Key Insights

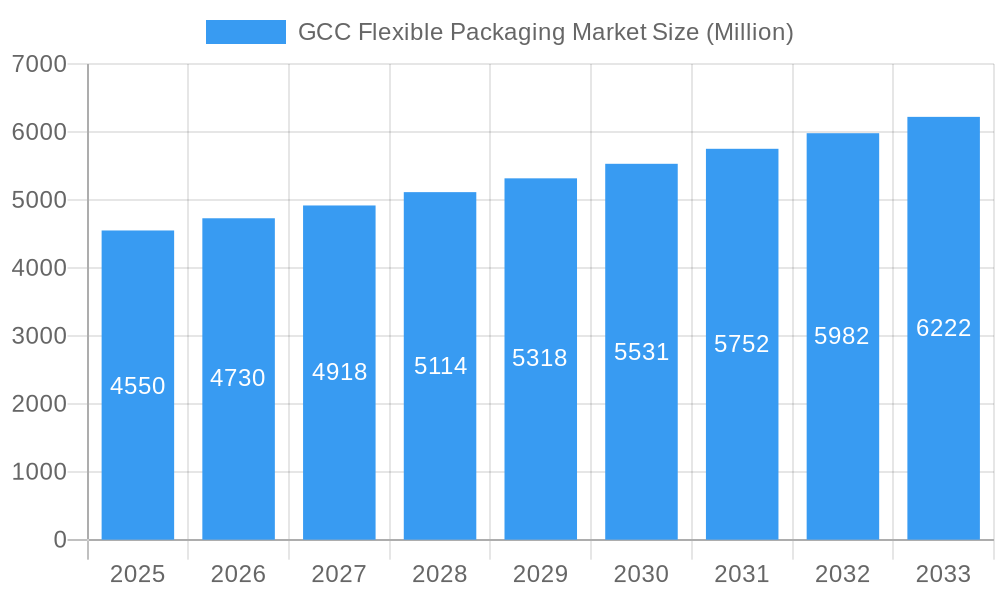

The GCC flexible packaging market is poised for significant expansion, projected to reach an estimated USD 4.55 billion. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 4.07% anticipated between 2025 and 2033, indicating a dynamic and expanding industry. Key drivers underpinning this surge include the burgeoning demand from the food and beverage sector, propelled by population growth, changing consumer preferences for convenience, and a rising disposable income across the GCC region. The pharmaceutical and medical industries also contribute substantially, driven by an increasing focus on healthcare infrastructure and the need for sterile, protective packaging solutions. Furthermore, the household and personal care segment is experiencing a steady uplift, influenced by increased consumer spending on hygiene and cosmetic products. Innovations in material science, such as the development of sustainable and advanced barrier films, are also playing a crucial role in enhancing product shelf life and appeal.

GCC Flexible Packaging Market Market Size (In Billion)

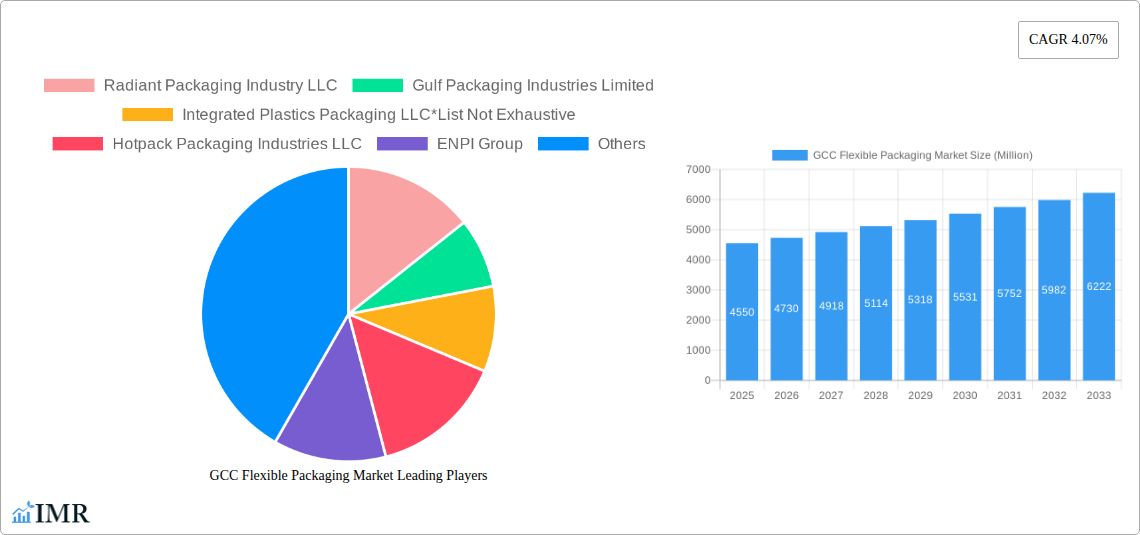

The market's trajectory is further shaped by prevailing trends in sustainability and customization. A growing consumer and regulatory emphasis on eco-friendly packaging solutions is driving the adoption of recyclable, biodegradable, and compostable materials, presenting both opportunities and challenges for manufacturers. The rise of e-commerce and the subsequent demand for specialized packaging that ensures product integrity during transit are also significant trends. While the market exhibits strong growth, certain restraints, such as fluctuating raw material prices and the capital-intensive nature of advanced manufacturing technologies, warrant strategic consideration. Nonetheless, the competitive landscape is vibrant, with established players like Radiant Packaging Industry LLC, Gulf Packaging Industries Limited, and Hotpack Packaging Industries LLC actively innovating and expanding their offerings to cater to the diverse needs across segments like bags and pouches, films and wraps, and other specialized product types.

GCC Flexible Packaging Market Company Market Share

GCC Flexible Packaging Market: In-depth Analysis and Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the GCC Flexible Packaging Market, offering insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, and competitive strategies. Leveraging extensive research and data, this report is an essential resource for industry stakeholders seeking to understand and capitalize on the evolving GCC flexible packaging sector. The study period covers 2019–2033, with the base year and estimated year at 2025, and the forecast period from 2025–2033, building upon the historical period of 2019–2024. All values are presented in Million units.

GCC Flexible Packaging Market Dynamics & Structure

The GCC flexible packaging market is characterized by a moderately concentrated structure, with key players investing heavily in technological innovation and capacity expansion. Regulatory frameworks are increasingly emphasizing sustainability and recyclability, driving the adoption of eco-friendly materials and processes. Competitive product substitutes, particularly in the rigid packaging segment, exert pressure, but the inherent advantages of flexible packaging, such as cost-effectiveness and superior product protection, maintain its stronghold. End-user demographics are shifting towards greater demand for convenience and premium packaging solutions, especially within the food and beverage sectors. Mergers and acquisitions (M&A) are active, aimed at consolidating market share, acquiring innovative technologies, and expanding geographical reach. For instance, the market witnessed XX M&A deals between 2019 and 2024, with an estimated value of $XXX Million. Barriers to innovation include the high cost of advanced machinery and the need for specialized expertise in developing sustainable packaging solutions.

- Market Concentration: Dominated by a few large players, but with a growing number of specialized manufacturers.

- Technological Innovation Drivers: Focus on high-barrier films, advanced printing techniques, and sustainable material development.

- Regulatory Frameworks: Increasing pressure for recyclability, biodegradability, and reduced plastic usage.

- Competitive Product Substitutes: Rigid plastics, glass, and metal containers present competition, countered by flexible packaging's lightweight and cost advantages.

- End-user Demographics: Growing middle class, urbanization, and demand for ready-to-eat and on-the-go food options.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and diversify product portfolios.

GCC Flexible Packaging Market Growth Trends & Insights

The GCC Flexible Packaging Market is poised for robust growth, driven by escalating consumer demand for convenience, enhanced product shelf-life, and visually appealing packaging. The market size is projected to reach $XX,XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. Adoption rates for advanced flexible packaging solutions are accelerating, particularly in the food and beverage sectors, which account for over XX% of the market share. Technological disruptions, including the development of compostable and recyclable films, alongside advancements in printing and lamination technologies, are reshaping the industry landscape. Consumer behavior shifts towards greater environmental consciousness are directly influencing purchasing decisions, favoring brands that demonstrate a commitment to sustainable packaging. The rise of e-commerce has also spurred demand for protective and lightweight flexible packaging for shipping diverse products.

- Market Size Evolution: Expected to experience significant expansion due to increasing demand across various end-user industries.

- Adoption Rates: High and growing adoption of advanced flexible packaging solutions, especially in food & beverage and healthcare.

- Technological Disruptions: Innovations in material science, printing, and barrier technologies are key growth enablers.

- Consumer Behavior Shifts: Increased preference for convenience, health-conscious products, and sustainable packaging options.

- Market Penetration: Estimated at XX% in 2025, with a projected increase to XX% by 2033.

- CAGR (2025-2033): XX%

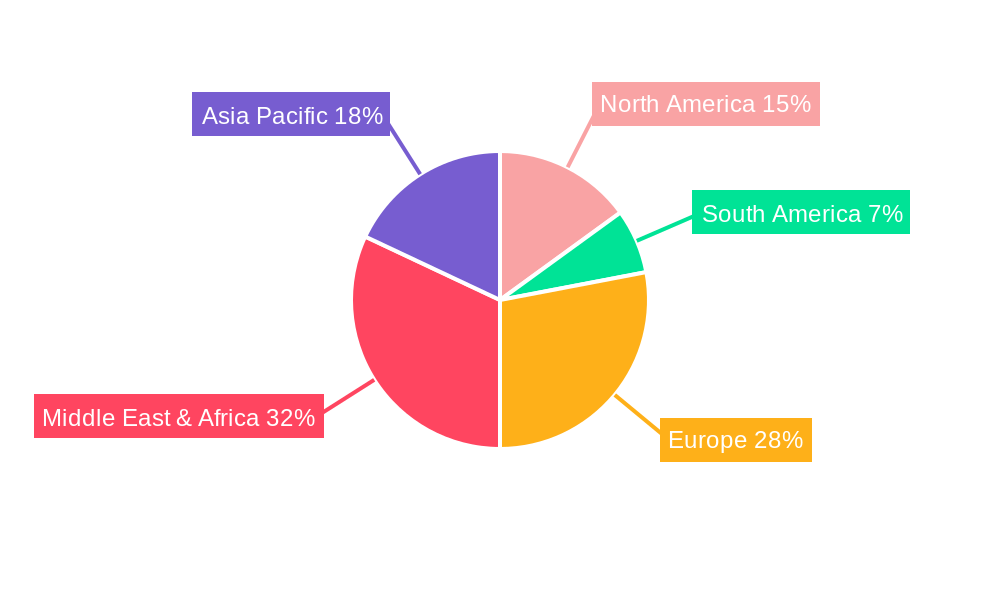

Dominant Regions, Countries, or Segments in GCC Flexible Packaging Market

Within the GCC Flexible Packaging Market, the Plastic segment within Material Type holds a dominant position, driven by its versatility, cost-effectiveness, and superior barrier properties. The Food end-user industry segment also leads in market share, owing to the region's substantial consumption of packaged food products and the growing demand for convenience foods, snacks, and ready-to-eat meals. Saudi Arabia and the UAE emerge as the leading countries, characterized by significant economic development, a large consumer base, and substantial investments in the food processing and retail sectors. Economic policies supporting industrial diversification and foreign direct investment further bolster the growth in these key markets. Infrastructure development, including advanced logistics and warehousing facilities, facilitates efficient distribution of flexible packaging solutions. Market share within the plastic material type is estimated at over XX%, while the food segment captures approximately XX% of the total market.

- Dominant Material Type: Plastic (XX% market share), owing to its cost-effectiveness and excellent barrier properties.

- Dominant Product Type: Films and Wraps (XX% market share), essential for a wide range of food and consumer goods packaging.

- Dominant End-user Industry: Food (XX% market share), driven by population growth and demand for convenience.

- Leading Countries: Saudi Arabia and UAE, benefiting from economic growth and robust consumer spending.

- Key Drivers: Growing disposable incomes, urbanization, government initiatives promoting manufacturing, and increasing demand for convenience food.

- Growth Potential: High potential in Saudi Arabia and UAE, with emerging opportunities in Qatar and Oman.

GCC Flexible Packaging Market Product Landscape

The GCC Flexible Packaging Market product landscape is characterized by continuous innovation focused on enhancing functionality, sustainability, and aesthetic appeal. Key product innovations include advanced multi-layer films with superior oxygen and moisture barrier properties, crucial for extending the shelf life of perishable goods. The development of retort pouches capable of withstanding high-temperature sterilization processes is a significant advancement, particularly for ready-to-eat meals. Furthermore, the market is witnessing a rise in personalized and digitally printed flexible packaging, catering to the growing demand for customized branding and promotional campaigns. Performance metrics are increasingly being evaluated based on recyclability, compostability, and reduced material usage, aligning with global sustainability trends.

- Product Innovations: High-barrier films, retort pouches, compostable and recyclable materials, and smart packaging solutions.

- Applications: Wide-ranging applications across food & beverage, pharmaceutical, personal care, and industrial sectors.

- Performance Metrics: Focus on extended shelf-life, enhanced product protection, reduced material weight, and improved sustainability profiles.

- Unique Selling Propositions: Customization, advanced printing capabilities, and eco-friendly material options.

Key Drivers, Barriers & Challenges in GCC Flexible Packaging Market

The GCC Flexible Packaging Market is propelled by several key drivers, including the escalating demand for convenience food, the burgeoning e-commerce sector, and increasing consumer awareness regarding product shelf-life extension. Technological advancements in materials science and manufacturing processes enable the production of more efficient and sustainable packaging solutions. Government initiatives promoting local manufacturing and import substitution also contribute significantly to market growth.

However, the market faces several challenges. The fluctuating prices of raw materials, particularly petrochemicals, can impact production costs and profitability. Stringent environmental regulations regarding plastic waste and a growing consumer preference for sustainable alternatives necessitate significant investment in research and development for eco-friendly packaging. Intense competition from both domestic and international players can also lead to price wars and reduced profit margins. Supply chain disruptions and logistical complexities within the region can further impede efficient market operations.

- Key Drivers: Growing disposable income, rising population, increasing demand for convenience, e-commerce expansion, and technological advancements.

- Barriers & Challenges: Volatile raw material prices, stringent environmental regulations, intense competition, supply chain complexities, and the need for R&D in sustainable solutions.

Emerging Opportunities in GCC Flexible Packaging Market

Emerging opportunities in the GCC Flexible Packaging Market are centered around the growing demand for sustainable and innovative packaging solutions. The rise of niche food categories, such as organic and plant-based products, presents an untapped market for specialized flexible packaging. The increasing adoption of e-commerce for pharmaceuticals and healthcare products opens avenues for high-barrier, tamper-evident flexible packaging. Furthermore, there is a significant opportunity in developing biodegradable and compostable packaging alternatives that cater to the region's commitment to environmental sustainability. The penetration of flexible packaging in the household and personal care sector for premium and travel-sized products also offers considerable growth potential.

- Untapped Markets: Organic and plant-based food, e-commerce for pharmaceuticals, premium personal care products.

- Innovative Applications: Biodegradable and compostable packaging, smart packaging for tracking and authentication.

- Evolving Consumer Preferences: Demand for eco-friendly, convenient, and aesthetically pleasing packaging.

Growth Accelerators in the GCC Flexible Packaging Market Industry

The long-term growth of the GCC Flexible Packaging Market is being accelerated by significant technological breakthroughs in material science, leading to the development of advanced, lightweight, and sustainable packaging options. Strategic partnerships between raw material suppliers, packaging manufacturers, and end-user industries are fostering innovation and expanding market reach. Market expansion strategies, including mergers, acquisitions, and joint ventures, are consolidating the industry and enabling economies of scale. The increasing focus on localized manufacturing and the development of a circular economy for packaging materials are also acting as powerful catalysts for sustained growth, creating a more resilient and competitive market landscape.

- Technological Breakthroughs: Development of advanced barrier films, biodegradable polymers, and high-performance printing technologies.

- Strategic Partnerships: Collaborations for R&D, co-manufacturing, and market penetration.

- Market Expansion Strategies: Mergers, acquisitions, and joint ventures to enhance market presence and product offerings.

- Circular Economy Initiatives: Focus on recycling, waste reduction, and the use of recycled content in packaging.

Key Players Shaping the GCC Flexible Packaging Market Market

- Radiant Packaging Industry LLC

- Gulf Packaging Industries Limited

- Integrated Plastics Packaging LLC

- Hotpack Packaging Industries LLC

- ENPI Group

- Arabian Flexible Packaging LLC

- Amber Packaging Industries LLC

- Napco National

- Rotopacking Materials Ind Co LLC

- Huhtamaki Flexibles UAE

- Gulf East Paper & Plastic Industries LLC

- Emirates Printing Press (LLC)

Notable Milestones in GCC Flexible Packaging Market Sector

- December 2022: KEZAD Group, the integrated trade, logistics, and industrial hub of Abu Dhabi, signed a 50-year land lease agreement with Star Paper Mill, a specialty tissue manufacturer, to establish a new facility and manufacture recycled Kraft Paper Jumbo reels, eventually diversifying the company's product offering to serve a growing demand for biodegradable packaging papers in the UAE.

- November 2022: SABIC, a global chemical industry leader, teamed up with Bolsas De los Altos, a leading plastic film and packaging converter, and Guangdong Jinming Machinery Co., Ltd., a plastic packaging equipment manufacturer, to support the growth of polyolefin-based innovative applications in the flexible packaging segment. The flexible packaging market was still evolving due to sustainability initiatives. It was necessary to adapt existing film structures to meet modern circularity requirements. A collaboration including the extensive material expertise of SABIC, the world-class equipment production of Jinming, and the conversion ability of Bolsas was anticipated to overcome these difficulties.

In-Depth GCC Flexible Packaging Market Market Outlook

The GCC Flexible Packaging Market is set for a period of sustained growth, driven by a convergence of economic development, evolving consumer preferences, and a strong push towards sustainability. Future market potential is immense, fueled by the region's ongoing population growth and rising disposable incomes, which will continue to boost demand for packaged goods. Strategic opportunities lie in capitalizing on the increasing adoption of e-commerce, requiring sophisticated and secure flexible packaging solutions. The ongoing commitment to environmental stewardship within the GCC nations will further accelerate the adoption of biodegradable, compostable, and highly recyclable packaging materials. Investments in advanced manufacturing technologies and localized production will be crucial for capturing market share and ensuring a competitive edge in this dynamic sector.

GCC Flexible Packaging Market Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Paper

- 1.3. Metal

-

2. Product Type

- 2.1. Bags and Pouches

- 2.2. Films and Wraps

- 2.3. Other Product Types

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Pharmaceutical and Medical

- 3.4. Household and Personal Care

- 3.5. Other End-user Industries

GCC Flexible Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Flexible Packaging Market Regional Market Share

Geographic Coverage of GCC Flexible Packaging Market

GCC Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Urbanization Rates and the Use of Organized Retails like Supermarkets and Hypermarkets; Growing Adoption of Various Packaging Options in the FMCG Industry

- 3.3. Market Restrains

- 3.3.1. Growing Concerns Regarding the Environment and Recycling; Fluctuations in Raw Material Prices may Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Food Industry to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Metal

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bags and Pouches

- 5.2.2. Films and Wraps

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Pharmaceutical and Medical

- 5.3.4. Household and Personal Care

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America GCC Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.2. Paper

- 6.1.3. Metal

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bags and Pouches

- 6.2.2. Films and Wraps

- 6.2.3. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Pharmaceutical and Medical

- 6.3.4. Household and Personal Care

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. South America GCC Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.2. Paper

- 7.1.3. Metal

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bags and Pouches

- 7.2.2. Films and Wraps

- 7.2.3. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Pharmaceutical and Medical

- 7.3.4. Household and Personal Care

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe GCC Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.2. Paper

- 8.1.3. Metal

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Bags and Pouches

- 8.2.2. Films and Wraps

- 8.2.3. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Pharmaceutical and Medical

- 8.3.4. Household and Personal Care

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Middle East & Africa GCC Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Plastic

- 9.1.2. Paper

- 9.1.3. Metal

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Bags and Pouches

- 9.2.2. Films and Wraps

- 9.2.3. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Pharmaceutical and Medical

- 9.3.4. Household and Personal Care

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Asia Pacific GCC Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Plastic

- 10.1.2. Paper

- 10.1.3. Metal

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Bags and Pouches

- 10.2.2. Films and Wraps

- 10.2.3. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Pharmaceutical and Medical

- 10.3.4. Household and Personal Care

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Radiant Packaging Industry LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gulf Packaging Industries Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Integrated Plastics Packaging LLC*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hotpack Packaging Industries LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ENPI Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arabian Flexible Packaging LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amber Packaging Industries LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Napco National

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rotopacking Materials Ind Co LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huhtamaki Flexibles UAE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gulf East Paper & Plastic Industries LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Emirates Printing Press (LLC)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Radiant Packaging Industry LLC

List of Figures

- Figure 1: Global GCC Flexible Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Flexible Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America GCC Flexible Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America GCC Flexible Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America GCC Flexible Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America GCC Flexible Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America GCC Flexible Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America GCC Flexible Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America GCC Flexible Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America GCC Flexible Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 11: South America GCC Flexible Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: South America GCC Flexible Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 13: South America GCC Flexible Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America GCC Flexible Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America GCC Flexible Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America GCC Flexible Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America GCC Flexible Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe GCC Flexible Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 19: Europe GCC Flexible Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Europe GCC Flexible Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Europe GCC Flexible Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe GCC Flexible Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe GCC Flexible Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe GCC Flexible Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe GCC Flexible Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa GCC Flexible Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Middle East & Africa GCC Flexible Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Middle East & Africa GCC Flexible Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa GCC Flexible Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa GCC Flexible Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa GCC Flexible Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa GCC Flexible Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa GCC Flexible Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific GCC Flexible Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 35: Asia Pacific GCC Flexible Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Asia Pacific GCC Flexible Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Asia Pacific GCC Flexible Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific GCC Flexible Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific GCC Flexible Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific GCC Flexible Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific GCC Flexible Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Flexible Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global GCC Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global GCC Flexible Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global GCC Flexible Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global GCC Flexible Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Global GCC Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Global GCC Flexible Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global GCC Flexible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global GCC Flexible Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 13: Global GCC Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global GCC Flexible Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global GCC Flexible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global GCC Flexible Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 20: Global GCC Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global GCC Flexible Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global GCC Flexible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global GCC Flexible Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 33: Global GCC Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global GCC Flexible Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global GCC Flexible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global GCC Flexible Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 43: Global GCC Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: Global GCC Flexible Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global GCC Flexible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific GCC Flexible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Flexible Packaging Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the GCC Flexible Packaging Market?

Key companies in the market include Radiant Packaging Industry LLC, Gulf Packaging Industries Limited, Integrated Plastics Packaging LLC*List Not Exhaustive, Hotpack Packaging Industries LLC, ENPI Group, Arabian Flexible Packaging LLC, Amber Packaging Industries LLC, Napco National, Rotopacking Materials Ind Co LLC, Huhtamaki Flexibles UAE, Gulf East Paper & Plastic Industries LLC, Emirates Printing Press (LLC).

3. What are the main segments of the GCC Flexible Packaging Market?

The market segments include Material Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Urbanization Rates and the Use of Organized Retails like Supermarkets and Hypermarkets; Growing Adoption of Various Packaging Options in the FMCG Industry.

6. What are the notable trends driving market growth?

Food Industry to be the Largest End User.

7. Are there any restraints impacting market growth?

Growing Concerns Regarding the Environment and Recycling; Fluctuations in Raw Material Prices may Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

December 2022: KEZAD Group, the integrated trade, logistics, and industrial hub of Abu Dhabi, signed a 50-year land lease agreement with Star Paper Mill, a specialty tissue manufacturer, to establish a new facility and manufacture recycled Kraft Paper Jumbo reels, eventually diversifying the company's product offering to serve a growing demand for biodegradable packaging papers in the UAE.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the GCC Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence