Key Insights

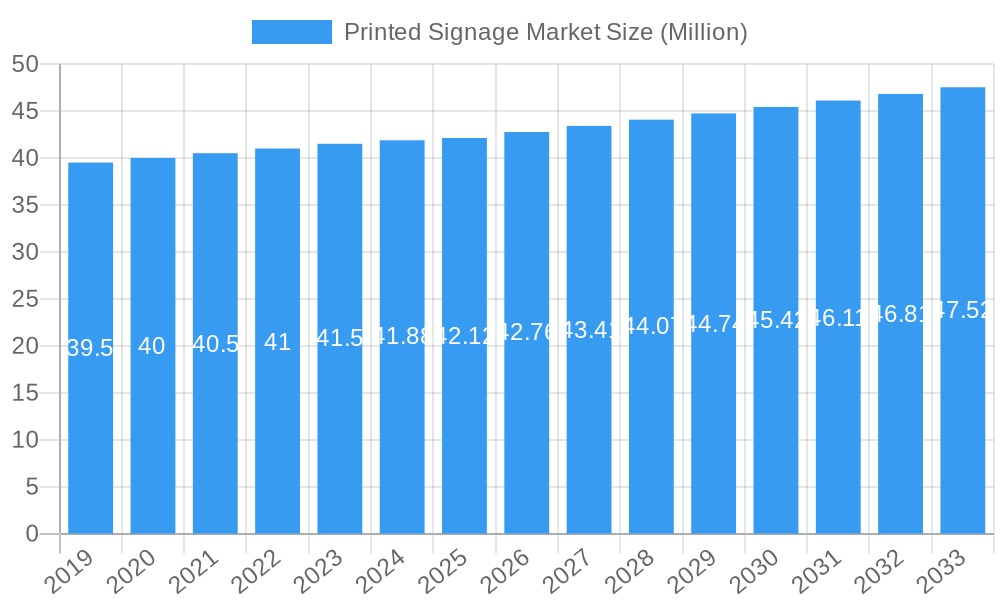

The global Printed Signage Market is projected to reach a substantial size of $41.88 million by 2025, demonstrating consistent growth with a Compound Annual Growth Rate (CAGR) of 1.56% during the forecast period of 2025-2033. This steady expansion is underpinned by a confluence of evolving consumer preferences and innovative technological advancements. The market's robustness is further fueled by its diverse applications across numerous end-user verticals. The retail sector, in particular, is a significant contributor, leveraging printed signage for effective branding, promotional campaigns, and in-store merchandising to enhance customer engagement and drive sales. Similarly, the transportation and logistics industry relies heavily on clear and durable signage for navigation, safety, and informational purposes. The healthcare sector also presents a growing demand for visually informative and compliant signage, while the BFSI segment utilizes signage for branch identification and customer guidance.

Printed Signage Market Market Size (In Million)

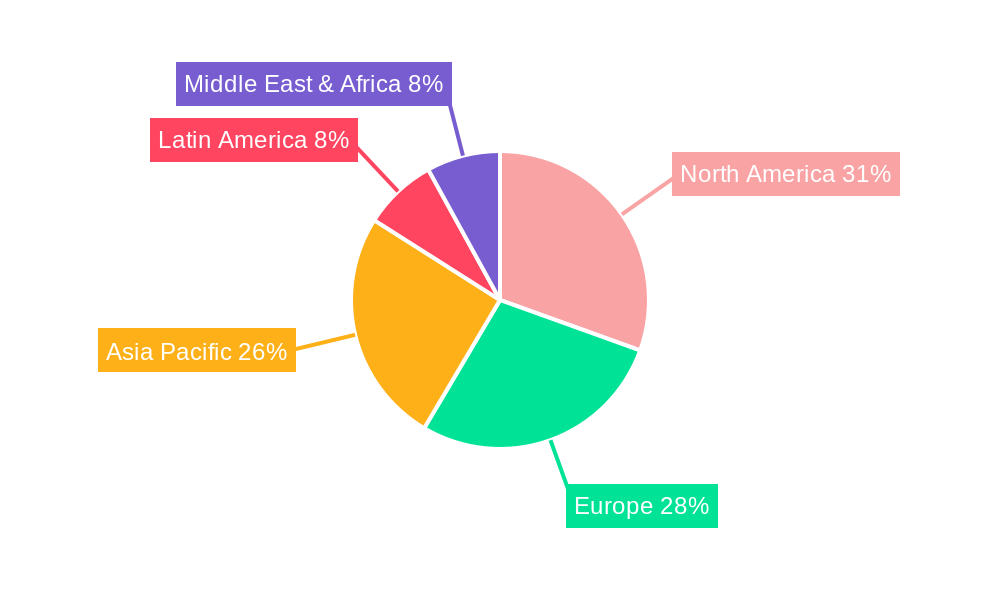

The market is characterized by a broad spectrum of product types, including versatile Banner and Backdrop solutions, impactful Corporate Graphics, dynamic Exhibitions and Trade Show displays, eye-catching Backlit Displays, convenient Pop Displays, and prominent Billboards. These offerings are brought to life through advanced print technologies such as Screen, Inkjet, and Sheetfed printing, each offering unique advantages in terms of durability, color vibrancy, and application suitability for both indoor and outdoor environments. Key market players, including Avery Dennison Corporation, Orafol Europe GmbH, and Lintec Corporation, are actively innovating and expanding their product portfolios to cater to these diverse needs. Geographically, North America and Europe are anticipated to remain dominant regions, driven by established markets and a strong presence of key industry players. However, the Asia Pacific region, with its rapidly growing economies and increasing urbanization, is poised for significant growth, presenting new opportunities for market expansion. The market's growth, while steady, is influenced by factors such as the increasing adoption of digital signage in certain applications, which can act as a restraint, alongside the ongoing demand for cost-effective and visually appealing traditional printed signage solutions.

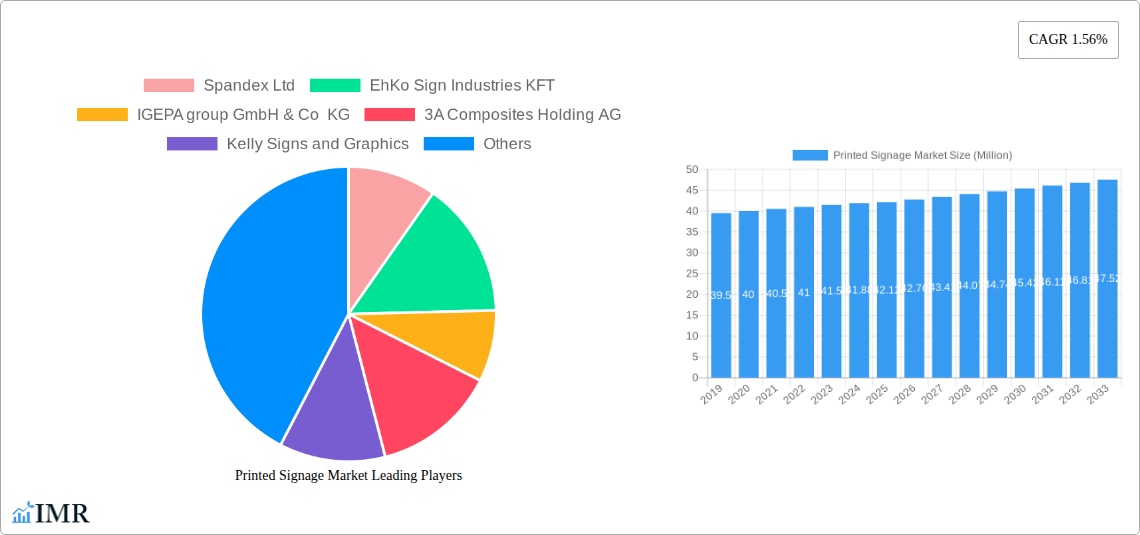

Printed Signage Market Company Market Share

Comprehensive Report: Printed Signage Market Analysis (2019-2033)

This in-depth report offers a definitive analysis of the global Printed Signage Market, encompassing historical trends, current dynamics, and future projections. With a study period spanning from 2019 to 2033, and focusing on the base year 2025, this research provides critical insights for industry stakeholders. Discover market size evolution, key growth drivers, emerging opportunities, and the competitive landscape, with all values presented in Million units for clarity. This report is meticulously designed for immediate use without requiring further modification, ensuring you receive actionable intelligence for strategic decision-making in the dynamic printed signage sector.

Printed Signage Market Market Dynamics & Structure

The Printed Signage Market exhibits a moderately concentrated structure, characterized by the presence of both large multinational corporations and numerous smaller, regional players. Market growth is primarily propelled by technological innovations in printing equipment and media, coupled with an increasing demand for customized and visually impactful signage solutions across diverse end-user verticals. Regulatory frameworks, while present, generally support industry growth by setting standards for safety and outdoor advertising. Competitive product substitutes such as digital displays and electronic signage present a growing challenge, yet printed signage retains its appeal due to cost-effectiveness, durability, and aesthetic versatility, especially for branding and promotional campaigns. End-user demographics are shifting, with a greater emphasis on experiential marketing and personalized branding, directly influencing signage design and application. Mergers and Acquisitions (M&A) are a significant trend, as companies consolidate to expand their market reach, acquire new technologies, and enhance their service offerings. For instance, the recent acquisition of Regal Signs & Designs by Kuhn Corp Print & Packaging in February 2024 highlights this consolidation. The market's resilience is further demonstrated by the continued investment in specialized printing technologies and materials. The growing preference for sustainable printing practices is also shaping market dynamics, pushing innovation towards eco-friendly inks and substrates.

- Market Concentration: Moderately concentrated, with a mix of large, established players and a fragmented base of smaller providers.

- Technological Drivers: Advancements in inkjet and screen printing, along with new material development, are key innovation drivers.

- Regulatory Impact: Evolving regulations around outdoor advertising and environmental impact influence material choices and placement.

- Competitive Landscape: Digital signage offers an alternative, but printed signage excels in cost, permanence, and tactile appeal.

- End-User Demand: Increasing demand for customized, eye-catching graphics for branding and promotional activities.

- M&A Activity: Ongoing consolidation aimed at market expansion, technology acquisition, and service diversification.

Printed Signage Market Growth Trends & Insights

The Printed Signage Market is on a robust growth trajectory, fueled by the insatiable demand for visual communication solutions across a spectrum of industries. The market size evolution reflects a steady upward trend, with projected significant expansion over the forecast period. Adoption rates are notably high in sectors prioritizing brand visibility and customer engagement, such as retail and exhibitions. Technological disruptions, including the advent of high-resolution inkjet printers and advanced material substrates, have democratized access to professional-quality signage, enabling smaller businesses to compete effectively. Consumer behavior shifts towards experiential retail and immersive brand experiences further bolster the need for impactful printed signage. The CAGR for the Printed Signage Market is estimated to be xx% during the forecast period 2025–2033. Market penetration continues to deepen as businesses recognize the enduring power of tangible advertising and branding. The integration of smart technologies within printed signage, such as QR codes, also enhances interactivity and data capture capabilities, driving further adoption. The increasing focus on sustainable and eco-friendly printing solutions is also a key trend, influencing material choices and production processes, and opening up new market segments for environmentally conscious brands. The resurgence of in-person events and exhibitions post-pandemic has also provided a significant impetus to the demand for printed signage, particularly for banners, backdrops, and exhibition displays. Furthermore, the growing e-commerce sector, paradoxically, drives demand for physical retail signage to attract foot traffic and reinforce brand identity in the competitive marketplace. The accessibility and affordability of digital printing technologies have also lowered barriers to entry, fostering innovation and diversification within the market. The shift towards personalized marketing strategies also means a higher demand for bespoke and on-demand printed signage solutions, catering to specific campaign needs and target audiences.

Dominant Regions, Countries, or Segments in Printed Signage Market

The Retail end-user vertical currently dominates the Printed Signage Market, driven by its pervasive need for dynamic in-store promotions, branding, and customer wayfinding. This segment's dominance is further amplified by its consistent demand for a wide array of printed signage types, including POP displays, banners, and corporate graphics, to create engaging shopping environments and drive sales. The Inkjet print technology segment is also a key driver of market growth due to its versatility, cost-effectiveness, and ability to produce high-quality, full-color graphics on a wide range of substrates.

- Dominant Segment: Retail End-User Vertical

- Key Drivers: High volume of in-store promotions, brand visibility requirements, customer experience enhancement, and seasonal sales campaigns.

- Market Share: Retail segment accounts for an estimated xx% of the total market value in 2025.

- Growth Potential: Continued investment in physical retail spaces and the need for differentiated branding ensure sustained demand.

- Application Diversity: Retail utilizes banners, backdrops, POP displays, and window graphics extensively.

- Dominant Technology: Inkjet Print Technology

- Key Drivers: Superior color reproduction, faster print speeds, ability to print on diverse materials (vinyl, fabric, paper), and lower initial investment compared to some other technologies.

- Market Share: Inkjet technology is projected to hold approximately xx% of the print technology market in 2025.

- Growth Potential: Ongoing advancements in inkjet print heads and ink formulations are enhancing quality and expanding application possibilities.

- Versatility: Essential for producing vibrant banners, detailed corporate graphics, and custom exhibition displays.

Geographically, North America and Europe are expected to remain dominant regions, owing to their mature economies, high disposable incomes, and a strong emphasis on branding and marketing. However, the Asia-Pacific region is exhibiting the fastest growth, driven by rapid urbanization, expanding retail sectors, and increasing investments in infrastructure and advertising. Countries within these regions, such as the United States, Germany, and China, are major contributors to the market's volume and value. The demand for Indoor applications, particularly within the retail and corporate environments, is also substantial, complemented by a robust market for Outdoor signage such as billboards and building wraps. The Exhibitions and Trade Shows segment, while cyclical, represents a significant opportunity for high-impact, short-term printed signage solutions.

Printed Signage Market Product Landscape

The Printed Signage Market is characterized by a diverse and evolving product landscape, driven by innovation in materials and printing technologies. Key product categories include durable vinyl banners and wraps for outdoor advertising, vibrant fabric backdrops for events and corporate spaces, eye-catching pop displays for retail promotions, and large-format billboards for widespread brand visibility. Advanced printing techniques, such as UV printing, enable the production of signage with enhanced durability, weather resistance, and vibrant, long-lasting colors. The incorporation of specialized finishes like matte or gloss coatings, as well as textured effects, further differentiates product offerings. Innovations also extend to eco-friendly substrates and inks, catering to the growing demand for sustainable signage solutions. The performance metrics of these products, including longevity, print quality, and ease of installation, are critical selling points.

Key Drivers, Barriers & Challenges in Printed Signage Market

Key Drivers:

- Increasing Demand for Branding and Advertising: Businesses across all sectors rely on printed signage for brand recognition and promotional activities.

- Technological Advancements: Innovations in printing technology (e.g., inkjet, UV printing) enhance quality, speed, and material compatibility.

- Growth of Retail and Event Industries: These sectors are significant consumers of various printed signage formats.

- Cost-Effectiveness: Compared to digital alternatives, printed signage often offers a more economical solution for long-term display.

- Customization and Versatility: The ability to create bespoke designs on a wide range of materials offers significant appeal.

Barriers & Challenges:

- Competition from Digital Signage: Digital displays offer dynamic content, which can be a substitute for static printed signs.

- Environmental Concerns: Increasing scrutiny on the environmental impact of printing materials and processes.

- Supply Chain Disruptions: Volatility in raw material prices and availability can impact production costs and lead times.

- Regulatory Hurdles: Zoning laws, permit requirements, and aesthetic guidelines can affect outdoor signage deployment.

- Short Lifespan for Some Applications: Certain promotional signage has a limited functional life, leading to recurrent replacement costs.

Emerging Opportunities in Printed Signage Market

Emerging opportunities in the Printed Signage Market lie in the growing demand for sustainable and eco-friendly signage solutions. The integration of augmented reality (AR) with printed signage offers new interactive possibilities, bridging the gap between the physical and digital worlds. The expansion of personalized and on-demand printing services caters to niche markets and custom branding needs. Furthermore, the increasing use of printed signage in emerging economies, driven by infrastructure development and growing consumer markets, presents significant untapped potential. The development of smart materials that can change color or display information based on environmental conditions also represents a futuristic opportunity.

Growth Accelerators in the Printed Signage Market Industry

Several catalysts are accelerating the growth of the Printed Signage Market. Technological breakthroughs in printing equipment and materials are continuously improving quality, speed, and cost-efficiency. Strategic partnerships between material manufacturers, print technology providers, and signage service companies are fostering innovation and market penetration. Furthermore, market expansion strategies, including the penetration of developing economies and the development of specialized signage solutions for niche applications like vehicle wraps and architectural graphics, are driving sustained growth. The increasing focus on brand storytelling and experiential marketing within the retail and event sectors also acts as a significant growth accelerator.

Key Players Shaping the Printed Signage Market Market

- Spandex Ltd

- EhKo Sign Industries KFT

- IGEPA group GmbH & Co KG

- 3A Composites Holding AG

- Kelly Signs and Graphics

- L&H Sign Company Inc

- Mactac LLLC (Lintec)

- Lintec Corporation

- Identity Group

- Avery Dennison Corporation

- Orafol Europe GmbH

- Signs Express

Notable Milestones in Printed Signage Market Sector

- February 2024: Kuhn Corp Print & Packaging strategically moved to fortify its position in the sign and display sector by successfully acquiring Regal Signs & Designs from its original owners. This acquisition is in line with Kuhn's commitment to expanding its signage operations and meeting growing customer demand, and it signifies a period of strategic growth for the company.

- December 2023: Panther Premier Print Solutions announced its recent acquisition of Advertising Arts, a company with a long-standing history of 74 years providing custom signage, decals, vehicle graphics, apparel, and promotional solutions.

- July 2023: Brother UK, a business technology solutions provider, launched a first-to-market multifunction printer as resellers move to support businesses wanting to produce high-quality signage and banners. The new MFC-J6959DW device is the first non-specialist, color inkjet printer proposing firms a way to create visuals, from sales banners to promotional signage.

In-Depth Printed Signage Market Market Outlook

The Printed Signage Market is poised for sustained and significant growth, driven by an ever-increasing demand for impactful visual communication. The market's future potential is immense, fueled by ongoing technological advancements that enhance print quality and expand application possibilities. Strategic opportunities lie in catering to the growing segment of sustainable printing, embracing digital integration through AR, and expanding into nascent markets. The ability of printed signage to offer cost-effective, customizable, and visually compelling solutions ensures its enduring relevance and continued market expansion.

Printed Signage Market Segmentation

-

1. Type

- 1.1. Banner and Backdrop

- 1.2. Corporate Graphics, Exhibitions, and Trade Shows

- 1.3. Backlit Displays

- 1.4. Pop Display

- 1.5. Billboards

-

2. Print Technology

- 2.1. Screen

- 2.2. Inkjet

- 2.3. Sheetfed

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Retail

- 3.3. Transportation and Logistics

- 3.4. Healthcare

-

4. Application

- 4.1. Indoor

- 4.2. Outdoor

Printed Signage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Thailand

- 3.6. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Printed Signage Market Regional Market Share

Geographic Coverage of Printed Signage Market

Printed Signage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness of Printed Signage; Inclination of the Retail Industry Toward the Application of Printed Signage

- 3.3. Market Restrains

- 3.3.1. High Competition from the Digital Signage Segment

- 3.4. Market Trends

- 3.4.1. The Retail Sector Expected to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Banner and Backdrop

- 5.1.2. Corporate Graphics, Exhibitions, and Trade Shows

- 5.1.3. Backlit Displays

- 5.1.4. Pop Display

- 5.1.5. Billboards

- 5.2. Market Analysis, Insights and Forecast - by Print Technology

- 5.2.1. Screen

- 5.2.2. Inkjet

- 5.2.3. Sheetfed

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. Transportation and Logistics

- 5.3.4. Healthcare

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Indoor

- 5.4.2. Outdoor

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Banner and Backdrop

- 6.1.2. Corporate Graphics, Exhibitions, and Trade Shows

- 6.1.3. Backlit Displays

- 6.1.4. Pop Display

- 6.1.5. Billboards

- 6.2. Market Analysis, Insights and Forecast - by Print Technology

- 6.2.1. Screen

- 6.2.2. Inkjet

- 6.2.3. Sheetfed

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. BFSI

- 6.3.2. Retail

- 6.3.3. Transportation and Logistics

- 6.3.4. Healthcare

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Indoor

- 6.4.2. Outdoor

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Banner and Backdrop

- 7.1.2. Corporate Graphics, Exhibitions, and Trade Shows

- 7.1.3. Backlit Displays

- 7.1.4. Pop Display

- 7.1.5. Billboards

- 7.2. Market Analysis, Insights and Forecast - by Print Technology

- 7.2.1. Screen

- 7.2.2. Inkjet

- 7.2.3. Sheetfed

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. BFSI

- 7.3.2. Retail

- 7.3.3. Transportation and Logistics

- 7.3.4. Healthcare

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Indoor

- 7.4.2. Outdoor

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Banner and Backdrop

- 8.1.2. Corporate Graphics, Exhibitions, and Trade Shows

- 8.1.3. Backlit Displays

- 8.1.4. Pop Display

- 8.1.5. Billboards

- 8.2. Market Analysis, Insights and Forecast - by Print Technology

- 8.2.1. Screen

- 8.2.2. Inkjet

- 8.2.3. Sheetfed

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. BFSI

- 8.3.2. Retail

- 8.3.3. Transportation and Logistics

- 8.3.4. Healthcare

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Indoor

- 8.4.2. Outdoor

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Banner and Backdrop

- 9.1.2. Corporate Graphics, Exhibitions, and Trade Shows

- 9.1.3. Backlit Displays

- 9.1.4. Pop Display

- 9.1.5. Billboards

- 9.2. Market Analysis, Insights and Forecast - by Print Technology

- 9.2.1. Screen

- 9.2.2. Inkjet

- 9.2.3. Sheetfed

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. BFSI

- 9.3.2. Retail

- 9.3.3. Transportation and Logistics

- 9.3.4. Healthcare

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Indoor

- 9.4.2. Outdoor

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Banner and Backdrop

- 10.1.2. Corporate Graphics, Exhibitions, and Trade Shows

- 10.1.3. Backlit Displays

- 10.1.4. Pop Display

- 10.1.5. Billboards

- 10.2. Market Analysis, Insights and Forecast - by Print Technology

- 10.2.1. Screen

- 10.2.2. Inkjet

- 10.2.3. Sheetfed

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. BFSI

- 10.3.2. Retail

- 10.3.3. Transportation and Logistics

- 10.3.4. Healthcare

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Indoor

- 10.4.2. Outdoor

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Spandex Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 EhKo Sign Industries KFT

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IGEPA group GmbH & Co KG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3A Composites Holding AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kelly Signs and Graphics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 L&H Sign Company Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mactac LLLC (Lintec)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lintec Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Identity Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Avery Dennison Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Orafol Europe GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Signs Express

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Spandex Ltd

List of Figures

- Figure 1: Global Printed Signage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Printed Signage Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Printed Signage Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Printed Signage Market Revenue (Million), by Print Technology 2025 & 2033

- Figure 5: North America Printed Signage Market Revenue Share (%), by Print Technology 2025 & 2033

- Figure 6: North America Printed Signage Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America Printed Signage Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Printed Signage Market Revenue (Million), by Application 2025 & 2033

- Figure 9: North America Printed Signage Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Printed Signage Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Printed Signage Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Printed Signage Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Printed Signage Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Printed Signage Market Revenue (Million), by Print Technology 2025 & 2033

- Figure 15: Europe Printed Signage Market Revenue Share (%), by Print Technology 2025 & 2033

- Figure 16: Europe Printed Signage Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Europe Printed Signage Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Europe Printed Signage Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Printed Signage Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Printed Signage Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Printed Signage Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Printed Signage Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Asia Printed Signage Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Printed Signage Market Revenue (Million), by Print Technology 2025 & 2033

- Figure 25: Asia Printed Signage Market Revenue Share (%), by Print Technology 2025 & 2033

- Figure 26: Asia Printed Signage Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 27: Asia Printed Signage Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 28: Asia Printed Signage Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Printed Signage Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Printed Signage Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Printed Signage Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Printed Signage Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Latin America Printed Signage Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Latin America Printed Signage Market Revenue (Million), by Print Technology 2025 & 2033

- Figure 35: Latin America Printed Signage Market Revenue Share (%), by Print Technology 2025 & 2033

- Figure 36: Latin America Printed Signage Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 37: Latin America Printed Signage Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 38: Latin America Printed Signage Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Latin America Printed Signage Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Latin America Printed Signage Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Printed Signage Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Printed Signage Market Revenue (Million), by Type 2025 & 2033

- Figure 43: Middle East and Africa Printed Signage Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Middle East and Africa Printed Signage Market Revenue (Million), by Print Technology 2025 & 2033

- Figure 45: Middle East and Africa Printed Signage Market Revenue Share (%), by Print Technology 2025 & 2033

- Figure 46: Middle East and Africa Printed Signage Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 47: Middle East and Africa Printed Signage Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 48: Middle East and Africa Printed Signage Market Revenue (Million), by Application 2025 & 2033

- Figure 49: Middle East and Africa Printed Signage Market Revenue Share (%), by Application 2025 & 2033

- Figure 50: Middle East and Africa Printed Signage Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Printed Signage Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Printed Signage Market Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 3: Global Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Printed Signage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Printed Signage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Printed Signage Market Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 8: Global Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Global Printed Signage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Printed Signage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Printed Signage Market Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 15: Global Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Printed Signage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Printed Signage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Germany Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Printed Signage Market Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 24: Global Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 25: Global Printed Signage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Printed Signage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: China Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Thailand Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Australia and New Zealand Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Printed Signage Market Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 35: Global Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 36: Global Printed Signage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Printed Signage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Brazil Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Mexico Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 41: Global Printed Signage Market Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 42: Global Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 43: Global Printed Signage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global Printed Signage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 45: United Arab Emirates Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Saudi Arabia Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: South Africa Printed Signage Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Printed Signage Market?

The projected CAGR is approximately 1.56%.

2. Which companies are prominent players in the Printed Signage Market?

Key companies in the market include Spandex Ltd, EhKo Sign Industries KFT, IGEPA group GmbH & Co KG, 3A Composites Holding AG, Kelly Signs and Graphics, L&H Sign Company Inc, Mactac LLLC (Lintec), Lintec Corporation, Identity Group, Avery Dennison Corporation, Orafol Europe GmbH, Signs Express.

3. What are the main segments of the Printed Signage Market?

The market segments include Type, Print Technology, End-user Vertical, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness of Printed Signage; Inclination of the Retail Industry Toward the Application of Printed Signage.

6. What are the notable trends driving market growth?

The Retail Sector Expected to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

High Competition from the Digital Signage Segment.

8. Can you provide examples of recent developments in the market?

February 2024: Kuhn Corp Print & Packaging strategically moved to fortify its position in the sign and display sector by successfully acquiring Regal Signs & Designs from its original owners. This acquisition is in line with Kuhn's commitment to expanding its signage operations and meeting growing customer demand, and it signifies a period of strategic growth for the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Printed Signage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Printed Signage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Printed Signage Market?

To stay informed about further developments, trends, and reports in the Printed Signage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence