*List Not Exhaustive.

3. What are the main segments of the Argentina Gluten-Free Food and Beverage Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4654.54 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

Growing Demand for Gluten free Food and Beverages.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Gluten-Free Food and Beverage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Gluten-Free Food and Beverage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Gluten-Free Food and Beverage Market?

To stay informed about further developments, trends, and reports in the Argentina Gluten-Free Food and Beverage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence