Key Insights

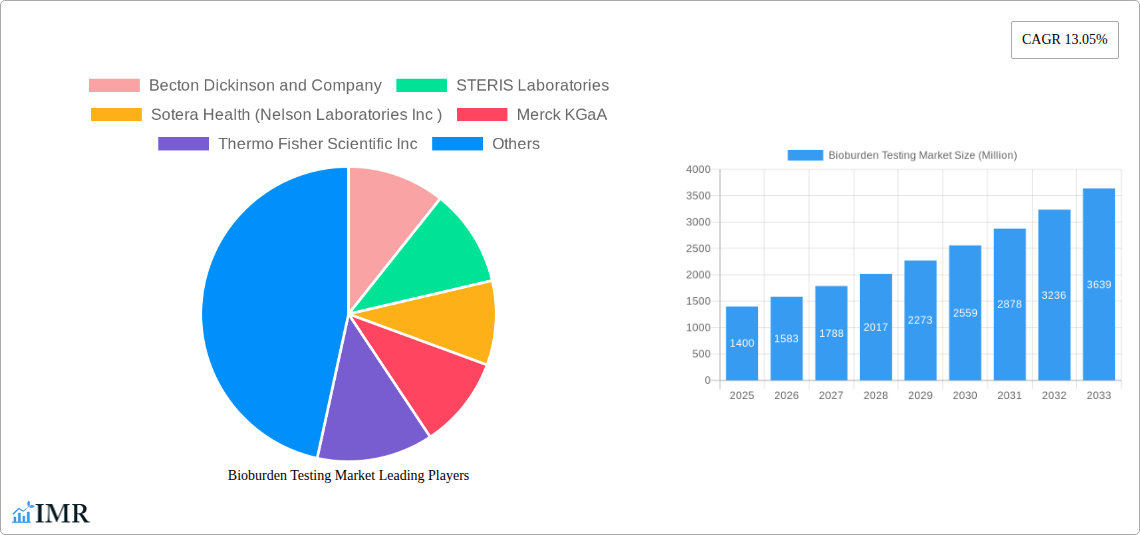

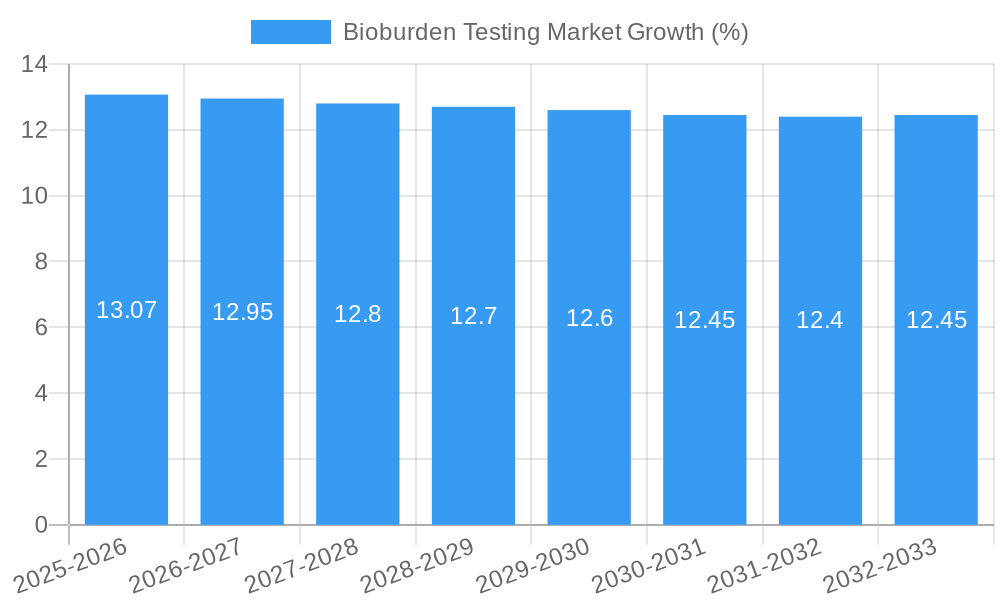

The global Bioburden Testing Market is poised for significant expansion, projected to reach approximately USD 1.40 billion in 2025. Driven by an impressive Compound Annual Growth Rate (CAGR) of 13.05%, the market is expected to experience robust growth throughout the forecast period extending to 2033. This upward trajectory is primarily fueled by the increasing stringency of regulatory requirements across various industries, particularly pharmaceuticals, medical devices, and food and beverage. The growing emphasis on product safety, the rise in the prevalence of infectious diseases, and the continuous development of advanced testing technologies are also key catalysts. The market's expansion is further supported by increasing R&D investments by key players and the growing demand for rapid and sensitive bioburden detection methods to ensure product integrity and patient safety.

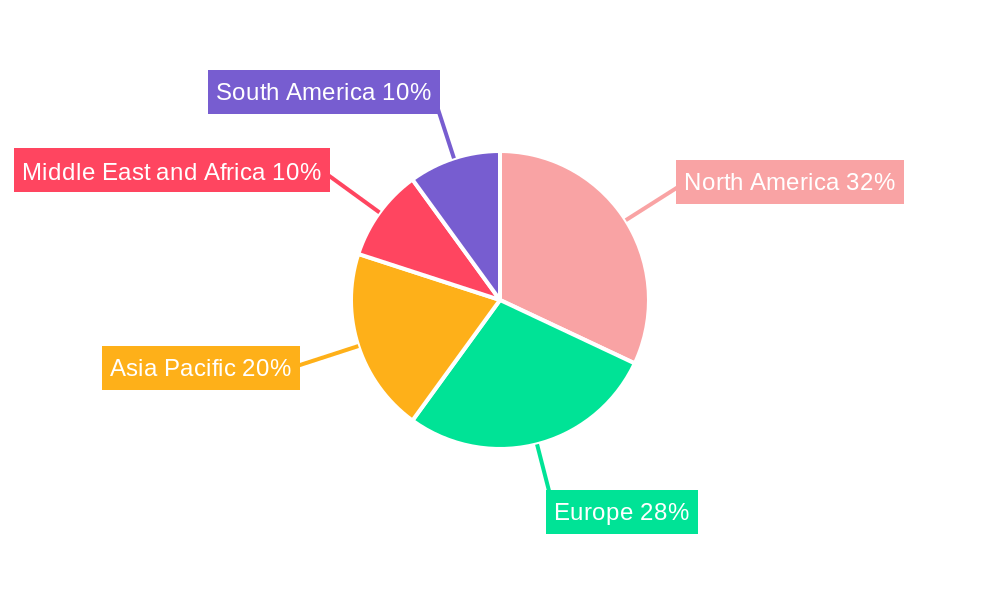

The Bioburden Testing Market is characterized by a diverse range of segments, each contributing to its overall dynamism. Consumables, including culture media and reagents, represent a substantial segment due to their recurring need in testing protocols. Within instruments, Automated Microbial Identification Systems and Polymerase Chain Reaction (PCR) Systems are gaining traction, offering enhanced speed and accuracy. Enumeration methods like Membrane Filtration and Plate Count Method remain prevalent, though advancements in other techniques are emerging. Applications are broad, spanning critical areas such as Raw Material Testing, Medical Devices Testing, and In-process Testing, underscoring the ubiquitous need for reliable bioburden assessment. Geographically, North America and Europe currently lead the market, owing to established regulatory frameworks and high adoption rates of advanced testing solutions. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by rapid industrialization, increasing healthcare expenditure, and a growing focus on quality control. Leading companies like Becton Dickinson and Company, Thermo Fisher Scientific Inc., and Merck KGaA are actively innovating and expanding their product portfolios to cater to the evolving demands of this vital market.

This in-depth report offers a definitive exploration of the global Bioburden Testing Market, providing critical insights into its dynamics, growth trajectory, and future outlook. Designed for pharmaceutical manufacturers, medical device companies, contract research organizations (CROs), and regulatory bodies, this analysis leverages high-traffic keywords and a detailed market segmentation to deliver actionable intelligence. The study meticulously covers the historical period of 2019–2024, with a base year of 2025, and extends through a robust forecast period of 2025–2033, offering a comprehensive view of market evolution. We delve into the parent market of Microbial Testing Services and its crucial child market, Bioburden Analysis, dissecting factors influencing their interconnected growth. All monetary values are presented in Million USD units.

Bioburden Testing Market Market Dynamics & Structure

The Bioburden Testing Market is characterized by a moderately consolidated structure, driven by stringent regulatory mandates for product safety and efficacy across the pharmaceutical, biotechnology, and medical device industries. Technological innovation remains a pivotal driver, with continuous advancements in rapid microbial detection systems and automation enhancing accuracy and reducing turnaround times. The regulatory framework, spearheaded by bodies like the FDA and EMA, enforces rigorous compliance, dictating the adoption of advanced bioburden testing methodologies. Competitive product substitutes, while existing, often fall short in meeting the comprehensive validation and sensitivity requirements of regulated industries. End-user demographics are dominated by large pharmaceutical corporations, medical device manufacturers, and a growing segment of Contract Manufacturing Organizations (CMOs) and CROs, all seeking to outsource specialized testing. Mergers and acquisitions (M&A) activity is notable, with larger players acquiring smaller, specialized firms to expand their service portfolios and geographic reach. For instance, recent years have witnessed a steady M&A volume, with approximately 10-15 significant deals annually, aimed at consolidating market share and integrating novel technologies. Innovation barriers include the high cost of R&D for novel detection methods and the lengthy validation processes required for regulatory approval.

Bioburden Testing Market Growth Trends & Insights

The global Bioburden Testing Market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033. This growth is underpinned by an escalating demand for stringent microbial quality control in life sciences, driven by increasing product complexity and a heightened global focus on patient safety. The adoption rate of advanced bioburden testing techniques, such as PCR-based methods and rapid enumeration systems, is accelerating as companies seek to optimize their manufacturing processes and reduce time-to-market. Technological disruptions are a constant feature, with the integration of AI and machine learning in data analysis and predictive microbiology offering new avenues for risk assessment and quality assurance. Consumer behavior shifts are also playing a role, with an increased emphasis on the safety and sterility of pharmaceutical products and medical devices by end-users and healthcare providers alike, directly influencing the stringency of testing protocols. Market penetration of advanced bioburden testing solutions is expected to reach over 70% by 2033, as regulatory bodies continue to update and enforce microbial limits. The overall market size is projected to reach USD 3,500 million by 2033, up from an estimated USD 1,600 million in 2025.

Dominant Regions, Countries, or Segments in Bioburden Testing Market

North America, particularly the United States, currently dominates the Bioburden Testing Market, driven by its robust pharmaceutical and biotechnology industry, extensive presence of leading medical device manufacturers, and stringent regulatory oversight from the FDA. The region benefits from high R&D investments, a skilled workforce, and a well-established infrastructure for advanced scientific testing. In terms of product segments, Consumables, specifically Culture Media and Reagents, represent a significant market share, accounting for approximately 55% of the total product revenue. This dominance is attributed to the continuous and high-volume consumption of these materials in routine microbial testing across all applications. Among Instruments, Automated Microbial Identification Systems are witnessing rapid adoption, contributing to about 30% of instrument revenue, due to their efficiency and accuracy in species identification.

The Membrane Filtration enumeration method remains a cornerstone, holding a substantial market share of over 40% due to its suitability for a wide range of sample types and its established validation for pharmaceutical applications. However, rapid methods are gaining traction. In terms of application, Medical Devices Testing is a primary growth engine, representing nearly 35% of the application market share, driven by the increasing complexity and invasiveness of modern medical devices and the critical need for sterility assurance. This is closely followed by Raw Material Testing, essential for ensuring the quality of incoming components in drug and device manufacturing.

Bioburden Testing Market Product Landscape

The Bioburden Testing Market product landscape is dynamic, characterized by continuous innovation aimed at improving speed, accuracy, and ease of use. Consumables, including specialized culture media and high-purity reagents, form a foundational segment, designed for optimal microbial growth and detection. In the instrument segment, automated microbial identification systems, leveraging technologies like mass spectrometry and molecular assays, are revolutionizing turnaround times, while polymerase chain reaction (PCR) systems offer highly sensitive and specific detection of microbial DNA. Microscopes continue to be vital for direct observation and enumeration. These product innovations are crucial for meeting the evolving demands of stringent regulatory environments and ensuring product safety.

Key Drivers, Barriers & Challenges in Bioburden Testing Market

Key Drivers:

- Stringent Regulatory Requirements: Global regulatory bodies like the FDA and EMA mandate rigorous bioburden testing for pharmaceuticals and medical devices, driving consistent demand.

- Increasing Incidence of Healthcare-Associated Infections (HAIs): Heightened awareness of HAIs fuels demand for effective sterilization and microbial control in healthcare settings and medical device manufacturing.

- Growth of the Pharmaceutical and Biotechnology Industries: Expanding drug development pipelines and the burgeoning biopharmaceutical sector require extensive microbial testing.

- Technological Advancements: Development of rapid and automated testing methods enhances efficiency, reduces costs, and improves accuracy.

Barriers & Challenges:

- High Cost of Advanced Instrumentation: Sophisticated automated systems and rapid detection technologies represent significant capital investment.

- Lengthy Validation and Regulatory Approval Processes: Introducing new testing methods or instruments requires extensive validation, leading to extended adoption timelines.

- Skilled Workforce Shortages: A scarcity of trained microbiologists and technicians capable of operating advanced equipment and interpreting complex data can hinder market growth.

- Supply Chain Disruptions: Global events can impact the availability and cost of essential reagents and consumables, posing a risk to consistent testing.

Emerging Opportunities in Bioburden Testing Market

Emerging opportunities in the Bioburden Testing Market lie in the development and adoption of point-of-care testing solutions for microbial contamination, particularly relevant for immediate environmental monitoring in critical care settings. The increasing use of biologics and advanced therapies necessitates highly sensitive and specific bioburden testing methodologies, creating a niche for specialized detection systems. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) for predictive microbial risk assessment and data analysis presents a significant opportunity to optimize testing strategies and proactively identify potential contamination issues before they impact product quality. Untapped markets in developing economies with growing pharmaceutical manufacturing sectors also offer substantial growth potential.

Growth Accelerators in the Bioburden Testing Market Industry

Long-term growth in the Bioburden Testing Market is being accelerated by several key factors. Technological breakthroughs in areas like rapid molecular diagnostics, particularly isothermal amplification techniques, are poised to dramatically reduce testing times. Strategic partnerships between instrument manufacturers, reagent suppliers, and contract testing laboratories are fostering innovation and expanding service offerings. Market expansion strategies by leading players into emerging economies, coupled with increasing local manufacturing of pharmaceuticals and medical devices, are creating new demand centers. The growing emphasis on process analytical technology (PAT) in pharmaceutical manufacturing further drives the need for real-time or near-real-time bioburden monitoring.

Key Players Shaping the Bioburden Testing Market Market

- Becton Dickinson and Company

- STERIS Laboratories

- Sotera Health (Nelson Laboratories Inc)

- Merck KGaA

- Thermo Fisher Scientific Inc

- SGS SA

- Sartorius AG

- WuXi AppTec Co Ltd

- Charles River Laboratories Inc

- Biomérieux SA

- North American Science Associates Inc

- Pacific BioLabs Inc

Notable Milestones in Bioburden Testing Market Sector

- August 2022: Lonza introduced the Nebula Multimode Reader, the first multimode reader certified for use with Lonza's turbidimetric, chromogenic, and recombinant endotoxin detection methodologies, enhancing multi-parameter testing capabilities.

- July 2022: Merck launched the first Microbiology Application and Training (MAT) Lab in Bengaluru, India. This facility, costing EUR 200,000 and covering 1,100 square feet, aims to enhance the Indian life science community's microbiological quality control capabilities.

In-Depth Bioburden Testing Market Market Outlook

- August 2022: Lonza introduced the Nebula Multimode Reader, the first multimode reader certified for use with Lonza's turbidimetric, chromogenic, and recombinant endotoxin detection methodologies, enhancing multi-parameter testing capabilities.

- July 2022: Merck launched the first Microbiology Application and Training (MAT) Lab in Bengaluru, India. This facility, costing EUR 200,000 and covering 1,100 square feet, aims to enhance the Indian life science community's microbiological quality control capabilities.

In-Depth Bioburden Testing Market Market Outlook

The future outlook for the Bioburden Testing Market remains exceptionally positive, driven by a confluence of persistent regulatory demands, ongoing innovation, and expanding global healthcare needs. Growth accelerators such as advancements in rapid detection technologies, strategic collaborations to broaden service portfolios, and the expanding footprint of pharmaceutical manufacturing in emerging economies will continue to fuel market expansion. The increasing complexity of biopharmaceutical products and the persistent threat of microbial contamination underscore the critical and evolving role of bioburden testing in ensuring global public health. Strategic opportunities lie in catering to the demand for highly specific testing for novel therapies and in leveraging digital solutions for enhanced data management and predictive analytics within quality control workflows.

Bioburden Testing Market Segmentation

-

1. Product

-

1.1. Consumables

- 1.1.1. Culture Media and Reagents

- 1.1.2. Other Consumables

-

1.2. Instrument

- 1.2.1. Automated Microbial Identification Systems

- 1.2.2. Polymerase Chain Reaction (PCR) Systems

- 1.2.3. Microscopes

- 1.2.4. Other Instruments

-

1.1. Consumables

-

2. Enumeration Method

- 2.1. Membrane Filtration

- 2.2. Plate Count Method

- 2.3. Most Probable Number (MPN)

- 2.4. Other Enumeration Methods

-

3. Application

- 3.1. Raw Material Testing

- 3.2. Medical Devices Testing

- 3.3. In-process Testing

- 3.4. Equipment Cleaning Validation

- 3.5. Other Applications

Bioburden Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Bioburden Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Frequency of Product Recall Due to Microbial Contamination; Increasing R&D Investments in Life Sciences

- 3.3. Market Restrains

- 3.3.1. High Costs of Microbial Enumeration Instruments

- 3.4. Market Trends

- 3.4.1. Polymerase Chain Reaction (PCR) Systems are Expected to Hold the Large Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Consumables

- 5.1.1.1. Culture Media and Reagents

- 5.1.1.2. Other Consumables

- 5.1.2. Instrument

- 5.1.2.1. Automated Microbial Identification Systems

- 5.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 5.1.2.3. Microscopes

- 5.1.2.4. Other Instruments

- 5.1.1. Consumables

- 5.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 5.2.1. Membrane Filtration

- 5.2.2. Plate Count Method

- 5.2.3. Most Probable Number (MPN)

- 5.2.4. Other Enumeration Methods

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Raw Material Testing

- 5.3.2. Medical Devices Testing

- 5.3.3. In-process Testing

- 5.3.4. Equipment Cleaning Validation

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Consumables

- 6.1.1.1. Culture Media and Reagents

- 6.1.1.2. Other Consumables

- 6.1.2. Instrument

- 6.1.2.1. Automated Microbial Identification Systems

- 6.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 6.1.2.3. Microscopes

- 6.1.2.4. Other Instruments

- 6.1.1. Consumables

- 6.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 6.2.1. Membrane Filtration

- 6.2.2. Plate Count Method

- 6.2.3. Most Probable Number (MPN)

- 6.2.4. Other Enumeration Methods

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Raw Material Testing

- 6.3.2. Medical Devices Testing

- 6.3.3. In-process Testing

- 6.3.4. Equipment Cleaning Validation

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Consumables

- 7.1.1.1. Culture Media and Reagents

- 7.1.1.2. Other Consumables

- 7.1.2. Instrument

- 7.1.2.1. Automated Microbial Identification Systems

- 7.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 7.1.2.3. Microscopes

- 7.1.2.4. Other Instruments

- 7.1.1. Consumables

- 7.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 7.2.1. Membrane Filtration

- 7.2.2. Plate Count Method

- 7.2.3. Most Probable Number (MPN)

- 7.2.4. Other Enumeration Methods

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Raw Material Testing

- 7.3.2. Medical Devices Testing

- 7.3.3. In-process Testing

- 7.3.4. Equipment Cleaning Validation

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Consumables

- 8.1.1.1. Culture Media and Reagents

- 8.1.1.2. Other Consumables

- 8.1.2. Instrument

- 8.1.2.1. Automated Microbial Identification Systems

- 8.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 8.1.2.3. Microscopes

- 8.1.2.4. Other Instruments

- 8.1.1. Consumables

- 8.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 8.2.1. Membrane Filtration

- 8.2.2. Plate Count Method

- 8.2.3. Most Probable Number (MPN)

- 8.2.4. Other Enumeration Methods

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Raw Material Testing

- 8.3.2. Medical Devices Testing

- 8.3.3. In-process Testing

- 8.3.4. Equipment Cleaning Validation

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Consumables

- 9.1.1.1. Culture Media and Reagents

- 9.1.1.2. Other Consumables

- 9.1.2. Instrument

- 9.1.2.1. Automated Microbial Identification Systems

- 9.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 9.1.2.3. Microscopes

- 9.1.2.4. Other Instruments

- 9.1.1. Consumables

- 9.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 9.2.1. Membrane Filtration

- 9.2.2. Plate Count Method

- 9.2.3. Most Probable Number (MPN)

- 9.2.4. Other Enumeration Methods

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Raw Material Testing

- 9.3.2. Medical Devices Testing

- 9.3.3. In-process Testing

- 9.3.4. Equipment Cleaning Validation

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Consumables

- 10.1.1.1. Culture Media and Reagents

- 10.1.1.2. Other Consumables

- 10.1.2. Instrument

- 10.1.2.1. Automated Microbial Identification Systems

- 10.1.2.2. Polymerase Chain Reaction (PCR) Systems

- 10.1.2.3. Microscopes

- 10.1.2.4. Other Instruments

- 10.1.1. Consumables

- 10.2. Market Analysis, Insights and Forecast - by Enumeration Method

- 10.2.1. Membrane Filtration

- 10.2.2. Plate Count Method

- 10.2.3. Most Probable Number (MPN)

- 10.2.4. Other Enumeration Methods

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Raw Material Testing

- 10.3.2. Medical Devices Testing

- 10.3.3. In-process Testing

- 10.3.4. Equipment Cleaning Validation

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Bioburden Testing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Becton Dickinson and Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 STERIS Laboratories

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sotera Health (Nelson Laboratories Inc )

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Merck KGaA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Thermo Fisher Scientific Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 SGS SA

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Sartorius AG*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 WuXi AppTec Co Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Charles River Laboratories Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Biomérieux SA

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 North American Science Associates Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Pacific BioLabs Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Bioburden Testing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Bioburden Testing Market Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Bioburden Testing Market Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Bioburden Testing Market Revenue (Million), by Enumeration Method 2024 & 2032

- Figure 15: North America Bioburden Testing Market Revenue Share (%), by Enumeration Method 2024 & 2032

- Figure 16: North America Bioburden Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Bioburden Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Bioburden Testing Market Revenue (Million), by Product 2024 & 2032

- Figure 21: Europe Bioburden Testing Market Revenue Share (%), by Product 2024 & 2032

- Figure 22: Europe Bioburden Testing Market Revenue (Million), by Enumeration Method 2024 & 2032

- Figure 23: Europe Bioburden Testing Market Revenue Share (%), by Enumeration Method 2024 & 2032

- Figure 24: Europe Bioburden Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Bioburden Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Bioburden Testing Market Revenue (Million), by Product 2024 & 2032

- Figure 29: Asia Pacific Bioburden Testing Market Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific Bioburden Testing Market Revenue (Million), by Enumeration Method 2024 & 2032

- Figure 31: Asia Pacific Bioburden Testing Market Revenue Share (%), by Enumeration Method 2024 & 2032

- Figure 32: Asia Pacific Bioburden Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Pacific Bioburden Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Bioburden Testing Market Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East and Africa Bioburden Testing Market Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East and Africa Bioburden Testing Market Revenue (Million), by Enumeration Method 2024 & 2032

- Figure 39: Middle East and Africa Bioburden Testing Market Revenue Share (%), by Enumeration Method 2024 & 2032

- Figure 40: Middle East and Africa Bioburden Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Middle East and Africa Bioburden Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East and Africa Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Bioburden Testing Market Revenue (Million), by Product 2024 & 2032

- Figure 45: South America Bioburden Testing Market Revenue Share (%), by Product 2024 & 2032

- Figure 46: South America Bioburden Testing Market Revenue (Million), by Enumeration Method 2024 & 2032

- Figure 47: South America Bioburden Testing Market Revenue Share (%), by Enumeration Method 2024 & 2032

- Figure 48: South America Bioburden Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 49: South America Bioburden Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 50: South America Bioburden Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Bioburden Testing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bioburden Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 4: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Bioburden Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 33: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 34: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 41: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 50: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 51: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 60: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 61: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Bioburden Testing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 67: Global Bioburden Testing Market Revenue Million Forecast, by Enumeration Method 2019 & 2032

- Table 68: Global Bioburden Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 69: Global Bioburden Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Bioburden Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bioburden Testing Market?

The projected CAGR is approximately 13.05%.

2. Which companies are prominent players in the Bioburden Testing Market?

Key companies in the market include Becton Dickinson and Company, STERIS Laboratories, Sotera Health (Nelson Laboratories Inc ), Merck KGaA, Thermo Fisher Scientific Inc, SGS SA, Sartorius AG*List Not Exhaustive, WuXi AppTec Co Ltd, Charles River Laboratories Inc, Biomérieux SA, North American Science Associates Inc, Pacific BioLabs Inc.

3. What are the main segments of the Bioburden Testing Market?

The market segments include Product, Enumeration Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

High Frequency of Product Recall Due to Microbial Contamination; Increasing R&D Investments in Life Sciences.

6. What are the notable trends driving market growth?

Polymerase Chain Reaction (PCR) Systems are Expected to Hold the Large Share of the Market.

7. Are there any restraints impacting market growth?

High Costs of Microbial Enumeration Instruments.

8. Can you provide examples of recent developments in the market?

In August 2022, Lonza introduced the Nebula Multimode Reader, the first multimode reader certified for use with Lonza's turbidimetric, chromogenic, and recombinant endotoxin detection methodologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bioburden Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bioburden Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bioburden Testing Market?

To stay informed about further developments, trends, and reports in the Bioburden Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence