Key Insights

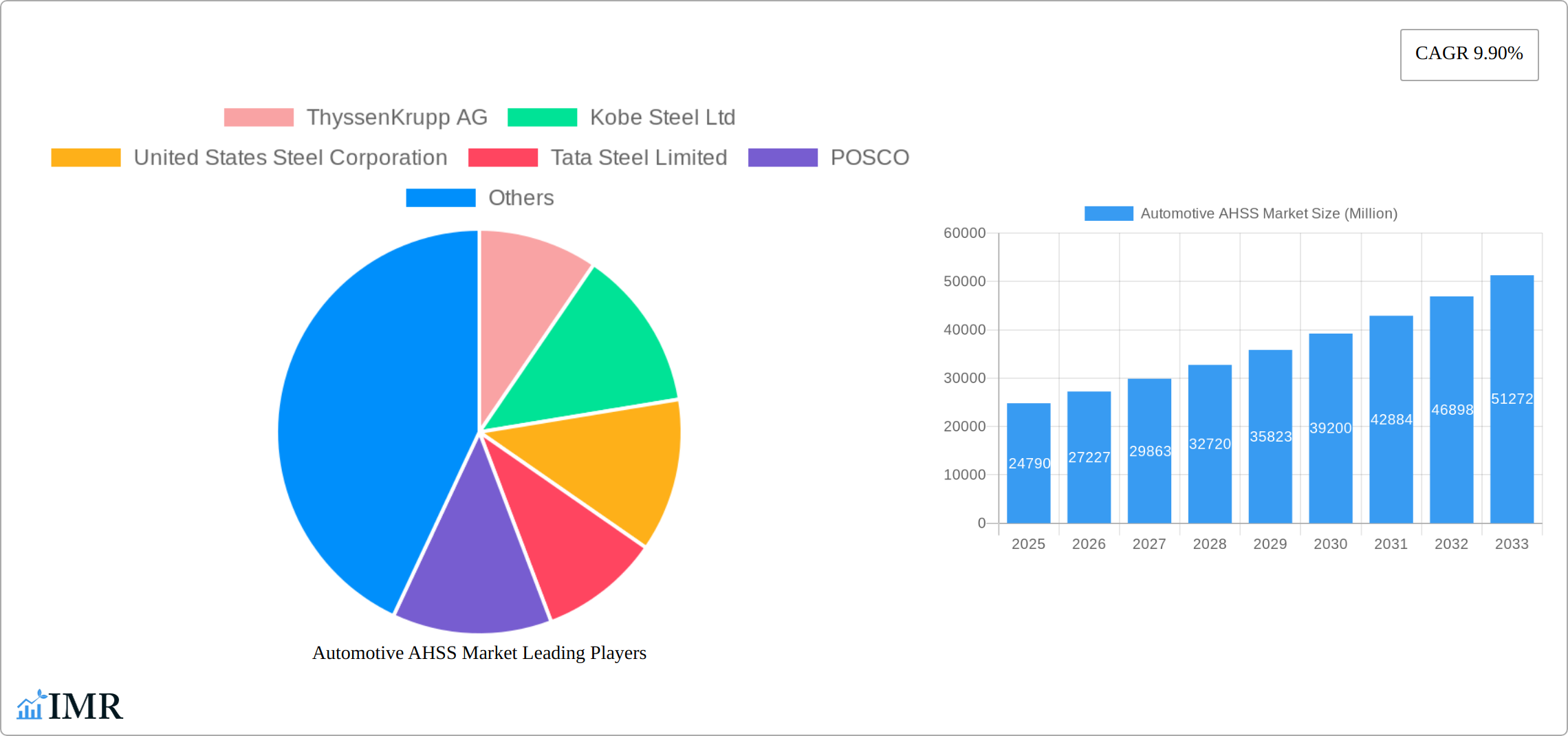

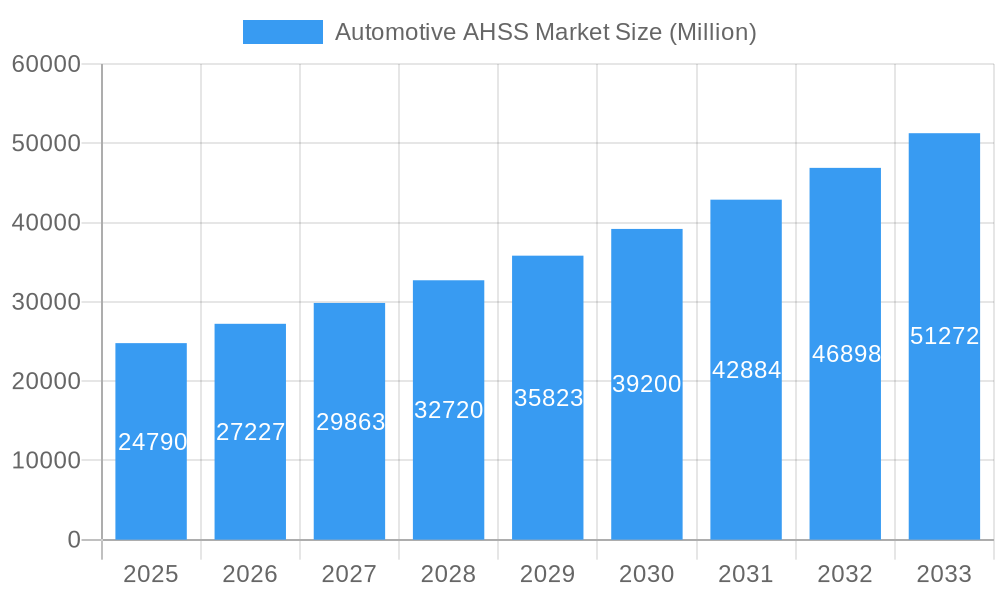

The Automotive Advanced High-Strength Steel (AHSS) market is experiencing robust growth, projected to reach \$24.79 billion in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 9.90% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for lighter vehicles to improve fuel efficiency and reduce emissions is a major catalyst. Stringent government regulations worldwide promoting fuel economy standards are further pushing the adoption of AHSS, which offers superior strength-to-weight ratio compared to conventional steel. Moreover, advancements in AHSS manufacturing processes, leading to improved cost-effectiveness and wider availability, are fueling market growth. The automotive industry's ongoing shift towards electric vehicles (EVs) also contributes positively, as AHSS plays a crucial role in enhancing the structural integrity and safety of EV battery packs and chassis. The growth is particularly strong in the passenger car segment, driven by increased production and sales globally. Key players like ThyssenKrupp AG, Kobe Steel Ltd, and United States Steel Corporation are strategically investing in research and development to enhance AHSS properties and expand their product portfolio to cater to this expanding market.

Automotive AHSS Market Market Size (In Billion)

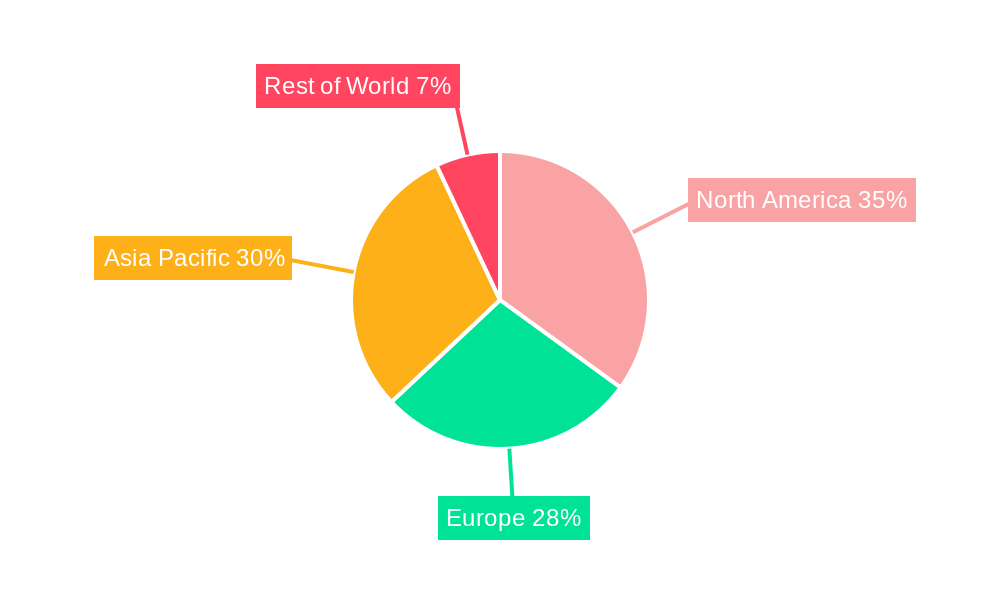

Geographic distribution reveals a strong presence in North America and Asia-Pacific regions, largely due to significant automotive manufacturing hubs in these areas. However, the European market also presents substantial growth opportunities driven by the region's commitment to sustainability and stringent emission standards. The market is segmented by application type (structural assembly and closures, bumpers, suspension, and others) and vehicle type (passenger cars and commercial vehicles). While structural applications dominate, the use of AHSS in bumpers and suspension systems is also gaining traction, signifying the material’s versatility and expanding applications within the automotive sector. Despite the promising outlook, potential challenges such as fluctuating raw material prices and the need for specialized manufacturing infrastructure could influence market dynamics in the coming years. However, the overall long-term outlook for the Automotive AHSS market remains exceptionally positive, driven by the sustained demand for fuel-efficient and safer vehicles.

Automotive AHSS Market Company Market Share

Automotive AHSS Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive Advanced High-Strength Steel (AHSS) market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for automotive manufacturers, steel producers, material suppliers, and industry investors seeking to understand and capitalize on opportunities within this dynamic market. The report analyzes both parent market (Steel Market - xx Million Units) and child market (Automotive AHSS Market - xx Million Units) for a holistic view.

Automotive AHSS Market Dynamics & Structure

This section delves into the competitive landscape of the Automotive AHSS market, analyzing market concentration, technological advancements, regulatory influences, and the impact of mergers and acquisitions (M&A). We examine the interplay of these factors and their influence on market growth and profitability.

- Market Concentration: The Automotive AHSS market exhibits a moderately concentrated structure, with key players like ThyssenKrupp AG, Kobe Steel Ltd, United States Steel Corporation, Tata Steel Limited, POSCO, SSAB AB, Cleveland-Cliffs Inc, and Baoshan Iron & Steel Co Ltd holding significant market share (xx%). However, the emergence of new entrants and technological disruptions is gradually altering this landscape.

- Technological Innovation: Continuous R&D efforts are driving the development of lighter, stronger, and more cost-effective AHSS grades. Innovation in manufacturing processes, such as advanced cold stamping and forming techniques, is further enhancing the properties and applications of AHSS.

- Regulatory Framework: Stringent fuel efficiency standards and emission regulations are pushing automakers to adopt lightweight materials, significantly increasing the demand for AHSS. Government incentives and policies focused on sustainable manufacturing also play a significant role.

- Competitive Product Substitutes: AHSS faces competition from other advanced materials, including aluminum alloys and carbon fiber composites. However, the cost-effectiveness and established manufacturing infrastructure of AHSS continue to provide a competitive edge.

- End-User Demographics: The growth of the automotive industry, particularly in emerging markets, is a primary driver for AHSS demand. The shift towards SUVs and larger vehicles further fuels this growth. Consumer preference for safety and fuel efficiency also influences the adoption of AHSS.

- M&A Trends: The Automotive AHSS market has witnessed several significant M&A activities in recent years, reflecting consolidation and strategic expansion efforts by leading players. For example, the acquisition of National Material of Mexico by Klöckner & Co. in August 2023 demonstrates this trend. The overall M&A deal volume in the period 2019-2024 is estimated at xx deals.

Automotive AHSS Market Growth Trends & Insights

The Automotive Advanced High-Strength Steel (AHSS) market is experiencing robust expansion, driven by an increasing imperative for lighter, safer, and more fuel-efficient vehicles. This section delves into historical and projected market sizing, adoption trajectories, and the pivotal technological innovations shaping the landscape. Leveraging sophisticated analytical methodologies, including Compound Annual Growth Rate (CAGR) calculations, we quantify past growth and forecast future market trajectories. Our analysis integrates nuanced insights into evolving consumer preferences, which increasingly prioritize vehicles that offer a compelling balance of performance, safety, and reduced environmental impact. The AHSS market is poised for substantial growth, with projections indicating a CAGR of xx% from 2025 to 2033, anticipating a market valuation of xx million units by the conclusion of the forecast period. This upward trend is underpinned by escalating global vehicle production volumes, the persistent tightening of fuel economy mandates and emissions regulations worldwide, and a sustained demand for enhanced vehicle safety features that AHSS effectively addresses.

Dominant Regions, Countries, or Segments in Automotive AHSS Market

This section identifies the leading regions, countries, and segments within the Automotive AHSS market, examining the factors contributing to their dominance. Analysis includes market share, growth potential, economic policies, and infrastructure development.

- Leading Region/Country: [Insert Leading Region/Country based on data - e.g., North America] is projected to maintain its dominance in the Automotive AHSS market due to robust automotive production, stringent emission regulations, and the presence of major steel manufacturers.

- Leading Application Type: The [Insert Leading Application Type based on data – e.g., Structural Assembly and Closures] segment holds the largest market share, driven by the significant use of AHSS in enhancing vehicle body strength and safety.

- Leading Vehicle Type: [Insert Leading Vehicle Type based on data – e.g., Passenger Cars] is the major consumer of AHSS, owing to higher production volumes and increasing demand for enhanced safety and fuel efficiency in passenger vehicles. However, the commercial vehicle segment is anticipated to witness significant growth due to the increasing adoption of lightweight materials for improving fuel efficiency.

Key drivers in these dominant segments include:

- Stringent government regulations on vehicle fuel efficiency and safety.

- Growing demand for lightweight vehicles to enhance fuel economy.

- Increasing adoption of advanced automotive technologies.

Automotive AHSS Market Product Landscape

The Automotive AHSS market is characterized by a sophisticated and diverse product portfolio, meticulously engineered to meet the demanding requirements of various vehicle components. These AHSS grades are distinguished by their finely tuned properties, including exceptional tensile strength, advanced formability for intricate geometries, and optimized weldability for efficient, high-volume manufacturing processes. A significant recent advancement in this sector is the introduction of third-generation AHSS by industry leader ArcelorMittal in September 2021. This innovation significantly enhances cold stamping and forming capabilities, enabling the production of even lighter and more robust automotive components. These advancements directly contribute to improved vehicle fuel efficiency and superior crash safety performance. Key differentiating features and unique selling propositions of these AHSS products include their unparalleled strength-to-weight ratios, exceptional formability that allows for the creation of complex structural designs, and enhanced weldability characteristics that streamline and optimize assembly line operations.

Key Drivers, Barriers & Challenges in Automotive AHSS Market

Key Drivers:

- The paramount importance of reducing vehicle weight to enhance fuel efficiency and significantly lower tailpipe emissions is a primary catalyst for AHSS adoption.

- Stringent governmental regulations and evolving safety standards across global automotive markets are compelling manufacturers to integrate AHSS for improved occupant protection.

- Continuous technological advancements in metallurgical science and manufacturing processes are yielding novel AHSS grades with progressively higher strength and superior formability, expanding their application scope.

Key Challenges & Restraints:

- Volatility in the prices of key raw materials such as iron ore and coal poses a significant challenge to maintaining stable and predictable AHSS production costs.

- Intense competition from alternative lightweight materials, notably advanced aluminum alloys and high-performance composites, presents an ongoing challenge for AHSS market share.

- Disruptions in global supply chains, as vividly demonstrated during the COVID-19 pandemic, can impact the consistent availability and timely delivery of AHSS, potentially affecting production schedules and market growth. The pandemic's impact on market growth is estimated to have caused a reduction of approximately xx% in 2020.

Emerging Opportunities in Automotive AHSS Market

Emerging opportunities lie in the development of tailored AHSS grades for specific automotive applications, leveraging advanced manufacturing techniques like additive manufacturing. Untapped markets in developing economies present significant growth potential. Further advancements in material science and collaborative partnerships between steel manufacturers and automakers are expected to drive the development of next-generation AHSS solutions.

Growth Accelerators in the Automotive AHSS Market Industry

Technological advancements in steelmaking and processing continue to accelerate AHSS market growth. Strategic partnerships between steel producers and automakers facilitate the development of customized AHSS solutions optimized for specific vehicle platforms. Market expansion into emerging economies, driven by rising automobile production, further fuels market growth.

Key Players Shaping the Automotive AHSS Market Market

Notable Milestones in Automotive AHSS Market Sector

- August 2023: Klöckner & Co. strategically acquired National Material of Mexico, a move designed to substantially bolster its footprint and service capabilities within the critical North American automotive supply chain.

- January 2022: SSAB unveiled its ambitious new Nordic production system, a strategic initiative aimed at significantly enhancing its AHSS product offerings and aligning with the industry's growing emphasis on sustainable manufacturing and the green transition.

- September 2021: ArcelorMittal launched its innovative third generation of AHSS, a development that underscores significant advancements in cold stamping and forming technologies, paving the way for lighter and stronger automotive components.

In-Depth Automotive AHSS Market Market Outlook

The future of the Automotive AHSS market is bright, driven by continuous technological advancements, strategic partnerships, and expansion into new markets. The ongoing shift toward electric vehicles (EVs) and the demand for lightweight materials present significant opportunities for AHSS producers. Strategic collaborations between steel manufacturers and automakers will play a key role in developing customized AHSS solutions that cater to the specific requirements of future vehicle designs. The market is poised for sustained growth, with significant potential for innovation and market expansion in the coming years.

Automotive AHSS Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly and Closures

- 1.2. Bumpers

- 1.3. Suspension

- 1.4. Other Application Types

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Automotive AHSS Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive AHSS Market Regional Market Share

Geographic Coverage of Automotive AHSS Market

Automotive AHSS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Emission and Safety Regulations

- 3.3. Market Restrains

- 3.3.1. Disruptions in Supply Chain Can Hamper the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Passenger Cars to Propel the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly and Closures

- 5.1.2. Bumpers

- 5.1.3. Suspension

- 5.1.4. Other Application Types

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Structural Assembly and Closures

- 6.1.2. Bumpers

- 6.1.3. Suspension

- 6.1.4. Other Application Types

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Structural Assembly and Closures

- 7.1.2. Bumpers

- 7.1.3. Suspension

- 7.1.4. Other Application Types

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Structural Assembly and Closures

- 8.1.2. Bumpers

- 8.1.3. Suspension

- 8.1.4. Other Application Types

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Rest of the World Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Structural Assembly and Closures

- 9.1.2. Bumpers

- 9.1.3. Suspension

- 9.1.4. Other Application Types

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ThyssenKrupp AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kobe Steel Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 United States Steel Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Tata Steel Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 POSCO

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SSAB AB

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cleveland-Cliffs Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Baoshan Iron & Steel Co Lt

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 ThyssenKrupp AG

List of Figures

- Figure 1: Global Automotive AHSS Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive AHSS Market Revenue (Million), by Application Type 2025 & 2033

- Figure 3: North America Automotive AHSS Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 4: North America Automotive AHSS Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive AHSS Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive AHSS Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automotive AHSS Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive AHSS Market Revenue (Million), by Application Type 2025 & 2033

- Figure 9: Europe Automotive AHSS Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 10: Europe Automotive AHSS Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive AHSS Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive AHSS Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive AHSS Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive AHSS Market Revenue (Million), by Application Type 2025 & 2033

- Figure 15: Asia Pacific Automotive AHSS Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 16: Asia Pacific Automotive AHSS Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Automotive AHSS Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Automotive AHSS Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive AHSS Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive AHSS Market Revenue (Million), by Application Type 2025 & 2033

- Figure 21: Rest of the World Automotive AHSS Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Rest of the World Automotive AHSS Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Rest of the World Automotive AHSS Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Rest of the World Automotive AHSS Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive AHSS Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive AHSS Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Global Automotive AHSS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive AHSS Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive AHSS Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 5: Global Automotive AHSS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive AHSS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive AHSS Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 11: Global Automotive AHSS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Automotive AHSS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive AHSS Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 18: Global Automotive AHSS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 19: Global Automotive AHSS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive AHSS Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 26: Global Automotive AHSS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 27: Global Automotive AHSS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: South America Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Middle East and Africa Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive AHSS Market?

The projected CAGR is approximately 9.90%.

2. Which companies are prominent players in the Automotive AHSS Market?

Key companies in the market include ThyssenKrupp AG, Kobe Steel Ltd, United States Steel Corporation, Tata Steel Limited, POSCO, SSAB AB, Cleveland-Cliffs Inc, Baoshan Iron & Steel Co Lt.

3. What are the main segments of the Automotive AHSS Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Emission and Safety Regulations.

6. What are the notable trends driving market growth?

Growing Demand for Passenger Cars to Propel the Market Growth.

7. Are there any restraints impacting market growth?

Disruptions in Supply Chain Can Hamper the Market.

8. Can you provide examples of recent developments in the market?

Aug 2023: Klöckner & Co. announced the acquisition of National Material of Mexico, a leading independent service center and materials supplier serving automotive and industrial end markets in North America with ten facilities throughout Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive AHSS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive AHSS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive AHSS Market?

To stay informed about further developments, trends, and reports in the Automotive AHSS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence