Key Insights

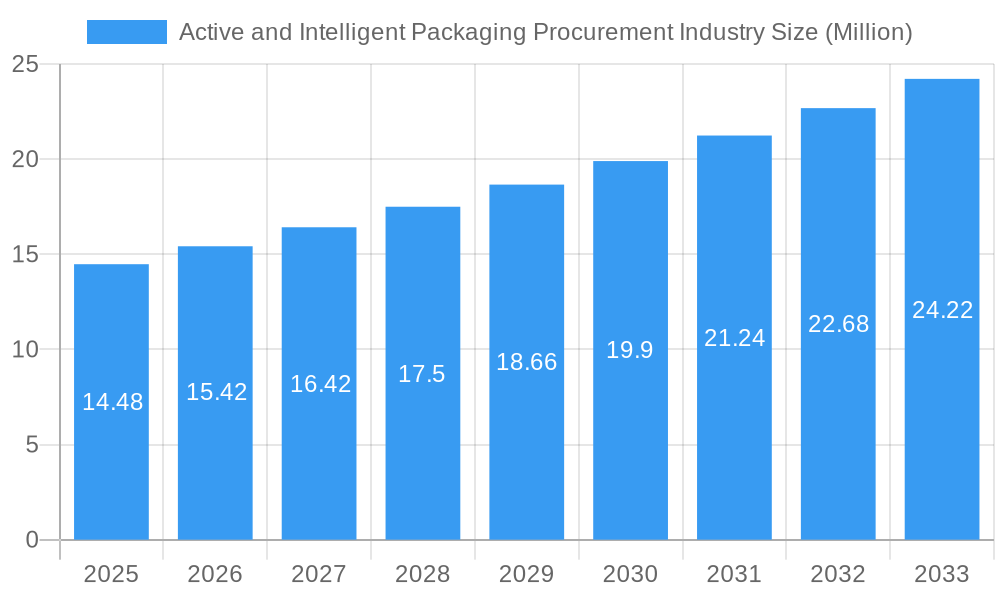

The global Active and Intelligent Packaging market is poised for substantial growth, projected to reach a market size of $14.48 million by 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 6.55% forecast through 2033. The increasing demand for enhanced food safety, extended shelf life, and improved product integrity across various end-user industries is a primary catalyst. Active packaging technologies, such as gas scavengers/emitters and moisture scavengers, are gaining traction for their ability to actively interact with the product and its environment, preserving freshness and reducing spoilage. Simultaneously, intelligent packaging solutions, incorporating features like coding and markings, RFID & NFC antennas, and sensors, are becoming indispensable for supply chain traceability, authentication, and consumer engagement. The food and beverage sectors are leading adoption due to stringent quality control requirements and a growing consumer awareness of product freshness.

Active and Intelligent Packaging Procurement Industry Market Size (In Million)

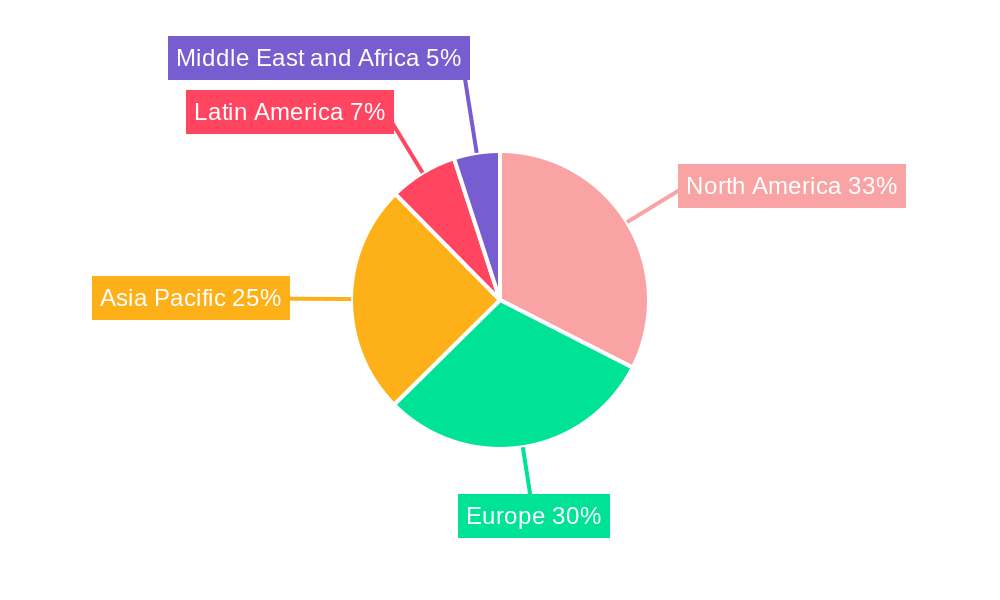

The market's trajectory is further bolstered by evolving consumer preferences for sustainable and high-quality products, coupled with advancements in material science and digital integration. While the significant market size and positive growth forecast highlight immense opportunities, potential restraints such as high initial investment costs for advanced technologies and a lack of widespread standardization could present challenges. However, the increasing focus on reducing food waste, the rise of e-commerce demanding robust packaging for transit, and the need for enhanced pharmaceutical safety are expected to outweigh these limitations. Geographically, North America and Europe are anticipated to remain dominant regions, with Asia Pacific exhibiting the fastest growth potential due to its expanding manufacturing base and increasing disposable incomes. Key players are investing heavily in research and development to innovate and meet the diverse needs of industries seeking to optimize their packaging strategies for efficiency, safety, and consumer appeal.

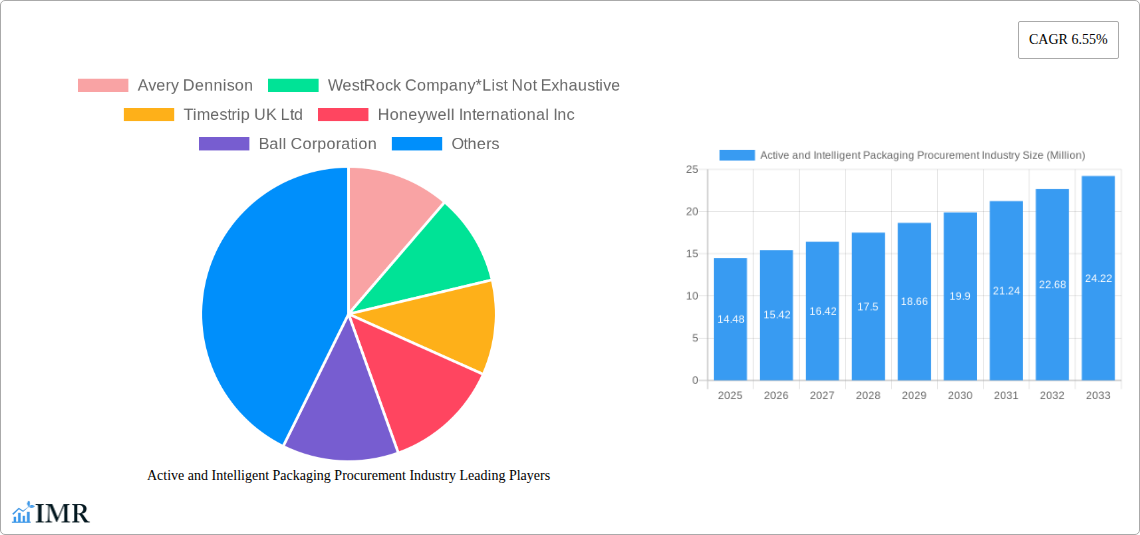

Active and Intelligent Packaging Procurement Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Active and Intelligent Packaging Procurement Industry, covering market dynamics, growth trajectories, regional dominance, product innovations, key drivers, barriers, opportunities, and the competitive landscape. With a focus on smart packaging solutions, food packaging innovation, pharmaceutical packaging safety, and RFID packaging integration, this report leverages high-traffic keywords and presents data in millions of units for clarity. It provides actionable insights for stakeholders seeking to navigate this rapidly evolving sector.

Active and Intelligent Packaging Procurement Industry Market Dynamics & Structure

The Active and Intelligent Packaging Procurement Industry exhibits a dynamic market structure characterized by increasing technological integration and a growing emphasis on product integrity and consumer engagement. Market concentration is moderate, with key players investing heavily in R&D to develop innovative solutions that address evolving consumer and regulatory demands. Technological innovation drivers include the miniaturization of sensors, advancements in embedded electronics, and the development of sustainable active materials. Regulatory frameworks, particularly concerning food safety and traceability, are compelling wider adoption of intelligent packaging. Competitive product substitutes, such as traditional packaging methods, are increasingly being challenged by the enhanced functionality and value proposition offered by active and intelligent solutions. End-user demographics are shifting, with a growing consumer preference for products with extended shelf life and transparent supply chain information. Mergers and acquisitions (M&A) are a notable trend, as larger corporations seek to acquire innovative technologies and expand their market reach. For instance, the period saw a surge in M&A activity aimed at consolidating expertise in areas like RFID integration and advanced barrier technologies. Innovation barriers include the high initial investment costs for sophisticated active and intelligent packaging systems and the need for standardization across different industries and supply chains.

- Market Concentration: Moderate, with strategic partnerships and acquisitions driving consolidation.

- Technological Innovation: Driven by advancements in sensors, connectivity (RFID/NFC), and material science for active components.

- Regulatory Influence: Increasing focus on food safety, anti-counterfeiting, and sustainability mandates.

- End-User Demographics: Growing demand for enhanced product freshness, extended shelf life, and supply chain transparency.

- M&A Trends: Active pursuit of innovative technologies and market expansion.

Active and Intelligent Packaging Procurement Industry Growth Trends & Insights

The Active and Intelligent Packaging Procurement Industry is poised for significant growth, driven by escalating consumer demand for enhanced product safety, extended shelf-life, and improved traceability. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) from its base year of 2025, reflecting a substantial increase in adoption rates across various end-user industries. Technological disruptions, including the integration of IoT capabilities and advanced sensing technologies, are revolutionizing packaging functionalities, enabling real-time monitoring of product conditions. Consumer behavior shifts, such as a heightened awareness of food waste and a demand for provenance information, are further propelling the adoption of smart and active packaging. The penetration of these advanced packaging solutions is expected to rise considerably, particularly in sectors like fresh food packaging, pharmaceutical cold chain logistics, and high-value consumer goods. The integration of digital technologies, such as QR codes and NFC tags, facilitates enhanced consumer engagement and provides valuable data analytics for manufacturers. The forecast period of 2025–2033 is anticipated to be a pivotal phase for market expansion, with innovations in areas like ethylene scavengers for produce, oxygen absorbers for packaged foods, and temperature indicators for sensitive pharmaceuticals becoming mainstream. The historical period of 2019–2024 has laid the groundwork for this accelerated growth, characterized by early adoption and incremental technological advancements. The estimated market size for 2025 is expected to be substantial, with projected growth reaching significant figures by 2033.

Dominant Regions, Countries, or Segments in Active and Intelligent Packaging Procurement Industry

North America and Europe are currently leading the charge in the Active and Intelligent Packaging Procurement Industry, driven by strong consumer demand for premium and safe products, coupled with advanced technological infrastructure and supportive regulatory environments. Within the Active Packaging Market, Food emerges as the dominant end-user industry, accounting for a substantial share, with gas scavengers/emitters and moisture scavengers being critical components in preserving freshness and extending shelf life for a wide array of perishable goods. The Beverages sector also shows significant adoption, particularly for products requiring extended shelf life and tamper evidence.

In the Intelligent Packaging segment, the Food and Pharmaceuticals industries are spearheading growth. The Food industry leverages intelligent packaging for enhanced traceability, quality monitoring, and consumer engagement through QR codes and RFID. The Pharmaceuticals sector prioritizes sensors and output devices for critical cold chain monitoring, ensuring drug efficacy and patient safety, alongside coding and markings for anti-counterfeiting. Antenna (RFID & NFC) technology is experiencing rapid expansion across both sectors for seamless supply chain management and product authentication.

Key drivers of dominance in these regions include:

- Economic Policies: Government initiatives promoting food safety standards and technological adoption.

- Infrastructure: Well-established logistics networks and a high penetration of digital technologies.

- Consumer Awareness: A highly informed consumer base demanding transparency and quality.

- Research & Development: Significant investment in innovation by leading companies like Amcor PLC and Sealed Air Corp.

The Food end-user industry, across both active and intelligent packaging categories, is expected to maintain its leading position due to the sheer volume of products requiring preservation and traceability. The Pharmaceuticals sector, however, is projected to exhibit the highest growth rate due to stringent regulatory requirements and the critical need for product integrity. Countries like the United States, Germany, and the United Kingdom are at the forefront of adoption, with a growing emphasis on sustainable packaging solutions that integrate active and intelligent functionalities. The market share within active packaging is heavily influenced by the demand for shelf-life extension solutions, while intelligent packaging's share is dictated by the need for traceability and counterfeit prevention.

Active and Intelligent Packaging Procurement Industry Product Landscape

The product landscape of the Active and Intelligent Packaging Procurement Industry is characterized by continuous innovation in material science and embedded technology. Key product innovations include advanced gas scavengers that precisely control atmospheric conditions within packaging, moisture scavengers that prevent spoilage and maintain product texture, and microwave susceptors that enable even heating of food products. In intelligent packaging, advancements are seen in the development of miniaturized RFID and NFC antennas for seamless data transfer, sophisticated sensors for real-time monitoring of temperature, humidity, and gas composition, and dynamic coding and marking systems for enhanced traceability and anti-counterfeiting. These products offer unique selling propositions such as extended product shelf life, reduced food waste, improved product quality, and enhanced consumer trust. Technological advancements are enabling the integration of these functionalities into diverse packaging formats, from flexible pouches to rigid containers, catering to a wide range of applications across the food, beverage, pharmaceutical, and logistics industries.

Key Drivers, Barriers & Challenges in Active and Intelligent Packaging Procurement Industry

The Active and Intelligent Packaging Procurement Industry is propelled by several key drivers. The increasing global demand for food safety and quality, coupled with a growing awareness of food waste, is a primary impetus. Technological advancements in sensing and communication technologies are making these solutions more accessible and effective. Furthermore, stringent regulatory requirements for product traceability and anti-counterfeiting, especially in the pharmaceutical sector, are significant drivers. The growing consumer preference for products with longer shelf lives and transparent supply chain information also contributes to market growth.

However, the industry faces notable barriers and challenges. High initial investment costs for implementing sophisticated active and intelligent packaging systems can be a deterrent for smaller businesses. The complexity of integration into existing supply chains and the need for standardization across different platforms pose significant hurdles. Supply chain disruptions and the availability of raw materials for specialized active components can also impact production. Furthermore, consumer education and acceptance of new packaging technologies require continuous effort. Competitive pressures from traditional packaging solutions, though diminishing, still present a challenge.

Emerging Opportunities in Active and Intelligent Packaging Procurement Industry

Emerging opportunities in the Active and Intelligent Packaging Procurement Industry lie in the expansion of applications beyond traditional food and pharmaceutical sectors. The logistics industry presents a significant untapped market for intelligent packaging to enhance shipment tracking, condition monitoring, and inventory management. Furthermore, the development of more sustainable and biodegradable active packaging materials aligns with growing environmental concerns and regulatory pressures. The integration of AI and machine learning with intelligent packaging data analytics offers opportunities for predictive spoiling, personalized product recommendations, and optimized supply chain management. The increasing demand for personalized nutrition and healthcare products also opens avenues for specialized active and intelligent packaging solutions.

Growth Accelerators in the Active and Intelligent Packaging Procurement Industry Industry

Several growth accelerators are poised to fuel the long-term expansion of the Active and Intelligent Packaging Procurement Industry. Technological breakthroughs in the miniaturization and cost reduction of sensors and microelectronics will drive wider adoption. Strategic partnerships between packaging manufacturers, technology providers, and end-user industries are crucial for co-creating innovative solutions and streamlining integration. Market expansion into emerging economies, where demand for enhanced product safety and quality is rising, represents a significant growth avenue. The development of smart packaging solutions that offer enhanced consumer engagement, such as interactive labels and personalized information delivery, will further accelerate market penetration. Continued research into novel active materials with improved performance and sustainability profiles will also be a key accelerator.

Key Players Shaping the Active and Intelligent Packaging Procurement Industry Market

- Avery Dennison

- WestRock Company

- Timestrip UK Ltd

- Honeywell International Inc

- Ball Corporation

- Desiccare Inc

- Crown Holdings Inc

- Coveris Holding SA

- Amcor PLC

- Sealed Air Corp

- Graphic Packaging International LLC

Notable Milestones in Active and Intelligent Packaging Procurement Industry Sector

- July 2022: Timestrip UK Ltd introduced Timestrip Neo, a platform for single-use electronic indicators suitable for pack-level monitoring with both time and multiple temperature settings. This innovation is particularly beneficial for protecting perishable foodstuffs that deteriorate faster at higher temperatures.

- May 2022: Coveris launched innovative MonoFlexBE pouches, utilizing 1g less plastic per pack for an easy-to-recycle solution for Iceland's grated cheese. This initiative supported the retailer's commitment to becoming the UK's first plastic-neutral supermarket, showcasing significant plastic weight savings.

- April 2022: Sealed Air introduced PRISTIQ, a digital packaging brand offering a portfolio of solutions including design services, digital printing, and smart packaging. This move aimed to eliminate waste and excess packaging while enhancing products and customer engagement.

In-Depth Active and Intelligent Packaging Procurement Industry Market Outlook

The Active and Intelligent Packaging Procurement Industry is set for robust growth, with future market potential driven by an increasing emphasis on product integrity, supply chain transparency, and consumer-centric solutions. Strategic opportunities abound in the development of integrated packaging systems that combine active preservation with intelligent monitoring capabilities. The continued advancement of sustainable materials and digital technologies will pave the way for innovative applications across diverse sectors. Addressing the challenges of cost and standardization will unlock new market segments, while fostering collaboration will accelerate the adoption of these transformative packaging solutions, ultimately leading to a more efficient, safe, and sustainable global supply chain.

Active and Intelligent Packaging Procurement Industry Segmentation

-

1. Active Packaging Market

-

1.1. By Type

- 1.1.1. Gas Scavengers/emitters

- 1.1.2. Moisture Scavengers

- 1.1.3. Microwave Susceptors

- 1.1.4. Other Active Packaging Technologies

-

1.2. By End-user Industry

- 1.2.1. Food

- 1.2.2. Beverages

- 1.2.3. Other End-user Industries

-

1.1. By Type

-

2. Intelligent Packaging

-

2.1. By Type

- 2.1.1. Coding And Markings

- 2.1.2. Antenna (RFID & NFC)

- 2.1.3. Sensors and Output Devices

- 2.1.4. Other Intelligent Packaging Technologies

-

2.2. By End-user Industry

- 2.2.1. Food

- 2.2.2. Beverages

- 2.2.3. Pharmaceuticals

- 2.2.4. Industrial

- 2.2.5. Logistics

- 2.2.6. Other End-user Industries

-

2.1. By Type

Active and Intelligent Packaging Procurement Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Active and Intelligent Packaging Procurement Industry Regional Market Share

Geographic Coverage of Active and Intelligent Packaging Procurement Industry

Active and Intelligent Packaging Procurement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Longer Shelf Life and Changing Consumer Lifestyle; Demand For Longer-lasting and Sustainable Packaging Products; Increasing Demand For Security and Tracking Solutions

- 3.3. Market Restrains

- 3.3.1. Issues With the Effects of Packaging Materials on the Human Body; High Initial Capital Investment and Installation Costs

- 3.4. Market Trends

- 3.4.1. Increasing Demand For Longer-lasting And Sustainable Packaging Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Active and Intelligent Packaging Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 5.1.1. By Type

- 5.1.1.1. Gas Scavengers/emitters

- 5.1.1.2. Moisture Scavengers

- 5.1.1.3. Microwave Susceptors

- 5.1.1.4. Other Active Packaging Technologies

- 5.1.2. By End-user Industry

- 5.1.2.1. Food

- 5.1.2.2. Beverages

- 5.1.2.3. Other End-user Industries

- 5.1.1. By Type

- 5.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 5.2.1. By Type

- 5.2.1.1. Coding And Markings

- 5.2.1.2. Antenna (RFID & NFC)

- 5.2.1.3. Sensors and Output Devices

- 5.2.1.4. Other Intelligent Packaging Technologies

- 5.2.2. By End-user Industry

- 5.2.2.1. Food

- 5.2.2.2. Beverages

- 5.2.2.3. Pharmaceuticals

- 5.2.2.4. Industrial

- 5.2.2.5. Logistics

- 5.2.2.6. Other End-user Industries

- 5.2.1. By Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 6. North America Active and Intelligent Packaging Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 6.1.1. By Type

- 6.1.1.1. Gas Scavengers/emitters

- 6.1.1.2. Moisture Scavengers

- 6.1.1.3. Microwave Susceptors

- 6.1.1.4. Other Active Packaging Technologies

- 6.1.2. By End-user Industry

- 6.1.2.1. Food

- 6.1.2.2. Beverages

- 6.1.2.3. Other End-user Industries

- 6.1.1. By Type

- 6.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 6.2.1. By Type

- 6.2.1.1. Coding And Markings

- 6.2.1.2. Antenna (RFID & NFC)

- 6.2.1.3. Sensors and Output Devices

- 6.2.1.4. Other Intelligent Packaging Technologies

- 6.2.2. By End-user Industry

- 6.2.2.1. Food

- 6.2.2.2. Beverages

- 6.2.2.3. Pharmaceuticals

- 6.2.2.4. Industrial

- 6.2.2.5. Logistics

- 6.2.2.6. Other End-user Industries

- 6.2.1. By Type

- 6.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 7. Europe Active and Intelligent Packaging Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 7.1.1. By Type

- 7.1.1.1. Gas Scavengers/emitters

- 7.1.1.2. Moisture Scavengers

- 7.1.1.3. Microwave Susceptors

- 7.1.1.4. Other Active Packaging Technologies

- 7.1.2. By End-user Industry

- 7.1.2.1. Food

- 7.1.2.2. Beverages

- 7.1.2.3. Other End-user Industries

- 7.1.1. By Type

- 7.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 7.2.1. By Type

- 7.2.1.1. Coding And Markings

- 7.2.1.2. Antenna (RFID & NFC)

- 7.2.1.3. Sensors and Output Devices

- 7.2.1.4. Other Intelligent Packaging Technologies

- 7.2.2. By End-user Industry

- 7.2.2.1. Food

- 7.2.2.2. Beverages

- 7.2.2.3. Pharmaceuticals

- 7.2.2.4. Industrial

- 7.2.2.5. Logistics

- 7.2.2.6. Other End-user Industries

- 7.2.1. By Type

- 7.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 8. Asia Pacific Active and Intelligent Packaging Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 8.1.1. By Type

- 8.1.1.1. Gas Scavengers/emitters

- 8.1.1.2. Moisture Scavengers

- 8.1.1.3. Microwave Susceptors

- 8.1.1.4. Other Active Packaging Technologies

- 8.1.2. By End-user Industry

- 8.1.2.1. Food

- 8.1.2.2. Beverages

- 8.1.2.3. Other End-user Industries

- 8.1.1. By Type

- 8.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 8.2.1. By Type

- 8.2.1.1. Coding And Markings

- 8.2.1.2. Antenna (RFID & NFC)

- 8.2.1.3. Sensors and Output Devices

- 8.2.1.4. Other Intelligent Packaging Technologies

- 8.2.2. By End-user Industry

- 8.2.2.1. Food

- 8.2.2.2. Beverages

- 8.2.2.3. Pharmaceuticals

- 8.2.2.4. Industrial

- 8.2.2.5. Logistics

- 8.2.2.6. Other End-user Industries

- 8.2.1. By Type

- 8.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 9. Latin America Active and Intelligent Packaging Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 9.1.1. By Type

- 9.1.1.1. Gas Scavengers/emitters

- 9.1.1.2. Moisture Scavengers

- 9.1.1.3. Microwave Susceptors

- 9.1.1.4. Other Active Packaging Technologies

- 9.1.2. By End-user Industry

- 9.1.2.1. Food

- 9.1.2.2. Beverages

- 9.1.2.3. Other End-user Industries

- 9.1.1. By Type

- 9.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 9.2.1. By Type

- 9.2.1.1. Coding And Markings

- 9.2.1.2. Antenna (RFID & NFC)

- 9.2.1.3. Sensors and Output Devices

- 9.2.1.4. Other Intelligent Packaging Technologies

- 9.2.2. By End-user Industry

- 9.2.2.1. Food

- 9.2.2.2. Beverages

- 9.2.2.3. Pharmaceuticals

- 9.2.2.4. Industrial

- 9.2.2.5. Logistics

- 9.2.2.6. Other End-user Industries

- 9.2.1. By Type

- 9.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 10. Middle East and Africa Active and Intelligent Packaging Procurement Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 10.1.1. By Type

- 10.1.1.1. Gas Scavengers/emitters

- 10.1.1.2. Moisture Scavengers

- 10.1.1.3. Microwave Susceptors

- 10.1.1.4. Other Active Packaging Technologies

- 10.1.2. By End-user Industry

- 10.1.2.1. Food

- 10.1.2.2. Beverages

- 10.1.2.3. Other End-user Industries

- 10.1.1. By Type

- 10.2. Market Analysis, Insights and Forecast - by Intelligent Packaging

- 10.2.1. By Type

- 10.2.1.1. Coding And Markings

- 10.2.1.2. Antenna (RFID & NFC)

- 10.2.1.3. Sensors and Output Devices

- 10.2.1.4. Other Intelligent Packaging Technologies

- 10.2.2. By End-user Industry

- 10.2.2.1. Food

- 10.2.2.2. Beverages

- 10.2.2.3. Pharmaceuticals

- 10.2.2.4. Industrial

- 10.2.2.5. Logistics

- 10.2.2.6. Other End-user Industries

- 10.2.1. By Type

- 10.1. Market Analysis, Insights and Forecast - by Active Packaging Market

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Avery Dennison

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WestRock Company*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Timestrip UK Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ball Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Desiccare Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Crown Holdings Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Coveris Holding SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amcor PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sealed Air Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Graphic Packaging International LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Avery Dennison

List of Figures

- Figure 1: Global Active and Intelligent Packaging Procurement Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Active and Intelligent Packaging Procurement Industry Revenue (Million), by Active Packaging Market 2025 & 2033

- Figure 3: North America Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Active Packaging Market 2025 & 2033

- Figure 4: North America Active and Intelligent Packaging Procurement Industry Revenue (Million), by Intelligent Packaging 2025 & 2033

- Figure 5: North America Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 6: North America Active and Intelligent Packaging Procurement Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Active and Intelligent Packaging Procurement Industry Revenue (Million), by Active Packaging Market 2025 & 2033

- Figure 9: Europe Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Active Packaging Market 2025 & 2033

- Figure 10: Europe Active and Intelligent Packaging Procurement Industry Revenue (Million), by Intelligent Packaging 2025 & 2033

- Figure 11: Europe Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 12: Europe Active and Intelligent Packaging Procurement Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Active and Intelligent Packaging Procurement Industry Revenue (Million), by Active Packaging Market 2025 & 2033

- Figure 15: Asia Pacific Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Active Packaging Market 2025 & 2033

- Figure 16: Asia Pacific Active and Intelligent Packaging Procurement Industry Revenue (Million), by Intelligent Packaging 2025 & 2033

- Figure 17: Asia Pacific Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 18: Asia Pacific Active and Intelligent Packaging Procurement Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Active and Intelligent Packaging Procurement Industry Revenue (Million), by Active Packaging Market 2025 & 2033

- Figure 21: Latin America Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Active Packaging Market 2025 & 2033

- Figure 22: Latin America Active and Intelligent Packaging Procurement Industry Revenue (Million), by Intelligent Packaging 2025 & 2033

- Figure 23: Latin America Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 24: Latin America Active and Intelligent Packaging Procurement Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Active and Intelligent Packaging Procurement Industry Revenue (Million), by Active Packaging Market 2025 & 2033

- Figure 27: Middle East and Africa Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Active Packaging Market 2025 & 2033

- Figure 28: Middle East and Africa Active and Intelligent Packaging Procurement Industry Revenue (Million), by Intelligent Packaging 2025 & 2033

- Figure 29: Middle East and Africa Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Intelligent Packaging 2025 & 2033

- Figure 30: Middle East and Africa Active and Intelligent Packaging Procurement Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Active and Intelligent Packaging Procurement Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Active Packaging Market 2020 & 2033

- Table 2: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Intelligent Packaging 2020 & 2033

- Table 3: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Active Packaging Market 2020 & 2033

- Table 5: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Intelligent Packaging 2020 & 2033

- Table 6: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Active Packaging Market 2020 & 2033

- Table 10: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Intelligent Packaging 2020 & 2033

- Table 11: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Active Packaging Market 2020 & 2033

- Table 18: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Intelligent Packaging 2020 & 2033

- Table 19: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Active and Intelligent Packaging Procurement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Active Packaging Market 2020 & 2033

- Table 25: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Intelligent Packaging 2020 & 2033

- Table 26: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Active Packaging Market 2020 & 2033

- Table 28: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Intelligent Packaging 2020 & 2033

- Table 29: Global Active and Intelligent Packaging Procurement Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Active and Intelligent Packaging Procurement Industry?

The projected CAGR is approximately 6.55%.

2. Which companies are prominent players in the Active and Intelligent Packaging Procurement Industry?

Key companies in the market include Avery Dennison, WestRock Company*List Not Exhaustive, Timestrip UK Ltd, Honeywell International Inc, Ball Corporation, Desiccare Inc, Crown Holdings Inc, Coveris Holding SA, Amcor PLC, Sealed Air Corp, Graphic Packaging International LLC.

3. What are the main segments of the Active and Intelligent Packaging Procurement Industry?

The market segments include Active Packaging Market, Intelligent Packaging.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Longer Shelf Life and Changing Consumer Lifestyle; Demand For Longer-lasting and Sustainable Packaging Products; Increasing Demand For Security and Tracking Solutions.

6. What are the notable trends driving market growth?

Increasing Demand For Longer-lasting And Sustainable Packaging Products.

7. Are there any restraints impacting market growth?

Issues With the Effects of Packaging Materials on the Human Body; High Initial Capital Investment and Installation Costs.

8. Can you provide examples of recent developments in the market?

July 2022 - Timestrip Uk Ltd introduced Timestrip Neo, a platform for a series of single-use electronic indicators suitable for pack level monitoring with both time and multiple temperature settings. The platform could be suitable for protecting goods such as perishable foodstuffs that deteriorate faster at higher temperatures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Active and Intelligent Packaging Procurement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Active and Intelligent Packaging Procurement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Active and Intelligent Packaging Procurement Industry?

To stay informed about further developments, trends, and reports in the Active and Intelligent Packaging Procurement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence