Key Insights

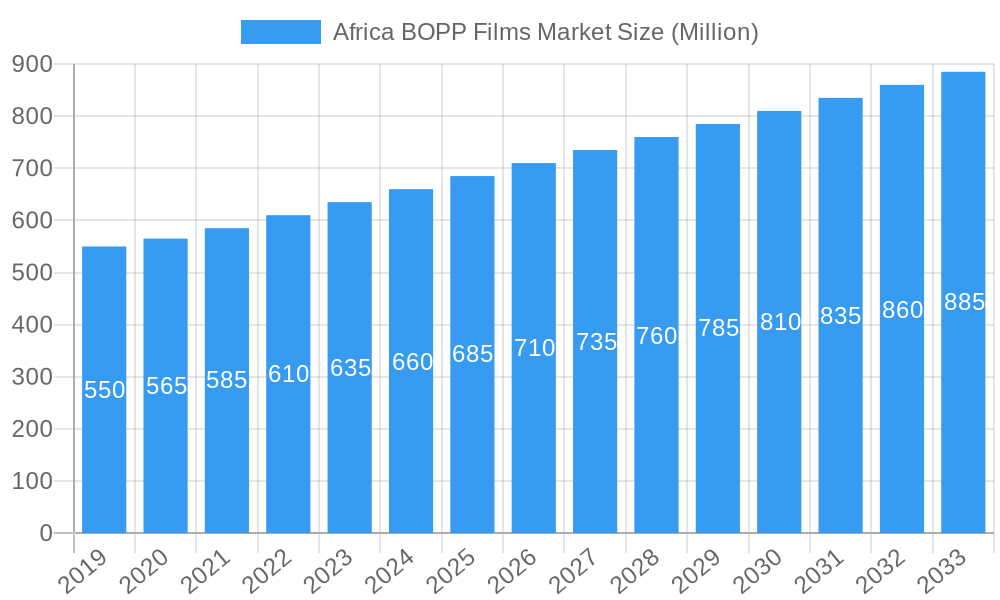

The Africa BOPP Films Market is poised for significant expansion, projected to reach an estimated USD 720 million by 2025, driven by a compound annual growth rate (CAGR) of 3.40% through 2033. This growth is underpinned by robust demand from the flexible packaging sector, a primary consumer of BOPP films due to their excellent barrier properties, printability, and cost-effectiveness. Key drivers include the burgeoning middle class across the continent, leading to increased consumption of packaged goods, and the growing e-commerce industry, which necessitates reliable and attractive packaging solutions. Furthermore, advancements in manufacturing technologies and the increasing adoption of BOPP films in industrial applications like lamination and adhesives are contributing to market momentum. The market's trajectory is further supported by a CAGR of 3.40%, indicating a steady and sustained upward trend in value.

Africa BOPP Films Market Market Size (In Million)

The market's growth, however, is not without its challenges. Restraints such as the fluctuating raw material prices, particularly for polypropylene, can impact manufacturing costs and profitability. Additionally, the presence of stringent environmental regulations concerning plastic waste management in some African nations may necessitate investments in sustainable alternatives or improved recycling infrastructure. Despite these hurdles, the market demonstrates a strong regional concentration, with South Africa and Nigeria emerging as key consumption hubs. The strategic importance of BOPP films in sectors like food and beverage, personal care, and healthcare packaging will continue to fuel demand, ensuring a dynamic and evolving market landscape across the African continent.

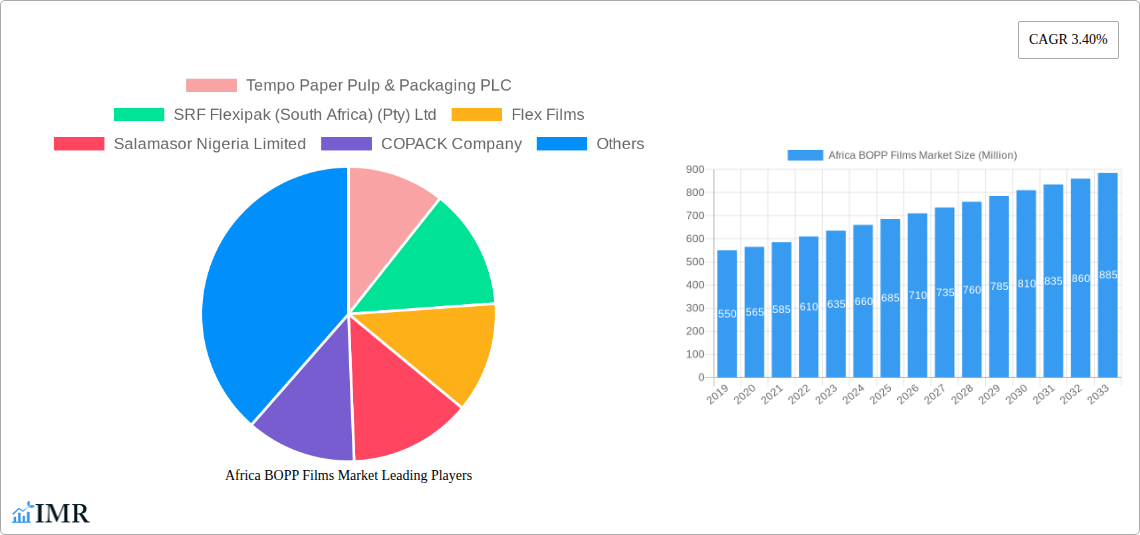

Africa BOPP Films Market Company Market Share

Africa BOPP Films Market: Comprehensive Analysis & Growth Forecast (2019-2033)

This in-depth report provides a detailed analysis of the Africa BOPP Films Market, offering critical insights into market dynamics, growth trends, key players, and future opportunities. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the burgeoning African BOPP films industry. We delve into the intricacies of the market, segmenting it by end-user verticals and key countries, and meticulously examining the growth drivers, barriers, and emerging opportunities.

Africa BOPP Films Market Market Dynamics & Structure

The Africa BOPP Films Market exhibits a moderate to high degree of market concentration, with several key global and regional players vying for dominance. Technological innovation remains a significant driver, particularly in enhancing film properties such as barrier performance, printability, and sustainability. Regulatory frameworks, while evolving, can present both opportunities and challenges for market entrants and established players alike, influencing product standards and import/export dynamics. Competitive product substitutes, primarily from other flexible packaging materials, necessitate continuous innovation and cost-efficiency. End-user demographics are increasingly influenced by a growing middle class and a rising demand for packaged goods, particularly in the food and beverage sector. Mergers and acquisitions (M&A) trends indicate a strategic consolidation to gain market share and expand geographic reach.

- Market Concentration: Dominated by a mix of multinational corporations and emerging regional manufacturers.

- Technological Innovation: Focus on enhanced barrier properties, metallization, and eco-friendly BOPP film formulations.

- Regulatory Frameworks: Emerging standards for food safety and recyclability impacting product development.

- Competitive Substitutes: PET films, CPP films, and paper-based packaging present ongoing competitive pressure.

- End-User Demographics: Growing urbanization and disposable incomes driving demand for premium packaged goods.

- M&A Trends: Strategic acquisitions to bolster production capacity and market presence.

Africa BOPP Films Market Growth Trends & Insights

The Africa BOPP Films Market is poised for substantial growth, projected to expand significantly driven by a confluence of economic development, increasing consumer demand for packaged goods, and evolving retail landscapes across the continent. The flexible packaging segment, a primary end-user vertical, is expected to lead this expansion, fueled by the rising popularity of convenience foods, beverages, and personal care products. This trend is further bolstered by investments in modern food processing and distribution infrastructure. The adoption rate of BOPP films is accelerating due to their excellent printability, barrier properties, and cost-effectiveness compared to traditional packaging materials. Technological disruptions, such as advancements in thinner yet stronger film grades and the development of more sustainable BOPP solutions, are key to capturing market share. Consumer behavior shifts towards visually appealing, convenient, and safely packaged goods directly translate into higher demand for BOPP films. The market is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Market penetration of BOPP films is steadily increasing in sectors like dairy, confectionery, and dry goods packaging. The "Rest of Africa" segment, encompassing countries with rapidly developing economies, is also expected to contribute significantly to overall market growth as local manufacturing capabilities expand.

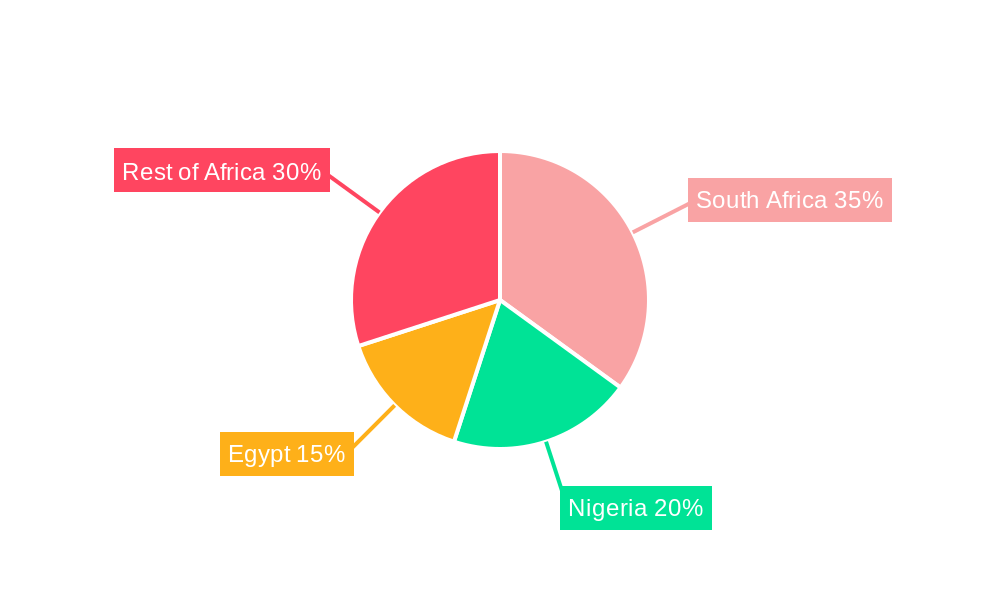

Dominant Regions, Countries, or Segments in Africa BOPP Films Market

The Flexible Packaging segment, as an end-user vertical, is the undisputed dominant force driving the Africa BOPP Films Market. This dominance stems from the continent's rapidly growing population, increasing urbanization, and the subsequent surge in demand for processed and pre-packaged food and beverages. Consumers are increasingly seeking convenient, safe, and aesthetically appealing packaging, which BOPP films are well-equipped to provide. The rising disposable incomes across several African nations further amplify this demand, as consumers are willing to spend more on packaged goods that offer enhanced shelf life and convenience.

Within the country-specific landscape, South Africa and Egypt currently hold significant sway in the Africa BOPP Films Market. South Africa, with its relatively developed industrial base and sophisticated retail sector, has a long-standing demand for high-quality flexible packaging solutions. The country's established food and beverage industry, along with its robust manufacturing sector, creates a consistent and substantial market for BOPP films. Egypt, on the other hand, benefits from a large population and a growing focus on modernizing its food processing and packaging industries. Government initiatives aimed at promoting local manufacturing and improving food security also contribute to Egypt's strong market position.

- Flexible Packaging Dominance:

- Fueled by demand for processed foods, beverages, and consumer goods.

- Growing middle class and urbanization are key drivers.

- Enhanced shelf-life and product protection offered by BOPP films.

- South Africa's Leadership:

- Mature retail and food processing sectors.

- Established manufacturing base for packaging materials.

- High adoption of advanced packaging technologies.

- Egypt's Growing Influence:

- Large and young population driving consumer demand.

- Government focus on industrial development and food security.

- Increasing investment in packaging infrastructure.

- Nigeria's Potential:

- Africa's most populous nation with substantial untapped market potential.

- Growing demand for packaged goods across various categories.

- Infrastructure development remains a key factor for growth.

Africa BOPP Films Market Product Landscape

The Africa BOPP Films Market is characterized by a diverse range of products tailored to meet specific application needs. Key innovations focus on enhancing barrier properties, particularly for oxygen and moisture, thereby extending product shelf life for food items. Metallized BOPP films are gaining traction for their superior barrier performance and attractive visual appeal, making them ideal for snacks, confectionery, and coffee packaging. High-barrier BOPP films, often co-extruded with specialized layers, are crucial for products requiring extended shelf stability. Furthermore, developments in surface treatments and coatings are improving printability and adhesion for various lamination processes. The industrial segment sees BOPP films utilized in applications like lamination for labels and tapes, as well as in capacitor manufacturing due to their dielectric properties. The unique selling propositions of BOPP films lie in their versatility, clarity, strength, and cost-effectiveness, making them a preferred choice for a wide array of packaging and industrial uses across the African continent.

Key Drivers, Barriers & Challenges in Africa BOPP Films Market

Key Drivers:

The Africa BOPP Films Market is propelled by a robust demand for convenient, safe, and visually appealing packaged goods, driven by a growing urban population and a rising middle class.

- Growing Consumer Base: Expanding population and increasing disposable incomes fuel demand for packaged foods and beverages.

- Urbanization: Concentration of populations in cities drives the need for convenient and packaged solutions.

- Food & Beverage Industry Growth: Expansion of processed food and beverage manufacturing requires reliable packaging.

- E-commerce Expansion: Growth of online retail necessitates robust and protective packaging.

- Technological Advancements: Development of high-barrier, printable, and sustainable BOPP films.

Barriers & Challenges:

The market faces significant hurdles, including infrastructure deficits, currency volatility, and a need for greater sustainability initiatives.

- Infrastructure Deficiencies: Inadequate logistics and cold chain infrastructure can impact film quality and delivery.

- Raw Material Price Volatility: Fluctuations in crude oil prices directly affect polypropylene resin costs.

- Competition from Substitutes: Other flexible packaging materials and traditional packaging pose competitive threats.

- Regulatory Landscape: Varying import duties and standards across African countries can create complexities.

- Sustainability Concerns: Growing pressure for recyclable and biodegradable packaging solutions requires investment in R&D and new technologies.

- Skilled Labor Shortages: Lack of trained personnel for operating advanced manufacturing machinery.

Emerging Opportunities in Africa BOPP Films Market

Emerging opportunities within the Africa BOPP Films Market are primarily centered on catering to the unmet demand in underserved regions and developing specialized film solutions. The increasing focus on health and hygiene is driving demand for packaging that ensures product integrity and safety, creating avenues for high-barrier BOPP films. The burgeoning e-commerce sector presents a significant opportunity for specialized BOPP films designed for tamper-evident and protective shipping applications. Furthermore, the growing awareness regarding environmental sustainability is opening doors for the development and adoption of recyclable or bio-based BOPP films, a niche that promises substantial growth. Partnerships with local converters and manufacturers to establish localized production and distribution networks will be crucial for market penetration.

Growth Accelerators in the Africa BOPP Films Market Industry

Several catalysts are poised to accelerate the growth of the Africa BOPP Films Market. Technological breakthroughs in film extrusion and coating technologies are enabling the production of thinner, stronger, and more sustainable BOPP films with enhanced properties, such as improved barrier performance and printability. Strategic partnerships and collaborations between global film manufacturers and local African businesses are crucial for knowledge transfer, market access, and capacity building. Expansion strategies by key players, including setting up new manufacturing facilities or expanding existing ones within strategic African economic zones, will directly contribute to increased market supply and accessibility. Furthermore, government initiatives promoting local manufacturing and investment in the packaging sector can significantly de-risk market entry and stimulate growth.

Key Players Shaping the Africa BOPP Films Market Market

- Tempo Paper Pulp & Packaging PLC

- SRF Flexipak (South Africa) (Pty) Ltd

- Flex Films

- Salamasor Nigeria Limited

- COPACK Company

- Flexible Packages Convertors (Pty) Ltd

- elm films

- Richflex (Pty) Ltd

- Taghleef Industries S A E

- Cosmo Films Ltd

Notable Milestones in Africa BOPP Films Market Sector

- February 2022: SRF, an Indian chemical and film conglomerate, announced the expansion of its global network by opening a second BOPP film manufacturing facility in Indore, Madhya Pradesh. This strategic move, alongside existing facilities in South Africa, India, and Thailand, underscores SRF's commitment to expanding its BOPP production capacity and market reach. The company also plans to establish an aluminium foil manufacturing facility at the new Jaitapur location in Indore. With significant capacities across multiple continents, SRF's Packaging Films Business is a key player.

In-Depth Africa BOPP Films Market Market Outlook

The future outlook for the Africa BOPP Films Market is exceptionally promising, driven by sustained economic development, a burgeoning consumer base, and increasing demand for quality packaging across diverse sectors. Growth accelerators, including technological advancements in film production, strategic market expansion by key players, and supportive government policies promoting local manufacturing, are set to fuel this upward trajectory. The increasing adoption of BOPP films in the food and beverage, personal care, and industrial segments, particularly in rapidly developing economies within the "Rest of Africa," presents significant untapped potential. Furthermore, the growing emphasis on sustainable packaging solutions is expected to spur innovation in recyclable and bio-based BOPP films, creating new market niches and growth opportunities. The market is well-positioned to benefit from continued urbanization and rising disposable incomes, making it an attractive landscape for investment and strategic development.

Africa BOPP Films Market Segmentation

-

1. End-user Vertical

- 1.1. Flexible Packaging

- 1.2. Industrial (Lamination, Adhesives, and Capacitor)

- 1.3. Other End-user Verticals

Africa BOPP Films Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa BOPP Films Market Regional Market Share

Geographic Coverage of Africa BOPP Films Market

Africa BOPP Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Retail Sector; Increasing Demand for Packaged Food

- 3.3. Market Restrains

- 3.3.1. Growing Threat from Other Environmentally Friendly Films

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Retail Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa BOPP Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Flexible Packaging

- 5.1.2. Industrial (Lamination, Adhesives, and Capacitor)

- 5.1.3. Other End-user Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tempo Paper Pulp & Packaging PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SRF Flexipak (South Africa) (Pty) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Flex Films

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Salamasor Nigeria Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 COPACK Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flexible Packages Convertors (Pty) Ltd*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 elm films

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Richflex (Pty) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Taghleef Industries S A E

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cosmo Films Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tempo Paper Pulp & Packaging PLC

List of Figures

- Figure 1: Africa BOPP Films Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa BOPP Films Market Share (%) by Company 2025

List of Tables

- Table 1: Africa BOPP Films Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 2: Africa BOPP Films Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Africa BOPP Films Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Africa BOPP Films Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Nigeria Africa BOPP Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: South Africa Africa BOPP Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Egypt Africa BOPP Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Kenya Africa BOPP Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Ethiopia Africa BOPP Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Morocco Africa BOPP Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Ghana Africa BOPP Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Algeria Africa BOPP Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Tanzania Africa BOPP Films Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ivory Coast Africa BOPP Films Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa BOPP Films Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Africa BOPP Films Market?

Key companies in the market include Tempo Paper Pulp & Packaging PLC, SRF Flexipak (South Africa) (Pty) Ltd, Flex Films, Salamasor Nigeria Limited, COPACK Company, Flexible Packages Convertors (Pty) Ltd*List Not Exhaustive, elm films, Richflex (Pty) Ltd, Taghleef Industries S A E, Cosmo Films Ltd.

3. What are the main segments of the Africa BOPP Films Market?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Retail Sector; Increasing Demand for Packaged Food.

6. What are the notable trends driving market growth?

Growing Demand from the Retail Sector.

7. Are there any restraints impacting market growth?

Growing Threat from Other Environmentally Friendly Films.

8. Can you provide examples of recent developments in the market?

February 2022: SRF, an Indian chemical and film conglomerate, will expand its global network of BOPP production facilities by opening a second BOPP film manufacturing facility in Indore, Madhya Pradesh. SRF now has BOPP production facilities in South Africa, India, and Thailand. At a new location in Jaitapur, Indore, the company will also establish an aluminium foil manufacturing facility. With a total capacity of 140,000 metric tonnes per year for BOPET and BOPP film capacity in India, 120,000 MTPA in Thailand, 45,000 MTPA in Hungary, and 30,000 MTPA in South Africa, SRF's Packaging Films Business stands out.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa BOPP Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa BOPP Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa BOPP Films Market?

To stay informed about further developments, trends, and reports in the Africa BOPP Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence