Key Insights

The Brazil plastic packaging films market is projected to expand steadily, with an estimated market size of 8.4 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 1.52% from the base year of 2025. This expansion is driven by evolving consumer needs and robust industrial applications. Key growth factors include increased demand for packaged food, particularly frozen foods, confectionery, and dairy, which utilize advanced plastic films for preservation. The healthcare sector's requirement for sterile packaging and the growth in personal and home care markets also contribute to demand. Furthermore, the expanding e-commerce sector necessitates efficient and durable industrial packaging, with plastic films playing a vital role in product protection during logistics.

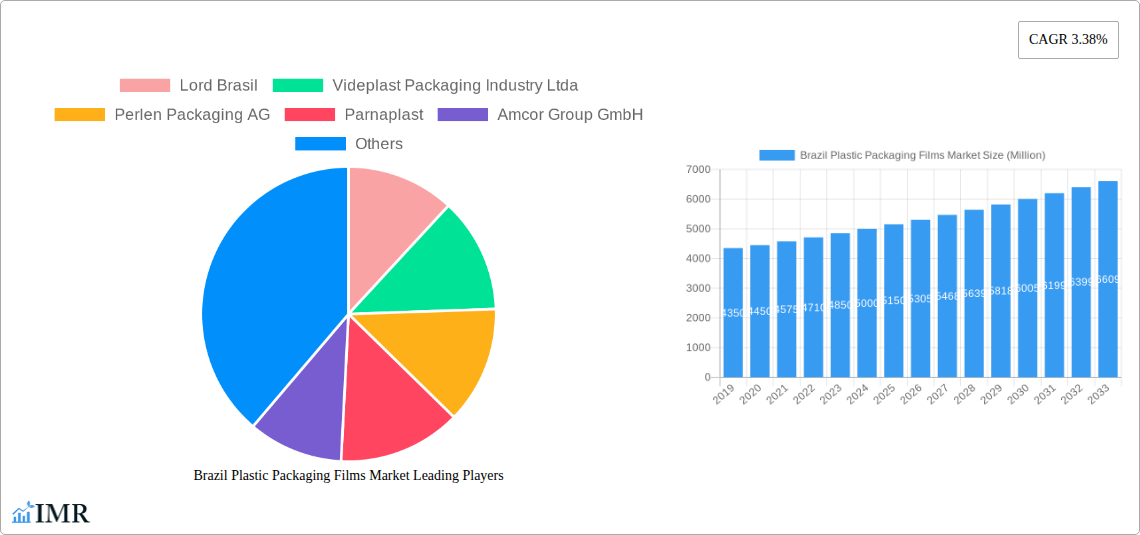

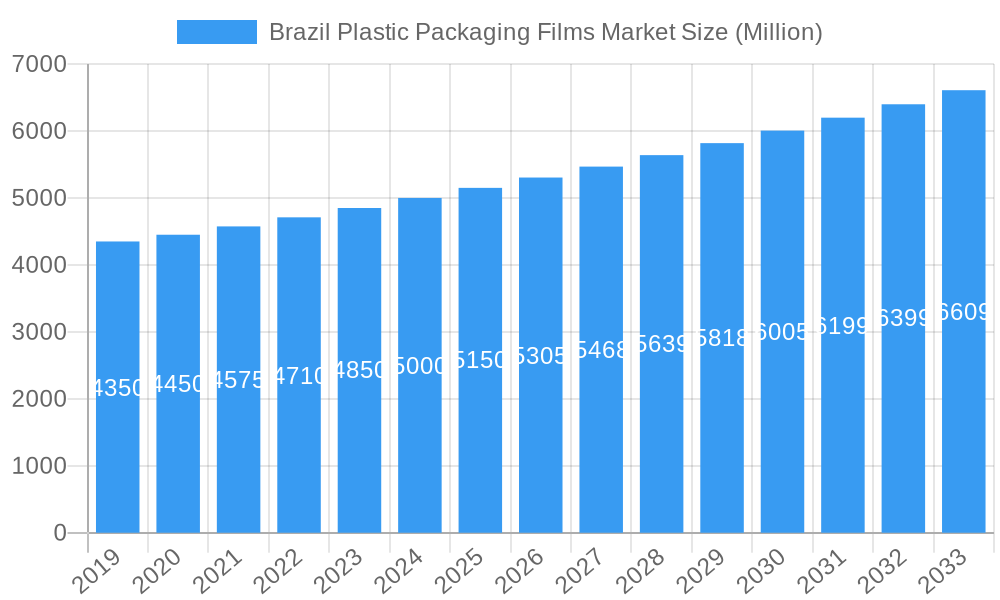

Brazil Plastic Packaging Films Market Market Size (In Billion)

Market trends include a growing preference for recyclable and bio-based plastic films, driven by environmental consciousness and fostering innovation in sustainable alternatives. Technological advancements in film properties, such as enhanced barrier capabilities, superior printability, and lightweight designs, are improving performance and cost-effectiveness. However, challenges such as fluctuating raw material prices for polymers and stringent regulations on plastic waste management may impact market dynamics. Despite these challenges, the resilience of key end-user industries and continuous technological innovation are expected to maintain a positive growth outlook for the Brazil plastic packaging films market.

Brazil Plastic Packaging Films Market Company Market Share

Brazil Plastic Packaging Films Market: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock critical insights into the dynamic Brazil Plastic Packaging Films Market, a vital sector within the broader packaging industry. This in-depth report provides a 360-degree view of market dynamics, growth trends, competitive landscape, and future opportunities, leveraging high-traffic keywords to ensure maximum visibility and engagement for industry professionals. Analyze parent and child market trends with precision, understanding the intricate interplay between different film types and end-user industries. All values are presented in Million Units.

Brazil Plastic Packaging Films Market Market Dynamics & Structure

The Brazil Plastic Packaging Films Market is characterized by a moderate to high concentration, with a few dominant players shaping its competitive landscape. Technological innovation is a significant driver, particularly in the development of sustainable and high-performance films. Regulatory frameworks, while evolving, are increasingly focused on environmental impact and recyclability, influencing material choices and production processes. Competitive product substitutes, such as paper-based packaging and alternative barrier materials, pose a constant challenge, necessitating continuous innovation in plastic film properties. End-user demographics, driven by a growing middle class and an expanding food and beverage sector, are key to sustained demand. Mergers and acquisitions (M&A) activity, while not excessively high, reflects strategic moves to consolidate market share and acquire technological capabilities.

- Market Concentration: Dominated by key players with significant production capacities.

- Technological Innovation Drivers: Focus on sustainability, enhanced barrier properties, and cost-efficiency.

- Regulatory Frameworks: Increasing emphasis on environmental compliance and recycling mandates.

- Competitive Product Substitutes: Growing demand for biodegradable and compostable alternatives.

- End-User Demographics: Driven by population growth, urbanization, and evolving consumer preferences for convenience and shelf-life.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios and market reach.

Brazil Plastic Packaging Films Market Growth Trends & Insights

The Brazil Plastic Packaging Films Market is poised for robust growth, driven by a confluence of economic expansion, evolving consumer behavior, and technological advancements. The market size evolution is a testament to the increasing demand for effective and versatile packaging solutions across various sectors. Adoption rates of advanced film technologies, such as multilayer films and high-barrier polymers, are on the rise as manufacturers seek to enhance product shelf-life, reduce waste, and meet stringent regulatory requirements. Technological disruptions, including advancements in bioplastics and chemical recycling, are creating new avenues for market expansion and product differentiation. Consumer behavior shifts, notably the growing preference for convenient, on-the-go consumption and the increasing awareness of food safety and hygiene, are significantly influencing the demand for specialized plastic packaging films.

The forecast period (2025–2033) anticipates a strong CAGR, fueled by sustained investments in the food and beverage, healthcare, and personal care sectors. The penetration of flexible packaging, enabled by the versatility and cost-effectiveness of plastic films, will continue to deepen across established and emerging applications. The demand for sustainable packaging solutions, particularly those made from recycled content or bio-based materials, is emerging as a dominant trend, compelling manufacturers to innovate and adapt their product offerings. This shift is not merely driven by consumer sentiment but also by proactive industry initiatives and evolving corporate sustainability goals. The intrinsic properties of plastic films – their lightweight nature, excellent barrier capabilities, and printability – continue to make them indispensable for a wide array of products, from perishable foods to sensitive pharmaceuticals.

Dominant Regions, Countries, or Segments in Brazil Plastic Packaging Films Market

The Brazil Plastic Packaging Films Market exhibits significant dominance across specific segments and end-user industries, primarily driven by robust economic activity and a large consumer base. The Polyethylene (PE) segment, encompassing both Low-Density Polyethylene (LDPE) and High-Density Polyethylene (HDPE), consistently leads the market due to its versatility, cost-effectiveness, and wide range of applications. Its dominance is further bolstered by its extensive use in the Food end-user industry, which itself is the largest consumer of plastic packaging films. Within the food segment, Dry Foods and Dairy Products represent substantial growth areas, demanding films that offer excellent moisture and oxygen barrier properties.

The Food end-user industry, as a whole, is the principal growth engine. The sub-segments of Candy and Confectionery and Meat, Poultry, and Seafood are particularly dynamic, requiring specialized films for extended shelf life and visual appeal. The burgeoning Pet Food market also contributes significantly to this segment's growth, with increasing demand for high-quality, durable packaging. Personal Care and Home Care products also represent a substantial and growing segment, requiring films that offer both aesthetic appeal and functional protection. The Industrial Packaging sector, while perhaps less volume-intensive than food, demands robust and high-performance films for protecting goods during transit and storage.

The Southeastern region of Brazil, encompassing states like São Paulo, Rio de Janeiro, and Minas Gerais, is the dominant geographical hub for plastic packaging films. This dominance is attributable to its high population density, well-developed industrial infrastructure, and concentration of major food processing, healthcare, and consumer goods manufacturers. Economic policies promoting industrial growth and significant investments in manufacturing facilities within this region further solidify its leading position. The presence of major players like Lord Brasil and Videplast Packaging Industry Ltda in this region underscores its strategic importance.

- Dominant Segment (Type): Polyethylene (LDPE, HDPE)

- Dominant End-user Industry: Food

- Key Food Sub-segments: Dry Foods, Dairy Products, Candy and Confectionery, Meat, Poultry, and Seafood.

- Dominant Region: Southeastern Brazil

- Key Drivers: High population density, advanced industrial infrastructure, concentration of end-user industries.

- Market Share Contribution: Polyethylene films account for approximately 40-45% of the total market volume.

- Growth Potential: Significant opportunities in high-barrier films and sustainable packaging within the food segment.

Brazil Plastic Packaging Films Market Product Landscape

The product landscape of the Brazil Plastic Packaging Films Market is characterized by continuous innovation aimed at enhancing performance, sustainability, and cost-effectiveness. Key product developments include advanced multilayer films with specialized barrier properties, such as those incorporating EVOH (Ethylene Vinyl Alcohol) for superior oxygen and aroma retention, crucial for extending the shelf-life of sensitive food products. The increasing demand for bio-based films, derived from sources like sugarcane-based ethylene, is also a significant trend, offering a more sustainable alternative to conventional petroleum-based plastics. Innovations in Polypropylene (PP) films focus on improved clarity, printability, and heat sealability, making them ideal for various confectionery and snack packaging applications.

The application spectrum is broad, ranging from flexible packaging for snacks, confectionery, and frozen foods to medical device packaging and hygiene product wrappers. Performance metrics are increasingly focused on puncture resistance, tear strength, UV protection, and recyclability. Unique selling propositions often revolve around the ability to meet stringent regulatory requirements for food contact, provide extended shelf-life solutions, and contribute to brands' sustainability objectives. Technological advancements in extrusion and co-extrusion techniques are enabling the production of thinner, yet stronger, films, thereby reducing material consumption and environmental impact.

Key Drivers, Barriers & Challenges in Brazil Plastic Packaging Films Market

The Brazil Plastic Packaging Films Market is propelled by several key drivers, predominantly the ever-growing demand from the food and beverage industry for extended shelf-life and product preservation solutions. The expanding middle class and increasing urbanization are also fueling consumption of packaged goods, indirectly driving the need for flexible packaging. Technological advancements in film manufacturing, leading to improved barrier properties and cost efficiencies, are crucial enablers. Furthermore, government initiatives promoting domestic manufacturing and investments in the packaging sector contribute to market growth.

Key challenges and restraints include the escalating volatility in raw material prices, particularly crude oil derivatives, which directly impacts production costs. Stringent environmental regulations and a growing societal preference for sustainable packaging alternatives present significant hurdles, requiring substantial investment in recycling infrastructure and the development of bio-based or compostable materials. Supply chain disruptions, often exacerbated by global economic uncertainties, can lead to delays and increased costs. The competitive pressure from alternative packaging materials, such as paper and glass, necessitates continuous innovation to maintain market share. For instance, the price sensitivity of the Brazilian market means that any significant increase in production costs can make plastic films less competitive.

Emerging Opportunities in Brazil Plastic Packaging Films Market

Emerging opportunities in the Brazil Plastic Packaging Films Market are predominantly centered around sustainability and specialized applications. The growing global and domestic push for a circular economy presents a significant opportunity for the development and widespread adoption of recycled plastic films, including those made from post-consumer recycled (PCR) content. Innovations in biodegradable and compostable films, catering to specific end-of-life scenarios and consumer demand for eco-friendly options, are also rapidly expanding. The increasing sophistication of the healthcare sector in Brazil is creating demand for specialized medical-grade packaging films with enhanced barrier properties and sterilization compatibility.

Furthermore, the burgeoning e-commerce sector in Brazil is creating a niche for lightweight, durable, and tamper-evident plastic packaging solutions that can withstand the rigors of shipping. Untapped markets in remote regions with growing populations also offer potential for expansion, provided that efficient distribution networks can be established. The development of smart packaging solutions, incorporating features like spoilage indicators or traceability markers, represents a future growth frontier, aligning with increasing consumer and industry demands for transparency and safety.

Growth Accelerators in the Brazil Plastic Packaging Films Market Industry

Several growth accelerators are shaping the long-term trajectory of the Brazil Plastic Packaging Films Market. Technological breakthroughs in polymer science, leading to the creation of advanced barrier films with enhanced recyclability and reduced material usage, are pivotal. Strategic partnerships and collaborations between film manufacturers, raw material suppliers, and end-users are crucial for driving innovation and ensuring market alignment with evolving demands, particularly in the realm of sustainable packaging.

Market expansion strategies, including investment in new production facilities and the adoption of advanced manufacturing technologies, are vital for meeting growing demand and improving operational efficiency. The increasing focus on developing and scaling up recycling technologies, such as chemical recycling, will be a significant accelerator for the use of recycled content in plastic films. Moreover, the development of bio-based plastic films derived from renewable resources like sugarcane is expected to gain substantial traction, driven by both consumer preference and regulatory incentives, further augmenting market growth.

Key Players Shaping the Brazil Plastic Packaging Films Market Market

- Lord Brasil

- Videplast Packaging Industry Ltda

- Perlen Packaging AG

- Parnaplast

- Amcor Group GmbH

- Finepack

- ACG World

- Sonoco Products Company

- Berry Global Inc

Notable Milestones in Brazil Plastic Packaging Films Market Sector

- March 2024: Berry Global Inc. collaborated across the value chain to increase the use of recycled content in packaging products, fostering new technologies and standards for recycled plastic films, enhancing their quality and performance.

- August 2023: Indorama Ventures completed the expansion of its recycling facility in Brazil, increasing its annual post-consumer recycled PET production capacity from 9,000 tons to 25,000 tons, ensuring a more substantial supply of rPET for plastic packaging films and meeting sustainable packaging demands.

- July 2023: Braskem invested USD 87 million to enhance its bio-based ethylene complex in Brazil, resulting in a 30% increase in production capacity to 260,000 tons of biopolymers annually, thereby increasing the availability of bio-based materials for packaging films.

In-Depth Brazil Plastic Packaging Films Market Market Outlook

The future outlook for the Brazil Plastic Packaging Films Market is exceptionally promising, characterized by sustained growth driven by innovation and adaptation. Key growth accelerators, including advancements in sustainable materials, the expansion of recycling infrastructure, and strategic industry collaborations, will continue to shape the market's trajectory. The increasing consumer demand for environmentally conscious packaging, coupled with supportive regulatory policies, will further propel the adoption of bio-based and recycled content films. Opportunities lie in addressing the evolving needs of the food, healthcare, and personal care sectors with specialized, high-performance, and sustainable packaging solutions. The market is expected to witness continued investment in advanced manufacturing technologies and R&D, ensuring its continued relevance and competitiveness in the global packaging landscape.

Brazil Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End-user Industry

-

2.1. Food

- 2.1.1. Candy and Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, and Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care and Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

Brazil Plastic Packaging Films Market Segmentation By Geography

- 1. Brazil

Brazil Plastic Packaging Films Market Regional Market Share

Geographic Coverage of Brazil Plastic Packaging Films Market

Brazil Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Long-lasting Packaging Products; Rising Demand for Sustainable and Innovative Food Packaging Products

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Long-lasting Packaging Products; Rising Demand for Sustainable and Innovative Food Packaging Products

- 3.4. Market Trends

- 3.4.1. Polyethylene Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.1.1. Candy and Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, and Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lord Brasil

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Videplast Packaging Industry Ltda

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Perlen Packaging AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Parnaplast

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amcor Group GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Finepack

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACG World

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sonoco Products Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Berry Global Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Lord Brasil

List of Figures

- Figure 1: Brazil Plastic Packaging Films Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Plastic Packaging Films Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Brazil Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Brazil Plastic Packaging Films Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Brazil Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Brazil Plastic Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Plastic Packaging Films Market?

The projected CAGR is approximately 1.52%.

2. Which companies are prominent players in the Brazil Plastic Packaging Films Market?

Key companies in the market include Lord Brasil, Videplast Packaging Industry Ltda, Perlen Packaging AG, Parnaplast, Amcor Group GmbH, Finepack, ACG World, Sonoco Products Company, Berry Global Inc.

3. What are the main segments of the Brazil Plastic Packaging Films Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Long-lasting Packaging Products; Rising Demand for Sustainable and Innovative Food Packaging Products.

6. What are the notable trends driving market growth?

Polyethylene Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increasing Demand for Long-lasting Packaging Products; Rising Demand for Sustainable and Innovative Food Packaging Products.

8. Can you provide examples of recent developments in the market?

March 2024: Berry worked collaboratively across the value chain to increase the use of recycled content in packaging products. Collaborations often lead to the development of new technologies and standards for incorporating recycled content into packaging. This helps improve the quality and performance of recycled plastic films, making them more attractive to manufacturers and consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the Brazil Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence