Key Insights

Germany's metal packaging market is set for significant growth, fueled by the inherent sustainability, durability, and recyclability of metal. The market is projected to reach 141.7 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.9% through 2033. This expansion is driven by escalating consumer demand for eco-friendly packaging, particularly in the food and beverage industries, where metal containers offer superior product protection and shelf life. Furthermore, regulatory support for recyclable materials and a reduction in plastic usage are key growth catalysts. The increasing demand for innovative metal packaging, including lightweight aluminum cans and premium steel containers for luxury goods, reflects evolving consumer preferences and brand strategies.

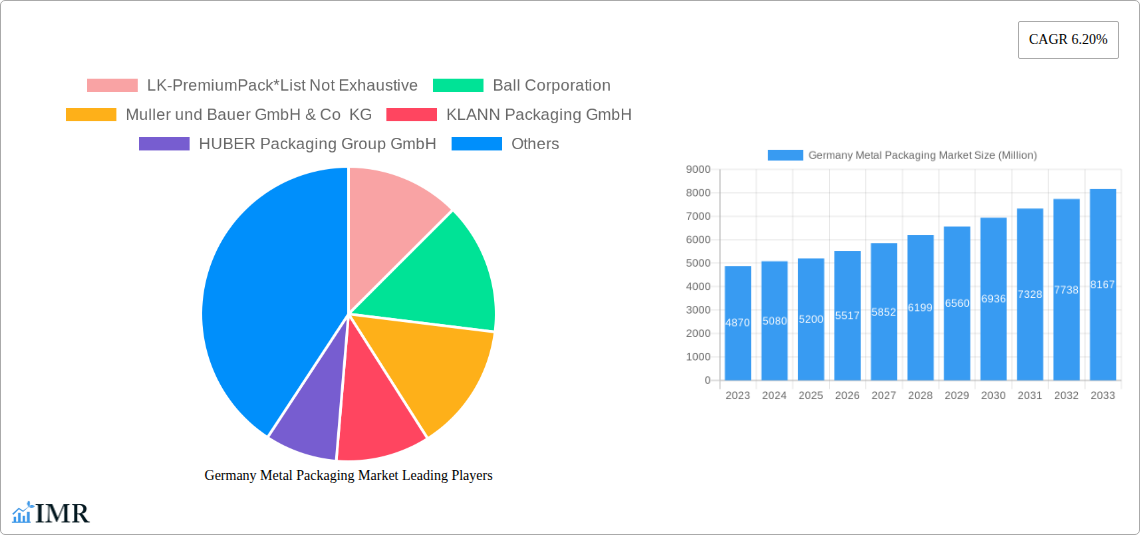

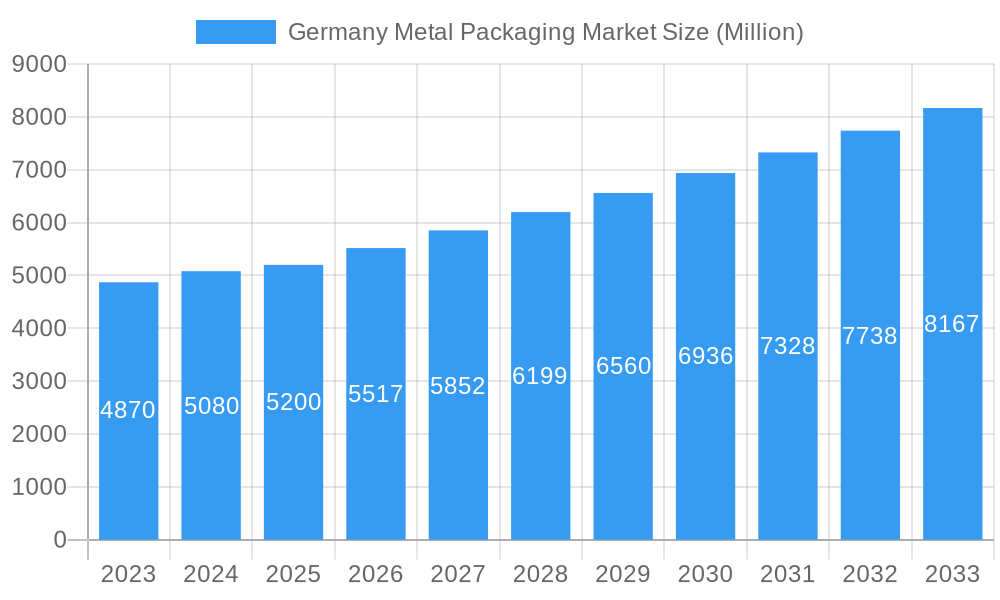

Germany Metal Packaging Market Market Size (In Billion)

While the outlook is positive, potential challenges exist. Volatile raw material prices, particularly for aluminum and steel, can affect manufacturing costs and profitability. The substantial capital investment for advanced production facilities and specialized finishes also presents a barrier for smaller manufacturers. However, technological advancements in production efficiency, enhanced recycling infrastructure, and the development of thinner, stronger metal alloys are mitigating these challenges. Germany's robust industrial sector and established recycling framework position it well to address these hurdles and leverage the ongoing demand for sustainable and premium metal packaging solutions across diverse industries.

Germany Metal Packaging Market Company Market Share

This comprehensive report offers an in-depth analysis of the German metal packaging market, a vital sector for industries including food & beverage, pharmaceuticals, and cosmetics. Delve into market dynamics, growth forecasts, regional trends, and key players influencing the future of sustainable and innovative packaging. With data presented in billions, gain critical insights into production, consumption, trade, and pricing dynamics.

Germany Metal Packaging Market Market Dynamics & Structure

The German metal packaging market is characterized by a mature yet dynamic landscape, driven by stringent environmental regulations, a strong emphasis on sustainability, and continuous technological innovation. Market concentration is moderate, with a few key players holding significant shares, while a host of specialized SMEs cater to niche segments. Key dynamics include the growing demand for recyclable and lightweight metal packaging solutions, driven by both consumer preference and legislative mandates. Technological advancements are focused on improving barrier properties, enhancing design aesthetics, and optimizing production efficiency. Regulatory frameworks, such as those concerning circular economy principles and food contact materials, play a pivotal role in shaping product development and market entry strategies. Competitive product substitutes, primarily from plastic and glass, pose a consistent challenge, necessitating ongoing innovation in metal packaging's performance and cost-effectiveness. End-user demographics are increasingly health-conscious and environmentally aware, influencing the demand for packaging that is not only functional but also perceived as eco-friendly. Mergers and acquisitions (M&A) activity, while not as rampant as in some other sectors, is strategic, often aimed at consolidating market share, expanding product portfolios, or acquiring advanced technologies.

- Market Concentration: Moderate, with established global and regional players alongside specialized SMEs.

- Technological Innovation Drivers: Sustainability, recyclability, lightweighting, barrier enhancement, advanced printing technologies.

- Regulatory Frameworks: Circular economy directives, REACH compliance, food safety standards, waste reduction targets.

- Competitive Product Substitutes: Flexible plastic packaging, rigid plastic containers, glass bottles and jars.

- End-User Demographics: Environmentally conscious consumers, demand for premium and safe packaging, convenience-driven purchasing.

- M&A Trends: Strategic acquisitions for technology access and market consolidation.

Germany Metal Packaging Market Growth Trends & Insights

The German metal packaging market is poised for sustained growth, driven by an escalating demand for sustainable and high-performance packaging solutions across various end-use industries. The market size evolution reflects a steady increase in both volume and value, underpinned by factors such as population growth, rising disposable incomes, and evolving consumer lifestyles that favor convenience and quality. Adoption rates for metal packaging, particularly for food and beverage applications, are high due to its excellent protective properties and recyclability. Technological disruptions are primarily focused on enhancing the sustainability profile of metal packaging, including the development of thinner gauges, improved internal coatings that are free from harmful substances, and advanced recycling technologies that ensure higher recovery rates. Consumer behavior shifts are a significant growth driver, with a pronounced preference for materials perceived as eco-friendly and premium. This has led to a resurgence in the use of metal for products where brand image and perceived value are paramount. The forecast period is expected to witness a consistent Compound Annual Growth Rate (CAGR) as the industry navigates the transition towards a more circular economy, further solidifying metal's position as a preferred packaging material. Market penetration for specific segments, such as aerosols and decorative tins, is expected to rise as manufacturers innovate to meet diverse consumer needs.

Dominant Regions, Countries, or Segments in Germany Metal Packaging Market

Within the German metal packaging market, food and beverage packaging consistently emerges as the dominant segment, driving substantial growth in both production and consumption. This dominance is fueled by Germany's robust food processing industry, its position as a major exporter of food products, and a strong consumer demand for safe, convenient, and aesthetically appealing packaging for a wide array of edibles and drinks. The beverage sector, in particular, sees significant demand for aluminum cans for beer, soft drinks, and ready-to-drink (RTD) beverages, driven by their portability, rapid chilling capabilities, and established recycling infrastructure. Similarly, the food segment utilizes metal cans extensively for preserving fruits, vegetables, meats, and pet food, benefiting from metal's superior barrier properties against light, oxygen, and moisture, which ensures product longevity and safety.

Production Analysis: The Rhine-Ruhr metropolitan region and Bavaria are key production hubs, boasting a high concentration of manufacturing facilities, advanced technology, and skilled labor. These regions benefit from well-established industrial infrastructure and proximity to raw material suppliers.

Consumption Analysis: Consumption mirrors production, with densely populated urban areas and major food processing centers exhibiting the highest demand. The increasing prevalence of convenience foods and premium beverages further boosts consumption figures across the nation.

Import Market Analysis (Value & Volume): While Germany is a major producer, imports play a role, particularly for specialized metal packaging components or finished goods where domestic production might be limited or less cost-effective. However, the overall import volume for basic metal packaging is relatively controlled due to the strong domestic manufacturing base.

Export Market Analysis (Value & Volume): Germany is a significant exporter of high-quality metal packaging products, especially to other European Union countries and beyond. This is driven by the reputation of German engineering, product quality, and adherence to strict environmental and safety standards. Exports of beverage cans and specialized food containers are particularly strong.

Price Trend Analysis: Price trends are influenced by raw material costs (primarily aluminum and steel), energy prices, and manufacturing efficiency. Fluctuations in global commodity markets directly impact the cost of production, leading to periodic price adjustments.

The dominance of the food and beverage segment is further reinforced by its inherent stability and continuous demand, even during economic downturns, making it a cornerstone of the German metal packaging industry.

Germany Metal Packaging Market Product Landscape

The German metal packaging product landscape is characterized by a commitment to innovation, sustainability, and enhanced functionality. Aluminum cans, particularly for beverages, dominate in terms of volume, driven by their lightweight, recyclability, and excellent thermal conductivity. Steel cans remain crucial for a wide range of food products, offering superior durability and barrier properties. Beyond standard formats, the market showcases advancements in decorative tin packaging for premium food items, cosmetics, and gifts, emphasizing intricate printing and embossing techniques. Aerosol cans continue to evolve with improved valve technologies and lighter wall thicknesses. Emerging product innovations include easy-open closures, specialized coatings for enhanced product protection, and a focus on minimizing material usage through advanced forming technologies.

Key Drivers, Barriers & Challenges in Germany Metal Packaging Market

Key Drivers:

- Sustainability Imperative: Growing consumer and regulatory demand for recyclable and circular packaging solutions.

- Durability and Protection: Metal's inherent strength and barrier properties ensure product integrity and shelf life.

- Premium Brand Perception: Metal packaging often conveys a sense of quality and luxury.

- Technological Advancements: Innovations in lightweighting, barrier coatings, and production efficiency.

- Circular Economy Initiatives: Government policies and industry commitments promoting recycling and material reuse.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in aluminum and steel prices impact production costs.

- Energy Intensity: The manufacturing process can be energy-intensive, posing challenges in meeting sustainability goals and managing costs.

- Competition from Alternative Materials: Ongoing competition from plastics, glass, and emerging sustainable materials.

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials and logistics.

- Regulatory Compliance Costs: Adhering to evolving environmental and safety regulations can incur significant expenses.

Emerging Opportunities in Germany Metal Packaging Market

Emerging opportunities in the German metal packaging market lie in the expanding demand for sustainable solutions beyond basic recyclability. This includes the development of metal packaging with a reduced carbon footprint, utilizing recycled content to a greater extent. The growth of the ready-to-drink (RTD) beverage market, including alcoholic and non-alcoholic options, presents a significant avenue for can manufacturers. Furthermore, the increasing consumer focus on health and wellness is driving demand for metal packaging in the pharmaceutical and nutraceutical sectors, where its protective qualities are highly valued. The food sector is seeing innovation in convenience formats, such as microwaveable metal containers and portion-controlled packaging, catering to busy lifestyles.

Growth Accelerators in the Germany Metal Packaging Market Industry

Several catalysts are accelerating growth in the German metal packaging industry. Technological breakthroughs in aluminum and steel production are enabling the creation of lighter yet stronger packaging, reducing material usage and transportation costs. Strategic partnerships between packaging manufacturers, material suppliers, and end-users are fostering collaborative innovation to meet evolving market demands for sustainability and performance. Market expansion strategies are focusing on exploring new applications for metal packaging, such as in the personal care and home care sectors, where its premium appeal and durability can be leveraged. The ongoing shift towards a circular economy, supported by supportive government policies and industry-led initiatives, is a significant growth accelerator, encouraging higher rates of collection, sorting, and recycling of metal packaging.

Key Players Shaping the Germany Metal Packaging Market Market

- LK-PremiumPack

- Ball Corporation

- Muller und Bauer GmbH & Co KG

- KLANN Packaging GmbH

- HUBER Packaging Group GmbH

- Duttenhofer

- Envases Ohringen GmbH

- Trivium Packaging Germany GmbH

- Ardagh group Italy Srl

- Silgan Closures GmbH

Notable Milestones in Germany Metal Packaging Market Sector

- November 2022: METPACK 2023 announced, setting the tone for future industry developments and providing a platform for new contacts and market expansion through discussions on new products and solutions.

- November 2022: The Aluminium Stewardship Initiative (ASI) certified Ardagh Metal Packaging (AMP) under its Performance Standard (V2) 2017 at its German regional headquarters and French aluminum production plant, highlighting a commitment to responsible sourcing and production.

In-Depth Germany Metal Packaging Market Market Outlook

The outlook for the German metal packaging market remains robust, driven by a compelling blend of environmental consciousness, technological innovation, and evolving consumer preferences. The industry's commitment to circular economy principles will continue to be a major growth accelerator, fostering increased use of recycled content and improved end-of-life management. Strategic collaborations and ongoing R&D investments will unlock new opportunities in areas like advanced coatings, lightweighting technologies, and specialized packaging formats for emerging product categories. As Germany continues to champion sustainability, metal packaging is well-positioned to benefit from its inherent recyclability and durability, solidifying its role as a preferred choice for a wide range of consumer and industrial goods. The market is set to witness sustained growth, offering significant potential for stakeholders committed to innovation and responsible packaging solutions.

Germany Metal Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Germany Metal Packaging Market Segmentation By Geography

- 1. Germany

Germany Metal Packaging Market Regional Market Share

Geographic Coverage of Germany Metal Packaging Market

Germany Metal Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Packaging Industry In Germany; Convenience and Lower Price Offered by Canned Food

- 3.3. Market Restrains

- 3.3.1. Presence of Alternate Packaging Solutions

- 3.4. Market Trends

- 3.4.1. Growing Packaging Industry In Germany

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LK-PremiumPack*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ball Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Muller und Bauer GmbH & Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KLANN Packaging GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HUBER Packaging Group GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Duttenhofer

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Envases Ohringen GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trivium Packaging Germany GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ardagh group Italy Srl

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Silgan Closures GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LK-PremiumPack*List Not Exhaustive

List of Figures

- Figure 1: Germany Metal Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Metal Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Metal Packaging Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Germany Metal Packaging Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Germany Metal Packaging Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Germany Metal Packaging Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Germany Metal Packaging Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Germany Metal Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Germany Metal Packaging Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Germany Metal Packaging Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Germany Metal Packaging Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Germany Metal Packaging Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Germany Metal Packaging Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Germany Metal Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Metal Packaging Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Germany Metal Packaging Market?

Key companies in the market include LK-PremiumPack*List Not Exhaustive, Ball Corporation, Muller und Bauer GmbH & Co KG, KLANN Packaging GmbH, HUBER Packaging Group GmbH, Duttenhofer, Envases Ohringen GmbH, Trivium Packaging Germany GmbH, Ardagh group Italy Srl, Silgan Closures GmbH.

3. What are the main segments of the Germany Metal Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 141.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Packaging Industry In Germany; Convenience and Lower Price Offered by Canned Food.

6. What are the notable trends driving market growth?

Growing Packaging Industry In Germany.

7. Are there any restraints impacting market growth?

Presence of Alternate Packaging Solutions.

8. Can you provide examples of recent developments in the market?

November 2022 -METPACK 2023 sets the tone for metal packaging. METPACK 2023 promises to be an excellent opportunity for the metal packaging industry to make new contacts and expand their market reach, especially by having personal discussions and exchanges about new products and solutions with their most important target groups.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Metal Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Metal Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Metal Packaging Market?

To stay informed about further developments, trends, and reports in the Germany Metal Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence