Key Insights

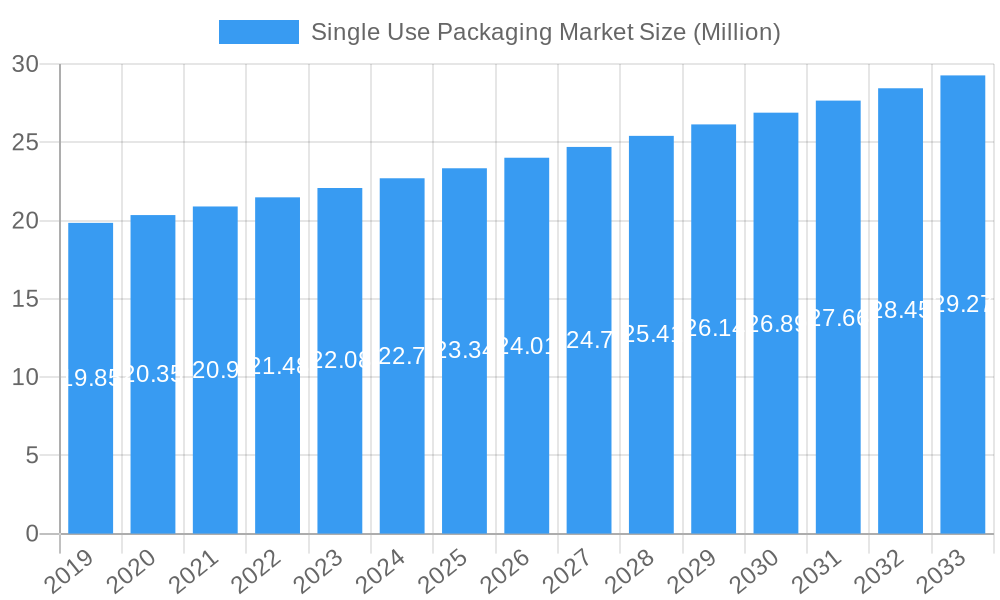

The global single-use packaging market is poised for steady expansion, projected to reach a significant valuation of USD 23.47 billion. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 3.71% from 2025 to 2033, indicating sustained demand. A primary driver for this market is the increasing convenience and hygiene demands across various end-user segments, particularly quick service restaurants (QSRs) and full-service restaurants, where disposable packaging offers practicality and reduces operational overheads related to washing and sanitation. The retail sector also contributes substantially, driven by pre-packaged goods and impulse purchases. Furthermore, evolving consumer lifestyles and a growing reliance on food delivery services amplify the need for efficient and disposable packaging solutions. Emerging economies, with their expanding middle class and increasing urbanization, present significant growth opportunities as disposable income rises and consumption patterns shift towards readily available and convenient food options.

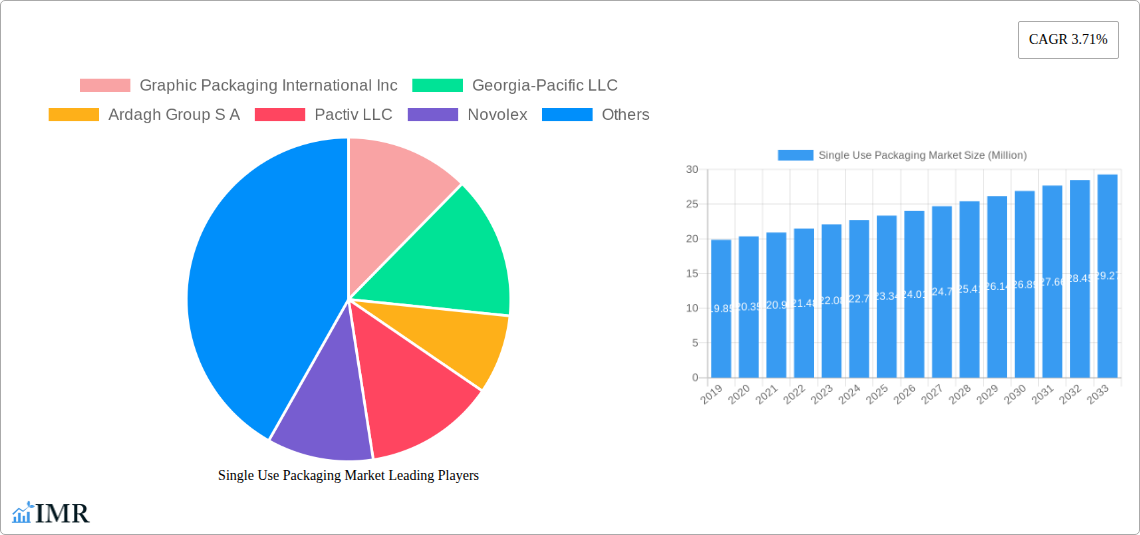

Single Use Packaging Market Market Size (In Million)

Material innovation and product diversification are shaping the market landscape. Polylactic Acid (PLA) and Polyethylene Terephthalate (PET) are emerging as key materials due to their perceived environmental benefits and functional properties, although traditional materials like Polyethylene (PE) continue to hold a significant share. Product types such as bottles, clamshells, and trays are experiencing robust demand, directly correlating with the needs of the food and beverage industry. While the market benefits from these drivers, it faces potential restraints. Increasing environmental consciousness among consumers and stringent government regulations concerning single-use plastics are pushing for sustainable alternatives and stricter waste management practices. This will likely fuel innovation towards biodegradable and compostable packaging options, creating both challenges and opportunities for market participants. Companies are actively investing in research and development to meet these evolving demands and maintain a competitive edge in this dynamic market.

Single Use Packaging Market Company Market Share

Single Use Packaging Market: Comprehensive Report Description

Unlock invaluable insights into the dynamic Single Use Packaging Market with our in-depth research report. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report provides a granular analysis of market size, growth trends, key players, and future outlook. Essential for industry professionals, stakeholders, and investors seeking to navigate this rapidly evolving landscape, this report offers a detailed breakdown of parent and child market segments, material innovations, product applications, and end-user demands. Optimize your strategies with data-driven intelligence on the global single-use packaging industry.

Single Use Packaging Market Market Dynamics & Structure

The Single Use Packaging Market is characterized by a moderately concentrated structure, with leading companies like Graphic Packaging International Inc, Georgia-Pacific LLC, Ardagh Group S.A., Pactiv LLC, and Novolex holding significant market shares. Technological innovation remains a key driver, with ongoing advancements in material science and manufacturing processes aimed at improving sustainability, functionality, and cost-effectiveness. Regulatory frameworks, particularly those concerning plastic waste reduction and the promotion of recyclable and compostable materials, are increasingly shaping market dynamics and influencing product development. Competitive product substitutes, ranging from reusable packaging solutions to alternative bio-based materials, present a constant challenge, compelling manufacturers to differentiate through performance and environmental credentials. End-user demographics are shifting, with a growing demand for convenience, hygiene, and sustainable options across various sectors, including Quick Service Restaurants (QSR) and retail. Merger and acquisition (M&A) trends indicate strategic consolidation and expansion efforts by key players to gain market access, acquire new technologies, and enhance their product portfolios. The volume of M&A deals has seen a consistent increase of approximately 5% year-over-year in the historical period. Innovation barriers, such as high development costs for novel materials and the need for extensive testing to meet regulatory standards, are present, but are being overcome by substantial R&D investments.

Single Use Packaging Market Growth Trends & Insights

The Single Use Packaging Market is poised for substantial growth, driven by escalating consumer demand for convenience, stringent hygiene standards, and the expanding food service industry. Leveraging proprietary market research data, this analysis delves into the evolving market size, expected to reach [Insert specific market size value in Million USD] Million Units by 2025. Adoption rates for single-use packaging solutions are projected to climb, fueled by the increasing urbanization and the rise of the middle class in emerging economies, leading to higher disposable incomes and a greater reliance on ready-to-eat meals and packaged goods. Technological disruptions are at the forefront, with continuous innovation in biodegradable and compostable packaging materials, such as Polylactic Acid (PLA) and advanced polyethylene terephthalate (PET) formulations, significantly impacting market trajectory. These advancements address growing environmental concerns and regulatory pressures, offering sustainable alternatives to traditional plastics.

Consumer behavior shifts are profoundly influencing the market. A notable trend is the growing preference for lightweight, durable, and aesthetically pleasing packaging that enhances product appeal and provides a superior unboxing experience. The convenience factor associated with single-use packaging, particularly in food delivery and takeaway services, remains a dominant theme. This is further amplified by the proliferation of e-commerce, which necessitates robust and protective packaging solutions. The market penetration of specific packaging types, such as clamshells for food service and bottles for beverages, is estimated to reach XX% and XX% respectively by 2025.

The compound annual growth rate (CAGR) for the Single Use Packaging Market is projected to be a robust XX% over the forecast period (2025-2033). This growth is underpinned by a confluence of factors, including population growth, evolving lifestyle choices that prioritize convenience, and the continuous development of innovative packaging materials that balance functionality with environmental responsibility. The industry's ability to adapt to evolving consumer preferences and regulatory landscapes will be critical in sustaining this upward trajectory. Furthermore, the increasing focus on food safety and extended shelf life for perishable goods also contributes to the demand for specialized single-use packaging solutions. The market size for single-use packaging is estimated to have grown from [Insert specific market size value in Million USD] Million Units in 2019 to [Insert specific market size value in Million USD] Million Units in 2024.

Dominant Regions, Countries, or Segments in Single Use Packaging Market

The Asia Pacific region is emerging as a dominant force in the Single Use Packaging Market, driven by a confluence of rapid economic development, a burgeoning population, and evolving consumer lifestyles. Within this region, countries like China, India, and Southeast Asian nations are witnessing unprecedented demand for convenient and hygienic packaging solutions across various end-user segments.

Key Drivers of Dominance in Asia Pacific:

- Rapid Urbanization and Growing Middle Class: Increasing urbanization is leading to a surge in demand for packaged foods, ready-to-eat meals, and beverages, all of which rely heavily on single-use packaging for convenience and safety. The expanding middle class with higher disposable incomes is willing to pay for these convenience-driven products.

- Growth of the Food Service Industry: The proliferation of Quick Service Restaurants (QSRs) and full-service restaurants, coupled with the booming food delivery sector, is a significant catalyst for single-use packaging consumption. Quick Service Restaurants in the Asia Pacific are estimated to account for XX% of the total single-use packaging demand in the region by 2025.

- E-commerce Expansion: The exponential growth of e-commerce in Asia Pacific necessitates robust and protective packaging to ensure product integrity during transit, further boosting the demand for various single-use packaging formats.

- Government Initiatives and Infrastructure Development: While some governments are implementing regulations to curb plastic waste, there's also investment in infrastructure that supports the production and distribution of packaging materials.

Dominant Product Types and Materials:

Within the Single Use Packaging Market, Polyethylene Terephthalate (PET) bottles continue to hold a significant share due to their versatility, durability, and cost-effectiveness in packaging beverages. However, Polyethylene (PE) based products, particularly films and containers for food and consumer goods, are also witnessing substantial demand. Clamshells and trays are pivotal product types, especially for the food service and retail sectors, providing secure containment and display.

Dominant End-Users:

- Quick Service Restaurants (QSRs): The fast-paced nature of QSRs necessitates efficient and hygienic single-use packaging for meals, drinks, and sides. The market size for single-use packaging in QSRs in Asia Pacific is projected to reach [Insert specific market size value in Million USD] Million Units by 2025.

- Retail: Packaged food items, fresh produce, and consumer goods in retail environments widely utilize single-use packaging for preservation, branding, and consumer convenience.

- Institutional End-users: Hospitals, schools, and corporate canteens are increasingly adopting single-use packaging for hygiene and convenience.

The market size for single-use packaging in the Asia Pacific region alone is estimated to reach [Insert specific market size value in Million USD] Million Units by 2025, representing a substantial portion of the global market. This dominance is projected to continue, driven by sustained economic growth and evolving consumer preferences. The market for Polyethylene Terephthalate (PET) in this region is estimated to be [Insert specific market size value in Million USD] Million Units by 2025.

Single Use Packaging Market Product Landscape

The Single Use Packaging Market is witnessing rapid innovation in its product landscape, with a strong emphasis on enhancing functionality, sustainability, and consumer appeal. Product developments are centered around improving barrier properties for extended shelf life, reducing material usage for lighter and more cost-effective solutions, and incorporating advanced designs for ease of use and enhanced consumer experience. For instance, innovative clamshells are now designed with enhanced venting systems to maintain food freshness, while trays are being engineered with improved stacking capabilities to optimize logistics. The adoption of novel materials like Polylactic Acid (PLA) for compostable food containers and thermoformed PET for rigid packaging applications is expanding the product portfolio. Performance metrics such as puncture resistance, heat seal strength, and transparency are continuously being optimized to meet stringent industry standards and evolving consumer demands for safe, convenient, and environmentally conscious packaging.

Key Drivers, Barriers & Challenges in Single Use Packaging Market

Key Drivers:

- Convenience and Hygiene: The paramount importance of convenience, especially in the food service and delivery sectors, alongside the increasing focus on hygiene, remains a primary driver for single-use packaging.

- Growing Food Service and E-commerce: The booming food delivery market and the relentless expansion of e-commerce channels continue to fuel the demand for disposable packaging solutions.

- Material Innovation: Advancements in sustainable materials like PLA and advanced PET formulations are expanding the applicability and environmental credentials of single-use packaging.

- Cost-Effectiveness: For many applications, single-use packaging offers a more economical solution compared to reusable alternatives, especially when considering cleaning and maintenance costs for the latter.

Barriers & Challenges:

- Environmental Concerns and Regulations: Growing public awareness and stringent governmental regulations regarding plastic waste and pollution pose a significant challenge, leading to bans and restrictions on certain single-use plastic items.

- Supply Chain Disruptions: Fluctuations in raw material prices, geopolitical instability, and logistics complexities can impact the availability and cost of production for single-use packaging.

- Competition from Sustainable Alternatives: The increasing availability and adoption of reusable and truly compostable packaging alternatives present a competitive threat.

- Infrastructure for Recycling and Disposal: Inadequate or inconsistent recycling and composting infrastructure in many regions can hinder the effective end-of-life management of single-use packaging, leading to environmental concerns.

Emerging Opportunities in Single Use Packaging Market

Emerging opportunities in the Single Use Packaging Market are largely centered around the development and adoption of sustainable and biodegradable materials. The demand for compostable and plant-based packaging, such as those made from Polylactic Acid (PLA) and other bioplastics, is rapidly increasing, driven by consumer preference and regulatory mandates. Innovations in smart packaging, which incorporates features like temperature indicators and anti-counterfeiting technologies, present a significant growth avenue, particularly in the pharmaceutical and high-value food segments. Furthermore, circular economy models, focusing on designing packaging for enhanced recyclability and incorporating recycled content, are opening up new market niches and collaborations within the industry. The untapped potential in emerging economies for convenient and hygienic packaging solutions also offers considerable growth prospects.

Growth Accelerators in the Single Use Packaging Market Industry

Several catalysts are propelling the long-term growth of the Single Use Packaging Market. Technological breakthroughs in material science, enabling the creation of lighter, stronger, and more sustainable packaging alternatives, are a key accelerator. Strategic partnerships between packaging manufacturers and food service providers are crucial for co-developing tailored solutions that meet evolving consumer demands. Furthermore, market expansion strategies by key players into high-growth regions, particularly in Asia Pacific and Latin America, are driving overall market expansion. The increasing focus on food safety and the need for extended shelf life for perishable goods also contribute to sustained demand for advanced single-use packaging solutions.

Key Players Shaping the Single Use Packaging Market Market

- Graphic Packaging International Inc

- Georgia-Pacific LLC

- Ardagh Group S A

- Pactiv LLC

- Novolex

Notable Milestones in Single Use Packaging Market Sector

- 2023 Q4: Launch of new compostable food trays by Novolex, utilizing advanced PLA blends to meet stringent environmental standards.

- 2024 Q1: Graphic Packaging International Inc. announces a significant investment in expanding its recycled content manufacturing capabilities to meet growing demand.

- 2024 Q2: Ardagh Group S.A. acquires a specialized plastic packaging manufacturer to enhance its portfolio in the beverage and food container segments.

- 2024 Q3: Pactiv LLC introduces an innovative range of lightweight PET bottles with improved recyclability features.

- 2024 Q4: Georgia-Pacific LLC patents a new barrier coating technology for paper-based packaging, offering enhanced moisture and grease resistance.

In-Depth Single Use Packaging Market Market Outlook

The future outlook for the Single Use Packaging Market is characterized by sustained growth, driven by a blend of evolving consumer needs and innovative solutions. Growth accelerators such as advancements in sustainable materials, the expanding global food service industry, and the ever-present demand for convenience will continue to shape market dynamics. Strategic opportunities lie in tapping into the vast potential of emerging markets, investing in R&D for biodegradable and compostable alternatives, and developing circular economy models that prioritize recyclability and the use of recycled content. The market is poised to witness further consolidation and strategic collaborations as companies strive to adapt to an increasingly environmentally conscious and technologically advanced landscape, ensuring a robust and dynamic future for single-use packaging solutions.

Single Use Packaging Market Segmentation

-

1. Material

- 1.1. Polylactic Acid (PLA)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polyethylene (PE)

- 1.4. Other Types of Materials

-

2. Product Type

- 2.1. Bottles

- 2.2. Clamshells

- 2.3. Trays, Cups & Lids

- 2.4. Other Product Types

-

3. End-User

- 3.1. Quick Service Restaurants

- 3.2. Full Service Restaurants

- 3.3. Institutional

- 3.4. Retail

- 3.5. Other End-users

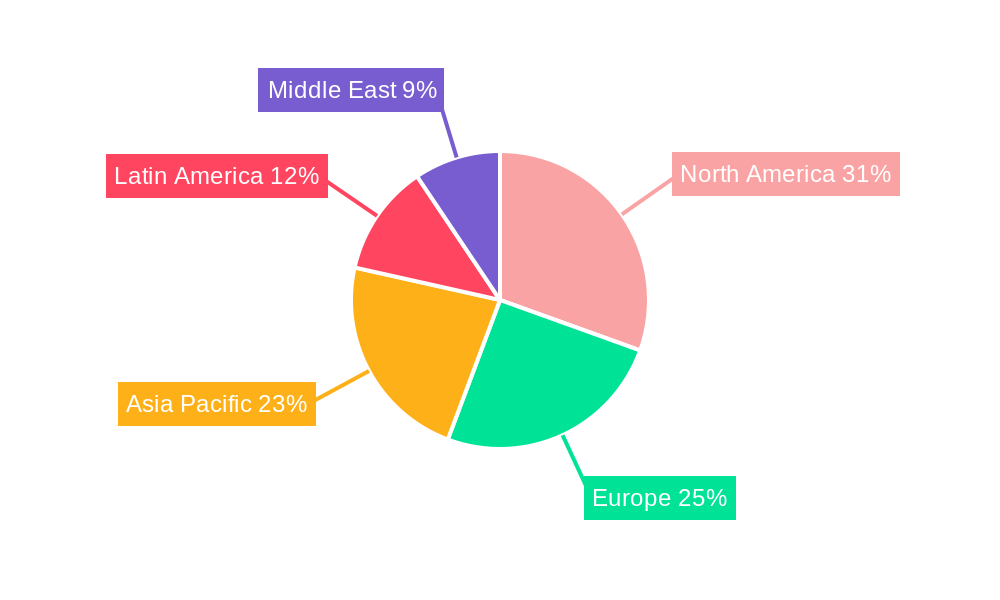

Single Use Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Single Use Packaging Market Regional Market Share

Geographic Coverage of Single Use Packaging Market

Single Use Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Food and Beverage Segment to Witness Significant Growth; Growing Number of QSR Aids to Market Growth

- 3.3. Market Restrains

- 3.3.1. Various Regulations Pertaining to Plastic Usage

- 3.4. Market Trends

- 3.4.1. PET is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Single Use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polylactic Acid (PLA)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polyethylene (PE)

- 5.1.4. Other Types of Materials

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles

- 5.2.2. Clamshells

- 5.2.3. Trays, Cups & Lids

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Quick Service Restaurants

- 5.3.2. Full Service Restaurants

- 5.3.3. Institutional

- 5.3.4. Retail

- 5.3.5. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Single Use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Polylactic Acid (PLA)

- 6.1.2. Polyethylene Terephthalate (PET)

- 6.1.3. Polyethylene (PE)

- 6.1.4. Other Types of Materials

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bottles

- 6.2.2. Clamshells

- 6.2.3. Trays, Cups & Lids

- 6.2.4. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Quick Service Restaurants

- 6.3.2. Full Service Restaurants

- 6.3.3. Institutional

- 6.3.4. Retail

- 6.3.5. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Single Use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Polylactic Acid (PLA)

- 7.1.2. Polyethylene Terephthalate (PET)

- 7.1.3. Polyethylene (PE)

- 7.1.4. Other Types of Materials

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bottles

- 7.2.2. Clamshells

- 7.2.3. Trays, Cups & Lids

- 7.2.4. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Quick Service Restaurants

- 7.3.2. Full Service Restaurants

- 7.3.3. Institutional

- 7.3.4. Retail

- 7.3.5. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Single Use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Polylactic Acid (PLA)

- 8.1.2. Polyethylene Terephthalate (PET)

- 8.1.3. Polyethylene (PE)

- 8.1.4. Other Types of Materials

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Bottles

- 8.2.2. Clamshells

- 8.2.3. Trays, Cups & Lids

- 8.2.4. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Quick Service Restaurants

- 8.3.2. Full Service Restaurants

- 8.3.3. Institutional

- 8.3.4. Retail

- 8.3.5. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Single Use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Polylactic Acid (PLA)

- 9.1.2. Polyethylene Terephthalate (PET)

- 9.1.3. Polyethylene (PE)

- 9.1.4. Other Types of Materials

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Bottles

- 9.2.2. Clamshells

- 9.2.3. Trays, Cups & Lids

- 9.2.4. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Quick Service Restaurants

- 9.3.2. Full Service Restaurants

- 9.3.3. Institutional

- 9.3.4. Retail

- 9.3.5. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East Single Use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Polylactic Acid (PLA)

- 10.1.2. Polyethylene Terephthalate (PET)

- 10.1.3. Polyethylene (PE)

- 10.1.4. Other Types of Materials

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Bottles

- 10.2.2. Clamshells

- 10.2.3. Trays, Cups & Lids

- 10.2.4. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Quick Service Restaurants

- 10.3.2. Full Service Restaurants

- 10.3.3. Institutional

- 10.3.4. Retail

- 10.3.5. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Graphic Packaging International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Georgia-Pacific LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ardagh Group S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pactiv LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Novolex

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Graphic Packaging International Inc

List of Figures

- Figure 1: Global Single Use Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Single Use Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Single Use Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Single Use Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Single Use Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Single Use Packaging Market Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America Single Use Packaging Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Single Use Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Single Use Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Single Use Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 11: Europe Single Use Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Single Use Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 13: Europe Single Use Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Single Use Packaging Market Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Single Use Packaging Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Single Use Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Single Use Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Single Use Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Asia Pacific Single Use Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Pacific Single Use Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Asia Pacific Single Use Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Pacific Single Use Packaging Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Single Use Packaging Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Single Use Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Single Use Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Single Use Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 27: Latin America Single Use Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Latin America Single Use Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Latin America Single Use Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Latin America Single Use Packaging Market Revenue (Million), by End-User 2025 & 2033

- Figure 31: Latin America Single Use Packaging Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Latin America Single Use Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Single Use Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Single Use Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 35: Middle East Single Use Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East Single Use Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Middle East Single Use Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Middle East Single Use Packaging Market Revenue (Million), by End-User 2025 & 2033

- Figure 39: Middle East Single Use Packaging Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East Single Use Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Single Use Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Single Use Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Single Use Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Single Use Packaging Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Single Use Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Single Use Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Single Use Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Global Single Use Packaging Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Single Use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Single Use Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Global Single Use Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Single Use Packaging Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Single Use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Single Use Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 14: Global Single Use Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 15: Global Single Use Packaging Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 16: Global Single Use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Single Use Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 18: Global Single Use Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 19: Global Single Use Packaging Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Global Single Use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Single Use Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 22: Global Single Use Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Global Single Use Packaging Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 24: Global Single Use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Single Use Packaging Market?

The projected CAGR is approximately 3.71%.

2. Which companies are prominent players in the Single Use Packaging Market?

Key companies in the market include Graphic Packaging International Inc, Georgia-Pacific LLC, Ardagh Group S A, Pactiv LLC, Novolex.

3. What are the main segments of the Single Use Packaging Market?

The market segments include Material, Product Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Food and Beverage Segment to Witness Significant Growth; Growing Number of QSR Aids to Market Growth.

6. What are the notable trends driving market growth?

PET is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Various Regulations Pertaining to Plastic Usage.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Single Use Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Single Use Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Single Use Packaging Market?

To stay informed about further developments, trends, and reports in the Single Use Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence