Key Insights

The North American polypropylene film market, covering the United States and Canada, is demonstrating substantial growth, propelled by rising demand across various end-use industries. The market size is projected to reach $100.73 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.5%. This expansion is largely driven by the food and beverage sector's reliance on polypropylene films for packaging, owing to their superior barrier properties, flexibility, and cost-efficiency. The pharmaceutical and medical industries also represent significant demand drivers, utilizing these films for sterile packaging and medical device applications. Furthermore, the industrial sector contributes to market growth through applications in protective wrapping and lamination. While other end-user segments are smaller, their growth is expected to align with the overall market trend.

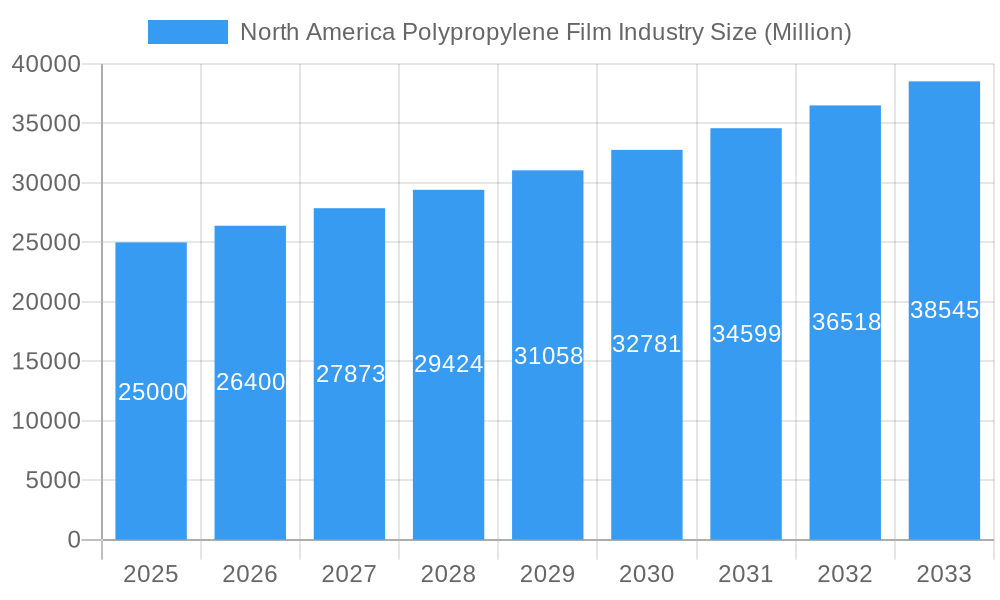

North America Polypropylene Film Industry Market Size (In Billion)

The North American polypropylene film market is forecasted to continue its upward trajectory, achieving a CAGR of 4.5% through 2033. This sustained growth is expected despite challenges such as raw material price volatility and environmental considerations surrounding plastic waste. Innovations in sustainable and biodegradable polypropylene film alternatives, alongside increasing consumer preference for eco-friendly packaging, are poised to influence the market's future dynamics. The competitive landscape features established players such as Dunmore Corporation, Cheever Specialty Paper & Film, and Toray Plastics (America) Inc., who are actively pursuing market share through innovation, capacity expansion, and strategic collaborations, indicating a stable and promising market for investment.

North America Polypropylene Film Industry Company Market Share

North America Polypropylene Film Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North American polypropylene film industry, encompassing market size, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report is crucial for businesses seeking to navigate this dynamic market and capitalize on emerging opportunities. The report analyzes the parent market of plastic films and the child market of polypropylene films within North America.

North America Polypropylene Film Industry Market Dynamics & Structure

This section analyzes the North American polypropylene film market's structure, encompassing market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends. The market is moderately consolidated, with the top five players holding approximately xx% market share in 2025.

- Market Concentration: Highly competitive with a few dominant players and numerous smaller niche players. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025.

- Technological Innovation: Focus on improved barrier properties, enhanced flexibility, and sustainable materials drives innovation. Bio-based polypropylene films are emerging as a significant area of focus.

- Regulatory Landscape: Stringent environmental regulations concerning plastic waste management and recyclability are shaping the market. Compliance costs represent a significant challenge.

- Competitive Substitutes: Other flexible packaging materials such as polyethylene films, paper, and biodegradable alternatives pose competition.

- End-User Demographics: Growing demand from the food and beverage sector, particularly for flexible packaging, drives market growth. The pharmaceutical and medical sectors represent an expanding segment.

- M&A Activity: The past five years have witnessed xx M&A deals, indicating consolidation and expansion within the industry, with a significant focus on acquisitions by larger players.

North America Polypropylene Film Industry Growth Trends & Insights

The North American polypropylene film market exhibits robust growth, driven by increasing demand across various end-use sectors. The market size, valued at xx million units in 2025, is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by several factors, including: rising consumer demand for packaged goods, advancements in film technology enhancing barrier properties and flexibility, and the increasing preference for convenient and lightweight packaging solutions. The adoption rate of polypropylene films in various applications, such as food packaging and industrial uses, continues to increase steadily. Technological disruptions, such as the introduction of recyclable and biodegradable options, are reshaping the market landscape. Consumer behavior shifts towards sustainable and eco-friendly products are also playing a significant role.

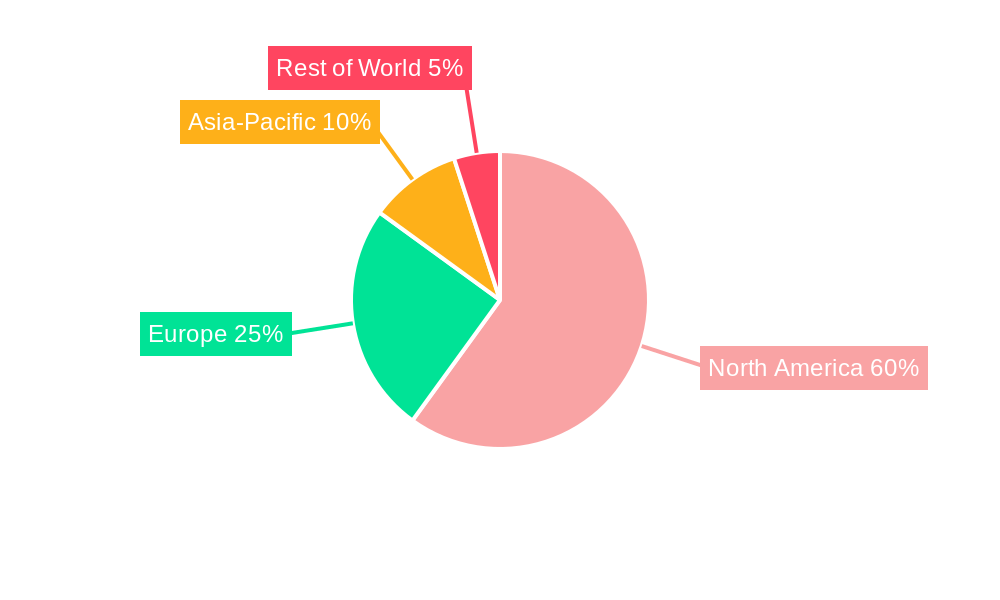

Dominant Regions, Countries, or Segments in North America Polypropylene Film Industry

The United States dominates the North American polypropylene film market, accounting for approximately xx% of the total market share in 2025. This dominance is attributed to: a large and diverse manufacturing base, high consumption of packaged goods, and a robust food and beverage industry.

- United States: High consumption of packaged goods, strong food & beverage sector, and established manufacturing base.

- Canada: Smaller market size compared to the US; however, growth is fueled by increasing demand from various end-use sectors.

By End-User Vertical: The food and beverage segment is the largest end-user vertical, contributing xx% to the market revenue in 2025, followed by the industrial and pharmaceutical & medical sectors. Growing demand for flexible packaging from food & beverage companies, coupled with stringent regulations regarding food safety, fuel market expansion in this segment.

North America Polypropylene Film Industry Product Landscape

The polypropylene film market offers a diverse range of products with varying properties tailored to specific applications. Innovations focus on enhancing barrier properties against moisture, oxygen, and aroma, improving film strength and flexibility, and incorporating features for enhanced recyclability and biodegradability. These advancements cater to the growing demand for sustainable and high-performance packaging solutions. The unique selling propositions are often based on superior barrier properties, specialized surface treatments, and tailored thicknesses for optimal performance in specific applications.

Key Drivers, Barriers & Challenges in North America Polypropylene Film Industry

Key Drivers:

- Growing demand for flexible packaging across various end-use sectors

- Advancements in film technology, improving barrier properties and flexibility

- Increased preference for convenient and lightweight packaging solutions.

Challenges & Restraints:

- Fluctuations in raw material prices (propylene) significantly impact production costs.

- Environmental concerns and increasing regulations regarding plastic waste management pose a challenge.

- Intense competition from other flexible packaging materials limits growth potential for some segments.

Emerging Opportunities in North America Polypropylene Film Industry

The North American polypropylene film industry presents several emerging opportunities:

- Growing demand for sustainable and eco-friendly packaging solutions (bio-based films, recyclable options).

- Expansion into niche applications within the medical and pharmaceutical sectors (sterile packaging, drug delivery systems).

- Development of specialized films with improved barrier properties for sensitive products.

Growth Accelerators in the North America Polypropylene Film Industry Industry

Long-term growth is fueled by several factors: strategic partnerships fostering innovation, technological breakthroughs in film production (e.g., advanced extrusion technologies), market expansion strategies targeting emerging applications and untapped segments, and increasing consumer demand for convenient and sustainable packaging.

Key Players Shaping the North America Polypropylene Film Industry Market

- Dunmore Corporation

- Cheever Specialty Paper & Film

- Toray Plastics (America) Inc

- Oben Holding Group

- Innovia Film

- Cosmo Films Inc

- Copol International Ltd

- Taghleef Industries

- Inteplast Group

Notable Milestones in North America Polypropylene Film Industry Sector

- 2021: Innovia Film launched a new range of recyclable polypropylene films.

- 2022: Significant investment by Cosmo Films in expanding its manufacturing capacity.

- 2023: Several key players announced initiatives to increase the use of recycled content in their films.

In-Depth North America Polypropylene Film Industry Market Outlook

The North American polypropylene film market is poised for sustained growth, driven by a confluence of factors. Technological innovations, such as the development of bio-based and readily recyclable films, will play a pivotal role in shaping market dynamics. Continued expansion into high-growth end-use segments, coupled with strategic partnerships to improve efficiency and sustainability, points towards a promising future for this dynamic industry. The market presents significant opportunities for companies to leverage innovation and sustainability initiatives to capture market share and drive long-term growth.

North America Polypropylene Film Industry Segmentation

-

1. End-User Vertical

- 1.1. Food

- 1.2. Beverage

- 1.3. Industrial

- 1.4. Pharmaceuticals & Medical

- 1.5. Other End-User Verticals

North America Polypropylene Film Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Polypropylene Film Industry Regional Market Share

Geographic Coverage of North America Polypropylene Film Industry

North America Polypropylene Film Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost-Effectiveness Of The Outsourcing; Access to the advanced technologies and expertise

- 3.3. Market Restrains

- 3.3.1. Monitoring issues and lack of standardization

- 3.4. Market Trends

- 3.4.1. Food Industry to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Polypropylene Film Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.1.1. Food

- 5.1.2. Beverage

- 5.1.3. Industrial

- 5.1.4. Pharmaceuticals & Medical

- 5.1.5. Other End-User Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-User Vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dunmore Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cheever Specialty Paper & Film

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toray Plastics (America) Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oben Holding Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Innovia Film

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cosmo Films Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Copol International Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Taghleef Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Inteplast Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Dunmore Corporation

List of Figures

- Figure 1: North America Polypropylene Film Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Polypropylene Film Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Polypropylene Film Industry Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 2: North America Polypropylene Film Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North America Polypropylene Film Industry Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 4: North America Polypropylene Film Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North America Polypropylene Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Polypropylene Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Polypropylene Film Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Polypropylene Film Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Polypropylene Film Industry?

Key companies in the market include Dunmore Corporation, Cheever Specialty Paper & Film, Toray Plastics (America) Inc, Oben Holding Group, Innovia Film, Cosmo Films Inc, Copol International Ltd, Taghleef Industries, Inteplast Group.

3. What are the main segments of the North America Polypropylene Film Industry?

The market segments include End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 100.73 billion as of 2022.

5. What are some drivers contributing to market growth?

Cost-Effectiveness Of The Outsourcing; Access to the advanced technologies and expertise.

6. What are the notable trends driving market growth?

Food Industry to Hold Major Share.

7. Are there any restraints impacting market growth?

Monitoring issues and lack of standardization.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Polypropylene Film Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Polypropylene Film Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Polypropylene Film Industry?

To stay informed about further developments, trends, and reports in the North America Polypropylene Film Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence