Key Insights

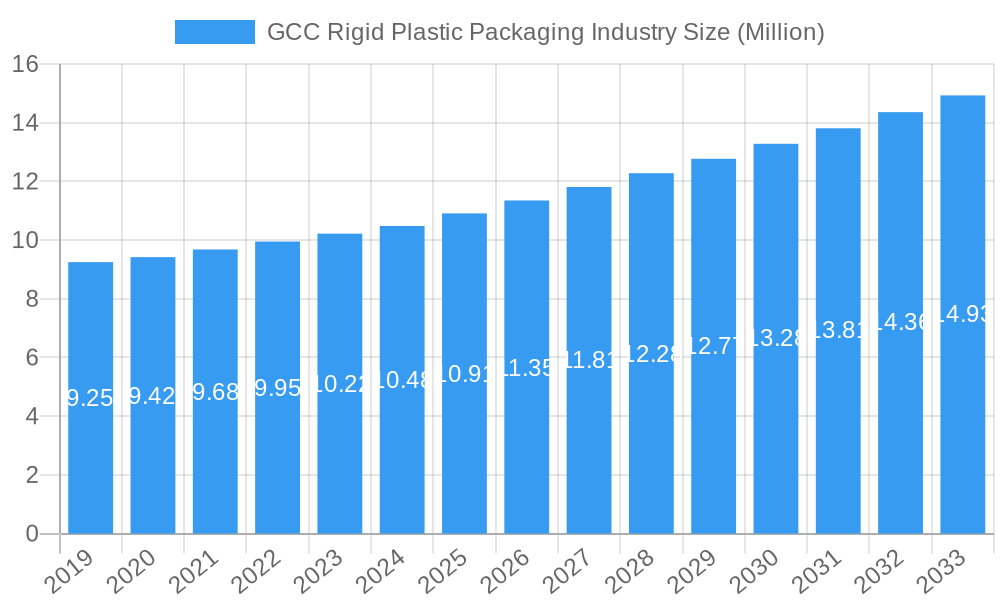

The GCC Rigid Plastic Packaging market is projected for substantial growth, expected to reach $396.27 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.6% through 2033. This expansion is driven by escalating demand from the food and beverage industries, leveraging rigid plastic packaging for its superior durability, safety, and cost-effectiveness in preserving product quality and extending shelf life. Growing consumer bases and increasing disposable incomes across GCC nations directly correlate with higher demand for packaged goods, consequently boosting the need for rigid plastic packaging solutions such as bottles, jars, trays, and containers. Significant investments in the healthcare and cosmetics sectors, prioritizing hygiene and product integrity, further contribute to market growth. The region's strategic focus on economic diversification and industrial development, encompassing construction and automotive, also fuels the requirement for specialized rigid plastic packaging across various applications.

GCC Rigid Plastic Packaging Industry Market Size (In Billion)

Key market trends include the adoption of advanced manufacturing techniques like injection and blow molding to enhance production efficiency and product quality. A significant shift towards sustainable and recyclable plastic materials, influenced by regulatory mandates and evolving consumer preferences, is driving innovation in eco-friendly alternatives. However, market restraints such as volatile raw material prices, particularly for petroleum-based resins, can affect profitability. Stringent environmental regulations on plastic waste management and a nascent but growing consumer preference for reusable packaging present potential challenges. Despite these obstacles, the GCC's strategic location, ongoing infrastructure development, and a burgeoning e-commerce sector provide a robust foundation for the continued expansion of the rigid plastic packaging industry, supported by key players investing in capacity enhancement and product innovation.

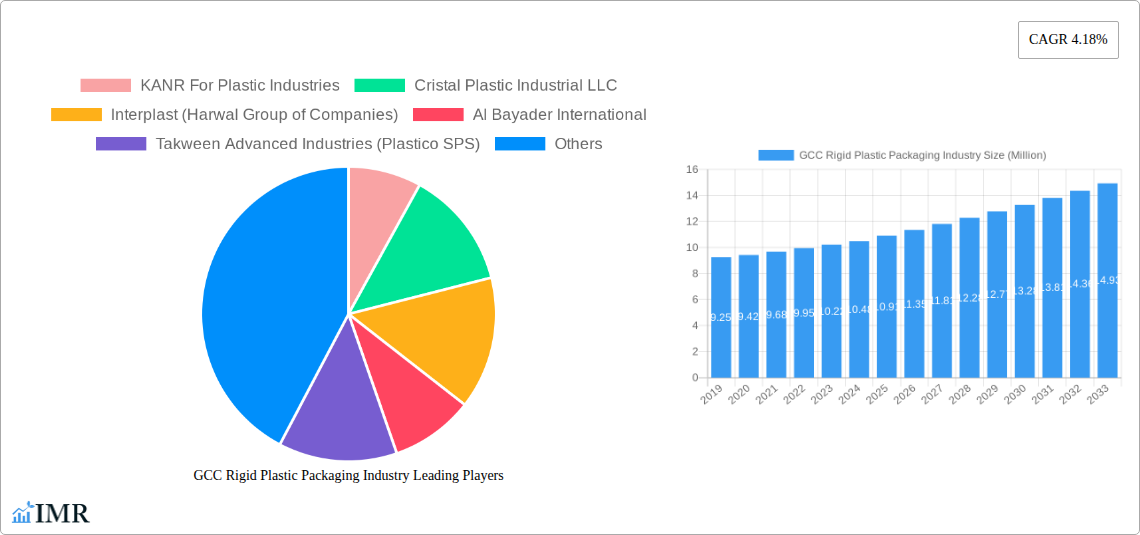

GCC Rigid Plastic Packaging Industry Company Market Share

GCC Rigid Plastic Packaging Market Report: Trends, Opportunities, and Competitive Landscape 2019-2033

This comprehensive report delivers an in-depth analysis of the GCC Rigid Plastic Packaging market, projected to reach XX Million Units by 2033. It meticulously examines market dynamics, growth trends, dominant segments, product innovations, key drivers, barriers, and emerging opportunities within the study period of 2019–2033, with a base year of 2025. Gain critical insights into the competitive landscape, featuring key players and notable industry milestones that are shaping the future of rigid plastic packaging across the region. This report is an essential resource for industry professionals seeking to understand market evolution, identify growth avenues, and make informed strategic decisions.

GCC Rigid Plastic Packaging Industry Market Dynamics & Structure

The GCC rigid plastic packaging market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, complemented by a growing number of specialized manufacturers. Technological innovation is a key driver, particularly in material science advancements leading to lighter, stronger, and more sustainable packaging solutions. Regulatory frameworks are increasingly influenced by global environmental mandates, pushing for higher recycling rates and the adoption of post-consumer recycled (PCR) content. Competitive product substitutes, such as glass and paperboard, present challenges, but the inherent advantages of plastic in terms of durability, cost-effectiveness, and versatility continue to secure its market position. End-user demographics are shifting towards greater demand for convenience, safety, and sustainability, impacting product design and material selection. Merger and acquisition (M&A) trends are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the drive towards circular economy initiatives is fostering strategic alliances and investments in recycling infrastructure.

- Market Concentration: Dominated by key players like KANR For Plastic Industries and lnterplast (Harwal Group of Companies), with growing participation from regional SMEs.

- Technological Innovation Drivers: Focus on lightweighting, barrier properties enhancement, and integration of recycled materials.

- Regulatory Frameworks: Increasing emphasis on Extended Producer Responsibility (EPR) schemes and plastic waste reduction targets.

- Competitive Product Substitutes: Glass, metal, and paperboard packaging continue to offer alternatives, particularly in niche applications.

- End-user Demographics: Rising demand for sustainable packaging from environmentally conscious consumers and stringent regulations in food and beverage sectors.

- M&A Trends: Strategic acquisitions aimed at enhancing production capacity, expanding product offerings, and integrating sustainable technologies.

GCC Rigid Plastic Packaging Industry Growth Trends & Insights

The GCC rigid plastic packaging market is poised for robust growth, driven by a confluence of economic development, increasing population, and evolving consumer preferences. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period, reaching XX Million Units by 2033. Adoption rates of innovative packaging solutions, particularly those incorporating recycled content and designed for recyclability, are steadily increasing. Technological disruptions are a constant, with advancements in material science enabling the creation of lighter, more durable, and cost-effective packaging. Consumer behavior shifts are significantly impacting demand, with a growing emphasis on sustainability, convenience, and product safety. The rise of e-commerce and the expanding food and beverage industries are further fueling the demand for diverse and specialized rigid plastic packaging solutions. The region's commitment to economic diversification and industrial growth, as outlined in national visions, is a significant underpinning for sustained market expansion.

The integration of advanced manufacturing techniques, such as precision molding and automation, is enhancing production efficiency and product quality. Furthermore, the increasing awareness and implementation of circular economy principles are creating new avenues for growth in the recycling and reprocessing of rigid plastic packaging materials. This shift is not only driven by environmental concerns but also by regulatory pressures and the potential for cost savings associated with using recycled feedstocks. The focus on food safety and extended shelf life continues to drive innovation in barrier technologies within rigid plastic packaging.

Dominant Regions, Countries, or Segments in GCC Rigid Plastic Packaging Industry

Within the GCC rigid plastic packaging industry, Saudi Arabia consistently emerges as the dominant country, propelled by its large population, robust industrial base, and significant investments in manufacturing and infrastructure. The Polyethylene (PE) resin type, particularly High-Density Polyethylene (HDPE), holds a leading position due to its versatility, durability, and cost-effectiveness, making it a preferred choice across numerous applications. In terms of product type, Bottles and Jars command the largest market share, driven by the ever-present demand from the beverage, food, and personal care sectors.

The Food end-user industry is the primary growth engine, with a substantial share attributed to Dairy Products and Dry Foods, followed closely by Frozen Foods and Fresh Produce. The burgeoning foodservice sector, particularly Quick Service Restaurants (QSRs), also contributes significantly to the demand for convenient and safe rigid plastic packaging. The strategic initiatives by governments in the region to bolster domestic manufacturing and reduce reliance on imports further strengthen the position of domestic players and key segments.

- Dominant Country: Saudi Arabia, due to its economic scale and industrial diversification efforts.

- Leading Resin Type: Polyethylene (PE), especially HDPE, owing to its broad applicability and performance characteristics.

- Dominant Product Type: Bottles and Jars, fueled by extensive use in beverages, food, and personal care.

- Key End-user Industry: Food, with significant contributions from Dairy Products, Dry Foods, and Frozen Foods segments.

- Driving Factors: Government support for manufacturing, growing population, increasing disposable incomes, and evolving consumer lifestyles.

- Emerging Opportunities: Growth in specialized packaging for health and wellness products, and sustainable packaging solutions for a circular economy.

GCC Rigid Plastic Packaging Industry Product Landscape

The GCC rigid plastic packaging product landscape is characterized by continuous innovation focused on enhancing functionality, sustainability, and consumer appeal. Product innovations range from lightweighted bottles and jars that reduce material consumption to advanced trays and containers offering superior barrier properties for extended shelf life in the food industry. Caps and closures are increasingly designed for tamper-evidence and ease of use, while Intermediate Bulk Containers (IBCs) and drums are optimized for logistics and industrial applications. Pallets are being developed with increased strength and recyclability. Performance metrics are consistently being improved through material science, leading to enhanced chemical resistance, impact strength, and thermal stability across all product categories. The incorporation of recycled content, such as post-consumer recycled PET (rPET) in beverage bottles, is a significant trend, driven by both regulatory push and consumer pull.

Key Drivers, Barriers & Challenges in GCC Rigid Plastic Packaging Industry

The GCC rigid plastic packaging industry is propelled by several key drivers, including a growing population, increasing disposable incomes, and a burgeoning food and beverage sector that demands safe and convenient packaging solutions. Technological advancements in material science and manufacturing processes also contribute significantly to market expansion. The region's focus on economic diversification and industrial development further bolsters demand.

- Key Drivers:

- Population growth and urbanization.

- Expanding food and beverage industry.

- Rising disposable incomes and consumer spending.

- Technological innovation in materials and manufacturing.

- Government initiatives promoting local manufacturing and industrial growth.

However, the industry faces considerable barriers and challenges. Stringent environmental regulations and growing public concern over plastic waste are pushing for more sustainable alternatives and recycling initiatives. Fluctuations in raw material prices, particularly for petrochemical feedstocks, can impact profitability. Intense competition from both domestic and international players, as well as from alternative packaging materials, also presents a challenge.

- Key Barriers & Challenges:

- Increasingly stringent environmental regulations and waste management policies.

- Volatility in raw material (resin) prices.

- Intensifying competition and price pressures.

- Limited availability of high-quality recycled plastic feedstock in some segments.

- Public perception and demand for eco-friendly alternatives.

- Supply chain disruptions and logistical complexities.

Emerging Opportunities in GCC Rigid Plastic Packaging Industry

Emerging opportunities in the GCC rigid plastic packaging industry lie in the increasing demand for sustainable and circular packaging solutions. The development and adoption of biodegradable and compostable rigid plastics, while still nascent, present a significant future avenue. Untapped markets within specialized sectors like niche beverages and premium personal care products offer potential for value-added packaging. Innovative applications, such as smart packaging with integrated sensors for quality monitoring, are also gaining traction. Evolving consumer preferences for personalized and on-the-go consumption models are creating opportunities for smaller, more convenient rigid packaging formats.

- Sustainable & Circular Packaging: Focus on rPET, bio-based plastics, and design for recyclability.

- Specialized Niches: Growth in packaging for premium food products, health supplements, and niche beverages.

- Smart Packaging: Integration of technologies for enhanced product tracking and consumer engagement.

- Convenience Formats: Development of single-serve and easy-to-open packaging for on-the-go consumption.

Growth Accelerators in the GCC Rigid Plastic Packaging Industry Industry

Several key catalysts are accelerating long-term growth in the GCC rigid plastic packaging industry. Technological breakthroughs in chemical recycling and advanced material science are enabling the production of higher-quality recycled plastics, thereby reducing reliance on virgin materials and enhancing sustainability. Strategic partnerships between resin producers, packaging manufacturers, and brand owners are fostering innovation and market penetration of new solutions. Market expansion strategies, including entering new geographical sub-markets within the GCC and diversifying product portfolios to cater to a wider range of end-user industries, are crucial growth accelerators. Furthermore, government support through favorable policies and incentives for the recycling and manufacturing sectors will continue to be a significant driver.

Key Players Shaping the GCC Rigid Plastic Packaging Industry Market

- KANR For Plastic Industries

- Cristal Plastic Industrial LLC

- lnterplast (Harwal Group of Companies)

- Al Bayader International

- Takween Advanced Industries (Plastico SPS)

- Zamil Plastic Industries Co

- Al Rashid Boxes and Plastic Co Ltd

- Saudi Arabian Packaging Industry WLL (SAPIN)

- Saudi Plastic Factory Company

- Al Jabri Plastic

- Precision Plastic Products Co (LLC)

- Nuplas Industries

- National Plastic Factory LLC

- AL-Ghandoura Plastic Co (GhanPlast)

- Packaging Products Company (PPC)

Notable Milestones in GCC Rigid Plastic Packaging Industry Sector

- April 2024: SABIC launched Saudi Arabia's inaugural circular packaging initiative, a key part of its TRUCIRCLE™ program, driving the adoption of a circular plastic economy.

- November 2023: PepsiCo pioneered the use of 100% recycled plastic bottles for its Pepsi, Diet Pepsi, and Pepsi Zero brands in the UAE, marking a significant milestone for locally produced, fully recycled packaging in the CSD segment.

In-Depth GCC Rigid Plastic Packaging Industry Market Outlook

The outlook for the GCC rigid plastic packaging industry remains highly positive, driven by strong foundational growth in end-user sectors and an increasing commitment to sustainability and circular economy principles. Growth accelerators, such as advancements in recycling technologies and strategic collaborations, are poised to unlock new market potential and enhance competitive advantages. Future market growth will be significantly shaped by the industry's ability to innovate in lightweighting, incorporate higher percentages of recycled content, and develop solutions that align with evolving consumer demand for eco-friendly products. Strategic opportunities lie in tapping into emerging applications within healthcare and automotive, while continuous investment in R&D and production capabilities will be crucial for sustained market leadership.

GCC Rigid Plastic Packaging Industry Segmentation

-

1. Resin Type

-

1.1. Polyethylene (PE)

- 1.1.1. Low-dens

- 1.1.2. High Density Polyethylene (HDPE)

- 1.2. Polyethylene terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 1.5. Polyvinyl chloride (PVC)

- 1.6. Other Resin Types

-

1.1. Polyethylene (PE)

-

2. Product Type

- 2.1. Bottles and Jars

- 2.2. Trays and Containers

- 2.3. Caps and Closures

- 2.4. Intermediate Bulk Containers (IBCs)

- 2.5. Drums

- 2.6. Pallets

- 2.7. Other Product Types

-

3. End-user Industry

-

3.1. Food**

- 3.1.1. Candy and Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Others Food Service Sectors

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other End-user Industries

-

3.1. Food**

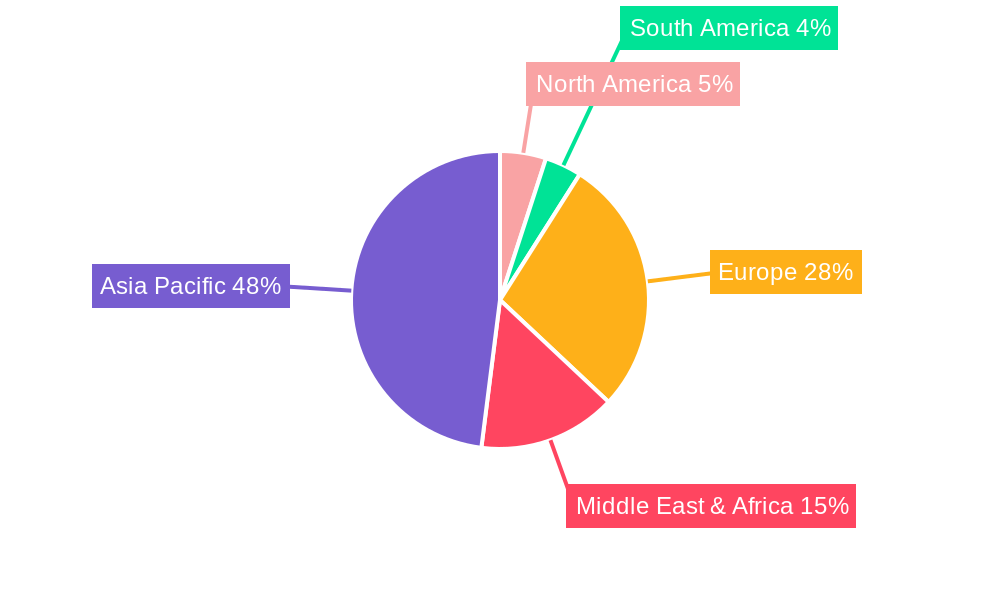

GCC Rigid Plastic Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Rigid Plastic Packaging Industry Regional Market Share

Geographic Coverage of GCC Rigid Plastic Packaging Industry

GCC Rigid Plastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Recyclable Rigid Plastic Packaging is Expected to Increase with New Regulations; Increasing Demand for Rigid Plastic Packaging to Increase Shelf Life of the Products

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Over Safe Disposal and Price Volatility of the Raw Materials

- 3.4. Market Trends

- 3.4.1. Food Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Polyethylene (PE)

- 5.1.1.1. Low-dens

- 5.1.1.2. High Density Polyethylene (HDPE)

- 5.1.2. Polyethylene terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.1.5. Polyvinyl chloride (PVC)

- 5.1.6. Other Resin Types

- 5.1.1. Polyethylene (PE)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Jars

- 5.2.2. Trays and Containers

- 5.2.3. Caps and Closures

- 5.2.4. Intermediate Bulk Containers (IBCs)

- 5.2.5. Drums

- 5.2.6. Pallets

- 5.2.7. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food**

- 5.3.1.1. Candy and Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Others Food Service Sectors

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other End-user Industries

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. North America GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Polyethylene (PE)

- 6.1.1.1. Low-dens

- 6.1.1.2. High Density Polyethylene (HDPE)

- 6.1.2. Polyethylene terephthalate (PET)

- 6.1.3. Polypropylene (PP)

- 6.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 6.1.5. Polyvinyl chloride (PVC)

- 6.1.6. Other Resin Types

- 6.1.1. Polyethylene (PE)

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bottles and Jars

- 6.2.2. Trays and Containers

- 6.2.3. Caps and Closures

- 6.2.4. Intermediate Bulk Containers (IBCs)

- 6.2.5. Drums

- 6.2.6. Pallets

- 6.2.7. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food**

- 6.3.1.1. Candy and Confectionery

- 6.3.1.2. Frozen Foods

- 6.3.1.3. Fresh Produce

- 6.3.1.4. Dairy Products

- 6.3.1.5. Dry Foods

- 6.3.1.6. Meat, Poultry, And Seafood

- 6.3.1.7. Pet Food

- 6.3.1.8. Other Food Products

- 6.3.2. Foodservice**

- 6.3.2.1. Quick Service Restaurants (QSRs)

- 6.3.2.2. Full-Service Restaurants (FSRs)

- 6.3.2.3. Coffee and Snack Outlets

- 6.3.2.4. Retail Establishments

- 6.3.2.5. Institutional

- 6.3.2.6. Hospitality

- 6.3.2.7. Others Food Service Sectors

- 6.3.3. Beverage

- 6.3.4. Healthcare

- 6.3.5. Cosmetics and Personal Care

- 6.3.6. Industrial

- 6.3.7. Building and Construction

- 6.3.8. Automotive

- 6.3.9. Other End-user Industries

- 6.3.1. Food**

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. South America GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Polyethylene (PE)

- 7.1.1.1. Low-dens

- 7.1.1.2. High Density Polyethylene (HDPE)

- 7.1.2. Polyethylene terephthalate (PET)

- 7.1.3. Polypropylene (PP)

- 7.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 7.1.5. Polyvinyl chloride (PVC)

- 7.1.6. Other Resin Types

- 7.1.1. Polyethylene (PE)

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bottles and Jars

- 7.2.2. Trays and Containers

- 7.2.3. Caps and Closures

- 7.2.4. Intermediate Bulk Containers (IBCs)

- 7.2.5. Drums

- 7.2.6. Pallets

- 7.2.7. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food**

- 7.3.1.1. Candy and Confectionery

- 7.3.1.2. Frozen Foods

- 7.3.1.3. Fresh Produce

- 7.3.1.4. Dairy Products

- 7.3.1.5. Dry Foods

- 7.3.1.6. Meat, Poultry, And Seafood

- 7.3.1.7. Pet Food

- 7.3.1.8. Other Food Products

- 7.3.2. Foodservice**

- 7.3.2.1. Quick Service Restaurants (QSRs)

- 7.3.2.2. Full-Service Restaurants (FSRs)

- 7.3.2.3. Coffee and Snack Outlets

- 7.3.2.4. Retail Establishments

- 7.3.2.5. Institutional

- 7.3.2.6. Hospitality

- 7.3.2.7. Others Food Service Sectors

- 7.3.3. Beverage

- 7.3.4. Healthcare

- 7.3.5. Cosmetics and Personal Care

- 7.3.6. Industrial

- 7.3.7. Building and Construction

- 7.3.8. Automotive

- 7.3.9. Other End-user Industries

- 7.3.1. Food**

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Europe GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Polyethylene (PE)

- 8.1.1.1. Low-dens

- 8.1.1.2. High Density Polyethylene (HDPE)

- 8.1.2. Polyethylene terephthalate (PET)

- 8.1.3. Polypropylene (PP)

- 8.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 8.1.5. Polyvinyl chloride (PVC)

- 8.1.6. Other Resin Types

- 8.1.1. Polyethylene (PE)

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Bottles and Jars

- 8.2.2. Trays and Containers

- 8.2.3. Caps and Closures

- 8.2.4. Intermediate Bulk Containers (IBCs)

- 8.2.5. Drums

- 8.2.6. Pallets

- 8.2.7. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food**

- 8.3.1.1. Candy and Confectionery

- 8.3.1.2. Frozen Foods

- 8.3.1.3. Fresh Produce

- 8.3.1.4. Dairy Products

- 8.3.1.5. Dry Foods

- 8.3.1.6. Meat, Poultry, And Seafood

- 8.3.1.7. Pet Food

- 8.3.1.8. Other Food Products

- 8.3.2. Foodservice**

- 8.3.2.1. Quick Service Restaurants (QSRs)

- 8.3.2.2. Full-Service Restaurants (FSRs)

- 8.3.2.3. Coffee and Snack Outlets

- 8.3.2.4. Retail Establishments

- 8.3.2.5. Institutional

- 8.3.2.6. Hospitality

- 8.3.2.7. Others Food Service Sectors

- 8.3.3. Beverage

- 8.3.4. Healthcare

- 8.3.5. Cosmetics and Personal Care

- 8.3.6. Industrial

- 8.3.7. Building and Construction

- 8.3.8. Automotive

- 8.3.9. Other End-user Industries

- 8.3.1. Food**

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Middle East & Africa GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Polyethylene (PE)

- 9.1.1.1. Low-dens

- 9.1.1.2. High Density Polyethylene (HDPE)

- 9.1.2. Polyethylene terephthalate (PET)

- 9.1.3. Polypropylene (PP)

- 9.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 9.1.5. Polyvinyl chloride (PVC)

- 9.1.6. Other Resin Types

- 9.1.1. Polyethylene (PE)

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Bottles and Jars

- 9.2.2. Trays and Containers

- 9.2.3. Caps and Closures

- 9.2.4. Intermediate Bulk Containers (IBCs)

- 9.2.5. Drums

- 9.2.6. Pallets

- 9.2.7. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food**

- 9.3.1.1. Candy and Confectionery

- 9.3.1.2. Frozen Foods

- 9.3.1.3. Fresh Produce

- 9.3.1.4. Dairy Products

- 9.3.1.5. Dry Foods

- 9.3.1.6. Meat, Poultry, And Seafood

- 9.3.1.7. Pet Food

- 9.3.1.8. Other Food Products

- 9.3.2. Foodservice**

- 9.3.2.1. Quick Service Restaurants (QSRs)

- 9.3.2.2. Full-Service Restaurants (FSRs)

- 9.3.2.3. Coffee and Snack Outlets

- 9.3.2.4. Retail Establishments

- 9.3.2.5. Institutional

- 9.3.2.6. Hospitality

- 9.3.2.7. Others Food Service Sectors

- 9.3.3. Beverage

- 9.3.4. Healthcare

- 9.3.5. Cosmetics and Personal Care

- 9.3.6. Industrial

- 9.3.7. Building and Construction

- 9.3.8. Automotive

- 9.3.9. Other End-user Industries

- 9.3.1. Food**

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Asia Pacific GCC Rigid Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Polyethylene (PE)

- 10.1.1.1. Low-dens

- 10.1.1.2. High Density Polyethylene (HDPE)

- 10.1.2. Polyethylene terephthalate (PET)

- 10.1.3. Polypropylene (PP)

- 10.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 10.1.5. Polyvinyl chloride (PVC)

- 10.1.6. Other Resin Types

- 10.1.1. Polyethylene (PE)

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Bottles and Jars

- 10.2.2. Trays and Containers

- 10.2.3. Caps and Closures

- 10.2.4. Intermediate Bulk Containers (IBCs)

- 10.2.5. Drums

- 10.2.6. Pallets

- 10.2.7. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food**

- 10.3.1.1. Candy and Confectionery

- 10.3.1.2. Frozen Foods

- 10.3.1.3. Fresh Produce

- 10.3.1.4. Dairy Products

- 10.3.1.5. Dry Foods

- 10.3.1.6. Meat, Poultry, And Seafood

- 10.3.1.7. Pet Food

- 10.3.1.8. Other Food Products

- 10.3.2. Foodservice**

- 10.3.2.1. Quick Service Restaurants (QSRs)

- 10.3.2.2. Full-Service Restaurants (FSRs)

- 10.3.2.3. Coffee and Snack Outlets

- 10.3.2.4. Retail Establishments

- 10.3.2.5. Institutional

- 10.3.2.6. Hospitality

- 10.3.2.7. Others Food Service Sectors

- 10.3.3. Beverage

- 10.3.4. Healthcare

- 10.3.5. Cosmetics and Personal Care

- 10.3.6. Industrial

- 10.3.7. Building and Construction

- 10.3.8. Automotive

- 10.3.9. Other End-user Industries

- 10.3.1. Food**

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 KANR For Plastic Industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cristal Plastic Industrial LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 lnterplast (Harwal Group of Companies)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Bayader International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Takween Advanced Industries (Plastico SPS)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zamil Plastic Industries Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Al Rashid Boxes and Plastic Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Saudi Arabian Packaging Industry WLL (SAPIN)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Saudi Plastic Factory Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Al Jabri Plastic

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Precision Plastic Products Co (LLC)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nuplas Industries

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 National Plastic Factory LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 AL-Ghandoura Plastic Co (GhanPlast)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Packaging Products Company (PPC)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 KANR For Plastic Industries

List of Figures

- Figure 1: Global GCC Rigid Plastic Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America GCC Rigid Plastic Packaging Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 3: North America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 4: North America GCC Rigid Plastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America GCC Rigid Plastic Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America GCC Rigid Plastic Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America GCC Rigid Plastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America GCC Rigid Plastic Packaging Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 11: South America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 12: South America GCC Rigid Plastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: South America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America GCC Rigid Plastic Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: South America GCC Rigid Plastic Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America GCC Rigid Plastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America GCC Rigid Plastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe GCC Rigid Plastic Packaging Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 19: Europe GCC Rigid Plastic Packaging Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 20: Europe GCC Rigid Plastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Europe GCC Rigid Plastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe GCC Rigid Plastic Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Europe GCC Rigid Plastic Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe GCC Rigid Plastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe GCC Rigid Plastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 27: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 28: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 35: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 36: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 37: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific GCC Rigid Plastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 2: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 6: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 13: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 20: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 21: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 22: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 33: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 35: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 43: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 45: Global GCC Rigid Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific GCC Rigid Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Rigid Plastic Packaging Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the GCC Rigid Plastic Packaging Industry?

Key companies in the market include KANR For Plastic Industries, Cristal Plastic Industrial LLC, lnterplast (Harwal Group of Companies), Al Bayader International, Takween Advanced Industries (Plastico SPS), Zamil Plastic Industries Co, Al Rashid Boxes and Plastic Co Ltd, Saudi Arabian Packaging Industry WLL (SAPIN), Saudi Plastic Factory Company, Al Jabri Plastic, Precision Plastic Products Co (LLC), Nuplas Industries, National Plastic Factory LLC, AL-Ghandoura Plastic Co (GhanPlast), Packaging Products Company (PPC).

3. What are the main segments of the GCC Rigid Plastic Packaging Industry?

The market segments include Resin Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 396.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Recyclable Rigid Plastic Packaging is Expected to Increase with New Regulations; Increasing Demand for Rigid Plastic Packaging to Increase Shelf Life of the Products.

6. What are the notable trends driving market growth?

Food Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Environmental Concerns Over Safe Disposal and Price Volatility of the Raw Materials.

8. Can you provide examples of recent developments in the market?

April 2024: SABIC, a prominent player in the global chemical industry and a member of GPCA announced Saudi Arabia's inaugural circular packaging initiative. This initiative is a pivotal part of SABIC's TRUCIRCLE program, designed to propel the adoption of a circular plastic economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Rigid Plastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Rigid Plastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Rigid Plastic Packaging Industry?

To stay informed about further developments, trends, and reports in the GCC Rigid Plastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence