Key Insights

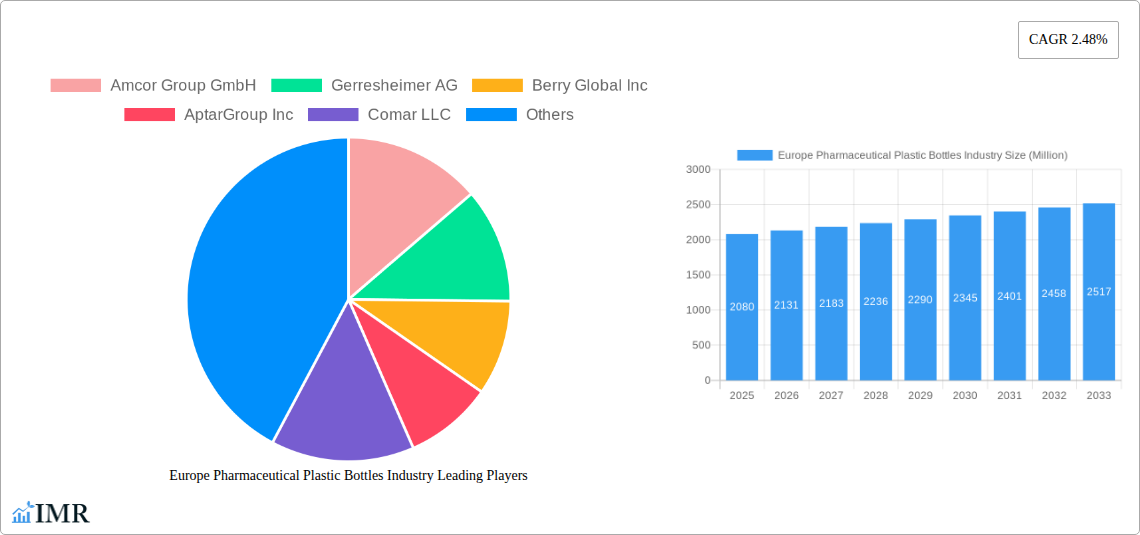

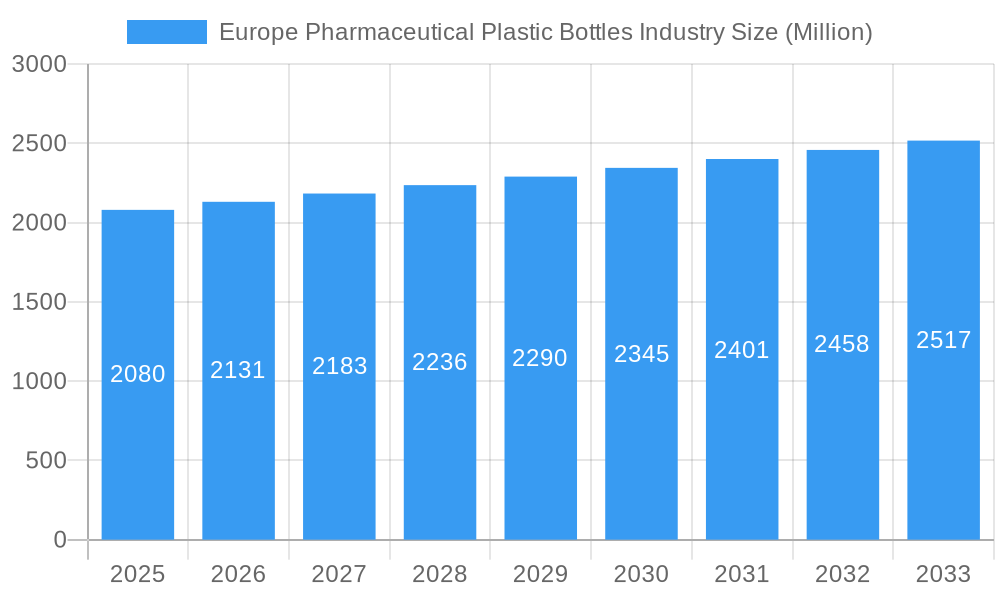

The Europe Pharmaceutical Plastic Bottles Market is poised for steady expansion, projected to reach approximately USD 2.08 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.48% anticipated over the forecast period from 2025 to 2033. This growth is underpinned by increasing healthcare expenditure across European nations and a rising demand for advanced drug delivery systems that utilize plastic packaging for its versatility, cost-effectiveness, and safety. Key market drivers include the growing prevalence of chronic diseases, necessitating consistent and reliable pharmaceutical packaging, and the continuous innovation in bottle designs and materials to enhance product shelf-life and patient compliance. The industry is witnessing a significant shift towards specialized container types like dropper bottles and nasal spray bottles, reflecting the evolving needs of the pharmaceutical sector and a greater focus on user-friendly drug administration.

Europe Pharmaceutical Plastic Bottles Industry Market Size (In Billion)

The market's dynamism is further shaped by several influential trends. A prominent trend is the increasing adoption of sustainable and eco-friendly packaging solutions. Manufacturers are investing in research and development to incorporate recycled plastics and explore biodegradable alternatives, driven by stringent environmental regulations and growing consumer consciousness. This trend is particularly evident in materials like Polyethylene Terephthalate (PET) and Polypropylene (PP), which are being optimized for their recyclability and reduced environmental impact. Conversely, certain restraints, such as fluctuating raw material prices and the stringent regulatory landscape governing pharmaceutical packaging, necessitate careful strategic planning by market players. Nevertheless, the robust growth in liquid bottles and oral care segments, alongside the ongoing innovation in other specialized types, indicates a resilient and adaptive market that is well-positioned to meet the future demands of the European pharmaceutical industry.

Europe Pharmaceutical Plastic Bottles Industry Company Market Share

This in-depth report provides a critical analysis of the Europe Pharmaceutical Plastic Bottles Industry, exploring its market dynamics, growth trajectories, and competitive landscape. With a forecast period extending from 2025 to 2033, this study delves into market size, segmentation by raw material and type, regional dominance, product innovation, key drivers, barriers, emerging opportunities, and growth accelerators. It offers essential insights for industry stakeholders, including manufacturers, suppliers, investors, and policymakers, seeking to navigate this evolving market. All quantitative values are presented in Million units.

Europe Pharmaceutical Plastic Bottles Industry Market Dynamics & Structure

The Europe Pharmaceutical Plastic Bottles Industry exhibits a moderately consolidated market structure, characterized by the presence of several key global and regional players. Technological innovation is a significant driver, with continuous advancements in material science leading to lighter, more durable, and sustainable plastic bottle solutions. Stringent regulatory frameworks, such as the European Medicines Agency (EMA) guidelines, dictate product quality, safety, and material compliance, influencing manufacturing processes and R&D investments. Competitive product substitutes, including glass and aluminum packaging, pose a constant challenge, pushing plastic bottle manufacturers to enhance their value proposition through features like tamper-evidence and child-resistance. End-user demographics, primarily the aging European population and rising prevalence of chronic diseases, are fueling the demand for pharmaceutical packaging. Mergers and acquisitions (M&A) trends indicate strategic consolidation aimed at expanding market reach, enhancing product portfolios, and achieving economies of scale. For instance, the acquisition of smaller specialized players by larger entities is a recurring strategy. The market concentration is estimated to be around 60-70%, with the top 5-7 players holding a significant share. Barriers to innovation include high R&D costs and the lengthy regulatory approval processes for new materials and designs.

Europe Pharmaceutical Plastic Bottles Industry Growth Trends & Insights

The Europe Pharmaceutical Plastic Bottles Industry is projected to experience robust growth, driven by an escalating demand for safe, reliable, and cost-effective pharmaceutical packaging solutions. The market size is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. The adoption rates of advanced plastic formulations and specialized bottle designs are steadily increasing, spurred by pharmaceutical companies' focus on enhancing drug delivery efficacy and patient compliance. Technological disruptions, such as advancements in barrier properties for extended shelf-life medications and the integration of smart packaging features for track-and-trace capabilities, are significantly reshaping the market. Consumer behavior shifts, including a growing preference for convenient and user-friendly packaging, further propel the demand for innovative plastic bottle designs. The increasing emphasis on sustainability is also a key factor, with a growing market penetration of recycled and bio-based plastics in pharmaceutical packaging. For instance, the market penetration of recycled PET (rPET) in pharmaceutical bottles is estimated to grow from 15% in 2025 to 30% by 2033. This evolving landscape necessitates continuous investment in research and development to meet the evolving needs of the pharmaceutical sector and maintain a competitive edge.

Dominant Regions, Countries, or Segments in Europe Pharmaceutical Plastic Bottles Industry

The Polyethylene Terephthalate (PET) raw material segment is anticipated to be the dominant force driving growth in the Europe Pharmaceutical Plastic Bottles Industry. PET's exceptional clarity, strength, chemical resistance, and recyclability make it an ideal choice for a wide array of pharmaceutical applications, from liquid formulations to solid dosage forms. Its lightweight nature also contributes to reduced transportation costs and environmental impact.

Key Drivers for PET Dominance:

- Excellent Barrier Properties: PET offers superior protection against moisture, oxygen, and other contaminants, crucial for maintaining the stability and efficacy of sensitive pharmaceutical products.

- Lightweight and Durable: This translates to lower shipping expenses and reduced risk of breakage during transit and handling, a critical factor in the pharmaceutical supply chain.

- Cost-Effectiveness: Compared to some alternative materials, PET provides a favorable balance of performance and cost, making it an economically viable option for mass production.

- Recyclability and Sustainability Initiatives: Growing environmental consciousness and regulations promoting circular economy principles favor PET due to its established recycling infrastructure and increasing availability of food-grade recycled PET (rPET).

- Versatility in Manufacturing: PET can be easily molded into various shapes and sizes, catering to diverse pharmaceutical packaging needs, including dropper bottles, nasal spray bottles, and liquid bottles.

Within the Type segmentation, Liquid Bottles are expected to hold the largest market share. This is directly attributable to the widespread use of liquid medications, including oral solutions, syrups, and injectables, across all therapeutic areas. The demand for precise dosing mechanisms, child-resistant closures, and tamper-evident features further solidifies the dominance of liquid bottles.

Factors Contributing to Liquid Bottle Dominance:

- High Prevalence of Liquid Dosage Forms: A significant portion of pharmaceutical formulations are administered in liquid form, necessitating specialized packaging.

- Patient Compliance: User-friendly designs, such as easy-to-open caps and clear volume markings, enhance patient compliance with prescribed treatments.

- Safety and Tamper Evidence: Robust closure systems and tamper-evident features are paramount to prevent contamination and ensure product integrity.

- Innovation in Dispensing: Advancements in integrated dispensing mechanisms and spray nozzles cater to specific drug delivery requirements, particularly for nasal sprays and inhalers.

Germany, the United Kingdom, and France are projected to be the leading countries in terms of market share, driven by their well-established pharmaceutical manufacturing sectors, advanced healthcare infrastructure, and significant investments in R&D and sustainable packaging solutions. The strong presence of leading pharmaceutical companies and packaging manufacturers in these regions further amplifies their market dominance.

Europe Pharmaceutical Plastic Bottles Industry Product Landscape

The Europe Pharmaceutical Plastic Bottles Industry is characterized by a dynamic product landscape driven by innovation and evolving market demands. Manufacturers are increasingly focusing on developing bottles with enhanced barrier properties to extend drug shelf life and protect sensitive formulations. Product innovations include lightweight yet durable designs, child-resistant closures (CRCs) and senior-friendly opening mechanisms to improve patient safety and usability. The integration of tamper-evident features remains a critical aspect, ensuring product integrity and consumer confidence. Furthermore, there is a growing trend towards the use of recycled PET (rPET) and bio-based plastics, reflecting the industry's commitment to sustainability. Unique selling propositions often revolve around specialized dispensing capabilities, such as precision dropper bottles for accurate dosage or advanced nasal spray bottles with controlled spray patterns. Technological advancements are also enabling the development of more sophisticated designs for oral care products and other specialized applications, meeting the stringent requirements of the pharmaceutical sector.

Key Drivers, Barriers & Challenges in Europe Pharmaceutical Plastic Bottles Industry

Key Drivers:

- Growing Pharmaceutical Market: The expanding global pharmaceutical industry, driven by an aging population and increasing prevalence of chronic diseases, fuels the demand for reliable and safe packaging solutions.

- Technological Advancements: Innovations in plastic materials, barrier technologies, and manufacturing processes enable the creation of more efficient, sustainable, and user-friendly pharmaceutical plastic bottles.

- Regulatory Support for Sustainability: Government initiatives and regulations promoting the use of recycled content and sustainable packaging solutions are encouraging manufacturers to adopt greener practices.

- Demand for Specialized Packaging: The need for specialized packaging for specific drug delivery systems, such as nasal sprays, dropper bottles, and oral care products, creates opportunities for niche market growth.

Barriers & Challenges:

- Stringent Regulatory Compliance: Adhering to strict quality control, safety standards, and regulatory requirements set by bodies like the EMA can be complex and costly.

- Competition from Alternative Materials: Glass and aluminum packaging remain competitive alternatives, particularly for certain high-value or sensitive pharmaceuticals, posing a constant challenge to plastic bottle dominance.

- Supply Chain Disruptions: Geopolitical events, raw material price volatility, and logistical challenges can impact the availability and cost of plastic resins, affecting production and profitability.

- Environmental Concerns and Public Perception: Negative perceptions surrounding plastic waste and its environmental impact can create pressure on manufacturers to demonstrate sustainability and invest in effective recycling solutions.

- High Investment in R&D: Developing innovative and compliant pharmaceutical plastic bottles requires significant investment in research and development, posing a barrier for smaller players.

Emerging Opportunities in Europe Pharmaceutical Plastic Bottles Industry

Emerging opportunities within the Europe Pharmaceutical Plastic Bottles Industry lie in the increasing demand for sustainable packaging solutions, particularly those made from recycled and bio-based plastics. The growing focus on drug delivery innovation presents avenues for developing specialized bottles with advanced features, such as integrated dispensing mechanisms for precise dosing and improved patient compliance. Furthermore, the trend towards personalized medicine is creating a need for smaller batch production and customized packaging solutions. The expansion of e-commerce for pharmaceuticals also presents an opportunity for robust, lightweight, and tamper-evident packaging designs that can withstand the rigors of shipping. Untapped markets within specific therapeutic areas, such as biologics and specialty drugs, also offer significant growth potential.

Growth Accelerators in the Europe Pharmaceutical Plastic Bottles Industry Industry

Several factors are acting as key growth accelerators for the Europe Pharmaceutical Plastic Bottles Industry. Continuous technological breakthroughs in material science, leading to enhanced barrier properties, increased recyclability, and improved product safety features, are significantly driving market expansion. Strategic partnerships between plastic bottle manufacturers and pharmaceutical companies, aimed at co-developing innovative packaging solutions tailored to specific drug formulations, are crucial. The increasing investment in research and development by major players to meet stringent regulatory demands and capitalize on emerging trends like sustainability and smart packaging is also a significant accelerator. Market expansion strategies, including the exploration of new geographic regions and the diversification of product offerings to cater to a wider range of pharmaceutical applications, are further propelling the industry forward.

Key Players Shaping the Europe Pharmaceutical Plastic Bottles Industry Market

- Amcor Group GmbH

- Gerresheimer AG

- Berry Global Inc

- AptarGroup Inc

- Comar LLC

- Frapak Packaging

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Silgan Holdings Inc

- Pretium Packaging

- Greiner Packaging International GmbH

Notable Milestones in Europe Pharmaceutical Plastic Bottles Industry Sector

- April 2024: The United Kingdom launched the Circularity in Primary Pharmaceutical Packaging Accelerator (CiPPPA) to enhance end-of-use recycling strategies for medicinal devices and pharmaceutical packaging, promoting the use of recycled materials for new bottle manufacturing.

- February 2024: The UK's National Health Service (NHS) University College London Hospitals (UCLH) initiative to recycle single-use surgical item packaging could positively impact the growth of the European pharmaceutical plastic bottle market by increasing demand for sustainable packaging solutions and driving innovation in recyclable or biodegradable alternatives.

In-Depth Europe Pharmaceutical Plastic Bottles Industry Market Outlook

The Europe Pharmaceutical Plastic Bottles Industry is poised for sustained growth, driven by a confluence of factors including an aging population, increasing healthcare expenditure, and a strong push towards sustainable packaging solutions. The industry's ability to adapt to evolving regulatory landscapes and embrace technological advancements will be critical for future success. Strategic investments in R&D, focusing on enhanced barrier properties, advanced drug delivery integration, and the widespread adoption of recycled and bio-based plastics, will unlock significant market potential. Collaboration between packaging manufacturers and pharmaceutical companies will continue to be a cornerstone for developing innovative solutions that meet the diverse needs of the pharmaceutical sector. Emerging opportunities in specialized packaging for biologics and the growing e-pharmacy market offer promising avenues for expansion and market leadership in the coming years.

Europe Pharmaceutical Plastic Bottles Industry Segmentation

-

1. Raw Material

- 1.1. Polyethylene Terephthalate (PET)

- 1.2. Polypropylene (PP)

- 1.3. Low-density Polyethylene (LDPE)

- 1.4. High-density Polyethylene (HDPE)

-

2. Type

- 2.1. Solid Containers

- 2.2. Dropper Bottles

- 2.3. Nasal Spray Bottles

- 2.4. Liquid Bottles

- 2.5. Oral Care

- 2.6. Other Types

Europe Pharmaceutical Plastic Bottles Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

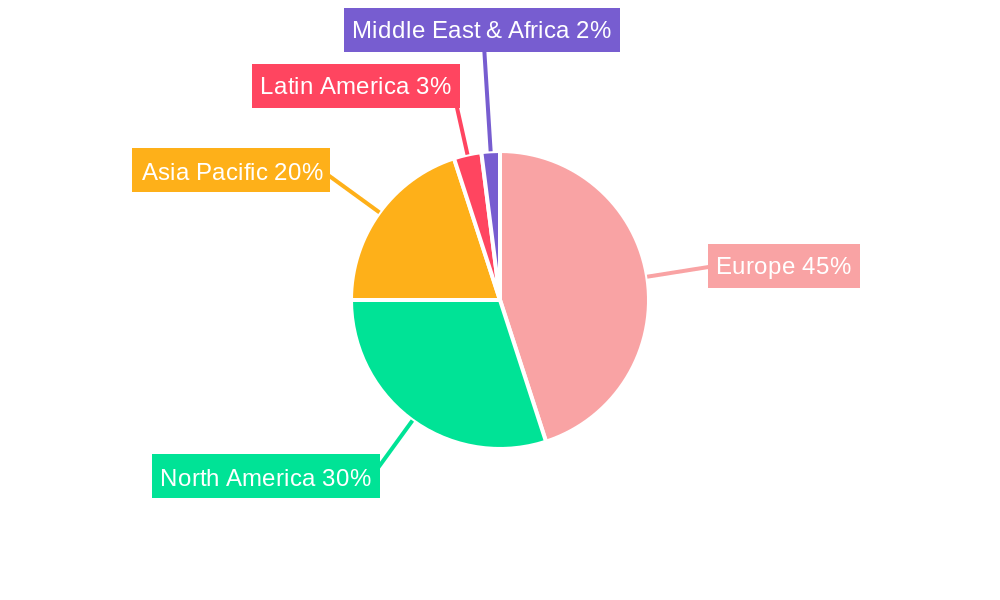

Europe Pharmaceutical Plastic Bottles Industry Regional Market Share

Geographic Coverage of Europe Pharmaceutical Plastic Bottles Industry

Europe Pharmaceutical Plastic Bottles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Healthcare Spending Boosts the Demand for Pharmaceutical Products and Packaging Solutions; Enhancing Patient Compliance Through Innovative Pharmaceutical Plastic Bottle Design

- 3.3. Market Restrains

- 3.3.1. High Healthcare Spending Boosts the Demand for Pharmaceutical Products and Packaging Solutions; Enhancing Patient Compliance Through Innovative Pharmaceutical Plastic Bottle Design

- 3.4. Market Trends

- 3.4.1. The Polyethylene Terephthalate (PET) Segment is Expected to Witness a Significant Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Plastic Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyethylene Terephthalate (PET)

- 5.1.2. Polypropylene (PP)

- 5.1.3. Low-density Polyethylene (LDPE)

- 5.1.4. High-density Polyethylene (HDPE)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solid Containers

- 5.2.2. Dropper Bottles

- 5.2.3. Nasal Spray Bottles

- 5.2.4. Liquid Bottles

- 5.2.5. Oral Care

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Group GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gerresheimer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AptarGroup Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comar LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Frapak Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Silgan Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pretium Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greiner Packaging International GmbH*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amcor Group GmbH

List of Figures

- Figure 1: Europe Pharmaceutical Plastic Bottles Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pharmaceutical Plastic Bottles Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 3: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 8: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 9: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Europe Pharmaceutical Plastic Bottles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Pharmaceutical Plastic Bottles Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Pharmaceutical Plastic Bottles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Pharmaceutical Plastic Bottles Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Plastic Bottles Industry?

The projected CAGR is approximately 2.48%.

2. Which companies are prominent players in the Europe Pharmaceutical Plastic Bottles Industry?

Key companies in the market include Amcor Group GmbH, Gerresheimer AG, Berry Global Inc, AptarGroup Inc, Comar LLC, Frapak Packaging, ALPLA Werke Alwin Lehner GmbH & Co KG, Silgan Holdings Inc, Pretium Packaging, Greiner Packaging International GmbH*List Not Exhaustive.

3. What are the main segments of the Europe Pharmaceutical Plastic Bottles Industry?

The market segments include Raw Material, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.08 Million as of 2022.

5. What are some drivers contributing to market growth?

High Healthcare Spending Boosts the Demand for Pharmaceutical Products and Packaging Solutions; Enhancing Patient Compliance Through Innovative Pharmaceutical Plastic Bottle Design.

6. What are the notable trends driving market growth?

The Polyethylene Terephthalate (PET) Segment is Expected to Witness a Significant Growth in the Market.

7. Are there any restraints impacting market growth?

High Healthcare Spending Boosts the Demand for Pharmaceutical Products and Packaging Solutions; Enhancing Patient Compliance Through Innovative Pharmaceutical Plastic Bottle Design.

8. Can you provide examples of recent developments in the market?

April 2024: The United Kingdom has initiated the Circularity in Primary Pharmaceutical Packaging Accelerator (CiPPPA) to spearhead the development and execution of strategies to enhance the end-of-use recycling of medicinal devices and pharmaceutical packaging. Furthermore, CPA focuses on enhancing the end-of-use recycling of medicinal devices and pharmaceutical packaging. By improving recycling infrastructure and practices, pharmaceutical plastic bottles can be recycled rather than disposed of, increasing the supply of recycled materials for manufacturing new bottles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Plastic Bottles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Plastic Bottles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Plastic Bottles Industry?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Plastic Bottles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence