Key Insights

The Indian automotive hydraulic actuators market is projected for substantial growth, fueled by key industry drivers. The market is estimated at 27.9 billion in 2024, with a projected Compound Annual Growth Rate (CAGR) of 3.1% through 2033. This expansion is largely attributed to the increasing demand for advanced automotive safety systems, such as sophisticated braking and adaptive cruise control, which require precise hydraulic actuation. Rising production of passenger and commercial vehicles in India, alongside a growing consumer preference for enhanced driving comfort and performance, are further accelerating the adoption of hydraulic actuators. Government initiatives supporting automotive manufacturing and the "Make in India" campaign are also fostering innovation and domestic production.

India Automotive Hydraulic Actuators Market Market Size (In Billion)

Key applications within the market include throttle, seat adjustment, brake, and closure actuators. While traditional hydraulic systems are dominant, emerging trends involve integrating smart actuators with Electronic Control Units (ECUs) for enhanced responsiveness and efficiency. However, the market faces challenges from the increasing adoption of electric and electronic actuators as alternatives and fluctuating raw material costs. Despite these hurdles, the sustained growth of India's automotive sector and the critical role of hydraulic actuators in vehicle functionality ensure a positive market outlook.

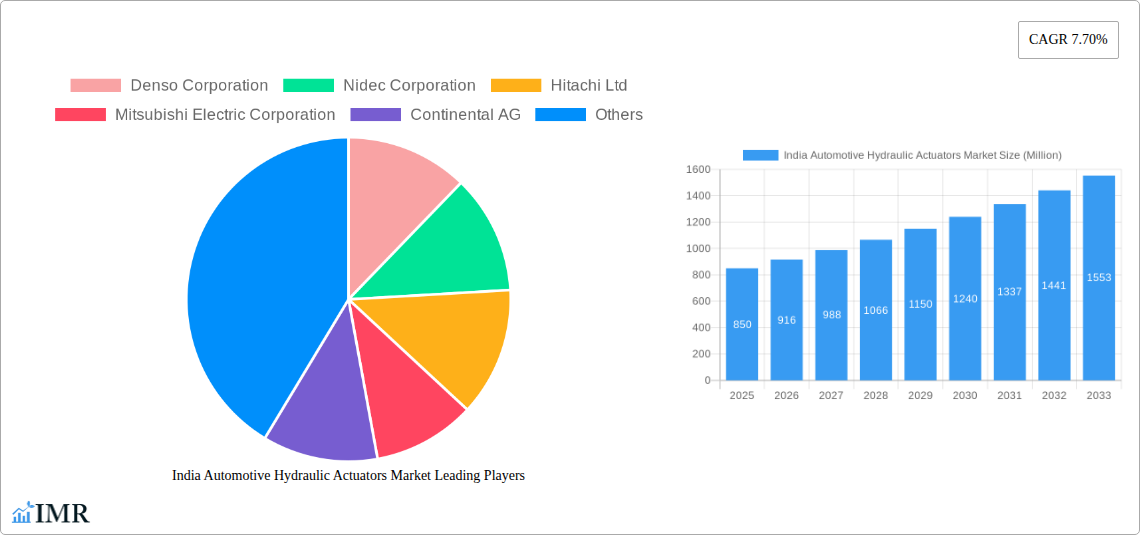

India Automotive Hydraulic Actuators Market Company Market Share

India Automotive Hydraulic Actuators Market: Comprehensive Insights and Future Projections (2019-2033)

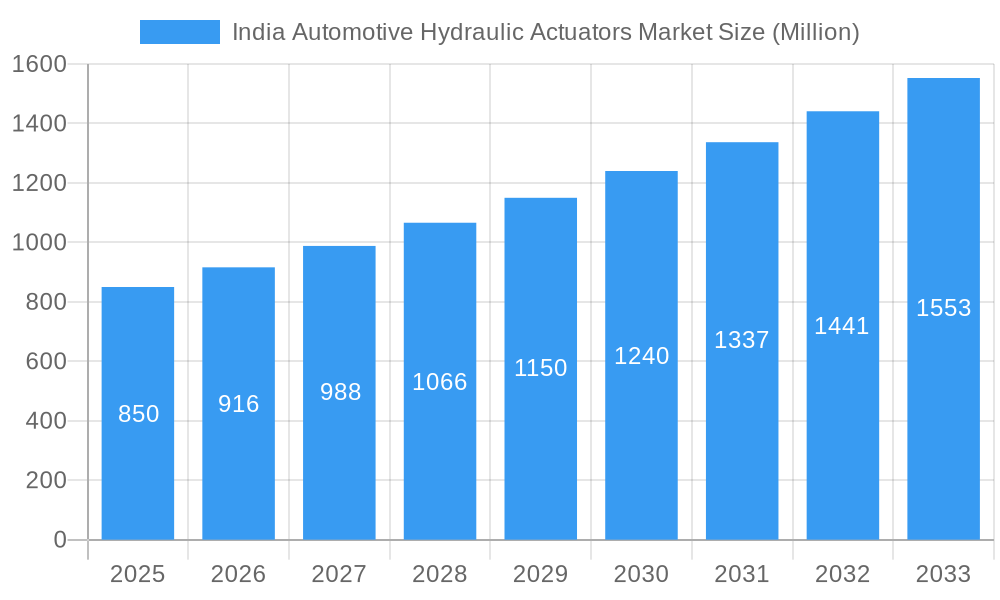

This in-depth report provides a comprehensive analysis of the burgeoning India Automotive Hydraulic Actuators Market. Covering the historical period from 2019 to 2024 and extending to a robust forecast period from 2025 to 2033, with 2025 serving as both the base and estimated year, this study delves into market dynamics, growth trends, competitive landscape, and emerging opportunities. We offer granular insights into parent and child markets, utilizing high-traffic keywords to maximize search engine visibility for industry professionals seeking to understand the intricate workings of this vital automotive component sector. All quantitative values are presented in Million units.

India Automotive Hydraulic Actuators Market Market Dynamics & Structure

The India Automotive Hydraulic Actuators Market is characterized by a moderately concentrated structure, with key global players and a growing number of domestic manufacturers vying for market share. Technological innovation serves as a primary driver, fueled by the increasing demand for advanced safety features, enhanced driving comfort, and improved fuel efficiency in vehicles. Regulatory frameworks, particularly those focusing on emissions and safety standards, are indirectly influencing the adoption of sophisticated actuator systems. Competitive product substitutes, such as electric actuators, are present but hydraulic actuators maintain a strong foothold due to their robustness, cost-effectiveness in certain applications, and established manufacturing ecosystem. End-user demographics are shifting towards a younger, tech-savvy population in urban centers demanding more sophisticated vehicle features. Mergers and acquisitions (M&A) trends are observed as larger players seek to consolidate their market position and expand their product portfolios.

- Market Concentration: Top 5 players are estimated to hold approximately 65% of the market share in 2025.

- Technological Innovation Drivers: Development of lighter, more compact, and energy-efficient hydraulic actuators, integration with advanced electronic control units (ECUs).

- Regulatory Frameworks: Stringent safety norms (e.g., ABS, ESC) mandate the use of advanced actuation systems.

- Competitive Product Substitutes: Growing adoption of electric power steering (EPS) and electric braking systems, posing a competitive threat in certain segments.

- End-User Demographics: Increasing demand for premium features in passenger cars, driving adoption of advanced seat adjustment and closure actuators.

- M&A Trends: Strategic acquisitions by established players to gain access to new technologies or expand manufacturing capabilities.

India Automotive Hydraulic Actuators Market Growth Trends & Insights

The India Automotive Hydraulic Actuators Market is poised for significant expansion, driven by a confluence of factors including robust automotive production, increasing vehicle electrification, and a growing emphasis on driver safety and comfort. The market size evolution is projected to witness a steady upward trajectory, reflecting the country's strong economic growth and increasing disposable incomes that translate into higher vehicle sales. Adoption rates of advanced hydraulic actuator technologies are expected to accelerate as automakers strive to meet evolving consumer expectations and stringent regulatory requirements. Technological disruptions, such as the integration of smart actuators with AI and IoT capabilities, are anticipated to reshape the market, offering enhanced functionality and predictive maintenance. Consumer behavior shifts are also playing a crucial role, with a growing preference for feature-rich vehicles and a willingness to invest in technologies that enhance the driving experience. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.8% during the forecast period (2025-2033). Market penetration of advanced hydraulic actuators in the passenger car segment is expected to reach over 75% by 2033, indicating a substantial increase from current levels. The increasing adoption of hybrid and electric vehicles, while seemingly a shift away from hydraulics, also presents opportunities for specialized hydraulic actuator applications within these powertrains and related systems, such as advanced braking and suspension. Furthermore, the aftermarket segment for hydraulic actuators is expected to grow considerably as the vehicle parc ages and replacement demand increases.

Dominant Regions, Countries, or Segments in India Automotive Hydraulic Actuators Market

The Passenger Car segment, within the Vehicle Type categorization, is currently the dominant force driving growth in the India Automotive Hydraulic Actuators Market. This dominance is propelled by several key factors. India's status as one of the largest and fastest-growing passenger car markets globally ensures a consistent and substantial demand for all types of automotive actuators. Economic policies promoting manufacturing and the "Make in India" initiative have further bolstered domestic automotive production, directly translating into higher actuator consumption. Infrastructure development, though still evolving, is supporting the growth of Tier 1 and Tier 2 cities, where vehicle ownership is higher and demand for feature-rich vehicles is pronounced.

Within the Application Type segmentation, the Throttle Actuator and Brake Actuator sub-segments are critical contributors to the market's expansion. Throttle actuators are integral to engine performance and fuel efficiency, essential for both internal combustion engine (ICE) vehicles and increasingly, for hybrid powertrains. The push for better emission control and performance optimization in ICE vehicles ensures sustained demand for advanced throttle actuation systems. Brake actuators, fundamental to safety systems like Anti-lock Braking Systems (ABS) and Electronic Stability Control (ESC), are experiencing a surge in demand driven by mandatory safety regulations. The increasing adoption of these safety features across all vehicle segments, from entry-level to premium, makes brake actuators a high-growth area.

- Dominant Vehicle Type: Passenger Car, contributing an estimated 60% to the overall market in 2025.

- Key Drivers: High sales volume, increasing disposable incomes, growing demand for comfort and safety features.

- Growth Potential: Continued expansion of the middle class and urbanization will sustain passenger car demand.

- Dominant Application Types:

- Throttle Actuator: Critical for engine management and fuel efficiency.

- Market Share: Estimated 25% of the application market in 2025.

- Growth Potential: Essential for optimizing performance in ICE and hybrid vehicles.

- Brake Actuator: Integral to advanced safety systems.

- Market Share: Estimated 30% of the application market in 2025.

- Growth Potential: Mandatory safety regulations and consumer preference for enhanced safety are key drivers.

- Throttle Actuator: Critical for engine management and fuel efficiency.

- Geographic Dominance: Southern and Western regions of India, owing to the presence of major automotive manufacturing hubs and a higher concentration of vehicle production facilities.

India Automotive Hydraulic Actuators Market Product Landscape

The product landscape for automotive hydraulic actuators in India is marked by continuous innovation aimed at enhancing performance, durability, and integration capabilities. Manufacturers are focusing on developing compact and lightweight designs that contribute to overall vehicle weight reduction, thereby improving fuel efficiency. Advanced sealing technologies are being implemented to ensure longevity and reliability under demanding operating conditions. Unique selling propositions often revolve around precise control, rapid response times, and seamless integration with vehicle electronic systems. For instance, advancements in variable displacement hydraulic pumps and sophisticated valve control systems are enabling finer control over engine power delivery and braking force. The development of integrated actuator modules that combine multiple functions into a single unit is also gaining traction, simplifying assembly and reducing system complexity.

Key Drivers, Barriers & Challenges in India Automotive Hydraulic Actuators Market

Key Drivers:

- Robust Automotive Production: India's position as a global automotive manufacturing hub ensures consistent demand for actuators.

- Increasing Safety Regulations: Mandates for ABS, ESC, and other safety features directly drive the demand for brake actuators.

- Growing Demand for Comfort Features: Advanced seat adjustment and closure actuators are becoming standard in passenger vehicles.

- Technological Advancements: Development of more efficient, compact, and intelligent hydraulic actuator systems.

- Urbanization and Rising Disposable Incomes: Leading to increased passenger car sales and demand for feature-rich vehicles.

Key Barriers & Challenges:

- Competition from Electric Actuators: The increasing adoption of electric powertrains presents a competitive threat in certain applications.

- Supply Chain Disruptions: Geopolitical factors and raw material price volatility can impact production costs and availability.

- Skilled Workforce Shortage: A need for skilled personnel in the design, manufacturing, and maintenance of advanced hydraulic systems.

- Stringent Emission Norms: While driving innovation, compliance with evolving emission standards requires significant R&D investment.

- Cost Sensitivity: The price-sensitive nature of the Indian automotive market can create challenges for premium, high-cost actuator solutions.

Emerging Opportunities in India Automotive Hydraulic Actuators Market

Emerging opportunities lie in the development of smart hydraulic actuators capable of sophisticated diagnostics and predictive maintenance, integrating with connected car technologies. The growing demand for advanced driver-assistance systems (ADAS) presents a significant avenue for specialized hydraulic actuator applications, particularly in braking and steering systems. Furthermore, the burgeoning electric and hybrid vehicle market, despite the shift towards electric actuation in some areas, still requires specialized hydraulic actuators for auxiliary systems and power transfer mechanisms. The aftermarket segment for hydraulic actuators in India is a largely untapped market, with the aging vehicle parc creating a substantial demand for replacement parts. Innovations in sustainable manufacturing processes and materials also present an opportunity for companies to differentiate themselves and align with growing environmental consciousness.

Growth Accelerators in the India Automotive Hydraulic Actuators Market Industry

Several catalysts are accelerating long-term growth in the India Automotive Hydraulic Actuators Market. Technological breakthroughs in micro-hydraulics and electro-hydraulic integration are enabling the development of more precise and energy-efficient actuator systems. Strategic partnerships between actuator manufacturers and vehicle OEMs are crucial for co-development and early adoption of new technologies. Market expansion strategies, including increased localization of manufacturing and the establishment of robust distribution networks, are vital for capturing market share. The ongoing evolution of autonomous driving technologies, even with a strong electric drive, will necessitate advanced and reliable actuation systems for precise vehicle control, opening new frontiers for hydraulic actuators in hybrid and specialized roles.

Key Players Shaping the India Automotive Hydraulic Actuators Market Market

- Denso Corporation

- Nidec Corporation

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Continental AG

- BorgWarner Inc

- Robert Bosch GmbH

- Aptiv Plc

Notable Milestones in India Automotive Hydraulic Actuators Market Sector

- 2021: Launch of new generation fuel-efficient throttle actuators by a leading global supplier, meeting BS6 emission norms.

- 2022: Major investment by a key player in expanding its manufacturing capacity for brake actuators in India to meet escalating demand.

- 2023: Introduction of advanced hydraulic seat adjustment systems with memory functions in premium passenger car models.

- 2024: Significant advancements in electro-hydraulic braking systems showcased at an Indian automotive expo, highlighting future trends.

In-Depth India Automotive Hydraulic Actuators Market Market Outlook

The India Automotive Hydraulic Actuators Market outlook is exceptionally promising, driven by a synergistic blend of robust domestic automotive growth and continuous technological innovation. Future market potential is anchored in the increasing sophistication of vehicle features, a strong emphasis on safety, and the evolving landscape of powertrain technologies, including hybrid and electric vehicles. Strategic opportunities abound for manufacturers who can offer advanced, cost-effective, and environmentally conscious hydraulic actuator solutions. The convergence of digital technologies with hydraulic systems, leading to intelligent and connected actuators, will be a key differentiator. Furthermore, the drive towards localized manufacturing and supply chain resilience will continue to shape the competitive landscape, presenting avenues for growth and market leadership.

India Automotive Hydraulic Actuators Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Application Type

- 2.1. Throttle Actuator

- 2.2. Seat Adjustment Actuator

- 2.3. Brake Actuator

- 2.4. Closure Actuator

- 2.5. Others

India Automotive Hydraulic Actuators Market Segmentation By Geography

- 1. India

India Automotive Hydraulic Actuators Market Regional Market Share

Geographic Coverage of India Automotive Hydraulic Actuators Market

India Automotive Hydraulic Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for ADAS Integration

- 3.3. Market Restrains

- 3.3.1. High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Hydraulic Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Hydraulic Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Throttle Actuator

- 5.2.2. Seat Adjustment Actuator

- 5.2.3. Brake Actuator

- 5.2.4. Closure Actuator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nidec Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BorgWarner Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aptiv Pl

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: India Automotive Hydraulic Actuators Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Automotive Hydraulic Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: India Automotive Hydraulic Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: India Automotive Hydraulic Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: India Automotive Hydraulic Actuators Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Automotive Hydraulic Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: India Automotive Hydraulic Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: India Automotive Hydraulic Actuators Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Hydraulic Actuators Market?

The projected CAGR is approximately 3.1%.

2. Which companies are prominent players in the India Automotive Hydraulic Actuators Market?

Key companies in the market include Denso Corporation, Nidec Corporation, Hitachi Ltd, Mitsubishi Electric Corporation, Continental AG, BorgWarner Inc, Robert Bosch GmbH, Aptiv Pl.

3. What are the main segments of the India Automotive Hydraulic Actuators Market?

The market segments include Vehicle Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for ADAS Integration.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Hydraulic Actuators Market to Grow.

7. Are there any restraints impacting market growth?

High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Hydraulic Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Hydraulic Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Hydraulic Actuators Market?

To stay informed about further developments, trends, and reports in the India Automotive Hydraulic Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence