Key Insights

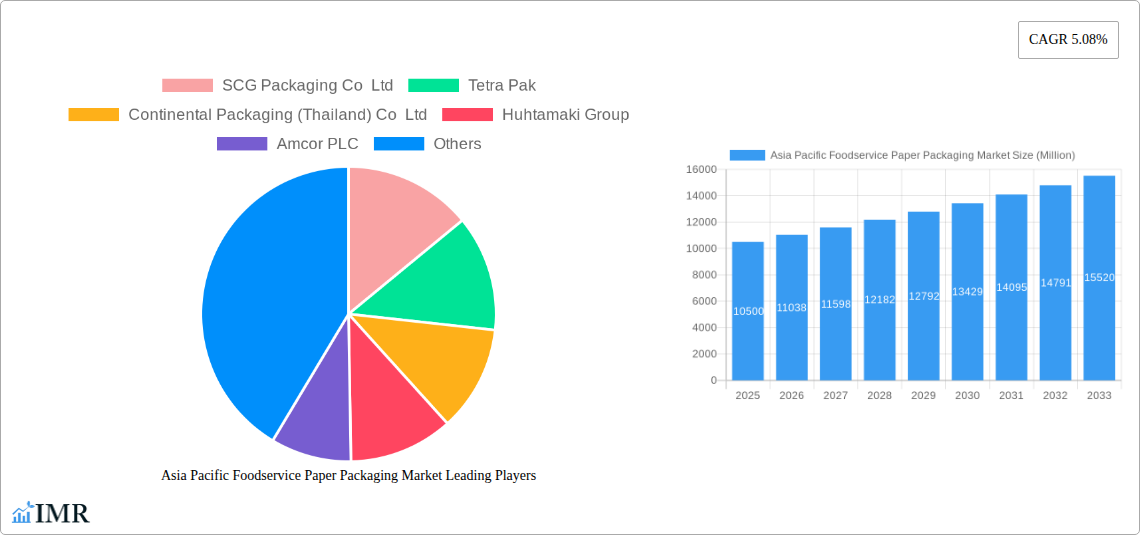

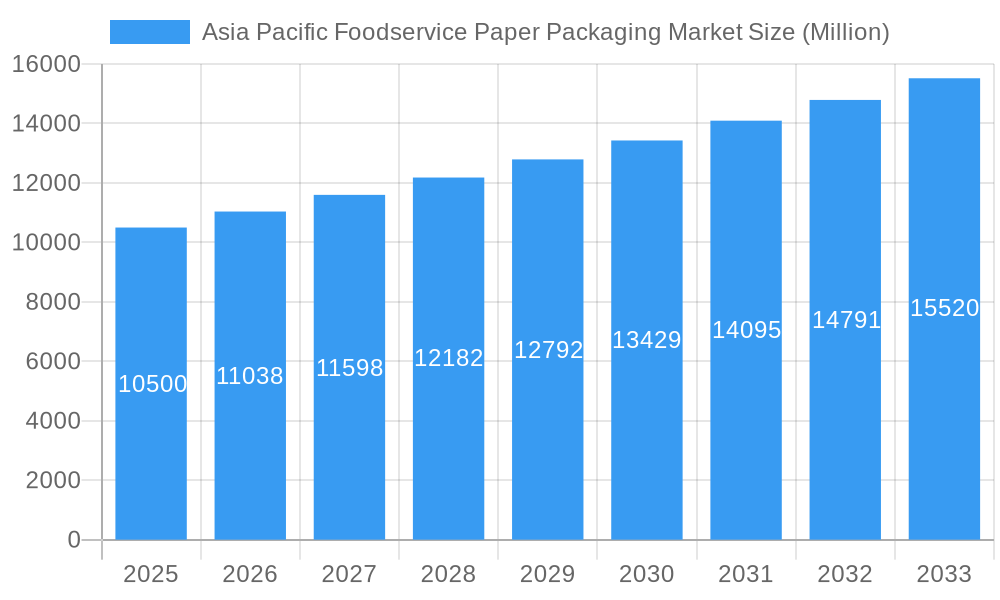

The Asia Pacific Foodservice Paper Packaging Market is poised for robust expansion, with an estimated market size of approximately $10,500 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 5.08%. This significant growth is fueled by a confluence of factors, primarily the escalating demand for convenient and sustainable packaging solutions across the region's burgeoning foodservice sector. A key driver is the increasing consumer preference for eco-friendly alternatives to single-use plastics, a trend strongly supported by government regulations and corporate sustainability initiatives. The rising disposable incomes in countries like China, India, and Southeast Asian nations are also contributing to a greater consumption of ready-to-eat meals, fast food, and takeout services, directly translating into higher demand for paper-based packaging for items such as cups, lids, boxes, and cartons.

Asia Pacific Foodservice Paper Packaging Market Market Size (In Billion)

Further bolstering this market are emerging trends like the innovation in paper packaging design, offering improved barrier properties, heat resistance, and recyclability, making them suitable for a wider array of food products including dairy, bakery, beverages, and meat. The expansion of quick-service restaurants (QSRs) and a growing retail establishment presence also play a crucial role. However, the market faces certain restraints, including the fluctuating raw material costs of paper pulp and the initial investment required for adopting advanced paper packaging technologies, particularly for smaller businesses. Despite these challenges, the overarching shift towards sustainable consumption and the continuous innovation in material science are expected to propel the Asia Pacific Foodservice Paper Packaging Market to new heights, ensuring its sustained and dynamic growth throughout the forecast period of 2025-2033.

Asia Pacific Foodservice Paper Packaging Market Company Market Share

Asia Pacific Foodservice Paper Packaging Market: Sustainable Solutions for a Growing Palate | Market Size, Trends, Forecast 2025-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific Foodservice Paper Packaging Market, a dynamic sector driven by evolving consumer preferences, sustainability mandates, and rapid urbanization. Explore market size, growth drivers, regional dynamics, competitive landscape, and future opportunities. Discover how leading companies are innovating to meet the demand for eco-friendly packaging solutions across diverse foodservice applications, from quick-service restaurants to retail and institutional sectors.

Asia Pacific Foodservice Paper Packaging Market Market Dynamics & Structure

The Asia Pacific Foodservice Paper Packaging Market is characterized by a moderate to high degree of concentration, with key players like SCG Packaging Co Ltd, Tetra Pak, Huhtamaki Group, and Amcor PLC holding significant market shares. Technological innovation is a primary driver, focusing on enhanced barrier properties, improved recyclability, and cost-effective production methods for paper-based packaging solutions. Regulatory frameworks, particularly those promoting sustainability and single-use plastic reduction, are increasingly influencing market trends. Competitive product substitutes, primarily plastic and compostable alternatives, present ongoing challenges, necessitating continuous innovation in material science and design. End-user demographics are shifting, with a growing middle class and an expanding foodservice industry in emerging economies fueling demand. Mergers and acquisitions (M&A) are a notable trend, with companies consolidating to gain market access, expand product portfolios, and achieve economies of scale. For instance, recent M&A activities in the sector indicate a strategic push towards vertical integration and geographical expansion to capture burgeoning market opportunities. The market is segmented by product type, application, and end-user, each exhibiting unique growth trajectories influenced by localized consumption patterns and economic development.

Asia Pacific Foodservice Paper Packaging Market Growth Trends & Insights

The Asia Pacific Foodservice Paper Packaging Market is poised for robust growth, projected to expand significantly from 2019 to 2033. Driven by escalating urbanization, a burgeoning middle class, and increasing disposable incomes, the demand for convenient and accessible food services is on a steady rise. This surge directly translates into a greater need for reliable and sustainable foodservice packaging solutions. The market size is estimated to reach XXX Million units in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Consumer behavior is increasingly skewed towards environmentally conscious choices, making paper packaging a preferred alternative to single-use plastics. This shift is further propelled by stringent government regulations aimed at curbing plastic waste and promoting circular economy principles across the region. Technological disruptions, such as advancements in barrier coatings for paper packaging, are enhancing their functionality, making them suitable for a wider range of food products, including those with high moisture or grease content. The adoption rate of advanced paper packaging technologies is on an upward trajectory, particularly in developed economies like Japan, South Korea, and Australia, as well as rapidly developing markets such as China and India. These adoption rates are closely monitored by key stakeholders to understand the penetration of sustainable packaging alternatives and identify regions ripe for further market expansion. The increasing penetration of e-commerce and food delivery services further amplifies the demand for durable and aesthetically pleasing paper packaging that can withstand transit while maintaining food integrity and brand appeal.

Dominant Regions, Countries, or Segments in Asia Pacific Foodservice Paper Packaging Market

China stands out as the dominant region driving growth in the Asia Pacific Foodservice Paper Packaging Market, propelled by its massive population, rapid economic expansion, and the sheer scale of its foodservice industry. The country's extensive urbanization and the proliferation of quick-service restaurants (QSRs) and food delivery platforms create an insatiable demand for paper packaging solutions, especially for beverages and bakery & confectionery items. China's market share within the Asia Pacific region is substantial, estimated at XX% in 2025, and is projected to continue its upward trajectory throughout the forecast period.

- Key Drivers in China:

- Vast Consumer Base: A rapidly growing middle class with increasing disposable income and a preference for convenient food options.

- Expanding Foodservice Sector: The booming QSR segment, alongside full-service restaurants and an ever-growing food delivery ecosystem, necessitates high volumes of packaging.

- Government Initiatives: Proactive policies aimed at reducing plastic pollution and promoting sustainable alternatives have created a favorable environment for paper packaging manufacturers.

- Technological Advancements: Significant investment in domestic manufacturing capabilities and adoption of advanced paper packaging technologies.

Among the product segments, Boxes & Cartons are a significant contributor to market growth, driven by their versatility across applications like bakery & confectionery, meat & poultry, and retail establishments. However, Cups & Lids for the beverage sector also represent a substantial and rapidly growing segment, particularly in the context of the booming coffee culture and the rise of convenient on-the-go consumption.

- Dominant Applications:

- Beverages: This segment holds a significant market share due to the widespread use of paper cups for hot and cold drinks, especially in the growing coffee and tea culture.

- Bakery & Confectionery: Paper boxes and cartons are essential for packaging a wide array of baked goods and confectionery items, catering to both retail and foodservice demands.

- Fruits and Vegetables: Increasingly, paper packaging is being adopted for fresh produce, driven by sustainability concerns and the need for attractive in-store presentation.

In terms of end-user applications, Restaurants (Quick & Full-service based) represent the largest segment, consuming vast quantities of paper packaging for takeaway orders, dine-in services, and food delivery. The growth of food delivery platforms is a particularly strong catalyst for this segment.

- End-User Dominance:

- Restaurants (Quick & Full-service based): This segment's dominance is underscored by the sheer volume of food consumed outside the home and the increasing reliance on takeout and delivery services.

- Retail Establishments: Supermarkets, convenience stores, and specialty food shops also contribute significantly through their pre-packaged food offerings and in-store deli counters.

The dominance of China, coupled with strong growth in Southeast Asian nations like Vietnam, Indonesia, and Thailand, paints a picture of an Asia Pacific foodservice paper packaging market heavily influenced by burgeoning economies and a clear consumer and regulatory push towards sustainability.

Asia Pacific Foodservice Paper Packaging Market Product Landscape

The product landscape for Asia Pacific foodservice paper packaging is characterized by a strong emphasis on functional innovation and environmental responsibility. Manufacturers are actively developing paper-based containers with enhanced barrier properties to effectively hold liquids, oils, and hot foods, thereby competing directly with traditional plastic packaging. This includes advanced coatings that improve grease and moisture resistance, extending product shelf life and maintaining food quality. Furthermore, the design aspect is crucial, with an increasing demand for visually appealing and brandable packaging solutions that enhance the consumer experience. Innovations also focus on creating customizable sizes and shapes to cater to the diverse needs of various food items, from delicate pastries to hearty meals. The performance metrics being optimized include tear resistance, thermal insulation, and ease of use for both consumers and foodservice operators.

Key Drivers, Barriers & Challenges in Asia Pacific Foodservice Paper Packaging Market

Key Drivers: The Asia Pacific Foodservice Paper Packaging Market is primarily propelled by a confluence of growing environmental consciousness and stringent government regulations aimed at curbing plastic waste. The escalating demand for sustainable and eco-friendly packaging alternatives, driven by consumer preference, acts as a significant catalyst. The rapid expansion of the foodservice industry, fueled by urbanization and rising disposable incomes, directly translates into increased consumption of packaging materials. Technological advancements in paper coating and manufacturing processes are enabling paper-based packaging to offer improved functionality, making them viable substitutes for plastics in a wider array of applications.

Barriers & Challenges: Despite the promising growth, the market faces considerable challenges. The cost-competitiveness of paper packaging compared to conventional plastics remains a key barrier, particularly in price-sensitive emerging markets. Ensuring adequate and efficient recycling infrastructure across the diverse Asia Pacific region is another significant hurdle, as low recycling rates can undermine the environmental benefits of paper packaging. Supply chain disruptions and volatile raw material prices, especially for pulp and paper, can impact production costs and availability. Furthermore, the performance limitations of some paper packaging solutions for specific food products (e.g., very high moisture content) necessitate ongoing innovation and may lead to the continued use of mixed-material packaging, complicating recyclability. Competitive pressures from other sustainable alternatives like bioplastics also present a challenge.

Emerging Opportunities in Asia Pacific Foodservice Paper Packaging Market

Emerging opportunities lie in the development of innovative, high-performance paper packaging solutions that can address the limitations of current offerings, particularly in moisture and grease resistance. Untapped markets in developing Southeast Asian economies present significant growth potential as their foodservice sectors mature and sustainability awareness rises. The increasing demand for personalized and premium food experiences also opens doors for custom-designed, aesthetically pleasing paper packaging. Furthermore, the integration of smart packaging technologies within paper formats, such as QR codes for traceability or temperature indicators, could offer new value propositions. The circular economy is a major opportunity, with advancements in paper recycling technologies and the development of compostable paper-based materials offering new avenues for sustainable product development and brand differentiation.

Growth Accelerators in the Asia Pacific Foodservice Paper Packaging Market Industry

The long-term growth of the Asia Pacific Foodservice Paper Packaging Market is being significantly accelerated by technological breakthroughs in material science, leading to enhanced functionalities and improved environmental profiles of paper packaging. Strategic partnerships between packaging manufacturers, food service providers, and raw material suppliers are crucial for developing integrated supply chains and fostering innovation. Market expansion strategies, including aggressive penetration into emerging economies and the development of localized product offerings, are further fueling growth. The increasing focus on corporate social responsibility (CSR) by businesses, leading them to adopt more sustainable packaging practices, is also a powerful growth accelerator. Government incentives and favorable policies promoting the use of eco-friendly packaging materials contribute to a supportive market environment, driving adoption and investment.

Key Players Shaping the Asia Pacific Foodservice Paper Packaging Market Market

- SCG Packaging Co Ltd

- Tetra Pak

- Continental Packaging (Thailand) Co Ltd

- Huhtamaki Group

- Amcor PLC

- Pura Group

- Oji Holdings Corporation

- International Paper Company

- Toppan Inc

- Sarnti Packaging Co Ltd

Notable Milestones in Asia Pacific Foodservice Paper Packaging Market Sector

- August 2022: Amcor added a new location in Jiangyin, China, to its network of Innovation Centers. Customers in the area now have access to Amcor's expertise through the new facility in China. This speeds up the development of packaging solutions that are better for the environment.

- March 2022: The Food Safety and Standards Authority of India (FSSAI) released new regulations to control the use of recycled plastic for food packaging in response to criticism from a group of worried scientific professionals. This was meant to be a good step toward better handling of the country's huge amount of plastic waste.

In-Depth Asia Pacific Foodservice Paper Packaging Market Market Outlook

The future outlook for the Asia Pacific Foodservice Paper Packaging Market is exceptionally bright, driven by a persistent global shift towards sustainability and the region's robust economic growth. Continued investment in R&D will likely unlock next-generation paper packaging with superior barrier properties and enhanced recyclability, directly addressing current market limitations. Strategic collaborations and a focus on building robust recycling infrastructure will be crucial for realizing the full environmental potential of these solutions. Emerging markets will present significant opportunities for market players willing to adapt to local needs and regulatory landscapes. The increasing consumer awareness and demand for eco-friendly products will ensure that paper packaging remains at the forefront of innovation in the foodservice sector, positioning it for sustained growth and market leadership.

Asia Pacific Foodservice Paper Packaging Market Segmentation

-

1. Type

- 1.1. Cups & Lids

- 1.2. Boxes & Cartons

-

2. Application

- 2.1. Fruits and vegetables

- 2.2. Dairy products

- 2.3. Bakery & Confectionery

- 2.4. Beverages

- 2.5. Meat & Poultry

- 2.6. Others

-

3. End User

- 3.1. Restaurants (Quick & Full-service based)

- 3.2. Retail establishments

- 3.3. Institutional

- 3.4. Other End-user Applications

Asia Pacific Foodservice Paper Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Foodservice Paper Packaging Market Regional Market Share

Geographic Coverage of Asia Pacific Foodservice Paper Packaging Market

Asia Pacific Foodservice Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials; Online Food Ordering Services are Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Price Volatility of Raw Materials

- 3.4. Market Trends

- 3.4.1. Online Food Ordering Services are Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Foodservice Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cups & Lids

- 5.1.2. Boxes & Cartons

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits and vegetables

- 5.2.2. Dairy products

- 5.2.3. Bakery & Confectionery

- 5.2.4. Beverages

- 5.2.5. Meat & Poultry

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Restaurants (Quick & Full-service based)

- 5.3.2. Retail establishments

- 5.3.3. Institutional

- 5.3.4. Other End-user Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SCG Packaging Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tetra Pak

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental Packaging (Thailand) Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amcor PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pura Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oji Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 International Paper Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toppan Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sarnti Packaging Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SCG Packaging Co Ltd

List of Figures

- Figure 1: Asia Pacific Foodservice Paper Packaging Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Foodservice Paper Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Foodservice Paper Packaging Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Asia Pacific Foodservice Paper Packaging Market?

Key companies in the market include SCG Packaging Co Ltd, Tetra Pak, Continental Packaging (Thailand) Co Ltd, Huhtamaki Group, Amcor PLC, Pura Group, Oji Holdings Corporation, International Paper Company, Toppan Inc, Sarnti Packaging Co Ltd.

3. What are the main segments of the Asia Pacific Foodservice Paper Packaging Market?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials; Online Food Ordering Services are Expected to Drive the Market.

6. What are the notable trends driving market growth?

Online Food Ordering Services are Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Price Volatility of Raw Materials.

8. Can you provide examples of recent developments in the market?

August 2022: Amcor added a new location in Jiangyin, China, to its network of Innovation Centers. Customers in the area now have access to Amcor's expertise through the new facility in China. This speeds up the development of packaging solutions that are better for the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Foodservice Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Foodservice Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Foodservice Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Foodservice Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence