Key Insights

The Indonesian metal packaging market is set for substantial growth, projected to reach $3 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 3.45%. This expansion is fueled by the rising demand for durable and sustainable packaging across key sectors, including food and beverages, where consumer preference for convenient and safe formats like cans is increasing. Growing disposable incomes and evolving lifestyles in Indonesia are further boosting packaged goods consumption, directly benefiting the metal packaging industry. Heightened awareness of metal's recyclability, aligning with global sustainability goals and circular economy initiatives, also serves as a significant growth catalyst. The paint, chemical, and industrial sectors also contribute significantly, relying on metal containers for secure storage and transportation due to their inherent durability and corrosion resistance.

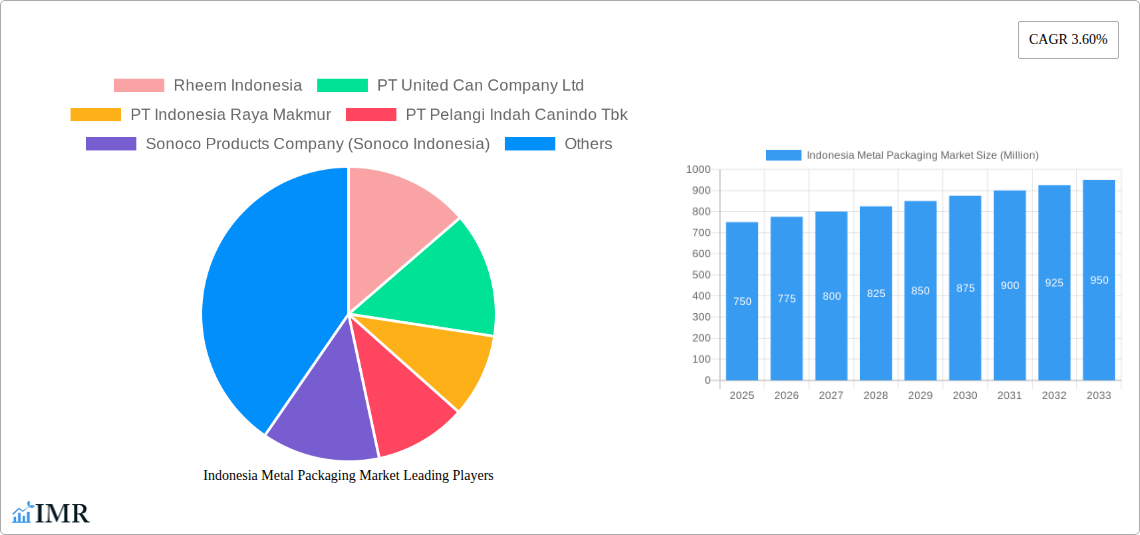

Indonesia Metal Packaging Market Market Size (In Billion)

While the market shows strong potential, challenges such as raw material price volatility (aluminum and steel) and competition from alternative materials like advanced plastics and flexible packaging may influence its trajectory. Nevertheless, the enduring advantages of metal packaging, including superior barrier properties, extended shelf-life, and robust product protection, ensure its continued relevance. Innovations in lightweighting and sustainable coatings will be vital for the industry to navigate these challenges and capitalize on emerging opportunities, particularly in the premium and eco-conscious food and beverage segments.

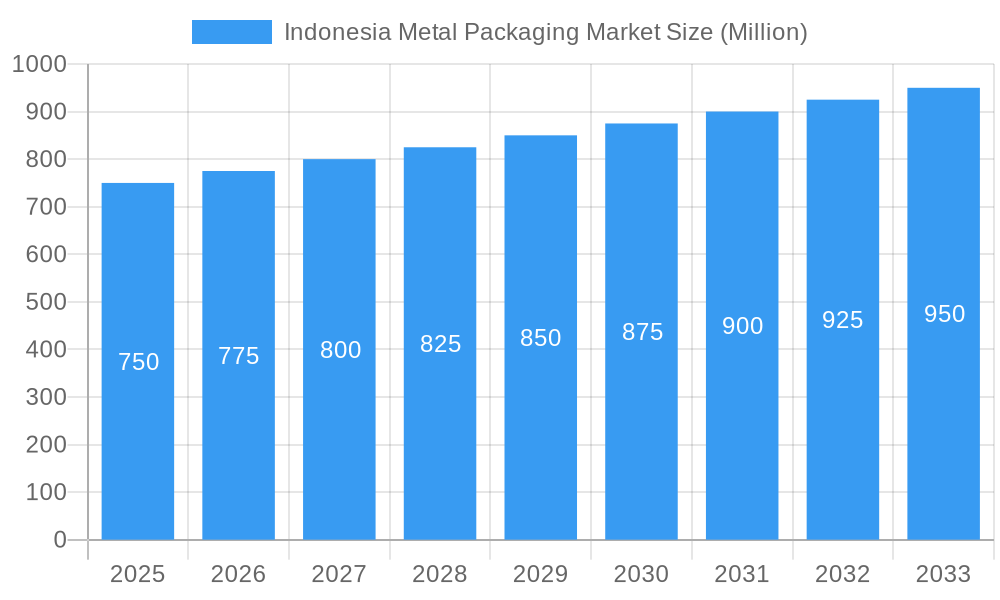

Indonesia Metal Packaging Market Company Market Share

Comprehensive Report: Indonesia Metal Packaging Market Analysis 2019–2033

This in-depth report provides a detailed analysis of the Indonesia metal packaging market, offering a critical look at its dynamics, growth trajectories, and future potential from 2019 to 2033. With a base year of 2025 and a forecast period extending through 2033, this study leverages exclusive data and expert insights to equip industry stakeholders with actionable intelligence. Explore the parent market (metal packaging) and its crucial child markets (specific product types like food cans and beverage cans) to understand the intricate web of demand, supply, and innovation shaping this vital sector.

Indonesia Metal Packaging Market Market Dynamics & Structure

The Indonesia metal packaging market is characterized by a moderately consolidated structure, with key players like Rheem Indonesia, PT United Can Company Ltd, and Crown Holdings Inc. holding significant influence. Technological innovation is a primary driver, particularly in material efficiency and advanced printing techniques, enabling manufacturers to meet evolving consumer demands for sustainability and aesthetic appeal. The regulatory framework, while supportive of industrial growth, emphasizes safety and environmental compliance. Competitive product substitutes, primarily from plastics and flexible packaging, present an ongoing challenge, necessitating continuous improvement in metal packaging's value proposition. End-user demographics, driven by a burgeoning middle class and increasing urbanization, are creating sustained demand across various segments. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to expand their production capacity, technological capabilities, and market reach. For instance, the expansion of steel drum manufacturing by PT Rheem Indonesia indicates strategic growth within the industrial segment.

- Market Concentration: Moderately consolidated with key players dominating.

- Technological Innovation: Focus on material efficiency, advanced printing, and barrier properties.

- Regulatory Framework: Emphasis on safety standards, environmental regulations, and recyclability.

- Competitive Substitutes: Ongoing competition from plastics, glass, and flexible packaging.

- End-User Demographics: Growing middle class and urbanization fueling demand across Food & Beverage, Paint & Chemical, and Industrial sectors.

- M&A Trends: Strategic acquisitions and expansions to enhance capacity and product portfolios.

Indonesia Metal Packaging Market Growth Trends & Insights

The Indonesia metal packaging market is poised for robust growth, projected to expand significantly over the forecast period. This upward trajectory is fueled by increasing consumption in the beverage and food sectors, directly impacting the demand for food cans and beverage cans. Economic development and rising disposable incomes are leading to higher per capita consumption of packaged goods, a trend that benefits aluminum and steel packaging solutions. Technological advancements in manufacturing processes, including enhanced coating technologies and improved sealing mechanisms for food cans, are contributing to market penetration. Consumer behavior shifts towards convenience and shelf-stability further bolster the demand for metal packaging, particularly for ready-to-eat meals and single-serve beverages. The increasing adoption of sustainable packaging solutions also favors metal, given its high recyclability. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period.

- Market Size Evolution: Consistent growth driven by increasing consumer spending and demand for packaged goods.

- Adoption Rates: High adoption rates for beverage cans and food cans due to their functional benefits and recyclability.

- Technological Disruptions: Innovations in material science and manufacturing processes enhance durability and aesthetic appeal.

- Consumer Behavior Shifts: Growing preference for convenience, ready-to-eat options, and sustainably packaged products.

- Market Penetration: Steady increase in the penetration of metal packaging across various end-user verticals.

Dominant Regions, Countries, or Segments in Indonesia Metal Packaging Market

Within the Indonesia metal packaging market, the Beverage end-user vertical stands out as a dominant growth driver, propelled by the country's massive and expanding consumer base. The increasing popularity of carbonated soft drinks, juices, and energy drinks directly translates into a surge in demand for beverage cans, particularly those made from aluminum. Economic growth, rising disposable incomes, and aggressive marketing by beverage manufacturers are key factors contributing to this segment's dominance. Furthermore, the Food end-user vertical, encompassing food cans for processed foods, canned fruits, and vegetables, also plays a crucial role. The Steel material segment, while facing competition from aluminum, remains vital for its strength and cost-effectiveness, especially in applications like shipping barrels & drums and industrial containers. The caps & closures segment, though smaller in unit volume, is essential for the integrity and safety of various metal packaging products. Major manufacturing hubs in Java, particularly around Jakarta and Surabaya, are centers for production and consumption, benefiting from robust infrastructure and logistics networks.

- Dominant End-user Vertical: Beverage, driven by a large and growing consumer base and increased demand for canned drinks.

- Key Product Types: Beverage Cans and Food Cans are major volume drivers.

- Dominant Material: Aluminum leads in beverage cans, while Steel remains critical for industrial applications and some food packaging.

- Dominant Regions: Java, especially around Jakarta and Surabaya, due to established manufacturing infrastructure and consumer density.

- Growth Drivers: Increasing disposable income, urbanization, and the expanding food and beverage industry.

- Market Share Insights: The beverage can segment is estimated to hold over 35% of the total market share by volume.

Indonesia Metal Packaging Market Product Landscape

The Indonesia metal packaging market showcases a diverse product landscape, with innovation focused on enhancing functionality, sustainability, and visual appeal. Food cans are seeing advancements in lining technologies to improve product preservation and shelf life, while beverage cans are increasingly lightweighted and feature advanced opening mechanisms. Aerosol cans are being developed with improved safety features and dispensing systems for a wider range of products. The bulk containers and shipping barrels & drums segment, especially from players like PT Rheem Indonesia, benefits from improved structural integrity and material resilience for industrial applications. The caps & closures segment is witnessing innovation in tamper-evident designs and ease of use. Unique selling propositions often revolve around recyclability, durability, and superior product protection. PT Indonesia Multi Colour Printing's recent investment in a state-of-the-art metal decorating facility signifies a push towards high-quality printing and enhanced service offerings, enabling intricate designs and branding on metal packaging.

Key Drivers, Barriers & Challenges in Indonesia Metal Packaging Market

Key Drivers:

- Growing Consumer Demand: A large and growing population with increasing disposable income drives demand for packaged food and beverages.

- Sustainability Trends: Metal's high recyclability makes it an attractive option as environmental consciousness rises.

- Industrial Growth: Expansion in sectors like paint, chemicals, and lubricants fuels demand for industrial metal packaging.

- Technological Advancements: Innovations in manufacturing and printing enhance product appeal and functionality.

Barriers & Challenges:

- Competition from Substitutes: Plastic, glass, and flexible packaging offer competitive pricing and specific functional advantages.

- Raw Material Price Volatility: Fluctuations in the global prices of aluminum and steel can impact manufacturing costs.

- Logistical Complexities: Indonesia's archipelagic nature can lead to higher transportation costs and supply chain challenges.

- Regulatory Compliance: Adhering to evolving environmental and safety regulations can necessitate significant investment.

Emerging Opportunities in Indonesia Metal Packaging Market

Emerging opportunities in the Indonesia metal packaging market lie in the increasing demand for premium and functional packaging solutions. The growing e-commerce sector presents a niche for specialized shipping barrels & drums and robust metal containers designed for online retail. Furthermore, the rise of the health and wellness trend is creating opportunities for metal packaging in segments like nutritional supplements and specialty foods, requiring enhanced barrier properties and premium aesthetics. Innovations in smart packaging, incorporating QR codes or NFC tags for product traceability and consumer engagement, also represent an untapped area. The development of more sustainable and lightweight metal packaging designs will further cater to environmentally conscious consumers and reduce overall material usage.

Growth Accelerators in the Indonesia Metal Packaging Market Industry

Long-term growth in the Indonesia metal packaging market is being accelerated by several key catalysts. Significant investment in advanced manufacturing technologies by companies like Crown Holdings Inc. and Sonoco Products Company (Sonoco Indonesia) is enhancing production efficiency and product quality, making metal packaging more competitive. Strategic partnerships between raw material suppliers and packaging manufacturers are ensuring a stable and cost-effective supply chain. Furthermore, the increasing focus on export markets for Indonesian-manufactured goods, which often require durable and safe packaging, is a substantial growth driver. Market expansion strategies by key players, including capacity enhancements and diversification into new product lines, are also contributing to sustained growth.

Key Players Shaping the Indonesia Metal Packaging Market Market

- Rheem Indonesia

- PT United Can Company Ltd

- PT Indonesia Raya Makmur

- PT Pelangi Indah Canindo Tbk

- Sonoco Products Company (Sonoco Indonesia)

- PT Cometa Can Corporation

- Crown Holdings Inc.

- PT Indonesia Multi Colour Printing

- P T New Red & White

- ATP Group

Notable Milestones in Indonesia Metal Packaging Market Sector

- December 2022: PT Rheem Indonesia commenced operations in steel drum manufacturing, subsequently expanding into plastic drums and jerry cans to meet diverse industry demands and upgrade plant capabilities for lubricant and chemical sectors.

- December 2022: In response to rising demand for high-quality printing, a company (likely referring to a major player in the sector) installed a new state-of-the-art metal decorating facility. This facility, capable of printing over 10,000 sheets per hour, complements their existing metal cans and closures manufacturing, catering to food, beverage, and cosmetic sectors.

In-Depth Indonesia Metal Packaging Market Market Outlook

The Indonesia metal packaging market outlook is highly positive, driven by sustained consumer demand for packaged goods, a growing emphasis on sustainability, and continuous technological innovation. Growth accelerators such as strategic investments in advanced manufacturing and expansion into export markets will solidify Indonesia's position in the global metal packaging landscape. Key players are actively enhancing their product portfolios and operational efficiencies, positioning the market for robust expansion. Opportunities in premium packaging, e-commerce logistics, and specialized applications offer further avenues for growth. The market is expected to witness sustained momentum as it adapts to evolving consumer preferences and embraces advancements in material science and production technologies.

Indonesia Metal Packaging Market Segmentation

-

1. Material

- 1.1. Aluminum

- 1.2. Steel

-

2. Product Type

-

2.1. Cans

- 2.1.1. Food Cans

- 2.1.2. Beverage Cans

- 2.1.3. Aerosol Cans

- 2.2. Bulk Containers

- 2.3. Shipping Barrels & Drums

- 2.4. Caps & Closures

- 2.5. Other Product Types

-

2.1. Cans

-

3. End-user Vertical

- 3.1. Beverage

- 3.2. Food

- 3.3. Paint & Chemical

- 3.4. Industrial

- 3.5. Other End-users Verticals

Indonesia Metal Packaging Market Segmentation By Geography

- 1. Indonesia

Indonesia Metal Packaging Market Regional Market Share

Geographic Coverage of Indonesia Metal Packaging Market

Indonesia Metal Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenience Food; Higher Recycling Rates Coupled with Higher End-user Manufacturing Demand in Indonesia

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Packaging Solutions

- 3.4. Market Trends

- 3.4.1. Growing Demand for Convenience Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Aluminum

- 5.1.2. Steel

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Cans

- 5.2.1.1. Food Cans

- 5.2.1.2. Beverage Cans

- 5.2.1.3. Aerosol Cans

- 5.2.2. Bulk Containers

- 5.2.3. Shipping Barrels & Drums

- 5.2.4. Caps & Closures

- 5.2.5. Other Product Types

- 5.2.1. Cans

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Beverage

- 5.3.2. Food

- 5.3.3. Paint & Chemical

- 5.3.4. Industrial

- 5.3.5. Other End-users Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rheem Indonesia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT United Can Company Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Indonesia Raya Makmur

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Pelangi Indah Canindo Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company (Sonoco Indonesia)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Cometa Can Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Crown Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Indonesia Multi Colour Printing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 P T New Red & White

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ATP Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rheem Indonesia

List of Figures

- Figure 1: Indonesia Metal Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Metal Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Metal Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Indonesia Metal Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Indonesia Metal Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Indonesia Metal Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Indonesia Metal Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Indonesia Metal Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Indonesia Metal Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Indonesia Metal Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Metal Packaging Market?

The projected CAGR is approximately 3.45%.

2. Which companies are prominent players in the Indonesia Metal Packaging Market?

Key companies in the market include Rheem Indonesia, PT United Can Company Ltd, PT Indonesia Raya Makmur, PT Pelangi Indah Canindo Tbk, Sonoco Products Company (Sonoco Indonesia), PT Cometa Can Corporation, Crown Holdings Inc, PT Indonesia Multi Colour Printing, P T New Red & White, ATP Grou.

3. What are the main segments of the Indonesia Metal Packaging Market?

The market segments include Material, Product Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenience Food; Higher Recycling Rates Coupled with Higher End-user Manufacturing Demand in Indonesia.

6. What are the notable trends driving market growth?

Growing Demand for Convenience Food.

7. Are there any restraints impacting market growth?

Availability of Alternative Packaging Solutions.

8. Can you provide examples of recent developments in the market?

December 2022: PT Rheem Indonesia started its business in steel drums manufacturing. To date, the company has expanded into plastic drums and jerry cans to cope with industry demands and changes by constantly upgrading its manufacturing facility and plant and product quality and service with which it is catering to lubricant and chemical (specialty and general) industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Metal Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Metal Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Metal Packaging Market?

To stay informed about further developments, trends, and reports in the Indonesia Metal Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence