Key Insights

The Diagnostic Flexible Packaging market is projected for substantial expansion, set to reach approximately $293.92 billion by 2025, driven by a strong Compound Annual Growth Rate (CAGR) of 5.3% from a base year of 2025. This growth is fueled by increasing demand for advanced diagnostic solutions and the inherent benefits of flexible packaging in this sector. Key growth drivers include the rising incidence of chronic diseases, the increasing focus on point-of-care diagnostics, and ongoing innovation in diagnostic technologies necessitating specialized and secure packaging. The trend towards miniaturization and the development of user-friendly diagnostic kits further underscore the need for lightweight, durable, and precisely engineered flexible packaging. Escalating global healthcare expenditure and the expanding availability of diagnostic services in underserved regions are also significant contributors to this market's upward trajectory.

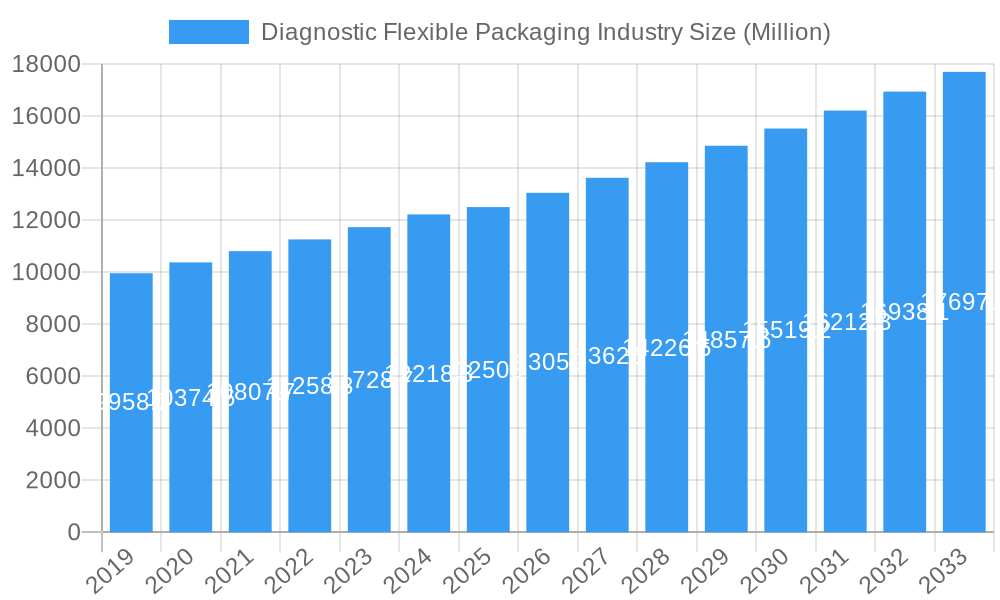

Diagnostic Flexible Packaging Industry Market Size (In Billion)

Evolving consumer preferences and stringent regulatory mandates for medical device packaging are also shaping market dynamics. While robust growth is evident, challenges such as cost sensitivity in certain healthcare segments and the requirement for specialized barrier properties to maintain sample integrity may arise. However, continuous research and development in material science are actively addressing these challenges, leading to the creation of enhanced barrier films and sustainable packaging alternatives. The market is segmented by product types including Bottles, Vials, Tubes, and Closures, each serving specific diagnostic applications. Primary end-users, such as Hospitals, Laboratories, and Academic Institutes, are the main consumers driving the adoption of these specialized packaging solutions. Leading companies like Thermo Fisher Scientific, Corning Incorporated, and Amcor Limited are actively innovating and competing within this evolving landscape.

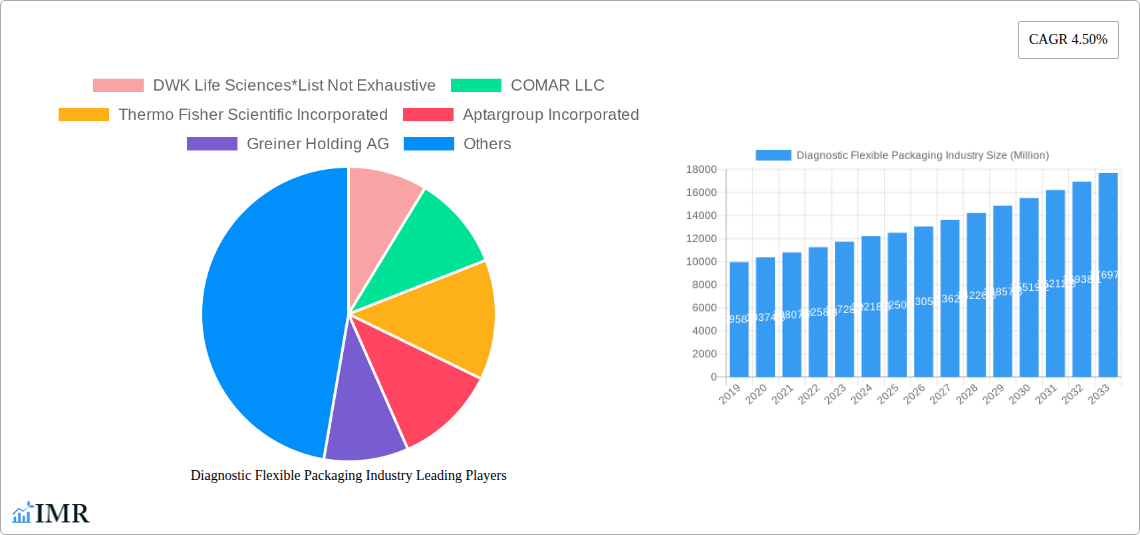

Diagnostic Flexible Packaging Industry Company Market Share

This SEO-optimized report provides a comprehensive overview of the Diagnostic Flexible Packaging industry, detailing market size, growth, and future forecasts to maximize search engine visibility and engage industry professionals.

Diagnostic Flexible Packaging Industry Market Dynamics & Structure

The Diagnostic Flexible Packaging Industry is characterized by a moderately concentrated market, driven by continuous technological innovation and stringent regulatory frameworks governing medical device packaging. Key drivers include the demand for sterile, tamper-evident, and high-barrier packaging solutions for diagnostic assays, reagents, and sample collection kits. The landscape is shaped by evolving end-user demographics, with a growing reliance on specialized packaging for Point-of-Care (POC) diagnostics and personalized medicine. Competitive product substitutes, while present, often fall short in meeting the stringent performance and safety requirements of diagnostic applications, reinforcing the demand for specialized flexible packaging. Mergers and acquisitions (M&A) are an integral part of the market's evolution, as companies seek to expand their product portfolios, geographical reach, and technological capabilities. Recent M&A activities indicate a trend towards consolidation and vertical integration, aiming to enhance supply chain efficiency and offer comprehensive packaging solutions.

- Market Concentration: Moderately concentrated with key players dominating specialized niches.

- Technological Innovation: Driven by advancements in material science, sterilization techniques, and intelligent packaging features for enhanced product integrity and traceability.

- Regulatory Frameworks: Stringent regulations from bodies like the FDA and EMA dictate material safety, sterilization protocols, and shelf-life requirements.

- Competitive Product Substitutes: Limited viable substitutes for high-performance diagnostic flexible packaging due to stringent performance demands.

- End-User Demographics: Shifting towards POC diagnostics, at-home testing, and personalized medicine, demanding flexible, convenient, and secure packaging.

- M&A Trends: Active M&A landscape with a focus on portfolio expansion, technological acquisition, and market consolidation.

Diagnostic Flexible Packaging Industry Growth Trends & Insights

The Diagnostic Flexible Packaging Industry is poised for robust growth, projected to expand from USD XXX Million in the base year 2025 to USD XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.XX% during the forecast period of 2025–2033. This significant expansion is underpinned by a confluence of escalating global healthcare expenditure, an increasing prevalence of chronic diseases, and a burgeoning demand for advanced diagnostic solutions, including molecular diagnostics, immunoassays, and companion diagnostics. The adoption rates for innovative flexible packaging formats, such as stand-up pouches with specialized barrier properties and advanced sealing technologies, are accelerating due to their ability to enhance product stability, extend shelf life, and improve user convenience for a wide array of diagnostic tests.

Technological disruptions are playing a pivotal role in shaping market dynamics. The integration of smart packaging features, including near-field communication (NFC) tags and QR codes, is gaining traction, enabling enhanced traceability, counterfeit detection, and real-time data logging for diagnostic kits. These advancements not only bolster product security but also provide valuable insights into supply chain management and product usage. Consumer behavior shifts, influenced by the growing preference for at-home testing and personalized healthcare, are further fueling the demand for user-friendly, single-use, and highly reliable diagnostic flexible packaging solutions. The focus on sustainability is also emerging as a significant trend, with manufacturers increasingly exploring recyclable and biodegradable materials without compromising on barrier properties or sterilization efficacy.

The historical period from 2019 to 2024 witnessed steady growth, driven by the increasing adoption of in-vitro diagnostics and the initial impact of emerging diagnostic technologies. The base year of 2025 serves as a critical inflection point, with anticipated acceleration in market penetration driven by technological advancements and a more proactive approach to disease management globally. The market penetration of advanced diagnostic flexible packaging solutions is expected to rise from XX.XX% in 2025 to XX.XX% by 2033, reflecting the growing confidence in these materials for critical healthcare applications. The expansion of liquid biopsy technologies and the continuous development of new diagnostic assays are expected to create sustained demand for specialized flexible packaging that can maintain the integrity of sensitive biological samples and reagents.

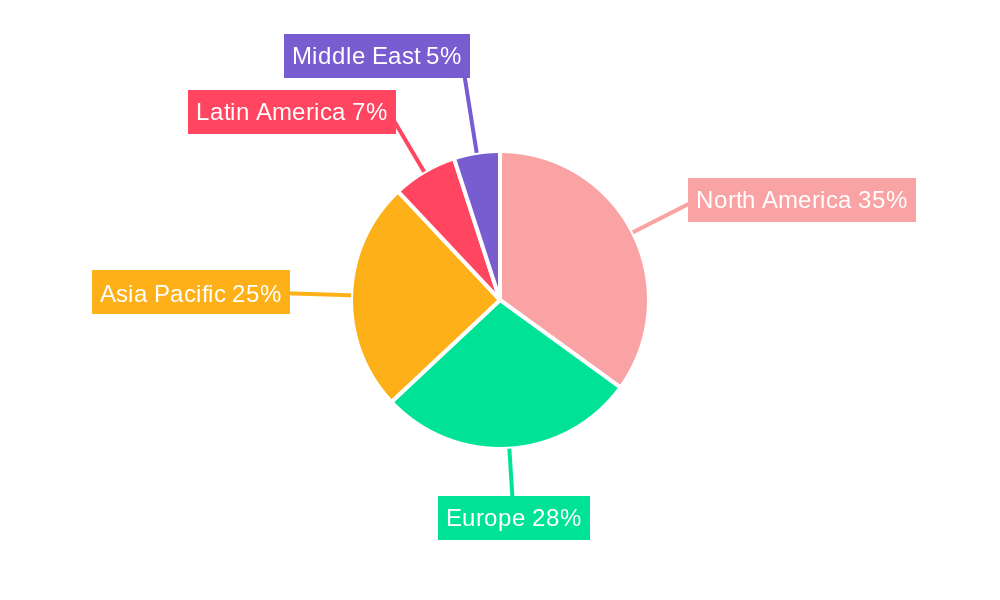

Dominant Regions, Countries, or Segments in Diagnostic Flexible Packaging Industry

The North America region is currently dominating the Diagnostic Flexible Packaging Industry, driven by a confluence of factors including advanced healthcare infrastructure, high research and development expenditure, and a proactive regulatory environment that fosters innovation. The United States, in particular, stands out as a key country within this region, boasting a substantial number of leading diagnostic companies and academic institutions that are at the forefront of developing and adopting novel diagnostic technologies. This dominance is further amplified by a strong demand for sophisticated diagnostic tests, fueled by an aging population, a rising incidence of chronic diseases, and an increasing focus on personalized medicine.

Within the Product segment, Vials and Bottles are experiencing significant demand, particularly for sample collection and reagent storage in clinical laboratories and hospitals. These products benefit from their established use in traditional diagnostics and the ongoing need for sterile containment of biological samples and chemical reagents. However, the Closures segment is witnessing rapid growth, driven by advancements in tamper-evident and child-resistant technologies that are crucial for the safety and integrity of diagnostic kits. The Other Product Types segment, encompassing specialized pouches for diagnostic test strips, microfluidic devices, and integrated sample collection/analysis kits, is also a significant growth engine, reflecting the innovation in diagnostic delivery formats.

In terms of End User, Laboratories represent the largest market share, encompassing clinical diagnostic laboratories, research laboratories, and contract research organizations (CROs). Their high throughput of diagnostic testing and constant need for reliable sample handling and reagent storage make them primary consumers of diagnostic flexible packaging. Hospitals are also significant contributors, particularly for point-of-care testing and in-house diagnostic procedures. Academic Institutes play a crucial role in driving innovation and early adoption of new diagnostic technologies, thereby influencing packaging requirements.

Key drivers for North America's dominance include favorable economic policies supporting the life sciences sector, robust investment in healthcare infrastructure, and the presence of a highly skilled workforce. The region's leading market share is estimated at XX.XX% in 2025, with an anticipated growth potential of XX.XX% over the forecast period. This strong performance is attributed to continuous technological advancements in diagnostic assays and the high disposable income that supports the adoption of premium diagnostic flexible packaging solutions.

Diagnostic Flexible Packaging Industry Product Landscape

The Diagnostic Flexible Packaging Industry is witnessing a surge in product innovation focused on enhanced barrier properties, sterilization compatibility, and user convenience. Key product types like bottles and vials are evolving with advanced features such as tamper-evident seals and inert interiors to preserve sample integrity. Specialized pouches, increasingly incorporating features like easy-open tabs and integrated sampling mechanisms, are gaining prominence for point-of-care and at-home diagnostic kits. Material science advancements are enabling the development of multilayer films with superior oxygen and moisture barriers, crucial for extending the shelf life of sensitive diagnostic reagents. Unique selling propositions include enhanced product security, improved traceability through integrated smart features, and the development of sustainable packaging alternatives that meet stringent regulatory requirements for medical applications.

Key Drivers, Barriers & Challenges in Diagnostic Flexible Packaging Industry

Key Drivers:

- Rising prevalence of chronic diseases: Increasing demand for diagnostic tests to monitor and manage chronic conditions.

- Technological advancements in diagnostics: Development of new assays, PCR, and molecular diagnostics requiring specialized packaging.

- Growth of point-of-care (POC) testing: Demand for convenient, stable, and easy-to-use packaging for decentralized testing.

- Focus on personalized medicine: Need for tailored diagnostic solutions and their associated packaging.

- Government initiatives and funding: Support for R&D and healthcare infrastructure expansion.

Barriers & Challenges:

- Stringent regulatory compliance: Meeting evolving standards for medical device packaging (FDA, EMA).

- High cost of specialized materials and manufacturing: Impacting price sensitivity for certain applications.

- Supply chain complexities: Ensuring consistent availability of high-quality raw materials and packaging components.

- Competition from rigid packaging: Though often less flexible, some applications may still favor rigid containers.

- Need for sustainable solutions: Balancing environmental concerns with the critical performance requirements of diagnostic packaging.

Emerging Opportunities in Diagnostic Flexible Packaging Industry

Emerging opportunities in the Diagnostic Flexible Packaging Industry lie in the expansion of at-home diagnostic testing kits, requiring user-friendly, sterile, and integrated packaging solutions. The burgeoning field of companion diagnostics, which links diagnostic tests with specific therapies, presents a growing demand for highly specialized and traceable packaging. Furthermore, advancements in nanotechnology are paving the way for smart packaging with embedded sensors for real-time monitoring of sample integrity and environmental conditions. The increasing adoption of liquid biopsy techniques also necessitates advanced flexible packaging that can maintain the stability and purity of sensitive biological samples during transit and storage.

Growth Accelerators in the Diagnostic Flexible Packaging Industry Industry

Growth accelerators for the Diagnostic Flexible Packaging Industry are primarily driven by disruptive technological breakthroughs in material science, enabling the development of packaging with superior barrier properties and enhanced shelf-life for diagnostic assays. Strategic partnerships between packaging manufacturers and diagnostic assay developers are crucial for co-creating innovative solutions tailored to specific diagnostic needs. Market expansion strategies, particularly in emerging economies with growing healthcare sectors and increasing awareness of diagnostic testing, will also fuel long-term growth. The continuous evolution of diagnostic platforms, such as microfluidics and lab-on-a-chip devices, will necessitate novel and highly integrated flexible packaging solutions, acting as significant catalysts for sustained market expansion.

Key Players Shaping the Diagnostic Flexible Packaging Industry Market

- DWK Life Sciences

- COMAR LLC

- Thermo Fisher Scientific Incorporated

- Aptargroup Incorporated

- Greiner Holding AG

- WS Packaging Group

- Amcor Limited

- Corning Incorporated

Notable Milestones in Diagnostic Flexible Packaging Industry Sector

- 2023: Launch of advanced multilayer films with enhanced oxygen and moisture barrier properties for extended diagnostic reagent shelf-life.

- 2022: Introduction of novel tamper-evident closure systems for diagnostic sample collection tubes, improving security and compliance.

- 2021: Development of biodegradable flexible packaging materials for diagnostic kits, addressing sustainability concerns.

- 2020: Increased adoption of integrated smart packaging solutions with QR codes for diagnostic kit traceability and authentication.

- 2019: Significant investment in R&D for sterile pouch solutions designed for Point-of-Care diagnostic devices.

In-Depth Diagnostic Flexible Packaging Industry Market Outlook

The Diagnostic Flexible Packaging Industry is on a robust growth trajectory, propelled by escalating global healthcare needs and continuous innovation in diagnostic technologies. Future market potential is immense, fueled by the increasing demand for personalized medicine and the decentralized delivery of healthcare services through point-of-care and at-home testing solutions. Strategic opportunities lie in the development of advanced, sustainable packaging solutions that meet stringent regulatory requirements while offering enhanced functionality, such as integrated sample preservation and real-time data tracking. Manufacturers that can adapt to evolving end-user preferences and invest in novel materials and smart packaging technologies are well-positioned to capitalize on the significant growth prospects within this vital industry sector.

Diagnostic Flexible Packaging Industry Segmentation

-

1. Product

- 1.1. Bottles

- 1.2. Vials

- 1.3. Tubes

- 1.4. Closures

- 1.5. Other Product Types

-

2. End User

- 2.1. Hospitals

- 2.2. Laboratories

- 2.3. Academic Institutes

- 2.4. Other End Users

Diagnostic Flexible Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Diagnostic Flexible Packaging Industry Regional Market Share

Geographic Coverage of Diagnostic Flexible Packaging Industry

Diagnostic Flexible Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Tubes; Increasing Number of Point-of-care Tests

- 3.3. Market Restrains

- 3.3.1. ; Environmental Concerns Related to Raw Materials for Packaging

- 3.4. Market Trends

- 3.4.1. Laboratories Segment to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Diagnostic Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bottles

- 5.1.2. Vials

- 5.1.3. Tubes

- 5.1.4. Closures

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Laboratories

- 5.2.3. Academic Institutes

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Diagnostic Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Bottles

- 6.1.2. Vials

- 6.1.3. Tubes

- 6.1.4. Closures

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Laboratories

- 6.2.3. Academic Institutes

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Diagnostic Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Bottles

- 7.1.2. Vials

- 7.1.3. Tubes

- 7.1.4. Closures

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Laboratories

- 7.2.3. Academic Institutes

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Diagnostic Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Bottles

- 8.1.2. Vials

- 8.1.3. Tubes

- 8.1.4. Closures

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Laboratories

- 8.2.3. Academic Institutes

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America Diagnostic Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Bottles

- 9.1.2. Vials

- 9.1.3. Tubes

- 9.1.4. Closures

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Laboratories

- 9.2.3. Academic Institutes

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East Diagnostic Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Bottles

- 10.1.2. Vials

- 10.1.3. Tubes

- 10.1.4. Closures

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Laboratories

- 10.2.3. Academic Institutes

- 10.2.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DWK Life Sciences*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 COMAR LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thermo Fisher Scientific Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aptargroup Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Greiner Holding AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 WS Packaging Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amcor Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Corning Incorporated

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 DWK Life Sciences*List Not Exhaustive

List of Figures

- Figure 1: Global Diagnostic Flexible Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Diagnostic Flexible Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Diagnostic Flexible Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Diagnostic Flexible Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Diagnostic Flexible Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Diagnostic Flexible Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Diagnostic Flexible Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Diagnostic Flexible Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 9: Europe Diagnostic Flexible Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Diagnostic Flexible Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Diagnostic Flexible Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Diagnostic Flexible Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Diagnostic Flexible Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Diagnostic Flexible Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 15: Asia Pacific Diagnostic Flexible Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Diagnostic Flexible Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Diagnostic Flexible Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Diagnostic Flexible Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Diagnostic Flexible Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Diagnostic Flexible Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 21: Latin America Diagnostic Flexible Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Latin America Diagnostic Flexible Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Latin America Diagnostic Flexible Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Diagnostic Flexible Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Diagnostic Flexible Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Diagnostic Flexible Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 27: Middle East Diagnostic Flexible Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East Diagnostic Flexible Packaging Industry Revenue (billion), by End User 2025 & 2033

- Figure 29: Middle East Diagnostic Flexible Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Diagnostic Flexible Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Diagnostic Flexible Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Diagnostic Flexible Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diagnostic Flexible Packaging Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Diagnostic Flexible Packaging Industry?

Key companies in the market include DWK Life Sciences*List Not Exhaustive, COMAR LLC, Thermo Fisher Scientific Incorporated, Aptargroup Incorporated, Greiner Holding AG, WS Packaging Group, Amcor Limited, Corning Incorporated.

3. What are the main segments of the Diagnostic Flexible Packaging Industry?

The market segments include Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 293.92 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Tubes; Increasing Number of Point-of-care Tests.

6. What are the notable trends driving market growth?

Laboratories Segment to Witness High Growth.

7. Are there any restraints impacting market growth?

; Environmental Concerns Related to Raw Materials for Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Diagnostic Flexible Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Diagnostic Flexible Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Diagnostic Flexible Packaging Industry?

To stay informed about further developments, trends, and reports in the Diagnostic Flexible Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence